Market Overview

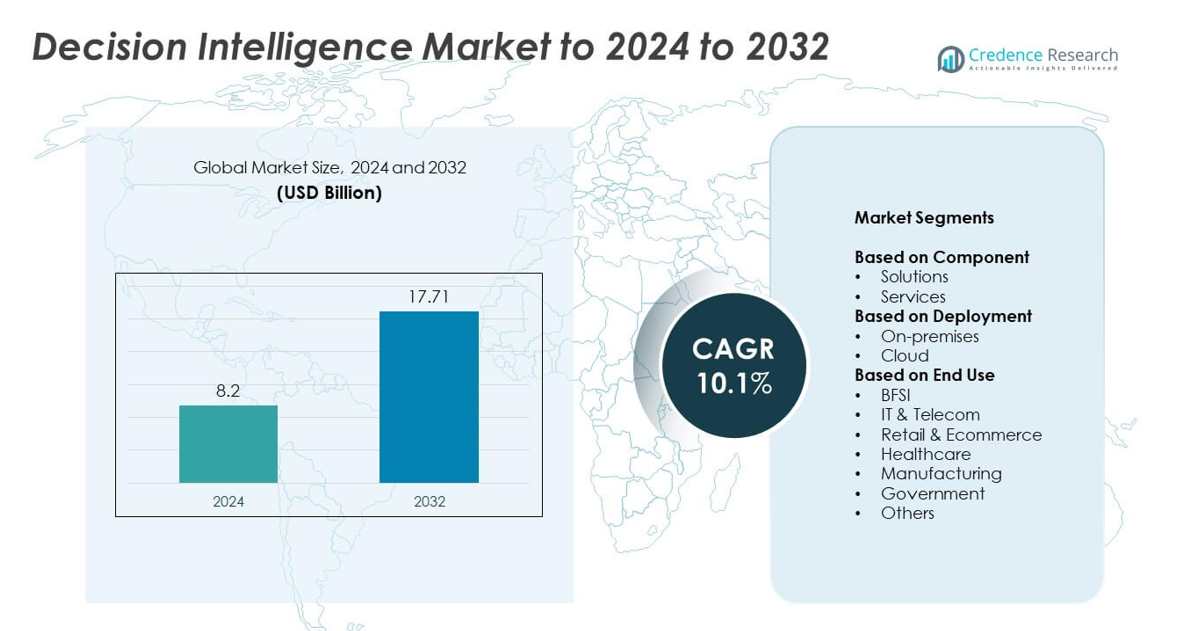

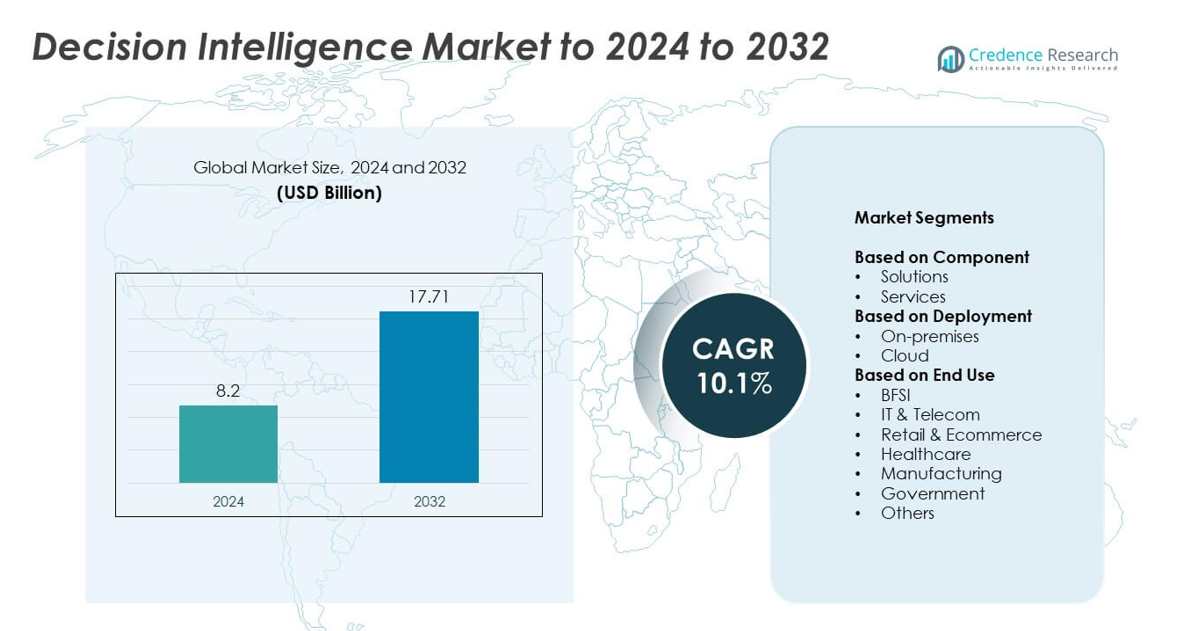

Decision Intelligence Market size was valued at USD 8.2 billion in 2024 and is anticipated to reach USD 17.71 billion by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decision Intelligence Market Size 2024 |

USD 8.2 billion |

| Decision Intelligence Market, CAGR |

10.1% |

| Decision Intelligence Market Size 2032 |

USD 17.71 billion |

The decision intelligence market is driven by major players such as Microsoft, Intel Corporation, Oracle, IBM, Google LLC, SAS, H2O.ai, Board International, Domo, Inc., and TATA Consultancy Services. These companies are focusing on developing AI-powered platforms, predictive analytics tools, and cloud-based decision frameworks to enhance business intelligence and automation. Strategic partnerships, product innovation, and data integration capabilities remain key growth strategies. North America led the global market in 2024 with a 38% share, supported by advanced digital infrastructure, strong enterprise adoption of AI technologies, and a high concentration of leading solution providers.

Market Insights

- The Decision Intelligence Market was valued at USD 8.2 billion in 2024 and is projected to reach USD 17.71 billion by 2032, growing at a CAGR of 10.1%.

- Rising demand for data-driven decision-making and AI integration across enterprises is fueling market expansion.

- Key trends include the growing adoption of cloud-based analytics and augmented intelligence to enhance predictive accuracy and business agility.

- The market is moderately competitive, with major players focusing on AI-enabled platforms, automation, and strategic collaborations to strengthen their portfolios.

- North America led the market with a 38% share in 2024, while the solutions segment dominated with 63%, followed by strong growth from Asia Pacific driven by digital transformation in China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solutions segment dominated the decision intelligence market in 2024 with a 63% share. The strong demand for analytics, machine learning, and data integration platforms drives this dominance. Enterprises are investing in advanced solutions to automate complex decision-making and enhance predictive accuracy. Continuous improvements in AI algorithms and the integration of business intelligence tools have further accelerated adoption. The services segment, including consulting and implementation, is also growing steadily as companies seek expert support to deploy and manage decision intelligence frameworks efficiently across business functions.

- For instance, Snowflake reported 12,062 total customers as of July 31, 2025, according to its Q2 FY26 earnings press release. Of those, 654 were customers generating more than $1 million in trailing 12-month product revenue.

By Deployment

The cloud segment led the decision intelligence market in 2024, holding nearly 68% of the share. Cloud deployment offers scalability, real-time analytics, and easier integration with AI-based tools, which attract enterprises of all sizes. Organizations prefer cloud-based models for flexibility and reduced infrastructure costs. The shift toward hybrid work and digital transformation further fuels demand for cloud-enabled decision-making solutions. On-premises deployment continues to serve sectors requiring strict data security, particularly in regulated industries like banking and government. However, cloud remains the preferred deployment mode due to its cost-efficiency and speed of implementation.

- For instance, MongoDB said Atlas surpassed 59,900 total customers as of July 31, 2025, reflecting broad cloud adoption.

By End Use

The BFSI sector accounted for the largest share of 28% in the decision intelligence market in 2024. Financial institutions rely on AI-driven insights for credit risk management, fraud detection, and customer personalization. Decision intelligence enables predictive analytics and data visualization that strengthen operational efficiency and compliance management. IT and telecom companies are rapidly adopting these tools for network optimization, while retail and e-commerce firms leverage them for inventory and customer behavior analysis. Healthcare and manufacturing sectors also show growing adoption as real-time analytics and automation enhance accuracy and productivity.

Key Growth Drivers

Rising Demand for Data-Driven Decision-Making

Organizations across industries are increasingly adopting data-driven approaches to improve operational accuracy. Decision intelligence solutions integrate AI, machine learning, and analytics to convert raw data into actionable insights. Businesses use these tools to enhance predictive accuracy, reduce uncertainty, and support strategic planning. This growing reliance on data-backed decisions boosts adoption across sectors such as BFSI, healthcare, and manufacturing. The expanding volume of structured and unstructured data continues to fuel demand for intelligent decision-support systems globally.

- For instance, BP uses over two million sensors across its operations, feeding data into AI systems to guide drilling and maintenance decisions.

Expansion of AI and Machine Learning Integration

Advancements in AI and machine learning are transforming decision-making processes across enterprises. Decision intelligence platforms leverage these technologies to analyze complex datasets and deliver real-time recommendations. AI integration enables automation of repetitive analytical tasks, improving efficiency and accuracy. Machine learning also allows systems to learn from historical data and enhance performance over time. As businesses move toward predictive and prescriptive analytics, AI-enabled decision intelligence solutions are becoming central to digital transformation strategies.

- For instance, Bradesco’s Watson assistant answers ~283,000 questions monthly at ~95% accuracy, with responses reduced from ~10 minutes to seconds.

Rising Adoption of Cloud-Based Platforms

Cloud deployment has emerged as a major enabler of decision intelligence adoption. Cloud-based systems offer scalability, flexibility, and real-time analytics, making them ideal for data-intensive operations. Enterprises prefer cloud models to avoid infrastructure costs and to ensure accessibility across distributed teams. The integration of decision intelligence with cloud ecosystems enables faster deployment and better collaboration. Growing investments in hybrid and multi-cloud architectures further accelerate the transition toward cloud-enabled intelligent decision-making frameworks.

Key Trends & Opportunities

Emergence of Augmented Analytics and Automation

Augmented analytics is reshaping how organizations extract value from data. It combines machine learning, natural language processing, and automation to simplify data interpretation. This trend helps business users make informed decisions without deep technical expertise. Automated insights also reduce human bias and speed up decision cycles. Companies are investing in augmented decision-making systems to enhance agility and responsiveness in competitive markets, creating new opportunities for technology providers and software developers.

- For instance, Qlik serves over 40,000 customers using its AI-powered analytics and data integration portfolio.

Integration with IoT and Edge Computing

The convergence of decision intelligence with IoT and edge computing is expanding analytical capabilities. Connected devices generate large volumes of real-time data that can be processed at the network edge for faster insights. This integration improves operational decision-making in sectors such as manufacturing, logistics, and healthcare. Organizations use this synergy to predict equipment failures, optimize energy use, and enhance customer engagement. The growing IoT ecosystem continues to present new opportunities for decision intelligence vendors.

- For instance, Microsoft’s 2024 Digital Defense Report cites analysis of 78 trillion security signals per day to detect threats.

Key Challenges

Data Privacy and Security Concerns

The widespread use of data-driven intelligence raises serious security and privacy challenges. Decision intelligence systems depend on sensitive business and consumer data, making them vulnerable to cyber threats. Strict data protection regulations across regions add complexity to implementation. Companies must ensure compliance while maintaining data accessibility for analytics. Balancing privacy with analytical depth remains a key challenge for enterprises adopting decision intelligence solutions, especially in sectors like BFSI and healthcare.

Integration Complexity and Skill Gaps

Implementing decision intelligence platforms across existing IT infrastructure requires significant technical expertise. Many organizations face challenges in integrating diverse data sources, legacy systems, and AI models effectively. The shortage of skilled professionals in data science and analytics further complicates adoption. Businesses often struggle to align decision intelligence tools with operational goals, leading to inefficiencies. Addressing these integration and talent gaps is essential for realizing the full potential of decision intelligence technologies.

Regional Analysis

North America

North America held the largest share of 38% in the decision intelligence market in 2024. The region benefits from strong adoption of AI, machine learning, and analytics platforms across major industries such as BFSI, healthcare, and retail. The presence of leading technology firms and advanced digital infrastructure further supports market growth. Enterprises increasingly use decision intelligence tools for automation and predictive modeling. The U.S. leads regional demand, driven by continuous investments in cloud computing and data analytics technologies, which enhance real-time decision-making capabilities across diverse enterprise applications.

Europe

Europe accounted for a 27% share of the decision intelligence market in 2024. The region’s growth is supported by the strong presence of analytics providers and the rising emphasis on digital transformation initiatives. Businesses in countries such as Germany, the U.K., and France are increasingly adopting AI-enabled decision platforms to improve business agility and regulatory compliance. Government-backed digital programs and funding for AI research also contribute to market expansion. Demand for decision intelligence is particularly high in financial services and manufacturing sectors focused on process optimization.

Asia Pacific

Asia Pacific captured a 24% share of the decision intelligence market in 2024 and is the fastest-growing region. The adoption of cloud computing, big data analytics, and AI technologies in emerging economies such as China, India, and Japan is accelerating market expansion. Businesses across retail, telecom, and manufacturing sectors are adopting decision intelligence platforms to improve efficiency and competitiveness. Regional governments are investing heavily in AI infrastructure and data-driven innovation, creating a strong ecosystem for growth. Increasing digitalization among small and medium enterprises further strengthens market potential.

Latin America

Latin America held a 6% share of the decision intelligence market in 2024. The region’s growth is driven by the gradual adoption of AI and analytics solutions, especially in banking, telecom, and retail industries. Countries such as Brazil and Mexico are focusing on digital transformation to enhance business performance. Enterprises are adopting cloud-based decision platforms to improve agility and cost efficiency. Although adoption remains slower than in developed regions, rising investments in IT infrastructure and regional innovation hubs are expected to drive steady growth in the coming years.

Middle East and Africa

The Middle East and Africa accounted for a 5% share of the decision intelligence market in 2024. The region is witnessing growing investments in digital transformation, particularly within the UAE, Saudi Arabia, and South Africa. Public and private organizations are implementing decision intelligence systems to improve governance, financial management, and customer service. Increasing use of cloud-based analytics and smart city initiatives is supporting market expansion. While market maturity remains in early stages, strong government focus on data-driven economies will continue to drive regional growth over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Component

By Deployment

By End Use

- BFSI

- IT & Telecom

- Retail & Ecommerce

- Healthcare

- Manufacturing

- Government

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The decision intelligence market is marked by intense competition among key players such as Microsoft, Intel Corporation, SAS, Oracle, H2O.ai, Board International, Bamboo Rose, Inc., Provenir, Pyramid Analytics BV., International Business Machines Incorporation, Domo, Inc., Google LLC, TATA Consultancy Services, Circuitry.ai, and IBM. The market features a blend of established technology providers and emerging innovators offering advanced analytics, AI-driven platforms, and cloud-based decision solutions. Companies are focusing on expanding product capabilities through AI integration, predictive modeling, and automation tools. Strategic partnerships, acquisitions, and R&D investments are being prioritized to enhance decision-making accuracy and data management capabilities. Vendors are also emphasizing user-friendly interfaces and scalability to cater to enterprises of all sizes. Continuous innovation in machine learning algorithms, integration with IoT systems, and cloud computing advancements are driving competition. The market’s competitive intensity is expected to rise further as organizations worldwide accelerate digital transformation initiatives.

Key Player Analysis

- Microsoft

- Intel Corporation

- SAS

- Oracle

- ai

- Board International

- Bamboo Rose, Inc.

- Provenir

- Pyramid Analytics BV.

- International Business Machines Incorporation

- Domo, Inc.

- Google LLC

- TATA Consultancy Services

- ai

- IBM

Recent Developments

- In 2024, IBM announced the general availability of watsonx Assistant for Z At the Think 2024 conference, a generative AI assistant designed to automate and simplify tasks for mainframe users.

- In 2024, SAS enhanced its Intelligent Decisioning software with advanced list capabilities, allowing users to create and manage tabular datasets with multiple keys for better decision-making.

- In 2024, Board International launched its cloud-native platform, Board 14, and acquired predictive planning software company Prevedere.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Integration of AI and machine learning will continue to enhance automated decision-making.

- Cloud-based platforms will dominate due to scalability and real-time analytics capabilities.

- Adoption will increase across BFSI, healthcare, and manufacturing for predictive operations.

- Augmented analytics will simplify data interpretation for non-technical business users.

- Growing IoT integration will enable faster insights from connected devices.

- SMEs will increasingly invest in decision intelligence to improve efficiency and agility.

- Data privacy and compliance will remain a key focus for global enterprises.

- Partnerships between tech vendors and enterprises will drive product innovation.

- Edge computing will expand decision-making capabilities closer to data sources.

- Continuous advances in AI models will make decision intelligence more accurate and adaptive.