Market Overview:

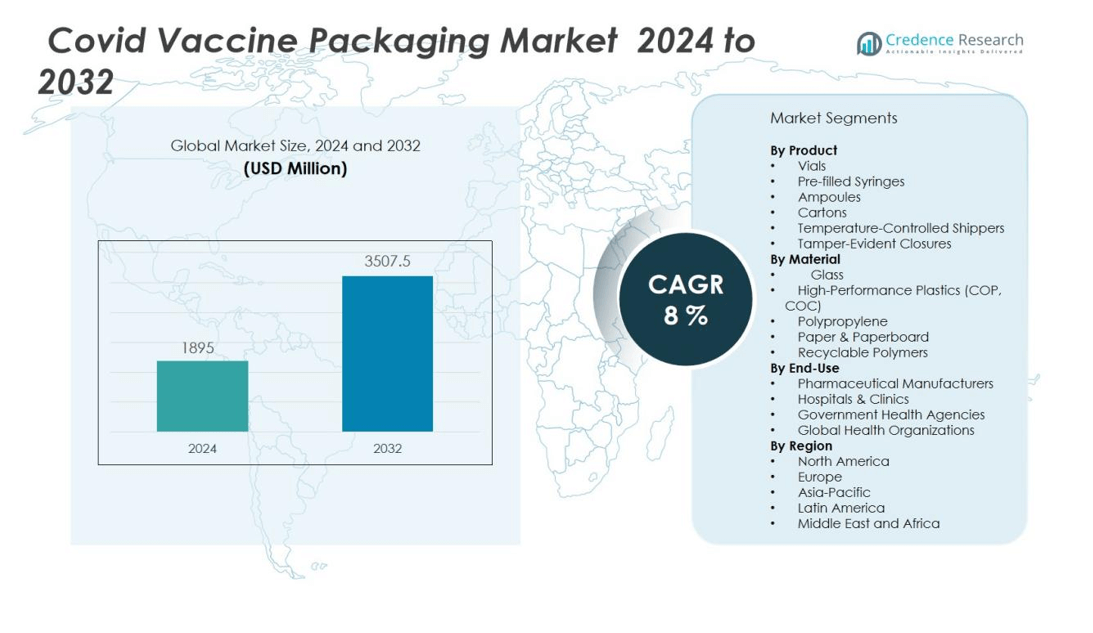

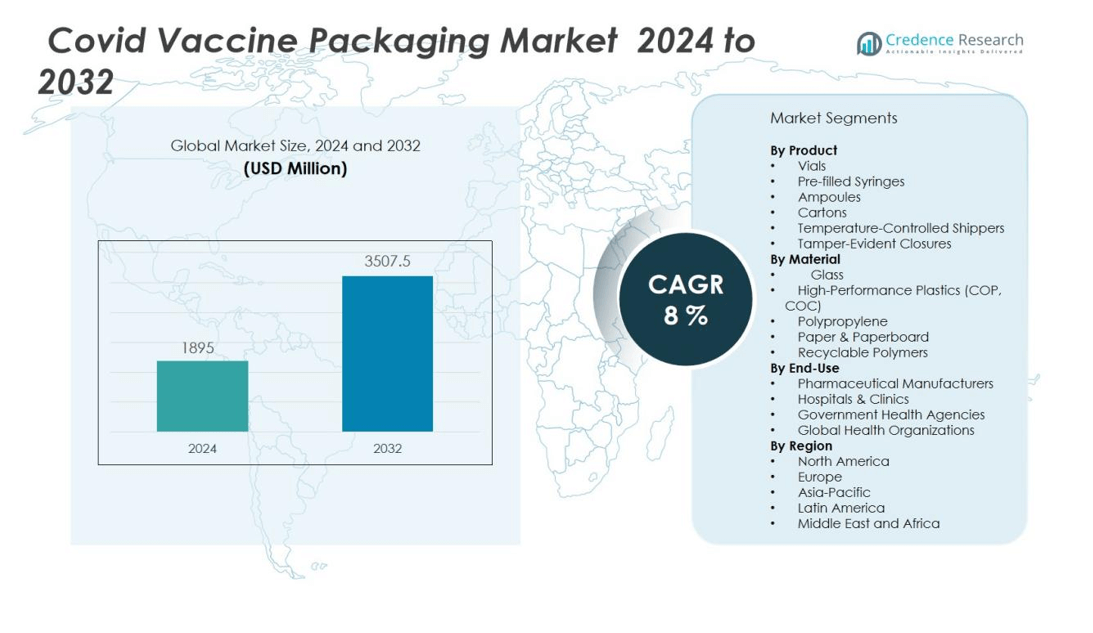

The Covid vaccine packaging market size was valued at USD 1895 million in 2024 and is anticipated to reach USD 3507.5 million by 2032, at a CAGR of 8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Covid Vaccine Packaging Market Size 2024 |

USD 1895 million |

| Covid Vaccine Packaging Market, CAGR |

8% |

| Covid Vaccine Packaging Market Size 2032 |

USD 3507.5 million |

Several key drivers fuel the expansion of the Covid vaccine packaging market. The ongoing need for booster shots and new vaccine variants increases shipment volumes, supporting consistent demand for reliable and compliant packaging. Manufacturers focus on advanced barrier materials, leak-proof closures, and anti-counterfeiting features to ensure product integrity and traceability throughout the supply chain. Regulatory guidelines issued by global agencies such as the WHO and FDA reinforce stringent quality standards for vaccine packaging, accelerating the adoption of specialized technologies. Sustainability initiatives also shape product development, as companies invest in recyclable and lightweight materials that align with circular economy goals without compromising safety or efficacy.

Regional analysis highlights North America as the leading market, supported by robust pharmaceutical manufacturing, advanced healthcare infrastructure, extensive government vaccination programs, and the strong presence of key players such as Aptar Group, Amcor, and Becton Dickinson. Europe follows closely, benefiting from strong regulatory oversight, a well-established cold chain network, and leading packaging firms including Gerresheimer and Aseptic. Asia Pacific demonstrates the fastest growth, driven by large-scale immunization efforts, expanding pharmaceutical production in countries like China and India, increasing investments in healthcare logistics, and a growing role for companies like Fengchen Group. Latin America and the Middle East & Africa represent emerging markets, where ongoing vaccination drives and improving healthcare infrastructure support future expansion of the Covid vaccine packaging sector.

Market Insights:

- The Covid vaccine packaging market is valued at USD 1,895 million in 2024 and is projected to reach USD 3,507.5 million by 2032.

- Booster shots and new vaccine variants continue to drive consistent demand for reliable, compliant packaging solutions.

- Manufacturers invest in barrier materials, leak-proof closures, and anti-counterfeiting features to protect vaccine integrity.

- Regulatory guidance from the WHO and FDA prompts rapid adoption of specialized and quality-certified packaging technologies.

- Sustainability initiatives push companies to develop lightweight, recyclable, and bio-based materials for packaging.

- North America leads with a 36% share, backed by robust manufacturing, advanced infrastructure, and key players like Aptar Group, Amcor, and Becton Dickinson.

- Asia Pacific shows the fastest growth, propelled by large-scale immunization, expanded pharmaceutical production, and increased investment in healthcare logistics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Specialized Packaging Solutions to Ensure Vaccine Integrity:

The Covid vaccine packaging market gains momentum from the urgent need to maintain vaccine efficacy throughout distribution. Complex formulations, including mRNA and viral vector vaccines, require temperature-sensitive storage and transport, prompting manufacturers to innovate with barrier-resistant materials and leak-proof closures. Companies deploy advanced cold chain packaging, such as insulated shippers and gel packs, to preserve product stability during long-distance shipments. Tamper-evident designs and serialization features further strengthen supply chain security. These technical requirements elevate the demand for precision-engineered primary and secondary packaging formats across the industry. Pharmaceutical firms and logistics providers continue to prioritize investments in packaging technologies that safeguard product integrity at every stage.

- For instance, Tower Cold Chain reports that in over 15,000 vaccine shipments, fewer than 0.1% experienced temperature excursions, highlighting the effectiveness of their passive temperature-controlled containers in maintaining stability for sensitive products like Covid-19 vaccines.

Stringent Regulatory Frameworks and Global Compliance Standards:

Strict regulatory mandates imposed by agencies such as the WHO, FDA, and EMA fuel adoption of compliant packaging formats. The Covid vaccine packaging market adapts rapidly to evolving guidelines, which mandate rigorous quality testing, traceability, and anti-counterfeiting features. Compliance with Good Manufacturing Practices (GMP) and serialization requirements ensures product authenticity and safety throughout global supply chains. Companies invest in quality management systems and automated inspection technologies to align with these regulations. The ongoing update of pharmacovigilance standards further supports market expansion, compelling packaging providers to remain agile and proactive. Regulatory-driven product innovation enhances consumer trust and facilitates broader vaccine access.

Continuous Investment in Cold Chain Infrastructure and Logistics:

The success of vaccination campaigns relies on robust cold chain infrastructure capable of supporting mass immunization. The Covid vaccine packaging market benefits from increased investment in refrigerated transport, temperature-monitoring systems, and data loggers. Logistics providers expand their fleets and warehousing capabilities to accommodate surging demand for temperature-controlled storage. Real-time monitoring of thermal conditions ensures vaccine potency, while smart packaging technologies provide instant alerts on temperature deviations. Stakeholders collaborate with packaging engineers to design solutions that meet evolving distribution needs. These efforts collectively reinforce the reliability and resilience of global vaccine supply chains.

- For instance, AKCP’s wireless temperature sensors, calibrated to NIST standards, provide real-time temperature monitoring for vaccine shipments, tracking every vial and issuing immediate alerts if temperatures deviate outside the safe 2°C to 8°C range, minimizing vaccine loss during transit.

Accelerating Shift Toward Sustainable and Recyclable Packaging Materials:

Growing environmental awareness shapes material innovation in the Covid vaccine packaging market. Companies prioritize the development of lightweight, recyclable, and bio-based packaging solutions that align with global sustainability goals. Research into advanced polymers, paper-based laminates, and reusable containers drives the transition away from single-use plastics. Initiatives focused on reducing packaging waste gain traction among major manufacturers and healthcare providers. Life cycle assessments and eco-label certifications help validate the environmental performance of new products. Market players recognize that sustainable packaging not only supports regulatory compliance but also strengthens corporate reputation in a competitive landscape.

Market Trends:

Integration of Smart Packaging and Digital Traceability Technologies:

Rapid digitalization shapes the Covid vaccine packaging market by driving the adoption of smart packaging solutions. Companies integrate temperature sensors, RFID tags, and QR codes into primary and secondary packaging formats to enable real-time monitoring and traceability. These technologies allow supply chain stakeholders to track shipments, authenticate products, and respond swiftly to temperature excursions or potential tampering. Regulatory agencies support the shift toward digital traceability to enhance transparency and minimize the risk of counterfeiting. Automation in packaging processes further increases production efficiency and consistency. It strengthens end-to-end visibility and reinforces consumer confidence in vaccine safety.

Emphasis on Customization and Flexible Packaging Formats for Diverse Vaccine Types:

Evolving vaccine formulations prompt the Covid vaccine packaging market to emphasize customization and flexibility in packaging design. Manufacturers develop adaptable packaging systems for mRNA, viral vector, and protein subunit vaccines, each with unique storage and handling requirements. Modular cold chain packaging and unit-dose containers allow pharmaceutical companies to scale distribution for both mass immunization and targeted booster campaigns. Lightweight and space-saving materials reduce transportation costs while supporting regulatory compliance. It encourages manufacturers to invest in versatile equipment and rapid-changeover production lines. Strategic collaboration between packaging providers and vaccine producers accelerates the development of tailor-made solutions for evolving public health needs.

- For instance, Jurata Thin Film MSI-TX Thin Film technology allows up to 500 vaccine doses to be packed on a single 8.5×11 in. sheet weighing just 5g, enabling transport and storage at room temperature and reducing vaccine packaging volume by over 99% compared to traditional vials—streamlining logistics for manufacturers scaling worldwide distribution.

Market Challenges Analysis:

Supply Chain Constraints and Shortages of Raw Materials:

The Covid vaccine packaging market faces persistent challenges related to global supply chain disruptions and limited availability of critical raw materials. High demand for glass vials, specialized polymers, and barrier films strains manufacturing capacity, often causing production delays and higher procurement costs. Logistics bottlenecks further complicate the timely delivery of packaging components, especially during periods of pandemic-driven transportation restrictions. It requires companies to diversify sourcing strategies and invest in local supply networks to mitigate risks. Quality assurance becomes more difficult when switching between material suppliers. These pressures threaten the continuity of vaccine distribution efforts and impact market stability.

Complex Regulatory Compliance and Escalating Cost Pressures:

Evolving international regulations present a significant hurdle for the Covid vaccine packaging market. Companies must continuously adapt to new compliance standards, serialization mandates, and anti-counterfeiting requirements set by global health authorities. The complexity and frequency of these regulatory updates increase operational costs and extend product development timelines. It challenges packaging manufacturers to invest in advanced inspection and documentation systems. Navigating the diverse requirements of different regions further intensifies administrative burdens. These factors create barriers for market entry and limit the ability of smaller firms to compete effectively.

Market Opportunities:

Expansion into Emerging Markets and Public-Private Partnerships:

Growing immunization programs in emerging markets present significant opportunities for the Covid vaccine packaging market. Governments in Asia Pacific, Latin America, and Africa continue to scale up vaccination efforts, fueling demand for reliable cold chain and secure packaging solutions. Companies benefit from forming strategic public-private partnerships to accelerate technology transfer and localize production. It enables faster response to regional requirements and reduces dependency on global supply chains. These collaborations support capacity-building and facilitate broader vaccine access. Manufacturers that invest in regional presence and tailored solutions stand to capture long-term growth.

Innovation in Sustainable and High-Performance Packaging Solutions:

Rising demand for eco-friendly materials drives innovation within the Covid vaccine packaging market. Companies focus on developing lightweight, recyclable, and biodegradable packaging that meets both environmental and regulatory expectations. Research in advanced barrier films and reusable containers unlocks new commercial opportunities for product differentiation. It helps manufacturers align with global sustainability initiatives while maintaining product integrity. Early adoption of green technologies enhances corporate reputation and appeals to environmentally conscious buyers. Market players leveraging sustainability as a value proposition can strengthen competitiveness in a rapidly evolving landscape.

Market Segmentation Analysis:

By Product:

The Covid vaccine packaging market features a diverse product landscape that addresses the critical demands of vaccine preservation and distribution. Vials remain the dominant segment due to their widespread use for multi-dose and single-dose formulations, offering compatibility with various filling technologies. Pre-filled syringes gain traction as pharmaceutical companies prioritize ease of administration and reduced contamination risk in clinical settings. Ampoules, cartons, and secondary packaging components provide secure containment and efficient bulk handling. The market responds to evolving vaccine platforms by offering specialized kits, tamper-evident closures, and temperature-controlled shippers.

- For instance, SCHOTT’s adaptiQ® platform offers more than 750 combinations of ready-to-use glass vials, pre-washed and pre-sterilized, and the company is tripling its U.S. production capacity to meet the growing demand for high-quality pharmaceutical vials.

By Material:

Material selection shapes product performance and regulatory compliance in the Covid vaccine packaging market. Glass leads as the preferred material for vials and ampoules, valued for its chemical resistance and inert properties. High-performance plastics, such as cyclic olefin polymer (COP) and cyclic olefin copolymer (COC), expand usage in pre-filled syringes and specialized containers, enabling design flexibility and breakage resistance. The market advances eco-friendly solutions by integrating recyclable polymers and lightweight secondary materials that support cold chain logistics without compromising safety.

- For instance, Corning Valor® Glass vials offer at least 30× greater protection against cracks compared to conventional borosilicate vials and can boost filling line efficiency by up to 50 Percent, while also reducing glass particulate generation on commercial lines by 92%.

By End-Use:

Pharmaceutical manufacturers represent the largest end-use segment in the Covid vaccine packaging market, driving large-scale procurement for mass immunization campaigns. Hospitals and clinics rely on ready-to-administer packaging formats that streamline handling and reduce error risk. Government health agencies and global organizations contribute through strategic stockpiling, distribution, and vaccination programs. The market adapts to end-user needs by offering scalable, compliant, and secure packaging solutions tailored to each stakeholder’s operational requirements.

Segmentations:

By Product:

- Vials

- Pre-filled Syringes

- Ampoules

- Cartons

- Temperature-Controlled Shippers

- Tamper-Evident Closures

By Material:

- Glass

- High-Performance Plastics (COP, COC)

- Polypropylene

- Paper & Paperboard

- Recyclable Polymers

By End-Use:

- Pharmaceutical Manufacturers

- Hospitals & Clinics

- Government Health Agencies

- Global Health Organizations

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 36% share in the Covid vaccine packaging market, reflecting its established pharmaceutical sector and advanced healthcare infrastructure. Leading packaging manufacturers operate extensive production facilities in the United States and Canada, supporting high-volume vaccine rollout initiatives. Strong regulatory oversight from agencies such as the FDA drives consistent adoption of compliant and innovative packaging formats. The region’s well-developed cold chain logistics networks enable efficient storage and distribution, maintaining vaccine integrity across diverse climates. Investment in digital traceability technologies and automated packaging solutions enhances supply chain resilience. The market benefits from strong public and private sector collaboration focused on mass immunization programs.

Europe:

Europe accounts for 28% share in the Covid vaccine packaging market, anchored by its robust regulatory environment and mature pharmaceutical industry. Countries such as Germany, France, and the United Kingdom lead in both vaccine production and packaging technology adoption. Strict compliance with EMA guidelines ensures widespread use of tamper-evident and anti-counterfeit features across packaging formats. Regional initiatives to strengthen cold chain infrastructure support effective cross-border distribution and storage. Sustainability regulations accelerate the shift toward recyclable and low-impact materials, driving product innovation. The market’s growth is reinforced by strategic partnerships between packaging firms and government health agencies.

Asia Pacific :

Asia Pacific represents 22% share in the Covid vaccine packaging market and demonstrates the fastest growth trajectory among all regions. Rapid vaccine production and distribution initiatives in China, India, and Southeast Asia stimulate demand for both primary and secondary packaging solutions. Expansion of domestic pharmaceutical capacity and investment in advanced packaging technologies bolster regional competitiveness. Governments in the region prioritize infrastructure improvements and digital monitoring for efficient cold chain management. Collaboration with global packaging leaders supports technology transfer and local expertise development. It positions Asia Pacific as a key contributor to the future growth of the vaccine packaging industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aptar Group

- Amcor

- Aseptic

- Fengchen Group

- Gerresheimer

- Becton Dickinson

- CSafe

- Blowkings

- Corning

- DWK Life Sciences

Competitive Analysis:

The Covid vaccine packaging market features a competitive landscape shaped by innovation, global reach, and strict regulatory compliance. Leading players such as Aptar Group, Amcor, Aseptic, Fengchen Group, Gerresheimer, and Becton Dickinson control substantial shares through advanced manufacturing capabilities and diversified product portfolios. The market rewards companies that deliver tamper-evident, temperature-stable, and sustainable packaging solutions tailored for mass immunization. It sees strong investment in digital traceability technologies and automation to support high-volume vaccine distribution. Strategic partnerships with pharmaceutical firms and public health organizations enable rapid scaling and global deployment. The emphasis on reliability, safety, and operational efficiency drives continuous product development and differentiation among key competitors.

Recent Developments:

- In May 2025, Aptar Group introduced the Derma Series, a curated range of dispensing solutions specifically addressing dermatological market needs.

- In March 2025, Amcor launched the industry-first 2oz retort bottle, featuring StormPanel™ technology, in partnership with Insymmetry® for shelf-stable nutritional shots.

- In April 2025, PCI Pharma Services announced the acquisition of US-based aseptic fill-finish CDMO Ajinomoto Althea, expanding its manufacturing footprint; the deal is scheduled for completion in May 2025.

Market Concentration & Characteristics:

The Covid vaccine packaging market demonstrates a moderate to high level of concentration, with a few global companies controlling a significant share of supply. Leading players include established pharmaceutical packaging firms with extensive manufacturing capabilities, regulatory compliance expertise, and strong distribution networks. The market is characterized by rapid innovation, stringent quality standards, and a critical emphasis on cold chain management. It attracts investments in smart packaging technologies and sustainable materials to address evolving regulatory and customer requirements. Competitive dynamics focus on product reliability, anti-counterfeiting features, and the ability to scale for large-volume vaccine campaigns. The market’s structure supports robust collaborations between packaging providers, pharmaceutical companies, and government health agencies.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Market evolves steadily through ongoing adoption of digital traceability tools like RFID tags and temperature sensors to enhance supply chain visibility.

- Packaging firms invest in smart, sensor-integrated designs that monitor thermal conditions and signal deviation during transit.

- Material innovation shifts toward eco‑friendly alternatives, including biodegradable barrier films and recyclable containers to support sustainability goals.

- Customized packaging systems emerge to support diverse vaccine types, including single‑dose formats and modular vial assemblies.

- Automation accelerates in packaging lines to improve throughput, maintain consistent quality, and reduce manual error risk.

- Regional expansion expands in emerging markets through localized manufacturing and public‑private partnerships enabling faster access.

- Demand for tamper‑evident closures and serialization strengthens to prevent counterfeiting and reinforce regulatory compliance.

- Cold chain logistics integrate real‑time temperature monitoring and data‑logging solutions to preserve vaccine efficacy during distribution.

- Collaborative innovation between packaging providers and vaccine manufacturers accelerates technology transfer and rapid deployment.

- Market players focus on flexible, scalable production platforms that support rapid changeovers between vaccine variants and batches.