Market overview

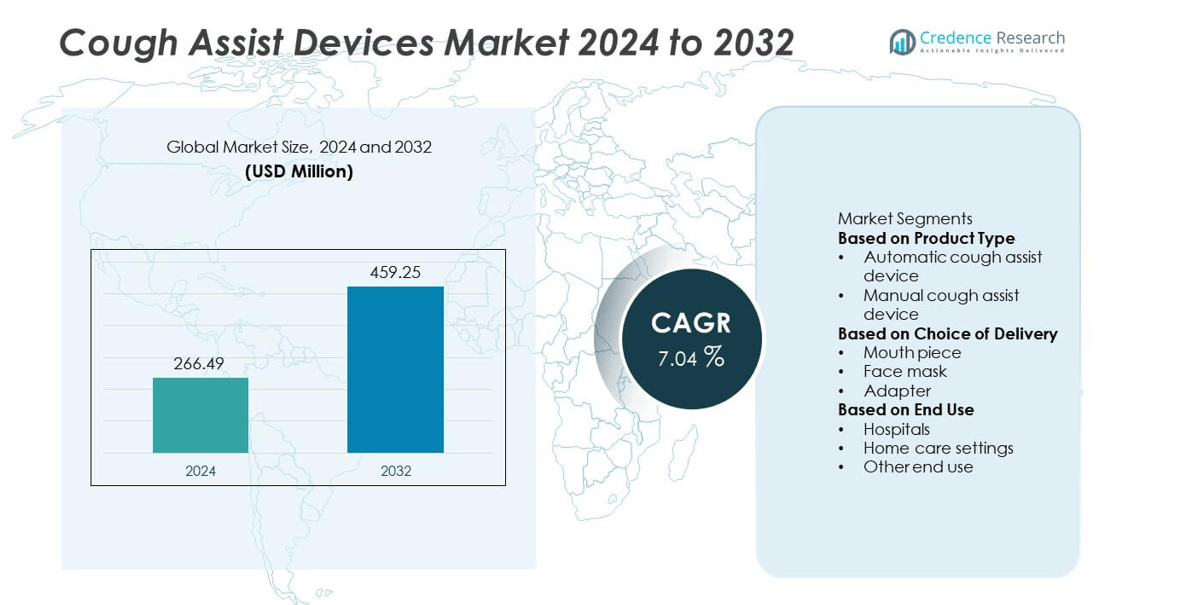

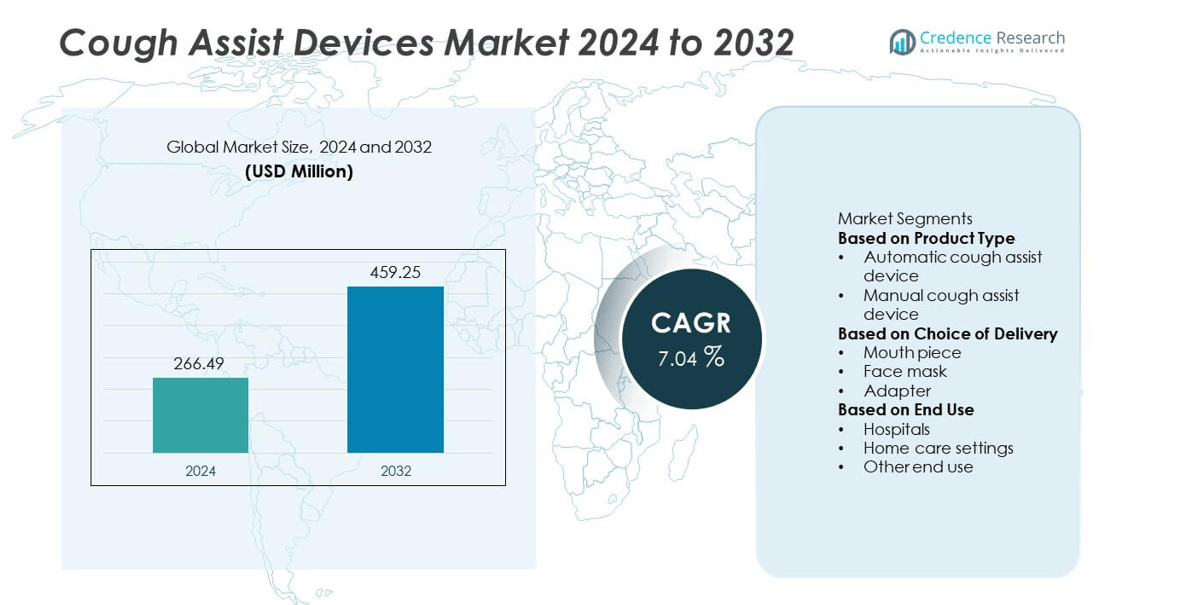

The Cough Assist Devices market was valued at USD 266.49 million in 2024 and is projected to reach USD 459.25 million by 2032, growing at a CAGR of 7.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cough Assist Devices Market Size 2024 |

USD 266.49 million |

| Cough Assist Devices Market, CAGR |

7.04% |

| Cough Assist Devices Market Size 2032 |

USD 459.25 million |

The cough assist devices market is led by key players such as Philips, ABM Respiratory Care, Smith’s Medical (ICU Medical), PARI, Breas Medical, Air Liquide Healthcare, Dima Italia, Physio Assist (Simeox), Baxter, and Seoil Pacific. These companies focus on developing advanced, user-friendly, and portable devices to support patients with chronic respiratory disorders. North America held the leading share of 38% in 2024, supported by strong healthcare infrastructure and growing awareness of non-invasive respiratory therapies. Europe followed with 31%, driven by increasing adoption in home care settings, while Asia-Pacific accounted for 25%, supported by expanding medical device accessibility and respiratory health initiatives.

Market Insights

- The cough assist devices market was valued at USD 266.49 million in 2024 and is projected to reach USD 459.25 million by 2032, growing at a CAGR of 7.04% during the forecast period.

- Rising cases of chronic respiratory disorders such as COPD, ALS, and muscular dystrophy are driving demand for both automatic and manual cough assist devices.

- Technological advancements in automatic devices with digital controls and portable designs are shaping market trends and enhancing patient compliance.

- The market is competitive, with key players focusing on innovation, ergonomic designs, and strategic partnerships to expand their global reach.

- North America holds 38%, Europe 31%, and Asia-Pacific 25% of the market share, while the automatic cough assist device segment dominates with 56% share, driven by its superior performance and efficiency in clinical and home care settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The automatic cough assist device segment dominated the cough assist devices market in 2024 with a 63% share. Its strong performance is driven by increasing preference for automated systems that provide consistent airflow cycles and adjustable pressure settings. These devices enhance patient comfort and reduce caregiver effort, making them suitable for individuals with neuromuscular disorders and chronic respiratory conditions. Rising awareness about non-invasive airway clearance and technological advancements, such as portable and programmable models, continue to drive adoption in hospitals and home care environments, strengthening the dominance of automatic devices in global sales.

- For instance, ABM Respiratory Care developed the BiWaze® Cough system equipped with dual pressure sensors that deliver inspiratory and expiratory pressures up to 70 cmH₂O. The device allows fully automated cough cycles with precise timing control of 0.5 to 3 seconds per phase and integrates a digital feedback loop to ensure consistent airway clearance across pediatric and adult patients.

By Choice of Delivery

The face mask segment held the largest share of 48% in 2024, supported by its widespread use for non-invasive airway clearance in both hospital and home settings. Face masks offer better sealing, improved pressure control, and ease of use compared to mouthpieces or adapters. Their suitability for patients across all age groups, including children and elderly individuals, contributes to their high preference. Increased integration of ergonomic and comfortable mask designs enhances patient compliance. The segment’s growth is further driven by rising demand for portable devices with customizable interface options to improve therapeutic efficiency.

- For instance, Philips Respironics designed the CoughAssist T70 with a full-face mask interface that maintains a pressure range of ±70 cmH₂O and airflow capacity exceeding 200 L/min. The mask incorporates a soft-seal silicone cushion to minimize air leakage and improve patient comfort during therapy, enabling efficient mucus clearance in both hospital and home-care applications.

By End Use

The hospital segment led the cough assist devices market in 2024 with a 52% share, reflecting the growing use of advanced respiratory support systems in clinical settings. Hospitals adopt these devices for managing patients with spinal cord injuries, muscular dystrophy, and post-surgical respiratory complications. The availability of trained healthcare professionals and integration of digital monitoring systems further support adoption. Additionally, hospital-based respiratory care programs and rising healthcare spending worldwide drive the segment’s growth. However, home care settings are gaining momentum due to increasing awareness of self-care and the shift toward non-hospital respiratory management.

Key Growth Drivers

Increasing Prevalence of Respiratory and Neuromuscular Disorders

Rising cases of chronic respiratory diseases and neuromuscular disorders such as muscular dystrophy, ALS, and spinal cord injuries are major drivers of the cough assist devices market. These conditions impair natural coughing ability, making airway clearance difficult. Cough assist devices provide effective mucus removal, preventing infections and improving patient outcomes. Growing awareness among healthcare professionals about early intervention and non-invasive ventilation therapies is accelerating device adoption. Expanding patient populations in both developed and emerging economies continue to strengthen market demand globally.

- For instance, Breas Medical introduced the Vivo 65 ventilator with inspiratory pressures up to 60 cmH₂O and a PEEP range of 2 to 30 cmH₂O. The device supports patients with neuromuscular diseases like ALS by offering a comprehensive set of ventilation modes, including Pressure and Volume modes, for invasive and non-invasive therapy. The Vivo 65 does not have an integrated cough assist mode.

Growing Adoption of Home-Based Healthcare Solutions

The increasing shift toward home healthcare is significantly driving the cough assist devices market. Patients with long-term respiratory conditions prefer portable and easy-to-use devices for daily management outside clinical environments. Technological advancements have enabled compact, battery-powered models suitable for self-administration. Rising healthcare costs and the need to reduce hospital readmissions encourage the adoption of home-based solutions. This trend supports greater independence for patients and improved continuity of care, contributing to sustained growth in the home respiratory therapy segment.

- For instance, Dima Italia developed the Pegaso E7 portable cough assist device, which weighs only 3.2 kg. It comes with a rechargeable internal battery that provides an average of 3 hours of continuous use. The device delivers adjustable positive and negative pressure cycles, up to 70 hPa (approximately ±70 cmH₂O), and has customizable inspiratory-expiratory timing. This allows patients to perform airway clearance effectively at home.

Technological Advancements in Airway Clearance Devices

Continuous innovation in cough assist technologies enhances device functionality, usability, and patient comfort. Modern systems now include digital pressure control, smart feedback mechanisms, and automated airflow adjustments for precise therapy delivery. Integration of telemonitoring features enables remote supervision by healthcare providers, improving treatment compliance. Manufacturers are focusing on lightweight, quiet, and customizable designs to support both clinical and home use. These advancements not only improve therapeutic efficiency but also broaden product accessibility across different patient populations and healthcare environments.

Key Trends and Opportunities

Integration of Digital and Remote Monitoring Capabilities

The incorporation of digital connectivity in cough assist devices is transforming respiratory care. Devices equipped with Bluetooth and cloud-based platforms allow remote tracking of usage data and therapy outcomes. This integration supports personalized treatment adjustments and enhances patient adherence. Healthcare providers benefit from real-time monitoring, improving clinical decision-making and reducing emergency visits. As telehealth adoption rises, demand for connected respiratory care devices is expected to surge, creating significant opportunities for innovation and service-based healthcare models.

- For instance, Philips Healthcare integrated its Care Orchestrator platform with connected respiratory devices, enabling automatic synchronization of therapy data from cough assist and ventilator systems. The platform collects and analyzes more than 1 million therapy sessions daily, allowing clinicians to remotely adjust settings such as pressure levels and cycle duration.

Growing Focus on Pediatric and Geriatric Patient Care

The rising number of pediatric and geriatric patients with respiratory complications presents strong growth opportunities. Children with congenital muscular disorders and older adults with chronic lung diseases require frequent airway clearance support. Manufacturers are developing gentler, ergonomically designed devices tailored to sensitive users. The growing emphasis on non-invasive, age-appropriate respiratory management further drives this segment. Enhanced awareness and improved access to specialized care programs contribute to the expanding use of cough assist devices among vulnerable age groups.

- For instance, PhysioAssist developed the Simeox® airway clearance system, using patented pneumatic vibratory technology operating at 12 Hz to mobilize mucus without forced pressure.

Key Challenges

High Cost and Limited Reimbursement Coverage

The high cost of advanced cough assist devices poses a significant challenge to market growth, especially in developing regions. Limited reimbursement support from healthcare systems restricts patient access, particularly for home-based users. Hospitals and clinics in cost-sensitive markets often rely on basic or manual devices. Although long-term benefits justify the expense, initial investment remains a barrier. Manufacturers are working to introduce affordable, durable options and partnering with insurers to expand reimbursement frameworks to improve accessibility and adoption rates.

Low Awareness and Underdiagnosis in Developing Regions

In several low- and middle-income countries, limited awareness of cough assist therapy and respiratory rehabilitation reduces adoption. Healthcare providers often lack training in using these devices, leading to underutilization despite medical need. Additionally, inadequate diagnostic infrastructure and low prioritization of non-invasive respiratory care hinder market penetration. Expanding educational initiatives, professional training, and government-supported respiratory care programs are essential to overcome this challenge and ensure equitable access to effective airway clearance technologies worldwide.

Regional Analysis

North America

North America held a 38% share of the cough assist devices market in 2024, driven by a high prevalence of respiratory and neuromuscular disorders. The United States dominates the region due to advanced healthcare infrastructure, strong reimbursement frameworks, and growing home care adoption. Continuous product innovations and the presence of key manufacturers strengthen regional growth. Increasing awareness of non-invasive ventilation therapies and early disease management further supports demand. Canada also contributes significantly through public health initiatives and expanding respiratory care programs focused on chronic obstructive pulmonary disease and muscular dystrophy management.

Europe

Europe accounted for a 29% share of the global cough assist devices market in 2024, supported by favorable healthcare policies and a strong focus on patient rehabilitation. The United Kingdom, Germany, and France are leading markets, emphasizing early diagnosis and home-based respiratory therapies. Expanding geriatric populations and government-led funding for neuromuscular disease treatment boost demand. The region’s robust regulatory framework ensures product quality and clinical efficacy. Growing adoption of portable, digitally connected devices and rising awareness about preventive respiratory care continue to drive market expansion across European healthcare systems.

Asia-Pacific

Asia-Pacific captured a 25% share of the cough assist devices market in 2024, emerging as the fastest-growing region. Rising incidence of chronic respiratory diseases and improving healthcare accessibility in China, Japan, and India are major growth drivers. The growing focus on home-based treatment and expansion of telemedicine platforms further enhance adoption. Regional manufacturers are investing in cost-effective and user-friendly devices to meet increasing patient demand. Government initiatives promoting respiratory health awareness and infrastructure modernization contribute to strong market growth, positioning Asia-Pacific as a key future hub for airway clearance technologies.

Latin America

Latin America accounted for a 5% share of the cough assist devices market in 2024, supported by rising healthcare investments and improved access to respiratory care. Brazil and Mexico lead the region due to growing prevalence of chronic lung and neuromuscular diseases. Increasing awareness about non-invasive airway management is promoting device utilization in hospitals and rehabilitation centers. However, limited reimbursement and high equipment costs hinder faster adoption. Expanding government healthcare programs and local distribution partnerships are expected to strengthen regional market development over the forecast period.

Middle East & Africa

The Middle East & Africa region held a 3% share of the global cough assist devices market in 2024, driven by growing respiratory disease burden and improving medical infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are increasing investments in advanced respiratory care technologies. Expanding critical care facilities and rising public health awareness are fueling adoption. Despite cost-related barriers and limited clinical expertise in some areas, ongoing initiatives to enhance healthcare accessibility and import of advanced medical equipment are expected to support steady market growth in the coming years.

Market Segmentations:

By Product Type

- Automatic cough assist device

- Manual cough assist device

By Choice of Delivery

- Mouth piece

- Face mask

- Adapter

By End Use

- Hospitals

- Home care settings

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

Competitive landscape analysis of the cough assist devices market highlights major players such as Philips, ABM Respiratory Care, Smith’s Medical (ICU Medical), PARI, Breas Medical, Air Liquide Healthcare, Dima Italia, Physio Assist (Simeox), Baxter, and Seoil Pacific. These companies focus on innovation, product efficiency, and improved patient comfort to strengthen their market position. Continuous advancements in automatic cough assist technology and digital integration, including smart monitoring systems, are enhancing treatment precision and home-based care convenience. Strategic collaborations with healthcare facilities and regional distributors are expanding global accessibility. Manufacturers are also investing in ergonomic designs and portable models to address the rising prevalence of chronic respiratory disorders. Increasing R&D activities and adherence to international medical safety standards continue to intensify competition across the industry, with leading firms prioritizing cost-effectiveness, user-friendly operation, and advanced airflow technology to capture growing demand from hospitals and home care settings worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Philips

- ABM Respiratory Care

- Smith’s Medical (ICU Medical)

- PARI

- Breas Medical

- Air Liquide Healthcare

- Dima Italia

- Physio Assist (Simeox)

- Baxter

- Seoil Pacific

Recent Developments

- In December 2024, Inogen Inc. received U.S. FDA 510(k) clearance for the SIMEOX 200 airway clearance device, designed to support effective treatment of patients with chronic respiratory diseases across the U.S.

- In September 2024, Baxter International launched its next-generation airway clearance system, the Vest Advanced Pulmonary Experience (APX) System, at the North American Cystic Fibrosis Conference, enhancing therapy for patients with chronic respiratory conditions.

- In February 2024, Philips officially removed the CoughAssist product line from its Sleep & Respiratory portfolio updates.

- In September 2023, Philips discontinued the CoughAssist T70 airway clearance device. Philips said it will continue servicing and supplying parts until October 1, 2028

Report Coverage

The research report offers an in-depth analysis based on Product Type, Choice of Delivery, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cough assist devices will rise with the growing prevalence of respiratory disorders.

- Adoption of automatic devices will expand due to improved comfort and efficiency.

- Integration of smart monitoring and digital interfaces will enhance remote patient management.

- Growth in home healthcare will drive demand for portable and user-friendly devices.

- Manufacturers will focus on ergonomic designs and cost-effective production.

- Partnerships between medical device firms and hospitals will improve distribution networks.

- Advancements in non-invasive ventilation technology will increase product effectiveness.

- Asia-Pacific will emerge as a key growth hub due to expanding healthcare infrastructure.

- Regulatory approvals and product standardization will support global market expansion.

- Rising awareness and early diagnosis of respiratory conditions will sustain long-term market growth.