CHAPTER NO. 1 : INTRODUCTION 20

1.1.1. Report Description 20

Purpose of the Report 20

USP & Key Offerings 20

1.1.2. Key Benefits for Stakeholders 20

1.1.3. Target Audience 21

1.1.4. Report Scope 21

CHAPTER NO. 2 : EXECUTIVE SUMMARY 22

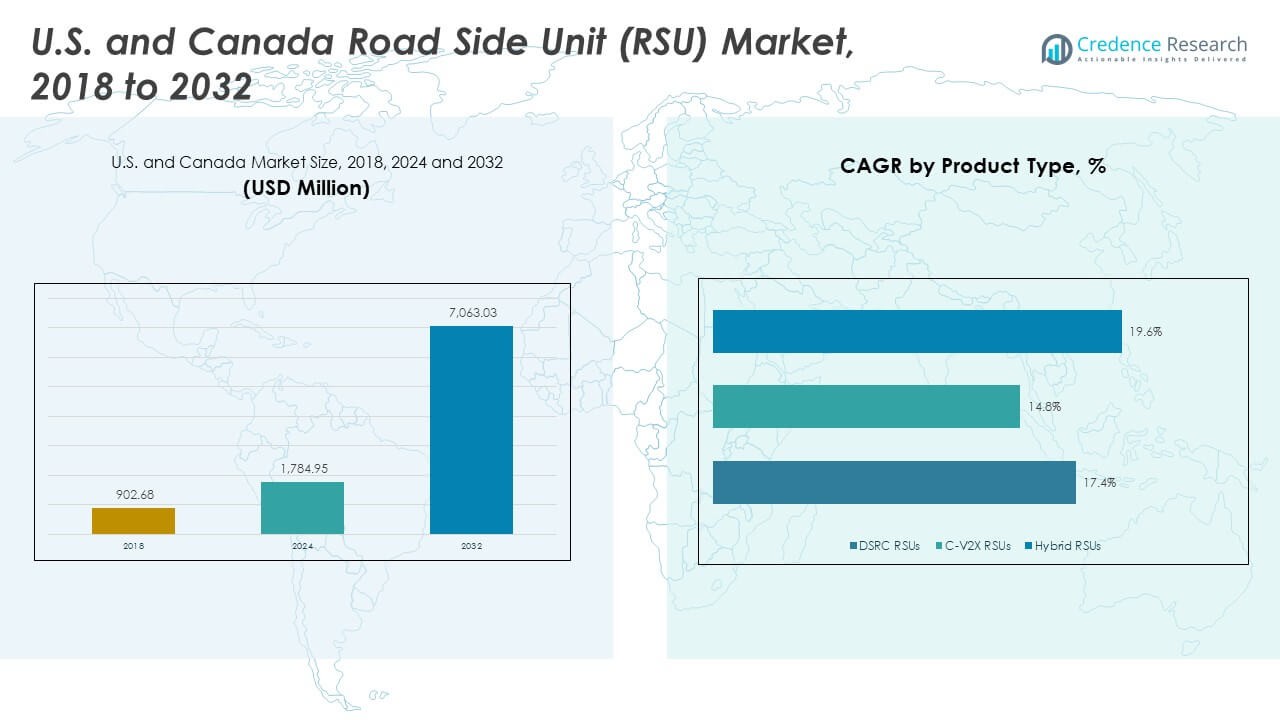

2.1. Road Side Unit (RSU) Market Snapshot 22

2.1.1. Country Road Side Unit (RSU) Market, 2020 – 2033 (Units) (USD Million) 24

2.2. Insights from Primary Respondents 24

CHAPTER NO. 3 : ROAD SIDE UNIT (RSU) MARKET – INDUSTRY ANALYSIS 25

3.1. Introduction 25

3.2. Market Drivers 26

3.2.1. Expansion of Electronic Toll Collection (ETC) and Multi-Lane Free Flow (MLFF) Systems 26

3.2.2. Accelerated Deployment of C-V2X and 5G Infrastructure for Connected Vehicles 27

3.3. Market Restraints 28

3.3.1. Interoperability Challenges Between DSRC and C-V2X Technologies 28

3.4. Market Opportunities 29

3.4.1. Market Opportunity Analysis 29

3.5. Porter’s Five Forces Analysis 30

3.6. Value Chain Analysis 31

3.7. Buying Criteria 32

3.8. Technical challenges and opportunities for each technology alternative 33

3.9. Competitive analysis of technology providers and product-specific offerings 34

CHAPTER NO. 4 : ADVANCED TECHNICAL & PRODUCT ALTERNATIVES FRAMEWORK 35

4.1. Analysis of fixed vs. modular RSU hardware 35

4.2. Evaluation of chipsets, processors, and communication radios 35

4.3. Comparison of middleware, toll engines & back-office software 35

4.4. Assessment of single-tech vs. hybrid RSU deployments 35

4.5. DSRC → C-V2X migration strategy mapping 35

4.6. Cross-border US–Canada interoperability review 35

CHAPTER NO. 5 : PRICE ANALYSIS 36

5.1. Price Analysis by Region 36

5.1.1. Country Road Side Unit (RSU) Market Price, By Region, 2020 – 2025 36

5.1.2. Country Product Type Market Price, By Region, 2020 – 2025 36

5.2. Price Analysis by Product Type 37

5.2.1. Country Road Side Unit (RSU) Market Price, By Product Type, 2020 – 2025 37

5.2.2. Country Product Type Market Price, By Product Type, 2020 – 2025 37

CHAPTER NO. 6 : ANALYSIS COMPETITIVE LANDSCAPE 38

6.1. Company Market Share Analysis – 2024 38

6.1.1. Country Road Side Unit (RSU) Market: Company Market Share, by Volume, 2024 38

6.1.2. Country Road Side Unit (RSU) Market: Company Market Share, by Revenue, 2024 39

6.1.3. Country Road Side Unit (RSU) Market: Top 6 Company Market Share, by Revenue, 2024 40

6.1.4. Country Road Side Unit (RSU) Market: Top 3 Company Market Share, by Revenue, 2024 40

6.2. Country Road Side Unit (RSU) Market Company Volume Market Share, 2023 41

6.3. Country Road Side Unit (RSU) Market Company Revenue Market Share, 2023 42

6.4. Company Assessment Metrics, 2024 43

6.4.1. Stars 43

6.4.2. Emerging Leaders 43

6.4.3. Pervasive Players 43

6.4.4. Participants 43

6.5. Start-ups /SMEs Assessment Metrics, 2024 43

6.5.1. Progressive Companies 43

6.5.2. Responsive Companies 43

6.5.3. Dynamic Companies 43

6.5.4. Starting Blocks 43

6.6. Strategic Developments 44

6.6.1. Acquisitions & Mergers 44

6.6.2. New Product Launch 44

6.6.3. Regional Expansion 44

6.7. Key Players Product Matrix 45

CHAPTER NO. 7 : PESTEL & ADJACENT MARKET ANALYSIS 46

7.1. PESTEL 46

7.1.1. Political Factors 46

7.1.2. Economic Factors 46

7.1.3. Social Factors 46

7.1.4. Technological Factors 46

7.1.5. Environmental Factors 46

7.1.6. Legal Factors 46

7.2. Adjacent Market Analysis 46

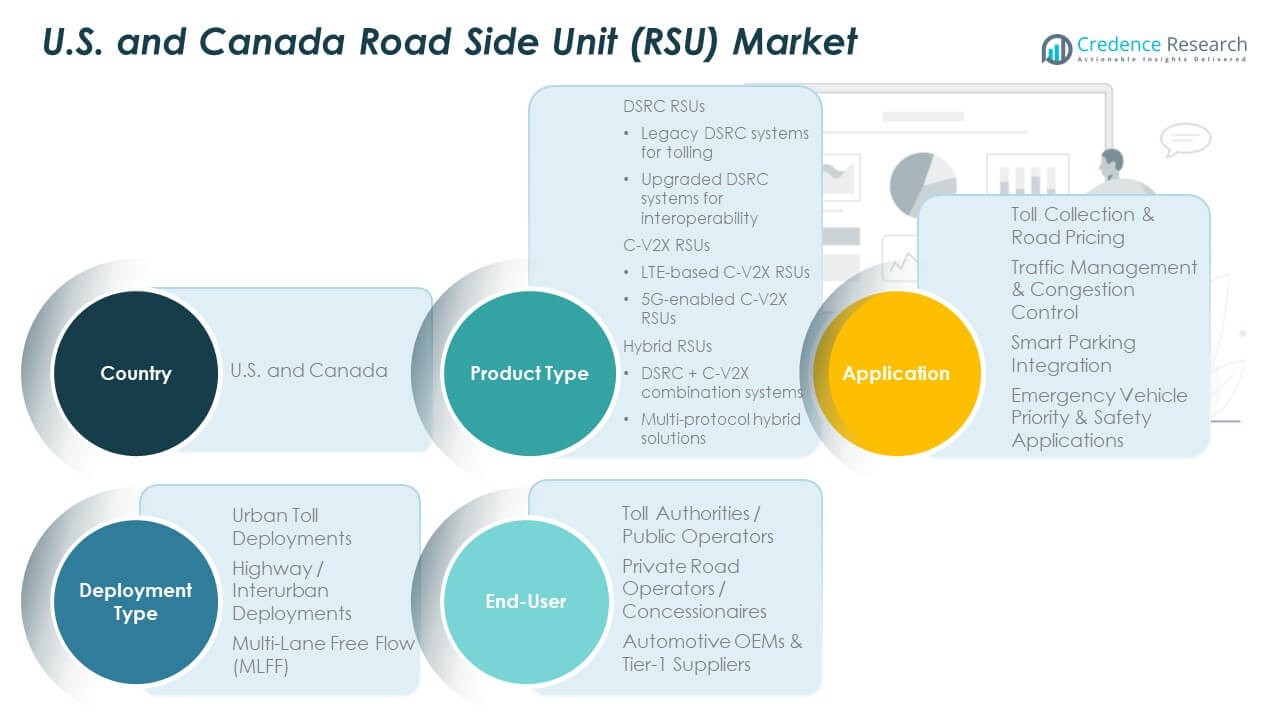

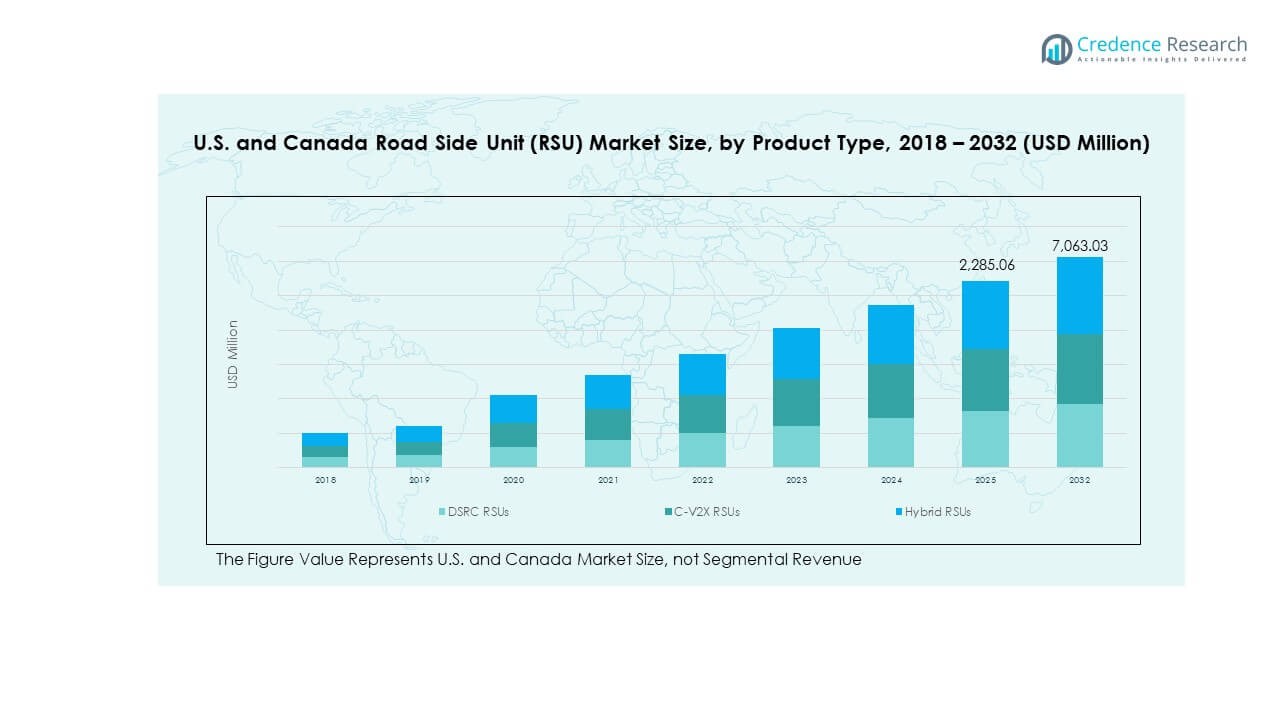

CHAPTER NO. 8 : ROAD SIDE UNIT (RSU) MARKET – BY PRODUCT TYPE SEGMENT ANALYSIS 47

8.1. Road Side Unit (RSU) Market Overview, by Product Type Segment 47

8.1.1. Road Side Unit (RSU) Market Volume Share, By Product Type, 2024 & 2033 48

8.1.2. Road Side Unit (RSU) Market Revenue Share, By Product Type, 2024 & 2033 48

8.1.3. Road Side Unit (RSU) Market Attractiveness Analysis, By Product Type 49

8.1.4. Incremental Revenue Growth Opportunity, by Product Type, 2026 – 2033 50

8.1.5. Road Side Unit (RSU) Market Revenue, By Product Type, 2020, 2024, 2029 & 2033 51

8.2. DSRC RSUs 52

8.3. C-V2X RSUs 53

8.4. Hybrid RSUs 54

CHAPTER NO. 9 : ROAD SIDE UNIT (RSU) MARKET – BY APPLICATION SEGMENT ANALYSIS 55

9.1. Road Side Unit (RSU) Market Overview, by Application Segment 55

9.1.1. Road Side Unit (RSU) Market Volume Share, By Application, 2024 & 2033 56

9.1.2. Road Side Unit (RSU) Market Revenue Share, By Application, 2024 & 2033 56

9.1.3. Road Side Unit (RSU) Market Attractiveness Analysis, By Application 57

9.1.4. Incremental Revenue Growth Opportunity, by Application, 2026 – 2033 58

9.1.5. Road Side Unit (RSU) Market Revenue, By Application, 2020, 2024, 2029 & 2033 59

9.2. Toll Collection & Road Pricing 60

9.3. Traffic Management & Congestion Control 61

9.4. Smart Parking Integration 62

9.5. Emergency Vehicle Priority & Safety Applications 63

CHAPTER NO. 10 : ROAD SIDE UNIT (RSU) MARKET – BY DEPLOYMENT TYPE SEGMENT ANALYSIS 64

10.1. Road Side Unit (RSU) Market Overview, by Deployment Type Segment 64

10.1.1. Road Side Unit (RSU) Market Volume Share, By Deployment Type, 2024 & 2033 65

10.1.2. Road Side Unit (RSU) Market Revenue Share, By Deployment Type, 2024 & 2033 65

10.1.3. Road Side Unit (RSU) Market Attractiveness Analysis, By Deployment Type 66

10.1.4. Incremental Revenue Growth Opportunity, by Deployment Type, 2026 – 2033 67

10.1.5. Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020, 2024, 2029 & 2033 68

10.2. Urban Toll Deployments 69

10.3. Highway / Interurban Deployments 70

10.4. Multi-Lane Free Flow (MLFF) 71

CHAPTER NO. 11 : ROAD SIDE UNIT (RSU) MARKET – BY END-USER SEGMENT ANALYSIS 72

11.1. Road Side Unit (RSU) Market Overview, by End-User Segment 72

11.1.1. Road Side Unit (RSU) Market Volume Share, By End-User, 2024 & 2033 73

11.1.2. Road Side Unit (RSU) Market Revenue Share, By End-User, 2024 & 2033 73

11.1.3. Road Side Unit (RSU) Market Attractiveness Analysis, By End-User 74

11.1.4. Incremental Revenue Growth Opportunity, by End-User, 2026 – 2033 75

11.1.5. Road Side Unit (RSU) Market Revenue, By End-User, 2020, 2024, 2029 & 2033 76

11.2. Toll Authorities / Public Operators 77

11.3. Private Road Operators / Concessionaires 78

11.4. Automotive OEMs & Tier-1 Suppliers 79

CHAPTER NO. 12 : ROAD SIDE UNIT (RSU) MARKET – NORTH AMERICA 80

12.1. U.S. 80

12.1.1. Key Highlights 80

12.1.2. U.S. Road Side Unit (RSU) Market Volume, By States, 2020 – 2033 (Units) 81

12.1.3. U.S. Road Side Unit (RSU) Market Revenue, By States, 2020 – 2025 (USD Million) 82

12.1.4. U.S. Road Side Unit (RSU) Market Volume, By Product Type, 2020 – 2025 (Units) 83

12.1.5. U.S. Road Side Unit (RSU) Market Revenue, By Product Type, 2020 – 2025 (USD Million) 84

12.1.6. U.S. Road Side Unit (RSU) Market Volume, By Application, 2020 – 2025 (Units) 85

12.1.7. U.S. Road Side Unit (RSU) Market Revenue, By Application, 2020 – 2025 (USD Million) 87

12.1.8. U.S. Road Side Unit (RSU) Market Volume, By Deployment Type, 2020 – 2025 (Units) 89

12.1.9. U.S. Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020 – 2025 (USD Million) 90

12.1.10. U.S. Road Side Unit (RSU) Market Volume, By End-User, 2020 – 2025 (Units) 91

12.1.11. U.S. Road Side Unit (RSU) Market Revenue, By End-User, 2020 – 2025 (USD Million) 92

CHAPTER NO. 13 : ROAD SIDE UNIT (RSU) MARKET – CANADA 93

13.1. Canada 93

13.1.1. Key Highlights 93

13.1.2. Canada Road Side Unit (RSU) Market Volume, By States, 2020 – 2033 (Units) 94

13.1.3. Canada Road Side Unit (RSU) Market Revenue, By States, 2020 – 2025 (USD Million) 96

13.1.4. Canada Road Side Unit (RSU) Market Volume, By Product Type, 2020 – 2025 (Units) 98

13.1.5. Canada Road Side Unit (RSU) Market Revenue, By Product Type, 2020 – 2025 (USD Million) 99

13.1.6. Canada Road Side Unit (RSU) Market Volume, By Application, 2020 – 2025 (Units) 100

13.1.7. Canada Road Side Unit (RSU) Market Revenue, By Application, 2020 – 2025 (USD Million) 101

13.1.8. Canada Road Side Unit (RSU) Market Volume, By Deployment Type, 2020 – 2025 (Units) 102

13.1.9. Canada Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020 – 2025 (USD Million) 103

13.1.10. Canada Road Side Unit (RSU) Market Volume, By End-User, 2020 – 2025 (Units) 104

13.1.11. Canada Road Side Unit (RSU) Market Revenue, By End-User, 2020 – 2025 (USD Million) 105

CHAPTER NO. 14 : COMPANY PROFILES – U.S. 106

14.1. Kapsch TrafficCom 106

14.1.1. Company Overview 106

14.1.2. Product Portfolio 106

14.1.3. Financial Overview 106

14.2. Savari / Harman 107

14.3. Yunex Traffic 107

14.4. Q-Free (C-ITS) 107

14.5. Commsignia 107

14.6. Company 6 107

14.7. Company 7 107

14.8. Company 8 107

14.9. Company 9 107

14.10. Company 10 107

CHAPTER NO. 15 : COMPANY PROFILES – CANADA 108

15.1. Company 1 108

15.1.1. Company Overview 108

15.1.2. Product Portfolio 108

15.1.3. Financial Overview 108

15.2. Company 2 109

15.3. Company 3 109

15.4. Company 4 109

15.5. Company 5 109

15.6. Company 6 109

15.7. Company 7 109

15.8. Company 8 109

15.9. Company 9 109

15.10. Company 10 109

List of Figures

FIG NO. 1. Country Road Side Unit (RSU) Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 24

FIG NO. 2. Porter’s Five Forces Analysis for Country Road Side Unit (RSU) Market 30

FIG NO. 3. Value Chain Analysis for Country Road Side Unit (RSU) Market 31

FIG NO. 4. Country Road Side Unit (RSU) Market Price, By Region, 2020 – 2025 36

FIG NO. 5. Country Road Side Unit (RSU) Market Price, By Product Type, 2020 – 2025 37

FIG NO. 6. Company Share Analysis, 2024 38

FIG NO. 7. Company Share Analysis, 2024 39

FIG NO. 8. Company Share Analysis, 2024 40

FIG NO. 9. Company Share Analysis, 2024 40

FIG NO. 10. Road Side Unit (RSU) Market – Company Volume Market Share, 2023 41

FIG NO. 11. Road Side Unit (RSU) Market – Company Revenue Market Share, 2023 42

FIG NO. 12. Road Side Unit (RSU) Market Volume Share, By Product Type, 2024 & 2033 48

FIG NO. 13. Road Side Unit (RSU) Market Revenue Share, By Product Type, 2024 & 2033 48

FIG NO. 14. Market Attractiveness Analysis, By Product Type 49

FIG NO. 15. Incremental Revenue Growth Opportunity by Product Type, 2026 – 2033 50

FIG NO. 16. Road Side Unit (RSU) Market Revenue, By Product Type, 2020, 2024, 2029 & 2033 51

FIG NO. 17. Country Road Side Unit (RSU) Market for DSRC RSUs, Volume & Revenue (Units) (USD Million) 2020 – 2033 52

FIG NO. 18. Country Road Side Unit (RSU) Market for C-V2X RSUs, Volume & Revenue (Units) (USD Million) 2020 – 2033 53

FIG NO. 19. Country Road Side Unit (RSU) Market for Hybrid RSUs, Volume & Revenue (Units) (USD Million) 2020 – 2033 54

FIG NO. 20. Road Side Unit (RSU) Market Volume Share, By Application, 2024 & 2033 56

FIG NO. 21. Road Side Unit (RSU) Market Revenue Share, By Application, 2024 & 2033 56

FIG NO. 22. Market Attractiveness Analysis, By Application 57

FIG NO. 23. Incremental Revenue Growth Opportunity by Application, 2026 – 2033 58

FIG NO. 24. Road Side Unit (RSU) Market Revenue, By Application, 2020, 2024, 2029 & 2033 59

FIG NO. 25. Country Road Side Unit (RSU) Market for Toll Collection & Road Pricing, Volume & Revenue (Units) (USD Million) 2020 – 2033 60

FIG NO. 26. Country Road Side Unit (RSU) Market for Traffic Management & Congestion Control, Volume & Revenue (Units) (USD Million) 2020 – 2033 61

FIG NO. 27. Country Road Side Unit (RSU) Market for Smart Parking Integration, Volume & Revenue (Units) (USD Million) 2020 – 2033 62

FIG NO. 28. Country Road Side Unit (RSU) Market for Emergency Vehicle Priority & Safety Applications, Volume & Revenue (Units) (USD Million) 2020 – 2033 63

FIG NO. 29. Road Side Unit (RSU) Market Volume Share, By Deployment Type, 2024 & 2033 65

FIG NO. 30. Road Side Unit (RSU) Market Revenue Share, By Deployment Type, 2024 & 2033 65

FIG NO. 31. Market Attractiveness Analysis, By Deployment Type 66

FIG NO. 32. Incremental Revenue Growth Opportunity by Deployment Type, 2026 – 2033 67

FIG NO. 33. Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020, 2024, 2029 & 2033 68

FIG NO. 34. Country Road Side Unit (RSU) Market for Urban Toll Deployments, Volume & Revenue (Units) (USD Million) 2020 – 2033 69

FIG NO. 35. Country Road Side Unit (RSU) Market for Highway / Interurban Deployments, Volume & Revenue (Units) (USD Million) 2020 – 2033 70

FIG NO. 36. Country Road Side Unit (RSU) Market for Multi-Lane Free Flow (MLFF), Volume & Revenue (Units) (USD Million) 2020 – 2033 71

FIG NO. 37. Road Side Unit (RSU) Market Volume Share, By End-User, 2024 & 2033 73

FIG NO. 38. Road Side Unit (RSU) Market Revenue Share, By End-User, 2024 & 2033 73

FIG NO. 39. Market Attractiveness Analysis, By End-User 74

FIG NO. 40. Incremental Revenue Growth Opportunity by End-User, 2026 – 2033 75

FIG NO. 41. Road Side Unit (RSU) Market Revenue, By End-User, 2020, 2024, 2029 & 2033 76

FIG NO. 42. Country Road Side Unit (RSU) Market for Toll Authorities / Public Operators, Volume & Revenue (Units) (USD Million) 2020 – 2033 77

FIG NO. 43. Country Road Side Unit (RSU) Market for Private Road Operators / Concessionaires, Volume & Revenue (Units) (USD Million) 2020 – 2033 78

FIG NO. 44. Country Road Side Unit (RSU) Market for Automotive OEMs & Tier-1 Suppliers, Volume & Revenue (Units) (USD Million) 2020 – 2033 79

FIG NO. 45. U.S. Road Side Unit (RSU) Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 80

FIG NO. 46. Canada Road Side Unit (RSU) Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 93

List of Tables

TABLE NO. 1. : Country Road Side Unit (RSU) Market: Snapshot 22

TABLE NO. 2. : Drivers for the Road Side Unit (RSU) Market: Impact Analysis 26

TABLE NO. 3. : Restraints for the Road Side Unit (RSU) Market: Impact Analysis 28

TABLE NO. 4. : Country Road Side Unit (RSU) Market Volume & Revenue, By Region, 2020 – 2025 36

TABLE NO. 5. : Country Road Side Unit (RSU) Market Volume & Revenue, By Product Type, 2020 – 2025 37

TABLE NO. 6. : U.S. Road Side Unit (RSU) Market Volume, By States, 2020 – 2025 (Units) 81

TABLE NO. 7. : U.S. Road Side Unit (RSU) Market Volume, By States, 2026 – 2033 (Units) 81

TABLE NO. 8. : U.S. Road Side Unit (RSU) Market Revenue, By States, 2020 – 2025 (USD Million) 82

TABLE NO. 9. : U.S. Road Side Unit (RSU) Market Revenue, By States, 2026 – 2033 (USD Million) 82

TABLE NO. 10. : U.S. Road Side Unit (RSU) Market Volume, By Product Type, 2020 – 2025 (Units) 83

TABLE NO. 11. : U.S. Road Side Unit (RSU) Market Volume, By Product Type, 2026 – 2033 (Units) 83

TABLE NO. 12. : U.S. Road Side Unit (RSU) Market Revenue, By Product Type, 2020 – 2025 (USD Million) 84

TABLE NO. 13. : U.S. Road Side Unit (RSU) Market Revenue, By Product Type, 2026 – 2033 (USD Million) 84

TABLE NO. 14. : U.S. Road Side Unit (RSU) Market Volume, By Application, 2020 – 2025 (Units) 85

TABLE NO. 15. : U.S. Road Side Unit (RSU) Market Volume, By Application, 2026 – 2033 (Units) 86

TABLE NO. 16. : U.S. Road Side Unit (RSU) Market Revenue, By Application, 2020 – 2025 (USD Million) 87

TABLE NO. 17. : U.S. Road Side Unit (RSU) Market Revenue, By Application, 2026 – 2033 (USD Million) 88

TABLE NO. 18. : U.S. Road Side Unit (RSU) Market Volume, By Deployment Type, 2020 – 2025 (Units) 89

TABLE NO. 19. : U.S. Road Side Unit (RSU) Market Volume, By Deployment Type, 2026 – 2033 (Units) 89

TABLE NO. 20. : U.S. Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020 – 2025 (USD Million) 90

TABLE NO. 21. : U.S. Road Side Unit (RSU) Market Revenue, By Deployment Type, 2026 – 2033 (USD Million) 90

TABLE NO. 22. : U.S. Road Side Unit (RSU) Market Volume, By End-User, 2020 – 2025 (Units) 91

TABLE NO. 23. : U.S. Road Side Unit (RSU) Market Volume, By End-User, 2026 – 2033 (Units) 91

TABLE NO. 24. : U.S. Road Side Unit (RSU) Market Revenue, By End-User, 2020 – 2025 (USD Million) 92

TABLE NO. 25. : U.S. Road Side Unit (RSU) Market Revenue, By End-User, 2026 – 2033 (USD Million) 92

TABLE NO. 26. : Canada Road Side Unit (RSU) Market Volume, By States, 2020 – 2025 (Units) 94

TABLE NO. 27. : Canada Road Side Unit (RSU) Market Volume, By States, 2026 – 2033 (Units) 95

TABLE NO. 28. : Canada Road Side Unit (RSU) Market Revenue, By States, 2020 – 2025 (USD Million) 96

TABLE NO. 29. : Canada Road Side Unit (RSU) Market Revenue, By Country, 2026 – 2033 (USD Million) 97

TABLE NO. 30. : Canada Road Side Unit (RSU) Market Volume, By Product Type, 2020 – 2025 (Units) 98

TABLE NO. 31. : Canada Road Side Unit (RSU) Market Volume, By Product Type, 2026 – 2033 (Units) 98

TABLE NO. 32. : Canada Road Side Unit (RSU) Market Revenue, By Product Type, 2020 – 2025 (USD Million) 99

TABLE NO. 33. : Canada Road Side Unit (RSU) Market Revenue, By Product Type, 2026 – 2033 (USD Million) 99

TABLE NO. 34. : Canada Road Side Unit (RSU) Market Volume, By Application, 2020 – 2025 (Units) 100

TABLE NO. 35. : Canada Road Side Unit (RSU) Market Volume, By Application, 2026 – 2033 (Units) 100

TABLE NO. 36. : Canada Road Side Unit (RSU) Market Revenue, By Application, 2020 – 2025 (USD Million) 101

TABLE NO. 37. : Canada Road Side Unit (RSU) Market Revenue, By Application, 2026 – 2033 (USD Million) 101

TABLE NO. 38. : Canada Road Side Unit (RSU) Market Volume, By Deployment Type, 2020 – 2025 (Units) 102

TABLE NO. 39. : Canada Road Side Unit (RSU) Market Volume, By Deployment Type, 2026 – 2033 (Units) 102

TABLE NO. 40. : Canada Road Side Unit (RSU) Market Revenue, By Deployment Type, 2020 – 2025 (USD Million) 103

TABLE NO. 41. : Canada Road Side Unit (RSU) Market Revenue, By Deployment Type, 2026 – 2033 (USD Million) 103

TABLE NO. 42. : Canada Road Side Unit (RSU) Market Volume, By End-User, 2020 – 2025 (Units) 104

TABLE NO. 43. : Canada Road Side Unit (RSU) Market Volume, By End-User, 2026 – 2033 (Units) 104

TABLE NO. 44. : Canada Road Side Unit (RSU) Market Revenue, By End-User, 2020 – 2025 (USD Million) 105

TABLE NO. 45. : Canada Road Side Unit (RSU) Market Revenue, By End-User, 2026 – 2033 (USD Million) 105

Market Segmentation Analysis

Market Segmentation Analysis