Market Overview

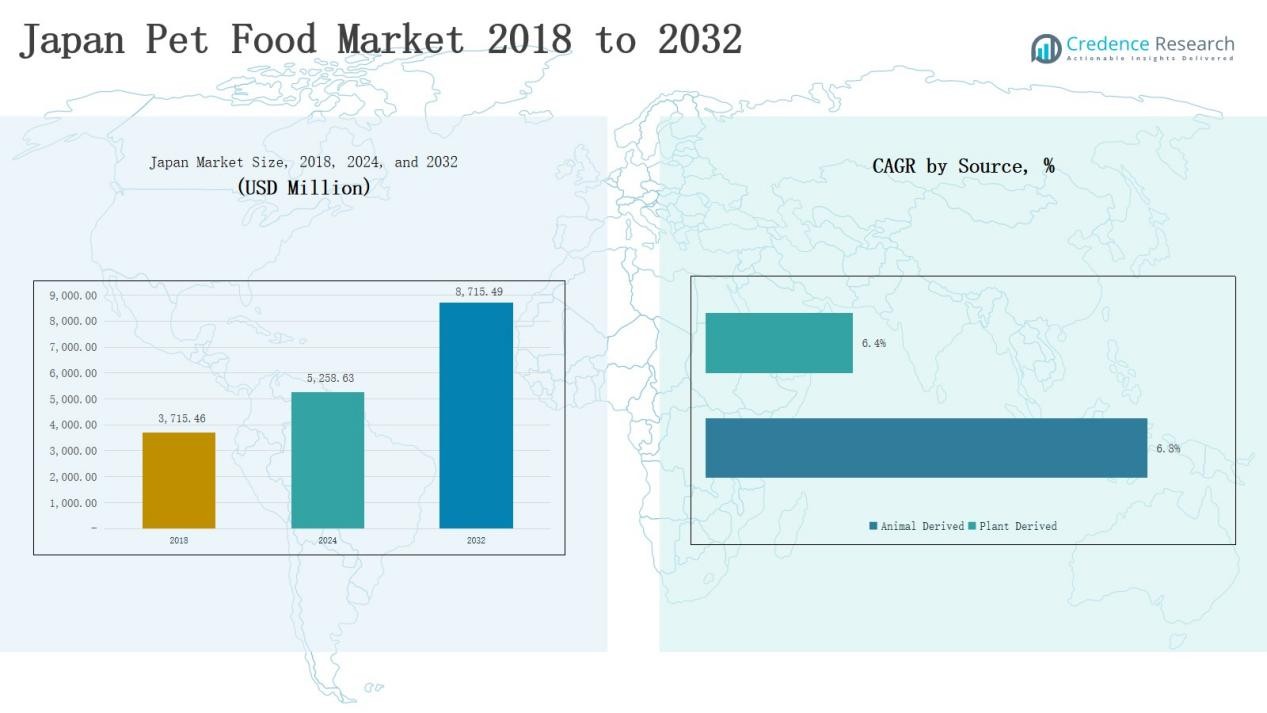

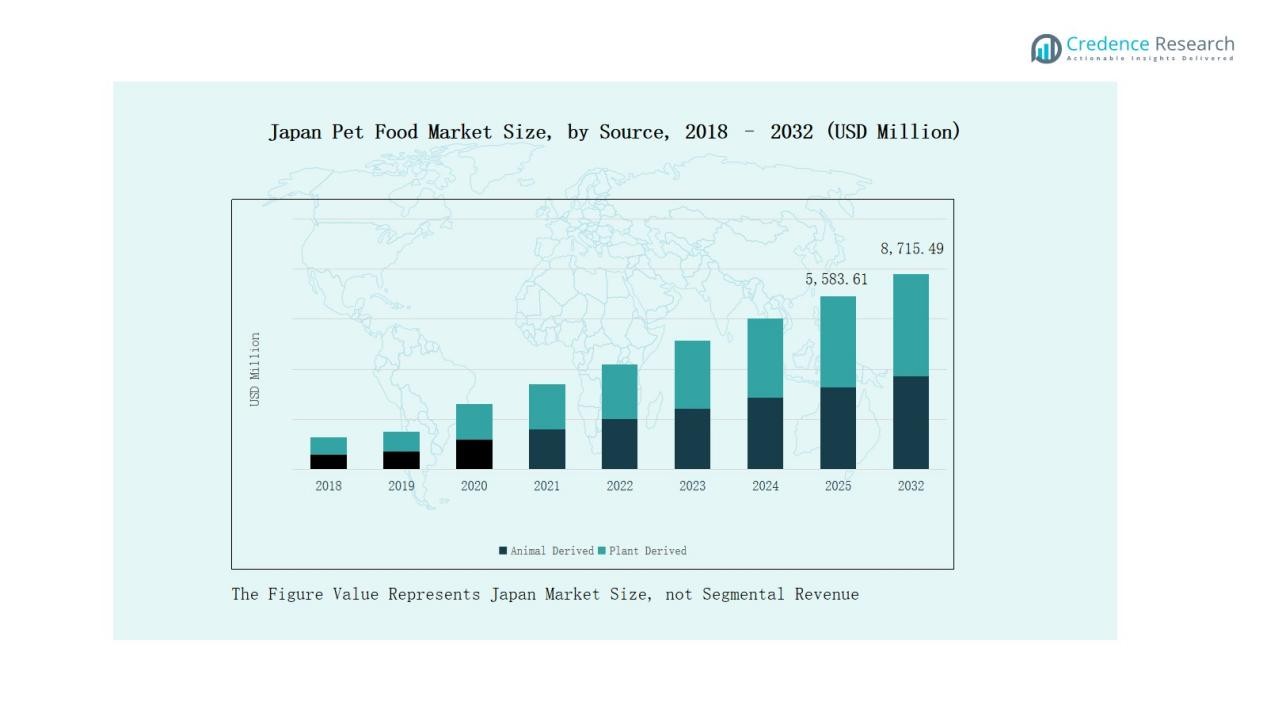

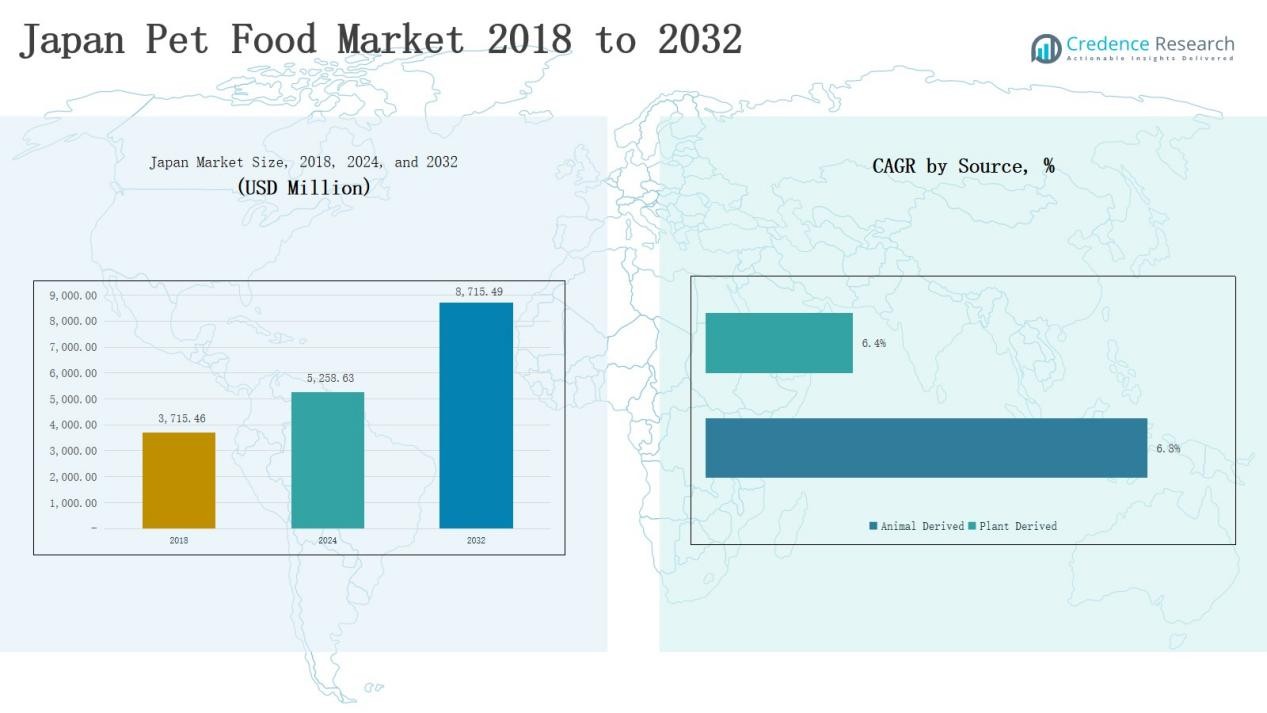

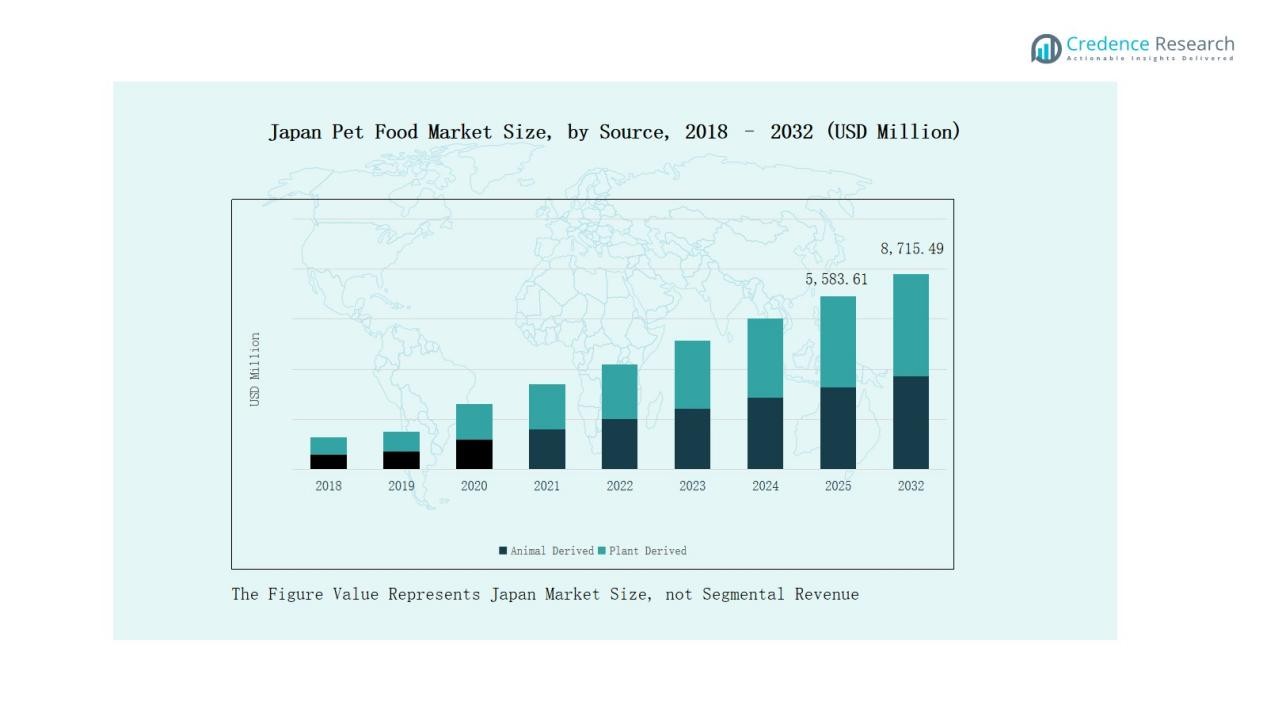

The Japan Pet Food Market was valued at USD 3,715.46 million in 2018, increased to USD 5,258.63 million in 2024, and is expected to reach USD 8,715.49 million by 2032, growing at a CAGR of 6.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Pet Food Market Size 2024 |

USD 5,258.63 Million |

| Japan Pet Food Market, CAGR |

6.69% |

| Japan Pet Food Market Size 2032 |

USD 8,715.49 Million |

The Japan Pet Food Market is led by prominent companies including Unicharm Corporation, Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, Inc., and NIPPON PET FOOD CO., LTD. These players maintain dominance through product innovation, strong brand portfolios, and extensive retail and online distribution. Their focus on premium, functional, and breed-specific formulations enhances consumer loyalty and market competitiveness. Strategic collaborations with e-commerce platforms and investments in sustainable packaging strengthen brand positioning. The Kanto region leads the market with a 36% share in 2024, driven by high urbanization, strong purchasing power, and the presence of major manufacturers and distributors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Pet Food Market grew from USD 3,715.46 million in 2018 to USD 5,258.63 million in 2024 and is projected to reach USD 8,715.49 million by 2032, expanding at a CAGR of 6.69%.

- Dry pet food led the market with a 47% share in 2024 due to its long shelf life, convenience, and balanced nutrition, appealing strongly to urban and dual-income households.

- Animal-derived products dominated the market with a 64% share, supported by demand for high-protein, meat-based formulations viewed as more natural and nutritious by pet owners.

- The dog segment held the highest share of 52% in 2024, driven by rising dog ownership, premium nutrition demand, and the popularity of small-breed dogs in Japanese urban areas.

- The Kanto region led the market with a 36% share, supported by high urbanization, disposable income, and the presence of key players such as Unicharm, Mars, and Nestlé Purina PetCare.

Market Segment Insights

By Food Type:

Dry pet food dominated the Japan Pet Food Market in 2024 with a 47% share. Its dominance stems from longer shelf life, convenience in storage, and balanced nutritional value. Pet owners prefer dry formulations for easy portion control and reduced spoilage risk. Manufacturers are focusing on high-protein and grain-free variants to meet growing demand for health-focused diets. Increasing urbanization and the rise of dual-income households further drive adoption of dry pet food across Japan’s pet owners.

- For instance, Unicharm introduced the AllWell dry series with 10 essential nutrients targeting adult cats, marketed with resealable packaging for freshness in urban households.

By Source:

The animal-derived segment led the Japan Pet Food Market in 2024, capturing a 64% share. This dominance is due to the preference for protein-rich formulations made from meat, fish, and poultry sources. Consumers view animal-based ingredients as more natural and nutritious for pets. Rising awareness of high-protein diets and strong demand for premium-grade meat-based products sustain growth. Continuous innovations in flavor profiles and digestibility also strengthen the appeal of animal-derived pet food.

- For instance, INABA-PETFOOD Co. Ltd. has been a key player in Japan, focusing on high-protein meat-based recipes that emphasize natural and nutritious ingredients preferred by pet owners for their pets’ health.

By Pet Type:

The dog segment accounted for the largest share of 52% in the Japan Pet Food Market in 2024. Rising dog ownership rates and growing preference for specialized nutrition support this trend. Premiumization in dog food—focused on joint health, digestion, and breed-specific formulas—drives market expansion. Increasing adoption of small-breed dogs in urban homes further fuels demand. Manufacturers continue to introduce tailored meal options and functional treats catering to diverse canine dietary needs.

Key Growth Drivers

Rising Pet Humanization and Premiumization

The growing perception of pets as family members fuels premium product demand in Japan. Pet owners increasingly seek high-quality, nutritious, and natural food options. Premium pet food brands emphasize organic ingredients, functional benefits, and human-grade quality. This shift supports market expansion across urban and affluent households. Manufacturers also capitalize on this sentiment by introducing tailored formulations targeting pet health, longevity, and emotional well-being, strengthening brand loyalty and consumer trust within the evolving Japanese pet care landscape.

- For instance, Japan’s ZEN Premium Dog GrainFree Fish uses fresh Japanese sardines and white fish as hypoallergenic ingredients, supported by over 90% domestically sourced materials to ensure quality and food allergy considerations.

Increasing Pet Ownership Among Urban Households

Urbanization and smaller family structures drive higher pet adoption rates in Japan. Single professionals and elderly citizens increasingly adopt pets for companionship, creating consistent food demand. The trend is particularly strong in cities like Tokyo and Osaka, where apartment-friendly pets such as cats and small dogs dominate. Growing awareness of pet nutrition and online product availability enhance accessibility. This urban lifestyle shift continues to create new growth opportunities across retail, online commerce, and specialized pet nutrition categories.

- For instance, PetKonnect is an India-based online pet products and services aggregator that provides a wide array of products and services and sells food from various brands, some of which feature breed-specific formulations, to customers across India.

Expansion of E-commerce and Retail Distribution

The rapid growth of e-commerce platforms has transformed Japan’s pet food distribution landscape. Online sales offer convenience, wider product selection, and subscription-based services for recurring purchases. Leading brands collaborate with digital platforms like Rakuten and Amazon Japan to improve reach and customer engagement. Supermarkets and specialty stores also expand shelf space for premium and functional pet food. The omnichannel retail approach strengthens consumer accessibility and drives steady sales growth across both domestic and international pet food brands.

Key Trends & Opportunities

Growth of Functional and Customized Nutrition

Japanese consumers increasingly favor functional pet food enriched with probiotics, omega-3 fatty acids, and joint-support nutrients. Manufacturers develop breed-specific and age-targeted products addressing health issues such as obesity, allergies, and digestion. Personalized nutrition supported by digital tools and subscription plans enhances customer loyalty. This trend aligns with Japan’s aging pet population, where preventive nutrition and wellness-focused diets present strong opportunities for innovation, differentiation, and sustained market expansion in premium product categories.

- For instance, SquarePet® launched VFS Active Joints dog food, a high-protein diet enriched with natural sources of glucosamine, chondroitin sulfate, and enhanced omega-3 fatty acids DHA & EPA, targeting joint health and mobility in pets.

Shift Toward Sustainable and Ethical Sourcing

Sustainability has emerged as a major opportunity in the Japan Pet Food Market. Consumers are more conscious of ingredient origin, packaging materials, and environmental footprint. Companies respond with eco-friendly packaging, plant-based ingredients, and responsibly sourced animal proteins. Collaborative efforts with sustainability organizations and traceable supply chains enhance transparency. Brands promoting ethical practices gain stronger market preference, aligning with Japan’s growing sustainability goals and consumer emphasis on environmental responsibility in everyday purchasing decisions.

- For instance, Aiken Genki emphasizes nutritional transparency and high-quality natural ingredients, partnering with local veterinarians for expert-backed recommendations, which has built strong consumer trust among health-conscious pet owners.

Key Challenges

High Cost of Premium and Imported Pet Food

Premium pet food prices remain a significant barrier for many Japanese consumers. Imported brands dominate the market but face high import tariffs and distribution costs. Currency fluctuations further increase retail prices, limiting affordability. Local manufacturers struggle to match international quality while maintaining competitive pricing. Balancing cost and quality without compromising nutritional standards remains challenging, particularly in urban markets where consumers demand both premium attributes and accessible price points.

Declining Population and Limited Pet Ownership Growth

Japan’s declining population and aging demographics restrict long-term pet ownership growth. Many elderly individuals hesitate to adopt pets due to health or mobility concerns. Younger generations living in smaller apartments face space and time constraints. This demographic shift slows market expansion despite rising per-pet spending. Industry players must innovate through rental pet services, compact packaging, and low-maintenance nutrition solutions to sustain engagement and counter slower adoption rates in the coming years.

Stringent Regulatory and Safety Compliance

The Japan Pet Food Market faces strict safety and labeling regulations set by the Ministry of Agriculture, Forestry and Fisheries (MAFF). Compliance with ingredient transparency, manufacturing standards, and nutritional claims demands continuous investment. Smaller manufacturers struggle with certification costs and regulatory updates. Frequent product testing and documentation requirements increase operational complexity. While regulations enhance consumer trust, they also limit market entry for emerging brands, creating barriers to competition and innovation in specialized product categories.

Regional Analysis

Kanto Region

The Kanto region dominated the Japan Pet Food Market in 2024 with a 36% share. It remains the center of economic activity and urban living, supporting a dense concentration of pet owners. Rising disposable incomes and smaller household structures drive higher spending on premium and functional pet food. Major cities such as Tokyo and Yokohama record strong demand for dry and wet food variants due to convenience and availability. Retail chains and online platforms expand rapidly in this region. The strong presence of leading manufacturers and distributors continues to strengthen Kanto’s market leadership.

Kansai Region

The Kansai region captured a 24% share of the market in 2024, led by major urban centers including Osaka and Kyoto. Its growing middle-class population and increasing pet adoption support market expansion. Consumers prefer high-quality, protein-rich, and locally sourced pet food. Manufacturers target this region through innovative product packaging and value-added nutrition. Specialty stores and supermarkets account for strong sales growth. It remains an important production and distribution hub due to its developed logistics and regional access.

Chubu Region

Chubu accounted for 18% of the Japan Pet Food Market in 2024. The region benefits from balanced urbanization and high purchasing power in prefectures such as Aichi and Shizuoka. Pet owners emphasize balanced nutrition and natural ingredient-based food. Rising awareness of pet wellness and veterinary recommendations drive adoption of fortified diets. Local brands expand presence through direct retail networks and cooperative stores. The region shows steady demand across both dog and cat food segments supported by an aging pet population.

Kyushu Region

Kyushu represented a 13% share in 2024, supported by rising pet ownership in urban centers like Fukuoka and Kumamoto. The regional market is characterized by a growing shift toward sustainable and organic pet food. Consumers favor locally produced brands with clear ingredient traceability. The availability of modern retail outlets and improved e-commerce delivery networks enhances accessibility. Pet care awareness campaigns by manufacturers and local organizations strengthen adoption of premium and functional pet diets.

Hokkaido and Tohoku Region

Hokkaido and Tohoku collectively held a 9% share of the market in 2024. These northern regions show growing interest in nutritious and weather-suited pet food formulations. Cold climates increase demand for energy-dense diets among dog owners. Local pet stores focus on specialized offerings tailored to regional preferences. Rural households with higher pet ownership rates sustain steady consumption levels. Rising internet penetration and online retail access are helping manufacturers expand distribution across these regions.

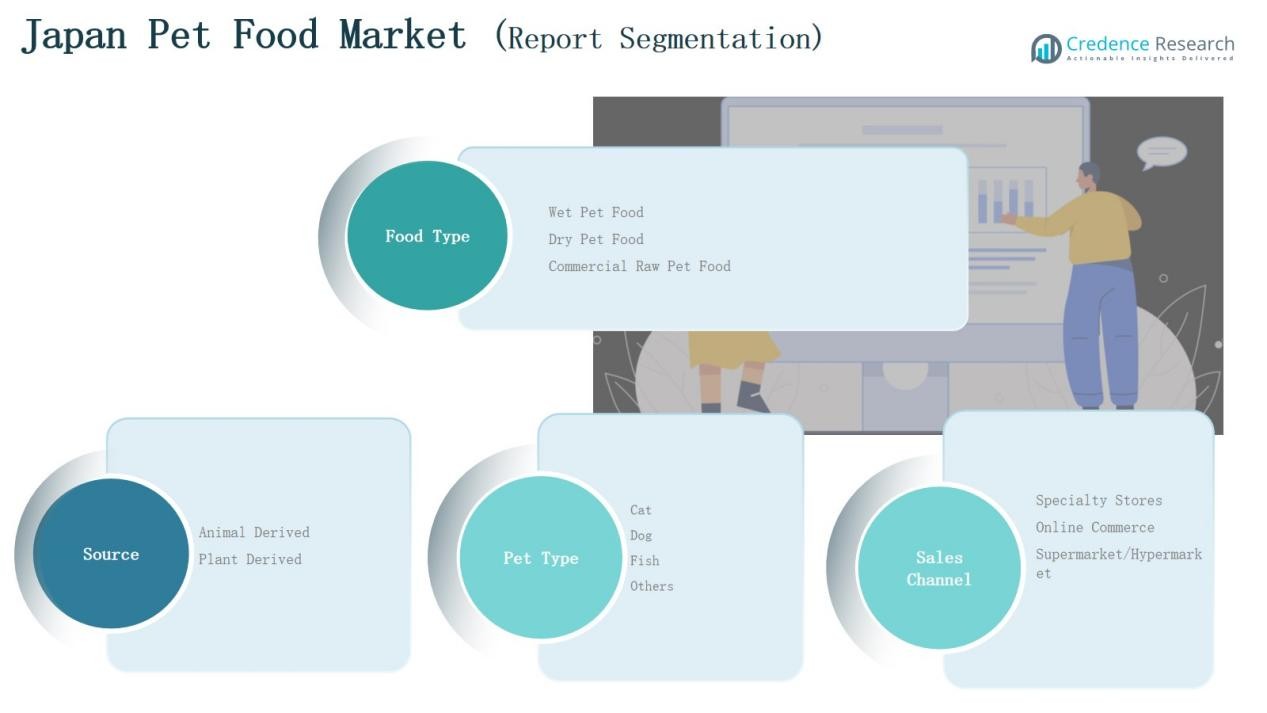

Market Segmentations:

By Food Type:

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source:

- Animal Derived

- Plant Derived

By Pet Type:

By Sales Channel:

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido and Tohoku

Competitive Landscape

The Japan Pet Food Market features a moderately consolidated competitive landscape, dominated by global and domestic players focused on innovation, product quality, and distribution strength. Leading companies such as Unicharm Corporation, Mars, Incorporated, and Nestlé Purina PetCare maintain strong market positions through premium formulations, advanced nutritional research, and brand trust. Domestic firms like NIPPON PET FOOD CO., LTD. and INABA-PETFOOD leverage local sourcing and regional preferences to sustain competitiveness. The market emphasizes functional, organic, and breed-specific products to meet evolving consumer demands. E-commerce partnerships with platforms like Rakuten and Amazon Japan strengthen online visibility and sales growth. Companies are also investing in eco-friendly packaging, sustainable ingredients, and personalized nutrition. Continuous product innovation, digital marketing, and expansion into specialty pet categories drive strategic competition. It remains a market where technological advancement and consumer-driven customization define long-term leadership and brand differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Unicharm Corporation

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- NIPPON PET FOOD CO., LTD.

- United Petfood

- Landini Giuntini SPA

- Affinity Petcare

- MG Group

- INABA-PETFOOD

- Other Key Players

Recent Developments

- In July 2025, Maruha Nichiro’s subsidiary AIXIA launched its first frozen dog food line, marking the company’s entry into Japan’s premium frozen pet food segment.

- In December 2024, Toppan Holdings announced the acquisition of Sonoco’s Thermoformed and Flexible Packaging division for USD 1.8 billion, strengthening its position in Japan’s pet food packaging sector.

- In June 2025, Maruha Nichiro established a dedicated Pet Food Business Promotion Office to accelerate domestic and overseas expansion, particularly in Japan and Thailand.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and functional pet food will continue to increase across urban areas.

- E-commerce platforms will play a greater role in driving pet food accessibility and subscription sales.

- Local brands will expand their share through affordable, nutritionally balanced formulations.

- Sustainable sourcing and recyclable packaging will become key competitive factors.

- Growth in senior and single-person households will support higher cat food consumption.

- Technological advancements will enable customized nutrition and data-driven product development.

- Veterinary recommendations will influence pet food purchases focused on health and longevity.

- International players will increase investments in Japan through partnerships and local production.

- Functional treats and supplements will emerge as new growth categories within the market.

- Rising consumer focus on transparency and clean labeling will shape future product innovation.