Market overview

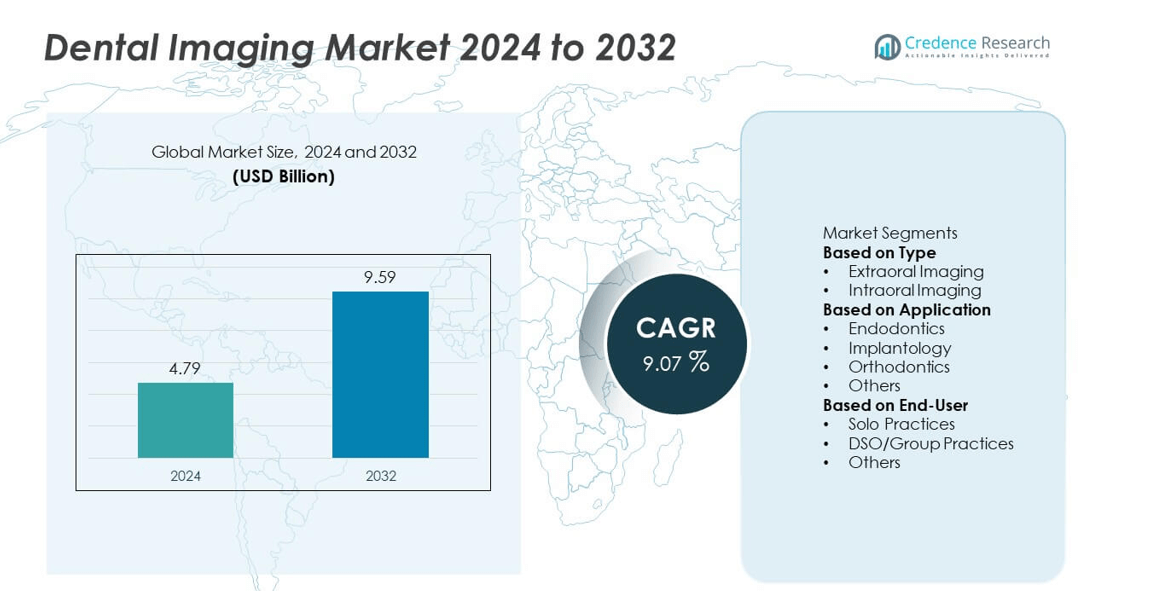

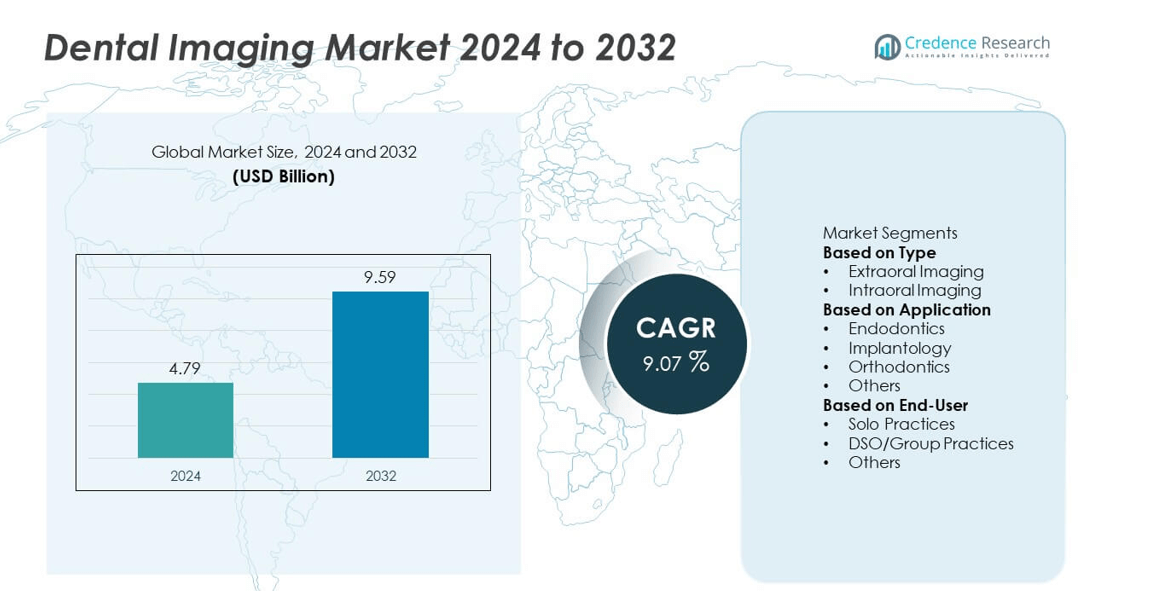

The Dental Imaging market was valued at USD 4.79 billion in 2024 and is projected to reach USD 9.59 billion by 2032, growing at a CAGR of 9.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Imaging Market Size 2024 |

USD 4.79 billion |

| Dental Imaging Market, CAGR |

9.07% |

| Dental Imaging Market Size 2032 |

USD 9.59 billion |

The dental imaging market is led by key players such as Dentsply Sirona, Planmeca OY, 3M Company, Carestream Dental, Align Technology Inc., Danaher Corporation, VATECH Co., Ltd., Midmark Corporation, Envista Holdings Corporation, and Owandy Radiology. These companies dominate through continuous innovation in 3D imaging, cone-beam computed tomography (CBCT), and AI-powered diagnostic tools that enhance precision and workflow efficiency. North America led the market with a 37% share in 2024, supported by advanced dental infrastructure and early adoption of digital technologies. Europe followed with 29% share, driven by strong preventive care programs, while Asia Pacific accounted for 24%, emerging as the fastest-growing region due to expanding dental networks and rising oral health awareness.

Market Insights

- The dental imaging market was valued at USD 4.79 billion in 2024 and is projected to reach USD 9.59 billion by 2032, growing at a CAGR of 9.07%.

- Rising demand for accurate dental diagnostics, cosmetic procedures, and preventive oral care is driving global market expansion.

- Key trends include the integration of AI in image analysis, adoption of cone-beam computed tomography (CBCT), and rising use of digital intraoral scanners.

- Major players such as Dentsply Sirona, Planmeca OY, and Danaher Corporation focus on product innovation, automation, and cloud-based imaging to strengthen competitiveness.

- North America led with 37% share in 2024, followed by Europe with 29% and Asia Pacific with 24%, while the intraoral imaging segment dominated with 63% share; however, high equipment costs and data integration issues remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The intraoral imaging segment dominated the dental imaging market in 2024 with a 63% share, driven by its extensive use in detecting cavities, periodontal diseases, and bone loss. Intraoral imaging systems, including sensors and scanners, offer high-resolution images that enhance diagnostic accuracy and patient comfort. The increasing adoption of digital sensors and photostimulable phosphor systems has improved workflow efficiency in dental practices. Technological advancements, such as AI-enhanced image processing and portable intraoral scanners, are further driving demand. The shift toward digital and radiation-efficient imaging solutions continues to strengthen the segment’s global dominance.

- For instance, Planmeca introduced the ProSensor HD intraoral imaging system featuring a resolution of 7 lp/mm and low radiation dose optimization. The system supports USB and Ethernet connectivity, allowing rapid data transfer and integration with imaging software. This innovation enables dental clinics to reduce image acquisition time to less than 5 seconds, improving clinical workflow and diagnostic reliability.

By Application

The implantology segment led the dental imaging market in 2024 with a 38% share, fueled by the rising demand for dental implants and advanced surgical planning. Imaging technologies like cone-beam computed tomography (CBCT) and 3D scanners are widely used for precise placement and bone assessment. Increasing cases of tooth loss and aesthetic dentistry trends are expanding implant procedures. The adoption of digital imaging for preoperative planning and real-time navigation has improved treatment accuracy. Growing awareness of implant success rates and technological integration supports sustained growth in this application segment.

- For instance, Dentsply Sirona’s Axeos CBCT system provides a maximum field of view of 17 cm × 13 cm with voxel sizes down to 80 µm for high-definition mode. The system features a low-dose mode for 3D scans and captures images efficiently to enhance implant planning accuracy and minimize patient exposure.

By End-User

The DSO/Group practices segment held the largest market share of 54% in 2024, supported by the consolidation of dental clinics and increasing preference for integrated care models. Group practices leverage advanced imaging technologies to standardize diagnostics and improve patient management efficiency. These organizations invest in digital imaging systems, such as CBCT and intraoral scanners, to enhance treatment outcomes and streamline workflows. Economies of scale and centralized procurement further strengthen adoption. The expansion of multi-specialty dental service organizations across developed markets continues to drive growth in this end-user segment.

Key Growth Drivers

Rising Demand for Advanced Dental Diagnostics

Growing awareness of oral health and increasing prevalence of dental disorders are driving the demand for advanced imaging solutions. Dentists are adopting digital imaging technologies for faster diagnosis, improved precision, and lower radiation exposure. The growing use of 3D imaging systems such as cone-beam computed tomography (CBCT) supports accurate treatment planning in implantology and orthodontics. The expansion of cosmetic and restorative dental procedures further accelerates the adoption of high-resolution digital imaging systems across clinics and hospitals.

- For instance, Carestream Dental’s CS 9600 CBCT system features a voxel resolution of 75 µm and supports up to 14 cm × 17 cm field of view imaging. The system integrates 120 kVp X-ray generation for optimized bone density evaluation and delivers images in under 10 seconds. These capabilities enhance diagnostic accuracy for implant placement and orthodontic planning across dental practices.

Technological Advancements in Digital and 3D Imaging

Rapid innovation in digital imaging, AI-assisted diagnostics, and 3D visualization is transforming dental care practices. CBCT, intraoral scanners, and AI-powered image analysis tools enhance diagnostic accuracy and treatment efficiency. The integration of machine learning allows early detection of cavities and jawbone issues with greater precision. Cloud-based imaging software supports real-time data sharing between professionals. These advancements improve patient experience, streamline workflow, and drive wider adoption of modern imaging systems globally.

- For instance, Align Technology’s iTero Element 5D scanner combines near-infrared imaging with optical scanning to capture frames at a high rate, enabling early caries detection without radiation. The system’s AI-driven modeling platform syncs directly with the Invisalign ClinCheck software.

Increasing Adoption in Emerging Dental Facilities

Expanding dental infrastructure in developing economies is significantly boosting the demand for digital imaging technologies. Rising disposable incomes, improved healthcare access, and government support for oral health programs are driving equipment investments. Dental clinics and hospitals are shifting from analog to digital imaging to enhance productivity and patient outcomes. Growing penetration of private dental networks and international dental tourism in Asia and Latin America also supports market expansion. This trend is expected to sustain strong growth over the forecast period.

Key Trends and Opportunities

Integration of AI and Cloud-Based Imaging Solutions

Artificial intelligence and cloud connectivity are reshaping dental diagnostics. AI algorithms analyze dental scans to identify cavities, fractures, and bone abnormalities faster and more accurately. Cloud-based platforms enable secure data storage and instant access to patient records, improving collaboration among dental professionals. These innovations enhance workflow efficiency and clinical decision-making. As digital transformation accelerates across healthcare, the integration of AI and cloud technologies in dental imaging presents significant growth opportunities for software developers and equipment manufacturers.

- For instance, Vatech Co., Ltd. developed the EzDent-i imaging software, a unified tool that allows for consultation, treatment planning, and patient education. This software helps dentists manage and store 2D dental images within a local network, with features including simulation tools and report generation.

Growing Demand for Portable and Chairside Imaging Devices

The increasing preference for mobile and compact imaging systems is transforming dental practices. Portable X-ray units and handheld scanners enable faster diagnosis directly at the patient’s chair, improving comfort and reducing waiting time. These devices are especially beneficial for small clinics and community dental programs. The trend toward chairside imaging supports real-time visualization and same-visit treatment planning. Continuous product innovations focused on mobility and radiation safety are expanding market potential among dental professionals worldwide.

- For instance, the Midmark Preva Intraoral X-ray system provides a 0.4 mm focal spot for high-resolution, sharp imaging. The system is mounted and hardwired, which ensures consistent power delivery and reduces radiation exposure to the operator.

Key Challenges

High Equipment Costs and Maintenance Requirements

The high cost of advanced imaging equipment such as CBCT and digital sensors limits adoption, especially among small dental clinics. Installation, software integration, and regular calibration add to overall expenses. Developing regions face additional challenges due to limited financing and import costs. While digital systems offer superior image quality and operational efficiency, their affordability remains a concern. Manufacturers are focusing on compact, cost-effective models to increase accessibility and support wider adoption in budget-constrained practices.

Data Security and Integration Challenges

With increasing digitization, data privacy and interoperability have become major concerns in dental imaging. Cloud-based systems require strong cybersecurity measures to protect patient information from breaches. Integration with existing practice management and diagnostic software can also be complex. Variations in data standards hinder seamless connectivity between devices and healthcare networks. To address these challenges, vendors are investing in secure, compliant, and user-friendly software frameworks that ensure safe and efficient information exchange across dental systems.

Regional Analysis

North America

North America held a 37% share of the dental imaging market in 2024, driven by advanced dental infrastructure and early adoption of digital technologies. The United States leads the region due to high awareness of preventive oral care, widespread availability of dental insurance, and strong presence of key manufacturers. Increasing demand for cosmetic and restorative procedures further supports market growth. Canada also contributes steadily through government-funded dental programs and adoption of AI-assisted imaging solutions. Continuous investments in 3D imaging, CBCT systems, and digital workflows reinforce the region’s leadership in global dental imaging innovation.

Europe

Europe accounted for 29% share of the dental imaging market in 2024, supported by a well-established healthcare infrastructure and high focus on preventive dentistry. Germany, France, and the United Kingdom dominate the regional market, driven by growing adoption of digital radiography and 3D imaging technologies. Supportive regulations on radiation safety and technological innovation encourage clinics to upgrade imaging systems. The growing number of dental specialists and aesthetic dentistry procedures also enhance market expansion. Increasing integration of AI-based diagnostic software and rising investments in modern dental equipment are strengthening Europe’s market position.

Asia Pacific

Asia Pacific captured 24% share of the dental imaging market in 2024, emerging as the fastest-growing regional segment. Rapid industrialization, rising disposable income, and increasing oral health awareness drive adoption of digital imaging technologies. China, Japan, and India lead demand, supported by expanding dental networks and government healthcare initiatives. The region is witnessing strong growth in dental tourism, further boosting investment in modern diagnostic tools. Affordable product offerings and partnerships between international and local manufacturers are expanding market accessibility. The increasing presence of private dental clinics continues to strengthen Asia Pacific’s growth outlook.

Latin America

Latin America held 6% share of the dental imaging market in 2024, driven by expanding private dental practices and growing awareness of advanced diagnostic solutions. Brazil and Mexico lead regional growth, supported by the modernization of healthcare systems and rising demand for cosmetic dental procedures. Government-led oral health programs and collaborations with global imaging providers are improving access to technology. However, limited affordability and uneven infrastructure remain key challenges. The expansion of low-cost digital imaging systems and mobile diagnostic units is expected to enhance adoption across underserved areas in the coming years.

Middle East & Africa

The Middle East and Africa accounted for 4% share of the dental imaging market in 2024, supported by growing investments in healthcare modernization and dental facility development. The United Arab Emirates and Saudi Arabia dominate regional demand, driven by increased spending on dental aesthetics and preventive care. In Africa, countries such as South Africa and Kenya are gradually expanding access to dental imaging through public-private partnerships. The introduction of portable imaging equipment and training programs for dental professionals is improving service quality. Rising awareness of oral hygiene and digital healthcare transformation continues to drive regional growth.

Market Segmentations:

By Type

- Extraoral Imaging

- Intraoral Imaging

By Application

- Endodontics

- Implantology

- Orthodontics

- Others

By End-User

- Solo Practices

- DSO/Group Practices

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the dental imaging market is defined by the presence of major players such as Dentsply Sirona, Planmeca OY, 3M Company, Carestream Dental, Align Technology Inc., Danaher Corporation, VATECH Co., Ltd., Midmark Corporation, Envista Holdings Corporation, and Owandy Radiology. These companies compete through continuous innovation, digital integration, and product diversification. Manufacturers focus on expanding their portfolios with advanced 3D imaging systems, cone-beam computed tomography (CBCT), and AI-enabled diagnostic software. Strategic collaborations with dental service organizations and clinics enhance global reach and strengthen distribution networks. Players are investing in research and development to improve image quality, radiation safety, and workflow efficiency. The growing demand for digital imaging and cloud-based data sharing also drives competitive differentiation. As dental practices shift toward precision diagnostics and aesthetic procedures, companies are emphasizing affordability, ergonomics, and smart imaging solutions to capture emerging market opportunities and maintain technological leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dentsply Sirona

- Planmeca OY

- 3M Company

- Carestream Dental

- Align Technology Inc.

- Danaher Corporation

- VATECH Co., Ltd.

- Midmark Corporation

- Envista Holdings Corporation

- Owandy Radiology

Recent Developments

- In May 2025, Dentsply Sirona announced the U.S. launch of AI-powered 3D X-ray diagnostic features on its DS Core platform, enhancing CBCT image analysis.

- In October 2024, Carestream Dental’s CS 8100SC 3D dental radiology unit was highlighted for its scanning time of about three seconds, improving throughput in clinics.

- In September 2024, Dentsply Sirona introduced Primescan 2, a cloud-native wireless intraoral scanner capable of full arch scans in under one minute, integrated with DS Core

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered imaging tools will enhance diagnostic precision and workflow automation.

- Demand for 3D and cone-beam computed tomography systems will continue to expand globally.

- Integration of cloud-based platforms will improve image storage, sharing, and remote diagnosis.

- Portable and chairside imaging devices will gain popularity for faster patient assessments.

- Growth in cosmetic and restorative dental procedures will drive advanced imaging adoption.

- Emerging economies will witness rapid installation of digital imaging systems in new dental clinics.

- Manufacturers will focus on energy-efficient and low-radiation imaging solutions.

- Collaboration between imaging providers and dental software firms will enhance interoperability.

- Continuous training and digital skill development will become crucial for dental professionals.

- Expansion of dental service organizations will boost demand for integrated digital imaging technologies.