Market Overview:

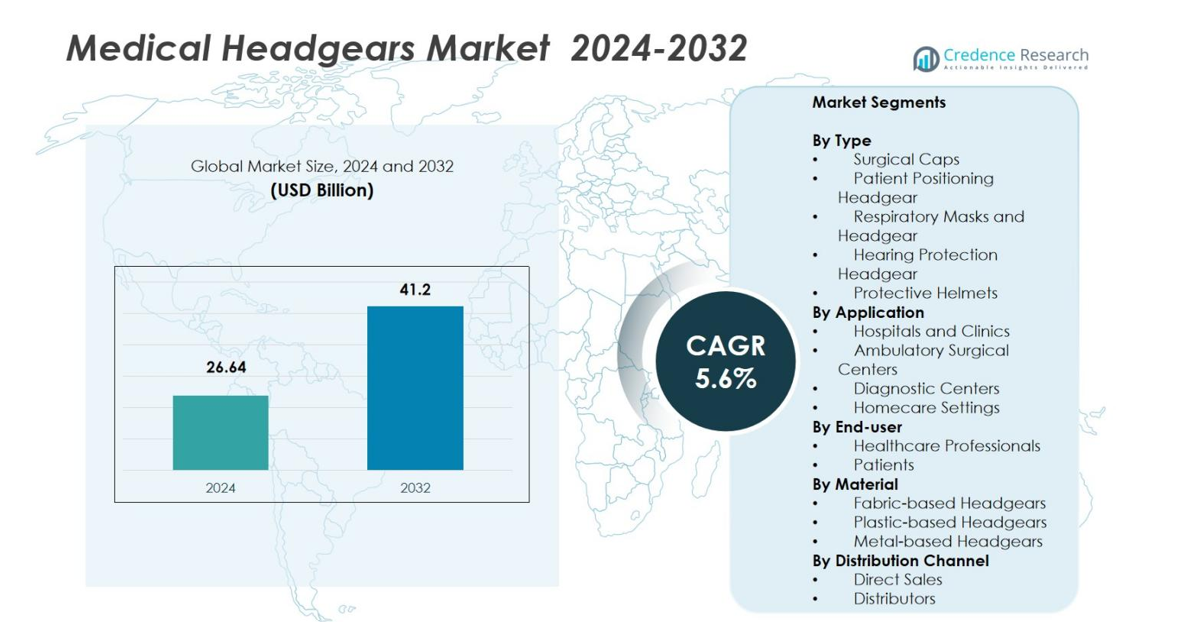

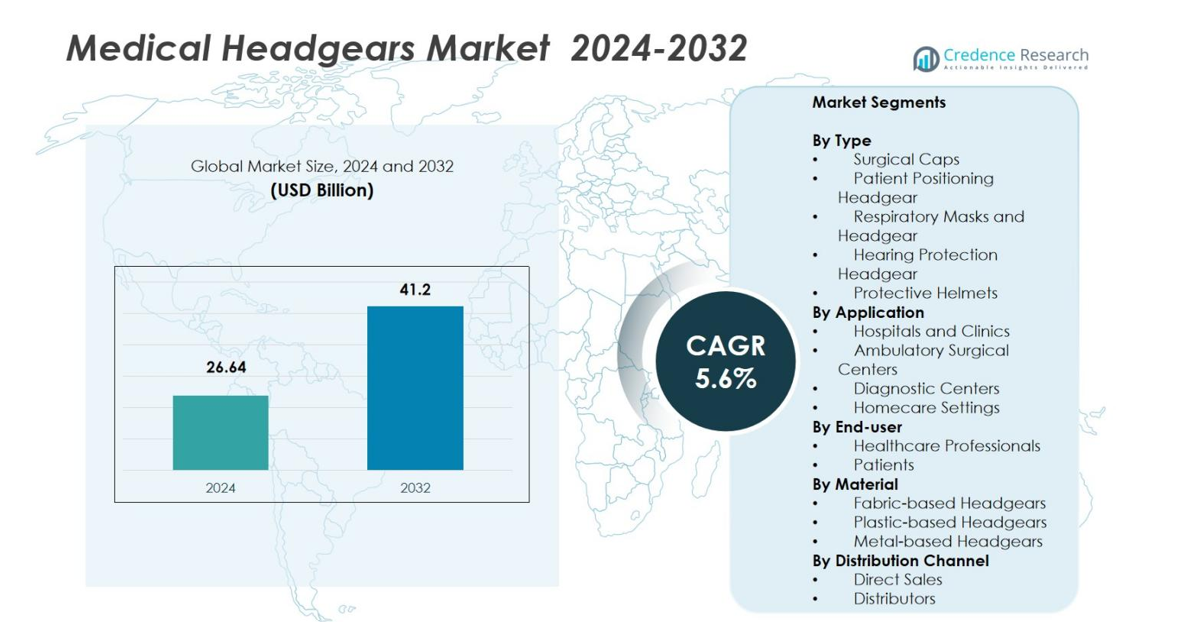

The Medical Headgears Market size was valued at USD 26.64 Billion in 2024 and is anticipated to reach USD 41.2 Billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Headgears Market Size 2024 |

USD 26.64 Billion |

| Medical Headgears Market, CAGR |

5.6% |

| Medical Headgears Market Size 2032 |

USD 41.2 Billion |

Medical Headgears Market features top players such as 3M Company, Honeywell International Inc., Ansell Limited, E I DuPont de Nemours and Company, MSA Safety Incorporated, Kimberly‑Clark Corporation, Lakeland Industries, Inc., Alpha Pro Tech, Ltd., Radians, Inc., and Delta Plus Group. North America leads the global market with a share of 40.00 %, supported by mature healthcare infrastructure and stringent safety regulations. Europe follows with a share of 28.00 %, driven by well‑established healthcare systems and strong regulatory frameworks. Asia Pacific accounts for 25.00 % of the market and represents a high‑growth region due to expanding healthcare infrastructure and rising demand for headgear in emerging economies. Latin America and the combined Middle East & Africa hold smaller proportions but present incremental opportunities as healthcare access improves globally.

Market Insights

- The Medical Headgears Market size was valued at USD 26.64 Billion in 2024 and is projected to reach USD 41.2 Billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Rising healthcare awareness and increasing surgical procedures globally are significant drivers, pushing demand for medical headgears across hospitals and clinics.

- Technological advancements in medical headgear, such as smart respiratory masks and improved filtration systems, are key trends that enhance product offerings and functionality.

- North America holds the largest share at 40.00%, followed by Europe at 28.00% and Asia Pacific at 25.00%, with emerging markets in Latin America and the Middle East offering potential for growth.

- High cost of advanced headgear and issues with comfort and fit remain key challenges, which may limit widespread adoption in smaller healthcare settings and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Within the “By Type” segmentation of the Medical Headgears Market, Respiratory Masks and Headgear lead with a 42.00 % market share. This dominance stems from heightened demand for respiratory protection across hospitals and clinics, driven by stringent infection‑control protocols, rising incidence of airborne diseases, and ongoing concerns around respiratory pathogens. Surgical Caps follow at 20.00 %, Patient Positioning Headgear at 15.00 %, Hearing Protection Headgear at 12.00 %, and Protective Helmets at 11.00 %. Growth for respiratory headgear is further bolstered by increasing adoption in emergency response and intensive care settings.

- For instance, 3M produces N95 respirators with advanced headgear straps designed for secure fit during prolonged hospital use in infection-prone environments.

By Application

Under “By Application,” Hospitals and Clinics represent the dominant sub‑segment with a 50.00 % share of the total market. This prominence reflects the continuous demand for headgear—such as surgical caps, respiratory masks, and protective helmets—to ensure sterile operating environments and safeguard healthcare workers during routine and emergency procedures. Ambulatory Surgical Centers control 20.00 %, Diagnostic Centers 15.00 %, and Homecare Settings 15.00 %. Rising inpatient admissions, expansions of hospital infrastructure, and mandatory regulatory compliance for healthcare facilities contribute strongly to growth in this segment.

By End‑user

In the “By End‑user” segmentation, Healthcare Professionals dominate with a 60.00 % share of the market. Their predominant use of headgear—including surgical, respiratory, and protective varieties—occurs due to occupational health requirements, mandated personal protective equipment (PPE) standards, and heightened awareness around workplace safety. Patients account for the remaining 40.00 %, primarily utilizing headgear for at‑home care or outpatient procedures. The professional group’s continuous, high‑volume consumption of disposables and reusable headgear forms the central growth driver in this segment.

- For instance, Medline Industries manufactures millions of disposable surgical caps annually for hospitals adhering to infection control protocols.

Key Growth Drivers

Rising Healthcare Awareness and Safety Standards

As healthcare awareness increases globally, stringent safety standards for medical professionals and patients continue to drive the demand for medical headgears. Health institutions are placing greater emphasis on protective gear to prevent infections, enhance workplace safety, and ensure optimal patient outcomes. Regulations and guidelines mandating the use of surgical caps, masks, and headgear in operating rooms and patient care areas further contribute to market growth. Hospitals and clinics, in particular, are expanding their usage of medical headgear, fostering the demand for more advanced and specialized products.

- For instance, Meridian Medical collaborated with a leading medical device company to design and manufacture an innovative surgical retractor system that exceeded expectations in safety and usability.

Increased Surgical Procedures and Inpatient Admissions

The growing volume of surgical procedures and rising inpatient admissions are major drivers of the medical headgear market. With an increasing global population and a higher prevalence of chronic conditions, more surgeries and treatments are being performed, requiring protective headgear. The rise in surgeries, especially those in emergency care and intensive care units, demands headgear solutions like surgical caps and respiratory masks. This growing surgical volume directly translates into increased demand for safety equipment designed for healthcare workers and patients in critical environments.

- For instance, the Lancet Commission reported that the unmet need for surgery globally reached at least 160 million operations per year in 2025, underscoring the vast requirement for surgical caps and masks in operating rooms.

Technological Advancements in Medical Headgear

Technological innovations in the design and functionality of medical headgear are spurring market growth. Modern medical headgear incorporates advanced materials, such as breathable fabrics for comfort, as well as antimicrobial coatings to ensure higher levels of hygiene. Innovations like disposable surgical caps and masks with enhanced filtration capabilities, as well as integrated respiratory protection systems, offer both healthcare professionals and patients superior safety. These technological advancements help meet the increasing demand for high-performance medical headgear in both clinical and at-home care settings.

Key Trends & Opportunities

Integration of Smart Technologies in Medical Headgear

A key trend in the medical headgear market is the integration of smart technologies into protective headgear. Smart respiratory masks with built-in sensors and monitoring systems that track air quality, breathing patterns, and oxygen levels are gaining popularity, particularly in hospitals and ambulatory settings. These innovations offer real-time data for healthcare professionals, improving patient care and workflow efficiency. As the demand for personalized healthcare solutions grows, integrating smart capabilities into headgear provides significant opportunities for market expansion and the development of high-tech medical safety solutions.

- For instance, 3M’s powered air-purifying respirators (PAPRs) incorporate airflow and filter status sensors to ensure optimal respiratory protection during long procedures.

Growth of Homecare and Ambulatory Surgical Centers

The increasing preference for homecare and the expansion of ambulatory surgical centers (ASCs) present significant opportunities for the medical headgear market. As patients increasingly seek non-hospitalized treatment options and home-based healthcare services, there is a growing need for medical headgear in these settings. The use of headgear for procedures performed outside traditional healthcare facilities, such as in-home care and outpatient surgeries, is on the rise. This trend offers a promising growth trajectory for headgear manufacturers, especially for products designed for homecare professionals and outpatient surgery settings.

- For instance, companies manufacturing chemo patient hats, such as FocusCare, offer lightweight, comfortable headgear tailored for homecare patients undergoing treatment, reflecting the trend toward non-hospitalized care requiring specialized headgear products.

Key Challenges

High Cost of Advanced Medical Headgear

A major challenge for the medical headgear market is the high cost of advanced protective headgear, especially those incorporating smart technology or specialized features. The expense of manufacturing high-quality, technologically advanced headgear can be prohibitive for many healthcare providers, particularly in developing regions with limited budgets. As medical headgear becomes more advanced and specialized, the cost factor could restrict its adoption, particularly in smaller clinics, homecare settings, or in regions with lower healthcare spending.

Concerns Regarding Comfort and Fit

Despite advancements in materials and design, comfort and fit remain persistent challenges in the medical headgear market. Healthcare professionals, particularly those working long shifts, often face discomfort due to poorly designed headgear that may not fit properly, leading to physical strain. Similarly, patients undergoing extended treatments may experience discomfort with certain types of headgear, reducing compliance. Manufacturers need to balance functionality with comfort to ensure widespread adoption of medical headgear solutions across both healthcare professionals and patients.

Regional Analysis

North America

North America holds a commanding position in the global medical headgears market, with a market share of 40.00%. The region benefits from advanced healthcare infrastructure, high per‑capita healthcare expenditure, and stringent regulatory mandates that emphasize the use of protective headgear in hospitals and clinics. Widespread adoption of personal protective equipment (PPE) standards by healthcare institutions and frequent updates to infection‑control protocols drive steady demand. Growth is further reinforced by a robust base of private and public hospitals, rising surgical procedures, and strong procurement budgets, making North America a stable and mature market.

Europe

Europe commands a substantial portion of the medical headgears market, with a share of 28.00%. The region’s well‑established healthcare systems, robust regulatory frameworks, and emphasis on worker and patient safety underpin this share. An aging population and increased demand for surgical interventions and respiratory care support continuous consumption of headgear products such as surgical caps, respiratory masks, and protective helmets. Additionally, growing public awareness about infection prevention and compliance with health standards in clinics and diagnostic centers sustain steady market performance across Western and Eastern European countries.

Asia Pacific

Asia Pacific holds a 25.00% share of the medical headgears market and represents the fastest‑growing region globally. This growth is driven by rising investments in healthcare infrastructure, increasing number of hospitals and ambulatory centers, and expanding access to medical care in emerging economies. Rising medical tourism, higher surgical volumes, and growing awareness around hygiene and safety standards further fuel demand. Rapid urbanization, expanding middle‑class populations, and increasing government healthcare expenditure in countries such as China and India support accelerating adoption of medical headgear across hospitals, diagnostic centers, and homecare settings.

Latin America (South & Central America)

The Latin America region accounts for 5.00% of the global medical headgears market. Adoption levels remain moderate due to variable healthcare infrastructure across countries and limited per‑capita expenditure in certain economies. However, demand for basic headgear such as surgical caps and masks persists, especially in urban hospitals and private clinics. Gradual improvements in public healthcare systems, increased focus on infection control, and growing investments in medical infrastructure present potential for gradual expansion. As healthcare access improves in major urban centers, Latin America may see incremental uptake of medical headgear solutions.

Middle East & Africa (MEA)

Middle East & Africa contribute 2.00% to the global medical headgears market. The region displays uneven growth, influenced by disparities in healthcare infrastructure and economic conditions across countries. In urban areas and major healthcare hubs, demand arises from hospitals and clinics upgrading PPE standards, driven by government initiatives and rising patient volumes. However, many regions continue to use basic headgear, limiting demand for more advanced or specialized products. Continued investment in healthcare modernization and regulatory improvements offer opportunities — but market growth remains gradual and dependent on improvements in overall healthcare access and funding.

Market Segmentations:

By Type

- Surgical Caps

- Patient Positioning Headgear

- Respiratory Masks and Headgear

- Hearing Protection Headgear

- Protective Helmets

By Application

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Homecare Settings

By End-user

- Healthcare Professionals

- Patients

By Material

- Fabric-based Headgears

- Plastic-based Headgears

- Metal-based Headgears

By Distribution Channel

- Direct Sales

- Distributors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global medical headgears market features leading players such as 3M Company, Honeywell International Inc., E I DuPont de Nemours and Company, Ansell Limited, MSA Safety Incorporated, Kimberly‑Clark Corporation, Lakeland Industries, Inc., Alpha Pro Tech, Ltd., Delta Plus Group, and Radians, Inc. These companies maintain strong market positions through broad product portfolios, robust distribution channels, and ongoing product innovations. Research and development investments focus on enhancing product quality, particularly in areas like filtration efficiency, comfort, and compliance with evolving safety regulations. Competitive strategies include frequent product launches, partnerships, and expanding into emerging markets to capture growing demand. Companies differentiate themselves with advanced materials, customization options, and products tailored for specific applications, such as surgical procedures or homecare settings. However, regional and cost-effective manufacturers—particularly in Asia Pacific—continue to drive competitive pressures, prompting industry leaders to innovate and optimize their supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Ansell Limited

- E I DuPont de Nemours and Company

- Kimberly‑Clark Professional

- Alpha Pro Tech, Ltd.

- Lakeland Industries, Inc.

- Moldex‑Metric, Inc.

- Radians, Inc.

Recent Developments

- In May 2025, Protective Industrial Products, Inc. (PIP) completed the acquisition of the PPE business of Honeywell International Inc. a move that may reshape supply‑chain dynamics and global distribution for medical headgear and PPE products.

- In October 2025, 3M launched upgrades to its “Aura™ Particulate Respirator 9300+ Series,” enhancing materials and design to improve comfort and protection reinforcing its position in the respirator and headgear segment.

- In November 2025, Clyype introduced a new combined medical helmet and respiratory‑protection system for use in healthcare settings, marking a technological evolution in headgear design.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing prevalence of infectious diseases globally will boost demand for medical headgears as healthcare institutions strengthen infection‑control protocols, driving consistent market expansion.

- Rising number of surgical procedures and expanding healthcare infrastructure — including hospitals, clinics, ambulatory centers, and home‑care setups — will broaden the user base for headgear solutions across diverse care settings.

- Increasing regulatory focus on occupational safety and hygiene standards will enforce greater adoption of headgear among healthcare professionals, elevating baseline demand even outside crisis periods.

- Growth in emerging economies and expanding access to quality healthcare in regions such as Asia‑Pacific will present new high‑potential markets for headgear manufacturers.

- Rising investments in R&D will enable development of advanced headgear comfortable, ergonomic, and high‑performance which will encourage broader adoption among healthcare providers.

- Increasing emphasis on preparedness for pandemics, outbreaks, and hospital‑acquired infections will sustain heightened demand for headgear as part of standard PPE kits in healthcare institutions worldwide.

- Growing trend toward homecare and outpatient care settings offers opportunities for headgear products tailored for non‑hospital environments, expanding end‑user segments beyond traditional hospitals.

- Expansion of smart and technologically enhanced PPE including headgear with improved filtration, fit, comfort, and potentially sensor integration will drive differentiation and attract premium customers.

- Increasing collaboration between PPE manufacturers and healthcare providers or regulatory bodies will streamline product standards and distribution, facilitating market penetration and scale‑up.

- Rising awareness among patients about hygiene and safety particularly in post‑pandemic context will expand demand for headgear not only from professionals but also from patients, supporting market growth across multiple end‑user segments.