Market Overview

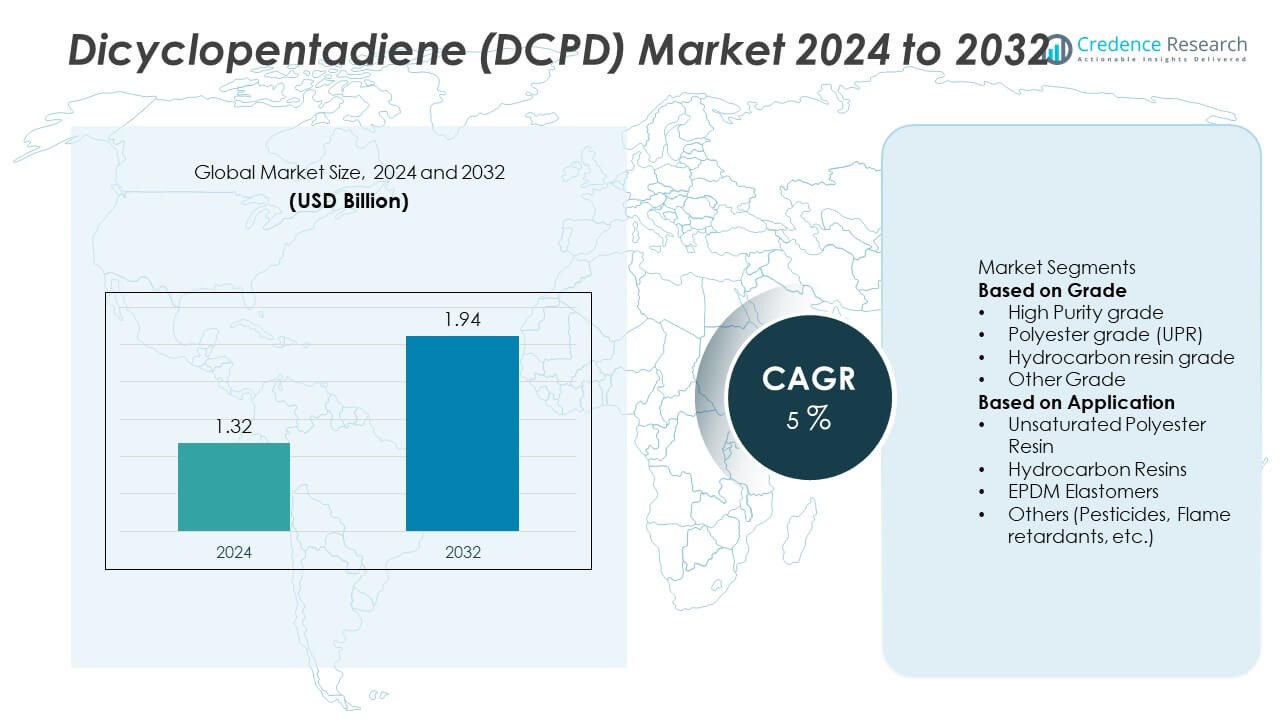

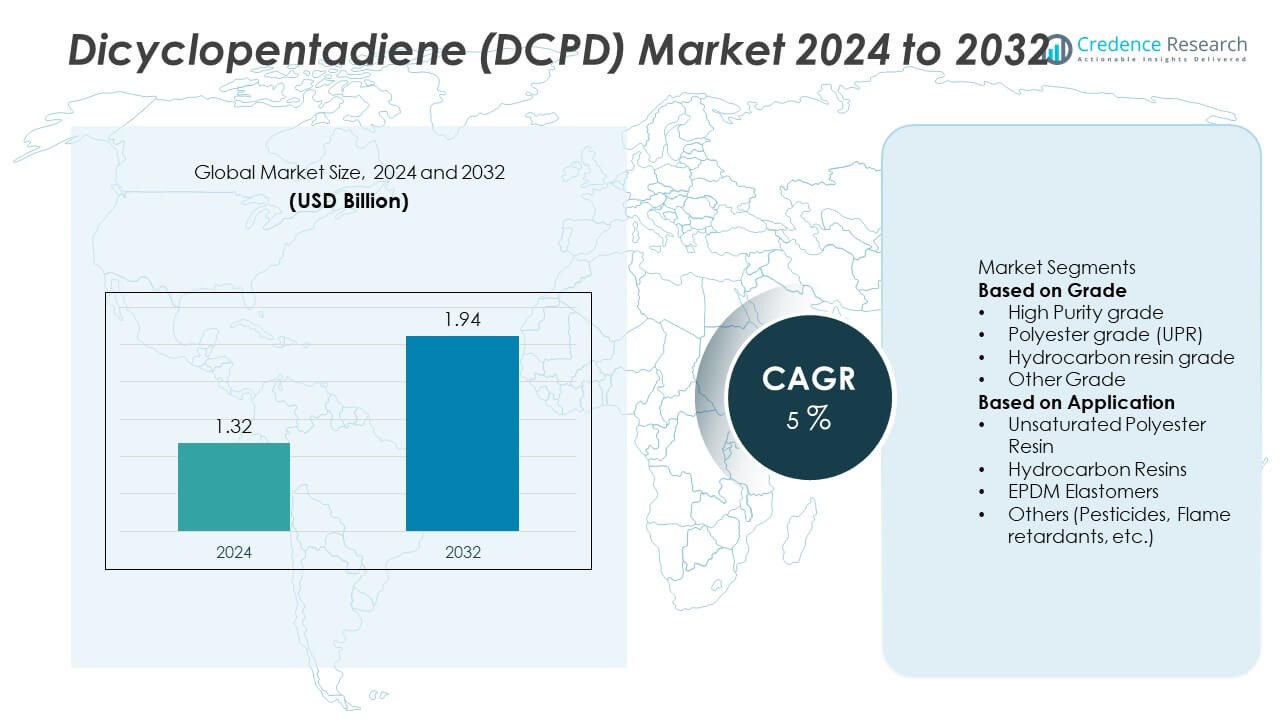

The Dicyclopentadiene (DCPD) Market was valued at USD 1.32 billion in 2024 and is projected to reach USD 1.94 billion by 2032, registering a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dicyclopentadiene (DCPD) Market Size 2024 |

USD 1.32 Billion |

| Dicyclopentadiene (DCPD) Market, CAGR |

5% |

| Dicyclopentadiene (DCPD) Market Size 2032 |

USD 1.94 Billion |

Top players in the Dicyclopentadiene (DCPD) market include NOVA Chemicals, Braskem, China Petrochemical Corporation, Sunny Industrial System GmbH, Royal Dutch Shell plc (Shell Chemicals), Nanjing Yuangang Fine Chemical Co., Cymetech Corporation, Chevron Phillips Chemical Company, LyondellBasell Industries Holdings B.V, and Maruzen Petrochemical. These companies strengthen their positions by expanding petrochemical capacity, improving cracking efficiency, and developing high-purity DCPD for advanced resin and elastomer applications. They focus on long-term supply agreements and integrated production systems to ensure stable feedstock availability. Regionally, Asia Pacific leads with a 38% share, driven by strong manufacturing activity and high consumption of composites, while North America follows with a 29% share, supported by robust petrochemical infrastructure and extensive use in UPR and hydrocarbon resin production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dicyclopentadiene (DCPD) market reached USD 1.32 billion in 2024 and will grow at a 5% CAGR through 2032, supported by expanding resin and elastomer applications.

- Rising demand for unsaturated polyester resins drives market growth, with the UPR segment holding a 51% share due to its extensive use in automotive, marine, and construction composites.

- Key trends include increasing use of DCPD in lightweight composites, expanding hydrocarbon resin production, and rapid growth of EPDM elastomer applications across global automotive manufacturing.

- Competition intensifies as major producers enhance cracking efficiency, expand high-purity DCPD capacity, and strengthen downstream partnerships, while feedstock price volatility and environmental regulations act as key restraints.

- Asia Pacific leads the market with a 38% share, followed by North America at 29% and Europe at 26%, supported by strong petrochemical bases and rising adoption of DCPD-based resins across multiple industrial sectors.

Market Segmentation Analysis:

By Grade

Polyester grade DCPD dominated the market with a 46% share in 2024, driven by its extensive use in manufacturing unsaturated polyester resins for automotive parts, marine components, and construction materials. Its strong reactivity and cost-effectiveness make it the preferred choice for large-volume industrial applications. High-purity grade accounted for a 28% share, supported by growing use in specialty chemicals and high-performance polymers. Hydrocarbon resin grade held a 20% share, driven by adhesive and coatings demand, while other grades represented the remaining 6%, used across niche industrial applications.

- For instance, Kolon Industries added 15,000 tons per year hydrocarbon resin capacity in 2021. This expansion lifted its total hydrocarbon resin capacity to 200,000 tons annually. The larger output supports DCPD-based grades used in adhesives, coatings, and road-marking materials.

By Application

Unsaturated polyester resin led the market with a 51% share in 2024, supported by rising demand for lightweight composites in marine, construction, and automotive sectors. DCPD-based UPR offers strong mechanical strength and heat resistance, driving its widespread adoption. Hydrocarbon resins accounted for a 27% share, driven by growth in adhesives, road-marking paints, and coatings. EPDM elastomers held a 15% share, benefitting from expanding automotive sealing applications. The remaining 7% came from pesticides, flame retardants, and other specialty uses where DCPD serves as a key intermediate.

- For instance, RUISEN Chemical’s PRS-5110 hydrogenated DCPD resin has a softening point between 105°C and 115°C. It maintains color below 50 Hazen and an acid value under 0.1 mgKOH per gram. The grade is used in hot-melt and pressure-sensitive adhesives for tapes, labels, and hygiene materials, supporting hydrocarbon resin demand in coatings and road-marking systems.

KEY GROWTH DRIVERS

Rising Demand for Unsaturated Polyester Resins

The expanding use of unsaturated polyester resins (UPR) in automotive, marine, and construction applications drives strong demand for DCPD. UPR formulated with DCPD offers high strength, corrosion resistance, and reduced weight, making it ideal for reinforced composites, paneling, and structural materials. Growth in infrastructure projects and rising production of lightweight automotive components further support consumption. As industries shift toward durable and cost-efficient composites, demand for DCPD-based UPR continues to accelerate across both developed and emerging markets.

- For instance, Helios Resins’ COLPOLY 732-D3 is an unsaturated polyester resin based on DCPD. The cured resin reaches tensile strength between 60 and 70 MPa in testing. Flexural strength ranges from 85 to 105 MPa, with tensile modulus near 3,300–3,500 MPa. Heat-distortion temperature lies between 70 and 80°C, enabling reliable performance in sanitary ware and building components.

Growing Adoption in Adhesives, Coatings, and Hydrocarbon Resins

DCPD plays a critical role in hydrocarbon resin production used in adhesives, road-marking paints, rubber formulations, and high-performance coatings. Rising construction activity, tire manufacturing, and industrial coating applications drive demand for these resins, strengthening DCPD consumption. The chemical’s ability to enhance hardness, tack, and thermal stability supports wide industrial usage. Expanding packaging needs and growing demand for pressure-sensitive adhesives also boost hydrocarbon resin production, creating sustained market growth for DCPD.

- For instance, commercially available hydrogenated DCPD hydrocarbon resins serve adhesive manufacturers worldwide. They are commonly used as tackifiers in hot-melt (HMA) and pressure-sensitive adhesive systems (PSA).

Increasing Use in EPDM Elastomers for Automotive Applications

Demand for EPDM elastomers continues to grow as automotive manufacturers adopt advanced sealing systems, gaskets, and weatherstrips. DCPD is a key raw material for producing high-quality EPDM with excellent flexibility, weather resistance, and durability. Rising vehicle production, electric vehicle expansion, and growing need for heat-resistant elastomers strengthen market uptake. As OEMs prioritize long-lasting and lightweight rubber components, DCPD-based EPDM formulations gain further importance, driving steady growth across global automotive supply chains.

KEY TRENDS & OPPORTUNITIES

Rising Demand for Lightweight and High-Performance Composites

Industries increasingly prioritize lightweight materials to improve fuel efficiency and structural performance. DCPD-based resins support the production of durable composite components used in automotive body parts, wind turbine blades, and marine structures. Growing investment in renewable energy and electric vehicles enhances opportunities for advanced composites. Continued innovation in polymer chemistry and resin formulation creates new application potential, expanding DCPD’s role in next-generation materials.

- For instance, Polynt S.p.A. offers a range of vinyl ester and terephthalic resins, with one Terephthalic resin confirmed to achieve a heat-distortion temperature of 127 °C. A different product, a Polynt ARMORSTAR® resin belonging to the IVSX series, is a Vinyl Ester blend infusion resin suitable for marine applications.

Expansion of DCPD Use in Specialty Chemicals and Agrochemicals

DCPD is gaining traction as an intermediate in pesticides, specialty polymers, and flame retardants. Rising agricultural modernization and need for efficient crop protection solutions drive its adoption in agrochemical synthesis. Meanwhile, stricter fire-safety regulations boost demand for flame-retardant compounds derived from DCPD. Growing research into high-purity DCPD grades creates new opportunities in specialty chemical manufacturing for electronics, aerospace, and high-performance polymers.

- For instance, Arkema’s Kepstan® PEKK production line integrates high-purity DCPD-based intermediates and delivers polymer grades with melting points between 305 °C and 345 °C. Density levels remain at 1.30 g/cm³, while tensile strength reaches 90 MPa in testing. These properties support use in aerospace brackets, electronic connectors, and fire-safe structural components.

Growth of Production Capacity in Asia Pacific

Asia Pacific continues to expand its petrochemical capacity, creating significant growth opportunities for DCPD. China, South Korea, and India invest heavily in new cracking units, resin plants, and elastomer production facilities. The region benefits from abundant feedstock, cost-efficient manufacturing, and rising domestic consumption across automotive and construction sectors. Increasing export of resins and elastomers further reinforces demand, positioning Asia Pacific as a global hub for DCPD production and utilization.

KEY CHALLENGES

Feedstock Price Volatility and Supply Chain Constraints

DCPD production depends heavily on naphtha cracking operations, making it vulnerable to fluctuations in crude oil prices and refinery output. Supply chain disruptions, maintenance shutdowns, or reduced cracker operations can limit availability and increase costs. These uncertainties affect resin producers and downstream industries relying on stable supply. Manufacturers face pressure to secure long-term contracts and diversify feedstock sources to maintain production stability.

Environmental Regulations and Emission Control Requirements

Stringent environmental regulations on petrochemical operations pose challenges for DCPD manufacturers. Emission control requirements, hazardous waste management standards, and restrictions on volatile organic compounds increase production costs and compliance burdens. Regulatory pressure in Europe and North America may lead to capacity reductions or operational adjustments. Manufacturers must invest in cleaner technologies and sustainable processing methods to ensure long-term viability while meeting evolving environmental standards.

Regional Analysis

North America

North America held a 29% share of the Dicyclopentadiene (DCPD) market in 2024, supported by strong demand for unsaturated polyester resins and hydrocarbon resins across automotive, construction, and electronics industries. The region benefits from advanced composite production, high adoption of lightweight materials, and a well-established petrochemical base. Growth in infrastructure rehabilitation projects and rising use of EPDM elastomers in vehicle manufacturing further strengthen market expansion. Continuous investment in specialty chemicals and resin technologies drives additional demand, while favorable regulatory frameworks support innovation in advanced polymer applications.

Europe

Europe accounted for a 26% share in 2024, driven by substantial demand from automotive, marine, and industrial manufacturing sectors. The region’s emphasis on lightweight composites for fuel-efficient vehicles and renewable energy systems supports strong consumption of DCPD-based resins. Countries such as Germany, Italy, and France lead adoption due to advanced chemical processing capabilities and mature downstream industries. Growth in wind energy installations and reinforced composite structures also contributes to market demand. Environmental regulations encourage the development of high-performance, low-emission resin systems, boosting the use of high-purity and specialty-grade DCPD.

Asia Pacific

Asia Pacific dominated the global market with a 38% share in 2024, driven by large-scale petrochemical production, rapid industrialization, and rising consumption of composites across automotive, marine, and construction applications. China, South Korea, India, and Japan lead regional demand due to expanding manufacturing capacity and high utilization of UPR, hydrocarbon resins, and EPDM elastomers. Strong infrastructure development and growing electric vehicle production further boost demand for DCPD-derived materials. Competitive production costs and increasing export activity position Asia Pacific as the fastest-growing and most influential region in the market.

Latin America

Latin America held a 4% share in 2024, supported by growing demand for UPR-based composites in construction, marine applications, and industrial equipment manufacturing. Brazil and Mexico drive regional consumption as investments in infrastructure, transportation, and chemical processing gradually expand. The region’s developing automotive industry also increases use of EPDM elastomers and DCPD-based resins. Although economic volatility and limited petrochemical capacity pose challenges, increasing foreign investments and modernization of production facilities contribute to moderate but steady market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024, driven by expanding petrochemical capabilities and rising use of DCPD derivatives in construction and industrial applications. Countries such as Saudi Arabia and the UAE invest heavily in resin production, downstream chemical processing, and composite manufacturing. Growing infrastructure development and diversification of industrial sectors support demand for hydrocarbon resins and UPR. In Africa, adoption remains small but is gradually increasing with industrial growth and new manufacturing initiatives, offering long-term potential for DCPD consumption across regional markets.

Market Segmentations:

By Grade

- High Purity grade

- Polyester grade (UPR)

- Hydrocarbon resin grade

- Other Grade

By Application

- Unsaturated Polyester Resin

- Hydrocarbon Resins

- EPDM Elastomers

- Others (Pesticides, Flame retardants, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Dicyclopentadiene (DCPD) market includes major players such as NOVA Chemicals, Braskem, China Petrochemical Corporation, Sunny Industrial System GmbH, Royal Dutch Shell plc (Shell Chemicals), Nanjing Yuangang Fine Chemical Co., Cymetech Corporation, Chevron Phillips Chemical Company, LyondellBasell Industries Holdings B.V, and Maruzen Petrochemical. These companies compete by expanding production capacity, improving feedstock efficiency, and developing high-purity and specialty-grade DCPD for advanced resin and elastomer applications. Strategic partnerships with composite manufacturers, automotive suppliers, and chemical processors support stronger downstream integration. Many players invest in new cracking technologies and sustainable processing solutions to reduce emissions and enhance energy efficiency. Global expansion into high-growth regions, particularly Asia Pacific, strengthens supply networks and market presence. As demand increases for unsaturated polyester resins, hydrocarbon resins, and EPDM elastomers, competition intensifies, pushing manufacturers to enhance product consistency, maintain cost competitiveness, and secure long-term feedstock availability.

Key Player Analysis

- NOVA Chemicals

- Braskem

- China Petrochemical Corporation

- Sunny Industrial System GmbH

- Royal Dutch Shell plc (Shell Chemicals)

- Nanjing Yuangang Fine Chemical Co

- Cymetech Corporation

- Chevron Phillips Chemical Company

- LyondellBasell Industries Holdings B.V

- Maruzen Petrochemical

Recent Developments

- In October 2025, Braskem did unveil innovations in bio-based product lines at the K 2025 trade fair in Düsseldorf, Germany, specifically highlighting a new bio-based low-density polyethylene (LDPE) for healthcare applications under the Medcol brand.

- In October 2023, Braskem S.A. announced the opening of its representative office in Tokyo, Japan, continuing its expansion of polymer and feedstock solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for DCPD will rise as industries expand the use of lightweight composite materials.

- Unsaturated polyester resin production will remain a major driver due to growth in marine and construction applications.

- Hydrocarbon resin usage will increase with rising demand for adhesives, coatings, and road-marking products.

- EPDM elastomer production will grow as automotive manufacturers adopt durable, heat-resistant sealing materials.

- Asia Pacific will strengthen its position as the leading production and consumption hub.

- Technological improvements in cracking processes will enhance DCPD purity and production efficiency.

- Manufacturers will expand capacity to meet increasing global demand for specialty resins.

- Sustainability initiatives will push producers to adopt cleaner processing and emission-control technologies.

- High-purity DCPD grades will gain traction in advanced chemical and polymer applications.

- Strategic partnerships across petrochemical and composite industries will accelerate market expansion.