Market Overview

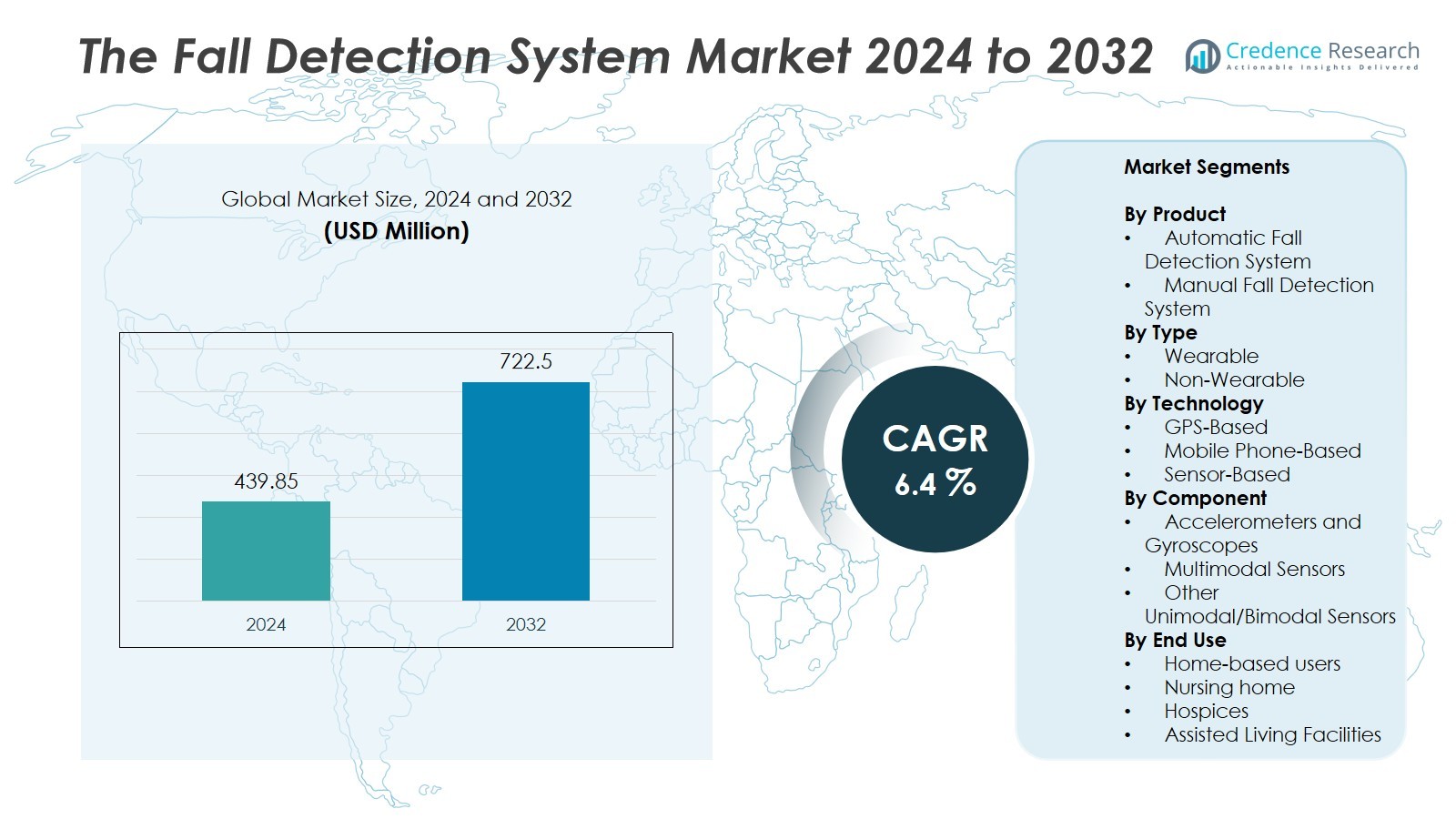

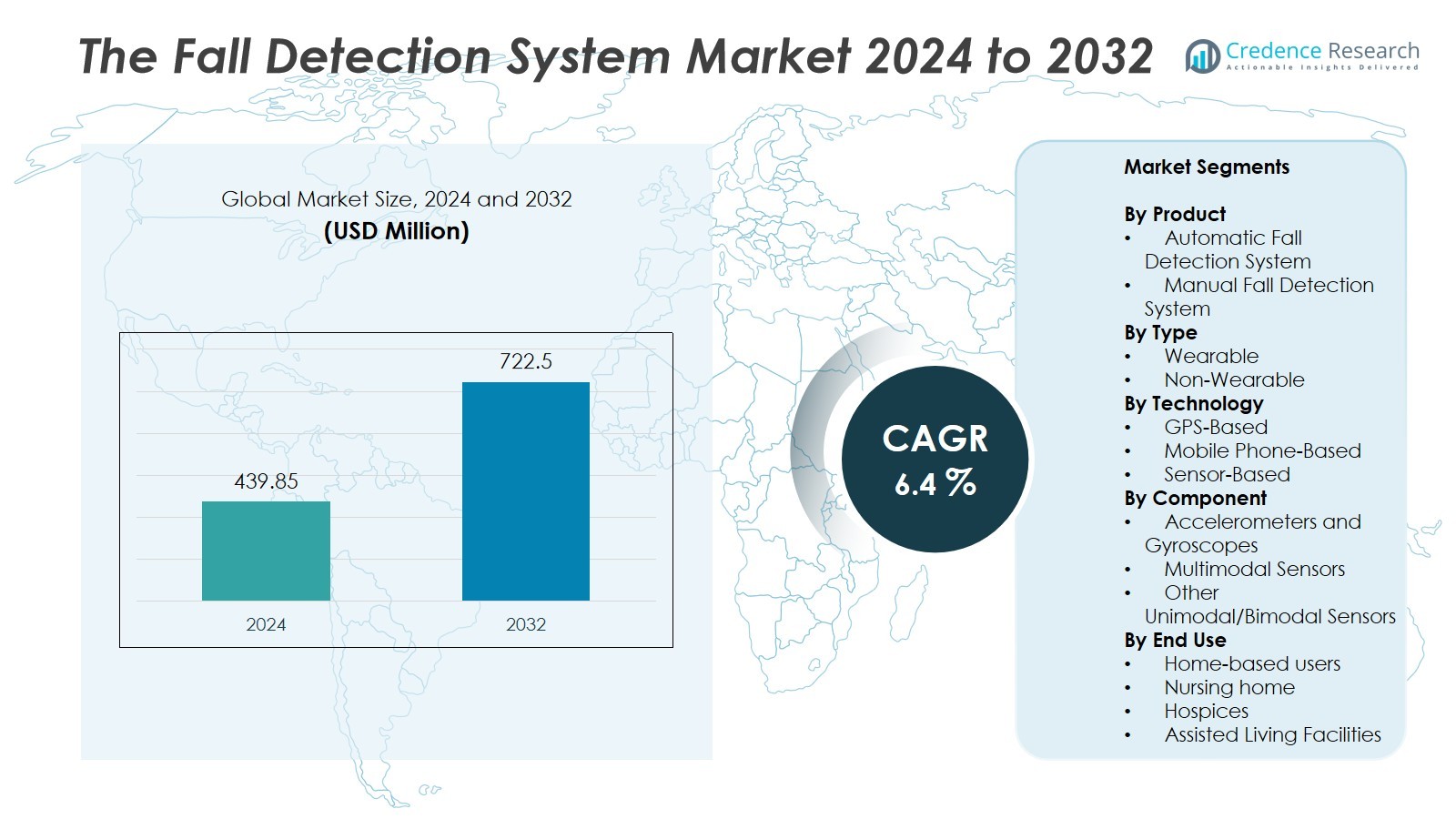

The Fall Detection System Market size was valued at USD 439.85 million in 2024 and is anticipated to reach USD 722.5 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fall Detection System Market Size 2024 |

USD 439.85 Million |

| Fall Detection System Market, CAGR |

6.4% |

| Fall Detection System Market Size 2032 |

USD 722.5 Million |

The fall detection system market is led by major players such as Apple Inc., Medical Guardian LLC, Semtech Corporation, Tunstall Group, SafeGuardian, Connect America, ADT, Koninklijke Philips N.V., MobileHelp, and MariCare. These companies focus on advanced sensor technology, AI integration, and cloud-based monitoring to enhance detection accuracy and response speed. Continuous innovation in wearable and non-wearable solutions strengthens their global market presence. North America dominates the market with a 38% share, supported by a robust healthcare infrastructure, strong adoption of connected medical devices, and growing awareness of elderly safety. Strategic partnerships and product diversification further reinforce regional leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fall Detection System Market was valued at USD 439.85 million in 2024 and is projected to reach USD 722.5 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Growing elderly population and rising cases of fall-related injuries drive strong demand for automatic and sensor-based systems, which together account for over 67% of total market share.

- Technological advancements in AI, IoT, and wearable devices enhance detection accuracy and expand applications across healthcare, residential, and assisted living sectors.

- Market competition intensifies as companies like Apple Inc., Philips, and Tunstall Group focus on miniaturized sensors, smart connectivity, and predictive analytics, while high device costs and data privacy concerns remain key restraints.

- North America leads with a 38% share, followed by Europe at 27%, driven by digital health adoption and regulatory support, while Asia-Pacific emerges as the fastest-growing regional market.

Market Segmentation Analysis:

By Product

The automatic fall detection system segment dominates the market with a 67% share in 2024. These systems use integrated sensors and algorithms to detect falls without user input, ensuring rapid emergency response. Their demand is increasing among elderly care facilities and home healthcare providers for enhanced safety. Advancements in AI-driven motion analysis and IoT connectivity are improving detection accuracy and response time. In contrast, manual systems hold a smaller share, primarily serving low-cost residential applications where user-activated alerts are sufficient for basic monitoring.

- For instance, Philips offers its Lifeline AutoAlert system, which utilizes advanced sensors and real-time algorithms to automatically detect falls and initiate emergency calls without user intervention, widely adopted in senior living communities.

By Type

The wearable segment leads the market, accounting for 74% share in 2024, driven by rising adoption of wrist-wear and neckwear devices. Wearables offer real-time monitoring and portability, making them ideal for elderly and chronically ill users. Wrist-worn devices remain the dominant sub-segment due to ease of use, continuous contact, and integration with smartwatches and fitness trackers. Non-wearable systems, including cameras and floor sensors, are expanding in hospitals and assisted living facilities, supported by demand for ambient fall monitoring without user involvement.

- For instance, Garmin continues to innovate with wrist-worn smartwatches, integrating AI-based mental health monitoring and performance tracking, popular among athletes and health-conscious consumers.

By Technology

The sensor-based systems hold the largest market share of 58% in 2024, as they provide precise motion tracking and high reliability in detecting falls. These systems use accelerometers, gyroscopes, and infrared sensors to capture posture changes in real time. Their integration with IoT platforms enables automated alerts and cloud-based data storage. GPS-based systems are gaining momentum for outdoor applications, offering real-time location tracking during emergencies, while mobile phone-based solutions appeal to cost-conscious consumers seeking app-enabled safety features within existing smartphones.

Key Growth Drivers

Rising Geriatric Population and Fall-Related Injuries

The increasing elderly population is a major growth driver for the fall detection system market. Aging individuals face higher risks of falls due to mobility limitations and chronic conditions, making real-time monitoring essential. According to the WHO, approximately 37 million severe falls occur each year among older adults. This demographic shift is driving demand for wearable and non-wearable fall detection devices in homecare and assisted living facilities. The integration of AI-enabled alert systems enhances safety and ensures timely medical response, reducing hospitalizations and long-term healthcare costs.

- For instance, Philips Lifeline with AutoAlert uses multiple sensors to detect 95% of falls automatically, reducing delayed medical response and enhancing independence in older adults.

Advancements in Sensor and Connectivity Technologies

Innovations in sensor technology, AI algorithms, and connectivity solutions such as IoT and 5G are transforming fall detection systems. Modern devices feature multi-axis accelerometers, gyroscopes, and barometric pressure sensors for improved motion accuracy. Enhanced connectivity allows faster emergency alerts and remote monitoring through mobile and cloud-based platforms. Manufacturers are increasingly embedding AI models capable of differentiating between actual falls and normal movements, minimizing false alarms. These advancements are expanding system adoption across healthcare, residential, and institutional environments globally.

- For instance, MOBOTIX integrates AI-powered cameras with sensors to track patient movements in real-time, enabling hospitals to reduce injuries by predicting risky behaviors and issuing immediate alerts

Growing Adoption of Smart Healthcare Devices

The rising trend of connected healthcare is fueling the adoption of smart fall detection systems. Consumers are increasingly using wearable health devices that combine multiple monitoring functions, including heart rate and fall detection. Integration with digital health ecosystems allows seamless data sharing between users, caregivers, and healthcare providers. Governments and insurance companies are also promoting the use of fall detection solutions for elderly care, incentivizing adoption through healthcare programs. The convenience, reliability, and remote accessibility of smart systems continue to attract both individual consumers and healthcare institutions.

Key Trends & Opportunities

Expansion of AI and Machine Learning Applications

Artificial intelligence is reshaping fall detection through predictive analytics and improved event recognition. Machine learning models are being trained on motion datasets to distinguish between accidental falls and regular activities. This advancement reduces false positives and enhances trust in automated systems. Manufacturers are focusing on integrating AI-driven analytics with cloud-based platforms to provide continuous learning and system improvement. The use of AI also opens opportunities for advanced analytics in patient behavior monitoring, supporting preventive healthcare and long-term data insights for caregivers.

- For instance, Vayyar Imaging Ltd.’s “Vayyar Care” radar-on-chip fall-detection system provides wide-room coverage and is installed in homes, with its sensor module originally developed for automotive and senior-care environments.

Shift Toward Non-Wearable and Ambient Monitoring Systems

There is a rising preference for non-intrusive fall detection technologies such as radar, LiDAR, and camera-based systems. These systems enable ambient monitoring without requiring users to wear any device, addressing compliance issues among elderly individuals. Smart home integration is accelerating this trend, allowing systems to communicate with voice assistants and automated emergency services. The opportunity lies in expanding such systems in hospitals, nursing homes, and smart living facilities where continuous, unobtrusive monitoring enhances safety while maintaining user comfort and privacy.

- For instance, Cherish Health’s “Serenity” system uses radar to track up to two individuals within a 40-foot range through walls, constructing a 13-point skeleton model in near real-time to distinguish falling from lying down.

Integration with Telehealth and Remote Monitoring Platforms

The growth of telehealth is creating strong opportunities for fall detection integration. Systems connected to telemedicine platforms enable caregivers to receive instant alerts and patient location data. This capability allows faster emergency responses and post-fall assessments through remote consultations. Integration with health apps and cloud databases also supports long-term care management. The synergy between fall detection technologies and telehealth infrastructure enhances patient safety and enables proactive healthcare, especially for rural and aging populations.

Key Challenges

High Cost and Limited Affordability

Despite growing demand, the high cost of advanced fall detection systems limits adoption, especially in developing regions. Devices incorporating multiple sensors, AI processing units, and cloud connectivity remain expensive for individual consumers. Subscription fees for remote monitoring and maintenance further increase ownership costs. Many elderly users in low-income demographics cannot afford premium wearable or ambient systems. Manufacturers must focus on cost optimization and scalable production to make fall detection solutions more accessible while maintaining high accuracy and reliability.

Privacy and Data Security Concerns

Fall detection systems, especially those integrated with cloud platforms and camera-based monitoring, raise concerns regarding personal privacy and data security. Continuous data collection from sensors and video devices can expose sensitive information about users’ daily activities. Unauthorized data access or breaches can lead to ethical and legal challenges for manufacturers and service providers. Compliance with data protection regulations such as GDPR and HIPAA remains critical. Ensuring secure data transmission, anonymization, and user consent will be key to maintaining consumer trust and widespread system adoption.

Regional Analysis

North America

North America dominates the fall detection system market with a 38% share in 2024, driven by a well-established healthcare infrastructure and high adoption of connected medical devices. The United States leads the region due to strong government initiatives promoting elderly care and home monitoring technologies. Advanced sensor innovation and integration of AI-based analytics by key players such as ADT Inc. and Philips Lifeline further enhance regional growth. Rising healthcare spending, increasing geriatric population, and expanding use of telehealth platforms continue to strengthen market penetration across both residential and institutional care settings.

Europe

Europe holds a 27% market share in 2024, supported by increasing demand for smart healthcare solutions and aging population across countries such as Germany, France, and the United Kingdom. Strong regulatory frameworks for elderly safety and technological advancements in fall prevention devices drive regional adoption. Companies like Tunstall Healthcare and Essence Group are expanding smart monitoring portfolios using AI and cloud-based analytics. Government-led programs for digital health transformation and the deployment of non-wearable systems in elderly care facilities further promote market expansion across Western and Northern Europe.

Asia-Pacific

The Asia-Pacific region accounts for a 22% share in 2024 and is projected to register the fastest growth through 2032. Rising healthcare digitization, expanding aging population in Japan and China, and growing awareness of elderly safety are driving adoption. Local players such as Vayyar Imaging and Huawei Technologies are developing low-cost, AI-integrated solutions suited for home and institutional use. Increasing investment in smart home infrastructure and healthcare modernization programs across India, South Korea, and Australia contribute to strong regional market momentum.

Latin America

Latin America captures an 8% market share in 2024, fueled by growing awareness of senior care technologies and government-led healthcare reforms. Brazil and Mexico are leading markets owing to improving medical infrastructure and rising adoption of IoT-based monitoring devices. The introduction of affordable wearable systems by regional distributors supports adoption among middle-income consumers. Partnerships between healthcare providers and technology firms are improving remote care access, especially in rural areas. Gradual expansion of smart city and telemedicine initiatives continues to open new opportunities for fall detection systems.

Middle East & Africa

The Middle East & Africa region represents a 5% market share in 2024, with steady growth expected as healthcare infrastructure improves. GCC nations such as the UAE and Saudi Arabia are investing in digital health and AI-based monitoring systems for elderly and hospital care. South Africa is witnessing increasing adoption of wearable fall detection devices for home-based care. Ongoing public health initiatives, expanding telehealth access, and collaborations with international medical device companies are enhancing awareness and system deployment across urban centers in the region.

Market Segmentations:

By Product

- Automatic Fall Detection System

- Manual Fall Detection System

By Type

By Technology

- GPS-Based

- Mobile Phone-Based

- Sensor-Based

By Component

- Accelerometers and Gyroscopes

- Multimodal Sensors

- Other Unimodal/Bimodal Sensors

By End Use

- Home-based users

- Nursing home

- Hospices

- Assisted Living Facilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fall detection system market features strong competition among global and regional players focusing on technological innovation, product integration, and service expansion. Leading companies such as Apple Inc., Medical Guardian LLC, Semtech Corporation, Tunstall Group, SafeGuardian, Connect America, ADT, Koninklijke Philips N.V., MobileHelp, and MariCare are driving advancements through AI-enabled analytics, IoT connectivity, and wearable technology. These firms are prioritizing miniaturized sensors, improved detection accuracy, and cloud-based emergency alert systems to enhance user safety and convenience. Strategic collaborations with healthcare providers and telecom operators are expanding product reach and reliability. Companies are also emphasizing data security and user privacy while integrating fall detection with broader health monitoring features. Continuous investment in R&D, smart home compatibility, and AI-driven predictive solutions is expected to strengthen market presence and support long-term growth in residential, institutional, and remote healthcare environments.

Key Player Analysis

- Apple Inc.

- Medical Guardian LLC

- Semtech Corporation

- Tunstall Group

- SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches

- Connect America

- ADT

- Koninklijke Philips N.V.

- MobileHelp

- MariCare

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In January 2025, Kami Vision unveiled a home security camera designed specifically for seniors living alone. The Kami Fall Detect Camera monitors for falls and alerts families or caregivers, offering features like an 87-degree view with 360-degree rotation and two-way audio communication. It employs AI technology to achieve 99.5% accurate fall detection, even if the person is partially obscured.

- In July 2024, Amsterdam-based tech company Gamgee introduced its Wi-Fi Fall Protection system, an advanced AI-powered Wi-Fi fall detection solution designed for elderly care. This innovative system improves seniors’ safety by providing instant alerts to family members and caregivers via an app.

- In January 2023, FallCall Solutions, LLC teamed up with Talius Group Limited (HSC Technology Group) to introduce a medical alert system for Android and iPhone users in Australia. This collaboration aimed to integrate next-generation Bluetooth medical alert devices with the HSC Talius Smart Care System, enhancing the FallCall application on users’ devices.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Technology, Component, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of AI-driven fall detection systems will increase across elderly care and healthcare facilities.

- Integration with IoT and smart home devices will enhance real-time monitoring and emergency response.

- Wearable devices will continue to dominate due to their convenience and multi-function health tracking capabilities.

- Non-wearable systems such as radar and vision-based sensors will gain popularity for ambient monitoring.

- Cloud-based analytics and remote healthcare platforms will strengthen connectivity and data-driven decision-making.

- Expansion of telehealth services will boost demand for integrated fall detection solutions.

- Manufacturers will focus on reducing device costs to improve accessibility in developing regions.

- Data privacy and cybersecurity measures will become critical for gaining user trust.

- Partnerships between technology companies and healthcare providers will expand service ecosystems.

- Asia-Pacific will emerge as the fastest-growing market due to rapid healthcare digitalization and aging demographics.