Market Overview:

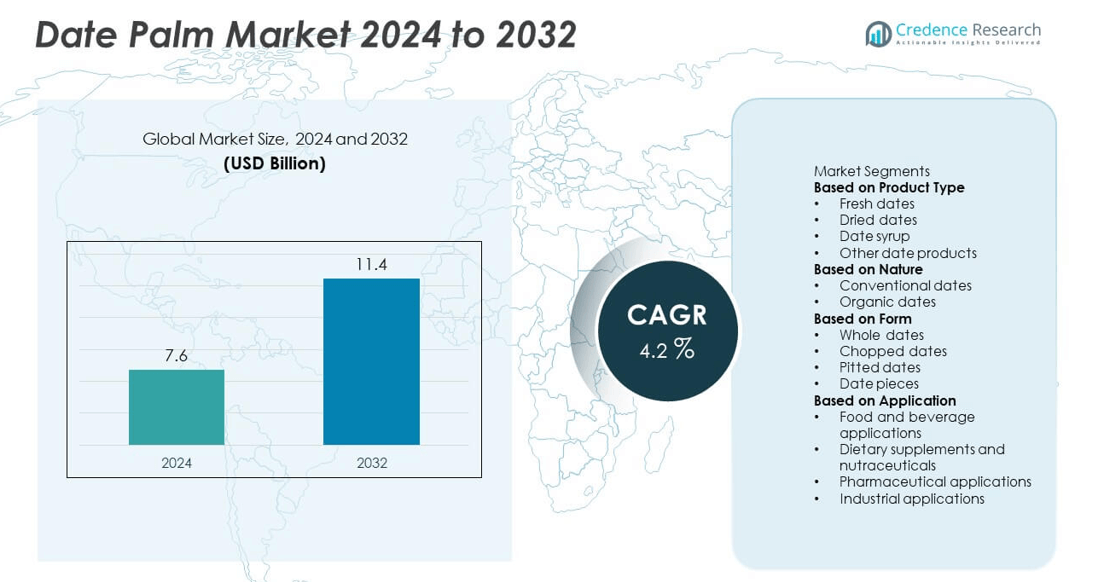

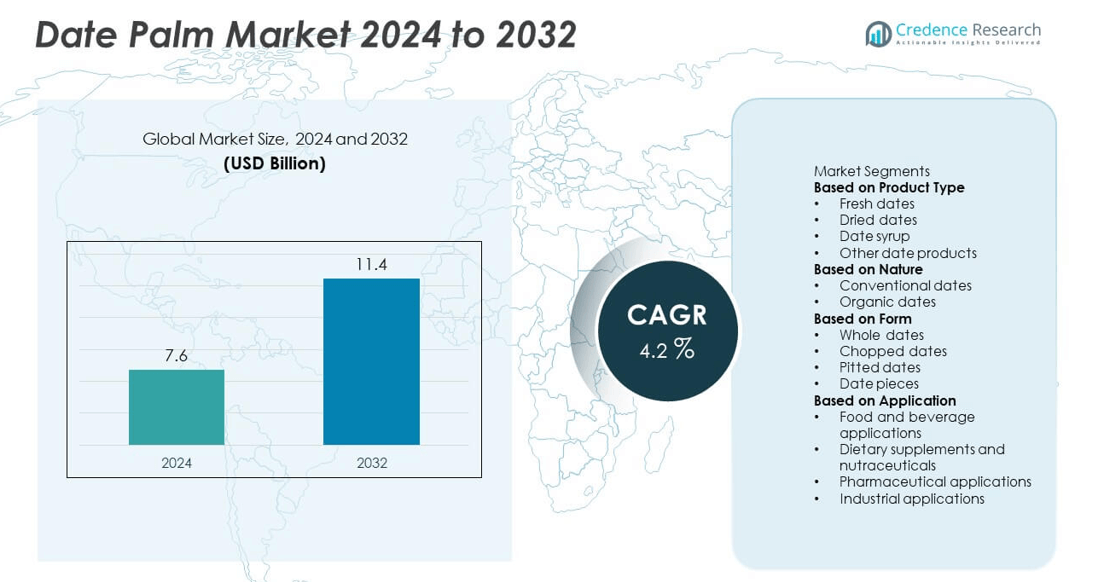

The Date Palm market was valued at USD 7.6 billion in 2024 and is projected to reach USD 11.4 billion by 2032, registering a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Date Palm Market Size 2024 |

USD 7.6 billion |

| Date Palm Market, CAGR |

4.2% |

| Date Palm Market Size 2032 |

USD 11.4 billion |

The date palm market is led by major players such as Al Foah Company, Al Barakah Dates Factory, Bateel International, Al Ain Dates, Hadiklaim Date Growers Cooperative, Maghadi Dates Factory, Atul Fruits and Dates Processing, Desert Valley Dates, Green Diamond Dates Factory, and Haifa Dates Company. These companies emphasize quality enhancement, sustainability, and advanced processing technologies to expand their market reach. The Middle East & Africa emerged as the dominant region with a 67.5% market share in 2024, driven by favorable climatic conditions, strong cultivation base, and government support for export growth. Asia-Pacific followed with a 15.6% share, supported by increasing imports and rising demand for nutritious, natural sweeteners.

Market Insights

- The date palm market was valued at USD 7.6 billion in 2024 and is projected to reach USD 11.4 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

- Rising demand for natural sweeteners and health-based food ingredients is driving consumption of fresh and dried dates, with the fresh dates segment leading at 46.8% share in 2024.

- Growing preference for organic and premium varieties, along with innovations in packaging and cold storage, is shaping global market trends.

- Key players are investing in sustainable farming, advanced processing, and product diversification to strengthen their competitive positions.

- Middle East & Africa dominated with a 67.5% share, followed by Asia-Pacific at 15.6%, supported by expanding imports and consumption of date-based products across emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The fresh dates segment dominated the date palm market with a 46.8% share in 2024. Fresh dates are highly demanded for direct consumption due to their natural sweetness, high fiber, and nutrient content. Increased global health awareness and the preference for minimally processed foods drive segment growth. The Middle East and North Africa remain major producers and exporters, supported by modern packaging and cold-chain systems. Expanding retail presence and online distribution have further improved market accessibility, strengthening the dominance of fresh dates in both local and export markets.

- For instance, Al Foah Company operates multiple date processing and cold-storage facilities, including locations in Al Ain and Al Marfa, with a combined annual production capacity of over 220,000 metric tons and a storage capacity of 70,000 metric tons.

By Nature

The conventional dates segment held a 71.3% share in 2024, supported by extensive cultivation across Middle Eastern and African regions. These dates are preferred for their wide availability and lower price compared to organic variants. Government-supported agricultural programs in Saudi Arabia, Egypt, and Iran have improved yield quality and export capacity. Although organic dates are gaining traction, especially in Europe and North America, conventional production continues to dominate due to established farming practices and cost-efficient processing systems that ensure consistent supply across global markets.

- For instance, Hadiklaim Date Growers Cooperative is Israel’s largest producer and exporter of dates, particularly the Medjool variety. In early 2023, the cooperative marketed around 10,000 tons of Medjool dates annually, which was part of its total export of 20,000 tons of dates and date products.

By Form

The whole dates segment accounted for the largest 52.4% share in 2024, driven by their versatility in direct consumption and food processing. Whole dates are widely used in confectionery, bakery, and snack applications owing to their rich flavor and high energy content. Increasing use in healthy snacks and ready-to-eat products boosts demand across both retail and industrial sectors. Advancements in pitting and packaging technology enhance shelf life and convenience, further supporting segment expansion. The growing trend toward natural, unprocessed food ingredients continues to sustain the dominance of whole dates globally.

Key Growth Drivers

Rising Demand for Healthy and Natural Sweeteners

Increasing consumer preference for natural sweeteners over refined sugar is a major growth driver for the date palm market. Dates provide essential nutrients, antioxidants, and dietary fiber, aligning with global health and wellness trends. Food manufacturers are incorporating dates into energy bars, confectionery, and bakery products as clean-label ingredients. The shift toward natural sugar alternatives, especially in North America and Europe, continues to boost demand for fresh and dried dates in both retail and food-processing sectors.

- For instance, Bateel International produces high-quality organic date syrup (dhibs) using sustainable farming practices, offering an all-natural and healthy alternative to refined sugar in food and beverage applications. Bateel’s process uses premium dates to create a product rich in the fruit’s natural minerals and antioxidants.

Expansion of Cultivation and Export Programs

Government initiatives in Middle Eastern and African countries are expanding date palm cultivation through advanced irrigation systems and improved farming practices. Countries like Saudi Arabia, Egypt, and the UAE are investing in large-scale date production and processing infrastructure to enhance export competitiveness. Supportive trade agreements and subsidies for sustainable agriculture strengthen international trade. Rising export volumes to Asia-Pacific and Europe further contribute to the global expansion of the date palm industry.

- For instance, Al Foah Company supports a network of approximately 24,000 registered farms, producing over 110,000 metric tons annually. The company engages in various sustainability initiatives, including training farmers in sustainable farming techniques and water conservation.

Growth in Processed Date-Based Products

The growing popularity of value-added date products such as syrups, pastes, and powders is fueling market growth. These products are increasingly used as natural sweeteners in dairy, bakery, and beverage applications. Advancements in processing technology enable higher yield and consistent quality, expanding their use in health-oriented foods. Global manufacturers are diversifying product lines to include organic and flavored date syrups, catering to rising consumer demand for convenient, nutritious alternatives to artificial sweeteners.

Key Trends & Opportunities

Rising Popularity of Organic and Premium Varieties

Organic and high-quality date varieties like Medjool and Deglet Noor are gaining strong market traction. Consumers are willing to pay premium prices for chemical-free, sustainably sourced dates. Producers are adopting eco-friendly cultivation practices and obtaining organic certifications to target European and North American markets. The growing popularity of these premium categories creates lucrative export opportunities for date-producing nations. Increasing online sales and specialty retail stores are further supporting the global reach of organic and premium dates.

- For instance, Bateel International operates over 40 boutiques across Europe and Asia, offering certified organic Medjool and Khidri dates cultivated under ISO 22000-certified farms. The company uses controlled irrigation systems to preserve water, ensuring high-quality organic output and demonstrating a commitment to sustainability.

Adoption of Advanced Post-Harvest and Packaging Technologies

Innovations in sorting, dehydration, and vacuum packaging are improving product shelf life and quality retention. These technologies help minimize post-harvest losses and ensure consistent exports throughout the year. Smart packaging with extended freshness features enhances the appeal of dates in international markets. Automation in grading and cleaning processes has reduced labor costs and improved efficiency. Such advancements enable producers to meet the rising demand for hygienic, ready-to-eat date products globally.

- For instance, Al Barakah Dates Factory in the UAE operates a cold-storage capacity of over 40,000 metric tons and uses vacuum packs ranging from 50 g to bulk units, with fully-automated sorting, washing and packaging lines in its Dubai facility.

Key Challenges

Climate Sensitivity and Water Resource Limitations

Date palm cultivation heavily depends on arid and semi-arid climates with stable irrigation systems. Fluctuating weather patterns, prolonged droughts, and water scarcity in major producing regions threaten yield and quality. Dependence on groundwater and inefficient irrigation methods further strain resources. To mitigate these issues, producers are adopting drip irrigation and water recycling systems, yet high setup costs remain a concern for small-scale farmers. Climate volatility continues to be a major barrier to sustainable production

Limited Processing Infrastructure in Developing Regions

Many date-producing countries face infrastructure limitations in processing, storage, and logistics. Inadequate cold-chain systems and outdated equipment lead to post-harvest losses and reduced export quality. Small and medium producers struggle to meet global food safety and packaging standards. Lack of investment in processing facilities restricts diversification into value-added products. Strengthening public-private partnerships and technology transfer initiatives is crucial to overcome these bottlenecks and unlock the full export potential of the date palm industry.

Regional Analysis

Middle East & Africa

The Middle East & Africa dominated the date palm market with a 67.5% share in 2024, driven by abundant cultivation in countries such as Saudi Arabia, Egypt, Iran, and the UAE. Favorable climatic conditions and government-backed agricultural programs enhance production efficiency. The region’s strong export orientation, coupled with growing domestic demand for fresh and processed dates, supports continued expansion. Technological upgrades in irrigation and post-harvest management further improve yield quality. Increasing investments in date-based food processing and packaging strengthen the region’s global leadership in production and trade.

Asia-Pacific

Asia-Pacific accounted for a 15.6% share in 2024, supported by rising imports and expanding consumer awareness of healthy food alternatives. India, Pakistan, and Malaysia are key markets with growing demand for fresh and dried dates. Increasing use of date syrups and pastes in bakery, confectionery, and beverage applications boosts regional growth. Favorable trade partnerships with Middle Eastern exporters ensure consistent supply. Urban population growth and higher disposable incomes are encouraging consumers to shift toward nutrient-rich natural foods, reinforcing the market’s expansion across emerging economies in Asia-Pacific.

Europe

Europe held a 9.3% share in 2024, driven by rising preference for organic and premium-quality dates. Strong demand in the U.K., Germany, and France stems from the growing trend toward plant-based diets and natural sweeteners. Importers focus on sourcing sustainable and certified products, enhancing opportunities for exporters from North Africa and the Middle East. Dates are increasingly used in functional foods and healthy snacks across European retail shelves. Expanding e-commerce and private-label offerings by food retailers further support the market’s steady growth in this region.

North America

North America captured a 5.7% share in 2024, supported by the growing popularity of natural sugar substitutes and clean-label food products. The U.S. leads the regional market, with rising demand for Medjool and Deglet Noor varieties produced in California and imported from the Middle East. Dates are gaining traction in nutrition bars, bakery items, and beverages. Consumer preference for organic and non-GMO products aligns with the expansion of premium date offerings. Ongoing innovations in packaging and marketing strengthen brand visibility across supermarkets and online distribution channels.

Latin America

Latin America accounted for a 1.9% share in 2024, with market development driven by gradual consumer adoption of natural and healthy snacks. Brazil, Mexico, and Chile are emerging importers, primarily sourcing from Middle Eastern producers. Awareness of the nutritional value of dates is increasing among urban consumers. Local distributors are expanding availability through retail and e-commerce platforms. Although production remains limited, rising consumption in health-conscious segments and growing food-processing industries are expected to create steady growth opportunities for date imports across Latin American markets.

Market Segmentations:

By Product Type

- Fresh dates

- Dried dates

- Date syrup

- Other date products

By Nature

- Conventional dates

- Organic dates

By Form

- Whole dates

- Chopped dates

- Pitted dates

- Date pieces

By Application

- Food and beverage applications

- Dietary supplements and nutraceuticals

- Pharmaceutical applications

- Industrial applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the date palm market is characterized by strong participation from key players such as Al Foah Company, Al Barakah Dates Factory, Bateel International, Al Ain Dates, Hadiklaim Date Growers Cooperative, Maghadi Dates Factory, Atul Fruits and Dates Processing, Desert Valley Dates, Green Diamond Dates Factory, and Haifa Dates Company. These companies focus on expanding production capacity, improving quality standards, and enhancing export capabilities. Leading producers are investing in modern irrigation systems, cold storage facilities, and automated sorting technologies to optimize yield and quality. Premium date brands emphasize organic certification, traceability, and innovative packaging to attract global consumers. Companies are also forming strategic partnerships with distributors and retailers to strengthen their international presence. Continuous product diversification into syrups, powders, and snacks is enabling manufacturers to cater to evolving dietary preferences and capture growing demand in health-oriented and functional food categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Al Foah Company

- Al Barakah Dates Factory

- Bateel International

- Al Ain Dates

- Hadiklaim Date Growers Cooperative

- Maghadi Dates Factory

- Atul Fruits and Dates Processing

- Desert Valley Dates

- Green Diamond Dates Factory

- Haifa Dates Company

Recent Developments

- In September 2025, Bateel International announced it is exploring an IPO and plans to open luxury boutiques, including one in New York, as part of global expansion.

- In May 2025, Al Barakah Dates Factory confirmed that its site in Dubai Industrial City can process over 120,000 metric tons per year of whole dates and date-ingredients via its automated production lines.

- In April 2025, Bateel International outlined a global expansion plan to open 500 stores worldwide by 2029 from under 200 outlets currently.

- In 2024, Maghadi Dates Factory described use of sustainable farming practices in its Al-Ahsa region operations, focusing on Medjool, Khudri and Ajwa varieties and exporting to over 30 countries

Report Coverage

The research report offers an in-depth analysis based on Product Type, Nature, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and premium date varieties will continue to increase globally.

- Producers will adopt advanced irrigation and precision farming technologies to enhance yield.

- Value-added products like syrups, pastes, and powders will gain wider popularity.

- Investments in modern packaging and cold storage will improve export quality and shelf life.

- Growing health awareness will drive demand for natural sweeteners in functional foods.

- E-commerce platforms will expand the global reach of date-based products.

- Sustainability and eco-friendly cultivation practices will become central to production strategies.

- The Middle East & Africa will remain the leading hub for large-scale date cultivation.

- Asia-Pacific will witness rising imports supported by growing consumer health trends.

- Strategic partnerships and brand diversification will strengthen the market presence of key producers.