Market overview

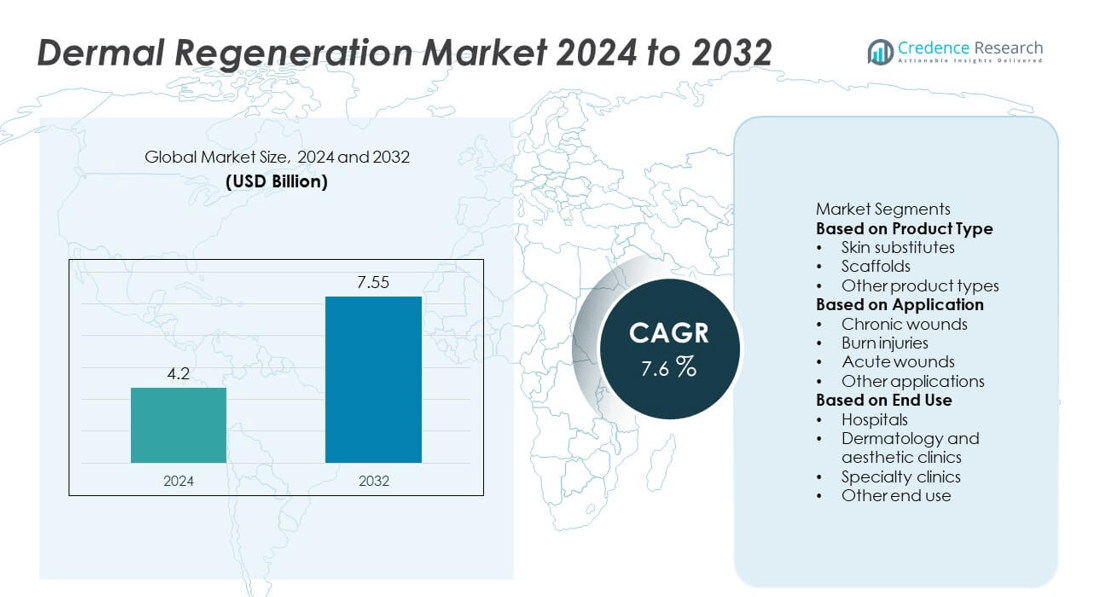

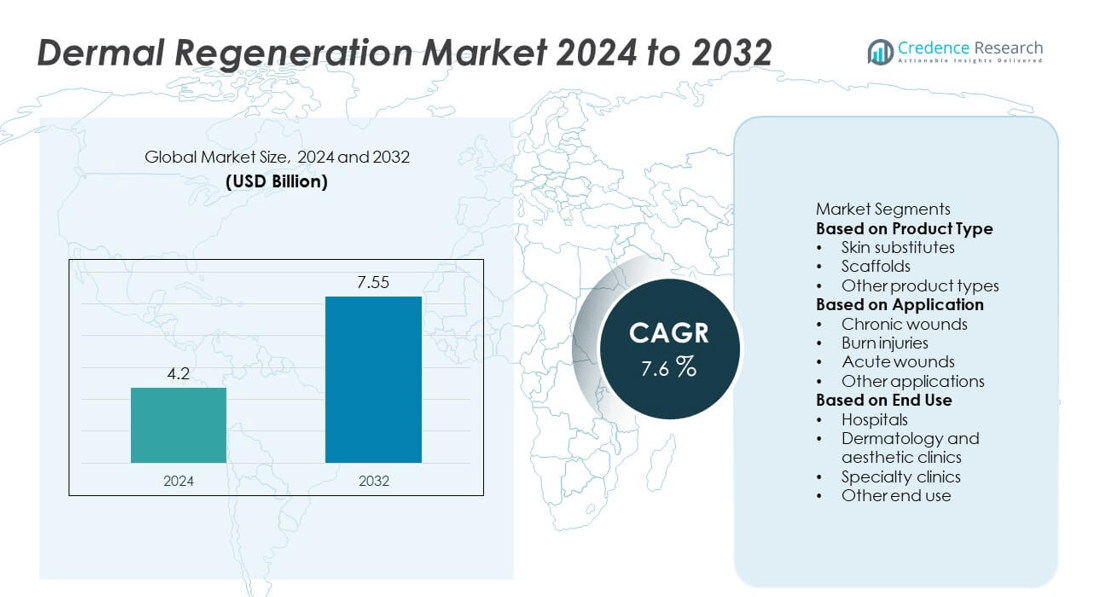

The dermal regeneration market was valued at USD 4.2 billion in 2024 and is projected to reach USD 7.55 billion by 2032, expanding at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermal Regeneration Market Size 2024 |

USD 4.2 billion |

| Dermal Regeneration Market, CAGR |

7.6% |

| Dermal Regeneration Market Size 2032 |

USD 7.55 billion |

The dermal regeneration market is led by major players including PolyNovo, BioTissue, Organogenesis, MedSkin Solutions Dr. Suwelack, Kerecis (Coloplast), Integra LifeSciences, Avita Medical, MiMedx, Gunze, and Extrimity Care. These companies dominate through innovations in bioengineered skin substitutes, collagen-based scaffolds, and cell-derived wound healing therapies. North America leads the global market with a 38% share, driven by advanced healthcare infrastructure and high adoption of regenerative technologies. Europe follows with a 29% share, supported by strong research funding and clinical adoption in wound care. Asia-Pacific, holding a 22% share, is emerging rapidly due to healthcare expansion, rising burn injury cases, and increased investment in biotechnological development.

Market Insights

- The dermal regeneration market was valued at USD 4.2 billion in 2024 and is projected to reach USD 7.55 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising cases of chronic wounds and burn injuries are driving demand for bioengineered skin substitutes and scaffold-based wound healing therapies.

- Advancements in 3D bioprinting, stem cell therapy, and collagen-based dermal matrices are reshaping treatment options and improving recovery outcomes.

- The market is highly competitive with key players such as PolyNovo, Organogenesis, Integra LifeSciences, and Kerecis (Coloplast) focusing on R&D and strategic partnerships.

- North America holds a 38% share, Europe 29%, and Asia-Pacific 22%, while skin substitutes lead the product segment with a 46% share, supported by strong hospital demand and expanding aesthetic treatment adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The skin substitutes segment dominated the dermal regeneration market in 2024 with a 46% share. Its dominance is driven by growing demand for advanced wound care products offering faster healing and reduced scarring. Skin substitutes replicate natural skin structure, improving cell regeneration and minimizing infection risk in chronic and burn wounds. Increasing use of bioengineered and collagen-based substitutes in reconstructive surgery strengthens the segment’s leadership. Key innovations such as bilayered artificial skin and stem cell-infused products further enhance treatment effectiveness and broaden clinical adoption across hospitals and specialized wound care centers.

- For instance, Integra LifeSciences developed the Integra Dermal Regeneration Template (IDRT), consisting of a cross-linked bovine tendon collagen and chondroitin-6-sulfate matrix over a silicone layer measuring 0.406 mm in thickness.

By Application

The chronic wounds segment held the largest market share of 42% in 2024, owing to the rising prevalence of diabetic ulcers, pressure sores, and venous leg ulcers. Growing geriatric population and increasing cases of lifestyle-related diseases are boosting long-term wound care needs. Advanced dermal regeneration products offer faster tissue recovery and reduced hospitalization time for chronic wound patients. Continuous improvements in hydrogel- and scaffold-based therapies have enhanced wound bed preparation and re-epithelialization, driving adoption in both developed and emerging markets. Hospitals and wound management clinics remain the primary users for chronic wound care products.

- For instance, MiMedx developed the EpiFix dehydrated human amnion/chorion membrane (dHACM) allograft, containing over 200 growth factors, cytokines, and extracellular matrix proteins. Clinical data show an average wound area reduction of 72.3 mm² per week in diabetic foot ulcer patients when applied weekly. The product promotes angiogenesis and fibroblast proliferation, significantly enhancing healing outcomes in chronic wound management.

By End Use

Hospitals accounted for the largest market share of 49% in 2024, supported by their high patient inflow and strong infrastructure for complex wound management procedures. Hospitals serve as the key centers for advanced treatments such as skin grafts, scaffold implantation, and tissue-engineered dermal substitutes. Growing healthcare investments and increased adoption of regenerative medicine techniques in trauma and burn care units drive segment dominance. Rising partnerships between hospitals and biotechnology firms to expand access to novel dermal regeneration products further strengthen their leadership, while specialty and dermatology clinics show increasing adoption for aesthetic and reconstructive procedures.

Key Growth Drivers

Rising Incidence of Chronic and Burn Wounds

Increasing global cases of chronic wounds and burn injuries are driving the dermal regeneration market. Factors such as diabetes, obesity, and aging contribute to delayed wound healing, raising the need for advanced treatment solutions. Hospitals are adopting engineered skin substitutes and scaffold technologies to improve recovery outcomes. For instance, the World Health Organization reports over 11 million severe burn cases annually, creating strong demand for effective tissue regeneration therapies across both developed and emerging healthcare systems.

- For instance, PolyNovo developed the NovoSorb Biodegradable Temporising Matrix (BTM), a synthetic polyurethane dermal scaffold featuring a 2 mm thick open-cell matrix. A case series involving 27 patients with 35 wounds showed 100% matrix integration in 33 of the wounds when the sealing membrane was removed.

Advancements in Bioengineered and Stem Cell-Based Therapies

Rapid progress in bioengineering and stem cell technologies is enhancing the effectiveness of dermal regeneration products. Companies are developing collagen- and polymer-based scaffolds that accelerate cellular growth and vascularization. These innovations enable faster healing with minimal scarring and better integration with natural tissue. The growing use of autologous stem cells in skin reconstruction further improves treatment outcomes. This technological evolution is expected to expand clinical applications and strengthen adoption among healthcare providers focused on regenerative medicine.

- For instance, Avita Medical introduced the RECELL System, which processes a small skin sample measuring 2×2 cm to create a regenerative cell suspension capable of covering wounds up to 320 cm². The system isolates keratinocytes, fibroblasts, and melanocytes within 30 minutes at the point of care.

Growing Focus on Aesthetic and Reconstructive Procedures

Rising demand for aesthetic enhancement and post-trauma reconstructive surgeries significantly supports market growth. Increasing awareness about minimally invasive skin restoration treatments encourages patients to choose dermal substitutes and matrix-based therapies. The cosmetic industry’s expansion and greater acceptance of advanced wound care solutions also contribute to segment growth. Hospitals and dermatology clinics are integrating regenerative products for scar reduction and skin rejuvenation, particularly in markets such as North America and Europe, where patient preference for advanced cosmetic care is steadily rising.

Key Trends and Opportunities

Integration of 3D Bioprinting and Tissue Engineering

3D bioprinting is emerging as a transformative technology in dermal regeneration. Researchers and manufacturers are using bioinks composed of collagen, keratin, and fibroblast cells to print skin layers that mimic natural structures. This innovation enhances product customization and reduces rejection risks. The integration of tissue engineering with bioprinting offers opportunities for scalable and patient-specific skin substitutes. Companies investing in these technologies aim to shorten healing times and improve clinical outcomes, fostering a major growth avenue for advanced regenerative solutions.

- For instance, Organovo Holdings developed a bioprinted human skin model composed of dermal and epidermal layers. The tissues consist of specific cell types, such as dermal fibroblasts and keratinocytes, and have been demonstrated to undergo differentiation.

Rising Investments in Healthcare Infrastructure and R&D

Increased government and private sector funding for regenerative medicine research is creating new opportunities. Healthcare systems are prioritizing wound care management and tissue repair innovations. Major companies are partnering with biotechnology institutes to develop novel dermal substitutes with enhanced biocompatibility and durability. The growing focus on personalized wound treatment and advanced biomaterials will likely accelerate new product launches. This trend supports long-term growth, particularly in emerging markets adopting advanced healthcare infrastructure and training for complex wound care procedures.

- For instance, Kerecis, a subsidiary of Coloplast, expanded its manufacturing facility in Ísafjörður, Iceland, doubling production capacity of its fish-skin–derived grafts to over 500,000 units annually. The acellular matrix retains natural omega-3 lipids and collagen structure, promoting angiogenesis and tissue remodeling.

Key Challenges

High Cost of Advanced Regenerative Products

The elevated cost of bioengineered skin substitutes and scaffold-based therapies limits accessibility, especially in developing economies. Manufacturing involves complex processes using living cells, collagen matrices, and sterile conditions, driving up production expenses. Limited reimbursement coverage for regenerative wound treatments further restrains adoption. Hospitals and clinics often struggle to balance treatment affordability with technological advancement. To expand market reach, manufacturers must focus on cost optimization, localized production, and strategic collaborations to deliver affordable dermal regeneration solutions without compromising quality or efficacy.

Stringent Regulatory and Approval Processes

The dermal regeneration market faces strict regulatory frameworks that slow product approvals and commercialization. Agencies such as the FDA and EMA impose rigorous testing standards to ensure biocompatibility, safety, and long-term efficacy of regenerative products. These complex procedures extend time-to-market for new technologies, discouraging small biotech firms from innovation. Moreover, varying global standards make it challenging for manufacturers to achieve multi-regional compliance. Streamlined approval processes and harmonized international guidelines are essential to encourage faster development and adoption of advanced dermal regeneration therapies.

Regional Analysis

North America

North America dominated the dermal regeneration market in 2024 with a 38% share, driven by strong healthcare infrastructure and early adoption of advanced wound care technologies. The region benefits from high incidences of chronic wounds, diabetic ulcers, and burn injuries, particularly in the U.S. Government initiatives supporting regenerative medicine research and favorable reimbursement policies strengthen market growth. Key companies such as Integra LifeSciences and Organogenesis are expanding bioengineered skin product portfolios. The presence of leading clinical centers and ongoing R&D investments continue to position North America as the primary hub for innovative dermal regeneration solutions.

Europe

Europe held a 29% share of the global dermal regeneration market in 2024, supported by expanding applications in wound care and reconstructive surgery. Countries such as Germany, France, and the U.K. are leading due to increased hospital adoption of collagen-based and stem cell-infused scaffolds. Rising healthcare spending and a growing elderly population enhance treatment demand. Regulatory support for advanced therapy medicinal products (ATMPs) further promotes product innovation. Collaborations between research institutions and biotech firms are boosting the availability of next-generation skin substitutes across Europe’s major healthcare systems.

Asia-Pacific

Asia-Pacific accounted for a 22% share of the dermal regeneration market in 2024, driven by rapid healthcare advancements and growing awareness of regenerative medicine. Increasing cases of burn injuries and diabetic wounds in China and India are fueling demand for cost-effective skin substitutes. Government healthcare reforms and investments in biotechnology research support regional growth. Local manufacturers are expanding production capacity to address affordability challenges. Rising cosmetic surgery trends in countries such as South Korea and Japan also contribute to market expansion, as clinics adopt advanced tissue-engineered products for aesthetic and reconstructive procedures.

Latin America

Latin America captured a 7% share of the global dermal regeneration market in 2024, supported by increasing healthcare modernization and growing awareness of advanced wound care therapies. Brazil and Mexico lead regional adoption, driven by a rise in burn injuries and diabetes-related ulcers. Expanding partnerships with global medical device companies are improving product accessibility and training for healthcare professionals. However, high product costs and limited reimbursement remain key barriers. Continued government efforts to enhance wound management infrastructure and promote affordable regenerative treatments are expected to improve adoption across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the dermal regeneration market in 2024, with growth driven by improving healthcare facilities and rising cases of trauma injuries. The UAE and Saudi Arabia are leading markets due to significant investments in advanced care units and regenerative treatment technologies. Increasing collaborations with global healthcare firms and the establishment of specialized wound care centers are supporting regional growth. While limited awareness and affordability challenges persist in parts of Africa, expanding medical tourism in the Gulf countries enhances market potential in the coming years.

Market Segmentations:

By Product Type

- Skin substitutes

- Scaffolds

- Other product types

By Application

- Chronic wounds

- Burn injuries

- Acute wounds

- Other applications

By End Use

- Hospitals

- Dermatology and aesthetic clinics

- Specialty clinics

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the dermal regeneration market is characterized by strong innovation and strategic expansion among key players such as PolyNovo, BioTissue, Organogenesis, MedSkin Solutions Dr. Suwelack, Kerecis (Coloplast), Integra LifeSciences, Avita Medical, MiMedx, Gunze, and Extrimity Care. These companies focus on developing advanced bioengineered skin substitutes, scaffolds, and cell-based therapies to enhance wound healing outcomes. Strategic collaborations with hospitals, research institutes, and biotechnology firms are expanding their clinical reach and accelerating product approvals. Firms are investing heavily in R&D to create next-generation dermal matrices with superior biocompatibility and faster tissue regeneration. Acquisitions and regional partnerships are also being used to strengthen global market presence. Increasing emphasis on stem cell technologies, 3D bioprinting, and collagen-based regeneration systems continues to shape the competitive environment. Companies that combine clinical efficacy with cost-effective manufacturing are expected to maintain a strong foothold in the evolving global dermal regeneration market.

[cr_cta type=”customize_now“]

Key Player Analysis

- PolyNovo

- BioTissue

- Organogenesis

- MedSkin Solutions Dr. Suwelack

- Kerecis (Coloplast)

- Integra LifeSciences

- Avita Medical

- MiMedx

- Gunze

- Extrimity Care

Recent Developments

- In April 2025, AVITA Medical launched the U.S. commercialization of Cohealyx, a collagen-based dermal matrix co-developed with Regenity Biosciences.

- In January 2025, Fesarius Therapeutics obtained U.S. FDA clearance for its novel product DermiSphere hDRT, a collagen-based hydrogel dermal regeneration template.

- In January 2025, MedSkin Solutions Dr. Suwelack published a breakthrough study showing that their MatriDerm® biologic dermal matrix demonstrates improved cell adhesion, proliferation, and differentiation compared to synthetic alternatives.

- In 2025, PolyNovo’s NovoSorb® BTM (Biodegradable Temporising Matrix) continues receiving clinical attention, with recent evaluations highlighting its resilience in reconstructing non-graftable wound beds and complex wound templates

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bioengineered and cell-based skin substitutes will continue to grow globally.

- Advancements in 3D bioprinting will enable personalized and faster tissue regeneration.

- Stem cell and gene therapy integration will enhance wound healing efficiency.

- Hospitals will remain the largest end users due to advanced care infrastructure.

- Adoption of collagen-based scaffolds will rise for chronic and burn wound treatments.

- Emerging economies in Asia-Pacific will drive market expansion through healthcare modernization.

- Strategic collaborations between biotech firms and research institutions will accelerate product innovation.

- Increasing aesthetic and reconstructive procedures will boost demand for dermal substitutes.

- Regulatory harmonization across regions will improve product approval timelines.

- Focus on affordable regenerative therapies will support wider accessibility and market penetration