Market Overview

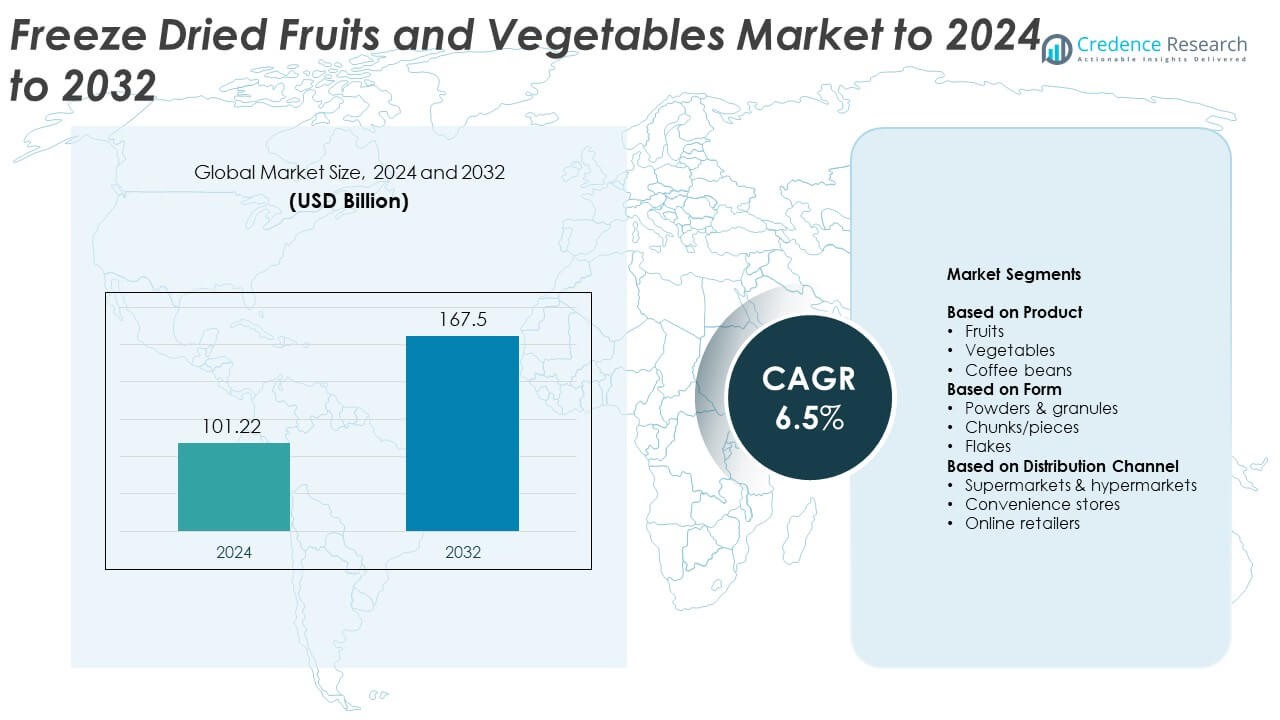

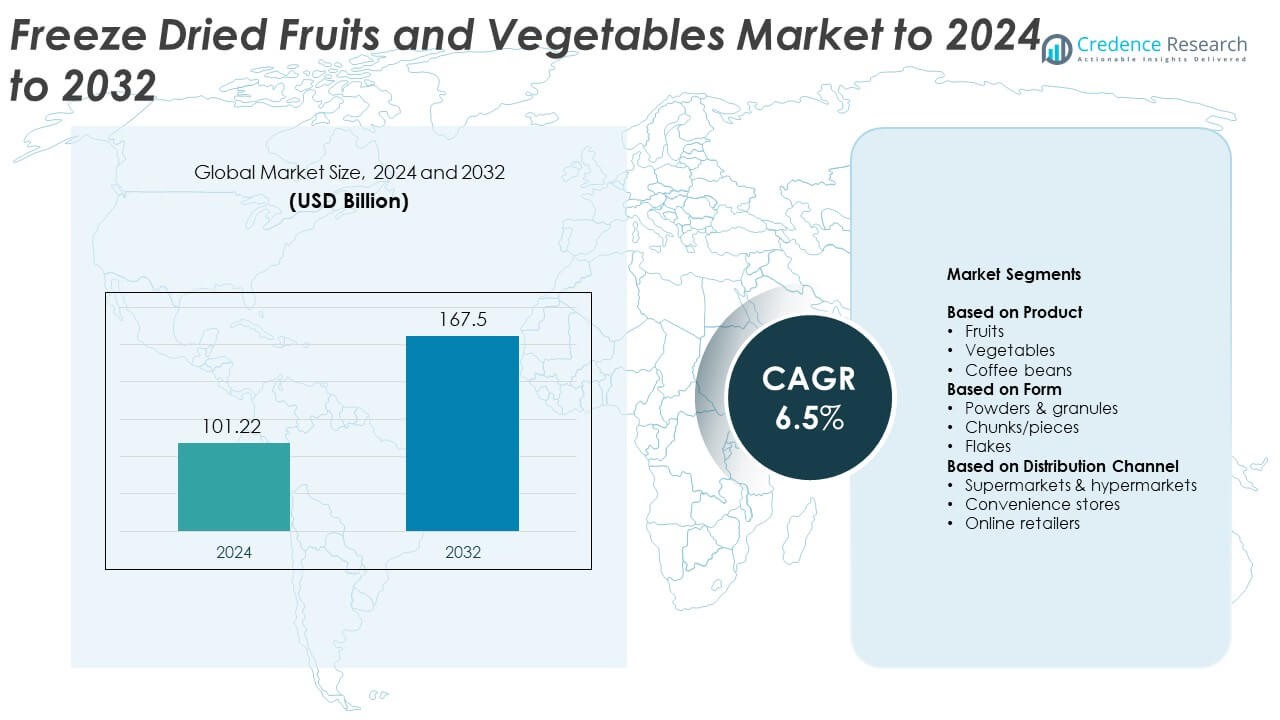

The Freeze Dried Fruits and Vegetables Market size was valued at USD 101.22 billion in 2024 and is anticipated to reach USD 167.5 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freeze Dried Fruits and Vegetables Market Size 2024 |

USD 101.22 Billion |

| Freeze Dried Fruits and Vegetables Market, CAGR |

6.5% |

| Freeze Dried Fruits and Vegetables Market Size 2032 |

USD 167.5 Billion |

The Freeze Dried Fruits and Vegetables Market is driven by major players such as Döhler, The Kraft Heinz Company, Olam International, Nestle SA, and European Freeze Dry Ltd. These companies focus on product innovation, sustainable sourcing, and advanced freeze-drying technologies to enhance nutritional value and shelf stability. They are also expanding through strategic partnerships with food manufacturers and global retail networks. North America dominated the market in 2024 with a 37% share, supported by strong demand for healthy snacks and extensive retail distribution. Europe followed with 29%, driven by increasing adoption of organic and clean-label freeze-dried products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Freeze Dried Fruits and Vegetables Market was valued at USD 101.22 billion in 2024 and is expected to reach USD 167.5 billion by 2032, growing at a CAGR of 6.5%.

- Increasing demand for convenient, nutrient-rich snacks and longer shelf life drives strong market expansion globally.

- Rising adoption of organic and plant-based products along with e-commerce growth are key ongoing trends shaping market demand.

- The market remains moderately fragmented, with key players investing in sustainable production and advanced drying technologies to gain a competitive edge.

- North America led the market in 2024 with a 37% share, followed by Europe at 29%, while the fruits segment dominated overall with 54% of global revenue.

Market Segmentation Analysis:

By Product

The fruits segment dominated the freeze-dried fruits and vegetables market in 2024 with a 54% share. Rising demand for healthy snacks and extended shelf life drives this segment’s growth. Fruits such as strawberries, apples, and mangoes are popular due to their flavor retention and nutritional value after drying. Their wide use in breakfast cereals, bakery items, and packaged snacks further supports demand. The increasing availability of ready-to-eat fruit mixes in retail channels strengthens this segment’s dominance over vegetables and coffee beans.

- For instance, Chaucer Foods runs 40 freeze-drying tunnels today (22 in China; 10 in France; 8 in the United States), supporting high-volume fruit ingredients for cereals and snacks.

By Form

Chunks and pieces led the market in 2024 with a 48% share, driven by strong use in snacks and confectionery applications. Consumers prefer this form for its texture, taste, and convenience in blending with yogurt, cereals, and smoothies. Manufacturers favor chunks due to easier packaging and rehydration efficiency compared to powders or flakes. The rising trend of natural fruit toppings and portable snacking options continues to propel this form’s demand globally.

- For instance, Paradise Fruits Freeze-Dried (Paradiesfrucht GmbH) supplies granulate formats available in a range of sizes, from 1 mm to 10 mm.

By Distribution Channel

Supermarkets and hypermarkets accounted for the largest share of 45% in 2024, supported by wide product availability and brand variety. These outlets offer freeze-dried fruits and vegetables from major brands under attractive promotional schemes. Consumer preference for physical inspection before purchase adds to their dominance. Retailers are expanding shelf space for premium and organic freeze-dried products, enhancing visibility. However, online retailers are rapidly gaining traction due to convenience and expanding delivery networks.

Key Growth Drivers

Rising Demand for Healthy and Convenient Foods

Increasing consumer awareness about health and nutrition is driving demand for freeze-dried fruits and vegetables. These products retain most nutrients, making them ideal for health-conscious individuals seeking natural food options. The convenience of lightweight, ready-to-eat, and long-lasting snacks boosts their use among travelers and busy consumers. Manufacturers are expanding flavor varieties and packaging formats to cater to fitness enthusiasts and urban populations seeking healthy snack substitutes.

- For instance, Oregon Freeze Dry (Mountain House) labels meals with a 30-year taste guarantee, highlighting long shelf life sought by health-minded, on-the-go consumers.

Expansion in Packaged and Functional Food Industry

The growing packaged food sector is a major contributor to market growth. Freeze-dried ingredients are widely used in cereals, soups, and bakery products for their preserved taste and color. Functional food producers use these ingredients for nutrient enrichment and extended product shelf life. As more brands focus on clean-label formulations, the demand for natural freeze-dried components is increasing significantly. This shift aligns with the global movement toward minimally processed food products.

- For instance, WK Kellogg Co’s Special K Red Berries clarifies the serving size while confirming the use of freeze-dried strawberries and the company’s status. The cereal lists freeze-dried strawberries as an ingredient. A single-serving cup (39g) contains 140 calories, whereas a larger 43 oz family-size pack.

Technological Advancements in Drying Processes

Advancements in freeze-drying technologies enhance product quality, flavor retention, and energy efficiency. Modern equipment allows large-scale, cost-effective production while maintaining nutritional content. Automation and digital monitoring systems improve process precision and reduce wastage. These innovations help manufacturers meet growing demand without compromising quality standards. The increasing investment in research and development for improved drying techniques continues to boost market competitiveness and profitability.

Key Trends and Opportunities

Rising Popularity of Plant-Based and Vegan Diets

The global rise of plant-based lifestyles is creating strong opportunities for freeze-dried fruits and vegetables. These products serve as natural, vegan-friendly ingredients in smoothies, snacks, and plant-based meals. Their extended shelf life supports sustainable consumption and reduces food waste. As consumers reduce reliance on animal-derived foods, the integration of freeze-dried options in daily diets is expected to grow steadily across developed and emerging markets.

- For instance, LYOFOOD’s expedition range shows breadth online, with a retailer listing 31 freeze-dried meal SKUs that include vegan options for outdoor and everyday use.

Expansion of Online Retail and Direct-to-Consumer Channels

E-commerce platforms are reshaping distribution in the freeze-dried foods market. Online retailers offer wider product assortments, bulk purchase options, and quick delivery. Manufacturers are partnering with digital platforms to reach health-conscious buyers directly. Subscription-based models and social media marketing enhance consumer engagement. The shift toward digital shopping, accelerated by convenience trends, is helping brands expand globally and reach new consumer segments efficiently.

- For instance, Nature’s Turn freeze-dried fruit holds Amazon category ranks (e.g., #9 in Dried Fruits on one item), reflecting strong ecommerce traction for ready-to-eat fruit snacks.

Key Challenges

High Production and Energy Costs

Freeze-drying is an energy-intensive process, increasing production costs compared to conventional drying methods. The use of advanced equipment and temperature-controlled environments raises operational expenses for manufacturers. These costs often lead to higher retail prices, limiting adoption among price-sensitive consumers. Small and medium enterprises face particular challenges in achieving economies of scale due to high initial capital investments required for setup and maintenance.

Supply Chain Constraints and Raw Material Availability

The market faces challenges from raw material price volatility and seasonal fruit availability. Dependence on specific harvest cycles can disrupt production and increase costs. Transportation and storage of raw produce before drying require strict conditions to maintain quality. Global supply chain disruptions, such as weather impacts or logistics delays, can further affect production schedules. Maintaining consistent quality and steady supply remains a critical issue for industry players.

Regional Analysis

North America

North America dominated the freeze-dried fruits and vegetables market in 2024 with a 37% share. The region benefits from high demand for healthy and convenient snacks, supported by advanced food processing infrastructure. Consumers increasingly prefer natural, preservative-free ingredients, fueling product use in cereals and packaged snacks. The United States leads due to strong retail distribution and innovation in freeze-drying technologies. Canada also shows growing demand, driven by rising awareness of nutritional diets and expanding e-commerce food sales channels.

Europe

Europe accounted for around 29% of the market share in 2024, supported by growing demand for clean-label and organic food products. Countries such as Germany, the United Kingdom, and France are key markets for freeze-dried ingredients used in bakery, dairy, and convenience foods. The region’s focus on reducing food waste and promoting sustainable consumption supports market growth. The rising popularity of plant-based diets and healthy snacking habits further enhances product adoption across both retail and food service sectors.

Asia Pacific

Asia Pacific held a 24% market share in 2024 and is expected to grow fastest through 2032. Increasing urbanization, changing dietary patterns, and demand for shelf-stable foods drive strong regional growth. China, Japan, and India lead consumption, supported by growing middle-class populations and expanding retail channels. The popularity of freeze-dried fruits in beverages and desserts contributes significantly. Rapid growth in online retail and product innovation across emerging economies further accelerates the market’s expansion across this region.

Latin America

Latin America represented about 6% of the global market share in 2024. Rising consumer interest in healthy, convenient, and long-lasting foods drives adoption of freeze-dried fruits and vegetables. Brazil and Mexico dominate regional consumption due to increasing use in smoothies, snacks, and bakery items. Manufacturers are investing in localized production to reduce costs and improve product accessibility. Expanding retail infrastructure and growing health awareness among urban consumers are strengthening regional market opportunities.

Middle East and Africa

The Middle East and Africa captured a 4% share of the market in 2024, driven by rising urban populations and growing imports of packaged food products. The United Arab Emirates and South Africa are leading markets with increasing adoption of freeze-dried foods for tourism and retail sectors. Expanding supermarket chains and demand for nutritious, portable foods are fueling growth. However, limited domestic production capacity and higher product costs remain challenges, leading to dependence on imports from Europe and Asia.

Market Segmentations:

By Product

- Fruits

- Vegetables

- Coffee beans

By Form

- Powders & granules

- Chunks/pieces

- Flakes

By Distribution Channel

- Supermarkets & hypermarkets

- Convenience stores

- Online retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Freeze Dried Fruits and Vegetables Market is moderately fragmented, with major players such as Döhler, The Kraft Heinz Company, Olam International, and Nestle SA leading through extensive product portfolios and advanced processing technologies. These companies focus on expanding their global presence by developing innovative freeze-drying solutions that preserve nutrients, taste, and color while ensuring energy efficiency. Strategic partnerships with food manufacturers, retail collaborations, and e-commerce expansion strengthen their distribution reach. Smaller regional producers emphasize niche offerings, including organic and exotic fruit varieties, to capture specific consumer segments. Continuous investment in automation, sustainability, and packaging innovation supports competitive differentiation across the global marketplace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Döhler

- The Kraft Heinz Company

- Olam International

- Nestle SA

- European Freeze Dry Ltd.

- OFD Foods

- Mercer Foods, LLC

- Van Drunen Farms

- Ajinomoto Co.

- Mondelez International, Inc.

- Freeze-Dry Foods GmbH

- Asahi Group

- Damtuh Co. Ltd.

- Prinova Europe Limited

- Accelerated Freeze Drying Company Ltd.

- Vancouver Freeze Dry Ltd.

- Wambugu Apples

- The J M Smucker Company, LLC

Recent Developments

- In 2025, Wambugu Apples expands with new freeze-dried fruits line. The Kenyan-based firm moves into the healthy snack market with a new line of freeze dried fruits, including apples, strawberries, mangoes, bananas, and dragon fruit.

- In 2025, Döhler has collaborated with The Perfect Pureé to introduce a range of freeze-dried fruit products under the Tastecraft brand in the North American market.

- In 2023, Vancouver Freeze Dry Ltd. Launched a new premium-range freeze-dried strawberry product, designed for versatile culinary applications such as smoothies and confectionery.

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for healthy, ready-to-eat food options.

- Technological innovation in freeze-drying will enhance energy efficiency and product quality.

- Manufacturers will focus on organic and clean-label product formulations to meet consumer preferences.

- Expansion in e-commerce and direct-to-consumer models will boost accessibility and sales.

- Partnerships with food and beverage brands will increase use in snacks, cereals, and beverages.

- Asia Pacific will emerge as the fastest-growing regional market due to urbanization and dietary shifts.

- Investments in sustainable packaging and waste reduction will gain strong attention from producers.

- Product diversification with exotic fruit and vegetable varieties will attract new consumer segments.

- Increasing government focus on food preservation and export promotion will support industry growth.

- Rising awareness of nutrient-rich, minimally processed foods will sustain long-term market demand.