Market Overview:

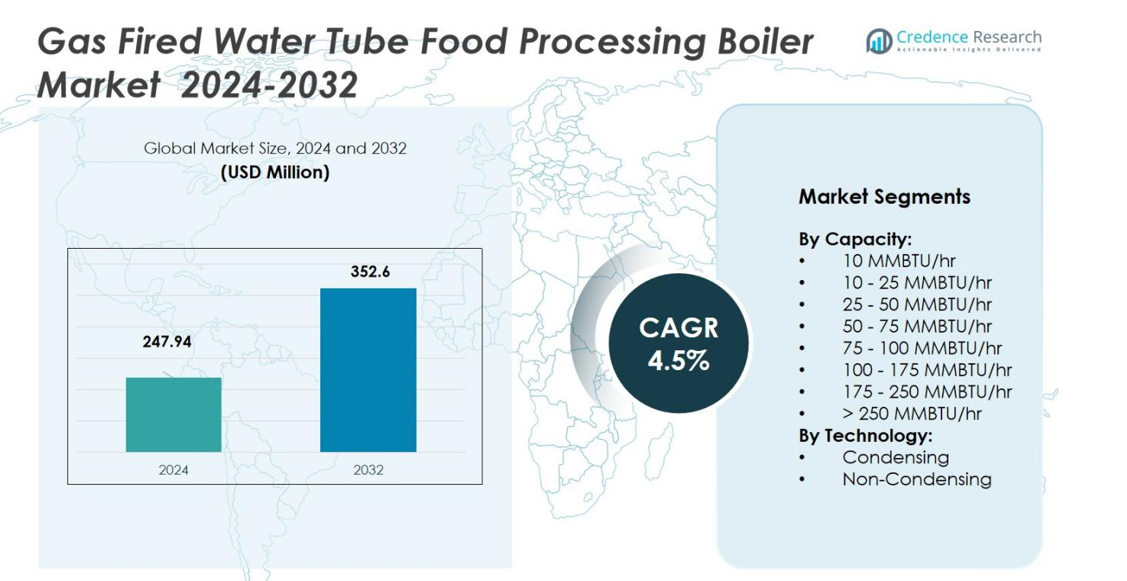

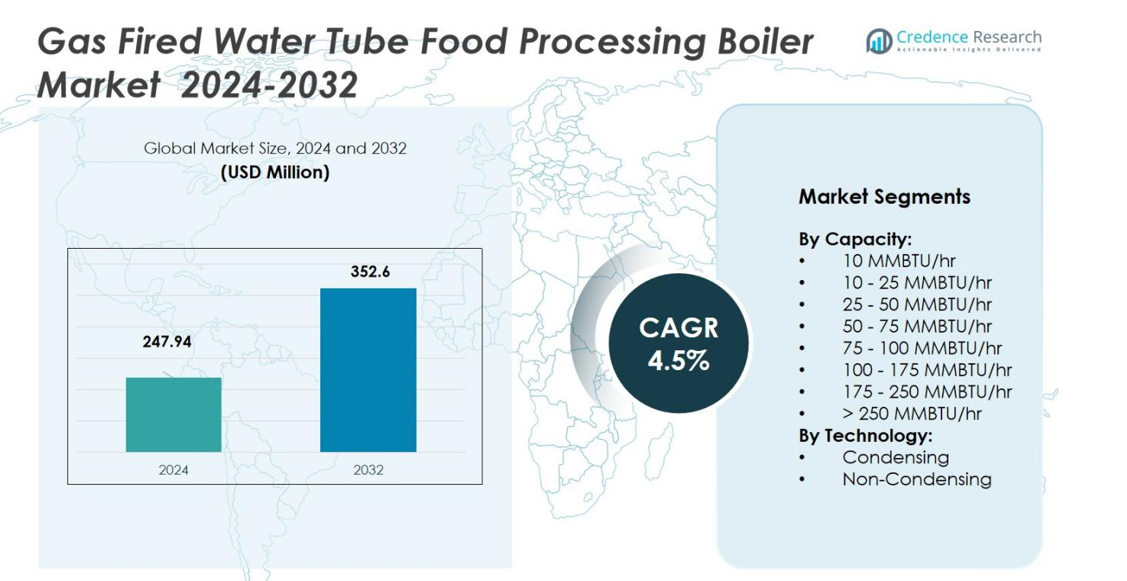

The Gas Fired Water Tube Food Processing Boiler market size was valued at USD 247.94 million in 2024 and is anticipated to reach USD 352.6 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Water Tube Food Processing Boiler Market Size 2024 |

USD 247.94 million |

| Gas Fired Water Tube Food Processing Boiler Market, CAGR |

4.5% |

| Gas Fired Water Tube Food Processing Boiler Market Size 2032 |

USD 352.6 million |

The Gas Fired Water Tube Food Processing Boiler market features prominent players such as Alfa Laval, Babcock & Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cleaver‑Brooks, Forbes Marshall, Fulton, Hurst Boiler and Johnston Boiler, each offering specialised solutions in energy‑efficient boiler systems. Regionally, North America leads with a 40 % market share driven by mature food‑processing infrastructure and stringent emissions regulations; Europe follows at 30 %, backed by strong sustainability mandates; and Asia‑Pacific holds 25 %, supported by rapid industrialisation and growth in processed food demand.

Market Insights

- The Gas Fired Water Tube Food Processing Boiler market size is valued at USD 247.94 million in 2024 and is projected to reach USD 352.6 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Key drivers include increasing demand for energy-efficient solutions, with food processors opting for high-performance, low-emission boilers to comply with stringent regulations and reduce operational costs.

- The market is witnessing a shift towards condensing boilers, which hold a dominant share of 60.5%, driven by their higher efficiency and ability to reduce fuel consumption.

- North America leads the market with a share of 40%, followed by Europe at 30%, and Asia-Pacific at 25%, fueled by industrial growth, regulatory demands, and food production expansion.

- Major challenges include high initial capital investment and the operational complexity of maintaining advanced systems, which can hinder adoption, especially among smaller food processing plants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The Gas Fired Water Tube Food Processing Boiler market is segmented by capacity, with the most significant sub-segment being the 10-25 MMBTU/hr range, which dominates with a market share of 28%. This capacity range is ideal for medium-scale food processing plants, offering a balance between energy efficiency and steam output. As food processors expand and upgrade facilities, the demand for this capacity is driven by the need for moderate steam generation without excessive capital expenditure. Other noteworthy capacities include the 25-50 MMBTU/hr and 50-75 MMBTU/hr ranges, both experiencing growth as they support larger operations, particularly in the dairy, beverage, and baked goods sectors.

- For instance, a company like Cochran Ltd., known for its expertise in manufacturing gas-fired boilers, has developed a highly efficient boiler model within the 10-25 MMBTU/hr range, which caters specifically to mid-sized food processing plants.

By Technology

In terms of technology, condensing boilers hold a dominant market share, particularly in the food processing sector, accounting for 60.5% of the market. This technology is preferred due to its high efficiency and ability to recover heat, which leads to lower operational costs and reduced carbon emissions. The demand for condensing boilers is bolstered by increasing regulatory pressure for energy-efficient solutions and rising fuel costs. In contrast, non-condensing boilers maintain a presence in the market, especially for smaller operations or retrofit projects where upfront cost is a significant consideration.

- For instance, Fulton Companies, known for its industrial heating solutions, has introduced the Condensing Boiler Series that enhances heat recovery by utilizing a state-of-the-art heat exchanger design. This technology allows for greater than 95% efficiency, making it a top choice for energy-conscious food manufacturers looking to lower operational costs and their carbon footprint.

Key Growth Drivers

Increasing Demand for Energy-Efficient Solutions

One of the primary drivers fueling growth in the Gas Fired Water Tube Food Processing Boiler market is the rising demand for energy-efficient solutions. As food processing plants seek to reduce operational costs, energy-efficient boilers have become essential. Condensing boilers, in particular, are gaining traction due to their ability to recover heat and reduce fuel consumption. With stringent energy regulations and the growing emphasis on sustainability, food manufacturers are increasingly opting for high-efficiency boiler systems to lower energy usage and minimize their environmental footprint.

- For instance, Cleaver-Brooks, a leader in industrial boiler solutions, has developed a range of condensing boilers that incorporate advanced heat recovery systems. These systems not only improve fuel efficiency but also reduce operating costs by utilizing waste heat to preheat incoming water, achieving efficiency rates above 90%.

Expansion of the Food Processing Industry

The growth of the global food processing industry plays a significant role in the increasing demand for gas-fired water tube boilers. As the global population expands and consumer preferences shift towards convenience foods, there is an accelerating need for efficient production lines. Boilers, as a critical component in food processing operations, are in high demand for heating, steam generation, and other processing functions. The rapid expansion of both small and large-scale food manufacturing plants globally is driving the need for advanced, reliable boiler solutions to support production growth.

- For instance, Babcock & Wilcox Enterprises, a global leader in energy and environmental technologies, has also benefited from the growing food processing industry. Their Water-Tube Package Boilers are designed for high-demand food production facilities, offering enhanced reliability and efficiency in steam generation, which is crucial for maintaining smooth operations in both small and large-scale food processing plants worldwide.

Regulatory Pressure for Lower Emissions

Governments worldwide are implementing stricter regulations regarding carbon emissions and environmental impact, which is driving the adoption of cleaner, more efficient boiler technologies. The food processing sector, being energy-intensive, faces increasing pressure to meet sustainability goals. The demand for gas-fired water tube boilers, particularly condensing models, has surged as they offer reduced emissions and better fuel efficiency. Compliance with emissions regulations is a crucial factor in the decision-making process for food manufacturers looking to modernize their boiler systems and meet environmental standards.

Key Trends & Opportunities

Integration of Smart Technologies

The integration of smart technologies into gas-fired water tube boilers is a key trend offering significant growth opportunities in the market. Advanced features like IoT connectivity, remote monitoring, and automated control systems are transforming the operational efficiency of boilers in food processing. These innovations allow real-time monitoring of performance, maintenance alerts, and energy optimization, reducing downtime and improving efficiency. As food processors increasingly prioritize smart manufacturing processes, the demand for advanced boilers with integrated digital technologies is expected to rise, presenting a lucrative opportunity for market players.

- For instance, Cleaver-Brooks has developed smart boiler systems equipped with remote monitoring capabilities in their ClearFire series. These boilers feature cloud-based control and data analytics, which provide real-time performance tracking and predictive maintenance notifications.

Focus on Sustainable Practices

Sustainability is becoming a focal point for food processors as they aim to meet environmental regulations and consumer expectations. The shift towards renewable energy sources and low-emission technologies is driving the demand for sustainable solutions in the boiler market. Gas-fired water tube boilers that incorporate eco-friendly features such as low NOx emissions and higher efficiency ratings are in high demand. Manufacturers are capitalizing on this trend by offering boilers that not only meet energy efficiency standards but also reduce the carbon footprint, creating new opportunities for growth in the market.

- For instance, Cleaver-Brooks produces gas-fired water tube boilers capable of firing renewable natural gas and hydrogen while achieving ultra-low NOx emissions of less than 2 ppm, significantly reducing harmful pollutants

Key Challenges

High Initial Capital Investment

One of the major challenges in the Gas Fired Water Tube Food Processing Boiler market is the high initial capital investment required for advanced boiler systems. While energy-efficient and high-performance boilers offer long-term savings, the upfront costs can be a barrier, especially for small and medium-sized food processing plants. The cost of installation, integration, and maintenance of sophisticated systems like condensing boilers can deter potential buyers, particularly in developing regions where cost constraints are more significant. Overcoming this financial hurdle remains a challenge for the widespread adoption of advanced boilers in the food processing sector.

Maintenance and Operational Complexity

Another challenge facing the Gas Fired Water Tube Food Processing Boiler market is the maintenance and operational complexity of these systems. Although these boilers offer high efficiency and long-term savings, their maintenance requires specialized knowledge and skills, which can increase operational costs. Regular maintenance, cleaning, and monitoring are essential to ensure optimal performance, but this can lead to increased downtime and additional labor costs. Food manufacturers need to invest in skilled personnel and comprehensive service agreements, which can be a deterrent for some businesses, especially those with limited resources.

Regional Analysis

North America

The North American region commands a dominant position in the Gas Fired Water Tube Food Processing Boiler Market, holding 40 % of the global market share. This leadership is driven by mature food‑processing infrastructure, stringent regulatory mandates on emissions and energy efficiency, and widespread adoption of advanced boiler systems. Key markets such as the United States and Canada benefit from large‑scale installations, retrofits of legacy plants, and high uptake of condensing boiler technologies. As food manufacturers in this region prioritize operational reliability and lifecycle cost savings, demand for high‑performance water‑tube boilers continues to rise.

Europe

In Europe, the market captures 30 % of global share, reflecting the region’s strong regulatory environment and focus on sustainable manufacturing. Countries like Germany, France, and the UK lead investments in modernizing food‑processing facilities and replacing older boilers with gas‑fired water‑tube models that offer higher efficiency and lower emissions. The emphasis on decarbonization within the European Union and the alignment of food‑industry standards with energy‑efficiency goals support robust adoption of advanced boiler systems across Western Europe. Demand is further bolstered by feedstock availability and the presence of key boiler‑manufacturing hubs in the region.

Asia‑Pacific

The Asia‑Pacific region accounts for 25 % of the global market share in the food‑processing boiler segment. Rapid industrialization, urbanization, and rising consumption of processed foods in China, India, and Southeast Asia drive demand for gas‑fired water‑tube boilers. Many food‑processing plants in the region are undergoing modernization, enabling the integration of high‑efficiency boiler technologies. Coupled with supportive government policies and international investment in manufacturing infrastructure, the Asia‑Pacific region is positioned for significant growth and will increasingly contribute to global boiler demand.

Latin America

Latin America represents a smaller but growing portion of the market, with market share estimated in the low‑single‑digit range around 7 %. Growth is supported by expansion of local food‑and‑beverage production, increased mechanization of processing plants, and rising interest in cleaner, gas‑fired equipment. Brazil and Chile are among the leading countries in the region investing in boiler system upgrades. Constraints such as infrastructure limitations, capital investment barriers, and variability in regulatory enforcement temper growth, yet the region presents untapped potential for boiler manufacturers.

Middle East & Africa (MEA)

The Middle East & Africa region 5 % of the market share in the gas‑fired water‑tube food‑processing boiler market. The region draws interest due to abundant natural‑gas supply, growing food‑processing capabilities, and increasing industrial investment in countries such as Saudi Arabia, UAE, and South Africa. However, adoption is moderated by infrastructure gaps, fragmented regulatory frameworks, and lower historic penetration of advanced boiler systems. Nonetheless, as food production shifts towards modern processing and export‑oriented manufacturing, MEA offers emerging opportunities for boiler vendors and service providers.

Market Segmentations:

By Capacity:

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

- 25 – 50 MMBTU/hr

- 50 – 75 MMBTU/hr

- 75 – 100 MMBTU/hr

- 100 – 175 MMBTU/hr

- 175 – 250 MMBTU/hr

- > 250 MMBTU/hr

By Technology:

- Condensing

- Non-Condensing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global gas-fired water tube food processing boiler market is characterized by well-established players such as Alfa Laval, Babcock and Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cleaver‑Brooks, Forbes Marshall, Fulton, Hurst Boiler and Johnston Boiler. These companies compete intensely on parameters of product efficiency, emissions performance, service network and regional footprint. They are investing in high-efficiency condensing models, digital monitoring capabilities and modular configurations to address evolving food‑processing plant requirements. Market entrants and regional manufacturers are pushing the boundaries of cost competitiveness, pushing established firms to differentiate via brand reliability, global service after sales and supply‑chain integration. As regulatory pressure for low‑NOₓ emissions and energy efficiency intensifies, the competitive environment is evolving toward performance‑led offerings rather than purely cost‑led ones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Cleaver-Brooks introduced myBoilerRoom, an advanced digital solution platform designed to optimize boiler efficiency, enhance reliability, and drive cost savings for food processing facilities through data-driven asset management and real-time monitoring.

- In May 2024, Miura Co., Ltd. (Japan) completed the acquisition of Cleaver-Brooks (United States) for USD 774 million. This significant transaction united two leading industrial boiler manufacturers, with Cleaver-Brooks being a prominent provider of water tube and fire tube boilers for commercial, industrial, and institutional applications including food processing facilities.

- In February 2024, Babcock Wanson Group acquired VKK Group (Germany), strengthening its position as a European leader in industrial boiler solutions and expanding its manufacturing capabilities for water tube boilers used in food processing

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from stricter energy‑efficiency regulations which will accelerate replacement of legacy boiler systems and drive demand for high‑efficiency gas fired water tube models.

- Growth in food processing and packaged food production will boost steam‑generation needs, thereby increasing installations of water tube boilers tailored for food processing operations.

- The transition from conventional to condensing boiler technology will open opportunities for manufacturers to develop advanced offerings, lowering fuel consumption and emissions.

- Emerging markets in Asia‑Pacific, Latin America and Middle East & Africa will offer new installation opportunities as food‑processing infrastructure expands and industrialisation rises.

- Digitalisation and IoT‑enabled boiler monitoring systems will gain traction, enabling predictive maintenance and operational optimisation in food‑processing plants.

- Modular and compact boiler designs will become more sought after to support flexible plant layouts, retrofit projects and smaller‑footprint food‑manufacturing facilities.

- Demand for boilers capable of handling larger steam loads will increase as major food‑processing plants consolidate operations and upgrade to high‑capacity systems.

- Integration of renewable energy and hybrid fuel systems (such as natural gas combined with biogas) will appeal to food manufacturers targeting sustainability and reduced carbon footprints.

- Supply‑chain optimisation and global manufacturing networks will shift toward vendors offering full lifecycle services installation, maintenance, parts to match food‑industry uptime requirements.

- However, the need for specialised technical expertise and higher upfront investment for advanced systems will challenge some smaller food‑processors and slow adoption in cost‑sensitive markets.