Market Overview:

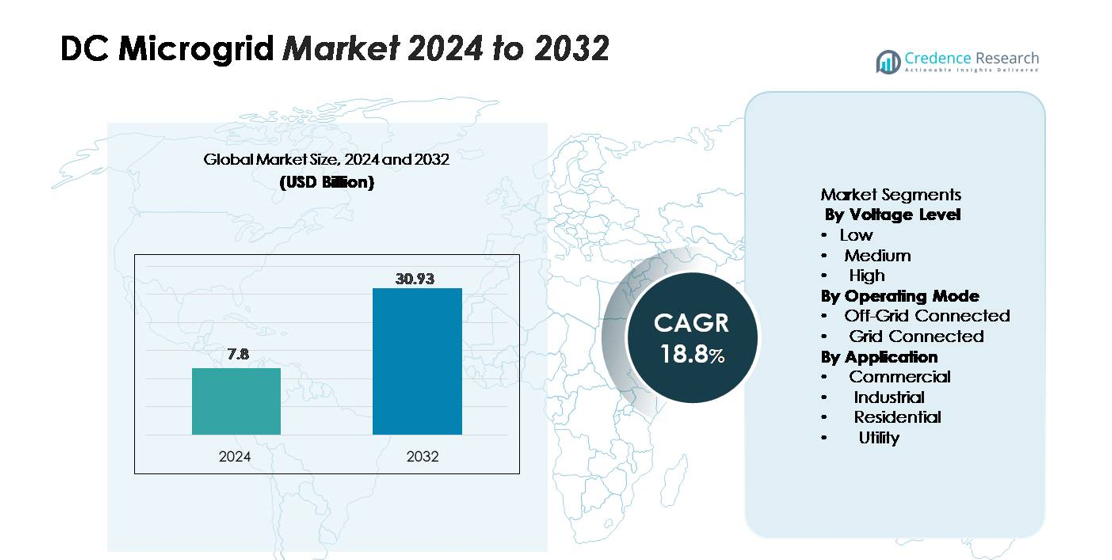

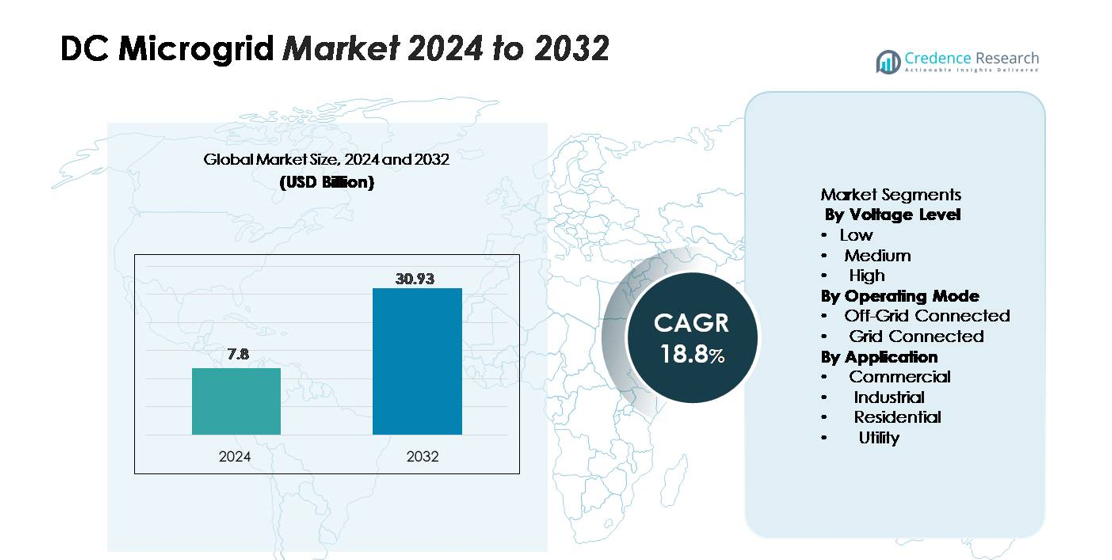

The DC Microgrid Market was valued at USD 7.8 billion in 2024 and is expected to reach USD 30.93 billion by 2032, registering a CAGR of 18.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Microgrid Market Size 2024 |

USD 7.8 billion |

| DC Microgrid Market, CAGR |

18.8% |

| DC Microgrid Market Size 2032 |

USD 30.93 billion |

The DC Microgrid Market includes key players such as ABB, Siemens, Schneider Electric, Eaton, AMERESCO, and Hitachi Energy. These companies deliver integrated microgrid controls, advanced battery systems, and turnkey solar-storage solutions for commercial, industrial, and remote applications. North America leads the market with a 32% share, supported by rapid deployment across data centers, telecom sites, EV charging networks, and community microgrids. Europe follows with strong adoption in smart buildings and renewable integration projects. Asia-Pacific continues to expand fastest, driven by electrification efforts in rural zones and rising commercial demand. These players focus on resilient, digital, and scalable DC microgrid solutions that reduce energy losses and improve system reliability.

Market Insights

- The DC Microgrid Market reached USD 7.8 billion in 2024 and will hit USD 30.93 billion by 2032 at a 18.8% CAGR.

- Demand rises due to the need for resilient power supply in telecom towers, data centers, and commercial buildings. Low-voltage systems hold the largest segment share because installation is easier and integration with solar PV and storage requires fewer conversion stages.

- Digital energy management tools, remote monitoring, and battery-based peak control shape new trends. Companies build modular microgrids for EV charging stations, off-grid facilities, and commercial campuses.

- High upfront cost and limited standardization remain key restraints. Many small businesses face financing challenges, and interoperability issues slow adoption in grid-connected deployments.

- North America leads with a 32% share, Europe follows, and Asia-Pacific is the fastest growing. The commercial sector holds the highest application share, driven by solar-battery expansion and energy cost savings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage Level

Low voltage DC microgrids hold the dominant market share because they suit small commercial buildings, residential communities, telecom sites, and remote facilities. Their lower installation cost, simplified control, and compatibility with solar PV and battery storage drive strong adoption. Medium voltage systems continue to gain traction in campuses and industrial clusters that require higher power transfer over longer distances. High voltage installations remain limited to utility-scale projects. The market favors low voltage solutions due to easy integration with distributed energy resources and reduced power loss in short-distance distribution networks.

- For instance, ABB has deployed commercial low-voltage DC microgrids based on a 380 VDC distribution backbone, linking solar arrays, battery storage, and building loads on a single direct-current bus, as documented in its Ability™ Microgrid Solutions portfolio.

By Operating Mode

Off-grid connected DC microgrids account for the largest market share due to increased electrification efforts in remote zones, islands, and rural regions. They offer energy independence through solar PV and storage, reducing reliance on diesel generators. Grid-connected systems grow steadily because commercial and industrial users seek backup power and peak shaving features. Many facilities deploy hybrid setups that switch between modes for improved stability. Government grants, mini-grid tenders, and renewable integration targets support the dominance of off-grid systems in developing economies.

- For instance, Hitachi Energy documented an off-grid DC microgrid in Cordova, Alaska, integrating solar generation with a 1,000 kW battery system that supplies islanded power to the local community during grid interruptions.

By Application

The commercial sector holds the leading market share, driven by telecom towers, data centers, business complexes, and EV charging infrastructure. Businesses adopt DC microgrids to cut electricity costs, improve power reliability, and meet carbon reduction goals. Industrial facilities gain interest as automation and continuous production require stable power quality. Residential systems expand slowly through smart home solar-storage packages. Utility applications focus on integrating renewables and reducing transmission losses. The commercial segment leads due to rapid rooftop solar deployment, growing storage capacity, and scalable deployment models.

Key Growth Drivers

Rising Demand for Reliable and Resilient Power Supply

Businesses and communities want stable electricity without outages or voltage swings. DC microgrids support critical loads and keep operations running during grid failures. Telecom towers, data centers, hospitals, and EV charging stations depend on uninterrupted supply. Solar PV and battery storage keep power stable without diesel fuel. Many regions face unstable grids, so users install DC microgrids to avoid downtime and equipment damage. Clean energy targets also support adoption because DC systems waste less energy during conversion. Companies replace diesel-based backup with solar-battery systems to cut noise and emissions. The need for resilient, uninterrupted power keeps demand strong.

- For instance, Schneider Electric helped deploy a microgrid at the Montgomery County Public Safety Headquarters in Maryland with a 2 MW solar array and a 1 MW / 2 MWh battery system, giving the facility enough stored energy to maintain critical operations during outages, according to Schneider Electric’s project documentation.

Strong Integration of Renewable Energy and Storage Technologies

DC microgrids support direct connection of solar panels, fuel cells, and batteries, making renewable power easier to store and use. Many commercial and industrial sites invest in storage to reduce peak tariffs and manage demand. Energy storage smooths solar fluctuations and keeps voltage consistent. Smart controllers optimize generation and load balance, reducing energy waste. Government incentives favor solar-battery mini-grids in remote regions. Falling prices of lithium-ion batteries speed adoption across islands, underserved areas, and off-grid communities. Renewable integration remains a major driver for DC microgrids.

- For instance, Tesla deployed a microgrid on the South Pacific island of Ta’u using more than 1,400 solar panels combined with 60 Tesla Powerpack units, delivering 6,000 kWh of usable storage documented in its project records, enabling continuous renewable power without diesel reliance.

Growing Electrification of Remote and Rural Regions

Rural areas in Asia, Africa, and Latin America still lack reliable grid access. DC microgrids deliver affordable power without long transmission lines. Solar and battery units reach villages faster than large utility projects. Telecom networks, cold storage sites, water pumps, and schools adopt DC microgrids to ensure reliable electricity. Development agencies fund mini-grid programs to expand rural electrification. Small systems are easy to install, maintain, and scale. They help communities replace diesel generators and lower fuel expenses. Expansion of digital services and rural industries increases electricity needs, increasing demand for DC microgrids.

Key Trends & Opportunities

Expansion of EV Charging and Commercial Infrastructure

DC power pairs well with electric vehicle fast-charging stations. Businesses set up DC microgrids with solar PV and batteries to cut charging costs and avoid grid overload. Malls, office complexes, telecom sites, and data centers deploy DC microgrids to improve energy efficiency. Many countries offer grants and tax benefits for charging networks. This creates strong opportunities for suppliers offering modular DC systems. The commercial sector remains a major growth area because users demand reliable, low-cost electricity.

- For instance, Alfen supplied a smart-charging project in the Netherlands using its Eve Double Pro chargers controlled by a microgrid that balanced power across 100 EV charging points, with each charging unit delivering up to 22 kW as documented in Alfen’s product sheet.

Digital Monitoring and Advanced Energy Management Systems

Smart energy management tools allow real-time monitoring of load, storage, and generation. AI-based control systems optimize charging, discharging, and peak load management. Remote monitoring reduces maintenance visits in rural zones. Cloud dashboards help operators detect faults early. These digital tools cut ownership costs and enhance system efficiency. Technology vendors see rising demand for software-based control platforms. As more microgrids move toward autonomy, digital solutions create major revenue opportunities.

- For instance, Siemens Microgrid Controllers, such as those in the SICAM A8000 series, utilize advanced control strategies and real-time algorithms to provide rapid corrective action during power fluctuations, ensuring high performance of the power supply system and excellent grid quality.

Key Challenges

High Initial Capital and Integration Costs

Many customers hesitate because upfront investment remains higher than diesel generators. Batteries, controllers, and protection devices raise project cost. Small businesses struggle to finance large systems without government support. Grid integration also demands skilled installers and advanced safety coordination. In some regions, lack of clear regulations delays projects. Although operating costs fall over time, financing barriers still limit rapid adoption.

Technical Standardization and Grid Compatibility Issues

DC microgrids require safe, standardized connectors, voltage levels, and protection systems. Different equipment vendors use different specifications, making interoperability difficult. Utilities worry about reverse power flow and system stability. In many countries, regulations focus only on AC systems, slowing DC approvals. Lack of trained technicians also increases risk during installation. Until standards become uniform, compatibility challenges remain a major concern for developers and utilities.

Regional Analysis

North America

North America holds the largest market share (32%) due to strong adoption of solar PV, battery storage, and backup systems across commercial and industrial facilities. Data centers, telecom sites, and EV charging stations depend on reliable electricity, boosting demand for DC microgrids. The United States leads installations, supported by incentives for clean energy projects and rapid smart grid modernization. Canada follows with deployments in remote communities, mining zones, and northern regions that lack dependable grid access. Strong regulations supporting carbon reduction strengthen market expansion and encourage wider deployment in private and public infrastructure.

Europe

Europe accounts for a significant market share (27%), driven by strict emission rules, rapid renewable integration, and grid modernization programs. Countries such as Germany, the U.K., and the Netherlands invest in smart energy solutions across commercial buildings, public infrastructure, and industrial sites. DC microgrids support electric mobility, warehouse automation, and clean power supply in residential communities. Replacing diesel generators with solar-battery systems remains a key trend. Government funding for sustainable energy transition and rising electricity prices increase adoption. Europe continues scaling microgrids to support energy independence and reduce grid congestion during peak hours.

Asia-Pacific

Asia-Pacific commands a substantial market share (18%) and remains the fastest-growing region due to strong electrification efforts in India, China, Indonesia, and Southeast Asia. Remote islands, rural communities, and telecom operators deploy DC microgrids to avoid diesel reliance and high fuel transport costs. China leads installations in industrial zones and military facilities, while Japan focuses on resilience and disaster preparedness. Telecom expansion and rising EV charging infrastructure support growth. Falling battery prices and large-scale solar programs attract both public and private investments, strengthening the region’s position in global microgrid deployment.

Latin America

Latin America holds a moderate market share (11%) but demonstrates rising adoption, supported by renewable energy programs and rural electrification projects. Brazil, Chile, and Mexico lead deployments in agriculture, mining, commercial buildings, and remote villages. Many communities shift from diesel generators to solar-storage microgrids for lower operational cost and cleaner power. Tourism zones and island territories also deploy DC-based systems to ensure energy reliability. Government-backed mini-grid tenders and international funding accelerate growth, especially in underserved rural regions and isolated industries.

Middle East & Africa

Middle East & Africa exhibit growing market share (7%), driven by high solar potential and demand for off-grid electrification. DC microgrids support oilfield operations, defense bases, and commercial facilities in remote deserts. African nations deploy microgrids for villages, telecom sites, and healthcare centers where grid access is limited. Gulf countries expand solar farms and energy storage to reduce reliance on fossil fuels and improve power security. International development agencies support large rural electrification programs, increasing DC microgrid installation across sub-Saharan Africa. As renewable investments grow, adoption strengthens across both regions.

Market Segmentations:

By Voltage Level

By Operating Mode

- Off-Grid Connected

- Grid Connected

By Application

- Commercial

- Industrial

- Residential

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC Microgrid Market includes technology developers, energy storage suppliers, renewable power companies, and system integrators that offer turnkey solutions for commercial, industrial, and remote deployment. Companies compete through advanced control software, integrated battery systems, and modular designs that support easy expansion. Many vendors focus on cost reduction and standardized components to simplify installation. Partnerships between solar providers, utility contractors, and telecom operators help speed project deployment across remote regions. Major players emphasize digital monitoring, predictive maintenance, and real-time energy management to improve system performance. Investments in hybrid microgrids that combine solar PV, fuel cells, and batteries strengthen market presence. Several companies also participate in pilot projects with governments and research institutes to support rural electrification and disaster-resilient infrastructure. Product launches, strategic collaborations, and service-based energy models drive competitive differentiation, while growing commercialization across commercial and industrial facilities expands business opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AEG International

- Siemens AG

- Eaton Corporation plc

- Alfen N.V.

- Hitachi Energy Ltd

- S&C Electric Company

- GE Vernova Inc.

- Schneider Electric SE

- Toshiba Energy Systems & Solutions Corporation

- ABB Ltd.

Recent Developments

- In September 2025, Eaton announced a collaboration with Xendee Corporation to deploy AI-powered design and operational tools for microgrids, combining Eaton’s hardware with Xendee’s software for optimized resilience and cost savings.

- In 2025, Siemens launched a next-generation modular edge data-center solution that integrates its power-distribution and microgrid technologies for rapid deployment of high-density compute infrastructure.

- In June 2024, AEG showcased a DC microgrid solution for its R&D and warehouse facility in Charlotte, NC that uses a DC-only solar and battery system to stay islanded when the grid fails.

Report Coverage

The research report offers an in-depth analysis based on Voltage level, operating mode, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Deployment will expand in telecom, data centers, and commercial campuses as power reliability becomes a priority.

- Adoption will rise in rural and island regions where grid access is weak or costly.

- Low-voltage systems will continue to lead due to easy installation and renewable compatibility.

- Energy storage capacity will grow as battery prices fall and efficiency improves.

- EV charging stations will integrate DC microgrids to reduce grid load and lower operating cost.

- Smart controllers and AI-based management will enhance load balancing and fault detection.

- Hybrid microgrids combining solar, fuel cells, and storage will gain wider acceptance.

- Governments will support mini-grid programs to push clean electrification in underserved areas.

- Businesses will shift from diesel backup to solar-storage systems to lower emissions.

- Standardization and interoperability improvements will reduce integration complexity and boost adoption.