Market Overview

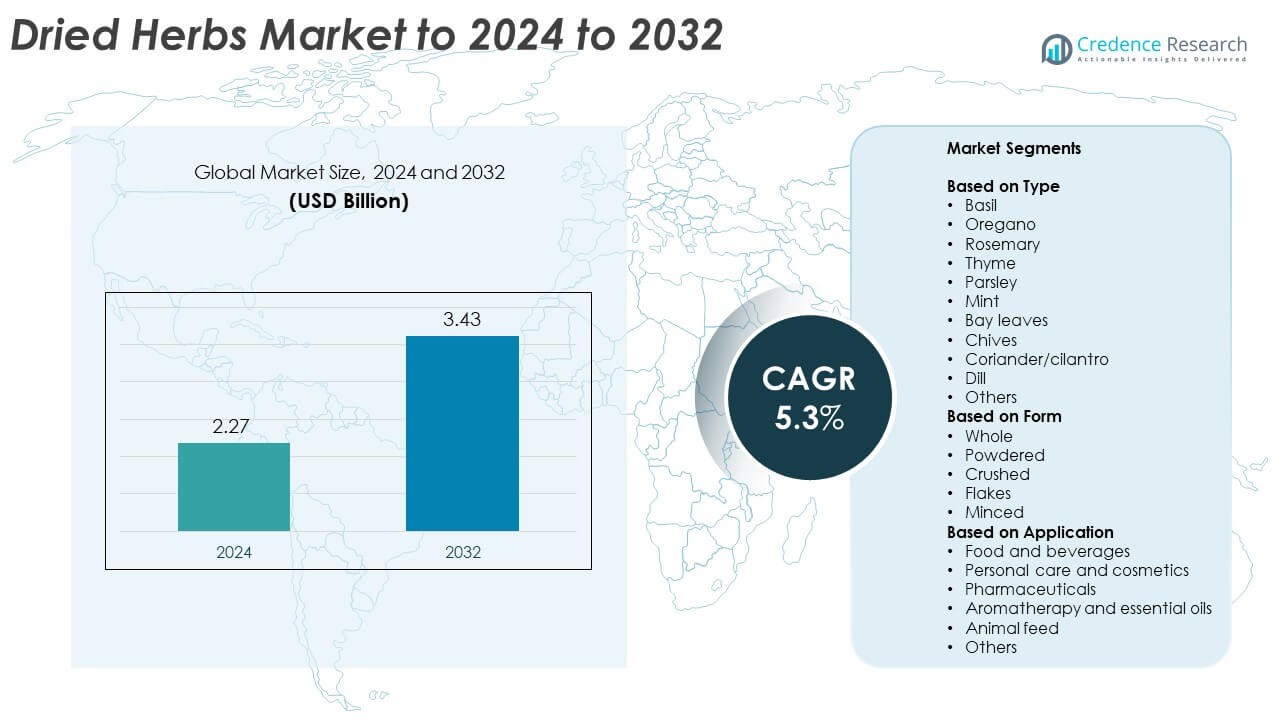

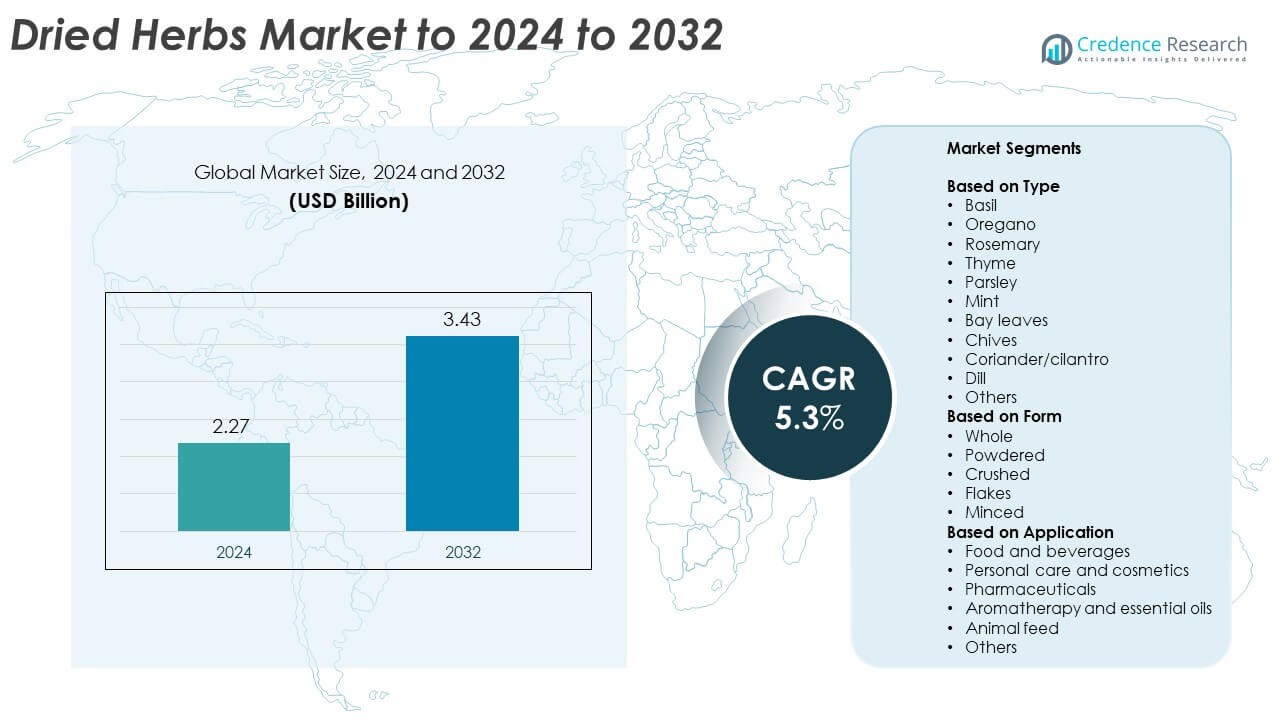

Dried Herbs Market size was valued USD 2.27 Billion in 2024 and is anticipated to reach USD 3.43 Billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dried Herbs Market Size 2024 |

USD 2.27 Billion |

| Dried Herbs Market, CAGR |

5.3% |

| Dried Herbs Market Size 2032 |

USD 3.43 Billion |

The dried herbs market is led by key players such as McCormick & Company, The Fuchs Group, Euroma, Simply Organic, British Pepper & Spice, Elite Spice, Kräuter Mix, Paulig, U.S. Spice Mills, Organic Herb, and Husarich. These companies focus on expanding their product portfolios with organic and sustainably sourced herbs to meet growing global demand. Strategic partnerships with food manufacturers and increased investment in flavor innovation strengthen their competitive position. Regionally, North America dominated the market in 2024 with a 32% share, driven by strong consumption in processed and packaged foods, while Europe followed closely due to its deep-rooted culinary traditions and robust herb cultivation base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dried herbs market was valued at USD 2.27 Billion in 2024 and is projected to reach USD 3.43 Billion by 2032, growing at a CAGR of 5.3%.

- Rising demand for natural flavoring ingredients and clean-label food products is a major driver of market growth across both developed and emerging economies.

- Growing trends in organic food consumption and the use of dried herbs in pharmaceuticals, cosmetics, and aromatherapy are boosting global demand.

- Leading players focus on expanding their organic product lines, improving supply chain traceability, and investing in advanced drying technologies to maintain quality and competitiveness.

- North America held the largest share at 32% in 2024, followed by Europe with 28% and Asia Pacific with 25%, while the food and beverages segment dominated with over 60% share due to widespread application in processed and convenience foods.

Market Segmentation Analysis:

By Type

Basil dominated the dried herbs market in 2024 with a share of over 22%. Its popularity stems from extensive use in sauces, soups, and ready-to-eat foods. The herb’s strong flavor and high antioxidant content drive its demand in both culinary and medicinal applications. Oregano and rosemary also show steady growth due to their use in Mediterranean and functional food products. Rising preference for natural seasonings and the expanding packaged food industry further fuel segment growth across global markets.

- For instance, ofi opened a Beni-Suef herb plant able to process 3,000 metric tons per year of basil, fennel, marjoram, parsley, and dill, sourced directly from Egyptian farmers.

By Form

Powdered dried herbs held the leading position in 2024, accounting for about 35% of total revenue. Their convenience, long shelf life, and consistent flavor make them widely preferred by food processors and home consumers. Powdered herbs are easy to blend in sauces, bakery mixes, and soups, boosting industrial demand. Crushed and flaked forms also gain traction with the growing popularity of gourmet and fusion cuisines. Expanding processed food production and spice exports sustain the segment’s dominance.

- For instance, Paulig (Santa Maria) reformulations replaced over 200 tons of salt with herbs, spices, and natural ingredients across products, aligning with cleaner labels in foods and drinks.

By Application

The food and beverages segment accounted for more than 60% of the market share in 2024. Increasing use of dried herbs in packaged meals, snacks, and beverages supports segment leadership. Consumers prefer these products for their natural flavor enhancement and nutritional benefits. Rising adoption of herbal ingredients in personal care and aromatherapy products also boosts secondary applications. Expanding food service chains and health-focused dietary patterns continue to drive this segment’s growth globally.

Key Growth Drivers

Rising Demand for Natural Flavoring Ingredients

Consumers increasingly prefer natural herbs over synthetic flavoring agents in food and beverages. This shift is driven by awareness of clean-label products and health-conscious eating habits. Dried herbs like basil, oregano, and thyme enhance flavor while offering antioxidant and antimicrobial benefits. The expanding packaged and processed food industry further strengthens demand across global markets.

- For instance, Synthite runs spice-extract and botanical lines with 300 metric tons per day oleoresin capacity across plants in India and China, supporting pharma and personal care inputs.

Expansion of Food Processing and HoReCa Sectors

The growth of the hospitality, restaurant, and catering (HoReCa) sectors boosts herb consumption. Food processors use dried herbs for convenience, consistency, and extended shelf life. Rapid urbanization and rising disposable incomes increase dining-out trends, promoting herb-based recipes. Demand for standardized seasoning blends fuels supplier partnerships with foodservice brands and manufacturers.

- For instance, Euroma consolidated drying and processing at its Zwolle site, built over an area the size of five soccer fields with a 29-meter high-bay store to raise throughput and food safety.

Growing Use in Pharmaceuticals and Cosmetics

Herbal extracts from dried herbs are widely used in natural medicines, skincare, and aromatherapy. The growing consumer preference for organic and chemical-free personal care products drives usage. Herbs like mint, rosemary, and parsley offer antimicrobial and soothing properties, attracting pharmaceutical and cosmetic companies. Rising R&D in herbal formulations further supports market expansion.

Key Trends & Opportunities

Surging Popularity of Functional and Organic Foods

Consumers are prioritizing functional foods enriched with herbal ingredients for better wellness. Organic dried herbs are gaining importance due to chemical-free cultivation and sustainable sourcing. Retailers and brands are introducing certified organic blends to meet clean-label demand. This trend offers new growth opportunities for suppliers focused on organic farming and traceable production systems.

- For instance, Givaudan works with more than 2,700 raw-material suppliers across more than 100 countries.

Growth in E-commerce and Global Distribution Networks

Online grocery platforms and global trade networks enhance herb accessibility and sales. Producers benefit from increased export opportunities supported by digital retail channels. Convenience-driven consumers favor small, resealable packs and subscription-based purchases. This e-commerce growth helps regional suppliers reach international markets with minimal intermediaries.

- For instance, Everest Spices, claims to reach over 25 million households daily and sell over 4 billion packs of its products each year, reflecting its growth and market leadership.

Key Challenges

Quality Variability and Supply Chain Issues

Inconsistent herb quality due to climatic changes, poor post-harvest handling, and fragmented supply chains challenges manufacturers. Maintaining flavor potency and purity during drying and storage remains complex. Lack of standardized grading systems and limited cold storage infrastructure impact exports and brand reliability in international markets.

Price Fluctuations and Regulatory Constraints

Volatile raw material prices and strict safety standards affect production costs and market stability. Import-export regulations, pesticide limits, and labeling requirements differ across regions, complicating global trade. Compliance costs increase for small producers, limiting their competitiveness. These challenges restrain overall market expansion in cost-sensitive regions.

Regional Analysis

North America

North America accounted for around 32% of the global dried herbs market share in 2024. The region benefits from a strong demand for natural flavoring ingredients in processed and ready-to-eat foods. The United States leads consumption due to the growing popularity of Italian, Mexican, and Mediterranean cuisines. Increasing awareness of organic and health-focused products drives further adoption. Canada also contributes to market growth through rising use in herbal teas and functional beverages. The presence of established spice manufacturers strengthens regional supply capabilities and export potential.

Europe

Europe held a 28% share of the global dried herbs market in 2024, driven by deep culinary traditions and strong herb cultivation. Countries like Italy, Spain, and France remain key producers and exporters, supplying both domestic and international food industries. The demand for premium and organic herbs continues to rise across the European Union. Government regulations favor natural additives over synthetic alternatives, supporting steady market growth. Increasing consumer preference for locally sourced and sustainable herbs enhances competitiveness among regional producers and exporters.

Asia Pacific

Asia Pacific represented about 25% of the global market share in 2024, supported by rising food processing activities and expanding urban populations. India and China serve as major suppliers of basil, coriander, and mint to global markets. Growing interest in herbal medicine and traditional remedies further increases herb utilization. Countries like Japan and South Korea are adopting dried herbs in functional foods and cosmetics. The region’s expanding e-commerce platforms and trade agreements help strengthen export networks and regional herb trade performance.

Latin America

Latin America captured nearly 9% of the global dried herbs market share in 2024. The region’s herb diversity, particularly oregano and bay leaves, supports steady exports to North America and Europe. Brazil, Mexico, and Chile are key contributors due to growing agricultural output and strong culinary influence. The regional market benefits from increasing herb-based seasoning use in processed meat and snacks. Investment in drying technology and improved packaging enhances quality and shelf stability, boosting Latin America’s competitiveness in international markets.

Middle East and Africa

The Middle East and Africa accounted for around 6% of the global dried herbs market in 2024. Rising consumer awareness of herbal health benefits and expanding retail networks support steady demand. Egypt and Morocco are major producers supplying basil, parsley, and dill to European and Asian markets. Increased tourism and hospitality growth across the Gulf countries contribute to rising consumption of dried herbs in regional cuisines. Infrastructure development in agriculture and export channels is expected to strengthen market performance in the coming years.

Market Segmentations:

By Type

- Basil

- Oregano

- Rosemary

- Thyme

- Parsley

- Mint

- Bay leaves

- Chives

- Coriander/cilantro

- Dill

- Others

By Form

- Whole

- Powdered

- Crushed

- Flakes

- Minced

By Application

- Food and beverages

- Personal care and cosmetics

- Pharmaceuticals

- Aromatherapy and essential oils

- Animal feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players such as McCormick & Company, The Fuchs Group, Euroma, Simply Organic, British Pepper & Spice, Elite Spice, Kräuter Mix, Paulig, U.S. Spice Mills, Organic Herb, and Husarich lead the competitive landscape of the dried herbs market. These companies focus on expanding production capacity, improving sourcing sustainability, and introducing organic and premium herb blends. Strategic collaborations with food manufacturers and retailers strengthen their market reach. Many participants invest in advanced drying and preservation technologies to retain flavor and aroma. Product innovation, clean-label certification, and eco-friendly packaging remain central to brand positioning. Companies are also expanding through mergers and acquisitions to enhance global distribution networks. Growing competition among private labels and established brands pushes innovation in product quality and differentiation. Digital marketing, e-commerce expansion, and traceable supply chains continue to play a key role in sustaining competitive advantage across domestic and international markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- McCormick & Company

- The Fuchs Group

- Euroma

- Simply Organic

- British Pepper & Spice

- Elite Spice

- Kräuter Mix

- Paulig

- S. Spice Mills

- Organic Herb

- Husarich

Recent Developments

- In 2025, McCormick unveiled the 25th edition of its Flavor Forecast, announcing Aji Amarillo as the 2025 Flavor of the Year.

- In 2023, Simply Organic launched a new line of globally inspired dry rubs and marinade mixes, including Chimichurri, Teriyaki, Buffalo, and Cajun

- In 2023, Olam Food Ingredients opened a new herb processing facility in Beni-Suef, Egypt, to process 3,000 metric tons of herbs annually.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and chemical-free dried herbs will continue to increase globally.

- Food manufacturers will focus on natural flavoring agents to replace synthetic additives.

- Growth in herbal medicine and nutraceuticals will expand market applications.

- E-commerce platforms will boost online sales and global herb accessibility.

- Innovation in drying and packaging technology will enhance product shelf life.

- Sustainable and traceable sourcing will become a key purchasing criterion for consumers.

- Functional foods using herbs for immunity and wellness will gain strong traction.

- Partnerships between farmers and processors will improve supply chain efficiency.

- Private-label herb brands will rise in supermarkets and specialty stores.

- Export opportunities from Asia and Latin America will strengthen due to rising global demand.