Market overview

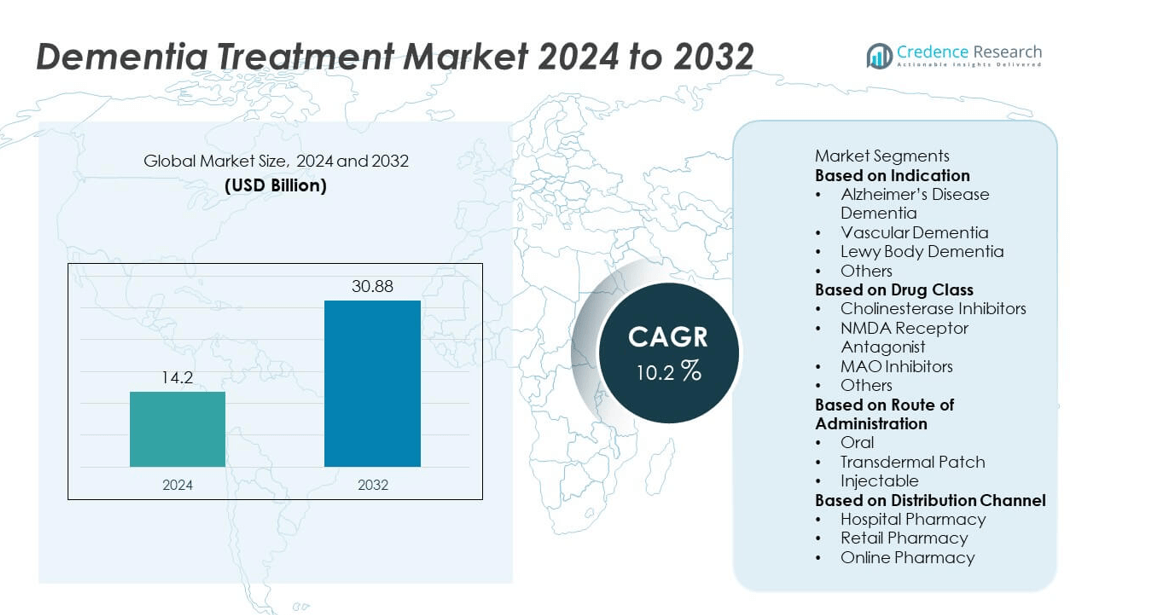

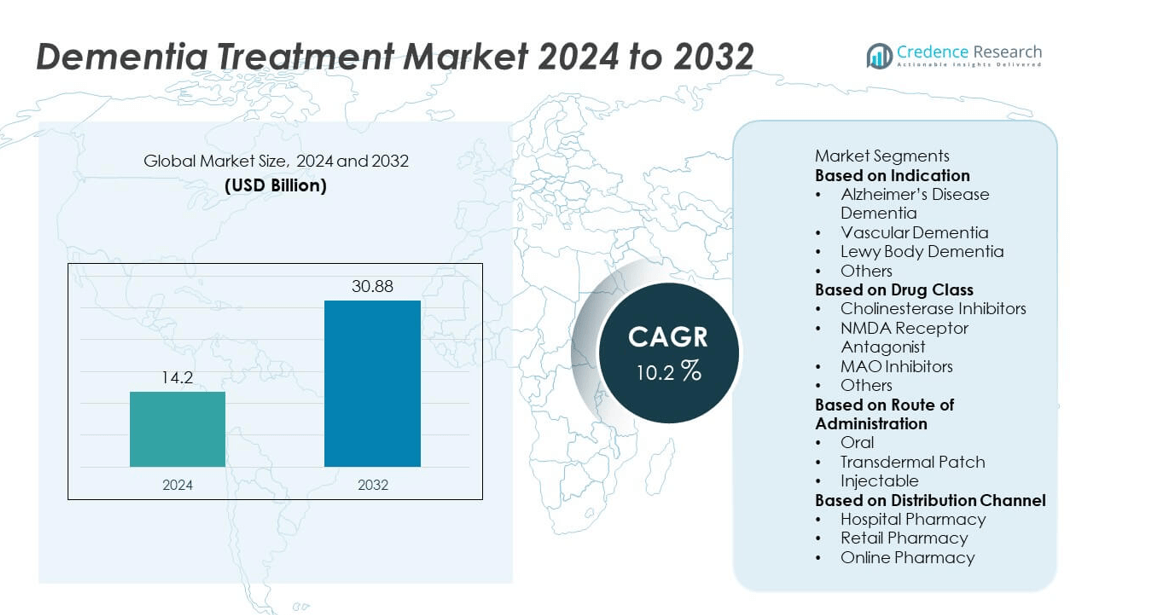

The Dementia Treatment market was valued at USD 14.2 billion in 2024 and is projected to reach USD 30.88 billion by 2032, expanding at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dementia Treatment Market Size 2024 |

UUSD 14.2 billion |

| Dementia Treatment Market, CAGR |

10.2% |

| Dementia Treatment Market Size 2032 |

USD 30.88 billion |

The dementia treatment market is led by major players such as Biogen, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Novartis AG, Viatris Inc., Lundbeck, Cipla, Eli Lilly and Company, Eisai Co., Ltd., and DAIICHI SANKYO COMPANY, LIMITED. These companies dominate through innovative drug portfolios, strong research capabilities, and strategic global collaborations. North America leads the market with a 39% share, supported by advanced healthcare infrastructure, early diagnosis programs, and widespread use of biologics. Europe follows with 32%, driven by government-funded dementia strategies and clinical research, while Asia-Pacific holds 22%, emerging as the fastest-growing region due to expanding healthcare access and rising geriatric populations.

Market Insights

- The dementia treatment market was valued at USD 14.2 billion in 2024 and is projected to reach USD 30.88 billion by 2032, growing at a CAGR of 10.2%.

- Rising prevalence of Alzheimer’s disease and increasing geriatric populations are driving demand for effective therapies and early diagnostic solutions.

- The market trend shows rapid adoption of biologics, disease-modifying drugs, and digital therapeutic tools improving patient management and outcomes.

- Leading players such as Biogen, AbbVie Inc., and Eli Lilly and Company dominate through innovation, clinical trials, and strategic partnerships in neurodegenerative research.

- North America holds a 39% share, followed by Europe at 32% and Asia-Pacific at 22%, while the Alzheimer’s disease dementia segment leads with a 61% share due to higher diagnosis rates and growing access to advanced treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Indication

The Alzheimer’s disease dementia segment dominated the dementia treatment market in 2024 with a 61% share. This dominance is driven by the rising global prevalence of Alzheimer’s, accounting for most dementia cases worldwide. Increasing diagnosis rates and the introduction of novel disease-modifying therapies have strengthened segment growth. Pharmaceutical companies are investing heavily in R&D to develop amyloid and tau-targeting drugs. Moreover, growing awareness programs and early screening initiatives are improving patient access to treatment, while supportive healthcare policies in developed economies continue to enhance therapeutic adoption.

- For instance, Eli Lilly and Company developed Kisunla (donanemab-azbt), which demonstrated measurable clinical benefit by significantly slowing cognitive and functional decline in early Alzheimer’s patients.

By Drug Class

The cholinesterase inhibitors segment held the largest share of 46% in the dementia treatment market in 2024. These drugs remain the first-line treatment for mild to moderate dementia, improving neurotransmitter activity and cognitive function. Their established efficacy, safety, and affordability sustain widespread use across clinical settings. However, the NMDA receptor antagonist segment is expanding rapidly due to its effectiveness in advanced dementia stages. Continuous innovation in combination therapies and the approval of new long-acting formulations are supporting further growth in this segment.

- For instance, extended-release memantine HCl, available as Namenda XR, improves patient compliance through once-daily dosing for those with moderate to severe Alzheimer’s. A large, 24-week clinical trial involving 677 patients demonstrated that adding extended-release memantine to a standard cholinesterase inhibitor regimen resulted in statistically significant benefits in cognition and overall clinical status compared to placebo. The trial, named MEM-MD-50, was randomized and placebo-controlled.

By Route of Administration

The oral segment led the dementia treatment market in 2024 with a 52% share. Oral formulations remain the preferred route due to convenience, patient compliance, and wide availability of generic options. Growing use of combination tablets and extended-release forms enhances dosing efficiency and adherence. Meanwhile, transdermal patches are gaining momentum as a non-invasive alternative for patients with swallowing difficulties or gastrointestinal intolerance. The injectable segment, though smaller, is poised for steady growth driven by emerging biologics and antibody-based therapies targeting specific neurological pathways.

Key Growth Drivers

Rising Global Dementia Incidence

The growing prevalence of dementia, particularly Alzheimer’s disease, is a major factor driving the dementia treatment market. Aging populations and increased life expectancy are significantly expanding the patient base worldwide. Governments and healthcare systems are promoting early diagnosis and awareness programs to improve patient outcomes. Rising healthcare investments and demand for long-term care solutions further strengthen the need for effective therapies. This growing burden of dementia continues to stimulate innovation and expand the adoption of advanced treatment options globally.

- For instance, Biogen collaborated with Eisai Co., Ltd. to commercialize Leqembi (lecanemab-irmb) for early-stage Alzheimer’s disease across multiple regions. In 2025, Eisai and Biogen have continued to expand patient access programs, including the launch of a new subcutaneous autoinjector and resources for patients.

Advancements in Therapeutic Development

Continuous progress in neuroscience and drug innovation is fueling the development of advanced dementia therapies. Pharmaceutical companies are focusing on disease-modifying drugs that target amyloid and tau proteins to slow disease progression. The integration of biomarker-based diagnostics enables early detection and personalized care. Increased funding from public and private sectors is accelerating research in biologics and small-molecule drugs. These advancements are improving treatment outcomes, creating opportunities for novel formulations, and transforming the global dementia care landscape.

- For instance, Novartis AG evaluated the monoclonal antibody NIS793, designed to inhibit the transforming growth factor beta pathway in tumors, for solid tumors and, before its development was discontinued, for metastatic pancreatic ductal adenocarcinoma.

Expansion of Healthcare Infrastructure and Investments

Rising healthcare expenditure and the strengthening of medical infrastructure are key drivers of market growth. Governments are implementing national dementia strategies and funding programs for diagnosis, research, and patient care. Emerging economies are expanding access to specialized neurological services and rehabilitation centers. Public–private partnerships are supporting innovation and capacity building in dementia treatment. This expansion of healthcare networks improves early intervention and long-term management, enhancing patient quality of life and driving sustained market growth.

Key Trends & Opportunities

Emergence of Digital Therapeutics and AI Solutions

Digital therapeutics and artificial intelligence are transforming dementia diagnosis and care delivery. AI-driven platforms improve early disease detection through imaging analysis and cognitive assessments. Mobile applications and wearable devices enable continuous monitoring and support cognitive therapy. Digital tools also help caregivers manage symptoms and track patient progress remotely. The growing integration of telemedicine and smart healthcare systems is enhancing accessibility and creating new opportunities for personalized, technology-enabled dementia treatment across global markets.

- For instance, Cognetivity Neurosciences has deployed its Integrated Cognitive Assessment (ICA) tool in clinical settings, including within the UK’s National Health Service (NHS) and in Dubai. The platform uses AI to analyze responses to a rapid visual categorization test, which takes approximately five to ten minutes to complete.

Increasing Focus on Biologics and Personalized Medicine

The adoption of biologics and precision medicine represents a major opportunity in dementia treatment. Advances in genomics and molecular biology are allowing the development of targeted therapies that address specific disease mechanisms. Monoclonal antibodies and gene-based drugs are gaining regulatory approvals for Alzheimer’s management. Personalized medicine approaches, guided by biomarker testing, are improving therapeutic effectiveness and reducing adverse effects. Collaboration between research institutions and pharmaceutical firms is accelerating innovation in this fast-evolving segment.

- For instance, Eisai Co., Ltd. and Biogen conducted a biomarker-driven Phase 3 trial for Leqembi (lecanemab-irmb) with 1,795 participants across sites in North America, Europe, and Asia, including Japan, the U.S., China, South Korea, Canada, Australia, and Singapore.

Key Challenges

High Cost of Advanced Therapies

The high cost of dementia drugs, especially biologics and novel therapies, poses a significant challenge to market accessibility. Complex manufacturing processes, costly R&D, and lengthy clinical trials contribute to elevated treatment expenses. These factors limit patient affordability and adoption, particularly in low-income regions. Additionally, long-term care requirements add financial strain on families and healthcare systems. Addressing this challenge requires pricing reforms, increased reimbursement support, and strategies to reduce production costs for advanced treatments.

Clinical Uncertainty and Regulatory Challenges

Developing effective dementia treatments remains complex due to limited understanding of neurodegenerative mechanisms. High failure rates in late-stage clinical trials and stringent regulatory requirements delay product approvals. The slow pace of innovation increases development costs and discourages smaller biotech firms from entering the field. Regulatory uncertainty surrounding safety and long-term efficacy further complicates market entry. Strengthening collaboration between regulators, pharmaceutical companies, and research institutions is essential to accelerate clinical success and bring effective therapies to patients faster.

Regional Analysis

North America

North America held the largest share of 39% in the dementia treatment market in 2024. The region’s dominance is driven by a high prevalence of Alzheimer’s disease, strong healthcare infrastructure, and early adoption of innovative therapies. The United States leads due to increased R&D investments, advanced diagnostic technologies, and favorable regulatory approvals for novel drugs. Canada also contributes through government-backed dementia strategies and public health programs promoting early intervention. Expanding insurance coverage, growing awareness campaigns, and rising use of biologics further strengthen North America’s leadership in the global dementia treatment market.

Europe

as Germany, France, and the United Kingdom lead in adopting advanced treatment options for Alzheimer’s and vascular dementia. The region benefits from government-funded dementia care initiatives and rising availability of specialized healthcare facilities. Increasing public awareness and accessibility to biomarker-based diagnostics enhance treatment adoption. Moreover, the European Union’s support for neurodegenerative disease research continues to drive innovation and clinical advancements in dementia therapeutics.

Asia-Pacific

Asia-Pacific captured a 22% share of the dementia treatment market in 2024 and remains the fastest-growing region. Rising geriatric populations in China, Japan, and India are fueling demand for dementia care solutions. Governments are investing in healthcare infrastructure, caregiver training, and early diagnosis programs. Growing pharmaceutical R&D and improving access to advanced therapeutics support regional expansion. Increasing collaborations between global drug manufacturers and local firms are accelerating the introduction of biologics and new treatments. The growing middle-class population and rising awareness of cognitive health further enhance dementia treatment adoption.

Latin America

Latin America held a 4% share of the dementia treatment market in 2024, driven by increasing awareness and healthcare investments. Countries such as Brazil and Mexico are expanding dementia care initiatives through national health programs and research funding. Rising elderly populations and growing access to affordable medications are supporting steady market growth. However, limited availability of specialized neurologists and diagnostic tools hinders early detection. Ongoing collaborations between healthcare providers and global pharmaceutical companies are improving access to advanced therapies and supporting long-term care solutions for dementia patients.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the dementia treatment market in 2024. The market is gaining traction due to rising life expectancy and growing healthcare modernization efforts. The United Arab Emirates and Saudi Arabia are leading with national dementia awareness campaigns and investments in specialized memory clinics. Africa is witnessing gradual progress through improved healthcare access and non-profit initiatives promoting dementia diagnosis. Despite challenges related to limited infrastructure and high treatment costs, government support and international partnerships are expected to enhance future market growth.

Market Segmentations:

By Indication

- Alzheimer’s Disease Dementia

- Vascular Dementia

- Lewy Body Dementia

- Others

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonist

- MAO Inhibitors

- Others

By Route of Administration

- Oral

- Transdermal Patch

- Injectable

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The dementia treatment market is highly competitive, with leading players including Biogen, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Novartis AG, Viatris Inc., Lundbeck, Cipla, Eli Lilly and Company, Eisai Co., Ltd., and DAIICHI SANKYO COMPANY, LIMITED. These companies focus on innovation in drug development, particularly targeting amyloid and tau protein pathways to slow disease progression. Strategic collaborations, mergers, and acquisitions are common as firms expand their neuroscience portfolios and strengthen global presence. Major players are investing in biomarker-based research and clinical trials to improve early diagnosis and personalized therapy options. Advancements in biologics and disease-modifying drugs have intensified competition, with companies racing to secure regulatory approvals for next-generation treatments. Additionally, the growing demand for cost-effective generics in emerging markets drives expansion strategies, while continuous investment in R&D and patient-centered care models ensures a sustainable competitive edge in the global dementia treatment landscape.

[cr_cta type=”customize_now“]

Key Player Analysis

- Biogen

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Viatris Inc.

- Lundbeck

- Cipla

- Eli Lilly and Company

- Eisai Co., Ltd.

- DAIICHI SANKYO COMPANY, LIMITED

Recent Developments

- In July 2025, Biogen and Eisai released four-year follow-up data showing Leqembi slowed Alzheimer’s progression, with patients maintaining improved cognitive scores by 1.01 points on the Clinical Dementia Rating-Sum of Boxes scale compared to untreated groups.

- In July 2024, Eli Lilly and Company gained U.S. FDA approval for Kisunla (donanemab-azbt), indicated for individuals with mild cognitive impairment or early symptomatic Alzheimer’s disease.

- In January 2024, Biogen announced the discontinuation of Aduhelm (aducanumab), formally ending commercial distribution and post-marketing studies by November 2024 to prioritize newer Alzheimer’s programs.

- In July 2023, Biogen and Eisai Co., Ltd. received full U.S. FDA approval for Leqembi® (lecanemab-irmb), marking a major advancement in Alzheimer’s disease treatment for patients in early stage

Report Coverage

The research report offers an in-depth analysis based on Indication, Drug Class, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for disease-modifying therapies will continue to rise as clinical research advances.

- Biologics and monoclonal antibodies targeting amyloid and tau proteins will gain wider adoption.

- Digital diagnostics and AI-based cognitive assessment tools will enhance early detection.

- Personalized medicine approaches will improve treatment effectiveness and patient outcomes.

- Public–private partnerships will expand funding for dementia research and care programs.

- Emerging markets will experience higher treatment adoption with better healthcare access.

- Governments will strengthen national dementia strategies and long-term care infrastructure.

- Pharmaceutical companies will increase collaboration to accelerate new drug approvals.

- Cost-effective generics and biosimilars will expand treatment accessibility worldwide.

- Integration of digital therapeutics and remote patient monitoring will redefine dementia care models.