Market Overview

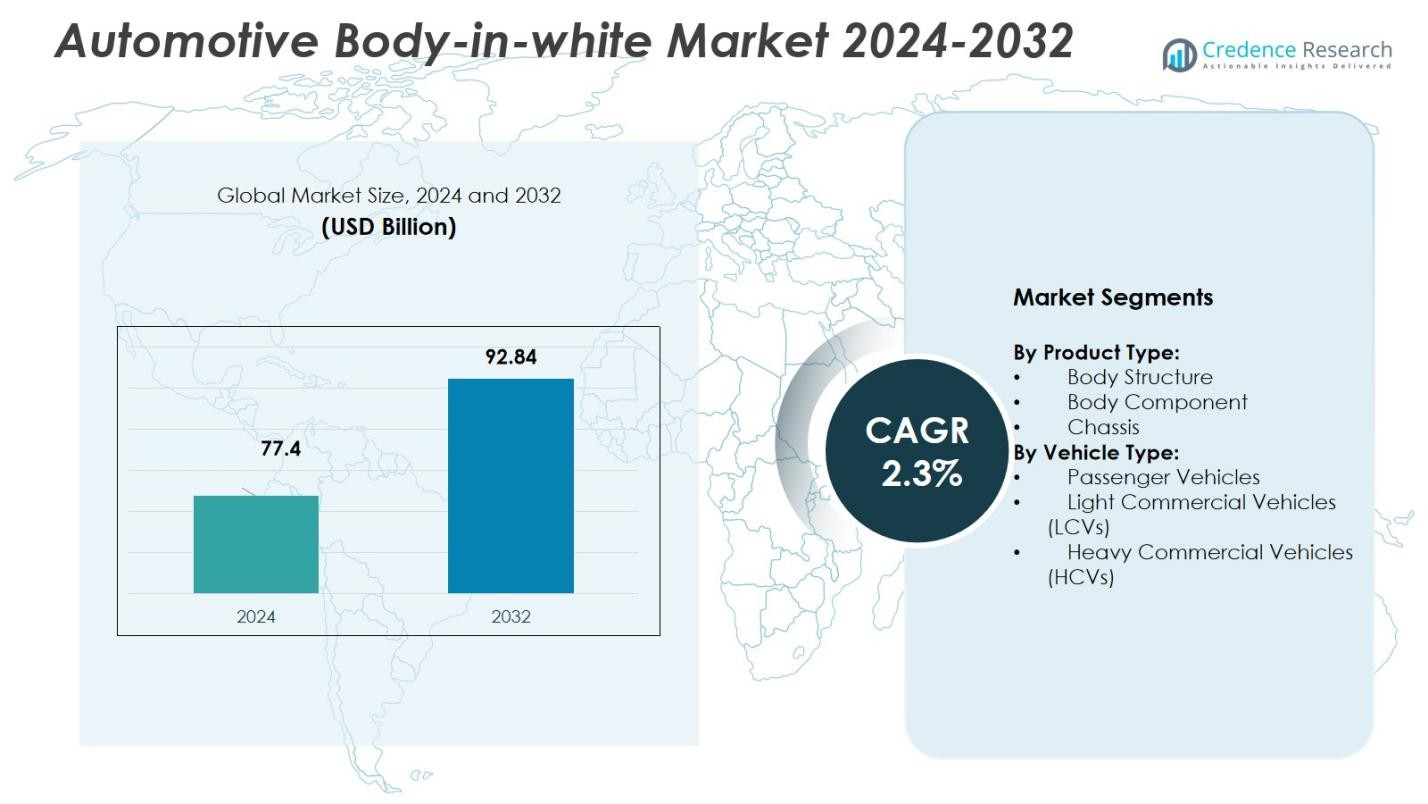

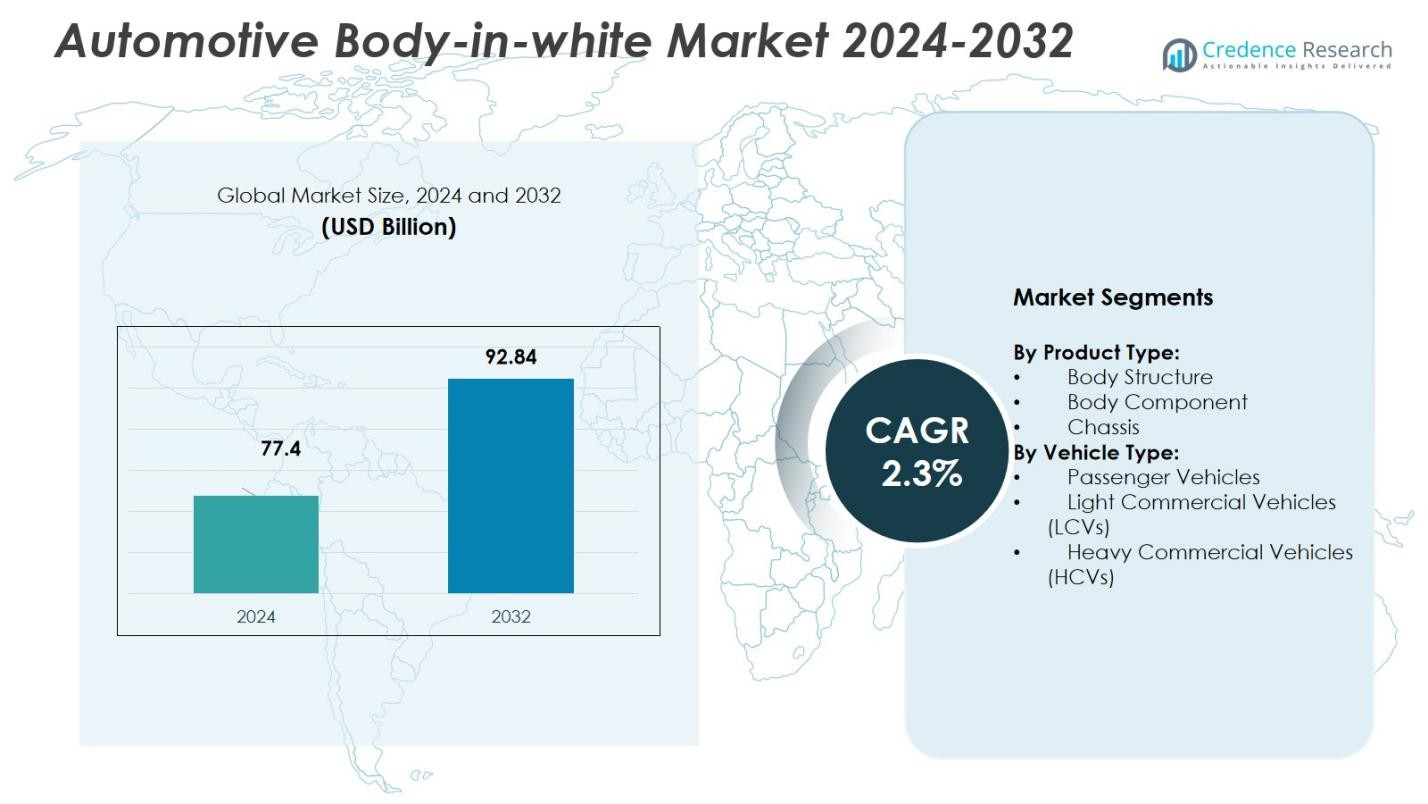

The Automotive Body-in-White Market size was valued at USD 77.4 billion in 2024 and is anticipated to reach USD 92.84 billion by 2032, growing at a CAGR of 2.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Body-In-White Market Size 2024 |

USD 77.4 Billion |

| Automotive Body-in-White Market, CAGR |

2.3% |

| Automotive Body-in-White Market Size 2032 |

USD 92.84 Billion |

Automotive Body-in-White Market is shaped by major players including Magna International, Toyota Boshoku, Hyundai Mobis, Valeo, Gestamp, Adient, Dura Automotive Systems, Faurecia and Lear Corporation. These firms leverage global supply‑chains, multi‑material expertise, and advanced manufacturing technologies to address evolving demand for lightweight, high‑strength body shells across vehicle types. The market’s regional dynamics highlight the dominance of the Asia-Pacific region, which captured 45.92% of global BIW market share in 2024, propelled by high vehicle production volumes, rapid EV adoption, and a robust component‑supplier ecosystem. Europe and North America trail Asia‑Pacific but remain significant contributors due to mature automotive industries and strong demand for premium and electric vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Body-in-White Market was valued at USD 77.4 billion in 2024 and is expected to reach USD 92.84 billion by 2032, growing at a CAGR of 2.3% during the forecast period.

- The increasing demand for lightweight materials, such as aluminum and advanced high-strength steel (AHSS), is driving the growth of the market. This trend is particularly crucial for electric vehicles (EVs) to improve battery efficiency and extend driving range.

- Key trends include the shift towards electric vehicles (EVs), the adoption of smart materials, and advancements in manufacturing technologies, such as robotic welding and multi-material joining techniques.

- High manufacturing costs, especially for advanced materials and production techniques, and the complexity in design and production pose significant challenges to market growth.

- Asia-Pacific dominates the market with a 45.92% share in 2024, followed by Europe at 30%, and North America at 18%. The passenger vehicle segment holds the largest share at 64.8%.

Market Segmentation Analysis:

By Product Type:

In the Automotive Body-in-White Market, the body structure segment dominates with a 45.2% market share in 2024. This segment’s growth is driven by the increasing demand for lightweight and durable materials, essential for improving fuel efficiency and reducing emissions. With the rise of electric vehicles (EVs), there is a heightened need for body structures that can support battery systems while keeping the vehicle weight low. Materials such as advanced steel, aluminum, and composites are crucial in meeting these requirements, ensuring that the body structure remains a key focus for automakers.

- For instance, BMW’s i3 employs a carbon-fiber-reinforced plastic (CFRP) body to balance lightness with strength.

By Vehicle Type:

The passenger vehicles segment leads the Automotive Body-in-White Market, holding a 64.8% share in 2024. This dominance is largely driven by growing consumer demand for personal vehicles, fueled by rising disposable incomes and advancements in vehicle safety and performance. Additionally, the increasing adoption of electric vehicles (EVs) plays a significant role, as these vehicles require advanced body-in-white designs to support their electric powertrains and optimize performance. The ongoing shift toward environmentally friendly transportation options is expected to further boost the passenger vehicle segment’s market growth.

- For instance, Tesla’s Model 3 uses an advanced body-in-white structure made from a mix of aluminum and high-strength steel, improving crash safety and reducing weight.

Key Growth Drivers

Increasing Demand for Lightweight Materials

The growing demand for lightweight materials is a significant driver for the Automotive Body-in-White Market. As automakers focus on reducing vehicle weight to improve fuel efficiency and meet stringent emissions regulations, materials such as aluminum, advanced high-strength steel (AHSS), and composites are being increasingly used in body structures. Lightweight body-in-white solutions are particularly crucial for electric vehicles (EVs) to optimize battery efficiency and extend driving range. This trend is expected to continue as manufacturers seek to comply with environmental standards while enhancing vehicle performance.

- For instance, Gestamp expands in Japan with hot-stamping lines for AHSS in BIW, focusing on weight reduction for regional automakers.

Shift Towards Electric Vehicles (EVs)

The rapid shift toward electric vehicles (EVs) is driving innovation in the Automotive Body-in-White Market. EVs require body-in-white designs that support larger battery packs while minimizing weight to improve energy efficiency. The demand for EVs, particularly in regions such as Europe and North America, is growing due to government incentives and the push for reduced carbon emissions. Consequently, automakers are investing in specialized body-in-white solutions tailored to electric powertrains, creating new opportunities for growth in this segment.

- For instance, Tesla employs advanced high-strength steels and topology optimization in their body structures to enhance safety and efficiency in EVs, addressing the weight challenges posed by substantial battery packs.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are accelerating the growth of the Automotive Body-in-White Market. The development of advanced welding, stamping, and forming techniques allows automakers to produce more complex and lighter body structures with improved strength and durability. Automation in body-in-white production processes, such as robotic welding and laser cutting, also reduces production costs and increases efficiency. These innovations are critical for meeting the demands of modern vehicles, particularly as consumer preferences shift toward more customized, high-performance, and eco-friendly options.

Key Trends & Opportunities

Integration of Smart Materials

The integration of smart materials into body-in-white designs is an emerging trend that offers significant opportunities. Smart materials, such as shape-memory alloys and self-healing coatings, can enhance the performance, durability, and safety of automotive body structures. These materials can respond to environmental stimuli, such as temperature and stress, to adapt and maintain the structural integrity of the vehicle. As the automotive industry focuses on sustainability and vehicle longevity, the use of smart materials in body-in-white production will become a major trend, providing added value to manufacturers and consumers alike.

- For instance, BMW’s i3 electric car features a body-in-white structure largely made from carbon-fiber-reinforced plastics (CFRP), which achieves a 52% weight reduction compared to conventional steel bodies, enhancing both vehicle efficiency and battery life.

Rising Demand for Autonomous Vehicles

The rise of autonomous vehicles presents an opportunity for growth in the Automotive Body-in-White Market. As autonomous vehicles require specialized designs to accommodate advanced sensors, computing systems, and other technologies, the need for innovative body-in-white solutions will increase. Manufacturers will need to develop body structures that provide optimal protection for these technologies while maintaining vehicle performance and safety standards. This trend offers substantial growth potential as the market for autonomous vehicles continues to evolve and expand.

- For instance, Baidu, Inc. received authorization in December 2022 to test fully driverless vehicles on public roads, requiring BIW modifications for onboard AI, sensors, and computing without safety operators.

Key Challenges

High Manufacturing Costs

One of the key challenges in the Automotive Body-in-White Market is the high manufacturing costs associated with advanced materials and production techniques. While lightweight and high-strength materials such as aluminum and AHSS offer numerous benefits, they are more expensive than traditional materials. Additionally, the cost of advanced manufacturing processes like robotic welding, laser cutting, and automated stamping can be prohibitive, particularly for smaller automakers or those operating in price-sensitive markets. These cost pressures may limit the widespread adoption of advanced body-in-white technologies, hindering market growth.

Complexity in Design and Production

The complexity involved in designing and producing body-in-white components poses another challenge. Modern vehicles, especially electric and autonomous models, require highly specialized body-in-white designs that integrate advanced materials, technologies, and safety features. Achieving the optimal balance between performance, weight, safety, and cost is a significant challenge for manufacturers. Additionally, the production of these complex designs requires sophisticated manufacturing facilities and skilled labor, which can be a barrier to entry for some companies and a source of inefficiency for established players.

Regional Analysis

Asia‑Pacific

Asia‑Pacific held 45.92% of the global Automotive Body-in-White Market in 2024. This region benefits from large-scale automotive production across major manufacturing hubs such as China, India, Japan, and South Korea. High vehicle output, increasing demand for passenger cars, and accelerated electrification motivate automakers to adopt lightweight, high‑strength BIW materials and locally source components. As Tier‑1 suppliers expand capacity and vertically integrate, Asia‑Pacific continues to dominate global BIW demand and production.

Europe

Europe accounts for 30.0% of the global BIW market in 2024. The region’s mature automotive sector couples well‑established manufacturing infrastructure with stringent safety, emissions, and recyclability regulations. OEMs here adopt advanced BIW solutions, including multi‑material body structures, high‑precision joining techniques, and modular chassis designs. Demand for premium and electric vehicles supports investment in lightweight, crash‑resistant BIW solutions, reinforcing Europe’s strong position in the global BIW market.

North America

North America represents 18.0% of the global BIW market in 2024. Its strength stems from advanced manufacturing infrastructure, high automation levels, and early adoption of electric‑vehicle platforms. The region leverages established aluminum and steel supply chains, robust tooling, and stringent quality‑control systems enabling efficient production of multi‑material, lightweight BIW structures. Ongoing demand for safety, performance, and regulatory compliance sustains steady BIW adoption across conventional and electric vehicles.

Latin America

Latin America comprises 6.0% of the global BIW market as of 2024. Although its share is modest compared to leading regions, it shows growth potential due to rising middle‑class incomes, improving infrastructure, and expanding automotive assembly operations in key countries such as Brazil and Mexico. Automakers in the region increasingly adopt cost‑efficient BIW solutions using lighter materials and simplified body designs to balance affordability with performance in local markets.

Middle East & Africa (MEA)

MEA accounts for 3.08% of the global BIW market in 2024. This emerging region sees growing demand prompted by rising consumer incomes, urbanization, and expansion of regional automotive manufacturing operations. Vehicles tailored for harsh climates and rough terrain prompt use of corrosion‑resistant coatings and robust body structures. As local production and adoption of modern vehicles increase, MEA is gradually scaling up its demand for BIW solutions.

Market Segmentations:

By Product Type:

- Body Structure

- Body Component

- Chassis

By Vehicle Type:

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Automotive Body-in-White (BIW) Market is shaped by the presence of key players such as Magna International, Toyota Boshoku, Hyundai Mobis, Valeo, Gestamp, Adient, Dura Automotive Systems, Faurecia, and Lear Corporation. These players dominate the market by leveraging advanced manufacturing technologies, strong regional footprints, and diverse product portfolios. Magna International and Gestamp are known for their large-scale production capabilities and extensive R&D investments, allowing them to offer innovative solutions in lightweight materials and multi-material body structures. Valeo and Faurecia are enhancing their competitive positioning by focusing on sustainability and offering eco-friendly BIW solutions for electric vehicles. Hyundai Mobis and Adient are gaining traction in the market by integrating automation and digitalization into their manufacturing processes, further enhancing the precision and efficiency of their BIW systems. Intense competition among these players drives continuous technological advancements, enabling them to meet the evolving demand for high-performance, lightweight, and safe body structures in the automotive industry.

Key Player Analysis

- Faurecia

- Lear Corporation

- Dura Automotive Systems

- Magna International

- Valeo

- Gestamp

- Hyundai Mobis

- Toyota Boshoku

- Adient

- Faurecia

Recent Developments

- In May 2025 Gestamp introduced a new family of structural products under the name “Ges‑Gigastamping®,” featuring large-format, multi-part body-in-white components including a one‑piece floor panel and wave rocker aimed at reducing material weight, simplifying assembly and improving crash performance.

- In 2024, Benteler Automotive enhanced BIW components with hybrid steel‑aluminum assemblies for multi‑platform production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global Automotive Body-in-White (BIW) market will see growth from rising electric vehicle adoption, boosting demand for lightweight, high-strength body structures.

- Increasing fuel-efficiency regulations will drive demand for multi-material BIW solutions, promoting the use of advanced materials like high-strength steel and aluminum.

- Rising passenger vehicle sales, especially SUVs and crossovers, will expand BIW market demand, requiring larger and more complex body structures.

- Growing light commercial vehicle (LCV) and commercial vehicle markets in emerging economies will drive BIW demand for durable, commercial-grade body structures.

- Advances in manufacturing technologies, including robotic welding and multi-material joining, will enhance BIW production efficiency, reducing costs and enabling innovation.

- The use of digital design tools and Industry 4.0 technologies will optimize BIW designs, improving safety, manufacturability, and weight efficiency.

- Expanding automotive manufacturing hubs in Asia-Pacific and other emerging regions will support local BIW production, fostering global market growth.

- The use of multi-material BIW solutions will offer automakers cost-effective, lightweight structures that meet crash safety and performance requirements.

- Demand for fuel-efficient and eco-friendly vehicles will encourage the adoption of recyclable materials in BIW production, aligning with environmental regulations.

- Increased competition among global BIW suppliers will foster innovation, strategic partnerships, and market consolidation, advancing the industry’s technological capabilities.