Market Overview

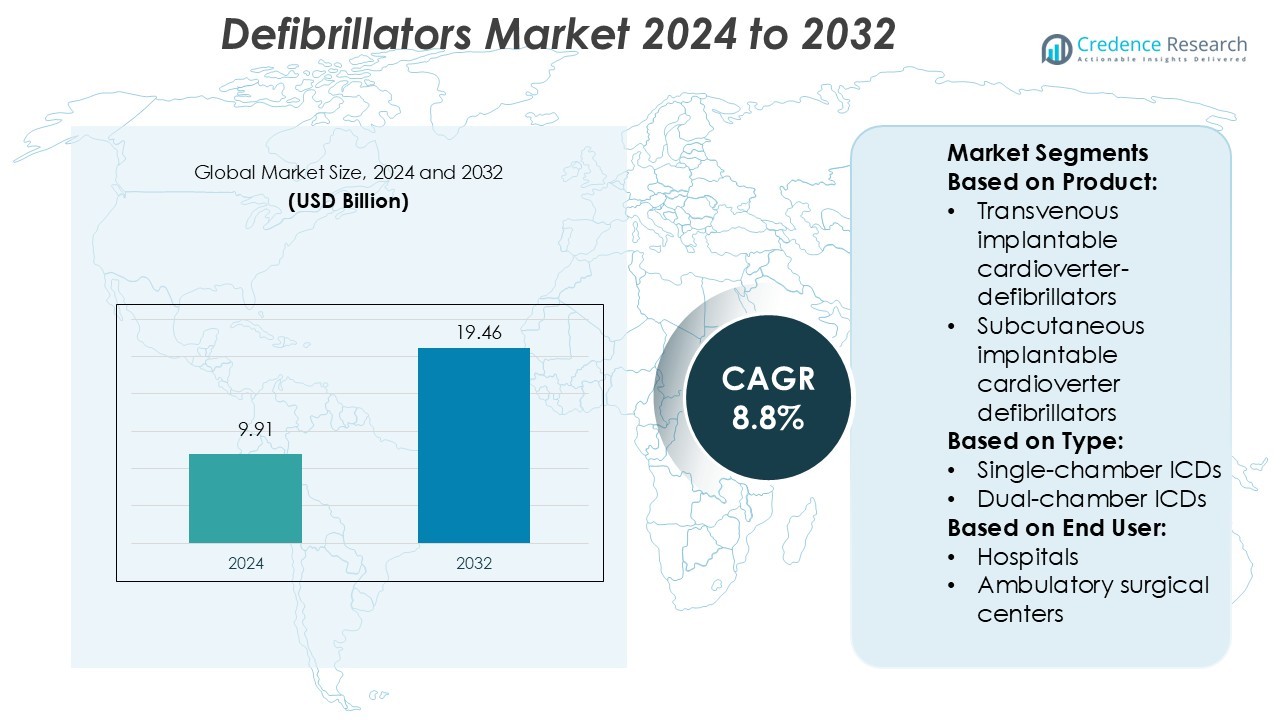

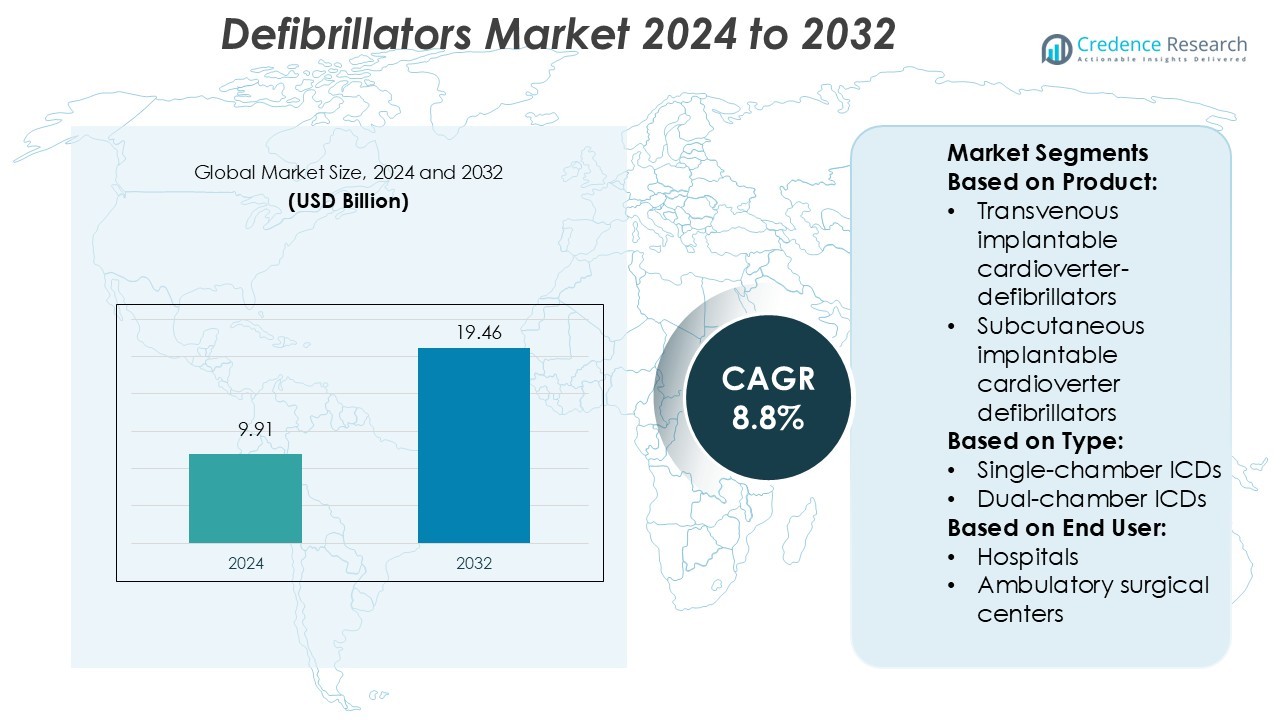

Defibrillators Market size was valued USD 9.91 billion in 2024 and is anticipated to reach USD 19.46 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defibrillators Market Size 2024 |

USD 9.91 Billion |

| Defibrillators Market, CAGR |

8.8% |

| Defibrillators Market Size 2032 |

USD 19.46 Billion |

The defibrillators market is driven by strong competition and technological advancements from leading companies such as IMRICOR MEDICAL SYSTEMS, Abbott Laboratories, LivaNova plc, Boston Scientific Corporation, Nohen Kohden Corporation, MicroPort Scientific Corporation, Medtronic plc, FUKUDA DENSHI CO. Ltd, BIOTRONIK SE & Co. KG, and Koninklijke Philips N.V. These players focus on innovation, AI integration, and strategic collaborations to enhance product performance and expand global reach. North America leads the global market with a 38% share, supported by advanced healthcare infrastructure, high awareness levels, and broad public access defibrillation programs. Strong regulatory support and continuous product launches further consolidate the region’s leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The defibrillators market was valued at USD 9.91 billion in 2024 and is projected to reach USD 19.46 billion by 2032, growing at a CAGR of 8.8%.

- Rising cardiovascular disease cases, technological innovations, and strong healthcare investments drive steady market growth.

- Key players focus on AI integration, product innovation, and strategic partnerships to strengthen their global presence and expand market penetration.

- High device costs and strict regulatory requirements act as restraints, particularly in low- and middle-income regions.

- North America leads with a 38% share, followed by Europe with 27% and Asia Pacific with 21%, while hospitals remain the dominant end-user segment, driving sustained demand across key markets.

Market Segmentation Analysis:

By Product

Transvenous implantable cardioverter-defibrillators hold the dominant share in the product segment of the defibrillators market. These devices account for a large portion of installations due to their proven effectiveness in managing sudden cardiac arrest and life-threatening arrhythmias. Their broad adoption is supported by well-established clinical guidelines, long-term reliability, and technological improvements in lead performance. Subcutaneous implantable cardioverter defibrillators are expanding steadily, driven by reduced infection risks and simplified procedures. The growing preference for minimally invasive solutions and increasing cardiovascular disease prevalence strengthen the demand for these advanced devices across healthcare systems.

- For instance, IMRICOR Medical Systems integrated MR-conditional technology into its Advantage-MR EP Recorder/Stimulator system, which operates at a magnetic field strength of 1.5 T, enabling precise monitoring during MR-guided procedures.

By Type

Single-chamber ICDs lead the market with the highest share among device types. Their dominance stems from lower procedural complexity, faster implantation times, and cost-effectiveness compared to dual-chamber or biventricular devices. These devices are widely used for primary prevention in patients at high risk of sudden cardiac death. Dual-chamber ICDs and biventricular devices are growing in demand due to better arrhythmia discrimination and support for patients with advanced heart failure. Rising clinical acceptance and continuous improvements in programming algorithms are further driving adoption across advanced cardiac care settings.

- For instance, Abbott’s Gallant™ Single Chamber ICD (model CDVRA500T) features a volume of 35 cc, a weight of 72 g, and delivers up to 40 J of defibrillation energy.

By End-user

Hospitals represent the largest end-user segment of the defibrillators market. They maintain the dominant share due to higher patient inflow, availability of skilled cardiologists, and advanced infrastructure for device implantation and monitoring. Hospitals also benefit from reimbursement programs and large-scale cardiac care programs that support ICD procedures. Ambulatory surgical centers are gaining traction as cost-efficient alternatives, supported by faster recovery times and growing outpatient cardiac procedures. Other end-users, including specialty clinics, contribute to expanding accessibility in remote and underserved regions, reinforcing the overall market demand.

Key Growth Drivers

Rising Incidence of Cardiovascular Diseases

The growing burden of cardiovascular diseases is driving strong demand for defibrillators. Sudden cardiac arrest cases have increased, prompting the adoption of advanced life-saving equipment in hospitals and public spaces. Governments and health organizations promote early response programs to reduce mortality rates. Public access defibrillator programs support wider deployment in airports, malls, and offices. Increased awareness among communities and the presence of trained responders further accelerate product adoption, strengthening the global market growth across developed and emerging economies.

- For instance, LivaNova’s PLATINIUM single-chamber ICD devices deliver a projected service life of more than 14 years and have a device can size of 31 cc-33 cc, enabling fewer replacement surgeries.

Technological Advancements and Product Innovation

Continuous innovation in defibrillator technology supports market expansion. Advanced features such as real-time CPR feedback, automatic rhythm analysis, and Bluetooth connectivity improve clinical outcomes and ease of use. Wearable and portable models enable faster emergency response outside hospitals. Manufacturers focus on integrating AI and IoT for predictive alerts and better patient monitoring. These innovations enhance accuracy, reduce human error, and promote wider adoption among healthcare providers and public institutions, boosting overall demand in both developed and emerging regions.

- For instance, Boston Scientific’s EMBLEM™ MRI S‑ICD System demonstrated a 1-year inappropriate shock rate of 1.8 % when the SMART Pass algorithm was On.

Government Initiatives and Awareness Programs

Supportive government programs and rising awareness of cardiac arrest management are key growth enablers. Many countries mandate defibrillator installations in public areas, workplaces, and educational institutions. Public training programs increase survival rates by promoting timely interventions. Funding schemes for healthcare infrastructure and emergency medical services encourage hospital procurement. Organizations like the American Heart Association and European Resuscitation Council play a central role in promoting CPR and AED use. These initiatives strengthen market penetration and drive consistent equipment demand globally.

Key Trends & Opportunities

Growing Demand for Wearable and Portable Defibrillators

Portable and wearable defibrillators offer flexibility and continuous monitoring, supporting rapid interventions. Patients with high cardiac risk benefit from real-time detection and immediate response. Advancements in battery technology and lightweight designs enhance mobility and comfort. The shift toward home-based care and remote patient management further fuels adoption. Healthcare systems recognize these devices as cost-effective solutions for emergency preparedness. This trend aligns with the broader move toward personalized healthcare and strengthens market opportunities for manufacturers.

- For instance, Nihon Kohden’s fully-automatic AED model “AED-3250” launched in February 2022 in Japan marks a key milestone in automatic defibrillator technology.

Integration of AI and Smart Connectivity

Defibrillators with AI-based analytics and wireless connectivity improve decision-making during emergencies. Smart systems automatically analyze heart rhythms and suggest precise actions, reducing response time. Cloud connectivity enables remote monitoring and data sharing with emergency services or hospitals. These features enhance treatment accuracy and patient outcomes. Healthcare providers benefit from better tracking and analytics for follow-up care. As digital health adoption grows, smart defibrillators become essential tools in modern emergency care systems worldwide.

- For instance, Aurora EV-ICD™ MRI SureScan™ system features a projected longevity of 11.7 years, delivers 40 J of defibrillation energy, and achieved implant success rate of 98.7 % in the pivotal trial.

Expansion of Public Access Defibrillation Programs

Wider public access programs create strong market opportunities. Governments and NGOs promote AED installations in transport hubs, sports arenas, and offices. Trained lay responders and improved infrastructure help reduce out-of-hospital cardiac arrest fatalities. Collaborations between manufacturers and public health bodies support large-scale deployments. This trend is gaining momentum in emerging economies, where healthcare access is improving. Increased funding and community participation further strengthen adoption, positioning public access AED programs as a key growth lever.

Key Challenges

High Cost of Advanced Defibrillator Devices

The high price of advanced defibrillators remains a major barrier, particularly in low- and middle-income countries. Sophisticated features and technology increase production and maintenance costs. Budget constraints in hospitals and emergency services limit large-scale adoption. Lack of reimbursement in certain regions further restricts accessibility. Smaller healthcare facilities often delay procurement, slowing overall market expansion. Manufacturers must address pricing strategies to support broader deployment and ensure equitable access to life-saving equipment.

Regulatory and Compliance Barriers

Strict regulatory requirements pose significant challenges for market entry and expansion. Approvals for new defibrillator models involve complex clinical testing and documentation. Delays in certification can slow product launches and increase costs. Differences in regulatory standards between regions add complexity for global players. Ensuring compliance with performance, safety, and labeling standards requires continuous investment. These barriers impact smaller manufacturers more heavily, limiting competition and innovation in the global defibrillator market.

Regional Analysis

North America

North America leads the global defibrillators market with a 38% share. Strong healthcare infrastructure and a high prevalence of cardiac diseases support large-scale adoption. The U.S. drives demand through hospital installations and public access programs in schools, airports, and malls. High awareness, favorable reimbursement policies, and well-developed emergency services strengthen market leadership. Major manufacturers and ongoing technological innovation also enhance product penetration. Increasing investments in advanced AEDs and wearable defibrillators sustain North America’s position as the leading regional market.

Europe

Europe holds a 27% share in the defibrillators market, driven by well-established healthcare systems and strict regulatory standards. Countries like Germany, the U.K., and France invest in advanced cardiac care infrastructure. Widespread training programs for CPR and AED usage improve survival rates and increase device installations in public places. Government mandates for AED deployment across transport hubs and workplaces further drive adoption. Strong collaboration between health authorities and manufacturers supports consistent market growth across key European economies.

Asia Pacific

Asia Pacific accounts for 21% of the global defibrillators market, with rapid healthcare expansion and rising cardiovascular disease cases driving demand. Countries like China, Japan, and India witness strong investments in hospital infrastructure and emergency response networks. Growing awareness programs and government initiatives promote early cardiac arrest interventions. Local and international manufacturers are increasing product availability through strategic partnerships. Rising urbanization and expanding public health programs make Asia Pacific the fastest-growing regional market in this segment.

Latin America

Latin America holds a 9% share of the defibrillators market, with steady adoption in urban centers. Brazil and Mexico lead regional demand, supported by healthcare modernization efforts. Governments are increasing investment in emergency medical services and expanding public access AED programs. However, economic constraints limit penetration in rural areas. Growing collaboration between private healthcare providers and NGOs strengthens deployment. Gradual regulatory improvements and awareness campaigns are expected to boost adoption in the coming years.

Middle East & Africa

The Middle East & Africa region captures a 5% market share, with growth supported by improving healthcare infrastructure and rising investments. Gulf countries like the UAE and Saudi Arabia lead with hospital modernization and emergency care upgrades. Public access AED programs are expanding, particularly in airports and large venues. However, uneven infrastructure in low-income countries slows overall growth. International partnerships and government initiatives are helping bridge gaps, positioning the region for gradual market expansion.

Market Segmentations:

By Product:

- Transvenous implantable cardioverter-defibrillators

- Subcutaneous implantable cardioverter defibrillators

By Type:

- Single-chamber ICDs

- Dual-chamber ICDs

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The defibrillators market players including IMRICOR MEDICAL SYSTEMS, Abbott Laboratories, LivaNova plc, Boston Scientific Corporation, Nohen Kohden Corporation, MicroPort Scientific Corporation, Medtronic plc, FUKUDA DENSHI CO. Ltd, BIOTRONIK SE & Co. KG, and Koninklijke Philips N.V. The defibrillators market is characterized by strong competition, rapid innovation, and expanding global reach. Companies focus on enhancing product performance, integrating smart technologies, and improving ease of use to meet rising demand. Advancements such as real-time monitoring, AI-assisted rhythm analysis, and wireless connectivity support faster emergency response and better patient outcomes. Manufacturers prioritize strategic collaborations, mergers, and regional expansions to strengthen their market position. Continuous investment in R&D accelerates the launch of next-generation AEDs and implantable devices. Growing emphasis on public access programs and hospital upgrades further fuels competition, driving sustained innovation and market growth worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IMRICOR MEDICAL SYSTEMS

- Abbott Laboratories

- LivaNova plc

- Boston Scientific Corporation

- Nohen Kohden Corporation

- MicroPort Scientific Corporation

- Medtronic plc

- FUKUDA DENSHI CO. Ltd

- BIOTRONIK SE & Co. KG

- Koninklijke Philips N.V

Recent Developments

- In April 2024, Welsh Ambulance Service tested the use of drones to deliver defibrillators. This project called the Drone-Delivered Defibrillators study (or 3D project), is a partnership between the Welsh Ambulance Service, the University of Warwick, and SkyBound.

- In November 2023, the Indian government announced the installation of 50 automated defibrillators in public places. These initiatives involve 85 hospitals at district and taluk centers as spoke centers and create 10 hubs across 16 major hospitals in cities.

- In October 2023, Medtronic plc received FDA clearance for the Aurora EV-ICD MRI SureScan and Epsila EV MRI SureScan defibrillation leads to treat extremely rapid heart rhythms that can result in SCA. This development will improve companies portfolio, thereby, enhancing its serviceability.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as cardiovascular disease rates continue to increase worldwide.

- Wearable and portable defibrillators will gain stronger adoption across patient groups.

- AI and IoT integration will enhance diagnostic accuracy and emergency response speed.

- Public access defibrillation programs will expand in both developed and emerging economies.

- Hospitals will upgrade to advanced devices with real-time monitoring and connectivity features.

- Strategic partnerships and mergers will strengthen product availability across global markets.

- Government funding will support wider device deployment in community and public spaces.

- Regulatory harmonization will improve market entry and accelerate product launches.

- Home healthcare adoption will rise, supporting personal emergency preparedness solutions.

- Continuous R&D will lead to lighter, smarter, and more efficient defibrillator technologies.