Market Overview

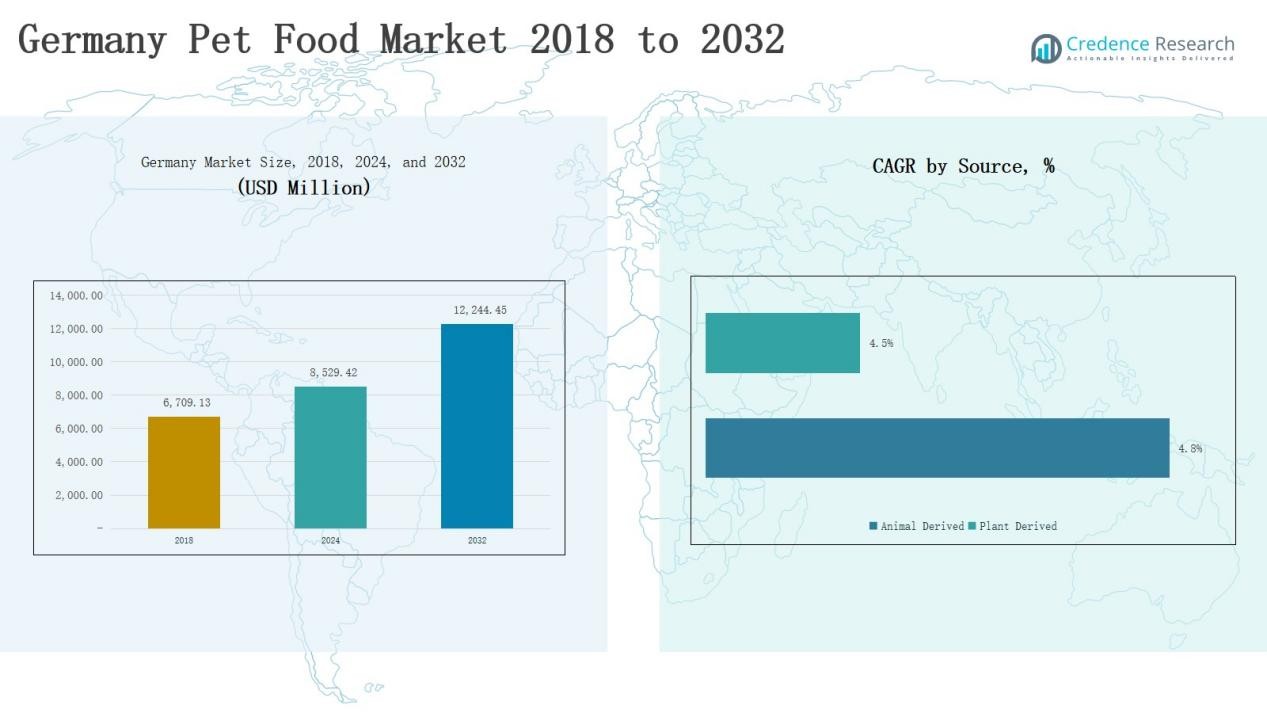

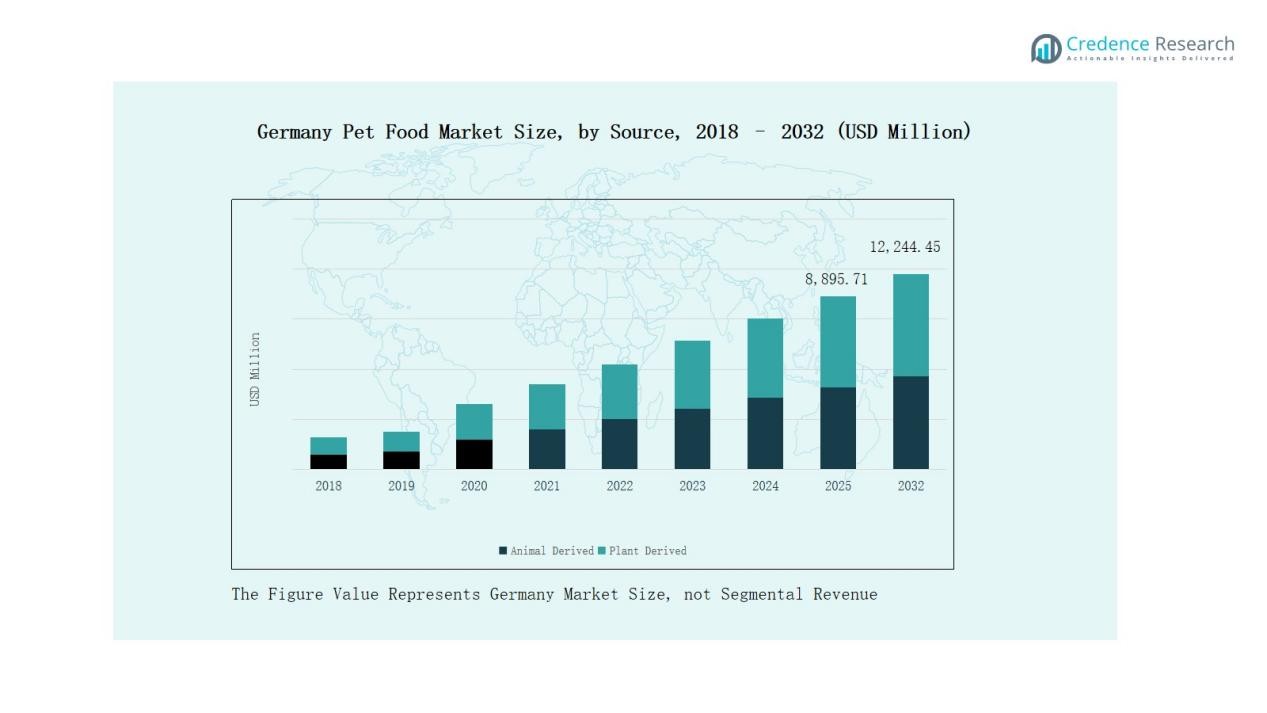

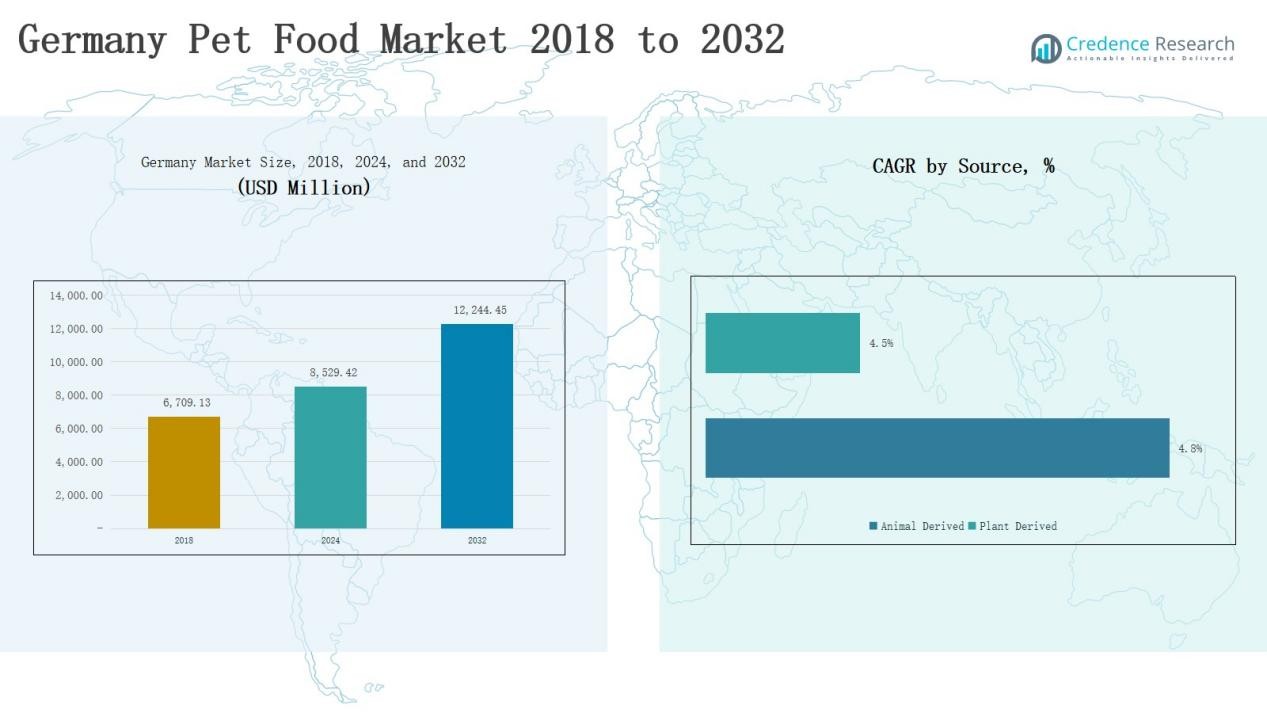

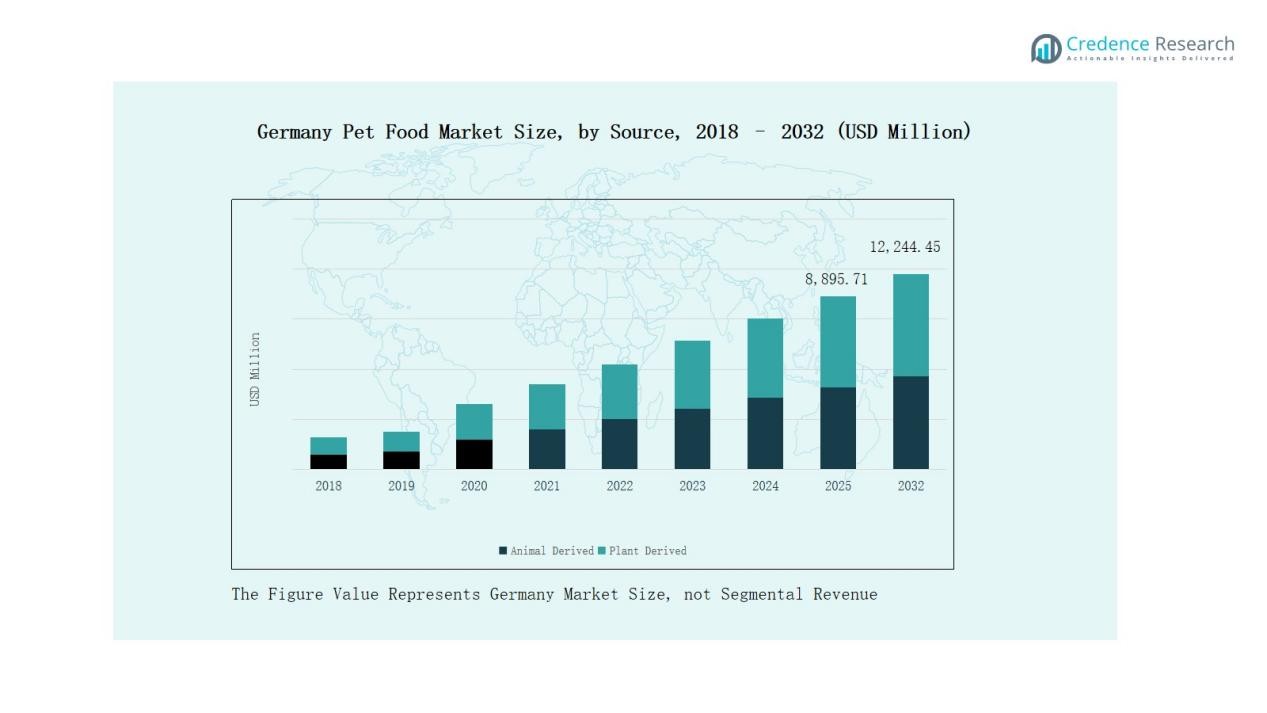

The Germany Pet Food Market size was valued at USD 6,709.13 million in 2018, increased to USD 8,529.42 million in 2024, and is anticipated to reach USD 12,244.45 million by 2032, growing at a CAGR of 4.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Pet Food Market Size 2024 |

USD 8,529.42 Million |

| Germany Pet Food Market, CAGR |

4.66% |

| Germany Pet Food Market Size 2032 |

USD 12,244.45 Million |

The Germany Pet Food Market is led by global players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and General Mills, Inc., alongside strong domestic brands including Heristo AG, Deuerer, United Petfood, and Bewital Petfood GmbH & Co. KG. These companies maintain dominance through extensive product portfolios, advanced nutrition research, and sustainable packaging initiatives. Regional manufacturers emphasize locally sourced ingredients and private-label production to compete effectively. Among all regions, South Germany emerged as the leading market in 2024, capturing a 29% share, driven by high pet ownership and strong purchasing power.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Pet Food Market grew from USD 6,709.13 million in 2018 to USD 8,529.42 million in 2024, and is projected to reach USD 12,244.45 million by 2032, at a CAGR of 4.66%.

- Dry pet food led the market with a 61% share in 2024, driven by affordability, easy storage, and the growing demand for grain-free and fortified diets.

- The animal-derived segment dominated with a 74% share, supported by strong preference for meat-based nutrition and sustainable protein sourcing.

- By pet type, dogs accounted for 58% of the market in 2024, reflecting higher spending on specialized and functional diets for canine health.

- South Germany emerged as the leading region with a 29% share, fueled by high pet ownership, premium product demand, and strong consumer purchasing power.

Market Segment Insights

By Food Type

Dry pet food dominated the Germany Pet Food Market in 2024 with a 61% share, driven by convenience, longer shelf life, and cost efficiency. Consumers prefer dry food for its easy storage and suitability for bulk purchases. The growing availability of fortified, grain-free, and breed-specific dry formulations further supports segment leadership. Wet food follows due to its higher palatability and digestibility, appealing to aging pets, while commercial raw pet food gains attention from premium and health-focused consumers.

- For instance, Hill’s Pet Nutrition enhanced its Science Plan Sensitive Stomach & Skin range with a new grain-free dry variant tailored for dogs with allergies, reflecting rising demand for fortified and specialized formulas.

By Source

The animal-derived segment held 74% share of the Germany Pet Food Market in 2024, supported by strong demand for protein-rich and meat-based formulations. Pet owners emphasize high nutritional value and taste, driving the popularity of products using poultry, beef, and fish ingredients. Companies invest in sustainable meat sourcing and transparency in labeling to maintain consumer trust. The plant-derived segment is growing as eco-conscious consumers explore vegan or hypoallergenic pet diets emphasizing environmental benefits.

- For instance, in March 2024, Mars Petcare Germany expanded its Cesar Natural Goodness range using responsibly sourced chicken and beef to meet growing demand for traceable ingredients.

By Pet Type

The dog segment accounted for 58% share of the Germany Pet Food Market in 2024, fueled by the country’s large dog population and rising spending on canine nutrition. Dog owners prefer high-quality, functional diets tailored for breed, size, and age-specific needs. The cat food segment follows due to urban households favoring compact pets. Fish and other small pets represent smaller shares but continue to grow through niche offerings such as specialized flakes, pellets, and natural feed formulations.

Key Growth Drivers

Rising Pet Humanization and Premiumization

The growing trend of treating pets as family members drives strong demand for premium and health-focused pet food in Germany. Consumers increasingly seek products with natural ingredients, organic certification, and tailored nutrition for specific breeds or life stages. Brands are expanding their premium portfolios with functional benefits like joint health, digestion, and skin care. This shift toward higher-value, wellness-oriented products continues to elevate market revenues and reshape purchasing behavior across both urban and rural households.

- For instance, THE PACK, a UK-based plant-based pet food company, grew its footprint in Europe in 2024 by securing a listing with Planet Organic and launching an equity crowdfunding campaign, demonstrating rising consumer preference for sustainable and organic pet products in northern and western Europe.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online sales platforms are rapidly transforming pet food distribution in Germany. Consumers favor e-commerce for its convenience, variety, and availability of subscription-based delivery models. Companies leverage digital platforms for personalized marketing and transparent ingredient sourcing. Leading players are enhancing their online presence through partnerships with pet care portals and retailers. This expansion increases accessibility for consumers, particularly in smaller cities, while offering brands valuable data insights to refine product offerings and marketing strategies.

- For instance, retailers like Fressnapf.de enhance accessibility through comprehensive online services, offering detailed product information and automated subscription options, thereby expanding pet food availability even in smaller cities.

Increasing Focus on Sustainable and Ethical Sourcing

Sustainability has become a core growth factor in the Germany Pet Food Market. Consumers actively prefer brands adopting eco-friendly packaging, responsibly sourced proteins, and carbon-neutral production. Manufacturers are introducing recyclable materials and renewable ingredients to meet regulatory and environmental expectations. Local sourcing initiatives and clean-label formulations further strengthen brand credibility. The rising alignment between ethical practices and consumer trust supports long-term growth and competitiveness among both multinational and regional market players.

Key Trends & Opportunities

Growth of Functional and Veterinary Diets

There is a notable surge in demand for pet food addressing specific health concerns such as allergies, obesity, and digestive disorders. Veterinary-recommended and functional diets enriched with probiotics, antioxidants, and omega fatty acids are gaining attention. This trend reflects growing awareness of preventive pet healthcare among German pet owners. Companies focusing on clinical nutrition and specialized formulations stand to capture premium segments and expand their brand presence in the fast-evolving pet wellness market.

- For instance, Dr.Clauder’s produces functional pet food formulations tailored to sensitive stomachs and dieters, developed through in-house research to ensure high quality and scientific backing.

Rise of Plant-Based and Alternative Protein Formulations

The shift toward sustainable lifestyles is accelerating interest in plant-based and insect protein pet food. German consumers increasingly value ethical, climate-friendly nutrition choices for their pets. Startups and established brands are developing products using pea, lentil, and insect protein to reduce carbon footprints. These formulations attract environmentally conscious consumers and pet owners with allergen-sensitive pets. This emerging opportunity is expected to reshape product innovation and broaden the market’s protein portfolio over the coming years.

- For instance, Omni, a German vegan pet food brand, launched a nutritionally complete cat food in 2024 made with cultivated chicken meat in partnership with cultivated meat producer Meatly. This innovation provides cats with essential nutrients from cruelty-free sources optimized for vitamin and mineral content, aligning with sustainability goals.

Key Challenges

Fluctuating Raw Material and Ingredient Costs

Volatility in prices of meat, grains, and packaging materials poses a major challenge for manufacturers. Supply disruptions and inflation increase production costs, impacting profit margins. Companies are compelled to adjust pricing strategies or reformulate products with cost-efficient ingredients. Maintaining quality and affordability amid rising costs remains critical for competitiveness. This challenge particularly affects small and mid-sized producers facing limited access to long-term supplier contracts or economies of scale in procurement.

Stringent Regulatory and Labeling Requirements

The German Pet Food Market faces strict compliance norms under EU food safety and labeling regulations. Companies must ensure transparency in ingredient sourcing, nutritional claims, and traceability. Compliance involves high operational costs and complex certification processes, especially for organic and functional products. Small manufacturers often struggle to meet evolving standards while maintaining profitability. Adhering to these regulations is essential for maintaining consumer confidence and sustaining exports across the broader European market.

Rising Competition and Market Saturation

Germany’s mature pet food sector is witnessing intense competition among global giants and local brands. The proliferation of new entrants offering niche and premium products increases market fragmentation. High brand loyalty and price sensitivity among consumers challenge differentiation efforts. Companies must continuously innovate and invest in marketing to retain market share. This competitive intensity limits margin expansion and forces players to explore strategic collaborations, private labels, and value-added offerings for growth.

Regional Analysis

North Germany

North Germany accounted for 24% share of the Germany Pet Food Market in 2024, supported by strong urbanization and a growing population of pet owners in cities like Hamburg and Bremen. The region benefits from advanced logistics infrastructure, facilitating efficient distribution across retail and online channels. Consumers in this region prefer high-quality, natural, and sustainable pet food brands. Local manufacturers emphasize organic sourcing and transparency to meet demand. Premium dog and cat food products drive most sales, supported by rising disposable incomes and modern retail penetration.

South Germany

South Germany held the largest 29% share of the Germany Pet Food Market in 2024, driven by high pet ownership rates and robust spending capacity across Bavaria and Baden-Württemberg. The region’s focus on premium and functional pet nutrition supports product innovation and private-label development. Manufacturers benefit from strong industrial infrastructure and proximity to major suppliers. Consumers actively choose products with high meat content and eco-friendly packaging. The region’s export-oriented companies strengthen its contribution to the national pet food sector.

East Germany

East Germany captured a 21% share of the Germany Pet Food Market in 2024, supported by expanding urban centers and improving retail availability. Pet adoption programs and awareness campaigns have increased ownership, particularly among younger consumers. The market is witnessing growing preference for affordable and value-based pet food products. Manufacturers target this region through discount chains and regional distributors. Investment in modern production facilities supports local supply, while gradual shifts toward premium options create long-term opportunities.

West Germany

West Germany accounted for 26% share of the Germany Pet Food Market in 2024, led by established consumer bases in North Rhine-Westphalia and Hesse. It benefits from high retail density, well-developed e-commerce platforms, and the presence of leading multinational brands. Pet owners in this region prioritize balanced nutrition and convenience in packaging. Companies emphasize brand loyalty programs and innovation in sustainable sourcing to retain customers. Rising pet care awareness continues to support consistent growth across all major distribution channels.

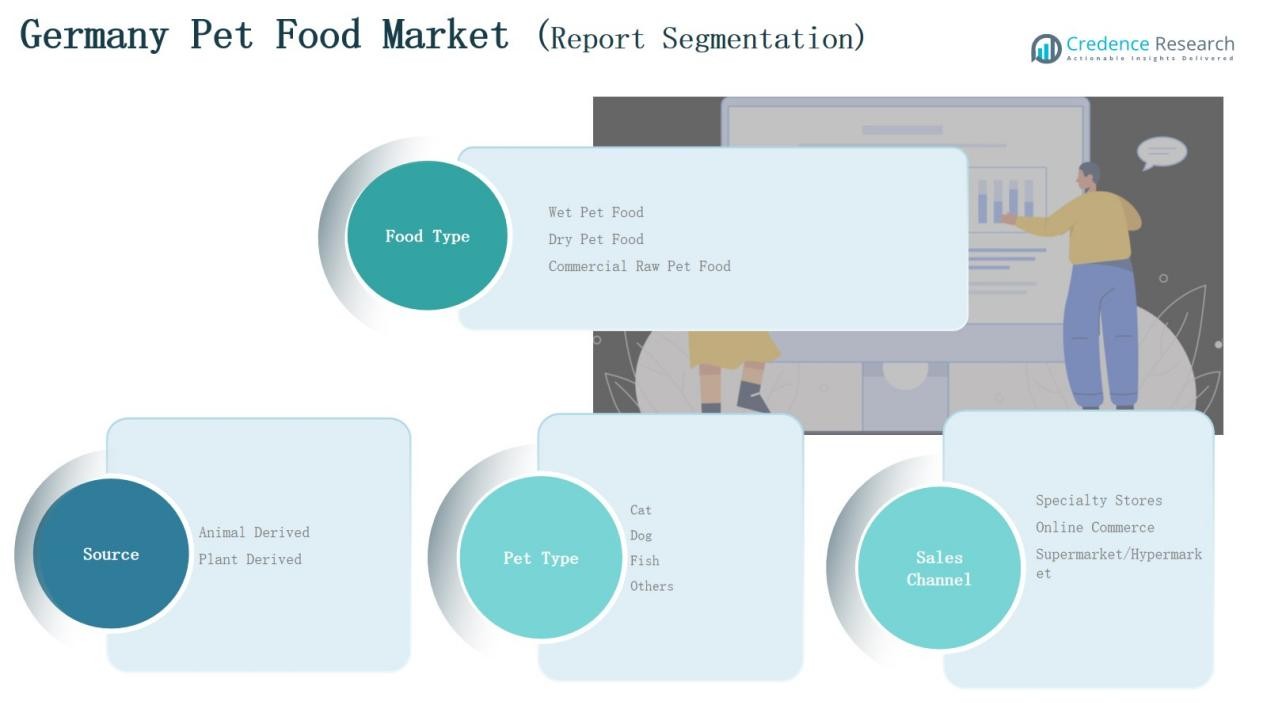

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Region

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The competitive landscape of the Germany Pet Food Market is characterized by the presence of major multinational corporations and strong domestic brands competing across premium and mass-market segments. Leading players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and General Mills, Inc. dominate through wide product portfolios, extensive retail networks, and continuous innovation in specialized nutrition. Local companies like Heristo AG, Deuerer, and United Petfood enhance market diversity with regionally sourced, private-label, and affordable product offerings. Competition centers on product quality, sustainable packaging, and ingredient transparency to align with evolving consumer expectations. Companies focus on expanding e-commerce presence, veterinary partnerships, and clean-label innovations to strengthen brand trust. The market remains moderately consolidated, with premiumization trends, health-oriented formulations, and sustainability driving strategic collaborations and product diversification among key participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Heristo AG

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- Deuerer

- United Petfood

- Bewital Petfood GmbH & Co. KG

- Pets Deli

- Pets Choice

- MPM Products

- Other Key Players

Recent Developments

- In May 2024, VAFO Group became the sole owner of German manufacturer Allco Tiernahrung via acquisition, integrating its operations under VAFO.de.

- In March 2025, The Nutriment Company (TNC) acquired German raw pet food firm BAF Petfood from Fressnapf to expand its raw food presence in Germany.

- In June 2025, TNC acquired another German pet food business, Graf Barf, to further strengthen its footprint in raw and human-grade nutrition.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and natural pet food products will continue to expand across Germany.

- Online retail and subscription-based delivery models will strengthen market accessibility.

- Sustainable packaging and eco-friendly sourcing will become central to brand positioning.

- Functional and veterinary diets will gain traction among health-conscious pet owners.

- Plant-based and alternative protein pet foods will attract environmentally aware consumers.

- Private-label brands from supermarkets will increase competition in the mid-price segment.

- Manufacturers will invest more in digital marketing and direct-to-consumer engagement.

- Product innovation will focus on breed-specific, age-specific, and allergen-free formulations.

- Partnerships with veterinarians and pet clinics will support trusted product recommendations.

- Expansion of regional production facilities will enhance supply efficiency and reduce import reliance.