Market overview

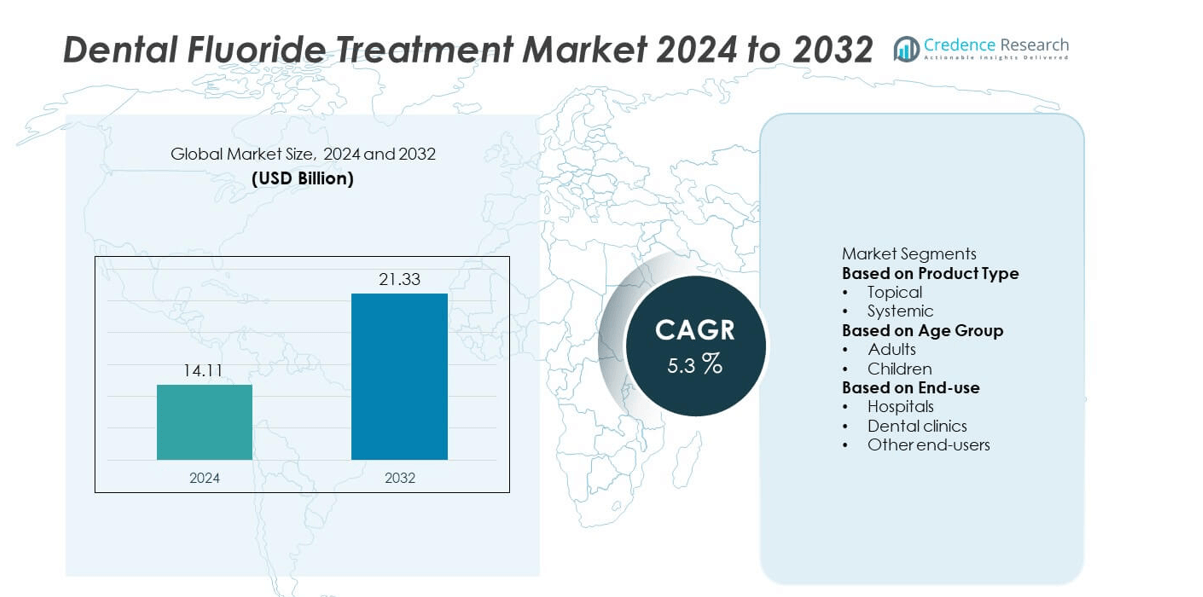

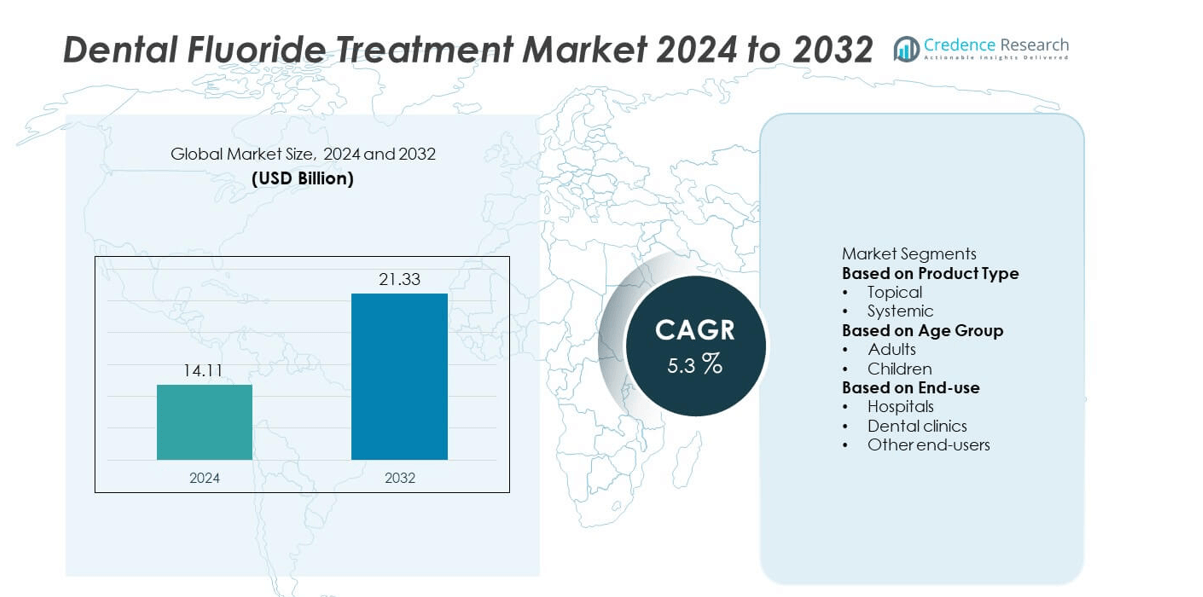

The Dental Fluoride Treatment market was valued at USD 14.11 billion in 2024 and is projected to reach USD 21.33 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Fluoride Treatment Market Size 2024 |

USD 14.11 billion |

| Dental Fluoride Treatment Market, CAGR |

5.3% |

| Dental Fluoride Treatment Market Size 2032 |

USD 21.33 billion |

The dental fluoride treatment market is led by major players such as Dentsply Sirona Inc., Colgate-Palmolive Company, GC International AG, Ivoclar Vivadent, and KaVo Dental. These companies dominate through innovation in preventive oral care products and global distribution strength. North America leads the market with a 38% share, driven by strong dental awareness, advanced treatment infrastructure, and widespread use of fluoride varnishes and gels. Europe follows with 31%, supported by preventive dental programs and high adoption of professional fluoride treatments. Asia-Pacific holds a 24% share, emerging as the fastest-growing region due to rising dental care awareness, expanding healthcare access, and increasing focus on pediatric oral health.

Market Insights

- The dental fluoride treatment market was valued at USD 14.11 billion in 2024 and is projected to reach USD 21.33 billion by 2032, expanding at a CAGR of 5.3%.

- Increasing focus on preventive oral care and growing prevalence of dental caries are driving demand for fluoride-based treatments across hospitals and dental clinics.

- The market trend shows growing use of fluoride varnishes and gels, supported by advancements in professional dental care and home-based oral hygiene products.

- Key players such as Dentsply Sirona Inc., Colgate-Palmolive Company, and GC International AG lead through product innovation and global expansion strategies.

- North America holds a 38% share, followed by Europe at 31% and Asia-Pacific at 24%, while the topical fluoride segment dominates with a 64% share due to its effectiveness in cavity prevention and ease of application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The topical segment dominated the dental fluoride treatment market in 2024 with a 63% share. Topical products, including gels, varnishes, and rinses, are preferred due to their direct application, quick action, and higher fluoride concentration, which help prevent tooth decay effectively. Rising demand for professional fluoride varnishes in dental clinics and the increasing availability of over-the-counter topical solutions support growth. The systemic segment, including tablets and supplements, remains relevant in pediatric and community dental care programs, particularly in regions with limited fluoride water access.

- For instance, Dentsply Sirona Inc. introduced its Nupro White Varnish line with a 5% sodium fluoride formulation delivering 20,400 µg/g fluoride release in the first two hours. Clinical studies across 65 dental practices confirmed consistent fluoride ion diffusion into enamel layers, strengthening tooth resistance to demineralization while reducing chair time for professional applications.

By Age Group

The adults segment held the largest share of 58% in the dental fluoride treatment market in 2024. High consumption of sugary foods, alcohol, and tobacco products has increased susceptibility to dental decay among adults, driving treatment adoption. Preventive dental care programs and cosmetic dentistry trends also contribute to this dominance. However, the children segment is expanding rapidly due to growing awareness of early oral health management and school-based preventive fluoride programs supported by government health initiatives in developing regions.

- For instance, the Colgate-Palmolive Company, in partnership with the UK’s public health initiative, committed to delivering millions of toothbrushing products over a five-year period to support a supervised toothbrushing program in early years settings. This program aims to improve pediatric oral health outcomes and is projected to reach hundreds of thousands of children each year.

By End-use

The dental clinics segment accounted for a 49% share of the dental fluoride treatment market in 2024, leading due to the wide availability of professional fluoride applications such as gels, foams, and varnishes. Clinics provide personalized care and preventive maintenance, making them the preferred setting for fluoride therapy. Hospitals follow, driven by advanced oral health infrastructure and increasing integration of fluoride treatments in routine dental checkups. The “other end-users” category, including community health centers and academic institutions, is also witnessing steady growth through awareness campaigns and public oral health initiatives.

Key Growth Drivers

Increasing Prevalence of Dental Caries

Rising incidences of dental caries globally are driving the demand for fluoride-based preventive treatments. Poor dietary habits, sugar consumption, and inadequate oral hygiene contribute significantly to tooth decay. Fluoride treatments strengthen enamel, reduce bacterial activity, and help prevent cavities. Growing awareness about oral health among both adults and children supports consistent product adoption. Public health programs promoting community-level fluoride use, especially in developing regions, further enhance treatment accessibility and drive sustained market expansion.

- For instance, GC Corporation, a prominent dental manufacturer with a long-standing presence in Japan, developed the MI Varnish product containing RECALDENT™ (CPP-ACP) and fluoride, which has been the subject of various clinical studies confirming its effectiveness in caries prevention and enhancing enamel acid resistance.

Growing Awareness and Preventive Dental Care Initiatives

The expansion of preventive dental care programs is a key growth driver for the dental fluoride treatment market. Governments and healthcare organizations are promoting oral health awareness through educational campaigns and subsidized fluoride applications. Dental clinics and schools are incorporating preventive care routines to reduce long-term dental complications. Increased dental insurance coverage and accessible fluoride-based products have strengthened consumer trust and adoption. This growing focus on preventive oral care continues to shape a robust demand outlook for fluoride treatments worldwide.

- For instance, Church & Dwight Co., Inc. markets its Arm & Hammer DentalCare fluoride products in North America, integrating its oral care product lines into public awareness initiatives on preventative hygiene.

Technological Advancements in Fluoride Formulations

Advancements in fluoride technology are improving treatment efficiency, safety, and patient comfort. New formulations such as slow-release fluoride varnishes and nano-fluoride gels enhance remineralization while minimizing fluoride toxicity. Manufacturers are developing products tailored to specific age groups and dental conditions, boosting market diversification. The integration of biocompatible materials and long-lasting coatings increases product efficacy in both professional and home-use applications. These innovations are setting new standards for preventive dentistry and expanding the role of fluoride treatments in comprehensive oral care solutions.

Key Trends & Opportunities

Rising Demand for Cosmetic and Preventive Dentistry

Growing emphasis on aesthetic oral health is driving demand for cosmetic and preventive dental procedures. Patients increasingly prefer fluoride-based treatments that not only prevent decay but also maintain natural enamel appearance. Integration of fluoride applications in routine dental cleanings and whitening procedures enhances market opportunities. The trend toward preventive care in cosmetic dentistry is also supported by growing disposable incomes and awareness of oral aesthetics, especially among younger populations in urban areas.

- For instance, Ivoclar Vivadent introduced its OptraGloss System, a universal polishing system with a high diamond concentration that is used in dental practices. It provides high-gloss polishing for ceramic restorations in two steps and for composite resin fillings in one step.

Expansion of Pediatric Dental Care Services

The pediatric segment presents strong growth opportunities in the dental fluoride treatment market. Rising awareness about early childhood caries prevention and the inclusion of fluoride varnish applications in routine pediatric visits are key drivers. Governments and NGOs are launching school-based oral health programs to promote fluoride use among children. Manufacturers are introducing child-friendly formulations and flavors to improve compliance. This expanding focus on pediatric dental health strengthens the market’s foundation for long-term preventive care adoption.

- For instance, DMG Dental-Material GmbH markets its Fluor Protector S varnish, which has been shown in various studies to increase fluoride uptake in tooth enamel, enhancing protection against demineralization and supporting oral health.

Key Challenges

Potential Health Risks from Excessive Fluoride Exposure

Excessive fluoride intake can lead to dental fluorosis and, in severe cases, skeletal fluorosis, raising health and regulatory concerns. Inconsistent fluoride concentration in water supplies and overuse of fluoride products pose safety challenges. Public misconceptions about fluoride toxicity also affect adoption rates. Manufacturers and healthcare authorities must ensure accurate dosage and patient education to maintain consumer confidence. Balancing fluoride’s preventive benefits with safety standards remains a critical challenge for global market growth.

High Cost of Professional Treatments and Limited Access in Low-Income Regions

The high cost of professional fluoride treatments and limited dental infrastructure in developing regions restrict widespread adoption. Many populations in low-income countries lack access to dental clinics offering fluoride applications. The absence of insurance coverage for preventive care further limits patient participation. Additionally, rural communities face shortages of trained dental professionals. Expanding low-cost fluoride programs and mobile dental services will be essential to overcoming these accessibility and affordability barriers in the global market.

Regional Analysis

North America

North America held the largest share of 38% in the dental fluoride treatment market in 2024. The region’s dominance is supported by a high prevalence of dental caries, advanced oral care infrastructure, and widespread preventive dental programs. The United States leads the market due to government-backed fluoride initiatives, insurance coverage for preventive dentistry, and strong consumer awareness. Canada also contributes significantly, driven by community fluoridation programs and access to professional fluoride treatments. Ongoing technological advancements and the presence of leading dental product manufacturers continue to strengthen North America’s leadership position in global fluoride treatment adoption.

Europe

Europe accounted for 31% of the dental fluoride treatment market in 2024, driven by robust public health programs and rising emphasis on preventive dental care. Countries such as Germany, the United Kingdom, and France are major contributors due to high oral health awareness and supportive government initiatives. Widespread implementation of water fluoridation and availability of advanced fluoride varnishes enhance treatment accessibility. The region’s strong focus on dental research, coupled with expanding pediatric care services, supports market growth. Moreover, the integration of fluoride treatments into national dental health policies continues to sustain steady market expansion across Europe.

Asia-Pacific

Asia-Pacific captured a 23% share of the dental fluoride treatment market in 2024 and emerged as the fastest-growing region. The rise in dental caries cases, expanding healthcare infrastructure, and growing awareness of preventive oral care are key factors driving regional growth. Countries such as China, Japan, and India are leading markets, supported by increasing government investments in oral health education and school-based fluoride programs. The growing middle-class population and rising access to dental insurance are improving treatment adoption. Multinational dental companies are also expanding operations in the region to cater to growing demand for affordable fluoride products.

Latin America

Latin America held a 5% share of the dental fluoride treatment market in 2024. Market growth is driven by increasing efforts to improve public dental health and expand fluoride access in countries such as Brazil and Mexico. The region benefits from national oral health campaigns promoting fluoride varnish use among children. However, unequal access to dental care in rural areas and limited reimbursement policies restrict broader adoption. Local partnerships with dental organizations and government-backed preventive programs are improving awareness. The increasing availability of low-cost fluoride products continues to enhance the region’s market outlook.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the dental fluoride treatment market in 2024. The region’s growth is supported by rising awareness of oral hygiene and expanding private dental practices. Countries such as Saudi Arabia and the United Arab Emirates are leading adoption through national oral health initiatives and partnerships with dental care providers. Africa is gradually expanding access through school-based fluoride programs and non-governmental health campaigns. Despite challenges such as limited infrastructure and high treatment costs, government investments in healthcare modernization are expected to strengthen market presence over the coming years.

Market Segmentations:

By Product Type

By Age Group

By End-use

- Hospitals

- Dental clinics

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The dental fluoride treatment market is highly competitive, with key players including Dentsply Sirona Inc., KaVo Dental, GC International AG, Ivoclar Vivadent, DMG Dental-Material GmbH, Colgate-Palmolive Company, Church & Dwight Co., Inc., DÜRR DENTAL SE, Kulzer GmbH, and Koninklijke Philips N.V. These companies lead through extensive product portfolios, strong brand presence, and advanced dental care innovations. Market leaders focus on developing fluoride-based varnishes, gels, and toothpaste designed for enhanced enamel remineralization and cavity prevention. Strategic partnerships with dental clinics and distributors strengthen their global reach. Continuous R&D investments are directed toward formulating high-efficacy fluoride treatments with minimal side effects. The rise of preventive dental care awareness and technological advancements in oral hygiene devices further intensify competition. Additionally, companies are expanding their presence in emerging economies by offering affordable, patient-friendly fluoride products, ensuring broader accessibility and sustained growth in the global dental fluoride treatment market.

[cr_cta type=”customize_now“]

Key Player Analysis

- Dentsply Sirona Inc.

- KaVo Dental

- GC International AG

- Ivoclar Vivadent

- DMG Dental-Material GmbH

- Colgate-Palmolive Company

- Church & Dwight Co., Inc.

- DÜRR DENTAL SE

- Kulzer GmbH

- Koninklijke Philips N.V.

Recent Developments

- In August 2025, Colgate-Palmolive Company collaborated with the UK National Health Service to distribute over 23 million oral care kits, including fluoride toothpaste and brushes, targeting preventive dental care among school-aged children.

- In March 2025, Dentsply Sirona Inc. expanded its Nupro White Varnish line, featuring a 5% sodium fluoride formulation that releases 20,400 µg/g fluoride within two hours, improving enamel remineralization and reducing application time in clinical use.

- In August 2023, Ames National Laboratory and Colgate-Palmolive Company collaborated to enhance the stability of stannous fluoride in toothpaste. The partnership allowed Colgate-Palmolive Company to leverage cutting-edge NMR technology to improve the formulation and effectiveness of their toothpaste products, ultimately leading to more stable and effective oral care solutions for consumers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for preventive dental care will continue to rise with growing oral health awareness.

- Adoption of fluoride varnishes and gels will expand among both adults and children.

- Technological innovation will enhance fluoride delivery methods and treatment precision.

- Government initiatives promoting dental hygiene will strengthen public fluoride treatment programs.

- Home-use fluoride products will gain popularity due to convenience and affordability.

- Emerging markets will experience strong growth driven by improving healthcare infrastructure.

- Dental clinics will remain the dominant end-use segment with rising professional treatments.

- Manufacturers will focus on developing fluoride formulations with reduced toxicity and better safety.

- Partnerships between dental product firms and healthcare providers will boost market penetration.

- North America and Europe will maintain leadership, while Asia-Pacific will witness the fastest expansion.