Market Overview

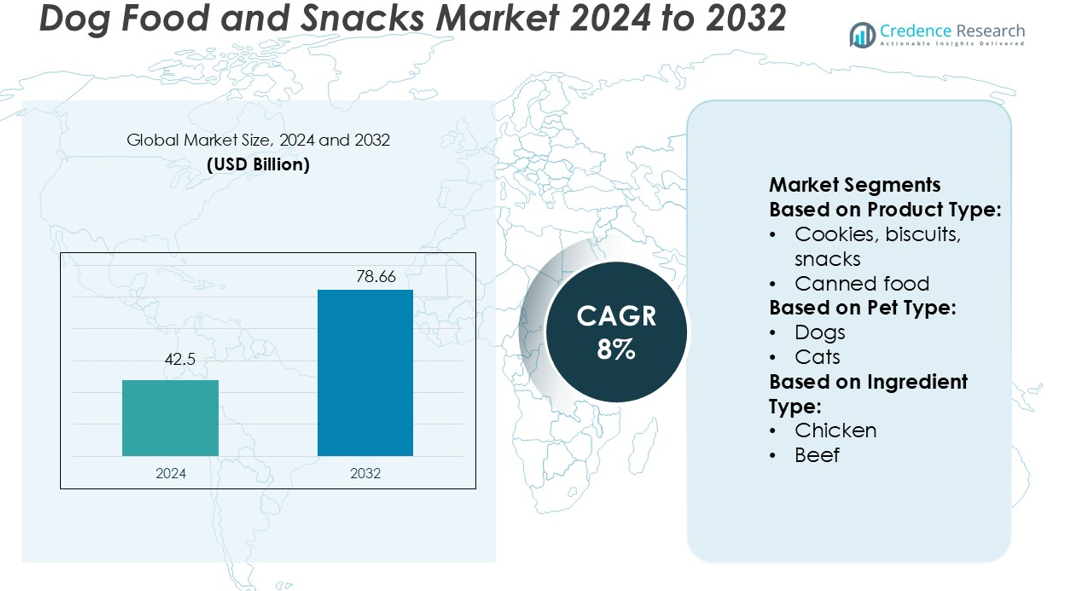

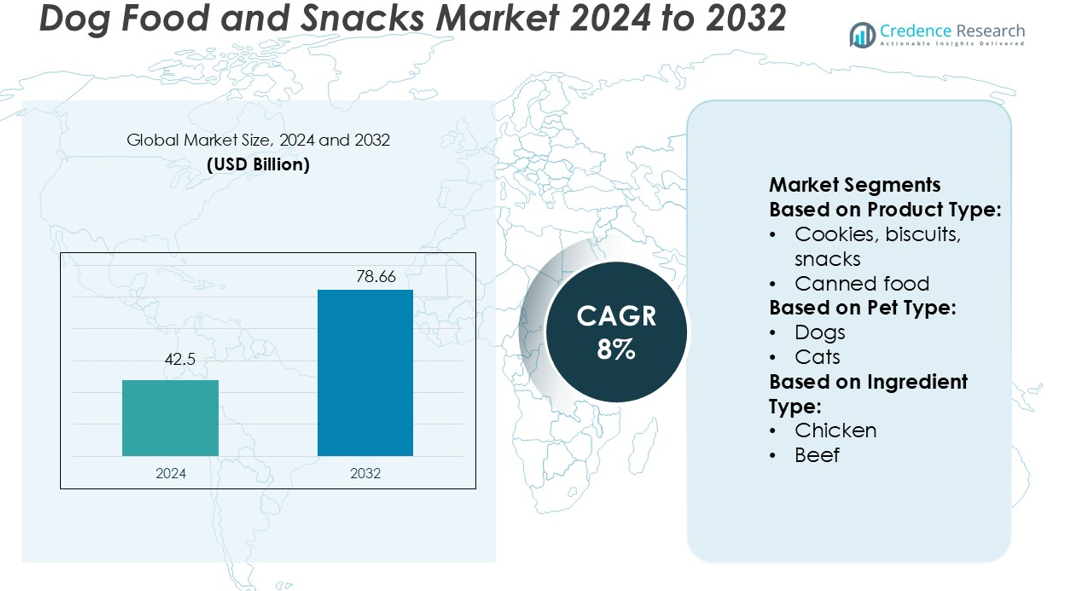

Dog Food and Snacks Market size was valued USD 42.5 billion in 2024 and is anticipated to reach USD 78.66 billion by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dog Food and Snacks Market Size 2024 |

USD 42.5 billion |

| Dog Food and Snacks Market, CAGR |

8% |

| Dog Food and Snacks Market Size 2032 |

USD 78.66 billion |

The dog food and snacks market is shaped by leading players such as Diamond Pet Foods, Hill’s Pet Nutrition, Inc., Blue Buffalo Pet Products, Inc., Freshpet, Mars Petcare US, Inc., General Mills, Inc., Heristo AG, Agrolimen S.A., Nestlé Purina PetCare Company, and Big Heart Pet Brands, Inc. These companies focus on premiumization, clean-label innovations, and advanced nutritional formulations to capture evolving consumer demand. North America leads the global market with a 36.5% share, supported by high pet ownership rates, strong purchasing power, and a well-developed retail and e-commerce infrastructure. Strategic product launches and brand loyalty programs strengthen their competitive position in this key region.

Market Insights

- Dog Food and Snacks Market size was valued at USD 42.5 billion in 2024 and is projected to reach USD 78.66 billion by 2032, at a CAGR of 8%.

- Rising pet humanization and growing demand for premium, natural, and clean-label products are driving market expansion across key segments.

- Innovation in functional formulations, sustainable packaging, and e-commerce adoption shapes competitive strategies among major players.

- High product costs and regulatory complexities in labeling and ingredient compliance act as key restraints in several regions.

- North America leads with a 36.5% market share, supported by strong retail infrastructure, followed by Europe with 28.3% and Asia Pacific with 22.7%, with dry food remaining the dominant product segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Dry food holds the largest market share in the dog food and snacks market. Its dominance is driven by long shelf life, lower cost, and easy storage. Many pet owners prefer dry food for its portion control and dental health benefits. Manufacturers enhance these products with added vitamins, minerals, and natural flavors to meet nutritional needs. Brands focus on high-protein formulations to support active lifestyles. Premium dry food ranges also attract urban consumers seeking healthier options. This strong preference positions dry food as the primary growth engine across global markets.

- For instance, Diamond Pet Foods conducts 5,520 ingredient nutritional tests per week and 40,095 finished product nutritional tests per week to ensure consistency and quality in its dry kibble lines.

By Pet Type

Dogs represent the dominant pet type segment with the highest market share. Rising dog adoption rates and growing spending on pet wellness fuel this lead. Dog owners increasingly demand specialized nutrition for different breeds, ages, and health needs. The availability of breed-specific and functional dog food drives premiumization. Marketing campaigns by leading brands strengthen product visibility. Urban households view dogs as family members, boosting spending on snacks and treats. This strong demand sustains the segment’s leadership in the pet food market.

- For instance, Hill’s also launched its 365,000-square-foot smart “Tonganoxie” wet food plant to double its canned pet food capacity and integrate robotics, AI, and end-to-end process controls.

By Ingredient Type

Chicken-based products account for the largest market share in the ingredient segment. High digestibility, protein content, and wide consumer acceptance make chicken a preferred choice. Major brands use lean chicken in kibble, treats, and wet food to ensure balanced nutrition. The ingredient’s mild flavor also appeals to pets with sensitive palates. Chicken products often carry clean-label claims, boosting trust among health-conscious owners. Strong supply chains support stable pricing and consistent availability. These advantages reinforce chicken’s leadership in the pet food ingredient landscape.

Key Growth Drivers

Rising Pet Humanization and Premiumization

Pet owners increasingly view dogs as family members, driving demand for high-quality food. This shift boosts spending on premium snacks, organic treats, and specialized diets. Brands respond with functional ingredients that support health and wellness. Urban households favor products with clean labels and natural proteins. Growth in dual-income families further supports higher per-pet expenditure. Premiumization also encourages brand loyalty and product differentiation. This evolving consumer mindset remains a key factor shaping market expansion.

- For instance, Blue Buffalo operates a manufacturing and research and development complex on an 89-acre site in Richmond, Indiana. The facility has undergone expansions since its initial opening in 2019 and includes significant warehousing space to manage distribution.

Increasing Dog Adoption Rates Worldwide

Growing dog adoption across urban and semi-urban areas fuels steady market growth. Governments and NGOs promote responsible pet ownership, increasing household penetration. Rising companionship needs among younger consumers support sustained demand. This demographic shift expands the customer base for dog food and snacks. Adoption trends also encourage tailored nutrition for different breeds. Brands leverage these opportunities with age-specific and health-targeted formulations. This broad adoption base strengthens long-term revenue potential for industry players.

- For instance, Freshpet’s Bethlehem “Kitchen” includes a 6,600 sq ft wastewater treatment facility that handles up to 200 gallons per minute, effectively removing pollutants from the kitchen’s wastewater before discharge.

Innovation in Functional and Nutritional Formulations

Manufacturers invest in advanced formulations to address specific canine health needs. Products fortified with omega-3, probiotics, and vitamins support immunity, digestion, and joint health. Functional snacks like dental chews and weight-control treats gain rapid traction. Clean-label claims and sustainable sourcing enhance consumer trust. Innovation in flavor, texture, and nutrient balance improves palatability. These advancements increase premium product uptake. Functional innovation positions brands competitively in a market driven by wellness trends.

Key Trends & Opportunities

Growing Popularity of Natural and Clean-Label Products

Consumers increasingly prefer dog food with minimal processing and transparent ingredient lists. Natural, organic, and preservative-free products gain strong retail traction. Pet owners value sustainability and traceable sourcing. This trend encourages brands to reformulate using plant-based and lean protein ingredients. Retailers also expand shelf space for clean-label brands. Transparent labeling strengthens consumer trust and boosts repeat purchases. This shift creates opportunities for new entrants and premium product launches.

- For instance, Mars invests in regenerative agriculture, including a 2024 pilot program that began covering more than 10,000 acres annually through a partnership with the Soil and Water Outcomes Fund.

Expansion of E-Commerce and Direct-to-Consumer Channels

Digital platforms offer easy product access, personalized recommendations, and subscription models. Online sales of dog food and snacks grow rapidly, especially among younger consumers. Brands invest in e-commerce partnerships and their own direct channels. Subscription boxes with curated treats build customer loyalty. Digital analytics help target niche segments more effectively. This channel expansion reduces distribution costs and increases market reach. E-commerce growth creates strong opportunities for innovative, smaller brands.

- For instance, Purina’s challenges was to manage the digital content for nearly 6,000 products and 104,000 digital assets across dozens of retailer endpoints.

Focus on Sustainable Packaging and Sourcing

Sustainability is becoming a key differentiator for leading brands. Companies adopt recyclable pouches, biodegradable containers, and eco-friendly sourcing methods. Consumers favor brands aligned with environmental values. This shift drives investment in low-impact packaging technologies. Regulatory support for sustainable practices accelerates adoption. Eco-focused products enhance brand reputation and customer retention. Sustainability strategies open new premium market opportunities.

Key Challenges

High Price Sensitivity in Developing Markets

Cost remains a major barrier in price-sensitive regions. Consumers often prefer homemade or low-cost alternatives over branded dog food. This limits premium product penetration outside urban centers. Fluctuating raw material prices further increase retail costs. Companies face pressure to balance quality with affordability. Weak distribution networks also restrict market reach. Overcoming price sensitivity requires strategic pricing and localized product lines.

Regulatory Complexity and Quality Compliance

Pet food regulations vary widely across countries and regions. Companies must meet strict labeling, ingredient, and safety standards. Compliance increases operational and testing costs. Non-compliance risks recalls and reputational damage. Frequent regulatory changes challenge smaller brands. Harmonizing standards remains difficult, slowing market entry. Effective compliance management is critical for sustainable expansion.

Regional Analysis

North America

North America holds the largest share of the dog food and snacks market at 36.5%. High pet ownership rates and strong consumer spending drive market expansion. Premiumization trends, supported by natural and organic product demand, strengthen the region’s leadership. The U.S. accounts for a major portion of revenue, supported by advanced distribution networks and strong e-commerce penetration. Key players focus on functional formulations and clean-label claims to target health-conscious owners. Growing popularity of subscription-based delivery models also enhances brand loyalty. Well-established regulations ensure product quality, reinforcing consumer trust and sustaining market dominance in the region.

Europe

Europe captures a 28.3% share of the dog food and snacks market, supported by a mature pet care sector. High awareness of animal nutrition drives steady demand for premium and specialized formulations. Countries like Germany, France, and the UK lead in adoption of sustainable and natural ingredients. Strong regulatory frameworks boost consumer confidence in product safety. Growth in plant-based and functional snacks aligns with rising environmental concerns. Retailers expand shelf space for organic and allergen-free offerings. The region’s stable economic environment and high per capita spending on pets sustain its strong market position.

Asia Pacific

Asia Pacific accounts for 22.7% of the dog food and snacks market, driven by rapid urbanization and rising pet adoption. Countries like China, Japan, India, and South Korea are witnessing fast growth in dog ownership. Expanding middle-class income supports spending on premium dog snacks and functional food. E-commerce platforms play a critical role in product accessibility and brand visibility. Local manufacturers increasingly focus on affordable, nutritionally balanced offerings. Urban households drive demand for convenience and clean-label options. Strong growth potential and evolving consumer behavior position Asia Pacific as a key high-growth region.

Latin America

Latin America holds a 7.4% share of the global dog food and snacks market. Rising dog adoption and increasing awareness of pet nutrition support market growth. Brazil and Mexico lead regional demand, backed by expanding retail networks and growing online sales. Consumers are shifting from table scraps to packaged food, boosting market penetration. Economic development improves disposable income, supporting spending on treats and functional products. Global players are expanding their presence through localized pricing strategies. Modern retail formats and product diversification strengthen the region’s growth outlook despite existing income disparities.

Middle East & Africa

The Middle East & Africa region represents 5.1% of the dog food and snacks market. Growing urbanization and rising pet adoption in markets like South Africa and the UAE support moderate expansion. Demand is shifting toward packaged snacks and functional food as pet care awareness improves. International brands lead the market, supported by modern retail infrastructure. However, price sensitivity and limited distribution networks restrict penetration in rural areas. Increasing availability of affordable, regionally adapted products drives gradual growth. The region presents significant long-term opportunities as consumer attitudes toward pet ownership continue to evolve.

Market Segmentations:

By Product Type:

- Cookies, biscuits, snacks

- Canned food

By Pet Type:

By Ingredient Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dog food and snacks market features strong competition among key players including Diamond Pet Foods, Hill’s Pet Nutrition, Inc., Blue Buffalo Pet Products, Inc., Freshpet, Mars Petcare US, Inc., General Mills, Inc., Heristo AG, Agrolimen S.A., Nestlé Purina PetCare Company, and Big Heart Pet Brands, Inc. The dog food and snacks market is highly competitive, driven by rapid innovation, strong branding, and expanding distribution networks. Companies focus on product diversification, emphasizing premium, natural, and functional formulations to meet rising consumer expectations. Clean-label claims, sustainable sourcing, and advanced packaging solutions are central to differentiation strategies. E-commerce platforms, subscription models, and direct-to-consumer channels play a crucial role in boosting market reach and customer retention. Mergers and acquisitions help strengthen supply chains and geographic presence. Intense competition encourages continuous investment in R&D, enabling brands to maintain pricing power, improve product quality, and build long-term customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Dogsee Chew raised in a Series B funding round to expand its production capacity and strengthen its distribution network across global markets. The investment is expected to accelerate innovation in healthy, Himalayan cheese-based pet treats.

- In January 2024, TABPS secured in seed funding to scale its operations, enhance its research capabilities, and introduce functional nutrition products tailored for Indian pet owners. The funds will also support expansion into tier-2 and tier-3 cities.

- In September 2023, Kellanova’s RXBAR brand partnered with podcaster Maria Menounos to launch a limited edition RXBAR ManifX bars with customizable wrappers. The RXBAR ManifX bars are available in Chocolate Sea Salt flavor, made with 12g of protein.

- In September 2023, Danone UK&I announced a fresh lineup of high-protein dairy snacks under the brand name GetPRO, designed specifically for individuals aiming to optimize their workout regimes. The GetPRO range has between 15-25g of protein per serving across its eleven products, which include high-protein yogurts, mousses, puddings, and beverages

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pet Type, Ingredient Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium and functional dog food products will gain stronger consumer preference.

- Clean-label and natural formulations will shape new product launches.

- E-commerce and direct-to-consumer channels will drive higher sales volumes.

- Subscription-based models will strengthen customer retention and loyalty.

- Sustainable packaging and sourcing will become standard industry practices.

- Regional players will expand their footprint through affordable, localized offerings.

- Advanced formulations targeting specific health benefits will see rapid adoption.

- Digital marketing and personalized recommendations will boost brand visibility.

- Private-label products will gain traction in emerging markets.

- Strategic mergers and partnerships will enhance global distribution networks.