Market Overview

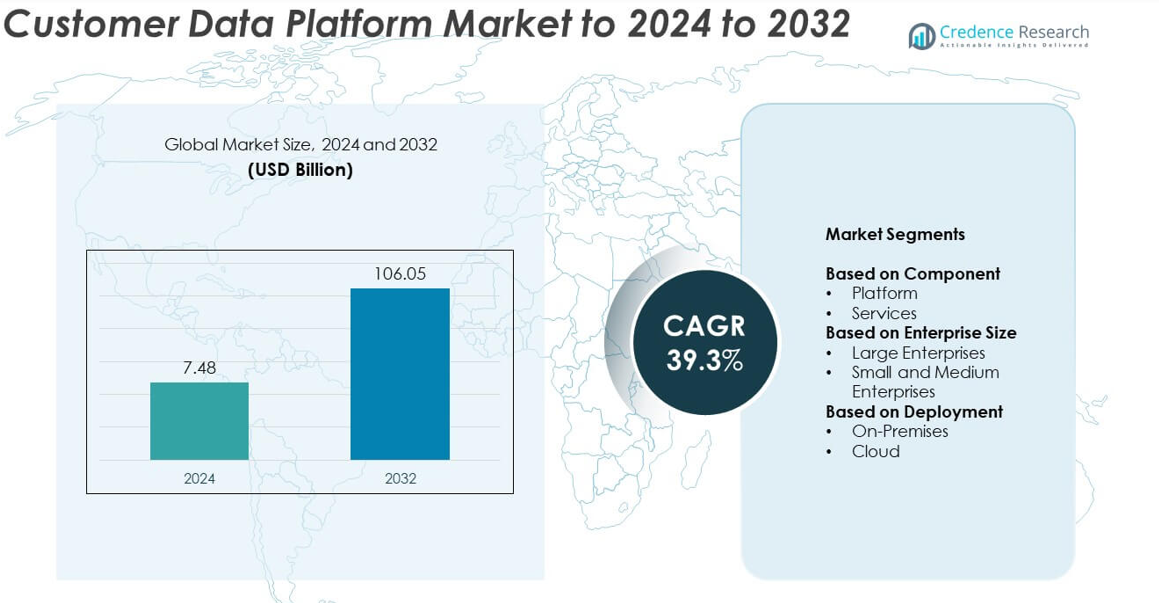

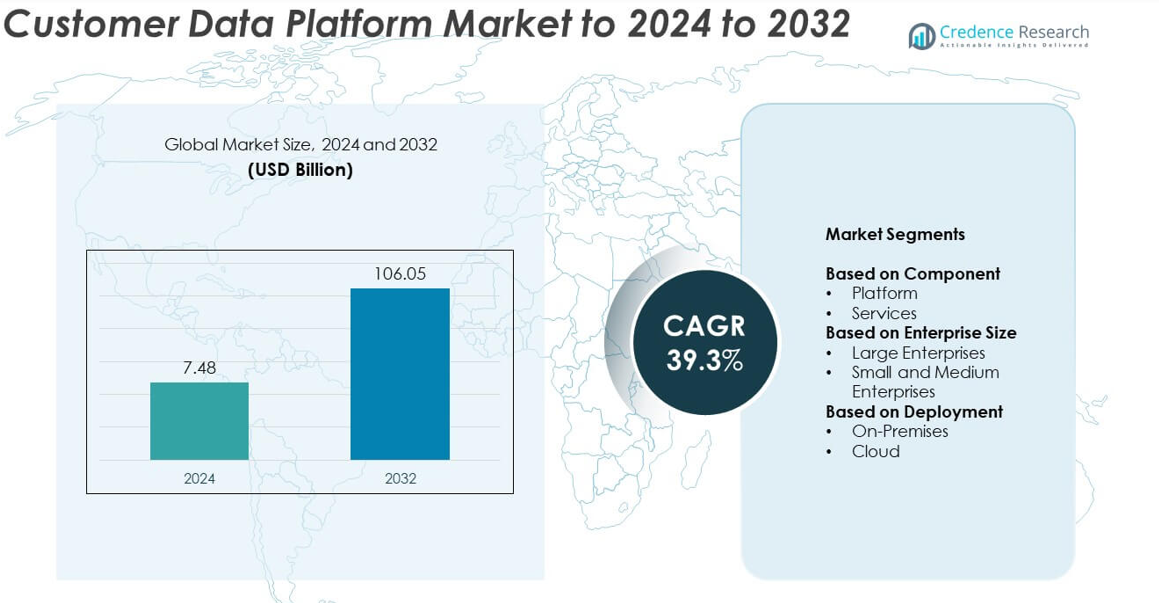

Customer Data Platform Market size was valued at USD 7.48 billion in 2024 and is anticipated to reach USD 106.05 billion by 2032, at a CAGR of 39.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customer Data Platform Market Size 2024 |

USD 7.48 billion |

| Customer Data Platform Market, CAGR |

39.3% |

| Customer Data Platform Market Size 2032 |

USD 106.05 billion |

The customer data platform market is dominated by major players such as Microsoft Corporation, SAP SE, Twilio Inc., Oracle Corporation, Tealium Inc., Nice Systems Ltd., Salesforce.com Inc., Cloudera Inc., SAS Institute, and Adobe Inc. These companies lead through advanced data integration, AI-powered analytics, and real-time personalization capabilities. Their platforms enable enterprises to unify customer data across multiple touchpoints, enhancing engagement and marketing efficiency. North America emerged as the leading regional market, accounting for around 38% of the global share in 2024, driven by strong digital adoption, cloud infrastructure, and early technological innovation.

Market Insights

- The customer data platform market was valued at USD 7.48 billion in 2024 and is projected to reach USD 106.05 billion by 2032, growing at a CAGR of 39.3%.

- Rising demand for personalized marketing, real-time analytics, and unified customer experiences is driving strong adoption across industries such as retail, BFSI, and healthcare.

- Cloud-based deployment dominates with over 70% share, supported by AI integration, predictive analytics, and omnichannel data synchronization trends.

- The market is highly competitive, with global players investing in automation, data security, and compliance-driven solutions to strengthen product portfolios.

- North America leads with 38% share, followed by Europe at 27% and Asia Pacific at 23%, while the platform segment accounts for over 68% of total market share, reflecting growing preference for centralized, scalable data management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The platform segment dominated the customer data platform market in 2024, accounting for over 68% of the total share. This dominance is driven by the growing need for unified data management, advanced analytics, and real-time customer insights across industries. Businesses increasingly rely on integrated platforms that centralize fragmented customer data from multiple channels. These platforms enhance marketing automation, improve personalization, and optimize customer engagement strategies. The services segment is also growing steadily as enterprises seek implementation, integration, and support solutions to maximize the value of their customer data investments.

- For instance, Salesforce Data Cloud processed more than 2,000,000,000,000,000 records in a quarter.

By Enterprise Size

Large enterprises held the largest market share of around 60% in 2024, primarily due to their significant data generation and advanced analytics adoption. These organizations prioritize customer data platforms to unify omnichannel customer journeys and deliver personalized experiences at scale. The demand is further fueled by complex customer touchpoints and strong investment in digital transformation initiatives. Meanwhile, small and medium enterprises are rapidly adopting cost-effective cloud-based CDPs to enhance marketing efficiency and improve data-driven decision-making capabilities without extensive IT infrastructure requirements.

- For instance, Twilio Segment serves a significant number of companies, and while it has previously reported handling over 1 trillion events monthly, more recently, Twilio reported its Segment platform processed 12.1 trillion API calls in 2023. Twilio, the parent company, had over 335,000 active customer accounts as of Q1 2025

By Deployment

The cloud segment led the customer data platform market in 2024, capturing more than 70% of the share. The dominance of cloud deployment is attributed to its scalability, flexibility, and lower upfront costs, making it ideal for real-time data access and integration. Cloud-based CDPs enable remote analytics and faster implementation, supporting agile marketing operations. In contrast, on-premises deployment continues to serve organizations with strict regulatory and security requirements. However, increasing digital adoption and SaaS innovations are accelerating the migration toward cloud-based CDP solutions across both large enterprises and SMEs.

Key Growth Drivers

Rising Demand for Personalized Customer Experiences

The growing focus on personalized engagement is a major driver of the customer data platform market. Businesses increasingly leverage CDPs to unify customer profiles and enable targeted marketing across digital channels. Real-time analytics and behavioral insights help brands tailor communication and boost customer retention. As consumers expect seamless experiences across platforms, enterprises are adopting CDPs to integrate omnichannel data and enhance campaign relevance, improving overall return on marketing investments.

- For instance, Starbucks reported 34,300,000 active U.S. loyalty members in Q1 2024 for targeting at scale.

Adoption of AI and Predictive Analytics

Artificial intelligence and predictive analytics are transforming how companies interpret customer data. Modern CDPs integrate AI models that forecast customer behavior, optimize marketing campaigns, and reduce churn. Predictive scoring and segmentation capabilities help organizations make faster, data-driven decisions. The integration of machine learning into CDPs empowers brands to anticipate customer needs and refine engagement strategies, driving higher operational efficiency and long-term loyalty across industries such as retail, banking, and telecommunications.

- For instance, Amperity customers activate 10,000,000,000 unified profiles daily to ad platforms.

Expansion of Omnichannel Marketing Ecosystems

The rapid expansion of omnichannel ecosystems drives CDP adoption among marketers aiming for unified data management. With customers interacting through multiple digital and physical touchpoints, organizations require a central platform to consolidate insights. CDPs streamline cross-channel coordination by integrating CRM, email, social, and web analytics tools. This integration enhances customer journey mapping and improves conversion rates, supporting businesses in creating consistent, personalized experiences across multiple engagement channels.

Key Trends & Opportunities

Shift Toward Cloud-Based Platforms

The increasing preference for cloud-based customer data platforms presents major growth opportunities. Cloud deployment offers scalability, cost-efficiency, and remote accessibility, making it suitable for businesses of all sizes. Vendors are enhancing their cloud offerings with AI-driven analytics, API-based integrations, and real-time data synchronization. This shift supports faster adoption among small and medium enterprises and enables flexible data collaboration across marketing, sales, and customer support functions.

- For instance, the 2024 State of the CDP report by Tealium found that 80% of CDP adopters see real-time data as critical to their objectives.

Integration with Privacy and Compliance Frameworks

Growing concerns around data security and compliance with regulations like GDPR and CCPA are shaping CDP innovation. Companies are adopting CDPs with built-in consent management, data lineage tracking, and encryption features to maintain transparency. This evolution is driving trust-based marketing and strengthening customer relationships. Vendors that provide compliant, secure data-handling capabilities are gaining a competitive advantage in attracting enterprises focused on ethical and regulatory adherence.

- For instance, according to the Treasure Data report “State of the CDPs: Data Unification, Activation, and Compliance” (2020), 92% of marketers considered a Customer Data Platform important to their privacy and compliance efforts.

Key Challenges

Data Integration and Quality Issues

One of the primary challenges in the customer data platform market is managing data integration and accuracy. Many organizations struggle to unify information from diverse systems such as CRM, ERP, and marketing automation tools. Inconsistent or duplicate data reduces the efficiency of personalization efforts and analytics accuracy. Overcoming this requires strong data governance frameworks and automated cleansing solutions to ensure consistent, high-quality datasets across multiple customer touchpoints.

High Implementation Costs and Skill Gaps

Implementing advanced CDP systems demands substantial investment and skilled technical expertise. Smaller organizations often face challenges in allocating resources for platform integration, customization, and employee training. Additionally, the shortage of professionals with data engineering and AI expertise slows adoption. Vendors are responding by offering low-code, pre-configured CDPs and managed services to reduce operational complexity and enhance accessibility for organizations with limited internal technical capabilities.

Regional Analysis

North America

North America held the largest share of around 38% in the customer data platform market in 2024. The region’s dominance is driven by high digital adoption, mature IT infrastructure, and strong investments in customer analytics by industries such as retail, BFSI, and healthcare. Leading enterprises in the United States and Canada are leveraging CDPs to improve omnichannel personalization and data-driven marketing. The presence of key vendors and growing integration of AI-based analytics further enhance market growth, making North America the primary hub for CDP innovation and technological advancement.

Europe

Europe accounted for approximately 27% of the global customer data platform market in 2024, supported by strict data privacy laws and rising focus on GDPR compliance. Countries such as Germany, the United Kingdom, and France are leading adopters due to their emphasis on ethical data management and digital transformation in customer engagement. European enterprises are increasingly deploying CDPs to align with data protection regulations while improving marketing automation and audience targeting efficiency, driving consistent regional growth.

Asia Pacific

Asia Pacific captured around 23% of the global market share in 2024, showing strong potential for expansion through 2032. Rapid digitalization, increasing e-commerce activity, and mobile-first consumer engagement are key growth factors. Markets such as China, India, and Japan are witnessing accelerated adoption of CDPs across retail, telecommunications, and financial sectors. The region benefits from a growing startup ecosystem, rising data volumes, and increased investments in AI-driven marketing tools, establishing Asia Pacific as a fast-emerging growth center for CDP solutions.

Latin America

Latin America represented about 7% of the customer data platform market in 2024, with adoption led by Brazil and Mexico. The region’s growth is supported by expanding digital marketing activities and increased focus on improving customer engagement in retail and financial services. Companies are investing in cloud-based CDPs to manage fragmented data and strengthen personalized marketing. Although adoption is slower than in developed markets, improving connectivity and the rise of local digital enterprises are expected to accelerate regional market expansion.

Middle East and Africa

The Middle East and Africa held nearly 5% of the customer data platform market in 2024, driven by growing digital transformation efforts across banking, retail, and telecom industries. The United Arab Emirates and South Africa are leading in adoption due to rapid technological modernization and increased cloud investments. Businesses in the region are adopting CDPs to optimize customer insights and improve cross-channel experiences. While the market is still emerging, increasing enterprise awareness and infrastructure development are expected to fuel long-term growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Component

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By Deployment

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The customer data platform market is highly competitive, with key players such as Microsoft Corporation, SAP SE, Twilio Inc., Oracle Corporation, Tealium Inc., Nice Systems Ltd., Salesforce.com Inc., Cloudera Inc., SAS Institute, and Adobe Inc. leading the landscape. The market features a mix of global technology giants and specialized software providers focusing on data unification, analytics, and real-time customer engagement. Companies are emphasizing AI-powered automation, scalable cloud infrastructure, and integration with marketing automation systems to enhance performance. Continuous innovation in predictive analytics, data security, and consent management supports product differentiation. Strategic partnerships, acquisitions, and expansion into emerging markets further strengthen players’ positions. Vendors are also prioritizing compliance-driven architecture to meet growing data privacy requirements under regulations such as GDPR and CCPA. This dynamic competition encourages constant technological advancement and improved interoperability across enterprise ecosystems.

Key Player Analysis

- Microsoft Corporation (U.S.)

- SAP SE (Germany)

- Twilio Inc. (U.S.)

- Oracle Corporation (U.S.)

- Tealium Inc. (U.S.)

- Nice Systems Ltd. (Israel)

- com Inc. (U.S.)

- Cloudera Inc. (U.S.)

- SAS Institute (U.S.)

- Adobe Inc. (U.S.)

Recent Developments

- In 2025, Adobe introduced several significant enhancements to its Real-Time Customer Data Platform (CDP) to improve cross-channel orchestration. These updates focused on leveraging first-party data, expanding partner integrations, improving personalization, and creating B2B-specific capabilities

- In 2024, Salesforce announced new, industry-specific modules for Data Cloud designed for banking, financial services, healthcare, and retail.

- In 2023, Nice Systems Ltd. Launched the CXone Fall Release, expanding AI and automation capabilities within its CXone platform.

Report Coverage

The research report offers an in-depth analysis based on Component, Enterprise Size, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth driven by increasing demand for real-time customer insights.

- Cloud-based deployment will continue to dominate due to scalability and lower operational costs.

- AI and machine learning integration will enhance predictive analytics and personalization.

- Adoption among small and medium enterprises will accelerate with affordable, modular CDP solutions.

- Data privacy and regulatory compliance will become major design priorities for CDP vendors.

- Omnichannel marketing capabilities will expand through deeper CRM and social media integrations.

- Industry-specific CDPs will emerge, offering tailored analytics for retail, healthcare, and finance.

- Partnerships between CDP providers and marketing automation platforms will increase efficiency.

- Real-time customer journey mapping will gain importance in improving user experience.

- Emerging regions like Asia Pacific and Latin America will experience rapid adoption driven by digital transformation.