Market Overview

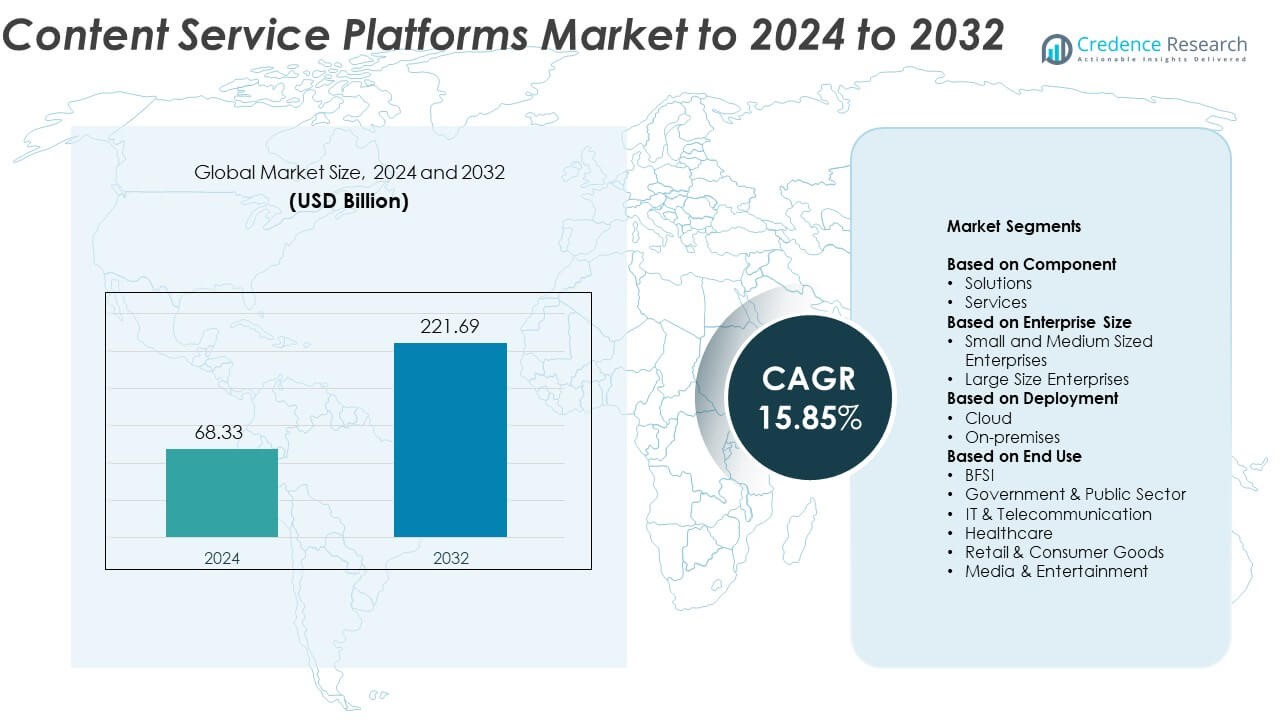

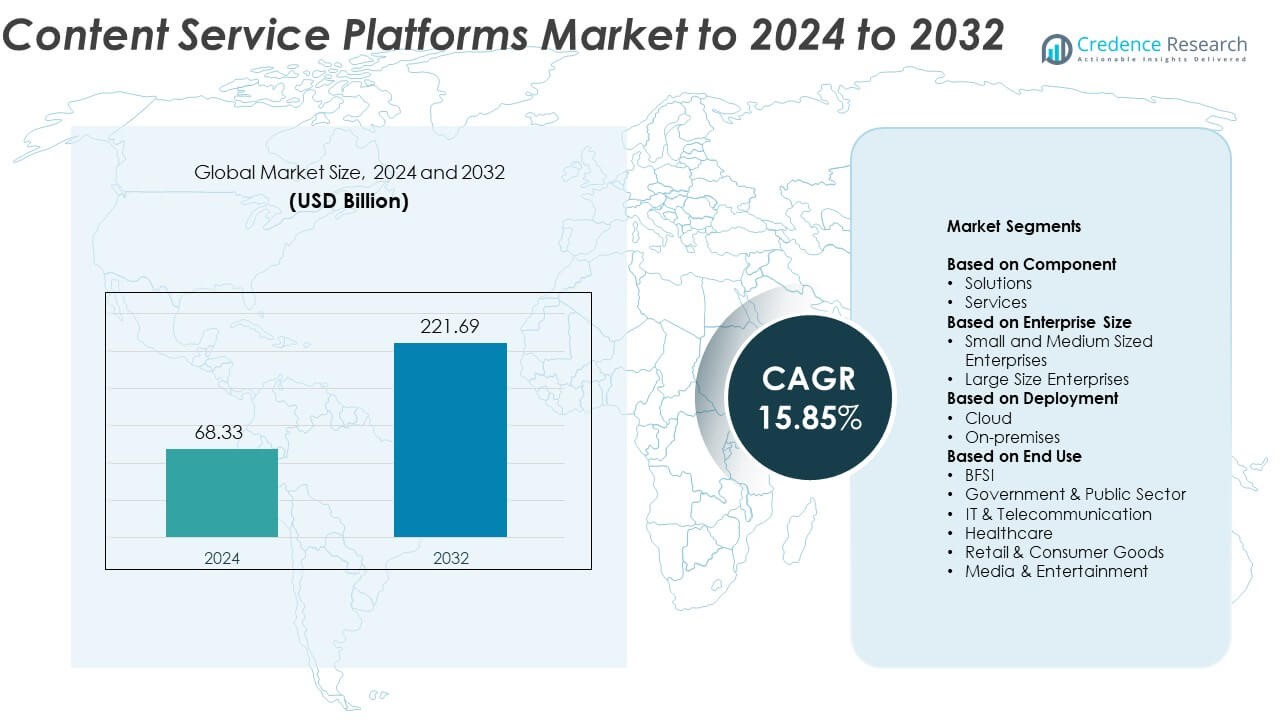

The Content Service Platforms Market size was valued at USD 68.33 Billion in 2024 and is anticipated to reach USD 221.69 Billion by 2032, at a CAGR of 15.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Content Service Platforms Market Size 2024 |

USD 68.33 Billion |

| Content Service Platforms Market, CAGR |

15.85% |

| Content Service Platforms Market Size 2032 |

USD 221.69 Billion |

The Content Service Platforms Market is led by major players including Microsoft, Oracle, IBM Corporation, Adobe, Open Text Corporation, Hyland Software, Inc., Laserfiche, Box, M-Files, and Fabasoft International Services GmbH. These companies focus on AI-powered automation, cloud integration, and advanced content analytics to strengthen their market position. North America leads the global market with a 37% share in 2024, driven by strong digital adoption and enterprise compliance needs. Europe follows with 29% share, supported by strict data protection regulations. Asia Pacific accounts for 23%, fueled by rapid digitalization and cloud expansion across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Content Service Platforms Market was valued at USD 68.33 Billion in 2024 and is projected to reach USD 221.69 Billion by 2032, growing at a CAGR of 15.85%.

- Rising enterprise digitalization and demand for AI-enabled workflow automation are key growth drivers, improving document management and regulatory compliance efficiency.

- Emerging trends include increasing adoption of cloud-based platforms, integration of machine learning for predictive content analytics, and expansion of content-as-a-service models.

- The market is highly competitive with major players focusing on innovation, strategic alliances, and scalable SaaS-based solutions to enhance market presence.

- North America leads with 37% share, followed by Europe at 29% and Asia Pacific at 23%, while the solutions segment dominates with 63% share due to strong demand for intelligent content management across BFSI, IT, and healthcare industries.

Market Segmentation Analysis:

By Component

Solutions dominate the content service platforms market, accounting for around 63% share in 2024. Their leadership stems from the growing demand for intelligent document management, workflow automation, and compliance tools. Organizations adopt advanced content solutions to improve operational efficiency and streamline unstructured data handling. The rising integration of AI-driven analytics and machine learning for content categorization and search optimization further boosts the segment. Meanwhile, the services segment gains momentum as enterprises increasingly rely on consulting, implementation, and managed services to enhance digital transformation efforts.

- For instance, OpenText Corporation reports that its Documentum CM platform manages 80 billion+ documents in production.

By Enterprise Size

Large enterprises held the leading position with nearly 58% share in 2024. These organizations prioritize advanced content management to handle massive data volumes, ensure regulatory compliance, and support global operations. High investments in AI-enabled and secure collaboration tools enhance productivity and governance standards. However, small and medium-sized enterprises are rapidly adopting cloud-based platforms to reduce infrastructure costs and enhance agility. The growing availability of subscription-based pricing models further encourages SMB participation in digital content ecosystems.

- For instance, An article from February 21, 2024, states that “36,179 live websites are actively utilizing AEM

By Deployment

The cloud segment leads the content service platforms market, capturing about 67% share in 2024. Its dominance is driven by scalability, reduced maintenance costs, and ease of remote access. Cloud-based deployments enable organizations to store, retrieve, and share digital content securely across distributed teams. Enhanced data protection, regular updates, and integration with other SaaS tools strengthen adoption. On-premises solutions continue to attract enterprises in highly regulated industries such as banking and government, where data sovereignty and internal control remain key priorities.

Key Growth Drivers

Rising Digital Transformation Across Enterprises

Enterprises across industries are rapidly adopting digital transformation to modernize content management. The shift toward automation and AI-driven workflows enhances productivity and governance. Businesses are investing in content service platforms to integrate structured and unstructured data, improving decision-making and collaboration. This transformation also supports hybrid work environments where accessibility and data security are vital. As companies scale operations globally, the need for unified content management systems continues to accelerate adoption across sectors such as banking, IT, and healthcare.

- For instance, ServiceNow’s AI platform for business transformation offers various document intelligence solutions and has a large global customer base, including more than 85% of the Fortune 500 companies, according to official company reports from 2024 and 2025.

Growing Demand for Cloud-Based Content Management

The growing preference for cloud-based deployment fuels market expansion. Cloud solutions offer scalability, cost-efficiency, and easy remote access to enterprise data. Organizations increasingly choose cloud platforms to reduce infrastructure costs and ensure flexibility across distributed teams. The ability to integrate with third-party applications and provide real-time collaboration further drives adoption. As businesses transition to hybrid work models, cloud-based content services are becoming critical for maintaining workflow continuity and enhancing operational efficiency.

- For instance, the Cloud Software Group (the parent company of Citrix) helps more than 100 million users across approximately 400,000 organizations evolve and succeed in cloud environments.

Increasing Emphasis on Regulatory Compliance and Data Security

Enterprises face strict compliance requirements for data storage and document management, especially in regulated industries. Content service platforms enable secure access, audit trails, and version control to meet global standards such as GDPR and HIPAA. Growing cybersecurity threats have intensified demand for encrypted storage and access control features. The need to safeguard sensitive data and ensure regulatory adherence pushes organizations to deploy advanced content management solutions that integrate AI-based risk detection and automated compliance monitoring.

Key Trends & Opportunities

AI and Machine Learning Integration

Artificial intelligence and machine learning are transforming how enterprises manage digital content. These technologies enable intelligent content classification, sentiment analysis, and predictive search capabilities. Automation reduces manual data entry, improves document retrieval accuracy, and enhances workflow speed. The growing use of natural language processing (NLP) in content tagging and analysis provides deeper insights, allowing businesses to optimize information governance and user experience across various applications.

- For instance, the Nuxeo Platform (which is now part of Hyland, a related content management company) has been benchmark tested to manage over 11 billion assets to ensure high performance and elastic scalability.

Expansion of Content-as-a-Service (CaaS) Models

The shift toward Content-as-a-Service is creating new growth opportunities for vendors and enterprises alike. CaaS models allow organizations to manage, deliver, and scale content across multiple platforms through APIs. This approach supports omnichannel content delivery, helping businesses maintain consistent messaging across web, mobile, and social media. Companies adopting CaaS benefit from reduced development time and improved content reusability, driving efficiency in marketing and enterprise communication strategies.

- For instance, Contentful reported handling 3.21 billion API delivery requests on Black Friday 2024, up from 2.31 billion in 2023, across its retail-category clients.

Growing Use of Automation and Workflow Orchestration

Automation tools are increasingly integrated into content service platforms to streamline document handling and approvals. Workflow orchestration enhances process visibility and reduces manual intervention. Organizations implement automation to improve content lifecycle management, from creation to archiving. The use of robotic process automation (RPA) and low-code integrations further accelerates digital transformation efforts, improving accuracy and compliance while minimizing operational delays.

Key Challenges

Data Privacy and Integration Complexity

Managing sensitive data across multiple systems presents significant challenges for enterprises. Integrating legacy infrastructure with modern content service platforms often causes compatibility and migration issues. Ensuring data privacy across different jurisdictions adds to complexity. Enterprises struggle to maintain uniform data protection policies while scaling across cloud and on-premises systems. Addressing these integration gaps and regulatory constraints remains crucial for smooth deployment and secure data operations.

High Implementation and Maintenance Costs

Although content service platforms provide long-term efficiency, high upfront investment and ongoing maintenance remain barriers. Small and medium-sized enterprises face financial constraints in adopting advanced content management solutions. The need for skilled professionals to manage customization, updates, and security further adds to costs. As the technology landscape evolves, vendors must offer flexible pricing models and simplified deployment frameworks to increase accessibility and adoption across diverse business sizes.

Regional Analysis

North America

North America leads the content service platforms market with about 37% share in 2024. The region’s dominance stems from strong adoption of cloud-based and AI-driven content management systems across industries such as BFSI, healthcare, and IT. Enterprises focus on improving regulatory compliance and data governance, driving investment in advanced content solutions. Major vendors including Microsoft, IBM, and OpenText have established strong regional presence, further enhancing innovation and scalability. The growing need for efficient digital workflows and hybrid work structures continues to strengthen demand in the United States and Canada.

Europe

Europe holds nearly 29% share of the content service platforms market in 2024. Strict data protection regulations such as GDPR have significantly boosted adoption across enterprises seeking secure document management. The region’s focus on digital transformation and government-led digitization initiatives enhances market growth. Industries like banking, public sector, and manufacturing increasingly rely on AI-based automation tools for compliance and content accessibility. Countries including Germany, the United Kingdom, and France are witnessing rising investments in hybrid deployment models, blending cloud flexibility with strong data privacy frameworks.

Asia Pacific

Asia Pacific accounts for around 23% share of the global content service platforms market in 2024. Rapid digitalization, expanding IT infrastructure, and growing cloud adoption among enterprises are driving growth. Organizations across India, China, Japan, and South Korea are investing in content automation and data analytics solutions to streamline operations. The presence of a large SME base adopting SaaS-based content management tools further accelerates market penetration. Government initiatives promoting paperless operations and digital documentation are also fueling adoption, particularly in sectors such as telecom, retail, and public administration.

Latin America

Latin America captures approximately 6% share in the content service platforms market in 2024. The region is witnessing gradual adoption of content management solutions as enterprises embrace cloud transformation and workflow digitization. Countries like Brazil and Mexico lead the regional demand, supported by the expansion of IT services and fintech sectors. Increasing focus on compliance, cost optimization, and remote work infrastructure drives investments. Local enterprises are partnering with global vendors to deploy scalable and secure content platforms tailored to regional business needs and evolving regulatory standards.

Middle East & Africa

The Middle East & Africa region represents about 5% share of the content service platforms market in 2024. Market growth is supported by rising digital government initiatives and enterprise modernization projects. Countries such as the United Arab Emirates and Saudi Arabia are at the forefront, adopting AI-enabled and cloud-based platforms for efficient document control. BFSI, energy, and public sectors are key contributors to demand, emphasizing secure data management. Increasing partnerships between regional enterprises and global content platform providers are expected to enhance adoption and drive digital transformation across the region.

Market Segmentations:

By Component

By Enterprise Size

- Small and Medium Sized Enterprises

- Large Size Enterprises

By Deployment

By End Use

- BFSI

- Government & Public Sector

- IT & Telecommunication

- Healthcare

- Retail & Consumer Goods

- Media & Entertainment

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the content service platforms market features major players such as Microsoft, Oracle, IBM Corporation, Adobe, Open Text Corporation, Hyland Software, Inc., Laserfiche, Box, M-Files, and Fabasoft International Services GmbH. Market competition is defined by rapid technological advancements, strategic partnerships, and increasing investments in AI-driven content automation. Companies focus on enhancing platform scalability, data integration, and analytics capabilities to improve workflow efficiency. Vendors are expanding cloud-based offerings to cater to hybrid work models and enterprise-wide digital transformation initiatives. Continuous innovation in data governance, compliance management, and workflow orchestration tools strengthens vendor positioning. The growing demand for secure and intelligent content management solutions is driving product differentiation strategies. Moreover, the focus on vertical-specific solutions and flexible subscription models supports long-term customer retention. Competitive intensity remains high as vendors emphasize interoperability, user experience, and automation to capture larger enterprise segments globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- Oracle

- IBM Corporation

- Adobe

- Open Text Corporation

- Hyland Software, Inc.

- Laserfiche

- Box

- M-Files

- Fabasoft International Services GmbH

Recent Developments

- In 2025, Microsoft Expanded SharePoint Advanced Management for stronger content governance and Copilot readiness

- In 2025, IBM Fusion delivered one of the industry’s first implementations of the NVIDIA AI Data Platform reference design, integrating NVIDIA RTX PRO GPUs and AI Enterprise software.

- In 2023, OpenText, in partnership with iCognition, launched ‘Ingress,’ an advanced content services platform leveraging OpenText Content Manager’s power to streamline content management within Microsoft 365 environments.

Report Coverage

The research report offers an in-depth analysis based on Component, Enterprise Size, Deployment, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as enterprises expand digital transformation initiatives.

- Cloud-based deployment will remain the preferred choice due to scalability and reduced maintenance.

- AI and machine learning will enhance content classification, analytics, and workflow automation.

- Integration with collaboration tools will drive wider adoption among hybrid and remote workforces.

- Data security and compliance-focused solutions will see higher demand across regulated industries.

- SMEs will increasingly adopt subscription-based content management systems for cost efficiency.

- Partnerships between technology vendors and system integrators will accelerate innovation.

- Industry-specific content solutions will emerge to meet sector-focused requirements.

- Expansion of Content-as-a-Service will create new revenue models for providers.

- Continuous investment in automation and analytics will shape the next phase of market maturity.