Market Overview:

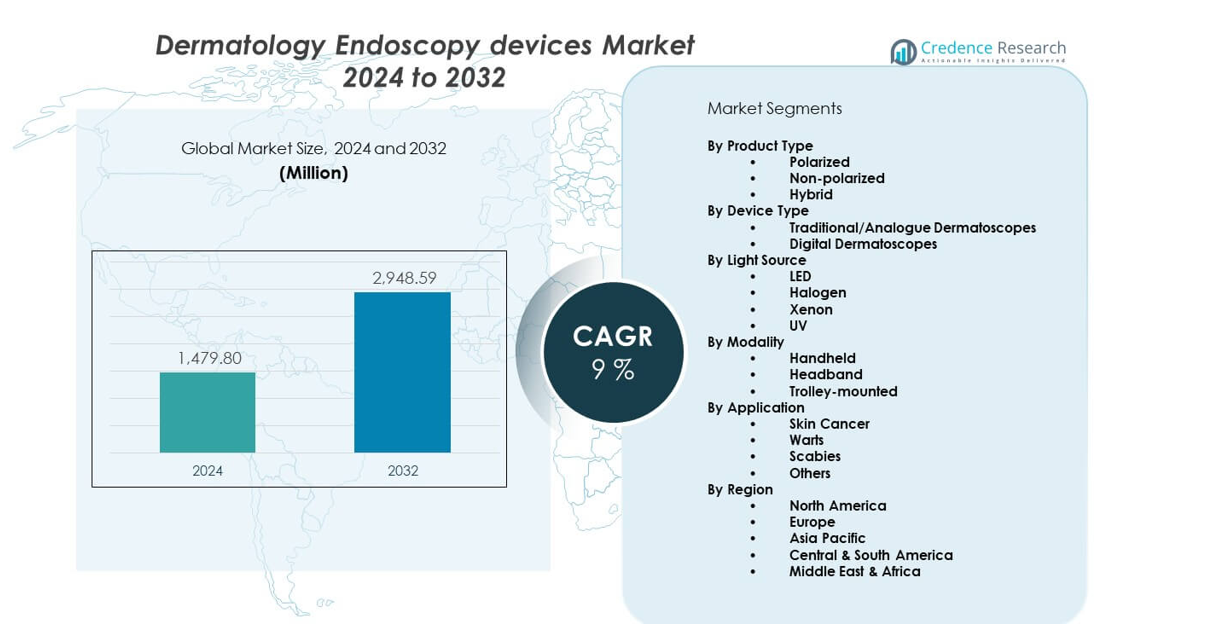

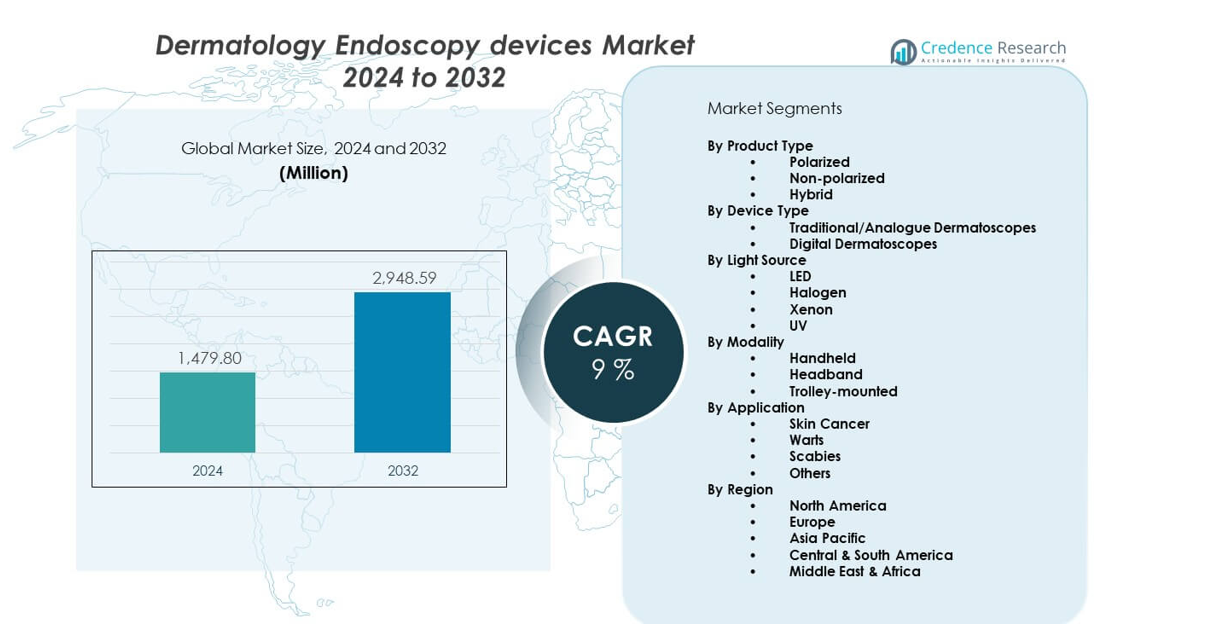

The Dermatology Endoscopy Devices Market is projected to grow from USD 1,479.8 million in 2024 to an estimated USD 2,948.59 million by 2032, with a compound annual growth rate (CAGR) of 9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermatology Endoscopy Devices Market Size 2024 |

USD 1,479.8 million |

| Dermatology Endoscopy Devices Market, CAGR |

9% |

| Dermatology Endoscopy Devices Market Size 2032 |

USD 2,948.59 million |

The market grows as clinics adopt advanced visualization tools that help detect early-stage skin disorders. Dermatologists use endoscopy systems to capture clear images of moles, lesions, and inflammatory conditions with higher accuracy. Rising focus on minimally invasive checks boosts interest in compact and digital scopes. Better diagnostic workflows support faster case evaluation and improve patient outcomes across routine and complex skin assessments.

North America leads due to strong adoption of digital dermatology tools and higher clinical awareness. Europe follows with growing use of dermatoscopes in specialty centers and wider screening programs. Asia Pacific emerges as a fast-growing region as hospitals increase investment in early skin cancer detection. Expanding healthcare access and rising dermatologist numbers strengthen regional growth across developing markets.

Market Insights:

- The Dermatology Endoscopy Devices Market reached USD 1,479.8 million in 2024 and is projected to hit USD 2,948.59 million by 2032, advancing at a 9% CAGR driven by strong demand for precision skin imaging.

- North America holds 35%, supported by advanced healthcare systems; Asia Pacific holds 28%, driven by rising screening awareness; Europe holds 25%, benefitting from structured cancer programs.

- Asia Pacific is the fastest-growing region with a 28% share, supported by healthcare expansion, rising dermatology clinics, and growing awareness of early skin cancer detection.

- Skin cancer applications account for 42% of segment share due to expanding screening programs and higher melanoma risk in major populations.

- Polarized devices lead with 48% share, supported by stronger clarity during deep-structure evaluation and higher adoption across specialty dermatology centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus On Early Skin Disorder Identification Through High-Clarity Imaging

Improved awareness of early skin condition detection lifts demand for advanced tools. Clinics rely on high-resolution optics to capture detailed lesion structures. Many specialists prefer scopes that reduce assessment errors. The Dermatology Endoscopy devices Market benefits from wider adoption across primary and specialty centers. It supports quicker evaluation for suspicious moles and pigment changes. Digital capture offers stronger visual clarity for long-term patient tracking. Hospitals increase device procurement to strengthen routine screening. Rising concern over rising melanoma cases raises interest in precise diagnostic solutions.

- For instance, the DermLite DL5 uses 32 high-powered LEDs and a 15× optical lens system, enabling detailed pigment network evaluation confirmed through official DermLite specifications.

Greater Shift Toward Minimally Invasive Skin Evaluation Methods Across Clinics

Dermatologists choose scopes that avoid discomfort during visual checks. Compact systems help teams examine sensitive areas with stable lighting. Many centers integrate portable units to improve workflow flexibility. The Dermatology Endoscopy devices Market gains traction due to increased preference for non-invasive tools. It helps providers complete full examinations within shorter cycles. Clear image output raises confidence in treatment planning. Clinics expand device fleets to support steady patient traffic. Strong push for accurate assessments drives higher replacement speed for outdated tools.

- For instance, HEINE’s Delta 30 dermatoscope features precision optics with 10× magnification and 30 LED HQ illumination, which improves non-invasive lesion assessment according to HEINE’s official product data.

Rapid Integration Of Digital Platforms That Strengthen Clinical Documentation Processes

Digital connectivity helps teams store vast image libraries for case review. Cloud support gives dermatologists easier access to historical scans. It reduces manual processes that slow diagnostic steps. High-precision zoom features enhance review quality for complex lesions. The Dermatology Endoscopy devices Market receives support from centers seeking smoother data workflows. Clinics use structured image sets to track patient progress. Strong demand for tele-evaluation drives more interest in digital hardware. Automated enhancements improve accuracy during follow-up sessions.

Growing Emphasis On Skin Cancer Surveillance In High-Risk Populations Worldwide

Rising awareness of melanoma risk prompts wider use of endoscopy systems. Public health programs promote periodic checks for early detection. The Dermatology Endoscopy devices Market progresses as specialists adopt tools for detailed mapping. It helps clinicians flag unusual changes before conditions advance. Strong educational outreach increases footfall at dermatology units. Device makers upgrade sensor quality to improve detection speed. Hospitals run dedicated screening camps to support community care. Broader access to skilled dermatologists boosts equipment uptake.

Market Trends:

Adoption Of AI-Enhanced Image Interpretation Tools Across Dermatology Centers

AI-ready platforms help specialists classify lesion patterns with high precision. Many clinics test systems that highlight abnormal tissue structures. It reduces manual strain during heavy patient load. The Dermatology Endoscopy devices Market observes steady movement toward automated review tools. AI support strengthens early-stage condition filtering. Cloud-linked algorithms help dermatologists compare visual markers. Hospitals explore workflow upgrades that blend human judgment with machine outputs. Increased trust in digital intelligence improves adoption across major facilities.

- For instance, MetaOptima’s DermEngine platform uses AI-powered pattern analysis to help dermatologists with image-based skin condition assessment. The system serves over 1,000 healthcare organizations and more than one million patients worldwide, according to MetaOptima’s corporate information.

Rising Demand For Portable Wireless Dermatoscopy Systems Among Mobile Practitioners

Portable units help dermatologists conduct fast checks outside hospitals. Battery-backed scopes support home-visit care and outreach programs. It expands service reach across remote or underserved regions. The Dermatology Endoscopy devices Market sees stronger attention toward flexible devices. Wireless transfer improves real-time image sharing. Clinics value compact units that fit varied examination styles. Mobile practitioners rely on sturdy designs for frequent travel. Enhanced mobility encourages broader deployment during screening drives.

- For instance, DermLite’s DL4 model offers industry-verified Bluetooth image transfer and 30-LED polarized illumination, enabling rapid wireless documentation in mobile settings.

Expanding Use Of Multi-Modal Imaging Platforms For More Reliable Skin Assessment

Clinics adopt devices that combine polarized light, fluorescence, and magnification. Multi-mode support helps specialists analyze deeper tissue layers. It boosts confidence in identifying atypical lesion behavior. The Dermatology Endoscopy devices Market benefits from rising trust in multi-layer scanning. Integrated tools offer stronger insight during complex cases. Dermatologists prefer unified systems that reduce equipment switching. Advanced imaging flow improves accuracy for recurring patient visits. Higher diagnostic need drives continued investment in hybrid platforms.

Shift Toward High-Durability Optical Components That Improve Lifecycle Performance

Manufacturers design scopes with stronger lenses and protective housings. It ensures stability during heavy daily use. Clinics rely on hardware that retains image clarity under repeated disinfecting cycles. The Dermatology Endoscopy devices Market moves toward materials that improve operating life. Reinforced builds reduce replacement frequency for busy units. Hospitals focus on tools that deliver stable brightness over long service periods. Rugged design increases appeal for large dermatology networks. Stronger optical stability supports more consistent evaluations.

Market Challenges Analysis:

High Device Costs And Limited Access To Skilled Dermatology Professionals

Many clinics struggle with cost barriers that slow procurement plans. High-grade scopes require strong budgets for full deployment. The Dermatology Endoscopy devices Market faces hurdles in regions with limited specialist access. It restricts adoption for advanced diagnostic work. Training needs increase operational pressure on small centers. Rural areas face a shortage of experienced dermatologists. Maintenance work requires skilled technicians, raising ownership cost. Budget constraints reduce upgrade volume for several facilities.

Variation In Regulatory Standards And Slow Integration Of Interoperable Systems

Regulators follow different rules for imaging hardware across regions. Compliance checks delay product rollout for several brands. The Dermatology Endoscopy devices Market must navigate strict safety norms. It creates longer launch cycles for innovation-heavy devices. Compatibility issues limit smooth flow of images across EHR platforms. Clinics struggle to merge older systems with new hardware. Slow alignment across standards reduces efficiency gains. Many facilities delay investment until stable guidelines emerge.

Market Opportunities:

Growing Use Of Digital Examination Tools Across Tele-Dermatology And Remote Care Programs

Remote channels support real-time reviews between patients and dermatologists. It helps clinics deliver structured skin checks without travel. The Dermatology Endoscopy devices Market finds new pathways through remote screening models. Integrated imaging tools enable faster second opinions for complex cases. Cloud transfer enhances collaboration among specialists. Wider interest in virtual care pushes hospitals to expand digital fleets. More patient engagement creates stronger demand for clear visual evidence. Device makers gain room to release compact tele-ready systems.

Strong Expansion Of Cosmetic Dermatology Services Across Urban And Semi-Urban Regions

Cosmetic clinics use scopes to track treatment results with stronger accuracy. It strengthens patient trust during aesthetic correction cycles. The Dermatology Endoscopy devices Market gains support from rising global cosmetic interest. Clinics invest in detailed imaging to guide personalized treatment plans. High-resolution capture improves monitoring for acne, scars, and pigmentation. Urban centers record higher patient flow for enhancement procedures. Semi-urban zones follow with growing spending power. Better awareness increases patient preference for image-guided cosmetic care.

Market Segmentation Analysis:

By Product Type

Polarized devices lead due to strong ability to reduce surface glare and reveal deeper skin structures. Non-polarized units support clear views of superficial patterns and help with routine assessments. Hybrid systems gain interest for combined viewing modes that improve flexibility across varied cases. The Dermatology Endoscopy devices Market benefits from broader adoption of hybrid tools that support precise decision-making in clinical workflows.

- For instance, Optilia’s digital dermatoscope kit, which is part of its medical-grade HD camera systems, features switchable polarized and non-polarized light sources for comprehensive skin examinations. The kit uses Optilia’s high-definition cameras, which are capable of delivering full-HD 1080p output at 60 frames per second, ensuring clear, real-time imaging. This allows clinicians to effectively visualize both superficial and deeper skin structures.

By Device Type

Traditional dermatoscopes maintain steady use in basic examinations. Digital dermatoscopes record stronger growth due to high-resolution imaging and integration with electronic documentation. Many specialists choose digital platforms for standardized follow-up and tele-dermatology support. It strengthens diagnostic workflows across high-volume facilities.

- For instance, Canfield Scientific’s Vectra WB360 captures 360-degree, full-body skin images using 92 synchronized cameras and produces a single, accurate, high-resolution 3D image in a rapid, single capture. The system’s integrated DermaGraphix software allows clinicians to navigate every lesion on the 3D body map.

By Light Source

LED systems dominate due to consistent brightness, low heat, and long operational life. Halogen and xenon units remain relevant for specific clinical preferences. UV-based tools support targeted assessments for select infections and pigment changes. Clinics compare light profiles to match varied skin evaluation needs.

By Modality

Handheld units lead due to ease of use and mobility within clinics. Headband systems support hands-free workflows during extended examinations. Trolley-mounted platforms serve specialized centers that require advanced imaging accuracy during complex reviews. Each format supports different depth and stability requirements.

By Application

Skin cancer screening holds the largest use case due to rising awareness of melanoma and non-melanoma conditions. Warts and scabies evaluations require clear visualization, driving steady deployment of compact scopes. Other applications span pigmentation checks and chronic skin disorder monitoring. Growing focus on accurate visual assessment strengthens demand across clinical segments.

Segmentation:

By Product Type

- Polarized

- Non-polarized

- Hybrid

By Device Type

- Traditional/Analogue Dermatoscopes

- Digital Dermatoscopes

By Light Source

By Modality

- Handheld

- Headband

- Trolley-mounted

By Application

- Skin Cancer

- Warts

- Scabies

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading position with an estimated 35% share of the Dermatology Endoscopy devices Market. Strong healthcare infrastructure supports wide adoption of polarized and hybrid dermatoscopes across hospitals and dermatology clinics. High awareness of melanoma risk drives frequent skin screening and faster replacement cycles for digital scopes. It benefits from strong reimbursement support that encourages consistent device usage across clinical workflows. Technological innovation moves faster in this region due to active participation from research bodies and domestic manufacturers. Strong tele-dermatology adoption increases the need for connected imaging tools. The region maintains steady demand due to early adoption behavior and strong clinical penetration.

Europe

Europe accounts for roughly 25% share and maintains stable growth supported by structured screening programs. Dermatology centers across Germany, France, and the UK invest in LED-based systems to improve diagnostic precision. It benefits from strong government-driven awareness efforts that raise participation in routine skin examinations. Adoption of hybrid devices increases due to rising preference for flexible clinical workflows. Hospitals focus on high-quality imaging tools to support early-stage cancer identification across dense urban populations. Digital documentation rules push faster integration of software-linked dermatoscopes. Market expansion continues across both public and private care ecosystems.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific holds approximately 28% share and records the fastest growth due to rising skin cancer awareness and rapid healthcare expansion. China, India, and Japan invest heavily in digital diagnostic systems to improve early detection quality. It gains momentum from a rising number of dermatology clinics in urban centers. Latin America holds around 6% share, supported by growing adoption of LED-based units in Brazil and Mexico. Middle East & Africa represent nearly 6% share, driven by expanding private healthcare networks and increased interest in advanced diagnostic tools. Regional growth outside Asia Pacific remains moderate due to limited specialist availability. Broader access to dermatology services strengthens long-term demand across developing markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HEINE Optotechnik GmbH & Co. KG

- 3Gen Consulting / DermLite

- MetaOptima Technology Inc.

- Optilia Instruments AB

- AMD Global Telemedicine

- KIRCHNER & WILHELM GmbH + Co. KG

- Genesis Biosystems, Inc.

- Canfield Scientific, Inc.

- Nikon Corporation

- Bausch Health Companies Inc.

- Alma Lasers

- Pro Scope Systems

- MeKo Manufacturing e.K.

- Biolitec

- Rudolf Riester GmbH

Competitive Analysis:

The competitive landscape in the Dermatology Endoscopy devices Market features strong participation from global and regional manufacturers focused on imaging precision, ergonomic design, and digital connectivity. Leading brands invest in optical innovation to strengthen clarity during diagnostic procedures. It emphasizes product durability, user-friendly features, and workflow compatibility. Companies expand portfolios through digital dermatoscopes that support cloud storage and tele-dermatology. Strong competition drives continuous upgrades in illumination, software integration, and portability. Firms target hospitals, specialty clinics, and mobile diagnostic units with differentiated offerings. Rising interest in hybrid visualization systems pushes manufacturers to enhance multi-mode features.

Recent Developments:

- In April 2025, Bausch Health announced the launch of Solta Medical’s Fraxel FTX, the next generation of skin resurfacing technology, which debuted at the American Society for Laser Medicine & Surgery 2025 Annual Conference. The Fraxel FTX system features a dual wavelength fractional laser for treating superficial and deep skin layers, a redesigned ergonomic handpiece, and an intelligent optical tracking system. The technology promises minimal downtime for patients and represents Bausch Health’s commitment to setting new standards in laser skin resurfacing for treating sun damage, wrinkles, acne scars, and pigmentation issues.

- In March 2025, UniDoc Health Corp. announced the acquisition of the Agnes Connect software from AMD Telemedicine along with related intellectual property, customer subscriptions, and the “AMD Telemedicine” name and goodwill. The acquisition, valued at $175,000 in cash with a revenue-sharing agreement, strengthened UniDoc’s Neil Connect platform and expanded its telehealth capabilities in the growing digital health market.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Device Type, Light Source, Modality, and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing use of digital dermatoscopes will strengthen clinical documentation and remote consultation workflows.

- Demand for AI-supported imaging tools will rise across hospitals and specialty clinics.

- Hybrid visualization systems will gain wider acceptance for multi-layer skin assessment.

- LED-based lighting will remain the preferred choice due to stable output and longevity.

- Handheld devices will dominate usage among mobile dermatology practitioners.

- Integration with tele-dermatology platforms will expand access to specialist reviews.

- Cosmetic dermatology centers will increase adoption for treatment progress tracking.

- Early melanoma detection programs will encourage higher device penetration rates.

- Manufacturers will invest more in ergonomic and wireless designs for improved mobility.

- Training programs for dermatologists will expand to support advanced imaging adoption.