Market Overview

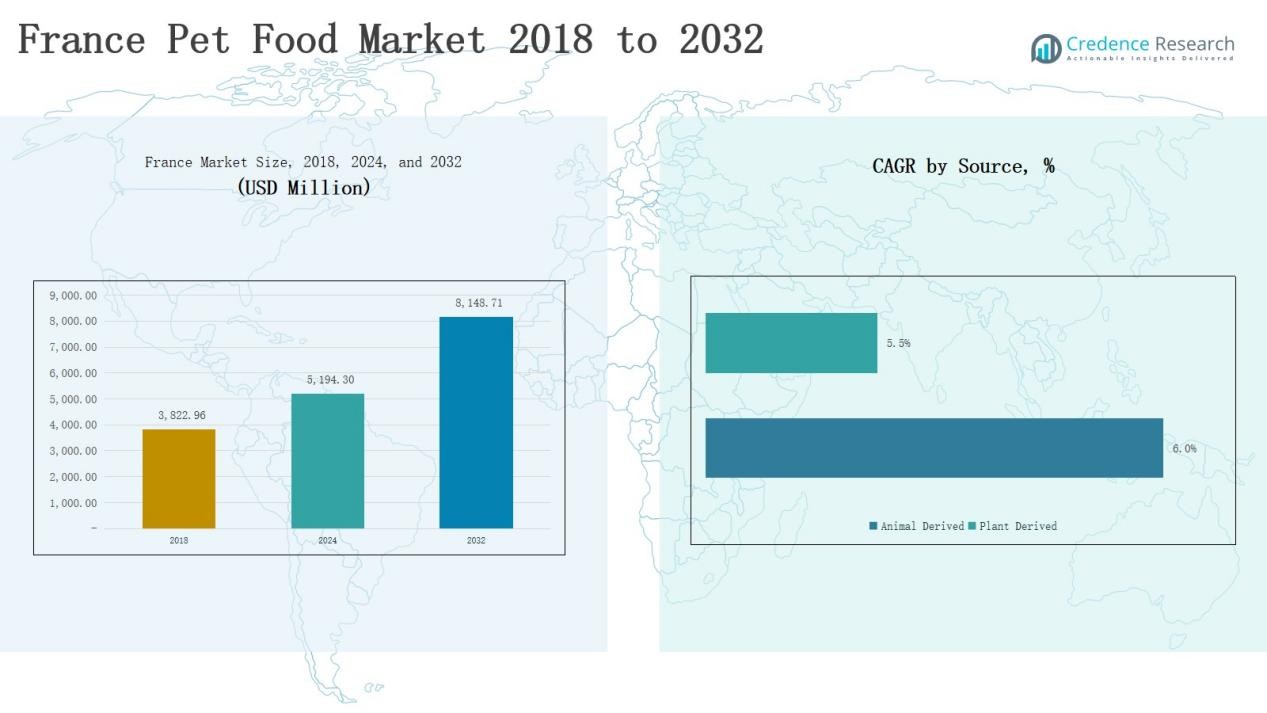

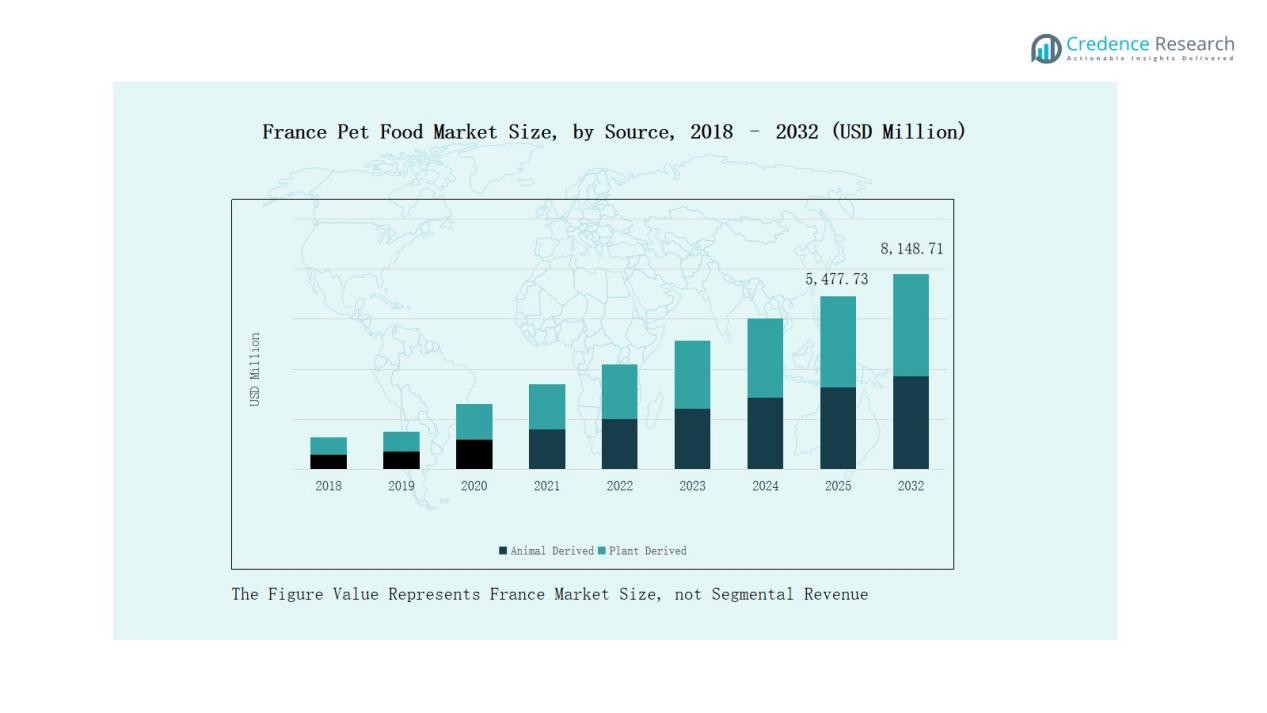

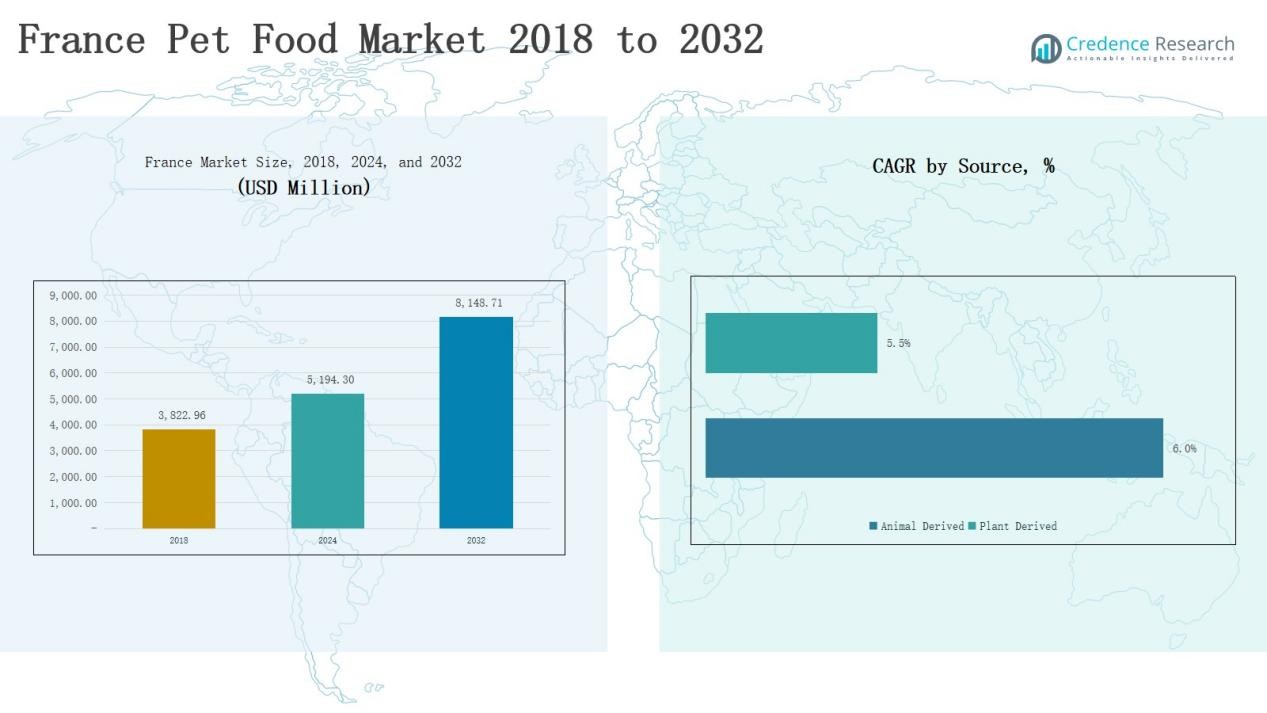

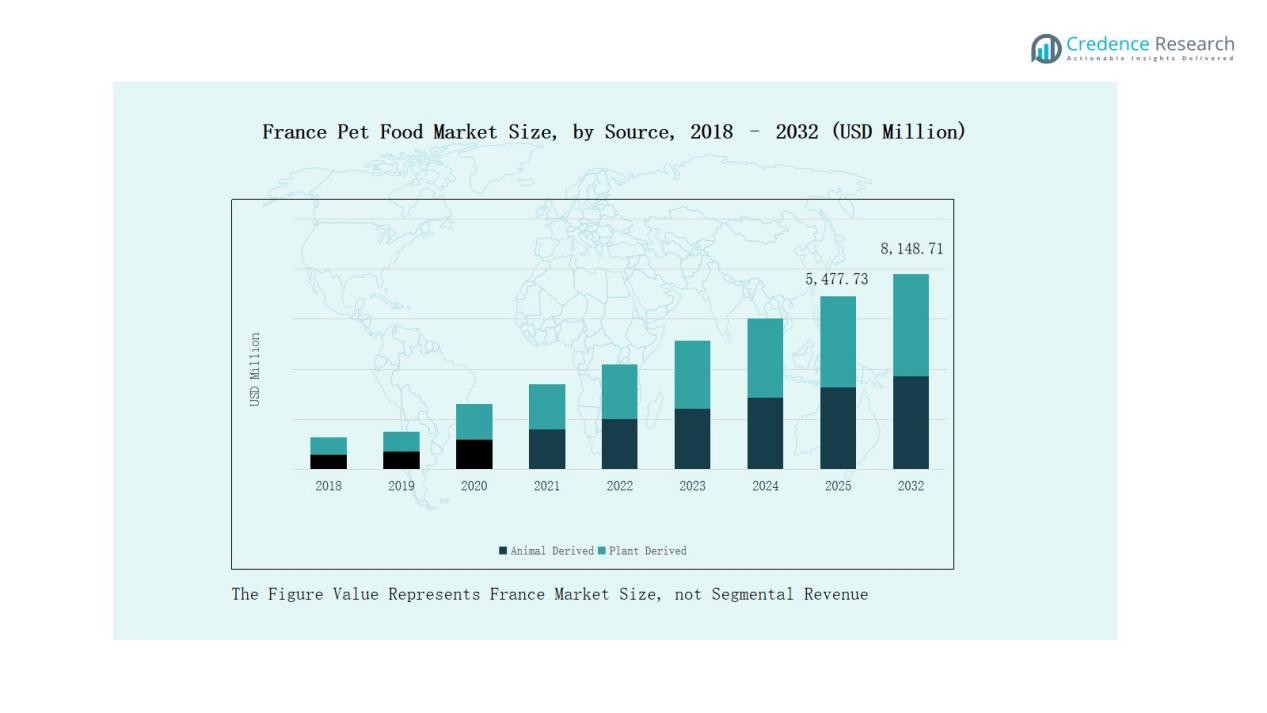

The France Pet Food Market size was valued at USD 3,822.96 million in 2018, increased to USD 5,194.30 million in 2024, and is anticipated to reach USD 8,148.71 million by 2032, growing at a CAGR of 5.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Pet Food Market Size 2024 |

USD 5,194.30 Million |

| France Pet Food Market, CAGR |

5.76% |

| France Pet Food Market Size 2032 |

USD 8,148.71 Million |

The France Pet Food Market is led by major players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and Royal Canin, which dominate through premium product portfolios, strong research capabilities, and extensive retail networks. These companies emphasize innovation, sustainable packaging, and nutrition-focused formulations to strengthen market presence. Regional manufacturers including United Petfood, Deuerer, Bewital Petfood GmbH & Co. KG, and Affinity Petcare enhance competition by offering locally sourced and cost-effective products. Among regions, Île-de-France emerged as the leading market in 2024 with a 28% share, driven by urban pet ownership, premiumization, and advanced retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Pet Food Market was valued at USD 3,822.96 million in 2018, reached USD 5,194.30 million in 2024, and is expected to reach USD 8,148.71 million by 2032, growing at a CAGR of 5.76%.

- Dry pet food led the market in 2024 with a 61% share due to convenience, longer shelf life, and affordability, while wet pet food followed with 29%, driven by its palatability and hydration benefits.

- Animal-derived ingredients dominated with a 72% share, supported by superior nutritional value and high protein quality, while plant-derived formulas gained traction among eco-conscious and vegan consumers.

- Dog food held the largest share of 57% in 2024, reflecting high pet ownership and demand for tailored nutrition, followed by cat food with 33% due to growing indoor pet trends.

- Île-de-France emerged as the leading region with a 28% share, driven by strong retail networks, premiumization, and high urban pet ownership, followed by Occitanie and PACA with 19% and 16%, respectively.

Market Segment Insights

By Food Type

Dry pet food dominated the France Pet Food Market in 2024 with a 61% share, driven by convenience, affordability, and longer shelf life. Its easy storage and suitability for daily feeding make it the preferred choice among busy pet owners. Wet pet food accounted for 29% of the market, supported by high palatability and hydration benefits. Commercial raw pet food, with a 10% share, gained traction among premium consumers seeking natural and protein-rich formulations.

- For instance, Mars Petcare doubled its wet food production capacity with these two new lines at the Saint-Denis-de-l’Hôtel plant, expected to produce up to 1 million pouches daily for European markets.

By Source

Animal-derived ingredients led the France Pet Food Market with a 72% share in 2024 due to their superior protein quality and nutritional value. Consumers prefer meat-based formulas that support digestive health and muscle strength in pets. Plant-derived pet food held a 28% share, growing steadily as eco-conscious and vegan pet owners seek sustainable, hypoallergenic alternatives using grains, legumes, and plant-based proteins without compromising pet nutrition.

- For instance, Edgard & Cooper France introduced its pea and sweet potato protein dry mix under the Plant Power range, aimed at hypoallergenic diets for adult dogs.

By Pet Type

Dog food remained the largest segment in the France Pet Food Market with a 57% share in 2024, supported by the country’s high dog ownership and demand for tailored nutrition. Cat food accounted for 33%, boosted by the rising population of indoor cats and growing preference for premium wet and mixed diets. Fish and other small pet food segments represented 10% collectively, reflecting steady demand among aquarium and small pet enthusiasts.

Key Growth Drivers

Rising Pet Humanization and Premiumization

The France Pet Food Market benefits from the growing humanization of pets, with owners treating pets as family members. This shift drives demand for high-quality, functional, and specialized nutrition products. Consumers increasingly prefer premium, grain-free, and organic options that support overall health, immunity, and digestion. Brands capitalize on this trend by expanding product portfolios with tailored recipes and age-specific formulations, reinforcing the country’s transition toward value-driven pet care consumption.

- For instance, Affinity Petcare specializes in premium and super-premium pet foods, with brands like Ultima and Brekkies. The company emphasizes research-driven product development, catering to evolving consumer preferences for organic and tailored pet nutrition in France.

Expansion of E-commerce and Direct-to-Consumer Channels

Rapid digitalization and changing shopping habits have strengthened online sales in the France Pet Food Market. Pet owners increasingly purchase through e-commerce platforms offering convenience, subscription models, and home delivery. Major brands and retailers invest in digital engagement, personalized marketing, and mobile-friendly apps to expand reach. This online shift enables small and niche brands to access wider audiences, enhancing competitiveness while improving price transparency and accessibility for consumers nationwide.

- For instance, Wanimo, a prominent French online pet supply store, captured a significant market share by offering competitive pricing, subscription services, and wide product accessibility, effectively broadening its consumer base nationwide.

Growth of Sustainable and Natural Pet Nutrition

Sustainability has become a major growth driver in the France Pet Food Market, aligning with Europe’s environmental goals. Consumers prefer eco-friendly packaging, ethically sourced ingredients, and plant-based proteins. Manufacturers are introducing recyclable materials and reducing carbon emissions through local sourcing and energy-efficient production. The demand for natural, clean-label pet food is rising sharply, as owners associate these attributes with long-term pet wellness and environmental responsibility.

Key Trends & Opportunities

Increasing Adoption of Functional Pet Food

Functional pet food is emerging as a leading trend in the France Pet Food Market. Products enriched with probiotics, antioxidants, and omega fatty acids address specific health concerns such as joint care, skin health, and digestion. Growing awareness of pet wellness encourages owners to choose scientifically formulated diets. This trend creates opportunities for innovation in specialized formulations and fortified blends tailored to different life stages, breeds, and medical conditions.

- For instance, Royal Canin introduced its Digestive Care Dry Dog Food in France, formulated with a fiber blend and prebiotics to support optimal nutrient absorption and gut flora balance.

Rising Demand for Customized and Fresh Pet Meals

Personalized pet food offerings are gaining momentum in France as owners seek nutrition tailored to their pets’ specific needs. Subscription-based brands offering fresh, portion-controlled, and veterinarian-approved meals are expanding. These products cater to health-conscious owners who value transparency and ingredient traceability. The shift toward fresh and minimally processed pet meals presents opportunities for premium brands to differentiate through nutritional personalization and sustainability-focused supply chains.

- For instance, Ultra Premium Direct uses a factory-to-consumer model with a subscription service, delivers grain-free, natural pet food tailored to carnivorous diets, and is a major, pioneering online brand in France.

Key Challenges

Fluctuating Raw Material Costs

Volatile prices of key ingredients, including meat, fish, and grains, pose a major challenge to the France Pet Food Market. Inflation, supply disruptions, and high energy costs increase production expenses. Manufacturers face difficulties maintaining product affordability while preserving quality. These fluctuations pressure margins and can lead to retail price adjustments that may affect consumer demand, particularly in mid-range and economy pet food segments.

Rising Competition and Brand Saturation

Intense market competition limits pricing flexibility and brand differentiation in the France Pet Food Market. Both international giants and regional brands compete aggressively through promotional strategies and product innovation. The presence of private-label and low-cost brands challenges established players in retail spaces. To sustain growth, companies must focus on branding, quality consistency, and innovation in formulation to maintain consumer loyalty in an increasingly saturated landscape.

Stringent Regulatory and Labeling Standards

France’s pet food industry faces strict compliance requirements under EU and national feed regulations. Producers must meet detailed labeling, ingredient safety, and traceability standards, increasing operational complexity. Smaller manufacturers often struggle with the costs of compliance, testing, and documentation. Frequent updates in regulatory frameworks, especially regarding sustainability and animal welfare claims, add further pressure, requiring continuous adaptation and transparency from market participants.

Regional Analysis

Île-de-France

The Île-de-France region dominated the France Pet Food Market in 2024 with a 28% share, driven by its dense urban population and high pet ownership among professionals. The region benefits from strong retail infrastructure, including specialty pet stores and online platforms catering to premium brands. Consumers in this area prefer high-quality, organic, and customized pet food products that align with modern lifestyles. Manufacturers focus on premium dry and wet food formulations to meet urban demand. Its affluent consumer base continues to drive innovation and brand diversification across pet categories.

Occitanie

Occitanie held a 19% share in the France Pet Food Market, supported by widespread pet adoption and growing awareness of pet health. Rural and suburban households in this region favor affordable dry food options due to convenience and cost efficiency. Expanding distribution networks and veterinary partnerships strengthen product reach in secondary cities. The region’s preference for local ingredients promotes demand for regionally sourced animal-derived pet food. It remains a key growth area for mid-tier brands targeting the expanding pet-owning population.

Provence-Alpes-Côte d’Azur (PACA)

The Provence-Alpes-Côte d’Azur region captured a 16% share of the France Pet Food Market in 2024, supported by rising demand for natural and sustainable products. Consumers in this region emphasize eco-friendly packaging and traceable ingredients. Premiumization trends drive strong sales of functional wet and raw pet food. Its coastal cities promote luxury pet products through specialty stores and e-commerce platforms. High purchasing power and lifestyle preferences fuel growth in health-oriented and grain-free product lines.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounted for a 14% share of the France Pet Food Market in 2024, supported by a mix of urban and rural consumers. The region benefits from robust pet retail channels and expanding online availability of premium pet food. Manufacturers introduce plant-based and protein-enriched diets to meet changing consumer tastes. Growing awareness of pet wellness supports demand for functional formulations. Its balanced demand across urban centers and countryside areas makes it a consistent contributor to national sales.

Hauts-de-France and Others

Hauts-de-France, along with other smaller regions, represented a 23% share of the France Pet Food Market in 2024. This combined segment benefits from strong manufacturing presence and distribution networks. Consumers seek both budget-friendly and mid-range options due to mixed income levels. Rising pet adoption in smaller towns contributes to volume growth, while e-commerce expansion bridges product availability gaps. It remains an emerging area for companies investing in regional promotions and value-driven offerings.

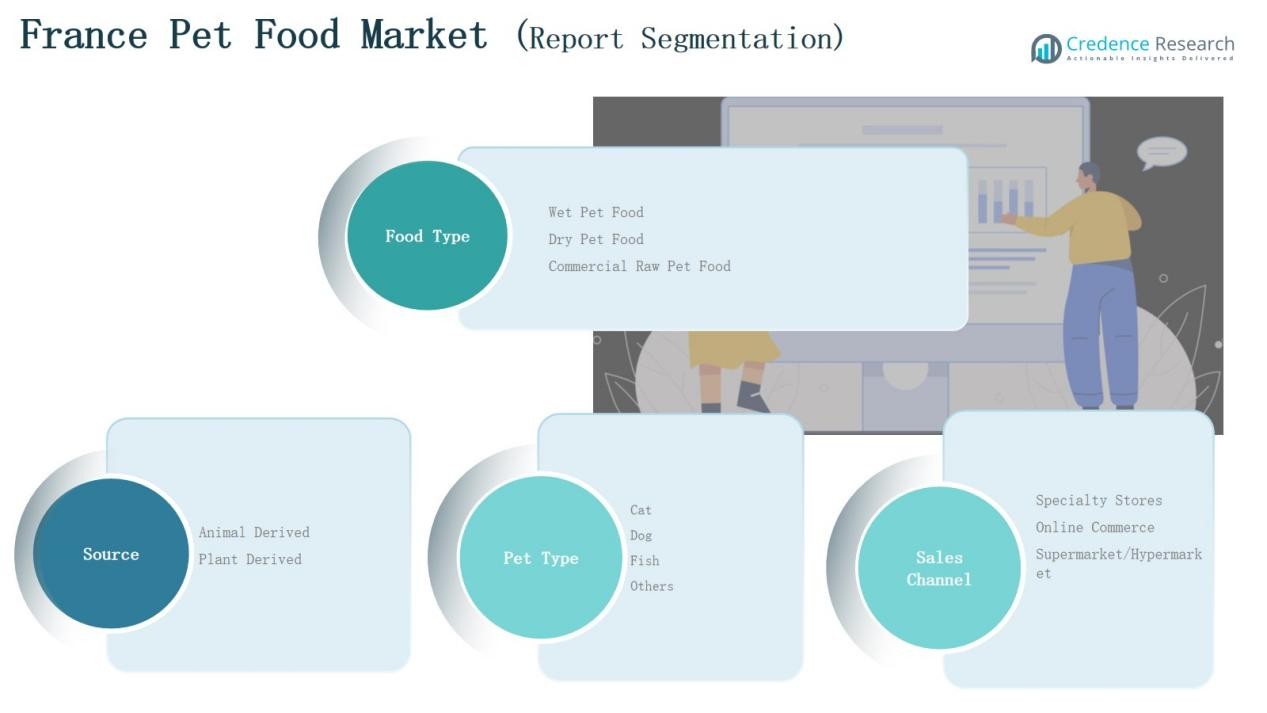

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derive

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Region

- Île-de-France

- Occitanie

- Provence-Alpes-Côte d’Azur (PACA)

- Auvergne-Rhône-Alpes

- Hauts-de-France

- Others

Competitive Landscape

The France Pet Food Market is highly competitive, featuring a strong mix of global leaders and regional manufacturers. Major companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and Royal Canin dominate through extensive brand portfolios, advanced R&D, and strong retail distribution. These players focus on premiumization, functional formulations, and sustainability-driven innovations to strengthen consumer trust. Regional companies such as United Petfood, Deuerer, Bewital Petfood GmbH & Co. KG, and Affinity Petcare enhance competition by offering affordable and locally sourced products. Private-label brands continue to expand in supermarket chains, appealing to cost-conscious buyers. Companies are investing in e-commerce platforms, subscription-based sales, and recyclable packaging to capture evolving consumer preferences. Partnerships with veterinarians and pet wellness centers further enhance credibility and brand loyalty. Continuous innovation and product diversification define the market’s competitive dynamics, positioning France as one of Europe’s most advanced and innovation-driven pet food markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Royal Canin

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- Deuerer

- United Petfood

- Bewital Petfood GmbH & Co. KG

- Affinity Petcare

- Pets Choice

- MPM Products

Recent Developments

l In October 2025, The Nutriment Company (TNC) acquired Easy-BARF, a French fresh pet food brand, to strengthen its raw and gently cooked pet food presence in France.

l In 2025, Mars Petcare launched two new production lines in its French facility at Saint-Denis-de-l’Hôtel, largely supporting Royal Canin wet food expansion.

l In June 2025, Mondi formed a partnership with Saga Nutrition, a French pet food maker, to roll out recyclable packaging for Saga’s dry pet food range.

l In September 2025, Virbac, a French animal health firm, introduced a medicated kibble for cats to support kidney disease treatment.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium, grain-free, and organic pet food will continue to grow steadily.

- E-commerce and subscription-based models will expand, improving product accessibility nationwide.

- Sustainable packaging and eco-friendly formulations will become key brand differentiators.

- Functional pet food with health benefits will gain wider consumer acceptance.

- Customized and breed-specific diets will rise in popularity among urban pet owners.

- Local sourcing and transparency in ingredient origin will influence purchase decisions.

- Partnerships with veterinary clinics will support product validation and trust building.

- Private-label brands will strengthen their market presence through affordability and innovation.

- Plant-based and alternative protein pet food options will see growing adoption.

- Investments in marketing and digital engagement will drive stronger brand loyalty and awareness.