Market overview

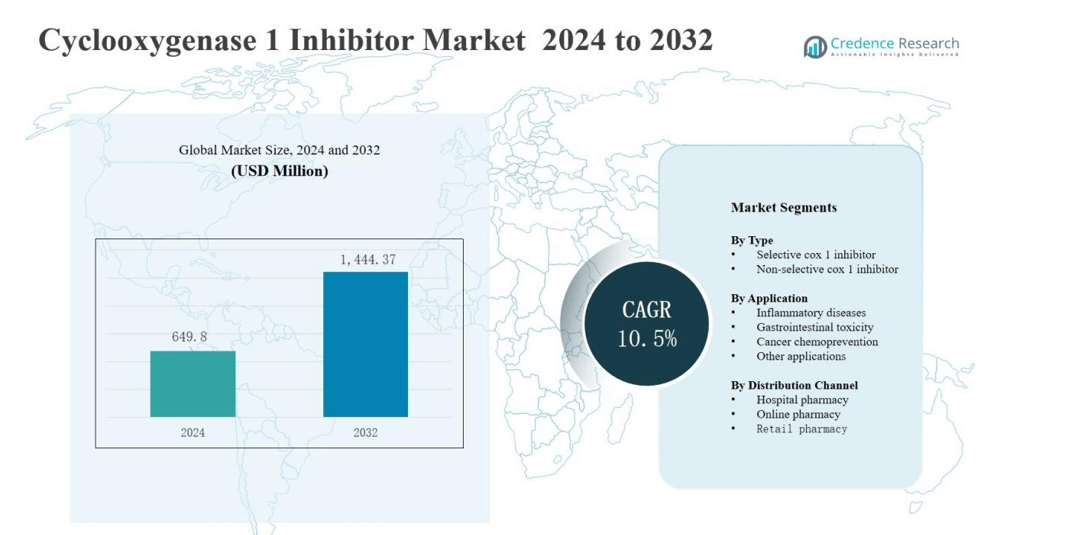

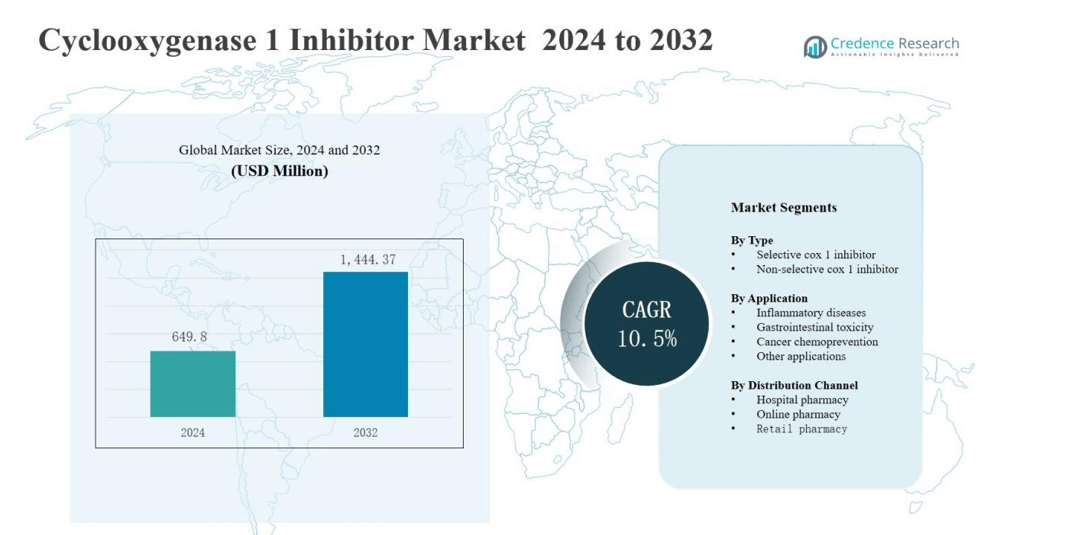

The Cyclooxygenase-1 (COX-1) Inhibitor Market size was valued at USD 649.8 million in 2024 and is anticipated to reach USD 1,444.37 million by 2032, growing at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclooxygenase 1 Inhibitor Market Size 2024 |

USD 649.8 million |

| Cyclooxygenase 1 Inhibitor Market, CAGR |

10.5% |

| Cyclooxygenase 1 Inhibitor Market Size 2032 |

USD 1,444.37 million |

The cyclooxygenase 1 inhibitor market is led by prominent players such as Pfizer Inc., AbbVie Inc., Johnson & Johnson, Bayer AG, Novartis AG, Boehringer Ingelheim International GmbH, Hikma Pharmaceuticals PLC, Cipla Limited, Alembic Limited, Aurobindo Pharma Limited, and Sabinsa. These companies focus on developing advanced anti-inflammatory formulations with improved safety and efficacy to strengthen their therapeutic portfolios. Strategic collaborations, clinical advancements, and expansion into emerging markets support their competitive positioning. North America remains the leading region in the market, commanding a 38% share in 2024, driven by strong R&D investments, high treatment adoption, and advanced healthcare infrastructure.

Market Insights

- The cyclooxygenase 1 inhibitor market was valued at USD 649.8 million in 2024 and is projected to reach USD 1,444.37 million by 2032, growing at 10.5%.

- The selective COX-1 inhibitor segment led the market with a 58% share in 2024, driven by demand for targeted anti-inflammatory therapies and improved safety profiles.

- The inflammatory diseases segment accounted for 47% of total applications in 2024, supported by the rising prevalence of arthritis, osteoarthritis, and autoimmune disorders.

- The hospital pharmacy segment dominated distribution channels with a 44% share, due to prescription-based dispensing and reliable patient access in clinical settings.

- North America held the largest regional share at 38% in 2024, driven by strong R&D investments, advanced healthcare infrastructure, and widespread adoption of selective COX-1 inhibitors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The selective COX-1 inhibitor segment dominates the cyclooxygenase 1 inhibitor market, accounting for 58% of total revenue in 2024. Its dominance is driven by high demand for targeted anti-inflammatory therapies that minimize off-target effects. Selective inhibitors offer improved safety and efficacy profiles compared to non-selective agents, promoting their adoption in chronic inflammatory and pain management treatments. Increasing R&D investment in selective enzyme modulation further supports this segment’s strong market position and expanding therapeutic relevance.

- For instance, Withings recently won FDA clearance for its BPM Pro 2 cellular blood pressure monitor, enabling direct remote patient monitoring via providers in the U.S. and potentially similar regulated markets.

By Application

The inflammatory diseases segment leads the cyclooxygenase 1 inhibitor market with a 47% share in 2024. The growing prevalence of arthritis, osteoarthritis, and autoimmune disorders drives the need for effective COX-1–targeted drugs. These inhibitors help control pain and inflammation by reducing prostaglandin synthesis. Increasing clinical use in long-term therapy and expanding availability of improved formulations support steady growth. Rising awareness of COX-1 inhibitors’ benefits in inflammation control reinforces their therapeutic adoption globally.

- For instance, Eli Lilly expanded its clinical research in autoimmune-related inflammation by initiating Phase II studies of peresolimab, a novel PD-1 agonist monoclonal antibody, designed for rheumatoid arthritis patients.

By Distribution Channel

The hospital pharmacy segment holds the largest share in the cyclooxygenase 1 inhibitor market, representing 44% of total revenue in 2024. Hospitals remain key distribution centers due to prescription-based drug dispensing and close physician oversight. Growing hospitalization rates for chronic inflammatory conditions and better inventory management strengthen this channel’s dominance. Hospital pharmacies also ensure higher patient compliance and timely access to prescribed COX-1 inhibitors, supporting steady product demand and reliable treatment availability across healthcare systems.

Key Growth Drivers

Rising Prevalence of Chronic Inflammatory Disorders

The growing incidence of arthritis, osteoarthritis, and autoimmune diseases fuels demand in the cyclooxygenase 1 inhibitor market. These conditions require long-term anti-inflammatory management, driving prescription volumes for COX-1 inhibitors. Increasing aging populations and lifestyle-related inflammation further amplify therapeutic need. Pharmaceutical companies are expanding portfolios with improved formulations targeting safer inflammation control, supporting steady revenue growth and expanding patient access to advanced COX-1–based treatments globally.

- For instance, Bayer AG expanded its anti-inflammatory research in 2024 by signing a research collaboration with Curadev to develop novel molecules that inhibit the STING pathway for the treatment of auto-inflammatory diseases.

Advancements in Drug Formulation and Delivery Technologies

Ongoing innovation in formulation technology enhances the bioavailability and safety of COX-1 inhibitors. Extended-release and combination therapies are gaining traction for better efficacy and reduced gastrointestinal side effects. Pharmaceutical firms invest heavily in nanotechnology and encapsulation methods to optimize targeted delivery. These advancements improve treatment outcomes, minimize adverse reactions, and strengthen physician preference, positioning technologically advanced COX-1 inhibitors as a key driver of sustained market expansion.

- For instance, newly synthesized N-hydroxyurea derivatives by researchers have demonstrated dual COX-2 and 5-LOX inhibition with good COX-1 selectivity and antioxidant properties, indicating improved safety and targeted action.

Growing Research in Cancer Chemoprevention Applications

Expanding studies linking COX-1 inhibition to cancer prevention create new market opportunities. Researchers highlight the enzyme’s role in tumor angiogenesis and metastasis, leading to development of COX-1 inhibitors as adjunct therapies in oncology. Ongoing clinical trials and favorable preclinical outcomes attract investment from global pharmaceutical companies. The growing focus on multi-target therapeutic strategies positions COX-1 inhibitors as emerging agents in chemopreventive treatment pipelines.

Key Trends & Opportunities

Shift Toward Selective COX-1 Inhibitors

The market shows a clear shift from non-selective to selective COX-1 inhibitors due to improved safety profiles. Selective inhibitors reduce risks associated with COX-2 suppression, such as cardiovascular complications. Pharmaceutical manufacturers focus on designing molecules that provide balanced efficacy and reduced gastrointestinal toxicity. This trend drives product innovation and regulatory approvals, reinforcing the segment’s dominance and creating opportunities for precision-targeted therapies in chronic inflammatory management.

- For instance, Pfizer’s PF-07275315 is a tri-specific monoclonal antibody, a biologic currently in Phase 2 clinical trials for the treatment of inflammatory conditions such as atopic dermatitis and asthma.

Expansion of Online Pharmaceutical Distribution

The rapid growth of e-pharmacy platforms enhances accessibility to COX-1 inhibitors globally. Online channels offer convenience, price transparency, and broad product availability, particularly in emerging economies. Increasing consumer preference for digital health services and regulatory support for e-prescriptions accelerate this shift. Companies are strengthening logistics and partnerships with online pharmacies to expand reach, making digital distribution a significant opportunity for market expansion in the coming years.

- For instance, Teva Pharmaceutical Industries launched an improved over-the-counter COX-1 inhibitor formulation with 15% better gastrointestinal tolerability, enhancing patient compliance through e-pharmacy availability.

Key Challenges

Adverse Gastrointestinal Side Effects

Gastrointestinal toxicity remains a major concern limiting COX-1 inhibitor adoption. Long-term usage can cause ulcers, bleeding, and gastric irritation, reducing patient compliance. Regulatory authorities emphasize strict safety labeling, which affects prescription rates. Manufacturers face ongoing challenges to develop safer alternatives with comparable efficacy. Addressing this issue through innovative formulations and adjunct protective therapies remains critical for sustaining market growth and patient trust.

Stringent Regulatory Approval Process

Obtaining regulatory approval for COX-1 inhibitors is complex and time-intensive. Authorities demand extensive clinical evidence for safety, efficacy, and long-term tolerability. These requirements increase development costs and delay commercialization. Emerging players face difficulties navigating regional variations in approval standards. The regulatory burden restricts rapid innovation, compelling companies to invest heavily in compliance and risk management throughout drug development cycles.

High Competition from Alternative Therapies

The availability of COX-2 inhibitors, biologics, and natural anti-inflammatory agents challenges COX-1 inhibitor demand. Healthcare providers increasingly prefer targeted biologics due to better efficacy in chronic inflammation control. Cost-effective generic NSAIDs also compete for the same therapeutic segment. This high competition pressures pricing strategies and limits profit margins. To sustain competitiveness, manufacturers must focus on differentiation through innovation, clinical validation, and enhanced patient safety profiles.

Regional Analysis

North America

North America dominates the cyclooxygenase 1 inhibitor market with a 38% share in 2024. The region benefits from advanced healthcare infrastructure, strong pharmaceutical manufacturing capacity, and high awareness of anti-inflammatory drug therapies. Rising cases of arthritis, osteoarthritis, and autoimmune diseases drive steady demand. Major companies such as Pfizer and Johnson & Johnson invest heavily in R&D and clinical trials to enhance product safety and efficacy. The growing adoption of selective COX-1 inhibitors supports regional market expansion and consistent prescription growth across hospitals and retail pharmacies.

Europe

Europe holds a 29% share in the cyclooxygenase 1 inhibitor market, supported by increasing use of anti-inflammatory drugs and a well-established regulatory framework. Countries such as Germany, France, and the United Kingdom lead in product adoption due to strong clinical research infrastructure and high patient awareness. Rising government support for chronic disease management boosts market penetration. Pharmaceutical firms like Bayer AG and Novartis AG actively invest in safer and more effective COX-1 formulations. The region’s focus on patient safety and precision medicine strengthens its position in the global market.

Asia-Pacific

Asia-Pacific accounts for a 23% share in the cyclooxygenase 1 inhibitor market, driven by expanding healthcare access and rising chronic disease incidence. Rapid growth in India, China, and Japan supports strong market potential. Increasing government healthcare spending and availability of affordable generic drugs improve patient accessibility. Companies such as Alembic Limited, Aurobindo Pharma, and Cipla play key roles in regional production. The growing middle-class population and improving prescription compliance contribute to sustained demand across hospital and online pharmacies.

Latin America

Latin America captures a 6% share in the cyclooxygenase 1 inhibitor market. Rising healthcare awareness and improving drug distribution networks drive gradual adoption across Brazil, Mexico, and Argentina. The market benefits from partnerships between regional distributors and global pharmaceutical firms. Expanding healthcare reforms and investments in pain management therapies support long-term growth. Growing medical tourism in the region also contributes to increasing demand for COX-1 inhibitors in hospital settings.

Middle East & Africa

The Middle East & Africa region represents a 4% share in the cyclooxygenase 1 inhibitor market. The market growth is supported by increasing healthcare modernization and improved access to prescription drugs. Countries such as the UAE, Saudi Arabia, and South Africa show higher uptake through hospital and retail channels. Growing awareness of chronic inflammatory disease management enhances product adoption. Expanding pharmaceutical imports and government focus on healthcare accessibility strengthen the region’s future market outlook.

Market Segmentations:

By Type

- Selective cox 1 inhibitor

- Non-selective cox 1 inhibitor

By Application

- Inflammatory diseases

- Gastrointestinal toxicity

- Cancer chemoprevention

- Other applications

By Distribution Channel

- Hospital pharmacy

- Online pharmacy

- Retail pharmacy

By Region

-

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Rest of Europe

-

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

-

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the cyclooxygenase 1 inhibitor market is moderately consolidated, featuring a mix of global pharmaceutical giants and regional manufacturers. Key players include Pfizer Inc., AbbVie Inc., Johnson & Johnson, Bayer AG, Novartis AG, Boehringer Ingelheim International GmbH, Hikma Pharmaceuticals PLC, Cipla Limited, Alembic Limited, Aurobindo Pharma Limited, and Sabinsa. These companies compete through innovation, strategic collaborations, and expansion of therapeutic portfolios focused on inflammation and pain management. Continuous R&D investments aim to enhance selectivity, reduce gastrointestinal side effects, and improve drug efficacy. Strategic mergers and regulatory approvals for advanced formulations strengthen their global presence. Emerging firms in Asia are increasing competition by offering cost-effective generics and improved drug delivery systems. Overall, the competitive dynamics emphasize technological advancement, clinical efficacy, and global supply chain expansion to maintain long-term market leadership in the COX-1 inhibitor drug segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Pfizer Inc.

- Alembic Limited

- Bayer AG

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson

- Aurobindo Pharma Limited

- AbbVie, Inc.

- Hikma Pharmaceuticals PLC

- Cipla Limited

- Sabinsa

Recent Developments

- In March 2024, AbbVie Inc. announced its acquisition of Landos Biopharma, Inc., a clinical stage biopharmaceutical company specializing in novel oral therapeutics. Landos Biopharma’s focus on therapies with a bimodal mechanism of action, offering anti-inflammatory effects and promoting epithelial repair, aligns with AbbVie’s commitment to advancing treatments.

- In April 2023, Boehringer Ingelheim International GmbH announced positive Phase II clinical trial results for its novel selective Cyclooxygenase 1 Inhibitor targeting inflammatory bowel disease (IBD). The drug demonstrated a 39% improvement in symptom control over placebo and has advanced to Phase III trials.

- In March 2023, Cipla Ltd. partnered with Zydus Group (India) to co-develop and commercialize a new class of non-selective Cyclooxygenase inhibitors for chronic osteoarthritis management. The collaboration aims to capitalize on India’s growing pharmaceutical market, which accounts for 8.4% CAGR growth in the COX-1 segment between 2025 and 2032, and enhance global supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for selective COX-1 inhibitors will increase due to improved safety profiles.

- Pharmaceutical companies will expand R&D to develop next-generation anti-inflammatory drugs.

- Cancer chemoprevention applications will emerge as a key growth avenue.

- Hospitals will remain the dominant distribution channel for prescription-based therapies.

- Online pharmacies will gain traction with increasing digital healthcare adoption.

- Asia-Pacific will witness strong growth driven by expanding healthcare infrastructure.

- Collaborations between global and regional firms will enhance drug accessibility.

- Formulation advancements will focus on reducing gastrointestinal side effects.

- Patent expirations will drive generic competition and lower treatment costs.

- Regulatory emphasis on drug safety and efficacy will shape product innovation.