Market Overview

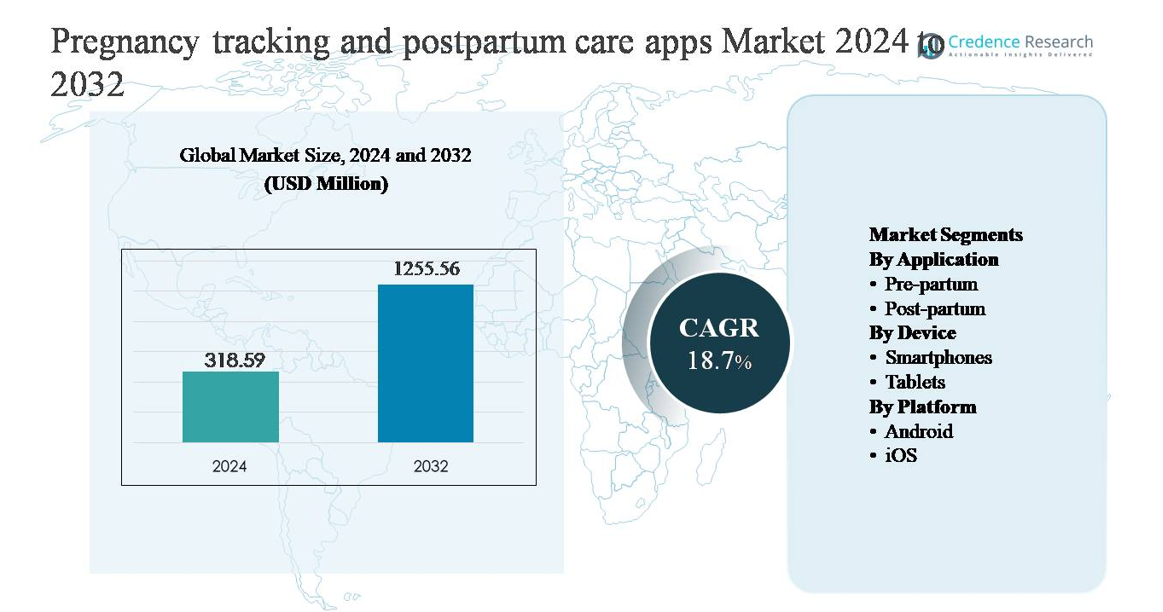

The pregnancy tracking and postpartum care apps market was valued at USD 318.59 million in 2024 and is projected to reach USD 1,255.56 million by 2032, expanding at a compound annual growth rate (CAGR) of 18.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pregnancy Tracking and Postpartum Care Apps Market Size 2024 |

USD 318.59 million |

| Pregnancy Tracking and Postpartum Care Apps Market, CAGR |

18.7% |

| Pregnancy Tracking and Postpartum Care Apps Market Size 2032 |

USD 1,255.56 million |

The pregnancy tracking and postpartum care apps market is led by a group of well-established digital health and maternal wellness companies, including Flo Health Inc., Ovia Health, Baby2Body Limited, Glow Inc., Babylist, Inc., Everyday Health, Inc., Preglife AB, AMILA, OTS Solutions, and Koninklijke Philips N.V. These players compete through feature-rich platforms covering fertility, pregnancy, postpartum recovery, and newborn care, with strong emphasis on personalization, content quality, and mental health support. Strategic partnerships, subscription-based models, and integration with broader digital health ecosystems strengthen their market positioning. North America leads the global market with an estimated 38% market share, supported by high app adoption rates, advanced healthcare digitization, and strong consumer awareness of maternal wellness technologies.

Market Insights

- The pregnancy tracking and postpartum care apps market was valued at USD 318.59 million in 2024 and is projected to reach USD 1,255.56 million by 2032, growing at a CAGR of 18.7% during the forecast period.

- Market growth is driven by rising adoption of digital maternal healthcare solutions, increasing smartphone penetration, and growing awareness of continuous pre-partum and post-partum monitoring, with pre-partum applications holding the dominant segment share due to longer engagement cycles.

- Key trends include AI-based personalization, integration of telehealth services, and expansion of mental health and newborn care features, while Android platforms and smartphone devices account for the largest platform and device shares respectively.

- The competitive landscape is moderately fragmented, with leading players focusing on subscription models, clinical content validation, data privacy compliance, and partnerships with healthcare providers to improve user retention and platform credibility.

- Regionally, North America leads with around 38% market share, followed by Europe at 27% and Asia Pacific at 25%, while Latin America and the Middle East & Africa collectively account for the remaining share, reflecting emerging adoption potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The application segment is led by pre-partum pregnancy tracking apps, which account for the dominant market share due to their widespread use across early pregnancy planning, trimester-wise fetal development tracking, appointment reminders, and symptom monitoring. Expectant mothers increasingly rely on pre-partum apps for ovulation tracking, due-date calculation, nutrition guidance, and prenatal health alerts, making them integral throughout pregnancy. Post-partum apps are gaining steady traction, driven by rising awareness of maternal mental health, breastfeeding support, recovery tracking, and newborn care features, but pre-partum remains dominant due to longer engagement duration and higher daily usage frequency.

- For instance, Flo Health’s Flo® app supports cycle and pregnancy tracking across more than 80 distinct health and symptom parameters, incorporates a gestational age calculator updated with personalized insights on a daily basis across all three trimesters, and has surpassed 380 million (and in some reports, up to 420 million) cumulative downloads globally, reflecting sustained, high-frequency engagement throughout pre-conception and pregnancy planning phases.

By Device

The smartphones segment holds the largest market share within devices, supported by near-universal smartphone ownership, continuous internet access, and app-centric user behavior among pregnant and postpartum women. Smartphones enable real-time tracking, push notifications, wearable integration, and personalized health insights, making them the preferred device for maternal health applications. Tablets maintain a smaller but relevant presence, particularly for educational content and teleconsultation use at home. Other devices, including desktops and hybrid platforms, represent a limited share due to lower portability and reduced daily engagement compared to smartphones.

- For instance, Philips’ Pregnancy+ app is optimized for both Android and iOS smartphones and supports daily gestational tracking across a 280-day pregnancy timeline, delivers push notifications aligned to weekly fetal development milestones, and integrates with Apple HealthKit and Google Fit to synchronize step count, sleep duration, and heart rate data collected from paired smartphones and wearables, enabling continuous, mobile-first maternal health monitoring.

By Platform

The Android platform dominates the market share, primarily driven by its large global user base, affordability of Android devices, and strong penetration in emerging economies. Android-based pregnancy and postpartum apps benefit from wider accessibility, flexible app development ecosystems, and integration with diverse hardware and wearable technologies. iOS holds a significant but smaller share, supported by higher spending propensity, strong data privacy frameworks, and premium user engagement in developed markets. While iOS users show higher app monetization rates, Android remains dominant due to scale and reach.

Key Growth Drivers

Rising Adoption of Digital Maternal Healthcare Solutions

The increasing shift toward digital healthcare is a primary growth driver for pregnancy tracking and postpartum care apps. Expectant and new mothers increasingly prefer mobile applications for continuous, personalized monitoring of pregnancy milestones, symptoms, and recovery progress. These apps provide real-time insights, educational resources, appointment reminders, and health alerts, reducing dependency on frequent in-person visits. Healthcare providers are also recognizing the value of digital maternal tools for improving patient engagement and continuity of care. Integration of clinical guidelines, evidence-based recommendations, and remote monitoring capabilities further enhances trust and usability. As maternal health awareness improves globally, digital solutions are becoming a core component of preventive and supportive care throughout pregnancy and the postnatal period.

- For instance, Ovia Health’s clinical-grade maternal platform incorporates obstetric care pathways aligned with U.S. prenatal visit schedules spanning up to 14 standard prenatal appointments, enables secure messaging with response tracking measured in hours rather than days, and supports longitudinal maternal health records from preconception through the 42-day postnatal recovery window, demonstrating how digitally integrated tools are becoming embedded within routine maternal care delivery.

Growing Smartphone Penetration and Internet Accessibility

Widespread smartphone adoption and expanding mobile internet access significantly accelerate market growth. Smartphones enable seamless access to pregnancy and postpartum apps, supporting features such as push notifications, symptom logging, teleconsultation, and wearable connectivity. Improved affordability of smart devices, particularly in emerging economies, expands the user base among women of reproductive age. Enhanced mobile infrastructure allows consistent usage of cloud-based health platforms, data synchronization, and multimedia educational content. This connectivity ensures uninterrupted engagement throughout pregnancy and post-delivery recovery. As mobile ecosystems continue to mature, smartphones remain the primary enabler of scalable, app-based maternal healthcare delivery.

- For instance, Glow Inc.’s Glow (fertility and period tracker) and Glow Nurture (pregnancy tracker) apps are indeed optimized for both iOS and Android smartphones. The apps support daily tracking, enabling users to log various data points.

Increasing Focus on Maternal Mental Health and Postpartum Care

Heightened awareness of maternal mental health and postpartum well-being strongly drives adoption of specialized care apps. Postpartum depression, anxiety, and physical recovery challenges have gained greater clinical and social recognition, encouraging mothers to seek digital support tools. Apps offering mood tracking, guided wellness programs, breastfeeding assistance, and newborn care education address previously underserved needs. Healthcare systems and advocacy organizations increasingly promote holistic maternal care beyond childbirth, reinforcing app usage during the postnatal phase. This expanded focus on emotional and physical recovery strengthens long-term engagement and increases overall app lifecycle value.

Key Trends & Opportunities

Integration of Artificial Intelligence and Personalized Insights

Advanced analytics and artificial intelligence are transforming pregnancy tracking and postpartum care apps by enabling highly personalized user experiences. AI-driven features analyze user inputs such as symptoms, activity levels, and health history to deliver customized recommendations, risk alerts, and behavioral insights. Predictive analytics support early identification of potential complications, enhancing preventive care. This personalization improves user trust, engagement, and retention while creating opportunities for premium subscription models. Developers that successfully leverage AI to balance accuracy, safety, and regulatory compliance are positioned to gain competitive advantage.

- For instance, Koninklijke Philips N.V. extends its AI health ecosystem into maternal care through connected fetal and maternal monitoring solutionsthat process continuous vital-sign streams, enabling clinical-grade analytics to be surfaced within companion digital platforms like IntelliSpace Perinatal.”

Expansion of Telehealth and Provider-Linked Ecosystems

The integration of telehealth services presents a significant growth opportunity for maternal health apps. Platforms increasingly incorporate virtual consultations, digital prescriptions, and secure data-sharing with healthcare providers. These capabilities improve access to obstetricians, midwives, and mental health professionals, particularly in regions with limited clinical infrastructure. Provider-linked ecosystems enhance clinical credibility and support reimbursement pathways through healthcare systems and insurers. This trend positions apps not only as consumer wellness tools but also as extensions of formal maternal healthcare delivery.

- For instance, OTS Solutions, a digital technology consulting company that drives healthcare innovation, provides custom healthcare software development and integration services, including EMR/EHR implementation and mobile app development, using industry standards like HL7 and FHIR to enable data exchange between different healthcare systems.”

Key Challenges

Data Privacy, Security, and Regulatory Compliance

Handling sensitive maternal and neonatal health data presents a major challenge for pregnancy and postpartum care app providers. Users expect strong data protection, transparent consent mechanisms, and compliance with evolving health data regulations across regions. Security breaches or misuse of personal health information can undermine trust and slow adoption. Regulatory complexity increases as apps integrate clinical features, AI-driven insights, and provider connectivity. Ensuring compliance while maintaining innovation requires sustained investment in cybersecurity, governance frameworks, and legal expertise.

User Retention and Clinical Credibility Concerns

Maintaining long-term user engagement remains challenging due to the limited duration of pregnancy and varying postpartum needs. Many users discontinue apps after childbirth, impacting retention and monetization. Additionally, the abundance of non-clinical or lifestyle-focused apps raises concerns about medical accuracy and reliability. Establishing clinical credibility through evidence-based content, professional validation, and partnerships with healthcare providers is essential. Without sustained trust and differentiated value, apps face high churn rates and intense competitive pressure.

Regional Analysis

North America:

North America holds the largest market share of approximately 38% in the pregnancy tracking and postpartum care apps market, driven by high smartphone penetration, advanced digital health infrastructure, and strong awareness of maternal wellness solutions. The region benefits from early adoption of mobile health technologies, widespread use of subscription-based health apps, and strong integration with telehealth services. High healthcare spending, employer-supported maternal care programs, and growing focus on postpartum mental health further support adoption. The United States remains the dominant contributor, supported by active participation from healthcare providers and insurers promoting digital maternal engagement tools.

Europe:

Europe accounts for around 27% of the global market share, supported by strong public healthcare systems and increasing emphasis on preventive maternal care. Countries such as Germany, the UK, France, and the Nordics show high adoption of pregnancy and postnatal apps due to favorable digital health policies and data protection frameworks. Government-backed maternal health initiatives and growing acceptance of remote monitoring solutions drive steady growth. Multilingual app availability and compliance with regional healthcare standards enhance user trust. The region shows balanced usage across both pre-partum and post-partum applications.

Asia Pacific:

Asia Pacific represents approximately 25% of the market share and is the fastest-growing regional segment. Rapid smartphone adoption, large reproductive-age population, and improving mobile internet connectivity strongly support growth. Countries such as China, India, Japan, and South Korea are witnessing rising awareness of digital maternal health tools, particularly among urban populations. Cost-effective Android-based apps and localized content accelerate adoption. Expanding private healthcare services and increasing focus on maternal and infant health outcomes further strengthen market expansion across both developing and developed Asia Pacific economies.

Latin America:

Latin America holds about 6% of the global market share, supported by growing mobile penetration and increasing awareness of maternal health tracking solutions. Brazil and Mexico are the leading contributors, driven by expanding digital health ecosystems and rising smartphone usage among women. Adoption is supported by the affordability of mobile apps compared to traditional healthcare access in underserved areas. However, uneven healthcare infrastructure and limited integration with clinical services constrain faster growth. Continued investment in digital health education and mobile connectivity is expected to support gradual market expansion.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 4% of the market share, reflecting an early-stage but emerging adoption landscape. Growth is driven by increasing smartphone usage, rising maternal health awareness, and digital health investments in Gulf Cooperation Council countries. Urban populations show higher adoption of pregnancy tracking apps, while rural access remains limited. Government-led healthcare digitization initiatives and partnerships with private health providers support gradual uptake. Despite infrastructure and affordability challenges, the region presents long-term growth potential as mobile health ecosystems continue to mature.

Market Segmentations:

By Application

By Device

By Platform

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pregnancy tracking and postpartum care apps market is moderately fragmented, characterized by a mix of established digital health platforms and specialized maternal wellness providers. Leading players compete on user experience, personalization capabilities, content quality, and integration with clinical and telehealth services. Companies focus on expanding feature sets across pre-partum and post-partum stages, incorporating AI-driven insights, mental health support, and newborn care tools to increase user retention. Strategic partnerships with healthcare providers, insurers, and wearable device manufacturers strengthen platform credibility and data depth. Monetization strategies increasingly rely on freemium models, premium subscriptions, and in-app services. Continuous updates, multilingual support, and compliance with data privacy regulations remain critical differentiators as competition intensifies and user expectations evolve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Royal Philips partnered with the March of Dimes to integrate evidence-based maternal health content into its Philips Avent Pregnancy+ app. This collaboration adds trusted guidance on topics such as preparing for Neonatal Intensive Care Unit (NICU) stays, preterm birth awareness, vaccination info, and low-dose aspirin guidance for hypertensive pregnancy disorders directly into the app experience. Pregnancy+ has recorded over 80 million lifetime downloads and includes 800+ educational articles, weekly pregnancy trackers, 3D fetal models, and expert-led audio/video courses.

- In January 2024,Flo Health made Flo Premium available for free to 1 billion women worldwide, expanding access to its pregnancy and cycle tracking features, including weekly baby growth tracking and expert-reviewed content.

Report Coverage

The research report offers an in-depth analysis based on Application, Device, Platform and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Pregnancy tracking and postpartum care apps will increasingly integrate advanced AI to deliver more accurate, personalized health insights and predictive alerts.

- Deeper integration with telehealth platforms will strengthen collaboration between users and healthcare providers across prenatal and postnatal care.

- Postpartum care features, including mental health support and recovery monitoring, will gain higher adoption and longer user engagement.

- Wearable device and remote monitoring integration will enhance real-time data collection and continuous maternal health tracking.

- Data privacy, security, and regulatory compliance will remain central to platform design and user trust.

- Localization of content and language support will expand adoption across diverse geographic and cultural markets.

- Subscription-based and hybrid monetization models will mature as users seek premium, clinically validated features.

- Employer-sponsored and insurer-backed maternal wellness programs will increase institutional adoption of apps.

- Partnerships with hospitals, clinics, and public health agencies will strengthen clinical credibility and care continuity.

- Platforms will evolve from tracking tools into comprehensive digital maternal health ecosystems.