Market Overview

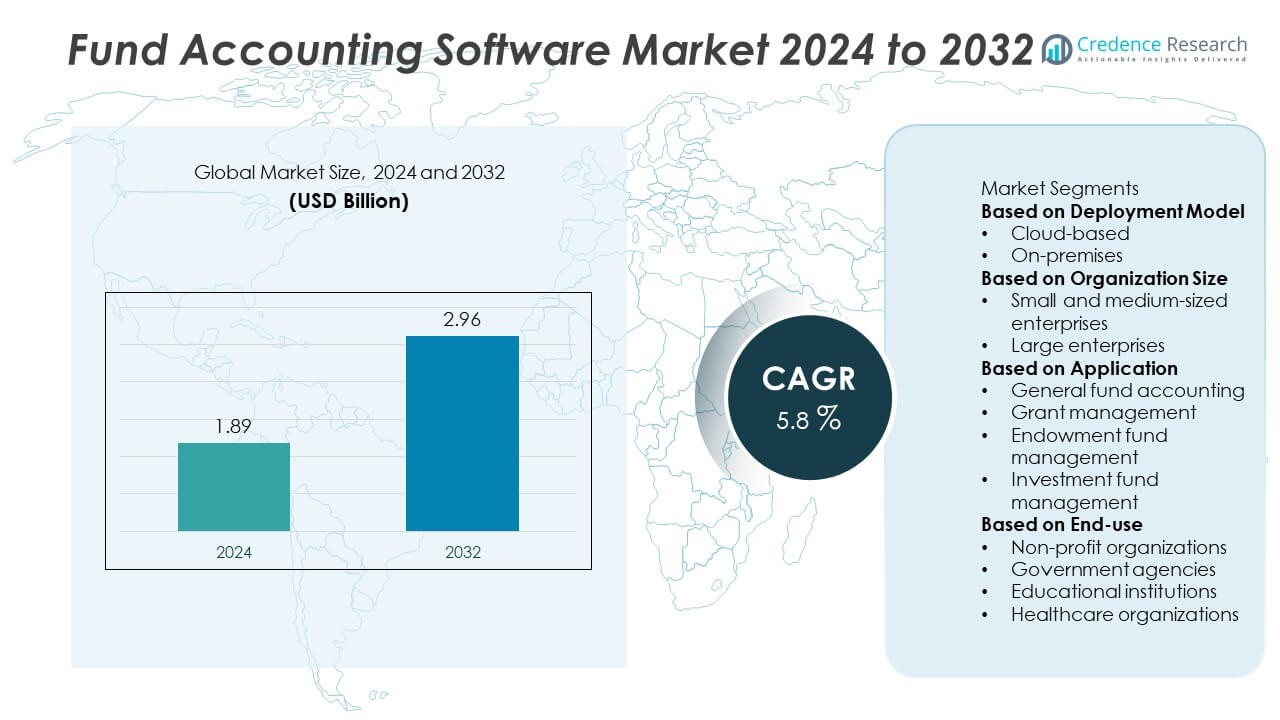

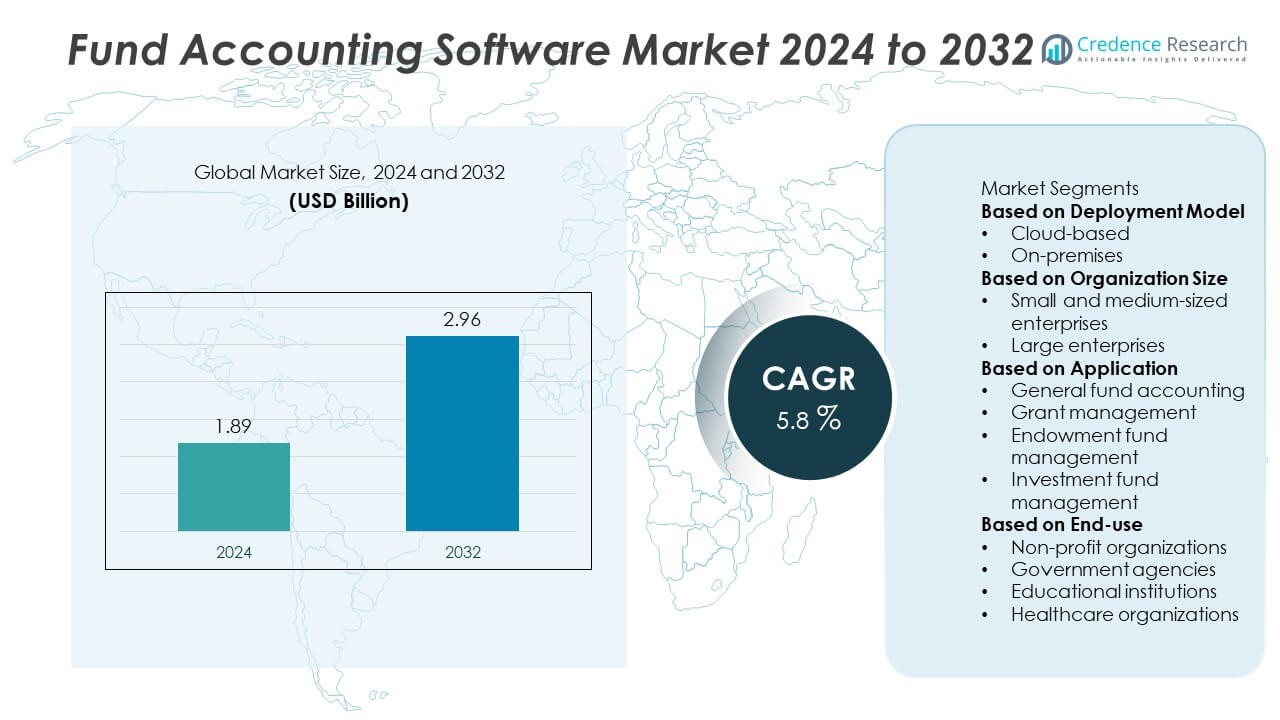

The Fund Accounting Software market size was valued at USD 1.89 billion in 2024 and is projected to reach USD 2.96 billion by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fund Accounting Software market Size 2024 |

USD 1.89 Billion |

| Fund Accounting Software market, CAGR |

5.8% |

| Fund Accounting Software market Size 2032 |

USD 2.96 Billion |

The Fund Accounting Software market is led by major players including Epicor, FinancialForce, Aplos, Blackbaud Financial Edge NXT, Fund EZ, Adaptive Insights (by Workday), AccuFund, Cougar Mountain Denali Fund, FIMS by Blackbaud, and Abila MIP Fund Accounting. These companies drive market competitiveness through cloud-based automation, data analytics, and compliance management tools tailored for nonprofits, governments, and enterprises. North America emerged as the leading region with a 39% market share in 2024, driven by strong digital adoption and regulatory compliance standards. Europe followed with 28%, supported by IFRS alignment and growing use of AI-enabled financial software.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fund Accounting Software market was valued at USD 1.89 billion in 2024 and is projected to reach USD 2.96 billion by 2032, growing at a CAGR of 5.8%.

- Rising demand for transparent financial reporting, automation, and compliance with global accounting standards is driving adoption across nonprofit, government, and investment organizations.

- Cloud-based solutions held a 64% share in 2024, supported by AI integration and SaaS subscription models enhancing scalability and efficiency.

- The market is highly competitive, with leading players such as Epicor, FinancialForce, Blackbaud, Aplos, and AccuFund focusing on AI-driven reporting and secure cloud deployment.

- North America led with 39% share, followed by Europe at 28% and Asia Pacific at 22%, reflecting increasing digital transformation initiatives and rising adoption of fund management platforms in public and private sectors.

Market Segmentation Analysis:

By Deployment Model

The cloud-based segment dominated the Fund Accounting Software market in 2024 with a 64% share. Cloud solutions gained traction due to scalability, real-time access, and reduced infrastructure costs. Nonprofits and financial institutions increasingly adopted SaaS platforms for improved transparency and compliance. The cloud model enables automatic updates, ensuring consistent adherence to evolving accounting standards. Integration with analytics and automation tools further enhanced efficiency. Meanwhile, the on-premises model retained users in data-sensitive sectors seeking higher control and customization, but its growth pace remained slower compared to cloud deployments.

- For instance, Blackbaud expanded its Financial Edge NXT cloud suite in 2024, adding new features including APIs for query, general ledger, and accounts payable, as well as new functionality for bank reconciliation and compliance reporting.

By Organization Size

Large enterprises held a leading 57% market share in 2024, driven by complex fund structures and extensive reporting requirements. These organizations invest heavily in automation, AI-enabled analytics, and integrated financial systems to manage diverse fund portfolios efficiently. They also require advanced compliance modules to meet multi-jurisdictional audit standards. Small and medium-sized enterprises, however, are emerging as a fast-growing segment due to cloud affordability and modular subscription models. Their adoption is supported by simpler setup needs and reduced upfront costs, making fund accounting technology accessible to smaller organizations.

- For instance, Workday Adaptive Planning helps numerous enterprises and mid-sized businesses with multi-entity consolidations, offering real-time insights to accelerate the financial close.

By Application

Investment fund management accounted for the dominant 41% share of the Fund Accounting Software market in 2024. Asset managers and institutional investors use these solutions for real-time portfolio tracking, risk evaluation, and return optimization. Automation in reconciliation and performance measurement enhances decision accuracy. General fund accounting followed closely, catering to government and nonprofit operations with transparent financial tracking. Grant and endowment fund management applications are expanding, supported by digital tools that ensure accountability and streamline multi-source funding processes across educational and research institutions.

Key Growth Drivers

Growing Demand for Financial Transparency and Compliance

Rising emphasis on financial accountability is a major driver in the Fund Accounting Software market. Regulatory frameworks require organizations to maintain clear and auditable records, pushing adoption across government, nonprofit, and investment sectors. These solutions automate compliance with standards such as GAAP and IFRS while minimizing reporting errors. Increasing scrutiny by auditors and funding agencies has further boosted demand for software that ensures accurate fund tracking and transparent budget allocation in real time.

- For instance, MIP Fund Accounting includes a fully automated audit trail feature that tracks detailed changes to transactions and records, enabling instant retrieval of transaction paths during audits. The system is built to handle high volumes of data for organizations of all sizes.

Adoption of Cloud-Based and AI-Integrated Solutions

Cloud technology and artificial intelligence are transforming fund accounting operations by enabling automation, scalability, and predictive insights. Cloud-based systems lower infrastructure costs while supporting multi-location collaboration. AI-powered tools improve transaction classification, fraud detection, and data-driven forecasting. These capabilities enhance accuracy and speed in fund reconciliation and reporting. The combination of cloud and AI adoption is helping organizations achieve operational efficiency and real-time visibility, making this a strong driver for market expansion globally.

- For instance, Oracle NetSuite has deployed an AI-powered Financial Management Suite that uses machine learning and intelligent automation to streamline financial processes for its over 43,000 customers. The system includes tools like Financial Exception Management, which automatically scans transactions to detect and flag anomalies that deviate from normal patterns, helping to ensure compliance and assist with audit preparation.

Rising Adoption Among Nonprofits and Public Institutions

Nonprofits and public sector entities are increasingly shifting to specialized fund accounting platforms to manage grants, donations, and endowments efficiently. These organizations rely on transparent accounting to demonstrate fiscal responsibility to donors and stakeholders. The need for automated reporting, donor tracking, and fund allocation tools has accelerated software adoption. Additionally, government initiatives promoting digital financial management and accountability are creating favorable conditions for market growth in this segment.

Key Trends and Opportunities

Integration with Analytics and Business Intelligence Tools

One major trend is the integration of fund accounting software with analytics and business intelligence solutions. Organizations seek data-driven insights for fund performance, risk evaluation, and strategic planning. Advanced dashboards and visualization tools allow real-time monitoring of transactions and key financial indicators. This trend enhances decision-making accuracy while increasing operational visibility across departments. Vendors are also embedding AI analytics to help users detect anomalies and improve audit readiness.

- For instance, FinancialForce (now Certinia), a Salesforce-native solution, integrated analytics capabilities, including those from Tableau, into its financial management module. This enabled automated financial analysis, providing deeper insights and improving the accuracy of financial forecasting for enterprise clients.

Expansion of SaaS-Based Subscription Models

The market is witnessing a growing shift toward SaaS-based subscription pricing models. These flexible payment structures attract small and medium-sized organizations by reducing upfront investment. Regular updates, remote accessibility, and scalability make SaaS models appealing for dynamic fund operations. Vendors are focusing on offering modular features that allow organizations to tailor solutions based on their fund management needs. This trend supports long-term customer retention and broadens software accessibility.

- For instance, Aplos is a cloud-based software platform that helps over 40,000 nonprofit and church organizations with their accounting, donations, and other administrative needs. It is known for providing tools for fund accounting, donor management, and online giving, demonstrating scalability and continuous cloud-based access for users.

Key Challenges

Data Security and Privacy Concerns

Data security remains a critical challenge for fund accounting software providers. Cloud-based systems, though efficient, expose financial data to potential breaches and cyberattacks. Ensuring compliance with data protection regulations such as GDPR and SOC 2 has become essential. Companies must implement multi-layered encryption, user authentication, and access control systems to maintain client trust. Failure to secure sensitive fund data can result in severe reputational and financial risks.

High Implementation and Integration Costs

High initial costs and complex integration processes limit adoption, particularly among small organizations. Implementing fund accounting systems often requires extensive customization, training, and migration from legacy platforms. This complexity can delay deployment and increase total ownership costs. Smaller institutions with limited budgets struggle to justify such investments despite operational benefits. Vendors are addressing this challenge by offering affordable cloud-based solutions and simplified onboarding processes.

Regional Analysis

North America

North America dominated the Fund Accounting Software market in 2024 with a 39% share. Strong regulatory compliance requirements, digital transformation initiatives, and widespread cloud adoption have fueled demand across financial institutions and nonprofits. The United States leads regional adoption due to advanced integration of AI, automation, and analytics in fund management processes. Major vendors continue investing in customized accounting platforms to support government and investment fund reporting needs. Canada’s growing nonprofit and educational sectors further contribute to regional growth through the use of cloud-based fund accounting solutions for transparent financial management.

Europe

Europe accounted for a 28% share of the global Fund Accounting Software market in 2024. The region benefits from strict regulatory frameworks such as IFRS and GDPR, driving organizations to adopt advanced accounting systems for compliance. Demand is strong among charities, universities, and public institutions seeking efficient grant and fund management. The United Kingdom, Germany, and France represent key growth hubs due to digitalization in the finance sector. Vendors in Europe are focusing on automation and real-time reporting tools to enhance accountability and improve fund utilization efficiency.

Asia Pacific

Asia Pacific captured a 22% market share in 2024, supported by expanding financial infrastructure and increasing adoption of digital accounting solutions. Growing awareness of transparent fund management in sectors such as education, government, and private investment is driving software deployment. Countries like India, Japan, and Australia are leading with cloud-based systems that improve efficiency and compliance. Regional governments are encouraging digital financial reporting for enhanced transparency. Rising investments from global software providers are further strengthening Asia Pacific’s position as a fast-growing market for fund accounting solutions.

Latin America

Latin America held a 6% share of the Fund Accounting Software market in 2024. The region is experiencing gradual digital transformation in public administration and nonprofit sectors. Brazil and Mexico are the primary contributors, adopting fund management platforms to enhance budget transparency and improve accountability in social programs. Cloud-based accounting systems are increasingly preferred for their affordability and scalability. However, limited technical infrastructure in smaller economies continues to restrict market expansion. Growing financial literacy and the modernization of public finance management systems are expected to support steady growth in the coming years.

Middle East and Africa

The Middle East and Africa together accounted for a 5% share in 2024. The adoption of fund accounting software is gaining momentum with rising interest in financial governance and digital transformation initiatives. Gulf countries, including the UAE and Saudi Arabia, are investing in cloud-based financial management tools across government and philanthropic organizations. In Africa, nonprofit institutions and international aid agencies are driving adoption to ensure transparent fund allocation. Despite slower technology penetration in some regions, increasing demand for compliance-ready and cost-effective accounting solutions is expected to foster gradual market growth.

Market Segmentations:

By Deployment Model

By Organization Size

- Small and medium-sized enterprises

- Large enterprises

By Application

- General fund accounting

- Grant management

- Endowment fund management

- Investment fund management

By End-use

- Non-profit organizations

- Government agencies

- Educational institutions

- Healthcare organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fund Accounting Software market features key players such as Epicor, FinancialForce, Aplos, Blackbaud Financial Edge NXT, Fund EZ, Adaptive Insights (by Workday), AccuFund, Cougar Mountain Denali Fund, FIMS by Blackbaud, and Abila MIP Fund Accounting. These companies focus on enhancing software capabilities through automation, cloud integration, and AI-based financial analytics. Blackbaud and FinancialForce maintain strong positions through robust cloud platforms that support nonprofit and enterprise fund management. Meanwhile, Aplos and AccuFund cater to small and mid-sized organizations with user-friendly and affordable solutions. Workday’s Adaptive Insights leverages advanced analytics and predictive tools for performance optimization. Vendors are investing heavily in SaaS-based solutions and modular systems to address rising demand for compliance, scalability, and data security. Continuous innovation and strategic partnerships are shaping competition as firms aim to expand their global presence and deliver high-value, regulatory-compliant accounting solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Epicor

- FinancialForce

- Aplos

- Blackbaud Financial Edge NXT

- Fund EZ

- Adaptive Insights (by Workday)

- AccuFund

- Cougar Mountain Denali Fund

- FIMS by Blackbaud

- Abila MIP Fund Accounting

Recent Developments

- In July 2025, Blackbaud introduced support for multiple bank accounts in Financial Edge NXT’s Payment Assistant, enabling use of more than one account per payment run. They also expanded backend capacity to permit up to 2,500 invoices in a single payment run.

- In May 2025, Epicor announced general availability of its agentic AI features (Epicor Prism) and predictive ML (Epicor Grow AI) across its ERP products.

- In April 2025, Blackbaud’s Financial Edge NXT rolled out a “Home page experience” redesign and new report generation modes (PDF, Excel, Word) to streamline user workflows.

- In 2025, Workday Adaptive Planning enabled “all-funds budgeting” at Iowa State University, integrating all fund types under the platform.

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Organization Size, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based deployment will continue to dominate due to flexibility and low maintenance costs.

- AI and automation will enhance real-time fund tracking and compliance reporting.

- Integration with business intelligence tools will improve financial transparency.

- Nonprofits and government institutions will remain key adopters of fund accounting software.

- Data security advancements will become a primary focus for software developers.

- SaaS-based pricing models will attract more small and medium-sized enterprises.

- Vendors will invest in modular platforms offering customizable accounting features.

- Expansion across emerging markets will drive new growth opportunities.

- Collaboration tools will become standard to support multi-user fund management.

- Regulatory technology integration will help organizations meet evolving global compliance standards.