Market Overview

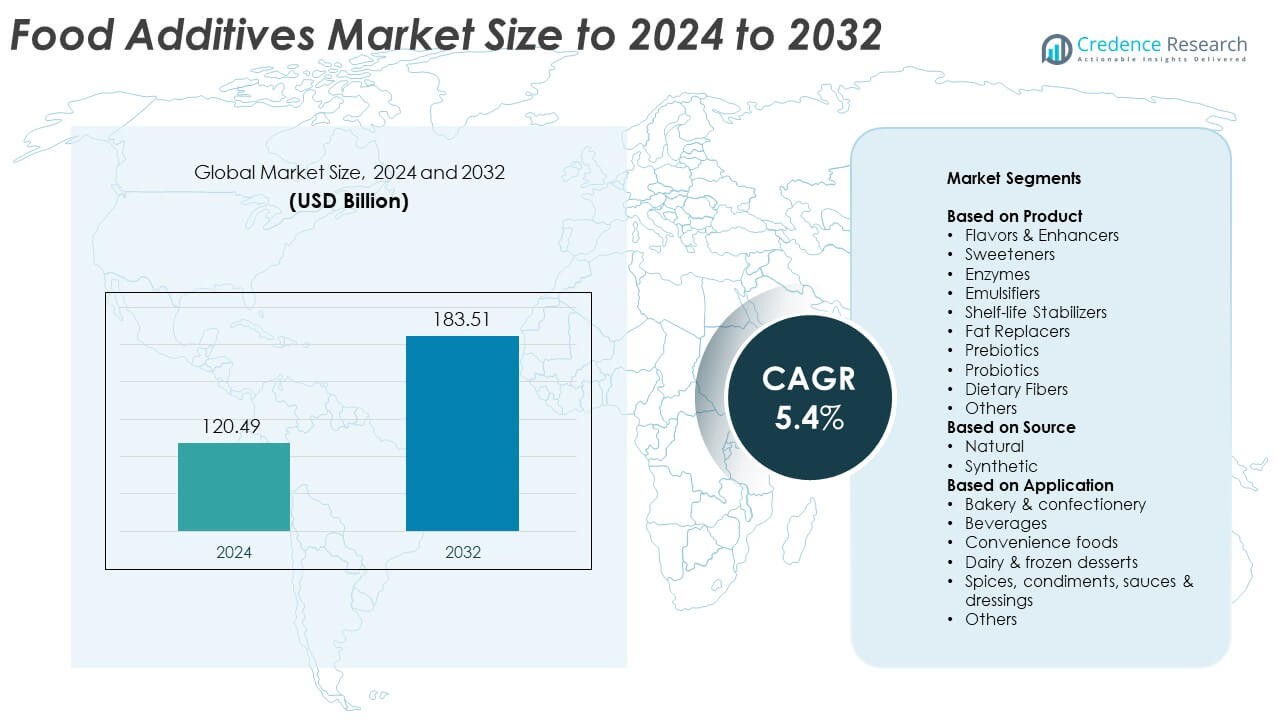

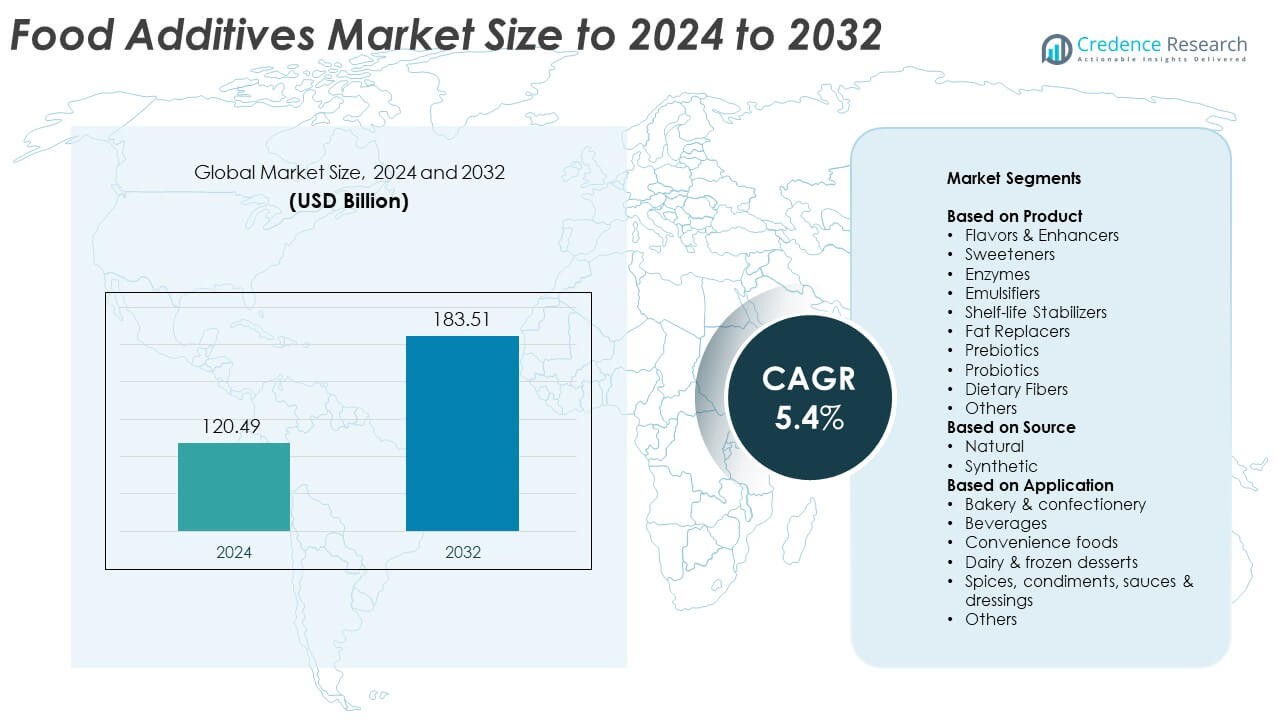

The Food Additives Market size was valued at USD 120.49 billion in 2024 and is anticipated to reach USD 183.51 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Additives Market Size 2024 |

USD 120.4 Billion |

| Food Additives Market, CAGR |

5.4% |

| Food Additives Market Size 2032 |

USD 183.51 Billion |

The food additives market is led by key players such as Kerry Group plc, DuPont, BASF SE, Cargill Incorporated, ADM, International Flavors & Fragrances Inc. (IFF), and Givaudan. These companies focus on innovation in natural, clean-label, and functional ingredient solutions to meet changing consumer preferences. Strategic investments in biotechnology, fermentation processes, and sustainable sourcing have strengthened their competitive positioning. Regionally, North America dominated the market in 2024 with a 34% share, driven by strong demand for processed and convenience foods. Europe and Asia Pacific followed, supported by growing interest in health-oriented and bio-based additive applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food additives market was valued at USD 120.49 billion in 2024 and is projected to reach USD 183.51 billion by 2032, growing at a CAGR of 5.4%.

- Rising demand for processed and convenience foods, along with clean-label and natural ingredients, is fueling market expansion globally.

- Trends such as bio-based additive development, enzyme innovation, and increased use of probiotics and prebiotics are shaping future growth.

- The market is moderately competitive, with players focusing on R&D, sustainable sourcing, and mergers to strengthen global presence and product portfolios.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while the flavors and enhancers segment dominated product demand with a 32% share.

Market Segmentation Analysis:

By Product

Flavors and enhancers dominated the food additives market in 2024, accounting for nearly 32% of the total share. Their dominance stems from rising demand for improved taste and aroma in processed and ready-to-eat foods. Manufacturers are developing natural and heat-stable flavoring agents to meet clean-label preferences and global taste diversification. The segment benefits from technological advancements in microencapsulation, which enhance flavor retention and stability during processing. Growing consumption of packaged snacks and beverages across Asia-Pacific and Europe continues to strengthen the market position of flavor and enhancer additives.

- For instance, IFF has 150 manufacturing facilities, creative centers, and labs globally (2024).

By Source

The natural source segment held the largest share of around 61% in 2024, driven by rising consumer preference for clean-label and plant-based ingredients. Increased awareness about health risks linked to synthetic additives has accelerated the transition toward natural alternatives derived from fruits, vegetables, and microorganisms. Food producers are investing in sustainable extraction technologies to enhance yield and purity. This trend is reinforced by government regulations promoting transparency in ingredient labeling. Expanding applications of natural additives in bakery, beverages, and dairy sectors further boost market growth across global food industries.

- For instance, Lallemand operates in 48 countries with yeast and bacteria production, labs, distribution networks.

By Application

The bakery and confectionery segment led the food additives market in 2024, holding approximately 28% share. The segment’s dominance is supported by high demand for flavoring agents, emulsifiers, and stabilizers that enhance texture, shelf life, and product consistency. Food manufacturers are innovating with natural colorants, low-calorie sweeteners, and enzyme-based solutions to meet consumer demand for healthier indulgence options. Growth in the global bakery sector, driven by urbanization and westernized eating habits, has fueled additive usage. Continuous innovation in functional and fortified bakery products further expands the application base in this segment.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The growing consumption of packaged and ready-to-eat foods is a primary driver of the food additives market. Urban lifestyles and increasing workforce participation are fueling demand for long-lasting and flavorful food products. Additives enhance taste, color, and texture while extending shelf life, making them essential for large-scale food production. Expanding retail and e-commerce food channels further support market penetration. Emerging economies in Asia-Pacific are witnessing higher processed food adoption, reinforcing the role of additives in maintaining product quality and freshness.

- For instance, Kerry operates 124 manufacturing facilities and reported reaching 1.36 billion people with positive-nutrition products in 2024.

Shift Toward Natural and Clean-Label Ingredients

Consumer awareness regarding artificial additives has accelerated the shift toward natural and clean-label formulations. Manufacturers are reformulating products with plant-based, enzyme-derived, and fermentation-based ingredients to meet safety and transparency demands. Regulatory pressure from agencies like the FDA and EFSA promotes natural alternatives in food production. This transition aligns with sustainability and wellness trends, encouraging the use of organic colorants, natural sweeteners, and bio-based emulsifiers. Brands leveraging this clean-label movement are gaining strong competitive advantages in health-conscious markets.

- For instance, Tate & Lyle’s PROMITOR® Soluble Fibre shows caloric values of 1.1–1.9 kcal/g across grades, supporting reformulation.

Technological Advancements in Additive Production

Advancements in biotechnology and food science have transformed additive manufacturing and application efficiency. Enzyme-based processing, microencapsulation, and nanotechnology enhance flavor stability and nutrient delivery. These innovations help reduce dosage levels, improve dispersion, and retain quality during storage and processing. Food producers benefit from improved cost-effectiveness and scalability through automation and digital quality control systems. Such technological evolution supports the creation of multifunctional additives tailored for specific textures, nutritional enhancements, and long shelf-life requirements in processed food segments.

Key Trends and Opportunities

Functional and Fortified Additives Gaining Traction

Rising consumer focus on nutrition and wellness is boosting demand for functional additives offering health benefits. Ingredients like probiotics, prebiotics, and dietary fibers are increasingly used to enhance gut health and immunity. Food manufacturers are integrating these additives into beverages, dairy, and snack products to attract health-focused consumers. This trend aligns with the growth of personalized nutrition and fortified food offerings, opening new opportunities for additive suppliers to develop specialized solutions that combine taste with functionality.

- For instance, UK Version Yakult in the UK contains a minimum of 20 billion CFUs of L. casei Shirota per 65 ml bottle.

Expansion of Sustainable and Bio-Based Additives

Sustainability has become a major opportunity in the food additives industry. Producers are shifting toward bio-based materials and renewable extraction methods to reduce environmental impact. Plant-derived stabilizers, natural emulsifiers, and biodegradable colorants are replacing petroleum-based ingredients. Companies investing in sustainable sourcing and green chemistry are gaining brand loyalty and regulatory support. This eco-friendly transformation not only meets consumer expectations but also enhances long-term profitability for global food manufacturers adapting to stricter sustainability standards.

- For instance, Givaudan’s PlanetCaps™ capsules reach >60% biodegradation in 60 days under OECD test criteria.

Key Challenges

Stringent Regulatory and Safety Compliance

The food additives market faces strict regulatory scrutiny regarding health and safety standards. Global authorities such as the FDA and EFSA impose rigorous approval processes and labeling requirements. Compliance increases production costs and delays product launches. Small and medium manufacturers often struggle to adapt to evolving regulations across different regions. Maintaining consistent quality and meeting allergen-free or GMO-free certifications adds complexity. These regulatory challenges limit innovation speed and create barriers for new entrants in competitive global markets.

Volatile Raw Material Prices and Supply Chain Disruptions

Fluctuating prices of natural raw materials, such as fruits, plant extracts, and fermentation substrates, pose major challenges. Supply chain disruptions caused by climate variability and geopolitical tensions further strain additive production costs. Synthetic ingredient producers also face instability in petrochemical supply. This volatility affects pricing consistency and profit margins across manufacturing operations. Companies are increasingly investing in local sourcing, vertical integration, and advanced logistics systems to reduce risks associated with material shortages and transport delays.

Regional Analysis

North America

North America held the largest share of around 34% in the food additives market in 2024. The region’s dominance is driven by strong demand for processed and convenience foods, coupled with a growing preference for clean-label and low-calorie ingredients. The United States leads with extensive use of flavor enhancers, emulsifiers, and sweeteners in bakery, beverage, and dairy applications. Ongoing product innovation and a robust regulatory framework from the FDA support market expansion. Increasing consumer awareness of health benefits from natural additives further encourages manufacturers to invest in sustainable and transparent ingredient formulations.

Europe

Europe accounted for approximately 28% of the global market in 2024, supported by rising demand for natural and functional additives. Countries such as Germany, France, and the United Kingdom are focusing on cleaner ingredient formulations driven by stringent EU food safety regulations. The market benefits from innovation in bio-based emulsifiers, enzyme blends, and organic colorants. Growth is also fueled by consumer interest in plant-based and fortified food products. Collaboration between food producers and biotechnology firms continues to strengthen the region’s position as a hub for sustainable additive innovation and development.

Asia Pacific

Asia Pacific captured about 24% share of the food additives market in 2024, emerging as the fastest-growing region. Rising disposable income, expanding urban populations, and westernization of diets are driving increased consumption of packaged and ready-to-eat foods. China, India, and Japan are major contributors due to rapid industrialization in food manufacturing and strong retail growth. The adoption of enzymes, flavor enhancers, and probiotics is growing across bakery, beverages, and dairy sectors. Government support for food quality improvements and investment in modern processing facilities continue to accelerate regional market growth.

Latin America

Latin America accounted for roughly 8% of the global market in 2024, led by Brazil and Mexico. The region’s growth is supported by increasing demand for processed meat, beverages, and confectionery products. Economic recovery and expansion of retail distribution networks are promoting greater adoption of additives. Local manufacturers are focusing on affordable flavoring and preservation solutions to meet price-sensitive consumer needs. Additionally, growing awareness of natural and fortified food ingredients is encouraging innovation in prebiotics and enzymes, improving competitiveness of regional producers in global trade.

Middle East & Africa

The Middle East and Africa represented nearly 6% share of the global market in 2024. Market growth is fueled by rising consumption of packaged foods and beverages across urban centers in the Gulf and Sub-Saharan regions. Increasing investment in food manufacturing infrastructure and import substitution programs supports domestic additive production. Demand for flavor enhancers, stabilizers, and preservatives is rising to meet food safety and quality standards. Ongoing efforts to expand cold-chain logistics and diversify food products are expected to enhance the region’s role in global additive trade.

Market Segmentations:

By Product

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Shelf-life Stabilizers

- Fat Replacers

- Prebiotics

- Probiotics

- Dietary Fibers

- Others

By Source

By Application

- Bakery & confectionery

- Beverages

- Convenience foods

- Dairy & frozen desserts

- Spices, condiments, sauces & dressings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food additives market size is characterized by the presence of leading players such as Kerry Group plc, DuPont, Sensient Technologies Corporation, BASF SE, Palsgaard, International Flavors & Fragrances Inc. (IFF), The Kraft Heinz Company, Novonesis, Cargill Incorporated, Fooding Group Limited, ADM, Corbion, Lonza, Givaudan, Ingredion, DSM, Tate & Lyle Plc, Ajinomoto Co., Inc., and Biospringer. These companies focus on expanding product portfolios through innovation in natural, functional, and sustainable additives. Strategic collaborations, acquisitions, and investments in R&D are driving technological advancements in enzymes, sweeteners, and flavor solutions. Firms are also enhancing production efficiency through bio-based and fermentation technologies while meeting evolving regulatory standards. Growing demand for clean-label and health-oriented ingredients has encouraged producers to diversify applications across bakery, dairy, beverages, and processed foods. Global expansion strategies, combined with digitalization in food formulation and manufacturing, continue to strengthen the competitive positioning of major market participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group plc

- DuPont

- Sensient Technologies Corporation

- BASF SE

- Palsgaard

- International Flavors & Fragrances Inc. IFF

- The Kraft Heinz Company

- Novonesis

- Cargill, Incorporated

- Fooding Group Limited

- ADM

- Corbion

- Lonza

- Givaudan

- Ingredion

- DSM

- Tate & Lyle Plc

- Ajinomoto Co., Inc.

- Biospringer

Recent Developments

- In 2024, Cargill Launched three new sustainable ingredient innovations at Food Ingredients Europe (FiE), including a cocoa-free chocolate alternative, a new drinks sweetener, and a microprotein.

- In 2024, Corbion Launched a circular lactic acid plant in Thailand with a low carbon footprint and earned a Gold EcoVadis Sustainability Rating.

- In 2024, BASF’s Isobionics brand launched Natural beta-Caryophyllene 80, a new natural flavor produced via fermentation biotechnology

- In 2023, Cargill Unveiled several health and nutrition ingredients at the Food Ingredients China (FIC) exhibition, including chicory root fiber, stevia sweeteners, and pea protein.

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing focus on clean-label and organic additives will drive product reformulation across food sectors.

- Advancements in enzyme technology will enhance processing efficiency and improve food texture.

- Rising use of probiotics and prebiotics will strengthen the functional food and beverage segment.

- Expansion of sustainable and bio-based additive production will support eco-friendly manufacturing practices.

- Increasing investment in R&D will enable the development of multifunctional and cost-effective additives.

- Adoption of AI and automation will optimize additive blending and quality control in production lines.

- Emerging economies will experience higher additive demand due to rapid urbanization and dietary shifts.

- Growing interest in low-sugar and fat-reduction solutions will accelerate innovation in sweeteners and fat replacers.

- Strategic mergers and partnerships among food ingredient companies will expand market reach globally.

- Regulatory harmonization and improved labeling standards will enhance consumer trust and transparency worldwide.