Market Overview

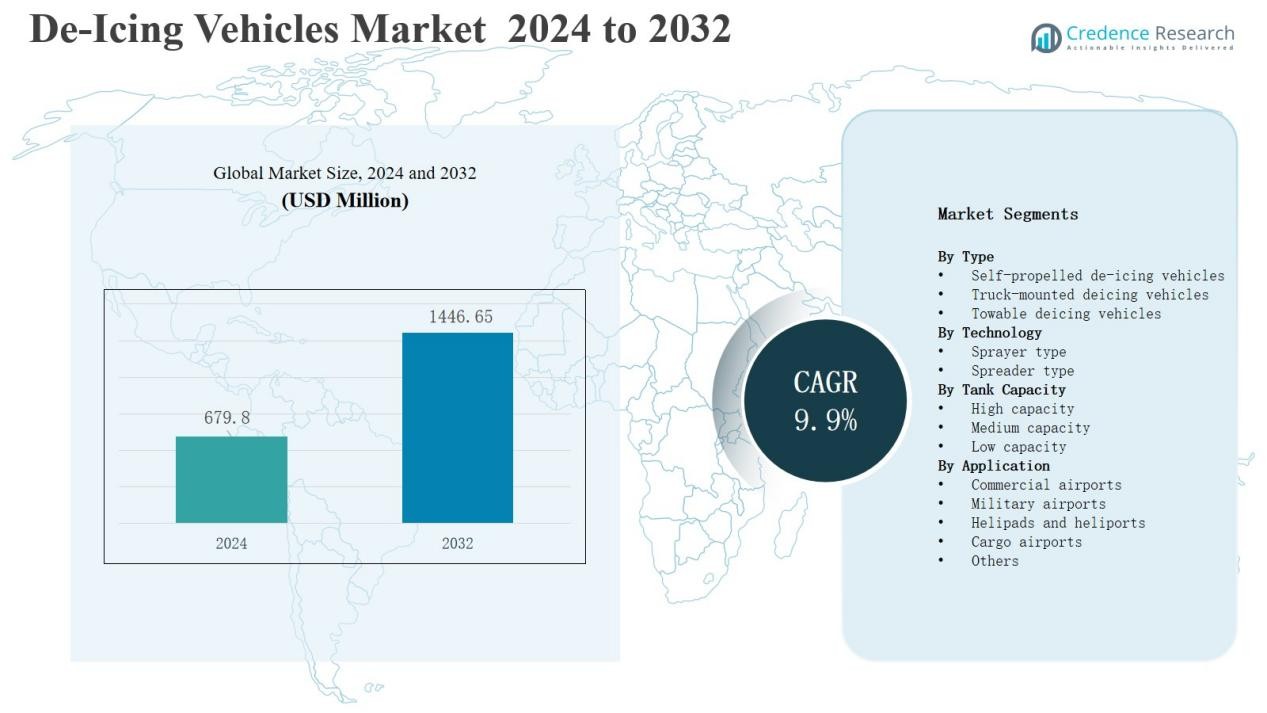

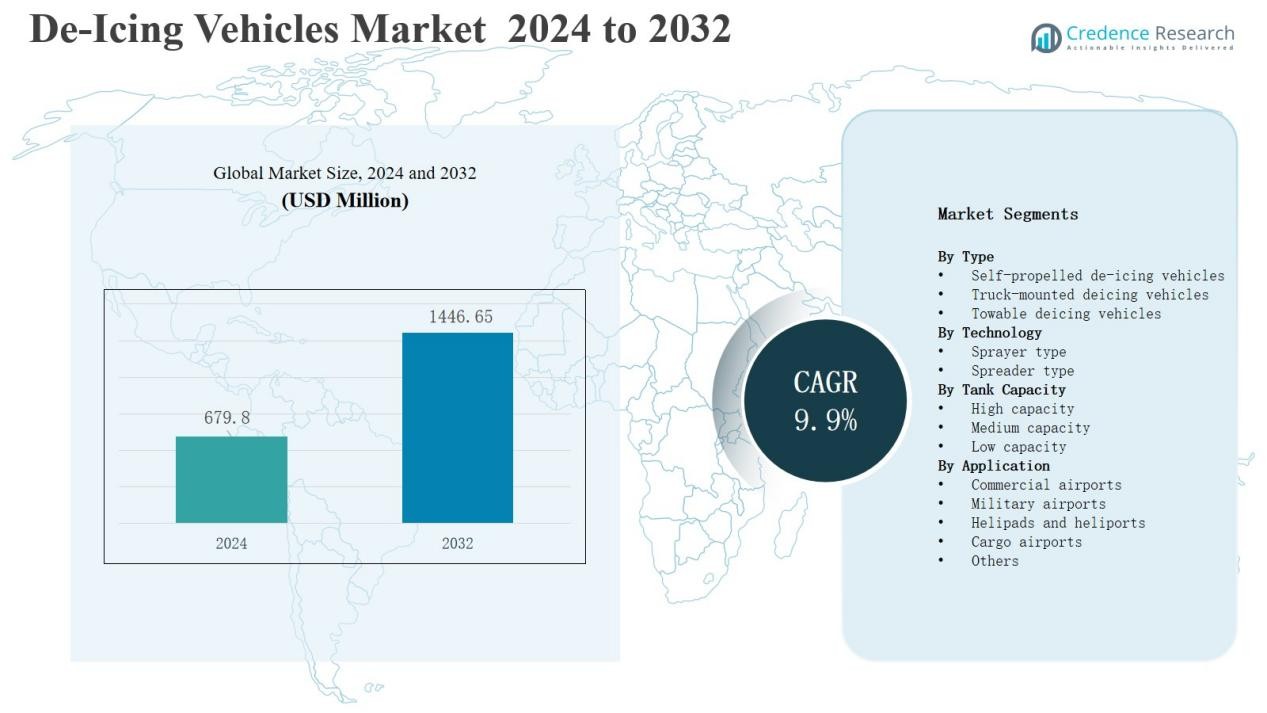

The De-Icing Vehicles Market size was valued at USD 679.8 million in 2024 and is anticipated to reach USD 1,446.65 million by 2032, growing at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| De-Icing Vehicles Market Size 2024 |

USD 679.8 Million |

| De-Icing Vehicles Market, CAGR |

9.9% |

| De-Icing Vehicles Market Size 2032 |

USD 1,446.65 Million |

The de-icing vehicles market is led by key players such as Oshkosh, Textron GSE, Vestergaard, Polar Mobility, TLD, Mallaghan Engineering, Weihai Guangtai Airport, PrimeFlight, Global Ground Support, and JBT Corporation. These companies compete through innovation, product efficiency, and compliance with environmental standards. They focus on developing automated, eco-friendly, and high-capacity de-icing systems that enhance operational safety and reduce fluid consumption. North America remains the leading region in the global market, holding a 41% share in 2024, driven by heavy snowfall, advanced airport infrastructure, and strong regulatory enforcement supporting modernization and fleet expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The de-icing vehicles market was valued at USD 679.8 million in 2024 and is projected to reach USD 1,446.65 million by 2032, growing at a CAGR of 9.9%.

- North America leads the market with a 41% share, supported by strong aviation infrastructure, frequent snowfall, and strict safety regulations across the United States and Canada.

- The truck-mounted de-icing vehicles segment dominates with a 54% share, favored for its flexibility, high spraying range, and efficient operation across commercial and military airports.

- The sprayer-type technology segment holds a 63% share due to its precision, minimal fluid wastage, and compatibility with eco-friendly de-icing solutions.

- The high-capacity tank segment accounts for 48% of the market, driven by demand from large international airports requiring efficient and continuous de-icing operations.

Market Segment Insights

By Type

The truck-mounted de-icing vehicles segment dominates the de-icing vehicles market, accounting for 54% of total revenue in 2024. These vehicles are preferred due to their flexibility, higher spraying range, and ability to operate in varied airport conditions. Their compatibility with multiple de-icing fluids and ease of maneuverability enhance operational efficiency. Growing airport expansion projects and the need for rapid aircraft turnaround drive demand for truck-mounted systems across both commercial and military aviation sectors.

- For instance, Vestergaard Company introduced the Elephant BETA Next Generation truck-mounted de-icer equipped with an advanced glycol recovery and recycling system, aimed at reducing fluid waste and turnaround time at airports.

By Technology

The sprayer-type technology segment leads the de-icing vehicles market with a 63% share in 2024. It is widely adopted for its precision, faster operation, and minimal fluid wastage during application. These systems support automated nozzles and temperature control, ensuring uniform coverage on aircraft surfaces. Increasing adoption of environmentally friendly glycol-based fluids and advanced spraying technologies further strengthens their usage. Airports prioritize these systems to maintain efficiency under harsh winter conditions.

By Tank Capacity

The high-capacity tank segment holds the largest share of 48% in the de-icing vehicles market in 2024. These vehicles are capable of serving multiple aircraft without frequent refills, reducing downtime and improving ground operation efficiency. Large international airports prefer them due to high traffic volumes and wider aircraft size ranges. Advancements in tank insulation and corrosion-resistant materials support longer fluid storage and reliability, boosting adoption across major airport hubs worldwide.

- For instance, Global Ground Support LLC launched its innovative GTV-5000 Glycol Transfer Vehicle in May 2025, which features a 5,425-gallon tank designed to transport glycol and refill deicing trucks on the deicing pad, thereby enabling faster turnaround times for high-volume airport operations.

Key Growth Drivers

Rising Air Traffic and Airport Expansion Projects

The de-icing vehicles market is driven by increasing global air traffic and expanding airport infrastructure. Growing flight frequencies in cold-weather regions create high demand for efficient de-icing operations. Governments and private operators are investing in airport modernization projects to improve safety and minimize flight delays. This expansion strengthens the need for advanced ground handling equipment, including automated and high-capacity de-icing vehicles that ensure quick turnaround times during winter operations.

- For instance, the Rochester International Airport developed an innovative de-icing system that produces its own liquid de-icing solution by mixing solid chemicals with water, cutting runway de-icing costs by 50% while maintaining compliance with FAA regulations.

Increasing Focus on Flight Safety and Operational Efficiency

A growing emphasis on flight safety drives adoption of de-icing vehicles across commercial and military sectors. Ice accumulation on aircraft surfaces impacts aerodynamic performance, making effective de-icing essential for safe takeoff and landing. Airlines are investing in modern, sensor-based systems that reduce chemical waste while maintaining high precision. Regulatory bodies also enforce strict de-icing standards, encouraging airports to upgrade fleets with automated and environmentally compliant vehicles.

Advancements in Eco-Friendly De-Icing Technologies

Rising environmental concerns and regulations on glycol usage push innovation toward eco-friendly de-icing vehicles. Manufacturers are developing systems that optimize fluid usage through smart sensors and efficient spraying technologies. Integration of heated-air systems and low-toxicity fluids reduces environmental impact while maintaining performance. These advancements align with global sustainability goals and encourage airport operators to transition to greener solutions, boosting demand for next-generation de-icing equipment.

- For instance, Vestergaard’s Elephant e-BETA Hybrid claims up to an 87 % cut in CO₂ and NOₓ emissions per truck per year by running all non-fluid-heating tasks electrically.

Key Trends & Opportunities

Integration of Automation and Smart Control Systems

Automation is a key trend reshaping the de-icing vehicles market. Smart control systems with sensors, GPS, and IoT connectivity enable precise monitoring and real-time operation tracking. Automated spraying systems improve accuracy, reduce chemical consumption, and enhance operator safety. This shift toward digital and connected solutions supports predictive maintenance and operational transparency, offering long-term cost savings for airport operators adopting smart de-icing technologies.

- For instance, the SmartPad Control Center technology integrates electronic message boards and AI algorithms to guide aircraft during de-icing at airports, reducing radio chatter and improving operational efficiency.

Growing Demand in Emerging Cold-Climate Regions

Airports in emerging cold-climate regions such as Eastern Europe and Asia-Pacific are expanding de-icing infrastructure. Rising regional connectivity, growing air travel, and new airport developments drive vehicle demand. Governments are investing in modern de-icing fleets to meet international safety standards and handle increasing flight traffic. This expansion presents strong opportunities for manufacturers offering cost-effective, customizable, and energy-efficient vehicle solutions tailored for developing markets.

- For instance, Narita International Airport in Japan is exploring and implementing various decarbonization and efficiency initiatives, such as using renewable diesel fuel for specialized vehicles and promoting the use of ground power units to minimize turnaround times and reduce emissions in all weather conditions.

Key Challenges

High Initial Investment and Maintenance Costs

De-icing vehicles require significant upfront investment, limiting adoption among smaller airports. Maintenance costs also remain high due to the need for corrosion-resistant materials and specialized equipment. The integration of automation and advanced fluid systems adds to operational expenses. These financial constraints challenge new buyers and delay replacement cycles, especially in developing regions with limited budgets for aviation ground support equipment.

Environmental and Regulatory Constraints

Stringent environmental regulations on glycol-based fluids pose challenges for the de-icing vehicles market. Manufacturers must comply with emission limits and fluid recovery standards, increasing design complexity and costs. Airports also face restrictions on fluid runoff management, demanding advanced recycling or containment systems. These compliance pressures raise operational costs and limit flexibility for smaller operators struggling to meet evolving environmental standards.

Operational Inefficiencies During Peak Demand

De-icing operations face time-sensitive challenges during severe winter conditions. Limited vehicle availability or mechanical failures can cause flight delays and congestion. Coordination issues between ground crews and air traffic control further impact performance. To maintain efficiency, airports require reliable equipment and trained operators, yet many smaller facilities lack sufficient resources, leading to reduced productivity and safety concerns during peak operations.

Regional Analysis

North America

North America dominates the de-icing vehicles market with a 41% share in 2024. The region’s dominance is driven by frequent snowfall, high air traffic, and strict aviation safety regulations. The United States and Canada lead in adopting automated and eco-friendly de-icing systems across major airports. Strong investments in airport infrastructure upgrades and modernization projects further support market expansion. Key manufacturers such as Oshkosh Corporation and Global Ground Support strengthen the regional presence through continuous innovation and large-scale fleet deployment.

Europe

Europe accounts for 32% of the de-icing vehicles market in 2024. The region’s growth is supported by severe winter conditions across Northern and Central Europe, requiring efficient aircraft ground handling solutions. Leading countries including Germany, the United Kingdom, and Russia invest heavily in advanced de-icing technologies to ensure flight reliability. Environmental regulations encouraging low-emission and glycol-free systems promote technology upgrades. The strong presence of established equipment manufacturers enhances competition and supports steady regional demand.

Asia-Pacific

Asia-Pacific holds a 17% share in the de-icing vehicles market in 2024. The region experiences increasing air travel and airport construction in countries such as China, Japan, and South Korea. Governments are investing in aviation safety and modern ground support infrastructure, driving de-icing equipment adoption. Expansion of regional airports in colder regions, including northern China and Japan, supports steady growth. It is expected to witness the fastest growth due to rising commercial aviation fleets and modernization of airport operations.

Latin America

Latin America represents 6% of the de-icing vehicles market in 2024. The market benefits from increasing air connectivity in mountainous and southern regions, where cold weather affects flight schedules. Airports in Chile, Argentina, and Brazil are gradually implementing modern de-icing systems to improve operational efficiency. Growing investments in aviation infrastructure and safety compliance contribute to regional demand. It continues to expand steadily with rising awareness about runway and aircraft de-icing safety requirements.

Middle East & Africa

The Middle East & Africa region holds a 4% share in the de-icing vehicles market in 2024. The demand remains limited but is increasing in areas prone to rare cold snaps and high-altitude airports. Countries such as Turkey and South Africa are modernizing airport facilities, creating moderate opportunities for de-icing vehicle suppliers. Rising international flight operations and fleet expansion encourage infrastructure improvements. It is expected to show gradual adoption of efficient and automated de-icing solutions in the forecast period.

Market Segmentations:

By Type

- Self-propelled de-icing vehicles

- Truck-mounted deicing vehicles

- Towable deicing vehicles

By Technology

- Sprayer type

- Spreader type

By Tank Capacity

- High capacity

- Medium capacity

- Low capacity

By Application

- Commercial airports

- Military airports

- Helipads and heliports

- Cargo airports

- Others

By Region

-

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Nordics

-

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- MEA

- UAE

- South Africa

- Saudi Arabia

Competitive Landscape

The de-icing vehicles market is moderately consolidated, with competition driven by technological advancement, fleet modernization, and compliance with environmental standards. Key players such as Oshkosh, Textron GSE, Vestergaard, Polar Mobility, TLD, Mallaghan Engineering, Weihai Guangtai Airport, PrimeFlight, Global Ground Support, and JBT Corporation dominate the global landscape. These companies focus on developing automated, eco-friendly, and high-capacity systems to enhance operational safety and reduce glycol consumption. Strategic initiatives, including partnerships with airport authorities, product upgrades, and regional expansions, strengthen their market presence. Leading manufacturers invest in smart spraying technologies and hybrid propulsion systems to improve energy efficiency and sustainability. Continuous innovation, adherence to strict aviation safety regulations, and the growing preference for customized solutions further intensify competition. Emerging players from Asia-Pacific are entering the market with cost-efficient models, challenging established global brands and expanding accessibility across developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Oshkosh

- Textron GSE

- Vestergaard

- Polar Mobility

- TLD

- Mallaghan Engineering

- Weihai Guangtai Airport

- PrimeFlight

- Global Ground Support

- JBT Corporation

Recent Developments

- In September 2025, Oshkosh AeroTech introduced the Tempest-si compact de-icer, designed for improved maneuverability and enhanced operational durability.

- In September 2024, Vestergaard Company launched the OPTIM-ICE semi-automatic de-icing system, featuring LIDAR-based precision and assisted nozzle guidance.

- In April 2023, JBT Corporation launched the Guardian 10000, an innovative self-propelled de-icing vehicle designed specifically for large international airports, featuring an advanced snow-melting system that reduces the time needed to clear runways by 25%, improving operational efficiency during peak seasons.

- In March 2023, Global Ground Support introduced the G4-6000, a cutting-edge truck-mounted de-icing vehicle with AI-powered weather tracking capabilities, allowing real-time adjustments to de-icing processes based on changing weather conditions, ensuring quicker and more accurate snow removal at busy airports.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Tank Capacity, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and sensor-based de-icing vehicles will continue to grow globally.

- Airports will prioritize eco-friendly systems using low-toxicity or glycol-free de-icing fluids.

- Integration of IoT and AI will improve operational accuracy and reduce fluid wastage.

- Manufacturers will focus on developing electric and hybrid-powered de-icing vehicles.

- Expansion of airports in cold-climate regions will increase procurement of high-capacity models.

- Partnerships between equipment manufacturers and airport operators will strengthen technology adoption.

- Maintenance cost reduction and modular vehicle design will gain more industry focus.

- Emerging economies will witness higher adoption with improved aviation safety investments.

- Continuous R&D in thermal and infrared de-icing technologies will enhance efficiency.

- Regulatory pressure for sustainable aviation operations will drive equipment modernization worldwide.