Market Overview

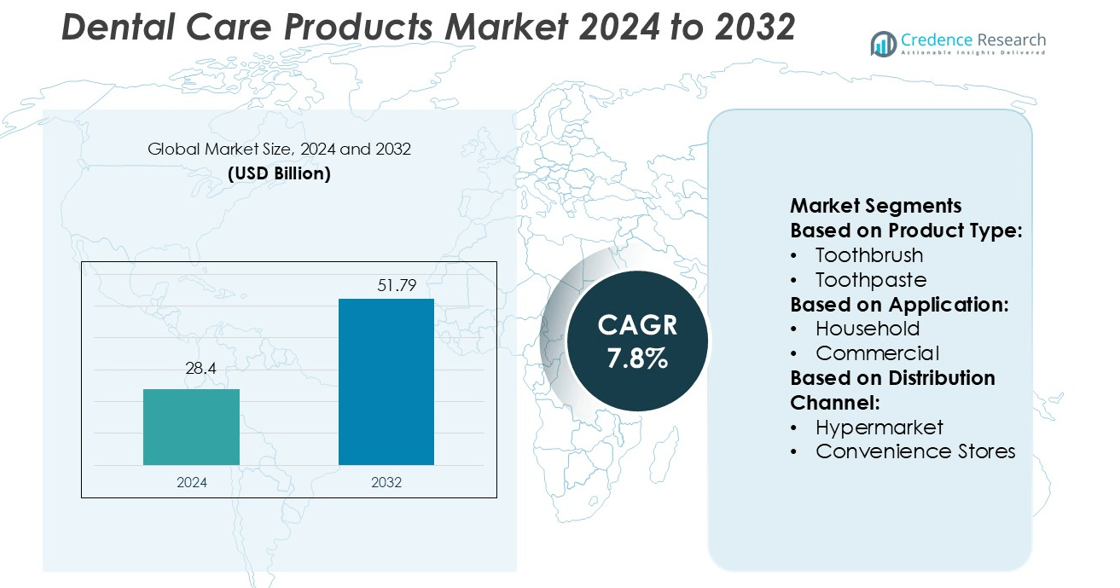

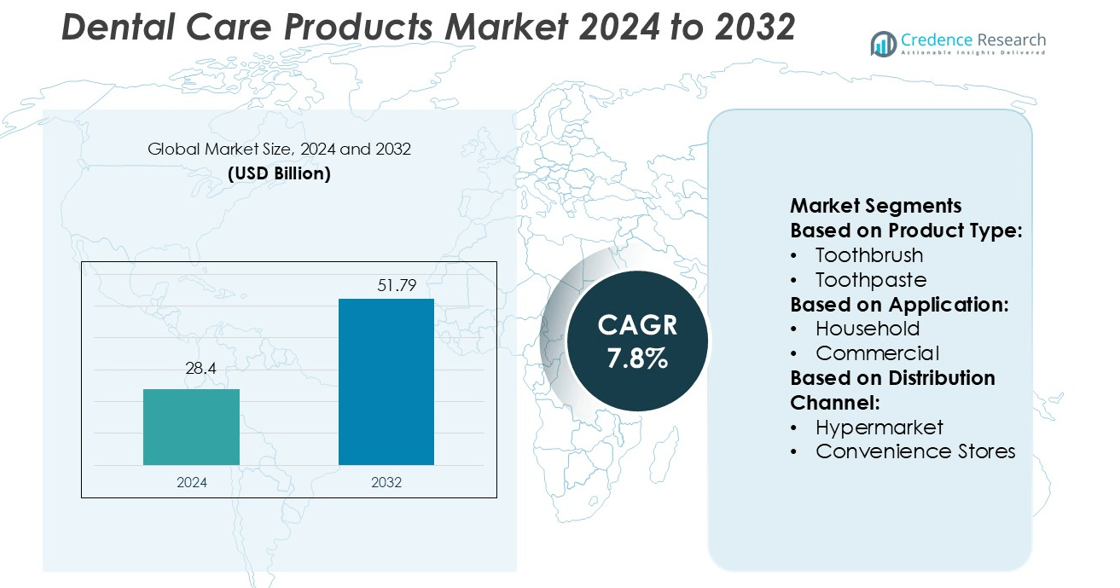

Dental Care Products Market size was valued USD 28.4 billion in 2024 and is anticipated to reach USD 51.79 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Care Products Market Size 2024 |

USD 28.4 billion |

| Dental Care Products Market, CAGR |

7.8% |

| Dental Care Products Market Size 2032 |

USD 51.79 billion |

The dental care products market is driven by major players including Lion Corporation, Unilever PLC, Sunstar Suisse S.A., Church & Dwight Co., Inc., GSK plc, GC Corporation, Procter & Gamble, Colgate-Palmolive Company, Henkel AG & Co. KGaA, and Johnson & Johnson Services, Inc. These companies focus on product innovation, sustainable packaging, and expansion through strong retail and e-commerce networks. They invest heavily in R&D to develop advanced formulations, smart oral care devices, and herbal-based solutions to meet rising consumer demand. Asia Pacific leads the global market with a 30.8% share, supported by growing oral hygiene awareness, rapid urbanization, and increasing middle-class spending power. Strategic product launches, brand collaborations, and digital marketing initiatives strengthen the competitive positioning of these players, ensuring steady market growth.

Market Insights

- The Dental Care Products Market was valued at USD 28.4 billion in 2024 and is projected to reach USD 51.79 billion by 2032, growing at a CAGR of 7.8%.

- Rising oral hygiene awareness, smart device adoption, and herbal-based formulations are driving strong product demand across both developed and emerging economies.

- Asia Pacific leads the market with a 30.8% share, supported by urbanization, growing middle-class spending, and expanding retail networks, followed by North America and Europe.

- Major players focus on innovation, sustainable packaging, and digital marketing strategies to strengthen competitiveness, with electric toothbrushes and whitening products holding the largest product segment share.

- High product pricing in premium categories and counterfeit product circulation remain key restraints, while strong regional investments and strategic collaborations are expected to sustain steady market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Toothpaste holds the dominant share of 42.3% in the dental care products market. Its strong position is driven by rising awareness of oral hygiene and the availability of fluoride-based and whitening variants. Toothpaste is an essential daily product, ensuring consistent and widespread consumer demand across all age groups. Manufacturers are focusing on advanced formulations, such as enamel repair and herbal blends, to strengthen product appeal. The increasing popularity of value-added toothpaste variants supports growth across both mature and emerging markets.

- For instance, Lion Corporation developed the CLINICA PRO plus Periodontal Barrier Toothpaste, which contains 1,450 ppm fluoride and stabilized β-Glycyrrhetinic acid at 0.3 mg/g, designed to prevent periodontal inflammation and strengthen enamel.

By Application

The household segment dominates the market with a 76.8% share. Its strong performance is supported by daily oral hygiene practices and high product consumption frequency. Growing health awareness, rising disposable incomes, and product innovation have further strengthened household demand. Easy availability through both offline and online channels boosts product penetration. Commercial use is expanding steadily in dental clinics and hospitals, driven by increased preventive dental care and professional cleaning services.

- For instance, Unilever’s Signal and Pepsodent toothpaste lines were reformulated into 100% recyclable high-density polyethylene (HDPE) tubes, enabling recycling through standard HDPE streams.

By Distribution Channel

Hypermarkets and supermarkets lead the distribution channel with a 38.6% market share. Their wide product variety, attractive pricing, and strong in-store promotions support large-scale sales. Consumers prefer these retail formats for bulk purchases and trusted brands. Convenience stores also play a key role in immediate or smaller purchases, particularly in urban areas. Online channels are growing fast due to subscription services and doorstep delivery, increasing accessibility for both urban and rural customers.

Key Growth Drivers

Rising Oral Hygiene Awareness

Growing awareness of oral hygiene is driving product adoption across both urban and rural areas. Governments and health organizations are running large-scale campaigns to promote brushing and mouth care. Increased education about gum diseases and cavity prevention is influencing consumers to purchase more dental products. In addition, pediatric dental care programs are boosting early adoption habits among children. Improved accessibility through pharmacies, retail chains, and e-commerce further supports market expansion.

- For instance, Sunstar GUM® Virtual Care partnership with Dentistry.One enables users to submit photos for AI analysis in under 1 minute; the system flags plaque, inflammation, or crowding.

Increasing Product Innovation and Launches

Manufacturers are introducing advanced dental care solutions with improved formulas and smart features. Whitening toothpaste, herbal-based products, and electric toothbrushes are gaining strong traction among consumers. Smart oral care devices with Bluetooth connectivity are also supporting better hygiene tracking. These innovations enhance product performance and convenience. Continuous R&D investments by leading brands strengthen consumer trust and accelerate market penetration.

- For instance, GSK holds a 55% equity stake in Galvani Bioelectronics, which develops implantable bioelectronic devices; one device was implanted successfully in a patient.

Growing Dental Problem Incidence

A steady rise in dental problems such as cavities, gum diseases, and sensitivity is boosting product consumption. Unhealthy diets, high sugar intake, and smoking habits are increasing the need for daily oral care. Rising dental visits and preventive treatments also support sustained product demand. This growth is further strengthened by aging populations and lifestyle-related oral conditions, creating strong opportunities for both traditional and premium product lines.

Key Trends & Opportunities

Expansion of E-commerce and Digital Platforms

Online sales channels are rapidly becoming a key growth avenue for dental care products. E-commerce platforms offer convenience, wider product access, and attractive discounts, driving higher purchase frequency. Subscription-based oral care boxes are gaining popularity, especially among young consumers. Digital promotions and influencer marketing are also improving product visibility. This shift allows manufacturers to reach broader audiences without heavy investment in physical retail.

- For instance, GC states it offers over 600 dental products via its online catalogs in more than 100 countries, supporting direct B2B e-orders. GC America’s education center supports online training: it houses 16 fully equipped workstations to run hybrid digital-offline training sessions for dentists.

Rising Preference for Natural and Sustainable Products

Consumers are increasingly favoring eco-friendly and chemical-free dental care solutions. Demand for herbal toothpaste, bamboo toothbrushes, and recyclable packaging is expanding. Manufacturers are reformulating products to remove harmful ingredients like parabens and sulfates. This trend aligns with broader sustainability goals and brand reputation strategies. Companies investing in green formulations are gaining a competitive edge in mature and emerging markets.

- For instance, Henkel’s Greenville, South Carolina adhesives plant saves about 30,000 gallons of water and reduces 56 tons of waste annually by process optimizations under its “No Waste” initiative.

Integration of Smart Oral Care Technology

Technology adoption in oral care is creating new opportunities for connected products. Smart toothbrushes with AI-driven tracking features help users improve brushing habits. Real-time feedback, mobile apps, and personalized recommendations enhance user experience. These innovations appeal to tech-savvy consumers and health-conscious households. Partnerships between dental product manufacturers and technology firms are expanding this segment further.

Key Challenges

High Product Price and Limited Affordability

Premium dental care products, including electric toothbrushes and specialized mouthwashes, are often expensive. This limits adoption in price-sensitive markets, especially in low- and middle-income regions. The high cost of advanced technologies also restricts mass penetration. Manufacturers must balance innovation with pricing strategies to make products accessible to wider demographics.

Intense Competition and Counterfeit Products

The dental care market faces strong competition from both global and regional brands. Price wars and similar product offerings make differentiation difficult. Additionally, the rise of counterfeit dental products affects brand reputation and consumer trust. These fake products often bypass quality checks, creating health risks and regulatory challenges for legitimate companies.

Regional Analysis

North America

North America holds a 31.4% share of the global dental care products market. High oral hygiene awareness, strong insurance coverage, and advanced dental infrastructure drive product demand. Consumers in the U.S. and Canada show strong preference for premium oral care solutions such as whitening toothpaste, electric toothbrushes, and mouthwash. Preventive oral health programs by dental associations further boost product penetration. Strong retail networks and e-commerce platforms enhance accessibility. Major brands continue expanding product portfolios in this region, supported by innovation and high per capita healthcare spending.

Europe

Europe accounts for a 27.6% share of the global market, driven by robust oral care awareness and strict regulatory standards. Countries like Germany, the UK, and France have well-established dental hygiene practices and high adoption of specialized products. Sustainable and eco-friendly products are gaining strong traction due to strict EU packaging and ingredient regulations. Preventive dental programs and reimbursement policies support steady market expansion. Digital oral care tools and connected devices are increasingly adopted. Strong presence of international brands and organized retail channels further strengthen market growth.

Asia Pacific

Asia Pacific leads the global dental care products market with a 30.8% share. Rapid urbanization, growing middle-class income, and increased awareness of oral hygiene are key drivers. India, China, and Japan represent major markets with rising consumption of toothpaste, toothbrushes, and mouthwash. Expanding retail and online channels enhance product availability across urban and semi-urban areas. International brands are entering the region through strategic partnerships and localized offerings. Government health campaigns and school dental programs further boost product adoption, particularly in developing economies with growing healthcare access.

Latin America

Latin America represents a 6.5% share of the dental care products market. Brazil, Mexico, and Argentina lead the region with rising awareness of preventive oral care. Urbanization and expanding retail networks are improving product accessibility. Economic growth is driving demand for affordable oral hygiene products. However, premium product penetration remains limited due to price sensitivity. Manufacturers are focusing on value-based products and targeted promotional campaigns. Increasing dental health initiatives and expanding e-commerce platforms are expected to support steady market growth in the coming years.

Middle East & Africa

The Middle East & Africa holds a 3.7% share of the global dental care products market. Growing healthcare investments, urbanization, and rising oral care awareness are contributing to gradual market growth. GCC countries such as the UAE and Saudi Arabia are key revenue contributors. Expansion of pharmacy chains and modern retail stores is improving product accessibility. However, low awareness in rural regions and limited dental infrastructure remain key barriers. International companies are strengthening their distribution networks to capture growing demand in emerging markets across this region.

Market Segmentations:

By Product Type:

By Application:

By Distribution Channel:

- Hypermarket

- Convenience Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dental care products market is shaped by key players such as Lion Corporation, Unilever PLC, Sunstar Suisse S.A., Church & Dwight Co., Inc., GSK plc, GC Corporation, Procter & Gamble, Colgate-Palmolive Company, Henkel AG & Co. KGaA, and Johnson & Johnson Services, Inc. The competitive landscape of the dental care products market is defined by strong brand positioning, continuous innovation, and expanding distribution networks. Companies focus on developing advanced formulations, sustainable packaging, and smart oral care technologies to meet evolving consumer preferences. Strategic investments in digital marketing and e-commerce platforms enhance global reach and strengthen customer engagement. Many players are diversifying product portfolios with herbal and fluoride-free options to capture niche segments. Innovation in electric toothbrushes, whitening solutions, and connected devices is intensifying competition. Strong retail partnerships, brand loyalty, and R&D capabilities play a crucial role in maintaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lion Corporation

- Unilever PLC

- Sunstar Suisse S.A.

- Church & Dwight Co., Inc.

- GSK plc

- GC Corporation

- Procter & Gamble

- Colgate-Palmolive Company

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

Recent Developments

- In February 2025, Dentsply Sirona announced the launch of MIS LYNX in the US market, an affordable dental implant solution created by MIS Implants Technologies. The companies state that MIS LYNX is a dependable option for various clinical applications.

- In October 2024, Integral Dental has announced the launch of its first product, OraclePI, the only early diagnostic test for peri-implant disease. This test provides a personalized care plan and disease diagnosis recommendations based on patient-centric data.

- In February 2024, ZimVie Inc. launched TSX® Implant in Japan. The launch of TSX in Japan allows the company to compete head-to-head with premium market leaders in the dental implant space.

- In January 2024, Align Technology, Inc. announced the launch of iTero Lumina intraoral scanner with a 3X wider field of capture in a 50% smaller and 45% lighter wand to deliver faster scanning speed, superior visualization, higher accuracy, and a more comfortable scanning experience.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and sustainable oral care products will continue to grow globally.

- Smart toothbrushes and connected devices will gain wider consumer adoption.

- E-commerce platforms will play a larger role in product distribution.

- Companies will focus more on personalized and targeted oral care solutions.

- Preventive dental care awareness campaigns will boost daily oral hygiene product use.

- Advanced formulations will drive product differentiation and brand loyalty.

- Emerging markets will become major growth hubs for mass and premium products.

- Strategic partnerships and acquisitions will expand market reach and portfolios.

- Regulatory standards on ingredients and packaging will shape product development.

- Digital marketing and subscription models will strengthen customer retention.