Market Overview

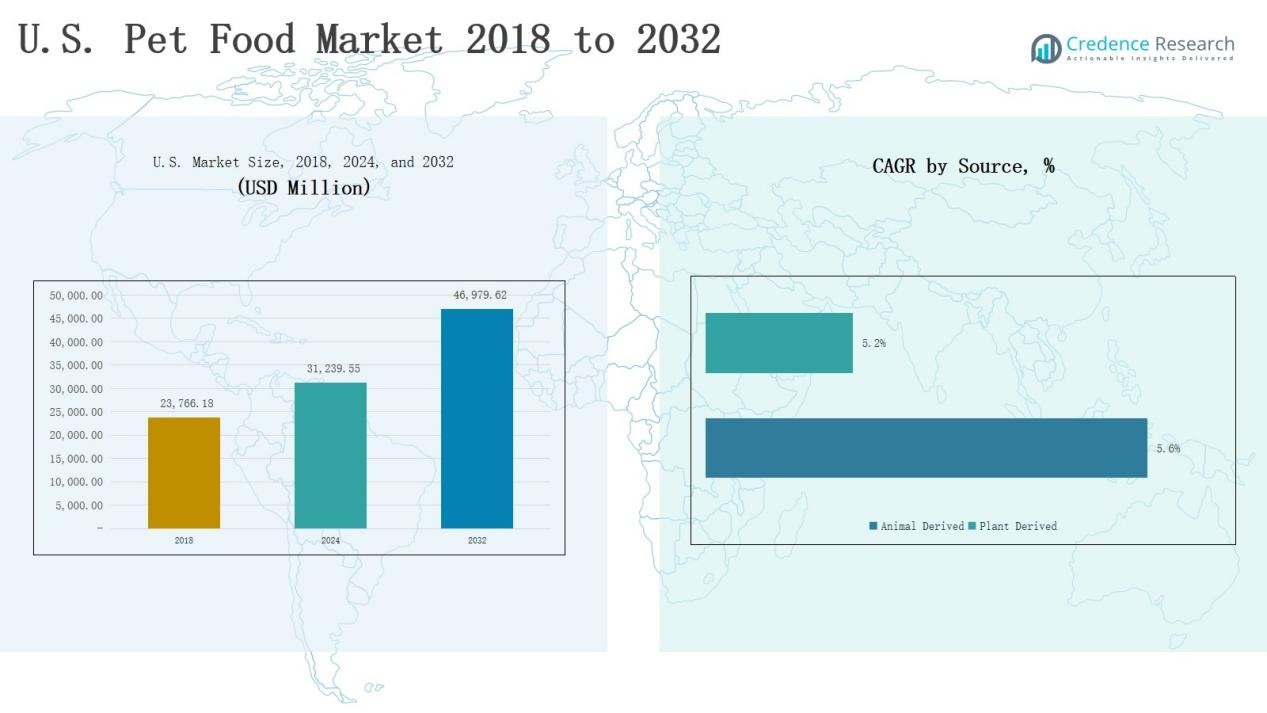

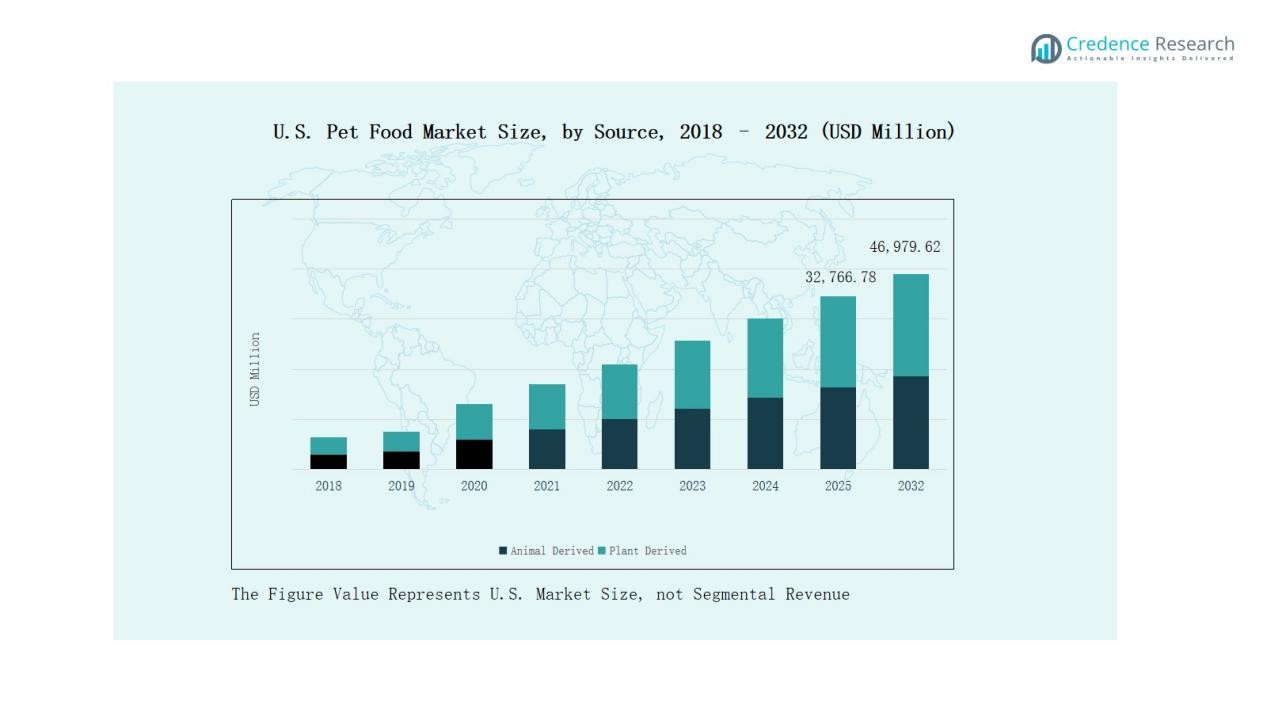

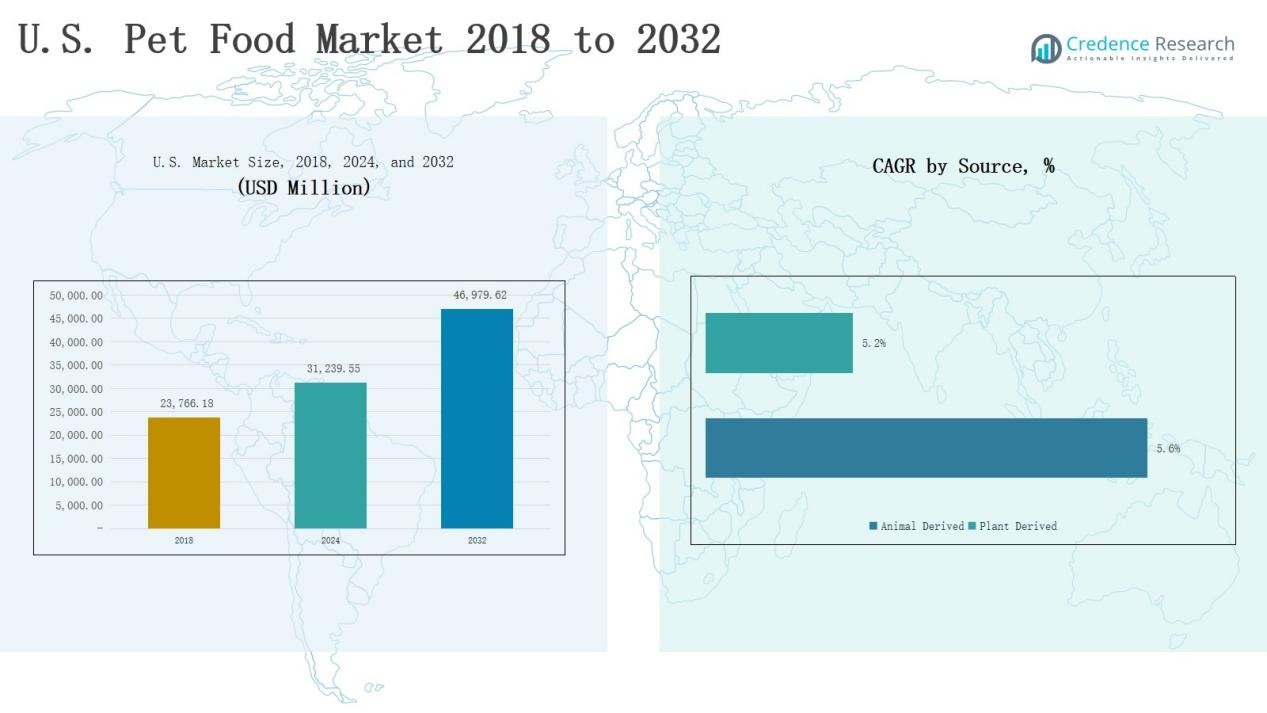

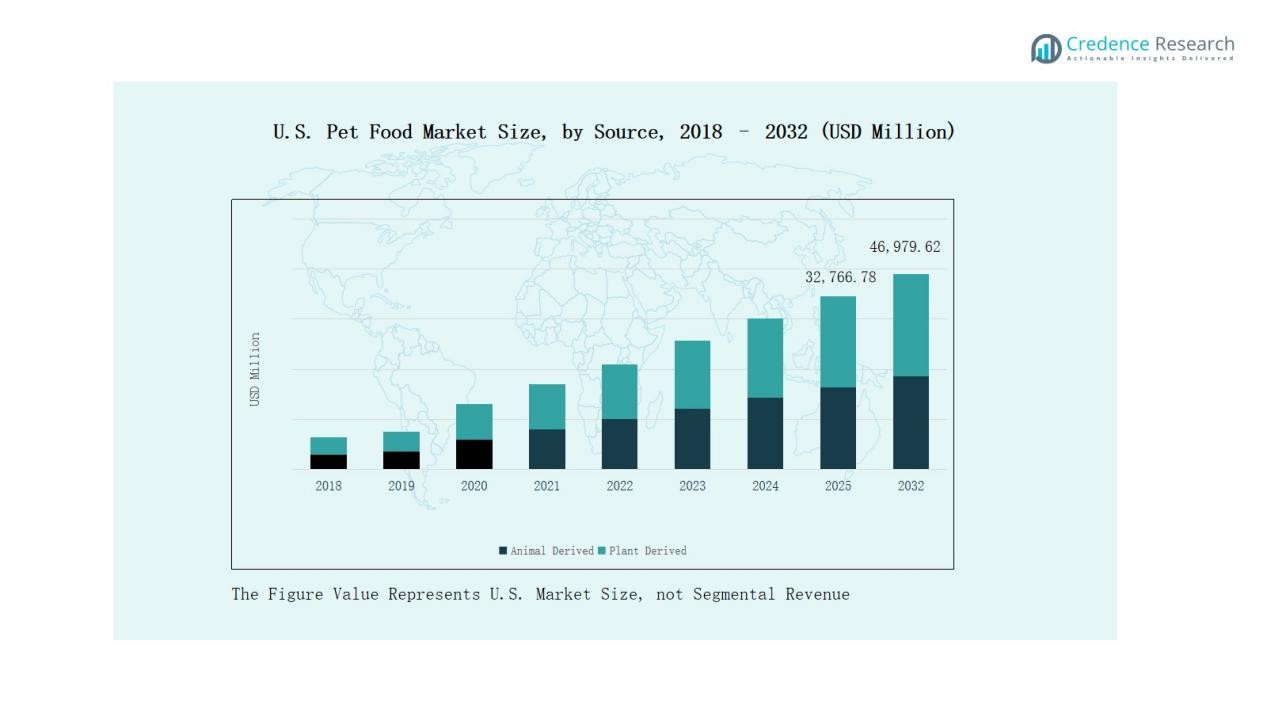

The U.S. Pet Food Market size was valued at USD 23,766.18 million in 2018, increased to USD 31,239.55 million in 2024, and is anticipated to reach USD 46,979.62 million by 2032, growing at a CAGR of 5.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Pet Food Market Size 2024 |

USD 31,239.55 Million |

| U.S. Pet Food Market, CAGR |

5.02% |

| U.S. Pet Food Market Size 2032 |

USD 46,979.62 Million |

The U.S. Pet Food Market is dominated by major companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, Inc., and J.M. Smucker Co., which lead through strong product portfolios, advanced nutrition research, and extensive retail distribution. These players focus on premium, functional, and sustainable formulations to meet evolving consumer preferences. United Petfood, Simmons Pet Food, and Archer Daniels Midland Company (ADM) strengthen competition through private-label and ingredient innovations. Regionally, the South led the market in 2024 with a 32% share, driven by high pet ownership, large production bases, and growing demand for customized, high-protein diets across diverse consumer segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Pet Food Market was valued at USD 23,766.18 million in 2018, reached USD 31,239.55 million in 2024, and is projected to hit USD 46,979.62 million by 2032, growing at a CAGR of 5.02%.

- Leading companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, and J.M. Smucker Co. dominate through innovation, premium formulations, and extensive retail presence.

- By food type, dry pet food led with a 61% share in 2024, driven by convenience, affordability, and the inclusion of functional ingredients that support pet health.

- By source, animal-derived food held a 68% share, supported by strong demand for protein-rich, grain-free, and meat-first products across premium and mainstream categories.

- Regionally, the South led the market with a 32% share in 2024, backed by high pet adoption, strong production capacity, and increasing demand for customized, high-protein diets.

Market Segment Insights

By Food Type

Dry pet food dominated the U.S. Pet Food Market in 2024 with a 61% share. Its long shelf life, easy storage, and convenience for portion control support high adoption among pet owners. The segment benefits from cost efficiency and the inclusion of functional ingredients such as probiotics and omega fatty acids. Increasing demand for premium dry formulations that promote oral health and digestion continues to strengthen this segment’s position across both dog and cat food categories.

- For instance, Hill’s Pet Nutrition introduced its Science Diet Perfect Digestion dry range, enhanced with ActivBiome+ to support gut health in both dogs and cats.

By Source

Animal-derived pet food accounted for a 68% share of the U.S. Pet Food Market in 2024. Consumers prefer protein-rich diets made from poultry, beef, and fish sources that align with pets’ natural feeding habits. Growth is supported by rising demand for high-protein, grain-free, and meat-first products. Expanding supply chains for sustainable animal protein and the introduction of freeze-dried meat inclusions further enhance the dominance of this segment in both premium and mass-market categories.

- For instance, Mars Petcare introduced Cesar Wholesome Bowls, featuring chicken and beef sources without grains or artificial preservatives, catering to rising demand for clean-label meat products.

By Pet Type

The dog food segment led the U.S. Pet Food Market in 2024, capturing a 57% share. High dog ownership rates and growing awareness of breed-specific nutritional needs drive segment expansion. Demand for tailored formulations addressing joint, coat, and digestive health continues to rise. The trend toward human-grade ingredients and grain-free recipes further strengthens sales in both dry and wet dog food categories, supported by increasing expenditure on canine health and well-being.

Key Growth Drivers

Rising Pet Humanization and Premiumization

Pet owners increasingly treat pets as family members, fueling demand for premium, nutritionally advanced food products. The shift toward human-grade, organic, and functional ingredients supports higher spending on pet health and wellness. Brands introducing fortified formulations with probiotics, antioxidants, and natural proteins attract health-conscious consumers. This humanization trend also boosts sales of gourmet and specialized diets, strengthening the market’s premium segment across both dog and cat food categories.

- For instance, The Honest Kitchen offers human-grade pet food where every ingredient meets standards for human consumption, resulting in reported improvements of 80% in pets’ digestion and 77% in wellbeing and energy levels.

Expanding E-Commerce and Direct-to-Consumer Channels

Online retail growth has transformed purchasing patterns in the U.S. Pet Food Market. E-commerce platforms offer subscription models, doorstep delivery, and personalized product recommendations. Pet owners prefer digital platforms for convenience and access to niche brands unavailable in stores. Direct-to-consumer brands use data analytics to create tailored feeding plans, improving loyalty. Enhanced logistics networks and temperature-controlled packaging strengthen online pet food accessibility and encourage steady repeat purchases across major urban markets.

- For instance, HelloFresh launched “The Pets Table” dog food subscription in summer 2023, offering “human-grade” meals as part of its strategy to broaden fully integrated food solutions.

Growing Demand for Functional and Natural Ingredients

Health-conscious consumers seek clean-label pet food free from artificial additives, preservatives, and fillers. Functional ingredients, such as omega-3 fatty acids, glucosamine, and probiotics, drive strong demand for products targeting immunity, joint, and digestive health. Manufacturers are reformulating recipes with superfoods and plant-based protein blends to align with sustainability and ethical sourcing goals. This trend supports innovation in both wet and dry food formats, expanding premium and specialty pet food portfolios.

Key Trends & Opportunities

Surge in Plant-Based and Alternative Protein Formulations

Plant-based and insect-derived proteins are gaining traction as sustainable alternatives to meat-based diets. Consumers increasingly favor eco-friendly formulations that reduce the carbon footprint of pet ownership. Companies are introducing products featuring pea, lentil, and algae proteins that maintain high nutritional value. This trend offers long-term growth opportunities in vegan and hypoallergenic pet food lines, driven by environmental awareness and expanding availability of plant-based protein sources in the U.S. market.

- For instance, PawCo, founded by a former Impossible Foods scientist, launched a fresh vegan dog food formula called GreenMeat™ using yeast and pea protein, offering a nutritionally complete diet exceeding AAFCO standards.

Personalization and Data-Driven Nutrition

Technology adoption enables pet food companies to provide personalized meal plans based on breed, age, and health conditions. AI-driven tools and smart feeding devices allow tracking of consumption patterns and nutritional needs. Subscription-based models use this data to tailor ingredient composition for optimal wellness. The trend toward individualized nutrition enhances customer engagement and supports premium product demand, offering brands new opportunities to differentiate within the competitive U.S. pet food landscape.

- For instance, FurrMeals offers a subscription plan with flexible customization options where owners can select ingredients and adjust plans based on their pet’s preferences and sensitivities.

Key Challenges

Fluctuating Raw Material Prices

Volatile costs of key ingredients such as meat, grains, and fats pose challenges for manufacturers. Rising feed and transportation expenses pressure profit margins, especially for small and mid-scale producers. Price instability disrupts supply chain planning, leading to inconsistent product pricing for consumers. Companies are increasingly exploring ingredient diversification and local sourcing strategies to reduce dependency on global commodity markets and ensure consistent cost management across product categories.

Stringent Regulatory and Labeling Requirements

Compliance with FDA and AAFCO standards requires continuous monitoring and reformulation of products. Frequent regulatory updates on ingredient approval, labeling claims, and safety testing increase operational complexity. Smaller firms face resource constraints in adapting to evolving nutritional labeling and sustainability disclosure rules. Ensuring traceability from raw materials to packaging remains critical to maintaining consumer trust and preventing recalls or reputational risks in the competitive pet food sector.

Rising Competition and Market Saturation

The U.S. Pet Food Market faces intense competition among established and emerging brands. Major players dominate through extensive distribution networks, while new entrants struggle to gain visibility. Constant innovation pressures increase marketing and R&D costs. With premiumization reaching maturity, differentiation through unique formulations or sustainability credentials becomes essential. Companies must invest in brand loyalty, supply chain agility, and digital engagement to sustain growth in this highly saturated marketplace.

Regional Analysis

Northeast

The Northeast held 21% of the U.S. Pet Food Market in 2024. High pet ownership in urban centers such as New York, Boston, and Philadelphia supports steady demand. Consumers favor premium, organic, and human-grade food products that align with wellness-focused lifestyles. Specialty stores and boutique pet retailers dominate distribution, emphasizing fresh and sustainable formulations. The strong presence of educated consumers drives awareness about nutrition and ingredient sourcing. It continues to attract global brands targeting affluent, health-conscious pet owners.

Midwest

The Midwest accounted for 25% of the U.S. Pet Food Market in 2024. The region benefits from abundant livestock supply, efficient manufacturing bases, and established distribution networks. Cost-effective dry food production supports volume growth, while rural pet ownership contributes to steady consumption. Local producers focus on value-driven offerings tailored for multiple pet types. It also shows rising demand for natural and protein-rich formulations. The expanding e-commerce infrastructure further increases accessibility across semi-urban areas.

South

The South led the U.S. Pet Food Market with a 32% share in 2024. High household pet adoption and the presence of major production hubs such as Texas and Georgia strengthen its dominance. Consumers display growing interest in grain-free, high-protein, and customized diets. Strong retail chains and online marketplaces enable broad product availability across both premium and economy categories. It also benefits from rising disposable incomes and increasing awareness of pet wellness. Ongoing industry investment reinforces regional market leadership.

West

The West region captured 22% of the U.S. Pet Food Market in 2024. States such as California and Washington drive strong demand for sustainable and plant-based pet food products. Consumers prioritize eco-friendly packaging and locally sourced ingredients, promoting innovation among manufacturers. The region’s focus on pet health and environmental responsibility supports growth in natural and functional product lines. It also benefits from high online sales penetration and technology-driven consumer engagement. Strong retail presence and premiumization sustain continued expansion.

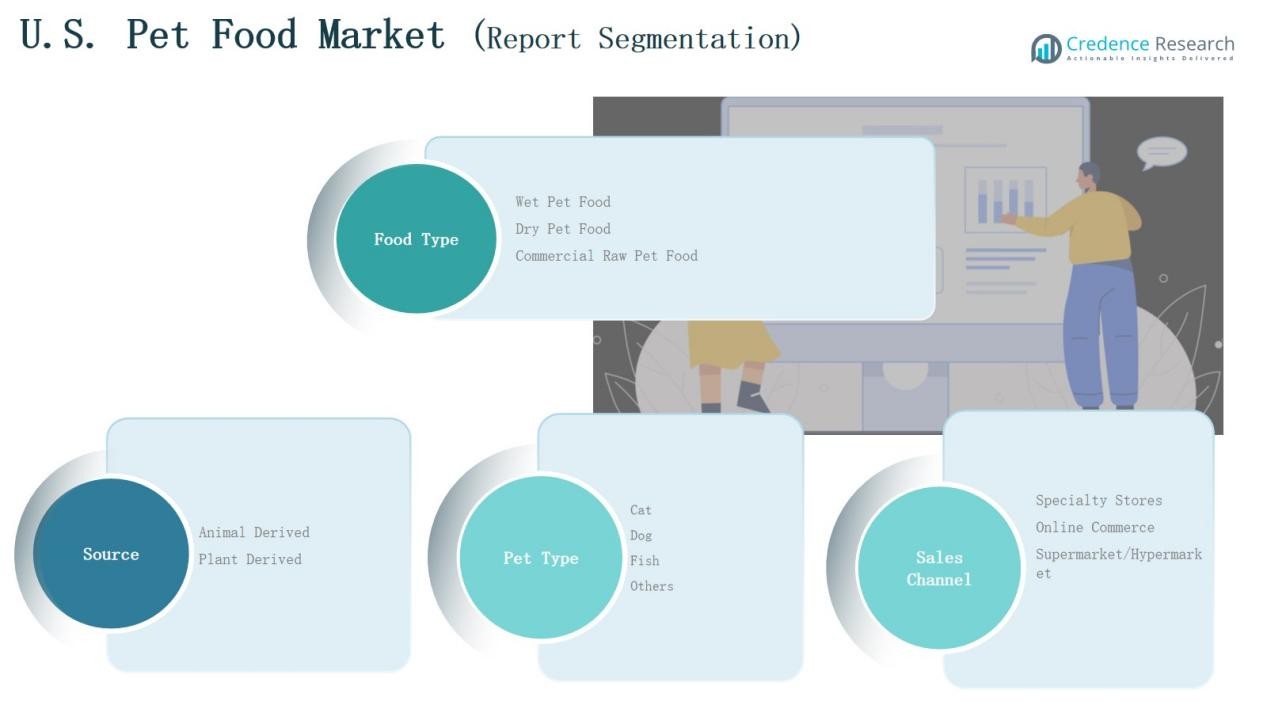

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Supermarket/Hypermarket

- Online Commerce

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Pet Food Market is highly competitive, with major players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, and J.M. Smucker Co. dominating through extensive product portfolios and robust distribution networks. These companies focus on innovation, launching functional, organic, and breed-specific formulations to capture evolving consumer preferences. Private-label and regional brands are expanding their presence by offering affordable, nutritionally balanced alternatives. Competition is further intensified by the rapid growth of e-commerce and direct-to-consumer brands, which leverage personalized marketing and subscription-based sales. Strategic acquisitions, partnerships with retailers, and investments in sustainable packaging are key strategies among leading firms to strengthen market share. Continuous emphasis on R&D, transparency, and ingredient quality remains central to brand differentiation, while emerging niche players gain traction by catering to rising demand for clean-label and plant-based pet food products across urban and suburban markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Hill’s Pet Nutrition Inc.

- Mars, Incorporated

- Nestlé Purina PetCare

- General Mills, Inc.

- M. Smucker Co.

- United Petfood

- Simmons Pet Food

- Elmira Pet Products

- Real Pet Food Co.

- Archer Daniels Midland Company (ADM)

- Unicharm Corporation

Recent Developments

- In June 2025, General Mills launched its new “Love Made Fresh” line under the Blue Buffalo brand, marking its entry into the fresh pet food segment.

- In 2024, Nestlé Purina PetCare opened a 1.3-million-square-foot manufacturing facility in Eden, North Carolina, expanding its U.S. production capacity.

- In late 2024, General Mills announced an acquisition agreement for Tiki Pets and Cloud Star brands from Whitebridge Pet Brands.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and human-grade pet food will continue to grow across major cities.

- Plant-based and alternative protein formulations will gain wider consumer acceptance.

- Personalized nutrition and data-driven meal planning will shape future product innovation.

- Sustainability and eco-friendly packaging will become key brand differentiators.

- E-commerce and subscription-based delivery models will expand their market share.

- Functional ingredients supporting immunity and joint health will drive new product launches.

- Pet ownership growth among millennials and Gen Z will sustain long-term demand.

- Strategic mergers and acquisitions will increase market consolidation among leading players.

- Regulatory focus on labeling transparency and quality control will strengthen brand trust.

- Technological integration in production and logistics will enhance efficiency and product traceability.