Market Overview:

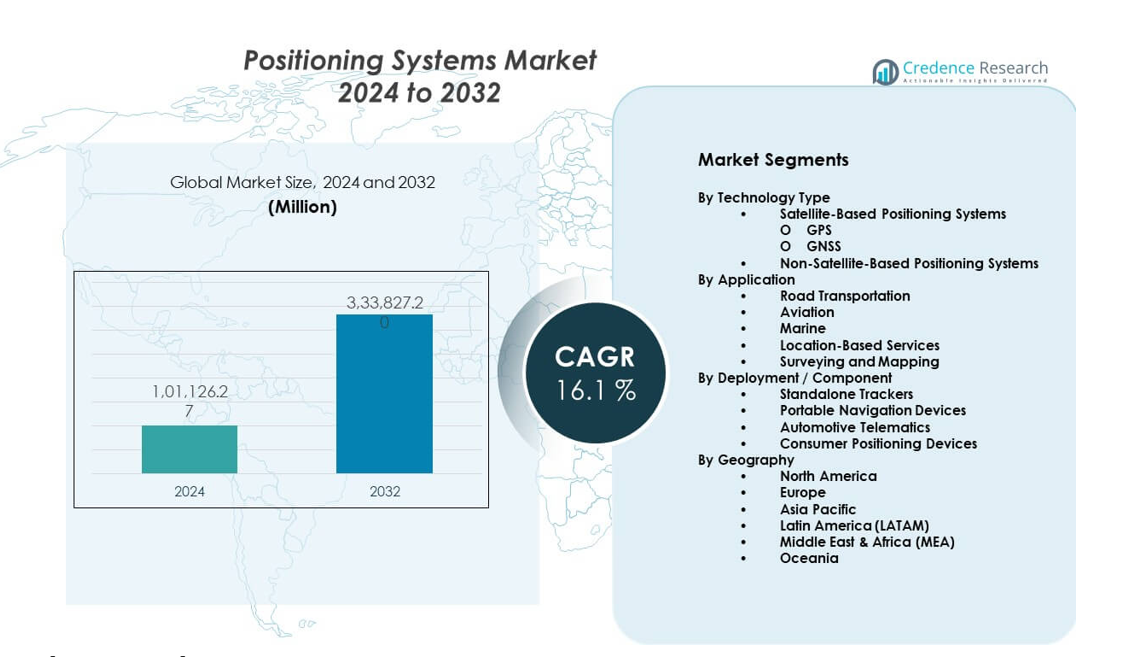

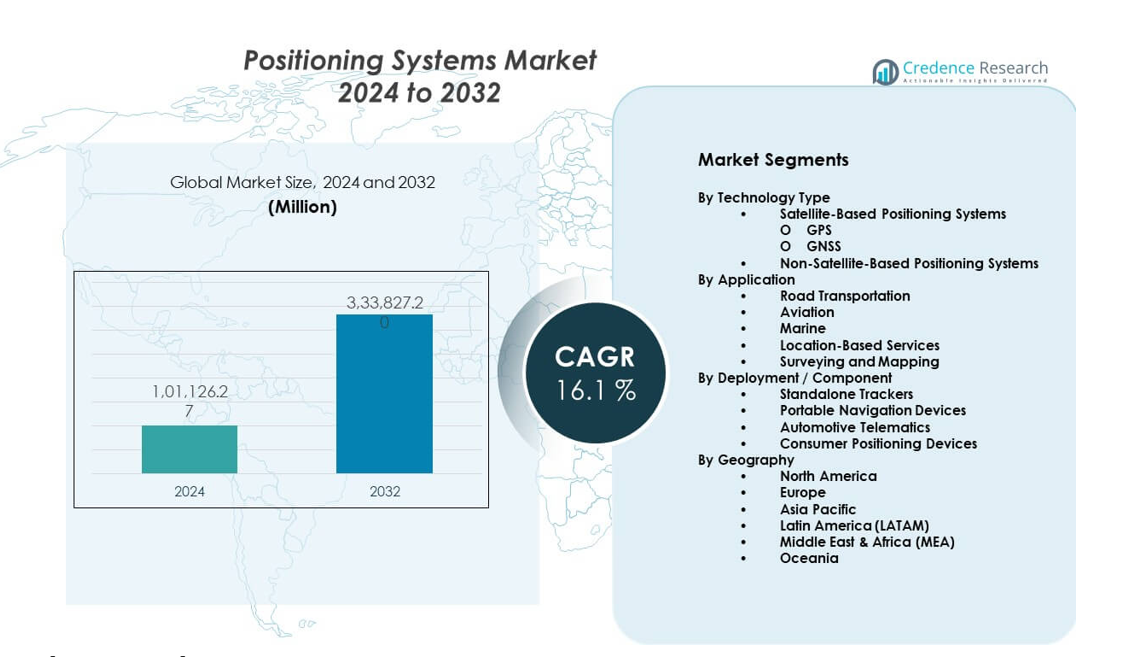

The Positioning Systems Market is projected to grow from USD 101,126.27 million in 2024 to an estimated USD 333,827.2 million by 2032, with a compound annual growth rate (CAGR) of 16.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Positioning Systems Market Size 2024 |

USD 101,126.27 million |

| Positioning Systems Market, CAGR |

16.1% |

| Positioning Systems Market Size 2032 |

USD 333,827.2 million |

Growth drivers include rising demand for precise location data across multiple industries. Navigation, mapping, and asset tracking rely on advanced positioning technologies. Smart transportation systems increase adoption in automotive and rail networks. Defense and aerospace sectors invest in resilient positioning solutions for mission accuracy. Industrial automation uses positioning tools to improve process control and safety. Consumer electronics support steady demand through smartphones and wearables. Integration with IoT and AI platforms enhances system accuracy and reliability. These factors collectively support strong market expansion across commercial and public applications worldwide.

North America leads the Positioning Systems Market due to strong defense spending and early technology adoption. The United States drives innovation through aerospace, automotive, and digital infrastructure investments. Europe follows with high demand from smart mobility and industrial automation projects. Germany and the United Kingdom remain key contributors. Asia Pacific emerges as the fastest-growing region, supported by manufacturing growth and smart city programs. China, Japan, and South Korea expand usage across logistics and transportation. Emerging markets adopt positioning systems to modernize infrastructure and public services.

Market Insights:

- The Positioning Systems Market reached USD 101,126.27 million in 2024 and is projected to hit USD 333,827.2 million by 2032, with a CAGR of 16.1%, driven by transport, defense, and digital services demand.

- North America leads with about 34% share due to defense spending, automotive technology, and strong digital infrastructure, while Asia Pacific follows at around 30% supported by logistics growth, manufacturing scale, and smart city programs.

- Europe holds nearly 26% share, led by Germany, the UK, and France, where automotive production, aviation activity, and regulatory focus on safety sustain adoption of advanced positioning solutions.

- Asia Pacific stands as the fastest-growing region with roughly 30% share, driven by rapid urbanization, expanding transportation networks, and large-scale infrastructure investment across China, Japan, and Southeast Asia.

- By segment, satellite-based positioning systems account for about 65% share due to GPS and GNSS dominance, while applications split mainly between transportation at nearly 40% and location-based services at around 25%, reflecting broad commercial usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand For High-Accuracy Location Data Across Critical Applications

The Positioning Systems Market benefits from rising need for accurate location data. Transportation systems depend on precise positioning for route planning and safety. Aviation and maritime sectors use it to support navigation and collision avoidance. Defense programs rely on secure positioning for mission coordination. Industrial operations apply positioning tools to improve workflow control. Agriculture adopts precision positioning for yield optimization. Emergency services depend on real-time location awareness. Urban planning also supports adoption through smart infrastructure projects.

- For instance, Trimble reports its RTK-enabled GNSS systems achieve centimeter-level accuracy, supporting surveying, construction, and precision farming operations worldwide.

Expansion Of Smart Mobility And Intelligent Transportation Networks Worldwide

Smart mobility programs strongly support demand for advanced positioning solutions. Connected vehicles require reliable location data for navigation systems. Public transport networks use positioning to improve scheduling accuracy. Traffic management platforms depend on real-time vehicle tracking. Rail systems adopt positioning to enhance operational safety. Autonomous vehicle testing further increases system deployment. Government funding accelerates intelligent transport adoption. This shift strengthens long-term demand across transport ecosystems.

- For instance, Qualcomm’s Snapdragon Auto platforms support lane-level positioning accuracy by combining GNSS with sensor fusion for advanced driver assistance systems.

Growing Adoption Of Automation And Digital Systems In Industrial Environments

Industrial automation drives steady demand for positioning technologies. Factories use positioning to track equipment and materials. Robotics systems depend on accurate spatial data for task execution. Warehousing operations apply positioning for inventory optimization. Energy and utilities use location systems for asset monitoring. Mining operations rely on positioning for worker safety. Process industries integrate it with control systems. These uses support consistent market expansion.

Strong Growth In Consumer Electronics And Location-Enabled Services

Consumer electronics continue to support positioning system demand. Smartphones integrate advanced location features for daily use. Wearable devices rely on positioning for fitness tracking. Location-based services improve user engagement across apps. E-commerce platforms depend on accurate delivery tracking. Gaming applications use location features for interactive experiences. Navigation apps sustain daily usage volumes. These trends reinforce volume-driven demand growth.

Market Trends:

Integration Of Positioning Systems With Artificial Intelligence Platforms

Artificial intelligence reshapes how positioning data is processed. AI improves location accuracy through advanced data analysis. Predictive models enhance signal correction capabilities. Smart systems adapt positioning outputs in real time. AI supports anomaly detection in navigation signals. Edge computing enables faster location processing. This integration improves system responsiveness. It strengthens value for advanced applications.

- For instance, Hexagon integrates AI with its positioning solutions to process billions of spatial data points annually across industrial and infrastructure applications.

Shift Toward Multi-Constellation And Hybrid Positioning Architectures

System providers adopt multi-constellation positioning strategies. Hybrid models combine satellite and terrestrial signals. This approach improves reliability in dense urban areas. Indoor positioning gains wider commercial acceptance. Multi-source systems reduce dependency on single networks. Enterprises value resilience against signal disruption. Service providers refine integration capabilities. This trend enhances overall system robustness.

- For instance, u-blox GNSS modules support GPS, GLONASS, Galileo, and BeiDou simultaneously, improving position availability and accuracy in challenging environments.

Rising Focus On Secure And Resilient Positioning Technologies

Security concerns shape positioning system development. Governments prioritize protection against signal interference. Encrypted positioning solutions gain strategic importance. Defense users demand resilient navigation capabilities. Infrastructure operators focus on service continuity. System designs address spoofing and jamming risks. Trusted positioning frameworks gain attention. These needs guide technology roadmaps.

Growth Of Location-Based Analytics For Business Intelligence Use

Enterprises adopt location analytics for decision support. Retail chains analyze movement patterns for store planning. Logistics firms optimize routes using spatial insights. Telecom operators use positioning data for network planning. Smart cities apply analytics for public services. Data platforms convert location data into insights. This trend expands software-driven revenue streams.

Market Challenges Analysis:

High System Complexity And Deployment Cost Across Advanced Applications

The Positioning Systems Market faces complexity challenges. Advanced systems require specialized infrastructure investments. Integration with legacy platforms increases project cost. Skilled workforce shortages affect deployment speed. Calibration and maintenance demand technical expertise. Small enterprises face budget constraints. Long implementation cycles delay returns. These factors limit adoption in cost-sensitive segments.

Signal Reliability Issues In Dense And Interference-Prone Environments

Urban environments pose major positioning challenges. High buildings disrupt satellite signal quality. Indoor locations limit traditional positioning effectiveness. Signal interference affects accuracy and reliability. Environmental conditions create data inconsistencies. Backup systems increase system design complexity. Performance variation concerns enterprise users. These limitations require continuous technology refinement.

Market Opportunities:

Expansion Of Smart City And Infrastructure Modernization Projects

Smart city projects create strong positioning system opportunities. Urban planners deploy location platforms for public services. Traffic optimization relies on accurate positioning data. Utility management uses spatial monitoring tools. Emergency response systems benefit from real-time location access. Digital infrastructure budgets support technology upgrades. Developing regions accelerate smart city investments. This environment opens long-term growth avenues.

Emerging Demand From Robotics, Drones, And Autonomous Platforms

Autonomous platforms expand positioning system applications. Drones require precise navigation for commercial missions. Robotics systems depend on spatial awareness for autonomy. Warehouse automation increases indoor positioning demand. Construction robotics use location data for precision tasks. Delivery drones rely on real-time positioning accuracy. Innovation ecosystems support rapid testing. These segments offer high-growth potential.

Market Segmentation Analysis:

By Technology Type

The Positioning Systems Market shows strong differentiation by technology type. Satellite-based positioning systems hold wide adoption due to global coverage and reliability. GPS supports navigation, tracking, and consumer applications with stable performance. GNSS improves accuracy by combining multiple satellite constellations. Government, defense, and logistics sectors rely on these systems for precise location data. Non-satellite-based positioning systems address indoor and signal-restricted environments. These solutions support factories, warehouses, and urban infrastructure. Technology diversity helps users select systems based on accuracy, coverage, and cost needs.

- For instance, Garmin states its multi-band GNSS receivers improve positioning accuracy by reducing signal interference in urban and mountainous regions.

By Application

Application-based segmentation reflects broad market usage. Road transportation leads demand through navigation, fleet tracking, and traffic management. Aviation depends on positioning for flight navigation and safety systems. Marine applications use location tools for vessel tracking and route planning. Location-based services support smartphones, retail analytics, and digital platforms. Surveying and mapping rely on high-precision positioning for infrastructure and land development. Each application values accuracy, reliability, and real-time data access. Sector-specific requirements shape system design and adoption rates.

- For instance, Topcon Positioning Systems delivers GNSS solutions capable of millimeter-level precision for large-scale construction and land surveying projects.

By Deployment / Component

Deployment segments highlight varied end-user preferences. Standalone trackers serve logistics and asset monitoring needs. Portable navigation devices remain relevant for personal and professional travel. Automotive telematics integrates positioning with vehicle diagnostics and safety features. Consumer positioning devices support fitness, navigation, and smart lifestyle use. Component diversity allows scalable deployment across industries. This structure supports steady demand across enterprise and consumer markets.

Segmentation:

By Technology Type

- Satellite-Based Positioning Systems

- Non-Satellite-Based Positioning Systems

By Application

- Road Transportation

- Aviation

- Marine

- Location-Based Services

- Surveying and Mapping

By Deployment / Component

- Standalone Trackers

- Portable Navigation Devices

- Automotive Telematics

- Consumer Positioning Devices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a leading share of the Positioning Systems Market, accounting for about 34% of global demand. The United States drives adoption through defense, aerospace, and automotive applications. Strong investment in smart transportation supports sustained system deployment. Technology firms advance innovation in navigation and telematics platforms. Logistics and fleet management sectors rely on accurate positioning tools. Canada contributes through infrastructure and resource management use. Regional maturity supports stable and high-value demand.

Europe

Europe represents nearly 26% of the global market share. Countries such as Germany, the United Kingdom, and France lead regional adoption. Automotive manufacturing drives demand for navigation and telematics systems. Aviation and marine sectors rely on advanced positioning solutions. Public infrastructure projects support surveying and mapping applications. Regulatory focus on safety and efficiency boosts system upgrades. Regional collaboration strengthens technology standards and deployment.

Asia Pacific, Latin America, Middle East & Africa, and Oceania

Asia Pacific accounts for around 30% of the global share and shows the fastest expansion. China, Japan, and South Korea lead due to logistics growth and smart city programs. Manufacturing and infrastructure development increase positioning system usage. Latin America holds about 5% share, supported by transportation and mining sectors. Middle East & Africa contribute nearly 4%, driven by defense and urban infrastructure projects. Oceania represents close to 1%, with demand from navigation and marine activities. These regions offer long-term growth opportunities through modernization initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Trimble Inc.

- Hexagon AB

- Qualcomm Technologies, Inc.

- Garmin Ltd.

- TomTom International BV

- Broadcom Inc.

- Texas Instruments Incorporated

- Topcon Positioning Systems, Inc.

Competitive Analysis:

The Positioning Systems Market features strong competition among global technology providers and specialized solution vendors. Leading companies focus on accuracy, reliability, and system integration capabilities. Product differentiation centers on satellite coverage, hybrid positioning, and software intelligence. Large players leverage scale to serve defense, automotive, and infrastructure clients. Mid-sized firms compete through niche applications and customization. Strategic partnerships support faster market access and technology upgrades. Continuous R&D strengthens signal resilience and precision. Competitive intensity remains high due to rapid technology cycles and diverse end-user requirements.

Recent Developments:

- In November 2025, Texas Instruments announced the opening of its second assembly and test facility in Melaka, Malaysia, featuring advanced factory automation designed to bump, probe, assemble, and test billions of analog and embedded chips annually.

- In October 2025, Topcon Positioning Systems announced a major collaboration with Amberg Technologies, launching fully integrated solutions specifically designed for rail and tunnel applications. The partnership, announced at INTERGEO 2025, focuses on the interoperability of hardware and software platforms to allow professionals to seamlessly combine technologies from both companies. This integration addresses the unique measurement and construction challenges presented by railways and tunnel infrastructure projects, enabling streamlined tasks such as track alignment, tunnel profiling, and volumetric analysis while reducing data translation gaps between different hardware and software platforms.

- In September 2025, Texas Instruments announced the release of the TMAG5134, an in-plane Hall-effect switch that sets a new industry benchmark in sensitivity for position-sensing applications. With an integrated magnetic concentrator enabling detection of magnetic fields as low as 1 mT, this device provides engineers with a practical and cost-effective alternative to magnetoresistive sensors. Its ability to optimize system performance while reducing overall design costs, combined with exceptional energy efficiency consuming only 0.6 µA on average makes it particularly suitable for portable and low-power applications.

- In February 2025, Topcon Positioning Systems and FARO Technologies announced a strategic agreement to develop and distribute innovative solutions in the laser scanning market. The collaboration combines the strengths of both organizations to advance technological capabilities for professionals across multiple industries, with particular focus on construction, surveying, mapping, architecture, forensics, building information modeling (BIM), and industrial plant and process applications. The agreement emphasizes seamless integration of Topcon and Sokkia solutions with FARO’s offerings, strengthening both companies’ market positions and delivering added value to users.

Report Coverage:

The research report offers an in-depth analysis based on technology type, application, and deployment or component segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of hybrid and multi-constellation positioning systems

- Rising adoption across autonomous vehicles and smart mobility

- Growing use of positioning in industrial automation

- Increased focus on secure and resilient navigation technologies

- Wider deployment of indoor positioning solutions

- Strong demand from logistics and fleet management

- Integration with AI and data analytics platforms

- Growth in consumer wearable and mobile applications

- Infrastructure modernization supporting system upgrades

- Continued innovation through partnerships and acquisitions