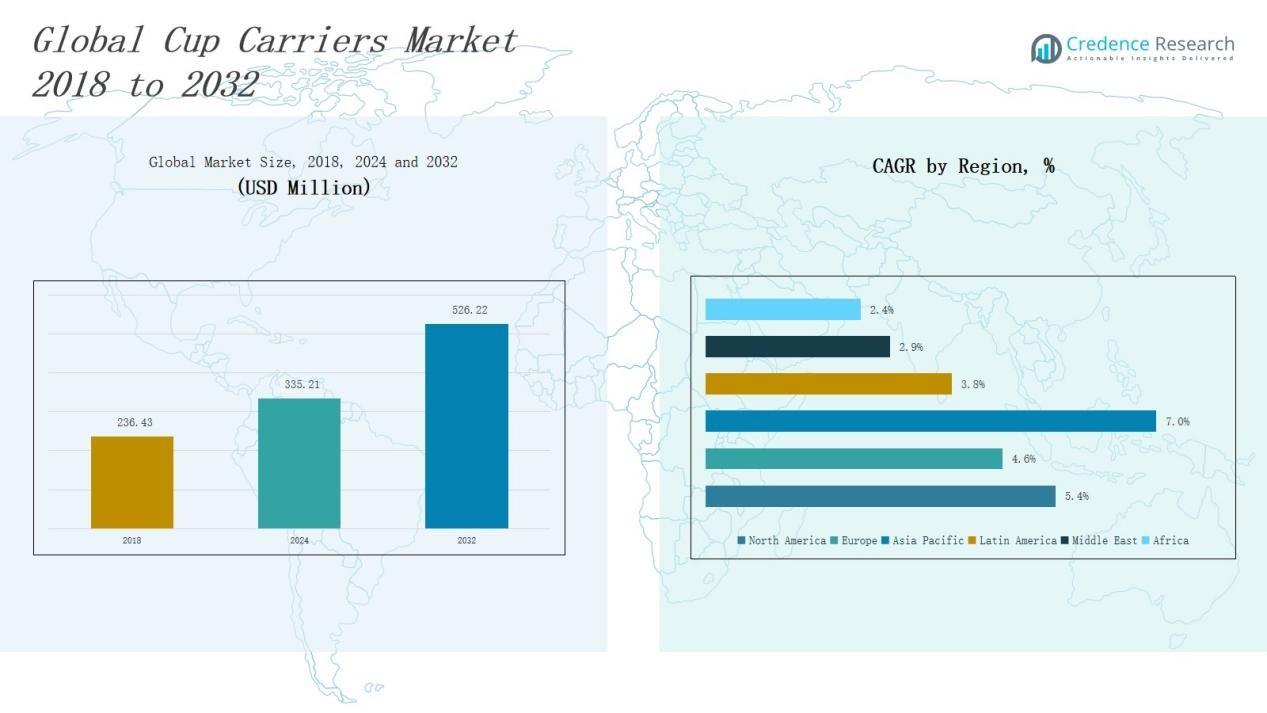

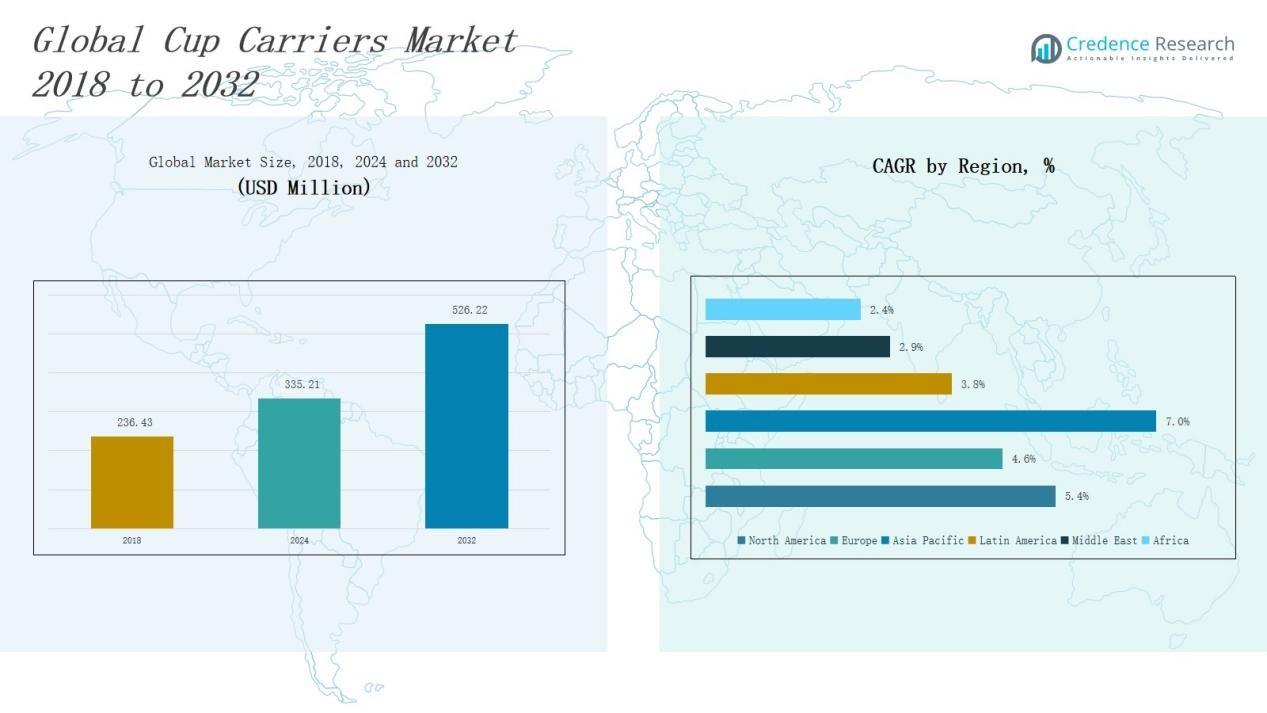

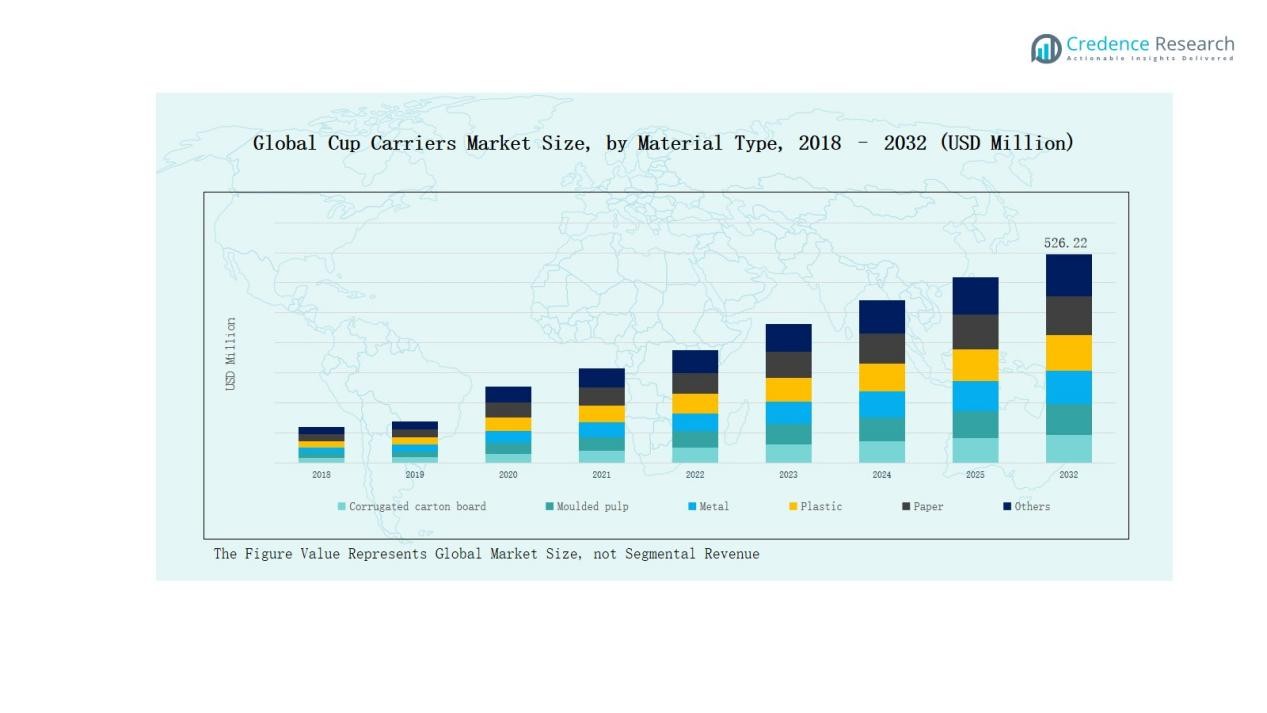

Cup Carriers Market size was valued at USD 236.43 million in 2018 to USD 335.21 million in 2024 and is anticipated to reach USD 526.22 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cup Carriers Market Size 2024 |

USD 335.21 Million |

| Cup Carriers Market, CAGR |

5.40% |

| Cup Carriers Market Size 2032 |

USD 526.22 Million |

The Cup Carriers Market is shaped by global leaders such as Huhtamaki Oyj, WestRock Company, Stora Enso Oyj, International Paper Company, Graphic Packaging International, Pactiv Evergreen Inc., Sabert Corporation, and Detpak (Detmold Group). These companies focus on sustainable innovations, recyclable materials, and strategic partnerships with quick-service restaurants, coffee chains, and retail distributors to strengthen their positions. North America emerged as the leading regional market in 2024, accounting for 34% of the global share, driven by strong coffee culture, widespread quick-service restaurant presence, and growing adoption of eco-friendly packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cup Carriers Market grew from USD 236.43 million in 2018 to USD 335.21 million in 2024 and is forecasted to reach USD 526.22 million by 2032.

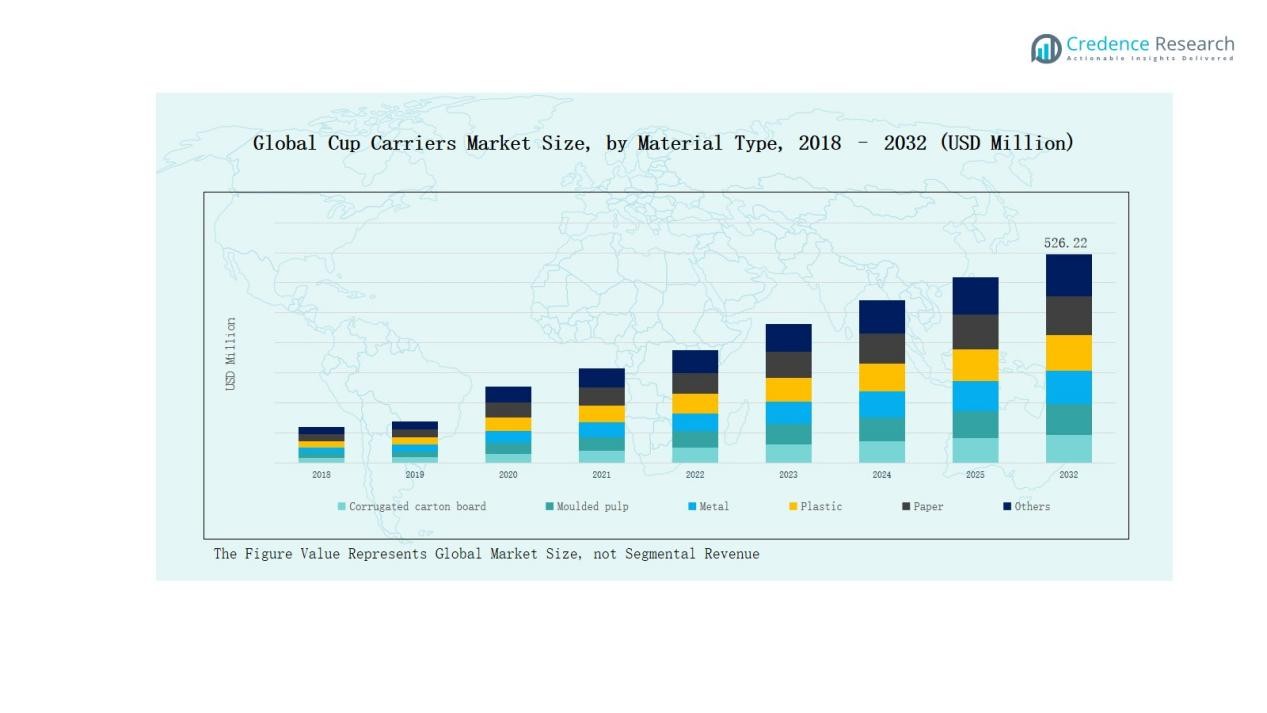

- Corrugated carton board led material types with 34% share in 2024, while moulded pulp held 28%, supported by rising demand for eco-friendly and compostable packaging solutions.

- The food and beverage industry dominated end-use with 41% share in 2024, followed by food outlets at 29%, reflecting the global trend of increasing takeaway and quick-service consumption.

- North America commanded the largest regional share at 34% in 2024, valued at USD 141.73 million, driven by coffee culture, QSR expansion, and eco-friendly packaging adoption.

- Europe accounted for 22% share, Asia Pacific 17%, Latin America 4%, Middle East 2%, and Africa 1% in 2024, highlighting clear regional demand disparities.

Market Segment Insights

By Material Type

Corrugated carton board leads the material type segment, holding around 34% share in 2024. Its dominance stems from strong demand in quick-service restaurants and beverage outlets, driven by sturdiness, recyclability, and cost efficiency. Moulded pulp follows with 28% share, supported by the rising focus on eco-friendly and compostable packaging solutions. Plastic accounts for 18% share, largely used in institutional and retail settings requiring durability. Paper holds 12% share, popular for lightweight and single-serve carriers in cafés. Metal and other niche materials collectively contribute 8%, serving premium and reusable carrier applications.

- For instance, Starbucks adopted molded fiber cup carriers in the U.S. to reduce single-use plastic, and Huhtamaki supplies molded pulp egg and drink trays globally, with plants producing over 3 billion fiber packages annually.

By End Use

The food and beverage industry dominates the end-use segment with nearly 41% share in 2024. Growth is fueled by rising coffee and takeaway beverage consumption across urban centers, alongside stricter sustainability guidelines that favor recyclable carriers. Food outlets, including QSRs and cafés, capture 29% share, supported by the surge in on-the-go lifestyles and strong demand for disposable carriers. Institutions hold 14% share, relying on durable and bulk-serving solutions for canteens and offices. Retail contributes 11% share, where supermarkets and convenience stores offer carriers for multipack beverages. Other applications, including events and travel services, represent the remaining 5%, adding incremental opportunities.

- For instance, McDonald’s UK rolled out fiber-based cup carriers in partnership with Huhtamaki, aiming to eliminate unrecyclable holders from its supply chai

Key Growth Drivers

Rising Consumption of On-the-Go Beverages

The increasing consumption of coffee, tea, and soft drinks is a key growth driver for the cup carriers market. Busy urban lifestyles and the popularity of takeaway beverages continue to expand demand, especially across quick-service restaurants and cafés. Beverage chains are adopting durable, convenient, and multi-cup carriers to enhance customer experience. This trend strengthens market penetration in developed regions and fuels adoption in emerging economies where disposable packaging and convenience-based dining are gaining momentum.

- For instance, McCafé uses molded fiber cup carriers for hot and cold beverages to provide spill protection and convenience for customers.

Shift Toward Sustainable Packaging Solutions

Sustainability concerns significantly drive demand for eco-friendly cup carriers made from moulded pulp, paper, and corrugated carton board. Governments and regulators impose restrictions on single-use plastics, encouraging widespread adoption of recyclable and compostable alternatives. Brands increasingly position themselves as environmentally responsible by offering biodegradable carrier solutions. This transition not only addresses consumer expectations but also reduces the environmental footprint of the food service industry. Consequently, the shift toward sustainable packaging provides long-term growth momentum for eco-conscious materials.

- For instance, Thermo Packers offers molded pulp-fiber cup carriers made in India from recycled materials that are fully compostable, designed to hold up to four beverage cups without assembly.

Expansion of Food Service and Retail Sectors

The rapid expansion of food outlets, cafés, and supermarkets directly supports cup carrier demand worldwide. Quick-service restaurants and coffee chains increasingly rely on carriers to accommodate rising delivery and takeaway orders. Retailers offer multi-pack beverage solutions where carriers enhance convenience and product safety. Growing institutional catering in schools, offices, and hospitals also boosts market growth. This expansion, coupled with digital food delivery platforms, accelerates the adoption of disposable carriers across both organized and unorganized food service sectors.

Key Trends & Opportunities

Technological Advancements in Packaging Design

Innovations in lightweight design, ergonomic handling, and improved strength drive new opportunities in the cup carriers market. Manufacturers are introducing carriers with smart folding mechanisms, higher cup capacity, and enhanced grip for consumer convenience. Such designs not only improve functionality but also reduce material usage, aligning with sustainability goals. Advanced digital printing technologies allow custom branding, giving businesses a marketing edge. This design-driven differentiation creates strong opportunities for suppliers catering to competitive retail and food service channels.

- For instance, Huhtamaki launched cup carriers made from molded fiber derived from recycled paper, cutting plastic use and meeting foodservice brands’ eco-targets.

Growth of E-Commerce and Delivery Services

The boom in online food delivery and e-commerce platforms creates strong opportunities for cup carrier adoption. Delivery-oriented packaging solutions require carriers that ensure spill-free, safe transportation of beverages. Food aggregators and beverage retailers increasingly adopt carriers designed for durability and branding. With consumer preference shifting toward doorstep delivery, demand for disposable and sustainable cup carriers is projected to rise steadily. This trend is particularly prominent in Asia Pacific, where rapid digital adoption strengthens the market outlook.

- For instance, Novolex acquired Pactiv Evergreen, expanding its sustainable beverage packaging solutions, including biodegradable and customizable cup carriers, for foodservice clients.

Key Challenges

Environmental Regulations on Plastic Usage

Stringent government regulations restricting single-use plastic products pose a challenge for market players. Plastic cup carriers, valued for durability, face declining acceptance in developed regions due to bans and sustainability laws. Manufacturers must transition to eco-friendly materials while balancing cost and performance. Non-compliance risks fines, brand damage, and loss of contracts with environmentally conscious clients. The regulatory push against plastic creates operational and investment challenges, requiring businesses to adopt new production processes and materials.

Fluctuating Raw Material Prices

Volatile prices of raw materials such as paper, pulp, and corrugated board directly affect production costs. Frequent fluctuations in global supply chains increase uncertainty for manufacturers, reducing profit margins and affecting pricing strategies. Small and medium-sized suppliers face greater difficulty in absorbing cost spikes compared to larger firms with diversified procurement networks. These variations also influence customer purchasing decisions, as higher costs may shift demand toward alternative materials or suppliers offering lower-cost solutions.

Competition and Margin Pressure

The cup carriers market faces intense competition from global packaging giants and regional players. Price wars in developing markets and customer demand for cost-efficient solutions put pressure on profit margins. Smaller manufacturers struggle to differentiate themselves in a fragmented market, often relying on commoditized designs with limited innovation. Additionally, high-volume buyers such as quick-service chains exert strong bargaining power, further challenging supplier profitability. This competitive environment pushes companies to balance affordability, quality, and innovation.

Regional Analysis

North America

North America dominates the global cup carriers market with a 34% share in 2024, valued at USD 141.73 million. The region is projected to grow at a 5.4% CAGR, reaching USD 223.12 million by 2032. Strong coffee culture in the U.S., the proliferation of quick-service restaurants, and expanding food delivery services drive demand. Eco-friendly packaging adoption further strengthens growth as regulations limit single-use plastics. Large-scale retail chains and institutional catering also contribute significantly, positioning North America as the leading market with continued innovation in sustainable solutions.

Europe

Europe holds the second-largest position with a 22% share in 2024, valued at USD 92.56 million. The market is expected to expand at a 4.6% CAGR, reaching USD 136.88 million by 2032. Rising demand for sustainable and recyclable carriers, coupled with strict EU regulations on plastic usage, drives adoption of paper and moulded pulp solutions. Food outlets, cafés, and retail beverage packaging remain key growth contributors. Germany, the UK, and France lead consumption, supported by strong institutional catering services. Growing preference for branded and customizable carriers also enhances demand across regional food service chains.

Asia Pacific

Asia Pacific is the fastest-growing regional market, capturing a 17% share in 2024, valued at USD 71.60 million. It is forecast to grow at a 7.0% CAGR, reaching USD 126.94 million by 2032. Expanding urban populations, rising disposable incomes, and rapid digital adoption in food delivery drive significant growth. China and India lead the region, while Japan, South Korea, and Southeast Asia add strong support. Sustainability initiatives push adoption of moulded pulp and paper carriers, while multinational coffee and QSR brands increase penetration. Asia Pacific’s strong growth trajectory positions it as a key future market hub.

Latin America

Latin America accounts for a 4% share in 2024, valued at USD 15.93 million. The region is set to expand at a 3.8% CAGR, reaching USD 22.19 million by 2032. Rising adoption of disposable packaging in food service and retail drives demand. Brazil and Mexico dominate consumption, supported by the growth of coffee culture and quick-service outlets. Local regulations promoting recyclable packaging encourage gradual transitions from plastic to paper-based solutions. While growth is moderate compared to Asia Pacific, increasing beverage retail chains and rising urbanization strengthen Latin America’s role in the global market.

Middle East

The Middle East represents a 2% share in 2024, valued at USD 7.65 million, with an anticipated 2.9% CAGR, reaching USD 9.91 million by 2032. Growth is supported by expanding retail networks, institutional catering, and the rising presence of international coffee chains. The Gulf Cooperation Council (GCC) countries dominate, driven by hospitality and tourism-led food service demand. However, limited regulatory push for sustainable packaging slows adoption compared to Europe and North America. Increasing investments in eco-friendly alternatives present future opportunities, particularly as consumer awareness of environmental issues gradually increases.

Africa

Africa holds the smallest share with 1% in 2024, valued at USD 5.74 million. The market is expected to grow at a 2.4% CAGR, reaching USD 7.18 million by 2032. Growth is primarily driven by rising urban populations and gradual expansion of retail and food service industries in South Africa, Nigeria, and Kenya. However, limited affordability and infrastructure challenges restrain broader adoption. Plastic carriers still dominate due to low cost, though paper and moulded pulp adoption is slowly increasing in urban areas. Africa remains an emerging but low-volume market with long-term potential for sustainable packaging solutions.

Market Segmentations:

By Material Type

- Corrugated carton board

- Moulded pulp

- Metal

- Plastic

- Paper

- Others

By End Use

- Food & Beverage Industry

- Food Outlets (QSRs, cafés, coffee chains)

- Institutions (schools, hospitals, offices)

- Retail (supermarkets, convenience stores)

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa (MEA)

- GCC Countries

- South Africa

- Rest of MEA

Competitive Landscape

The cup carriers market is moderately fragmented, with a mix of global packaging giants and regional suppliers competing across material segments. Leading players such as Huhtamaki Oyj, WestRock Company, Stora Enso, International Paper, and Graphic Packaging International dominate through strong product portfolios, sustainable innovations, and large-scale supply networks. These companies emphasize recyclable and compostable solutions, aligning with rising environmental regulations and consumer demand for eco-friendly carriers. Regional players, including Detpak, Pactiv Evergreen, Sabert Corporation, and Kari-Out Company, focus on niche markets with cost-effective and customizable products, strengthening their presence in food service and retail channels. Strategic partnerships with quick-service restaurants, coffee chains, and retail distributors are common to secure recurring demand. Competition is further shaped by material innovation, pricing strategies, and branding opportunities. As sustainability becomes a decisive factor, companies investing in moulded pulp, paper-based, and lightweight corrugated solutions are expected to gain a competitive edge over traditional plastic carrier suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Huhtamaki Oyj

- WestRock Company

- Stora Enso Oyj

- International Paper Company

- Genpak, LLC

- Georgia-Pacific LLC

- Graphic Packaging International LLC

- Kari-Out Company

- Pactiv Evergreen Inc.

- Sabert Corporation

- Detpak (Detmold Group)

- WinCup, Inc.

- Hood Packaging Corporation

- Eco-Products, Inc.

- Lollicup USA, Inc.

Recent Developments

- In December 2024, Novolex® and Pactiv Evergreen Inc. announced a definitive agreement to merge. This strategic union aims to strengthen their leadership in food, beverage, and specialty packaging through enhanced innovation and sustainable offerings.

- In July 2023, Huhtamaki Oyj invested approximately USD 30 million to expand its manufacturing capacity and consolidate operations in Paris, Texas. This move is designed to boost production for its growing food service business in North America.

- In March 2023, WinCup launched the industry’s first paper hot-beverage cups lined with PHA (a compostable biopolymer derived from canola oil). The product offers both home and industrial compostability, along with marine biodegradability.

Report Coverage

The research report offers an in-depth analysis based on Material Type, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly cup carriers will continue to rise due to stricter sustainability norms.

- Moulded pulp and paper-based carriers will gain wider acceptance over plastic alternatives.

- Quick-service restaurants and coffee chains will drive consistent demand for multi-cup solutions.

- Growth in online food delivery will increase the need for durable and spill-resistant carriers.

- Customizable and branded designs will enhance market opportunities for packaging suppliers.

- Emerging economies will see rapid adoption supported by urbanization and rising beverage consumption.

- Retail multipack beverage sales will expand carrier usage in supermarkets and convenience stores.

- Manufacturers will invest more in lightweight and ergonomic designs to improve user convenience.

- Partnerships with beverage brands and delivery platforms will strengthen recurring sales channels.

- Technological innovations in recyclable materials will shape long-term market competitiveness.