| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

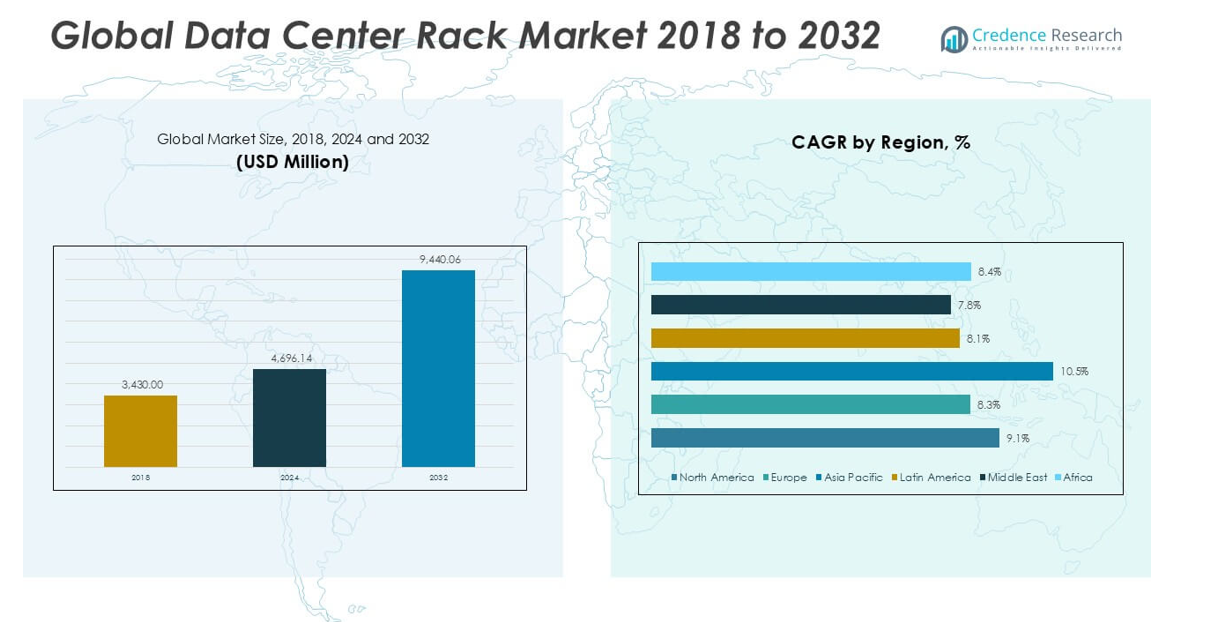

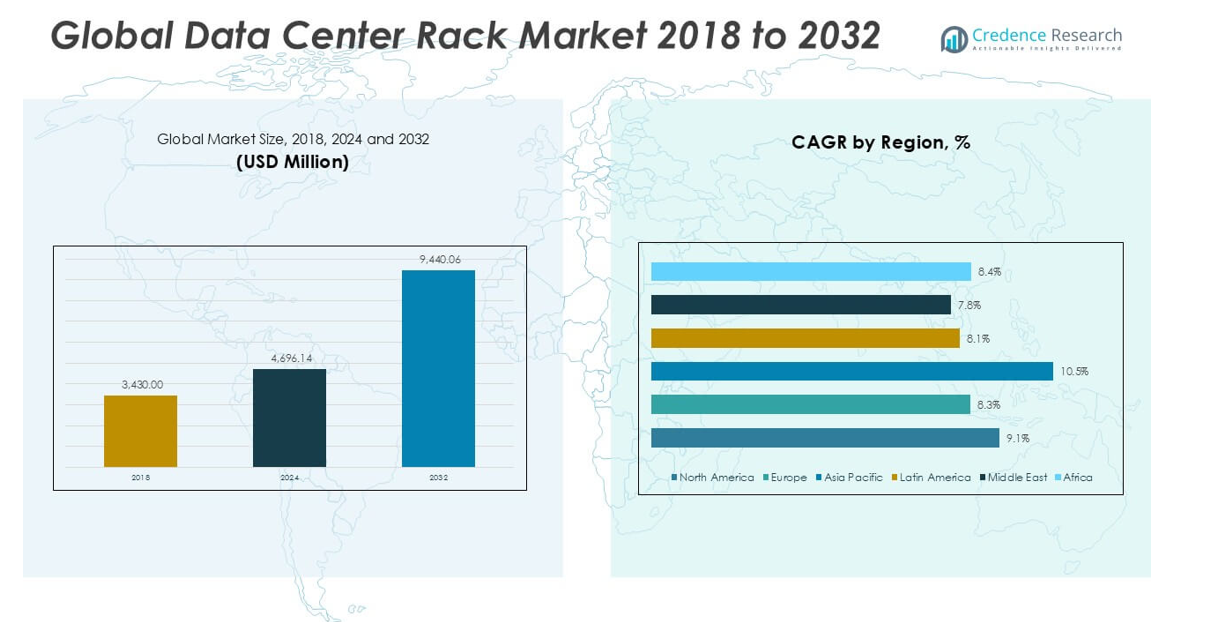

| Data Center Rack Market Size 2024 |

USD 4,696.14 million |

| Data Center Rack Market, CAGR |

9.14% |

| Data Center Rack Market Size 2032 |

USD 9,440.06 million |

Market Overview

The Global Data Center Rack Market is projected to grow from USD 4,696.14 million in 2024 to an estimated USD 9,440.06 million based on 2032, with a compound annual growth rate (CAGR) of 9.14% from 2025 to 2032.

Market growth is driven by rising adoption of virtualization, AI workloads, and big data analytics, which increase demand for high-performance computing systems requiring structured rack environments. Organizations are prioritizing energy-efficient, space-optimized rack systems to enhance operational efficiency and reduce overall data center costs. Furthermore, the transition to 5G and the ongoing proliferation of IoT devices are further intensifying demand for edge data centers, consequently boosting the need for compact and rugged rack solutions in remote locations.

Geographically, North America leads the market due to the concentration of hyperscale data centers and cloud service providers, while Asia-Pacific is witnessing the fastest growth owing to expanding digital infrastructure in countries like China, India, and Singapore. Europe remains a stable contributor, driven by data localization regulations and green data center initiatives. Key players in the global data center rack market include Schneider Electric, Vertiv Group Corp., Eaton Corporation, Rittal GmbH & Co. KG, Hewlett Packard Enterprise, Dell Technologies Inc., and Legrand SA.

Market Insights

- The Global Data Center Rack Market is projected to grow from USD 4,696.14 million in 2024 to USD 9,440.06 million by 2032, registering a CAGR of 9.14% from 2025 to 2032.

- Rising demand for cloud computing, AI workloads, and big data analytics is driving the need for high-density and scalable data center rack solutions.

- The rapid expansion of edge data centers and 5G infrastructure further boosts the adoption of compact, energy-efficient, and rugged rack systems.

- Modular and standardized rack designs are gaining popularity for their ability to support both legacy and modern IT equipment while offering easy scalability.

- High initial investment and increasing customization costs act as significant restraints for small and mid-sized data center operators.

- North America dominates the market share due to strong hyperscale data center presence, while Asia-Pacific shows the fastest growth driven by expanding digital infrastructure.

- Europe contributes steadily to market growth, supported by strict data localization policies and rising adoption of green data center initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Cloud Computing and Hyperscale Infrastructure

The Global Data Center Rack Market is expanding due to the rising adoption of cloud services and hyperscale data centers. Enterprises and cloud providers are building high-density data centers to support applications such as artificial intelligence, big data analytics, and machine learning. These facilities require efficient racking systems that can accommodate large volumes of servers, storage, and network equipment. Rack solutions play a critical role in optimizing airflow, cable management, and equipment accessibility. Organizations seek modular and scalable rack designs to streamline installation and adapt to rapid infrastructure expansion. The shift toward cloud-native architectures continues to push demand for high-performance, standardized rack solutions.

- For instance, according to the “2022 Global Data Center Survey” by Uptime Institute, more than one-third of data center operators reported a rapid increase in rack densities over the past three years, with deployments exceeding 20 kW per rack to support advanced computing workloads

Shift Toward Edge Data Centers and 5G Infrastructure Deployment

The deployment of edge data centers and rollout of 5G networks drive significant demand for compact, rugged, and power-efficient rack systems. The Global Data Center Rack Market benefits from the need to process and store data closer to end-users, especially in latency-sensitive applications such as autonomous vehicles, smart cities, and industrial IoT. It supports edge infrastructure by providing flexible, space-saving rack enclosures that ensure continuous operation in constrained environments. Telecom operators and enterprises look for racks that can support diverse hardware while meeting environmental and security requirements. The growth of 5G is accelerating investment in micro and modular data centers, increasing reliance on advanced rack configurations.

- For instance, as of mid-2024, there were 316 commercial 5G networks in service worldwide, fueling a surge in demand for specialized rack systems to support edge data center deployments and low-latency applications

Focus on Energy Efficiency and Thermal Management Solutions

Enterprises and colocation providers prioritize data center designs that lower energy consumption and improve cooling efficiency. The Global Data Center Rack Market is seeing increased adoption of racks with integrated cable management, airflow optimization, and compatibility with liquid and air cooling technologies. It enables operators to manage thermal output effectively, especially in high-density computing environments. Proper racking supports better airflow patterns, reducing the need for excessive cooling and lowering operating costs. Energy-efficient racks contribute to meeting environmental goals and regulatory compliance. Sustainable infrastructure remains a key procurement criterion for modern data centers.

Standardization and Modular Design Supporting Scalability

Standardization in data center infrastructure supports faster deployment and easier integration of IT systems. The Global Data Center Rack Market gains traction as organizations adopt modular racking solutions that align with international rack dimensions and mounting standards. It simplifies maintenance and allows for rapid scaling of infrastructure based on business needs. Modular designs improve inventory management, streamline supply chains, and reduce installation time. Enterprises favor racks that offer tool-less assembly and configurable layouts for different server sizes and densities. Scalability and operational flexibility remain vital in meeting the evolving demands of digital transformation.

Market Trends

Rising Adoption of High-Density Rack Solutions to Support Advanced Computing

The Global Data Center Rack Market is witnessing a clear shift toward high-density rack solutions to accommodate advanced computing needs. Organizations deploy powerful servers and storage systems that require racks capable of supporting greater weight and optimized cooling. It enables efficient housing of equipment while managing heat dissipation in space-constrained facilities. Enterprises focus on racks that improve power distribution and simplify cabling for high-density environments. This trend supports the growing use of artificial intelligence, big data, and complex analytics, which demand robust infrastructure. High-density racks continue to gain popularity among hyperscale and enterprise data centers aiming to maximize operational capacity.

- For instance, AFCOM’s 2022 State of the Data Center Report found that 69 out of every 100 data center operators surveyed reported an increase in rack density over the past three years, with 13 noting a significant increase to support advanced computing workloads.

Growing Popularity of Modular and Customizable Rack Designs

The demand for modular and customizable racks is growing steadily in the Global Data Center Rack Market. It allows data centers to build flexible environments that can quickly adapt to changes in server configurations and workload requirements. Modular racks support easy assembly, reconfiguration, and transport, making them suitable for both large and small-scale installations. Enterprises prefer racks that can fit varying sizes of IT equipment and allow seamless expansion. Customizable racks improve operational efficiency by offering better alignment with specific organizational needs. The trend toward modularity enhances supply chain efficiency and speeds up deployment timelines across diverse markets.

- For instance, Vertiv reported shipping over 1,500 modular data centers containing more than 5,000 racks to over 800 sites globally, demonstrating the widespread adoption of modular and customizable rack solutions in recent years

Integration of Smart Rack Features for Improved Monitoring and Security

Smart rack solutions with integrated monitoring and security features are gaining momentum in the Global Data Center Rack Market. It incorporates sensors that track temperature, humidity, power consumption, and physical access in real-time. These features help data center operators ensure system reliability and protect against equipment failure. Enterprises are investing in racks with smart locking mechanisms and remote access control to strengthen security. Enhanced monitoring capabilities support predictive maintenance strategies and improve asset management. Smart racks align with the growing demand for intelligent, automated data center operations.

Expansion of Green Data Centers Influencing Rack Material and Design Choices

The increasing focus on green data centers is shaping rack material selection and design preferences in the Global Data Center Rack Market. It encourages the use of lightweight, recyclable materials that support sustainability goals. Operators look for racks that optimize airflow and reduce reliance on energy-intensive cooling methods. Eco-friendly rack designs help organizations lower their carbon footprint while maintaining performance. Vendors are introducing racks that comply with international environmental standards to meet customer expectations. The push toward energy-efficient and environmentally responsible infrastructure continues to influence rack purchasing decisions across the industry.

Market Challenges

High Costs of Advanced Rack Systems and Customization Limit Adoption

The Global Data Center Rack Market faces significant cost-related challenges, especially for small and medium-sized enterprises. It often requires high initial investments for advanced, energy-efficient, and customizable rack solutions. Many organizations struggle to balance performance needs with budget constraints. Complex designs and premium materials increase procurement and installation costs, limiting access for smaller facilities. Customization adds further expenses, making modular racks less accessible for price-sensitive buyers. High capital costs remain a barrier to widespread adoption in emerging markets.

- For instance, the barebones price of a standard server rack ranges from $1,000 to $5,000 per unit, with additional installation, power, cooling, and maintenance expenses pushing the total annual cost of ownership for a single rack to between $5,000 and $50,000, depending on configuration and usage requirements.

Space Constraints and Thermal Management Issues Impact Performance

Managing space and thermal efficiency presents ongoing difficulties in the Global Data Center Rack Market. It must address increasing power densities while preventing overheating and airflow blockages. Operators face challenges in maintaining optimal rack layouts within limited floor space. Poor airflow management reduces cooling efficiency and raises energy consumption. Space-constrained facilities often experience difficulty accommodating new, larger rack systems. Thermal management remains a critical concern, requiring continuous innovation in rack design to meet performance and sustainability goals

Market Opportunities

Expansion of Edge Data Centers Creates Strong Demand for Compact Rack Solutions

The expansion of edge data centers offers significant growth opportunities for the Global Data Center Rack Market. It supports the increasing need for compact, durable, and power-efficient racks in remote and space-limited locations. Telecom operators and cloud providers are actively building edge facilities to improve data processing speeds and reduce latency. These deployments require customized rack solutions that can withstand harsh environmental conditions while maintaining secure operations. Compact rack designs help address space constraints and support quick deployment. Growth in 5G infrastructure and IoT applications further strengthens demand for edge-compatible rack systems.

Rising Interest in Smart and Sustainable Rack Designs Drives Innovation

The growing preference for smart and sustainable rack designs creates new opportunities in the Global Data Center Rack Market. It opens the door for vendors to offer racks with integrated sensors, real-time monitoring, and enhanced security features. Enterprises seek intelligent rack systems that enable predictive maintenance and improve asset tracking. Sustainability goals push data centers to adopt racks made from eco-friendly materials and designed for energy efficiency. Green rack solutions help reduce carbon emissions and support regulatory compliance. Vendors can capitalize on this trend by providing advanced, environmentally responsible rack products.

Market Segmentation Analysis

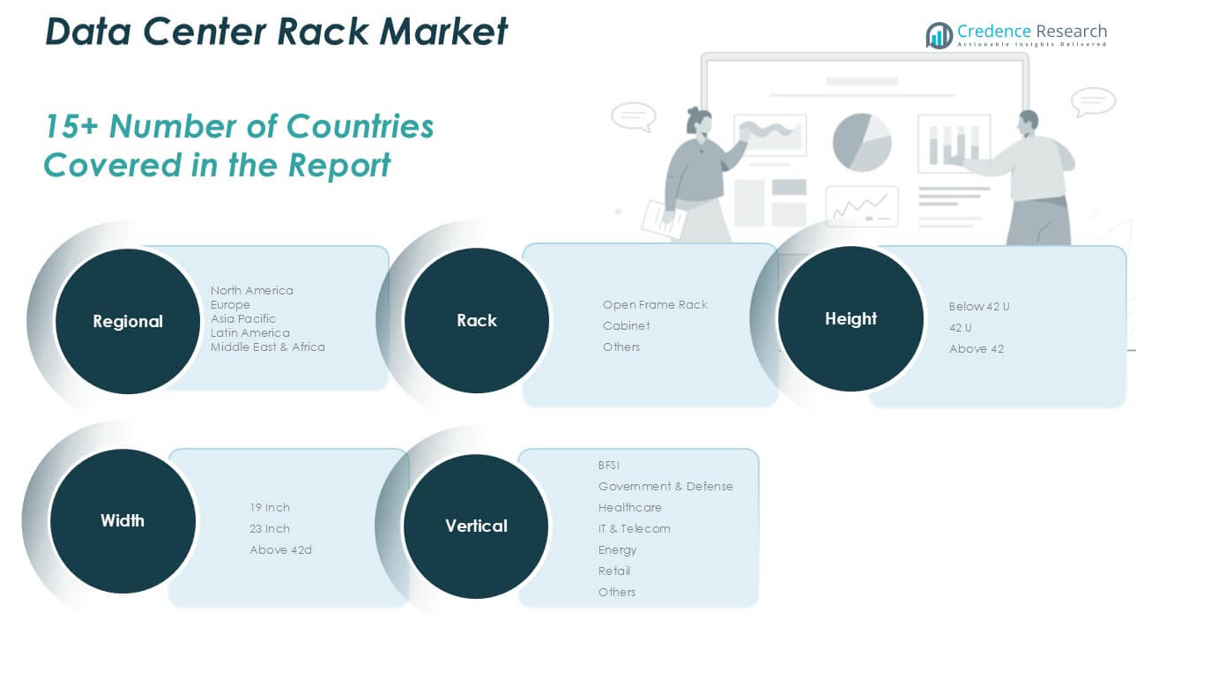

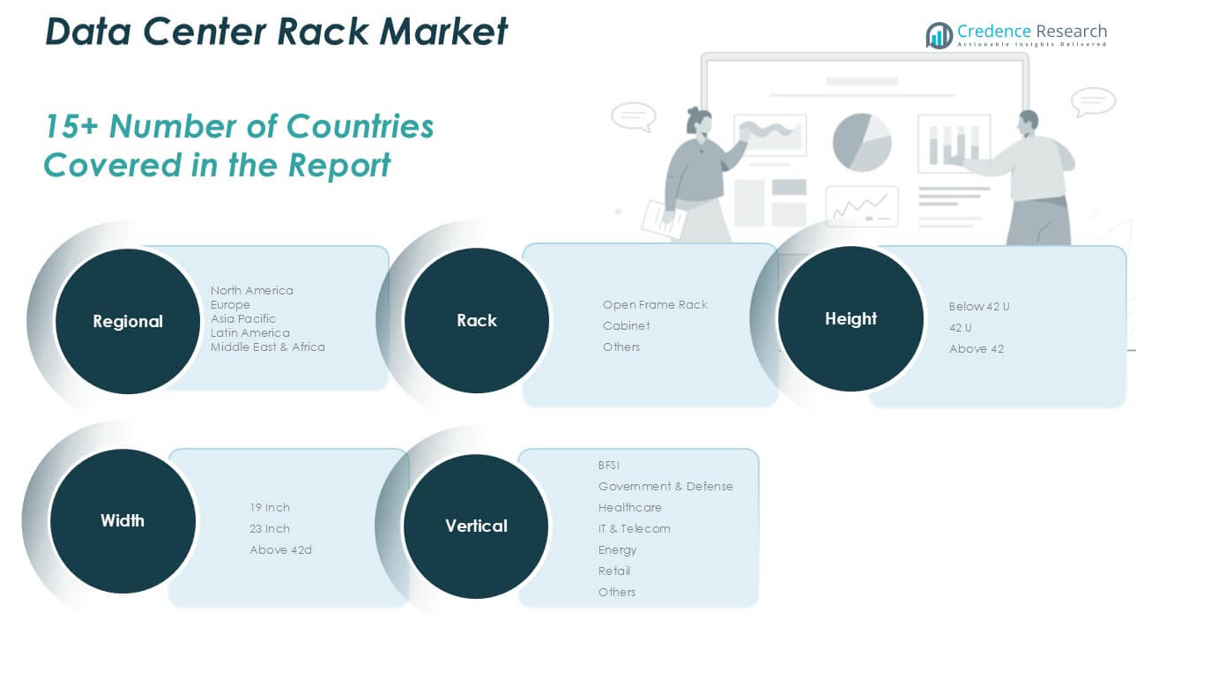

By Rack

The Global Data Center Rack Market is segmented into open frame racks, cabinets, and others. Open frame racks are popular for their easy accessibility and low-cost structure, making them suitable for network wiring closets and controlled environments. Cabinets hold the largest market share due to their security features, better airflow management, and ability to support high-density equipment. It offers flexibility and protects sensitive hardware from physical and environmental risks. The “others” segment includes specialized racks designed for unique operational needs, supporting niche applications across various industries.

- For instance, Schneider Electric reported that in 2024, it shipped over 1,300,000 data center cabinets globally, compared to 420,000 open frame racks and 90,000 specialized racks.

By Height

The Global Data Center Rack Market is categorized by height into below 42U, 42U, and above 42U racks. The 42U segment holds a significant revenue share because it offers the most widely accepted standard height for server racks, supporting compatibility with most data center equipment. Below 42U racks are suitable for smaller data centers and edge locations where space is limited. It meets compact infrastructure requirements while maintaining operational efficiency. Racks above 42U are gaining attention for their ability to accommodate high-density equipment in large data centers.

- For instance, according to a 2024 Vertiv industry survey, more than 950,000 units of 42U racks were deployed worldwide, while below 42U racks accounted for 350,000 units and above 42U racks for 180,000 units.

By Width

The Global Data Center Rack Market is segmented by width into 19-inch, 23-inch, and others. The 19-inch segment dominates due to its long-standing use as the industry standard, supporting most servers, switches, and other IT hardware. It offers high compatibility and ease of integration across global facilities. The 23-inch segment addresses specialized installations requiring wider equipment or additional cabling space. Other widths cater to custom-built solutions that meet specific operational demands.

By Vertical

The Global Data Center Rack Market serves multiple verticals including BFSI, government and defense, healthcare, IT and telecom, energy, retail, and others. IT and telecom lead the market, driven by the rapid expansion of cloud services, mobile networks, and hyperscale data centers. It supports high-density installations and requires reliable rack infrastructure for continuous operations. The healthcare sector is growing due to rising digitalization and data storage needs. BFSI, government, and energy sectors rely on secure and scalable rack solutions to manage increasing data loads and regulatory demands.

Segments

Based on Rack

- Open Frame Rack

- Cabinet

- Others

Based on Height

Based on Width

- 19 Inch

- 23 Inch

- Above 42d

Based on Vertical

- BFSI

- Government & Defense

- Healthcare

- IT & Telecom

- Energy

- Retail

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Data Center Rack Market

The North America Data Center Rack Market holds the largest regional market share, valued at USD 1,975.17 million in 2024 and projected to reach USD 3,959.07 million by 2032, with a CAGR of 9.1%. It benefits from the presence of major hyperscale data center operators and advanced cloud infrastructure. The U.S. and Canada lead investments in data center expansions, driven by strong demand for AI, big data, and IoT applications. This region emphasizes high-density and energy-efficient rack solutions to support sustainable growth. It also maintains strict regulatory standards that encourage the adoption of advanced rack technologies. North America’s significant market share reflects its established IT ecosystem and continuous infrastructure modernization.

Europe Data Center Rack Market

Europe’s Data Center Rack Market is valued at USD 1,130.70 million in 2024 and expected to reach USD 2,140.56 million by 2032, growing at a CAGR of 8.3%. The region holds a considerable share, fueled by investments in data localization and green data center initiatives across Germany, the UK, and France. It prioritizes racks with enhanced energy efficiency and security features to comply with stringent environmental regulations. The expansion of cloud services and government digitalization programs supports steady demand. It also focuses on modular rack designs to facilitate scalability and quick deployment. Europe’s market share underlines its commitment to sustainable and secure data infrastructure.

Asia Pacific Data Center Rack Market

The Asia Pacific Data Center Rack Market demonstrates the highest CAGR of 10.5%, with market size rising from USD 1,031.96 million in 2024 to an estimated USD 2,301.59 million by 2032. It captures an expanding regional market share due to rapid digital transformation in China, India, Japan, and Southeast Asia. Investments in 5G rollout, cloud adoption, and edge computing drive the demand for flexible and compact rack solutions. Data center infrastructure growth is supported by government incentives and rising enterprise cloud migration. It adapts to diverse climatic and operational needs with customizable rack offerings. The region’s growing share signals a shift in global data center investments toward Asia Pacific.

Latin America Data Center Rack Market

The Latin America Data Center Rack Market is valued at USD 273.74 million in 2024 and is projected to reach USD 507.59 million by 2032, growing at a CAGR of 8.1%. It holds a modest but growing regional market share, driven by digital infrastructure expansion in Brazil, Mexico, and Argentina. The increasing adoption of cloud services and e-commerce growth supports rack demand. It prioritizes cost-effective and scalable rack systems suitable for emerging data center environments. Public and private sector investments in IT infrastructure accelerate market growth. Latin America’s expanding market share reflects improving technological adoption and infrastructure modernization.

Middle East Data Center Rack Market

The Middle East Data Center Rack Market holds a developing market share with a valuation of USD 175.61 million in 2024 and an expected rise to USD 320.07 million by 2032, at a CAGR of 7.8%. Growth centers around the UAE, Saudi Arabia, and Qatar, fueled by investments in cloud infrastructure and smart city projects. The region demands racks that provide security and efficiency in harsh climatic conditions. It invests in modular and prefabricated rack systems to support rapid data center deployment. The expanding market share indicates increasing adoption of digital technologies across governmental and commercial sectors.

Africa Data Center Rack Market

Africa’s Data Center Rack Market is valued at USD 108.97 million in 2024 and projected to grow to USD 211.18 million by 2032, reflecting a CAGR of 8.4%. It maintains a smaller but emerging market share focused primarily in South Africa, Nigeria, and Kenya. Investments in cloud infrastructure and digital services drive rack demand. The region requires affordable, scalable, and durable rack solutions to support expanding telecom and IT networks. It faces challenges related to infrastructure gaps but benefits from increasing foreign and local investments. Africa’s growing market share demonstrates its rising role in the global data center landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- AMCO Enclosures

- Belden Inc.

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Eaton

- Fujitsu

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Legrand

- Panduit Corp

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

Competitive Analysis

The Data Center Rack Market features intense competition among established global players focused on innovation and expanding product portfolios. Companies invest heavily in developing energy-efficient, modular, and smart rack solutions that meet diverse customer requirements. It drives differentiation through advanced features such as integrated monitoring, enhanced thermal management, and security capabilities. Leading vendors pursue strategic partnerships, mergers, and acquisitions to strengthen market presence and geographic reach. Competitive pricing and customization options also influence buyer decisions. The market benefits from continuous technological advancements and rising demand for scalable infrastructure. Players that offer flexible, high-quality rack systems while addressing sustainability and operational efficiency maintain a competitive edge in the evolving landscape.

Recent Developments

- In February 2025, AMCO Enclosures released a blog post titled “5 Reasons To Design Your Own Custom Server Rack,” highlighting that 40% of their racks are customized in-house at their U.S. facility. The post emphasized their advanced fabrication capabilities and encouraged customers to consider custom designs for their server rack needs, citing benefits such as better airflow, enhanced security, and scalability.

- In March 2025, Vertiv released the PowerDirect Rack, an OCP-compliant 1U, high-density 50V DC power shelf. It supports up to 132kW per rack, is designed for AI/HPC environments, and accepts both AC and HVDC input. This solution offers high power density, energy efficiency, and flexibility for evolving data center needs.

Market Concentration and Characteristics

The Data Center Rack Market is moderately concentrated, with a mix of global leaders and regional players competing across key markets. It is characterized by strong product differentiation, driven by demand for modularity, energy efficiency, and smart features. Major companies focus on continuous innovation to offer advanced rack solutions that meet the requirements of hyperscale, edge, and enterprise data centers. The market emphasizes customization, rapid deployment, and compatibility with high-density computing environments. It shows steady growth supported by cloud expansion, digital transformation, and increasing investments in data infrastructure. Competitive dynamics encourage vendors to balance cost efficiency with performance and sustainability.

Report Coverage

The research report offers an in-depth analysis based on Rack, Height, Width, Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Data Center Rack Market will continue to grow steadily, supported by the expansion of hyperscale and cloud data centers worldwide. It will play a critical role in optimizing infrastructure efficiency and space management.

- Demand for high-density rack solutions will increase as enterprises deploy advanced computing systems to support artificial intelligence, machine learning, and big data applications. It will support greater processing power in limited spaces.

- Modular and customizable rack systems will gain wider acceptance, enabling faster deployment and improved scalability across diverse data center environments. It will help operators quickly adapt to changing infrastructure needs.

- Smart racks with integrated sensors and real-time monitoring capabilities will see rising adoption, helping data centers improve asset management, security, and predictive maintenance. It will support the push toward automated operations.

- Edge data centers will drive significant demand for compact and rugged racks designed to withstand harsh conditions and deliver consistent performance in remote locations. It will strengthen the need for flexible and durable designs.

- The focus on energy efficiency and green data center practices will push vendors to develop racks that improve airflow, reduce cooling requirements, and support sustainable operations. It will align with global environmental goals.

- Growing investments in 5G infrastructure and IoT deployment will fuel the need for distributed data processing, increasing demand for edge-compatible rack solutions. It will accelerate growth in telecom and industrial sectors.

- Standardization across rack sizes and designs will remain essential to simplify maintenance, ensure interoperability, and support seamless equipment integration. It will encourage consistent quality and faster global adoption.

- The rise of colocation and multi-tenant data centers will create opportunities for flexible and secure rack solutions that cater to shared facilities while supporting varying hardware requirements. It will help meet diverse customer needs.

- Vendors will continue to compete on product innovation, customization options, and value-added services to strengthen market position and address evolving technological trends. It will shape the competitive landscape and future product development.