Market Overview

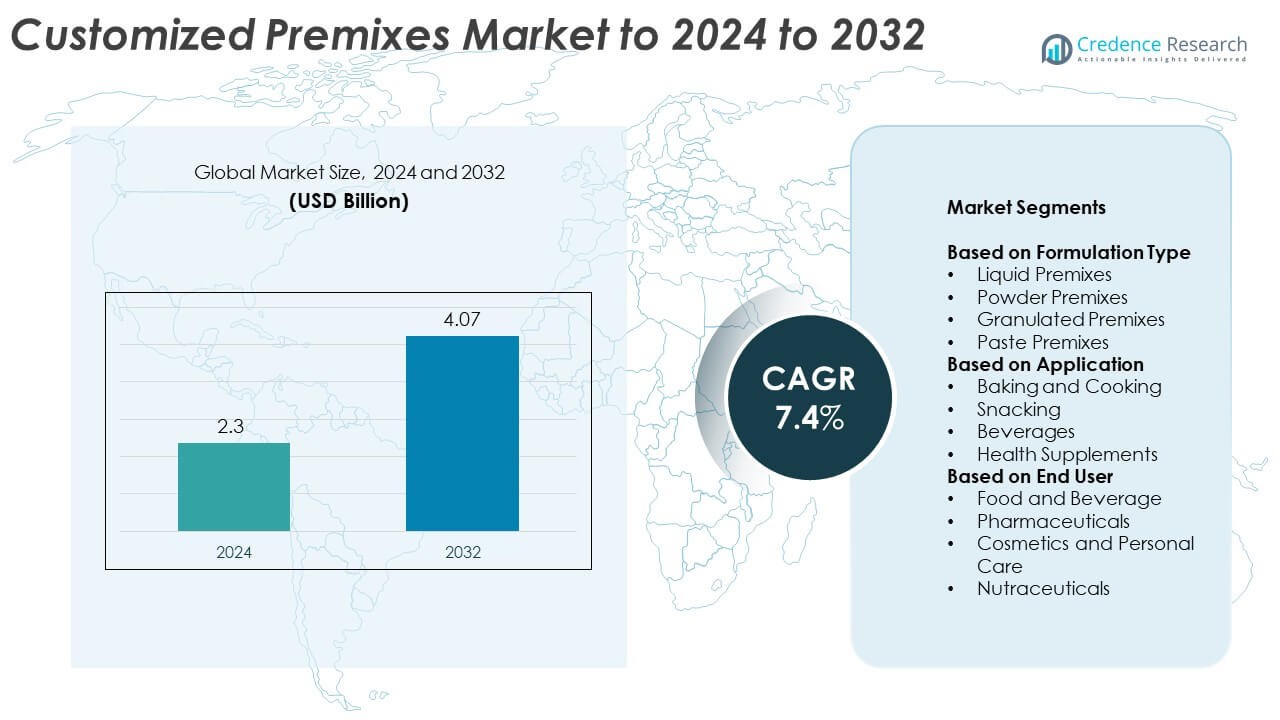

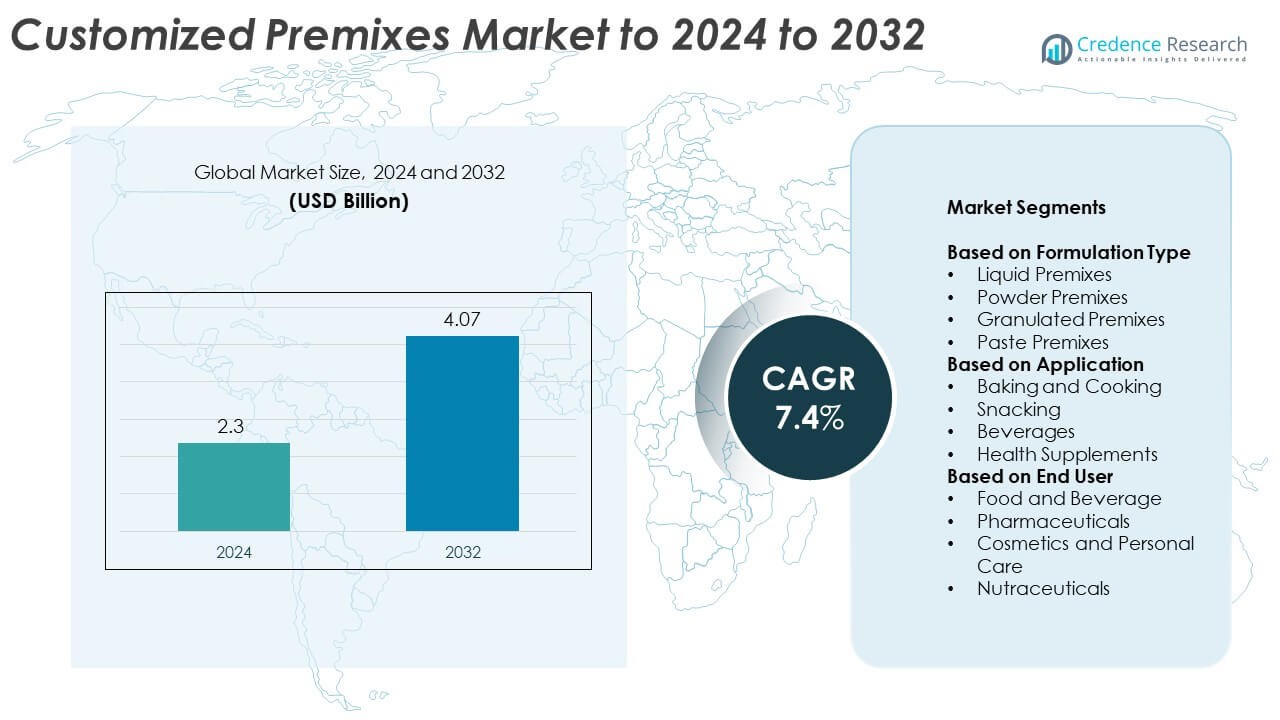

Customized Premixes Market size was valued USD 2.3 Billion in 2024 and is anticipated to reach USD 4.07 Billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customized Premixes Market Size 2024 |

USD 2.3 Billion |

| Customized Premixes Market, CAGR |

7.4% |

| Customized Premixes Market Size 2032 |

USD 4.07 Billion |

The Customized Premixes Market is led by major players including Cargill, BASF, Kerry Group, Archer Daniels Midland, Syngenta, Olam International, DuPont, Tate & Lyle, and Bunge. These companies focus on expanding their portfolios through product innovation, strategic partnerships, and advancements in nutrient blending technologies. Continuous investment in research and sustainable ingredient sourcing enhances their global presence. North America dominated the market in 2024 with a 35% share, driven by high demand for fortified foods and nutraceuticals. Europe followed with 28%, supported by strong regulations and growing consumer preference for clean-label nutrition solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Customized Premixes Market was valued at USD 2.3 billion in 2024 and is projected to reach USD 4.07 billion by 2032, growing at a CAGR of 7.4%.

- Rising consumer focus on health and nutrition is driving demand for fortified foods and beverages, increasing the use of customized vitamin and mineral blends.

- Emerging trends include personalized nutrition, clean-label formulations, and technological advancements in nutrient stability and microencapsulation.

- The market is highly competitive with global players investing in R&D, sustainability, and partnerships to expand product portfolios and regional presence.

- North America held 35% of the market share in 2024, followed by Europe with 28% and Asia Pacific with 25%, while the powder premixes segment dominated with 47% share due to its wide application in functional foods and beverages.

Market Segmentation Analysis:

By Formulation Type

Powder premixes dominated the Customized Premixes Market in 2024, accounting for nearly 47% of total revenue. Their extended shelf life, ease of transportation, and compatibility with dry food applications make them highly preferred across industries. Food manufacturers rely on powder premixes for consistent nutrient blending and cost efficiency. Liquid premixes are gaining traction in beverage formulations and ready-to-drink products due to better solubility and uniform dispersion. The rising demand for functional foods and fortified products is driving the adoption of advanced powder and liquid-based premix solutions globally.

- For instance, dsm-firmenich operates 13 nutrition premix plants supported by 1,300 production experts, enabling global powder premix supply.

By Application

Beverages represented the leading application segment in 2024, holding around 38% of the market share. Growing consumer focus on fortified drinks, such as energy beverages and nutritional shakes, has significantly boosted demand for customized premixes. Manufacturers increasingly use tailored micronutrient blends to meet regional health preferences and regulatory standards. Baking and cooking applications are also expanding due to clean-label and fortified ingredient innovations. The shift toward convenient and health-oriented food products is further enhancing the adoption of customized premixes in beverage and bakery formulations.

- For instance, Kerry’s BC30 probiotic is formulated at 1,000,000,000 CFU per serving in beverage applications, documented in peer-reviewed and technical materials.

By End User

The food and beverage sector dominated the market in 2024 with approximately 54% share. This segment benefits from the growing use of micronutrient and functional ingredient blends to enhance flavor, texture, and nutritional content. Key drivers include rising health awareness and the surge in fortified food production across developing economies. Nutraceutical companies are also expanding their use of premixes for targeted health solutions such as immunity and energy support. The increasing focus on personalized nutrition is encouraging collaboration between premix suppliers and major food manufacturers.

Key Growth Drivers

Rising Demand for Functional and Fortified Foods

Consumers are increasingly seeking foods enriched with essential vitamins, minerals, and amino acids. This shift toward preventive health and wellness has fueled the demand for customized premixes that cater to specific nutritional needs. Food and beverage manufacturers are introducing fortified snacks, dairy, and beverages to meet dietary expectations. The growing preference for nutrient-rich convenience products, especially among urban populations, continues to position fortified foods as a central growth driver in the global customized premixes market.

- For instance, Coca-Cola India’s Minute Maid Vitingo uses 18-gram sachets fortified with 7 listed micronutrients for school-age nutrition programs.

Growing Health Awareness and Lifestyle Shifts

Health-conscious consumers are focusing on balanced nutrition and clean-label ingredients. Customized premixes allow manufacturers to develop tailored products addressing immunity, energy, and weight management goals. Rising lifestyle-related disorders such as obesity and diabetes are prompting consumers to adopt nutritionally fortified foods. As a result, demand for vitamin and mineral-enriched formulations in functional foods and beverages is growing rapidly. This heightened health awareness across all age groups remains a key factor driving market expansion.

- For instance, Catalent’s St. Petersburg site has annual capacity for 18 billion softgel capsules used in nutrition and health products.

Expansion of Nutraceutical and Pharmaceutical Applications

The nutraceutical and pharmaceutical sectors are increasingly using customized premixes to enhance product efficacy and uniformity. Demand for precise ingredient blending has surged as companies aim to deliver consistent dosage and performance. The rise in dietary supplement consumption and preventive healthcare adoption further supports this growth. Pharmaceutical-grade premixes with improved solubility and bioavailability are gaining preference, strengthening supplier relationships and driving innovation in formulation development.

Key Trends and Opportunities

Adoption of Personalized Nutrition Solutions

Personalized nutrition is emerging as a major trend, driven by advances in health diagnostics and consumer data analytics. Manufacturers are leveraging customized premixes to formulate products that cater to individual dietary needs and preferences. This approach enables brands to target specific demographic segments, such as athletes, children, or the elderly. The integration of AI and digital tools for nutrition profiling presents significant opportunities for developing data-driven, customized premix solutions in the coming years.

- For instance, Persona (Nestlé Health Science) offers 60-plus supplements that generate over 5 trillion possible daily pack combinations via its assessment platform.

Technological Advancements in Premix Formulation

Innovation in microencapsulation, stability enhancement, and nutrient delivery systems is transforming premix production. These advancements ensure better nutrient retention and improve compatibility with diverse food matrices. Manufacturers are focusing on developing heat-stable and pH-resistant formulations to expand application scope. The growing use of automation and precision mixing technologies further enhances product uniformity and efficiency. Such advancements are enabling manufacturers to meet the evolving performance and regulatory demands across global markets.

- For instance, BASF supplies microencapsulated vitamin A beadlets specified at 1.0 million IU per gram, suitable for high-stress processing.

Key Challenges

High Cost of Customized Formulations

The development of specialized premixes involves higher raw material and production costs. Sourcing premium ingredients, ensuring uniform blending, and maintaining quality standards increase manufacturing expenses. These costs often limit adoption among small and medium-scale food producers. Price-sensitive markets in developing regions find it difficult to incorporate customized premixes in large-scale production. Balancing product innovation with cost efficiency remains a major challenge for industry players aiming for broad market penetration.

Stringent Regulatory Compliance and Quality Control

The customized premixes industry faces strict regulatory scrutiny across regions due to varying nutritional standards and labeling requirements. Ensuring compliance with international food safety norms and ingredient traceability demands extensive documentation and testing. Variations in permissible nutrient limits between countries add complexity to product formulation. Manufacturers must continually invest in R&D and certification to align with these regulations. Meeting these evolving standards while maintaining consistency and global scalability remains a key challenge for market participants.

Regional Analysis

North America

North America held the largest share of around 35% in the Customized Premixes Market in 2024. The region benefits from strong demand for fortified food and beverage products driven by growing health awareness and high disposable income. Major manufacturers in the United States focus on advanced formulation technologies and product innovation to meet specific dietary needs. Increasing adoption of personalized nutrition and functional ingredients across the food, nutraceutical, and pharmaceutical industries continues to strengthen market growth. Government initiatives promoting nutrient fortification further support market expansion across the region.

Europe

Europe accounted for nearly 28% of the global market share in 2024, supported by growing consumer preference for clean-label and fortified food products. Countries such as Germany, France, and the United Kingdom are leading adopters of nutrient-enriched beverages and dietary supplements. Stringent regulatory standards encourage the use of safe and traceable premix formulations, promoting product quality and transparency. The region’s focus on preventive healthcare and sustainable ingredient sourcing further drives demand. Expansion of plant-based and vegan-friendly premixes adds to Europe’s steady market performance.

Asia Pacific

Asia Pacific represented about 25% of the market share in 2024, making it one of the fastest-growing regions. Rising disposable income, urbanization, and shifting dietary habits are key contributors to growth. Countries such as China, India, and Japan are witnessing high demand for fortified beverages, infant nutrition, and health supplements. The expanding middle-class population and growing awareness of micronutrient deficiencies fuel regional consumption. Additionally, local manufacturers are partnering with global players to improve formulation expertise and expand distribution networks across emerging economies.

Latin America

Latin America captured approximately 7% of the market share in 2024, driven by increasing awareness of health and nutrition. Brazil and Mexico lead regional demand with growing adoption of fortified foods and beverages. Consumers are showing greater interest in dietary supplements and functional snacks due to lifestyle-related health issues. The market benefits from rising collaborations between regional food processors and global premix suppliers. However, fluctuating economic conditions and limited technological capabilities restrain faster adoption. Still, increasing investment in food fortification programs supports gradual market expansion.

Middle East and Africa

The Middle East and Africa accounted for around 5% of the market share in 2024. Growing efforts to address malnutrition and micronutrient deficiencies are driving government-led food fortification programs. Countries such as South Africa, the UAE, and Saudi Arabia are showing rising interest in customized nutritional solutions. The expanding food and beverage industry and increasing health awareness among younger populations support moderate growth. However, limited access to advanced processing technologies and higher production costs remain challenges. The region continues to offer untapped opportunities for future investment and product localization.

Market Segmentations:

By Formulation Type

- Liquid Premixes

- Powder Premixes

- Granulated Premixes

- Paste Premixes

By Application

- Baking and Cooking

- Snacking

- Beverages

- Health Supplements

By End User

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Nutraceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Customized Premixes Market features key players such as Cargill, BASF, Kerry Group, Archer Daniels Midland, Syngenta, Olam International, DuPont, Tate & Lyle, FMC Corporation, Bunge, Associated British Foods, Nutrien, dsm-firmenich, SABIC, Ingredion, and Mosaic Company. These companies are focusing on developing innovative nutrient blends and expanding their product portfolios through technological advancements. Strategic mergers, acquisitions, and partnerships are common to enhance market reach and strengthen supply chain capabilities. Many players are investing in advanced formulation technologies to improve bioavailability, stability, and nutrient integration across diverse applications. Sustainability initiatives, clean-label formulations, and regional production expansion are also shaping competitive strategies. Continuous R&D investment and collaboration with food and nutraceutical manufacturers are key priorities to meet changing consumer preferences. Global players are emphasizing localized solutions, flexible production systems, and digital formulation tools to capture emerging market opportunities and maintain long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill

- BASF

- Kerry Group

- Archer Daniels Midland

- Syngenta

- Olam International

- DuPont

- Tate & Lyle

- FMC Corporation

- Bunge

- Associated British Foods

- Nutrien

- dsm-firmenich

- SABIC

- Ingredion

- Mosaic Company

Recent Developments

- In 2024, dsm-firmenich launched its “Flavor of the Year,” Peach+, for innovative food and beverage applications. This initiative, combined with its premix expertise, helps manufacturers create custom-flavored and nutritionally fortified products.

- In 2023, dsm-firmenich announced its acquisition of Adare Biome, a postbiotics specialist. This move enhanced dsm-firmenich’s capabilities in creating customized premix solutions featuring next-generation, gut-health-supporting ingredients.

- In 2023, Cargill launched a new, $28 million automated premix plant in Vietnam, which significantly increased its production capacity for vitamin premixes and additives for livestock and aquaculture.

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized nutrition products will continue to rise across global markets.

- Food and beverage manufacturers will adopt more customized nutrient blends for product differentiation.

- Technological advancements in microencapsulation will improve nutrient stability and shelf life.

- Nutraceutical applications will expand due to growing preventive healthcare awareness.

- Clean-label and plant-based premixes will gain strong preference among consumers.

- Partnerships between global ingredient suppliers and local brands will strengthen distribution networks.

- Automation in formulation and blending processes will enhance product consistency.

- Regulatory harmonization across regions will support smoother market expansion.

- E-commerce growth will increase consumer access to fortified and functional food products.

- Sustainability initiatives will drive innovation in sourcing and formulation of customized premixes.