Market Overview

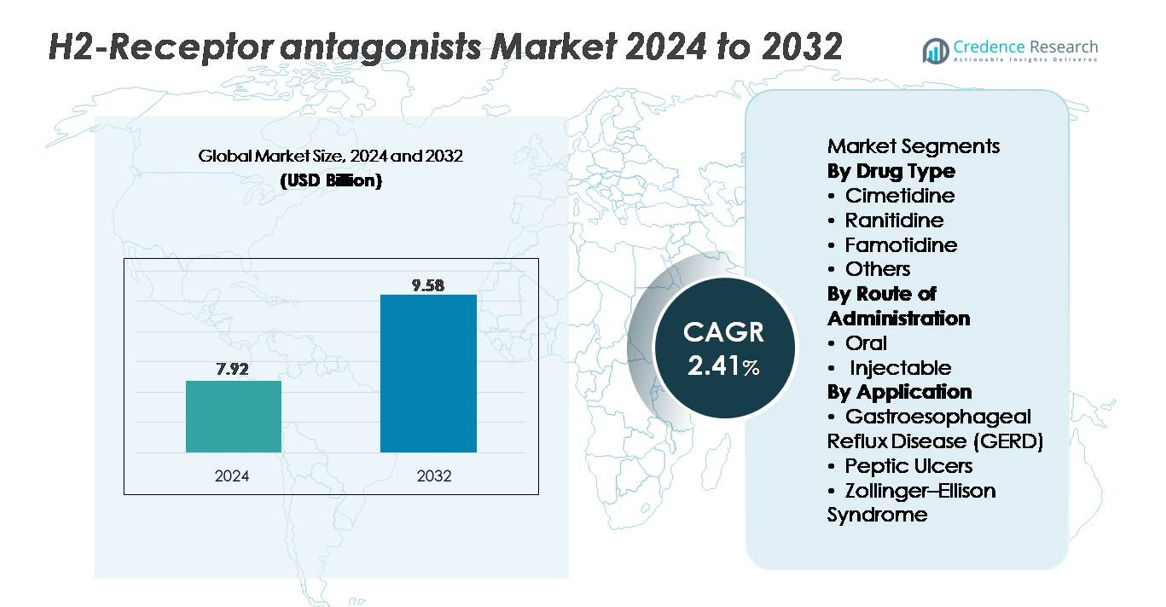

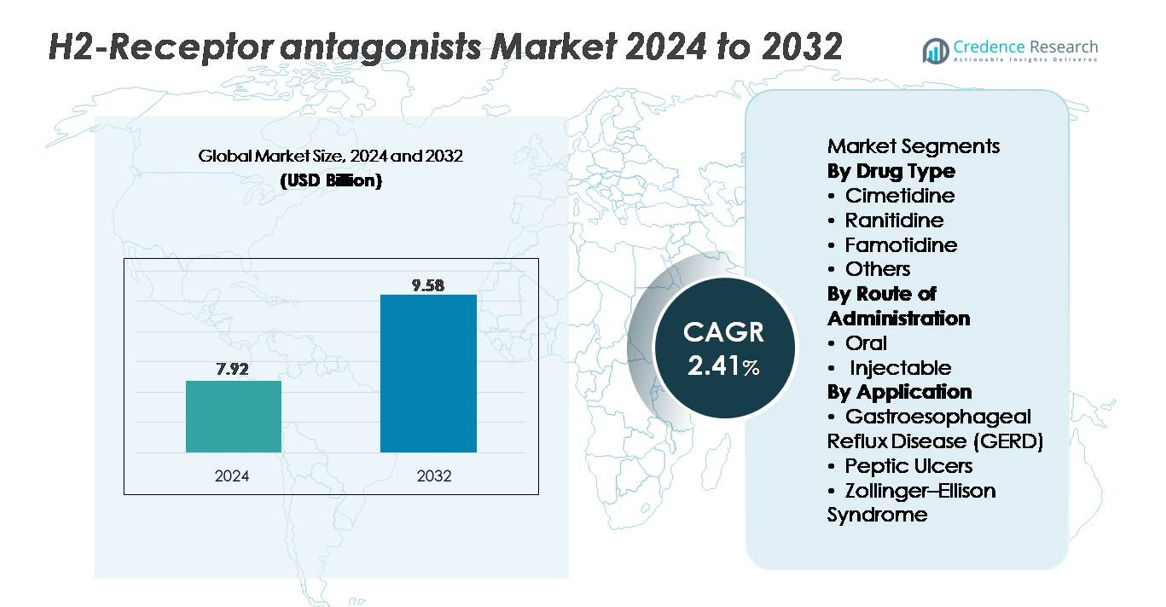

The H2-receptor antagonists market was valued at USD 7.92 billion in 2024 and is projected to reach USD 9.58 billion by 2032, reflecting a CAGR of 2.41% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| H2-Receptor Antagonists Market Size 2024 |

USD 7.92 billion |

| H2-Receptor Antagonists Market, CAGR |

2.41% |

| H2-Receptor Antagonists Market Size 2032 |

USD 9.58 billion |

The H2-receptor antagonists market features strong participation from major pharmaceutical companies such as AstraZeneca, AbbVie Inc., Johnson & Johnson, Takeda Pharmaceutical Company Limited, Novartis AG, Bayer AG, Merck & Co., Inc., Sanofi, GlaxoSmithKline plc, and Pfizer Inc. These players compete through broad product portfolios, large-scale manufacturing capabilities, and extensive OTC and prescription distribution networks. Strategic emphasis on high-quality famotidine production and diversified dosage formats strengthens their market presence across therapeutic settings. North America leads the global market with an approximate 35% share, supported by high GERD prevalence, strong retail pharmacy penetration, and rapid adoption of safer H2-blocker formulations, positioning it as the most influential region in shaping competitive dynamics.

Market Insights

- The H2-receptor antagonists market was valued at USD 7.92 billion in 2024 and is projected to reach USD 9.58 billion by 2032 at a CAGR of 2.41%, reflecting steady long-term therapeutic demand.

- Market growth is driven by rising GERD and peptic ulcer cases, increased OTC consumption of famotidine, and sustained clinician preference for safer alternatives following ranitidine withdrawal.

- Key trends include expanding use in combination therapy for nighttime acid breakthrough, broader adoption of fast-acting OTC formulations, and higher demand among geriatric populations and self-medicating consumers.

- Competitive intensity strengthens as global players enhance quality control, diversify oral and injectable formats, and expand famotidine production; however, strong PPI competition and supply-chain sensitivities restrain aggressive expansion.

- Regionally, North America leads with ~35% share, followed by Europe at ~28% and Asia-Pacific at ~25%; segment-wise, famotidine dominates the drug type category, while oral formulations account for the majority of global consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type:

Famotidine represents the dominant sub-segment due to its strong clinical safety profile, favorable pharmacokinetics, and continued preference as the primary H2 blocker following global discontinuation of ranitidine products. Its high receptor affinity and long duration of action support widespread adoption in both prescription and OTC formulations. Cimetidine maintains niche use despite its broader drug–interaction profile, while newer combinations and alternative H2 antagonists fall under the “Others” category with limited but stable therapeutic roles. Overall, famotidine’s reliability in treating acid-related disorders secures its leading market share across major healthcare settings.

- For instance, Pepcid AC, the branded form of famotidine, is owned by Kenvue after the consumer-health split from Johnson & Johnson. The product originated from a long-running marketing partnership between Merck and Johnson & Johnson. As a mass-market OTC tablet, Pepcid AC is produced through standard large-scale pharmaceutical tablet manufacturing processes used by major consumer-health producers.

By Route of Administration:

The oral route holds the largest market share, driven by its extensive use in chronic management of GERD and peptic ulcer disease, ease of self-administration, and widespread OTC availability. Tablets, capsules, and liquid formulations enable flexible dosing for adult and pediatric patients, strengthening its dominance. Injectable H2 antagonists remain essential in acute care, particularly in hospital settings where rapid acid suppression is required for perioperative prophylaxis or severe ulcer complications. However, their utilization remains comparatively limited, making the oral segment the primary revenue contributor across global markets.

- For example, Kenvue’s McNeil Consumer Healthcare division which markets famotidine-based OTC drugs such as Pepcid AC lists its Fort Washington, PA facility as its headquarters and one of its manufacturing sites. That site historically manufactures OTC products for gastrointestinal and other conditions, supporting supply for pharmacies and retail channels.

By Application:

GERD constitutes the dominant application segment, supported by its high global prevalence, increasing diagnosis rates, and frequent need for sustained acid-suppression therapy. H2 antagonists serve as first-line or adjunct treatments for nighttime acid breakthrough, mild symptoms, and maintenance therapy, securing strong demand in ambulatory and OTC settings. Peptic ulcer management continues to rely on H2 blockers in specific patient groups, while Zollinger–Ellison syndrome represents a smaller but stable therapeutic niche. GERD’s broad patient base, recurring treatment patterns, and compatibility with famotidine fuel its leading market share.

Key Growth Drivers

Rising Prevalence of Acid-Related Disorders

The growing incidence of GERD, functional dyspepsia, and peptic ulcer disease significantly drives demand for H2-receptor antagonists. Aging populations, dietary shifts, stress, and obesity contribute to the persistent rise in gastrointestinal discomfort requiring long-term acid suppression. Although proton pump inhibitors (PPIs) dominate severe cases, H2 blockers remain preferred for mild to moderate symptoms, nighttime acid breakthrough, and on-demand usage. Their rapid onset of action and favorable safety profile make them essential for patients seeking quick symptomatic relief without prolonged acid suppression. Increasing awareness of self-medication and OTC availability further expands their adoption across diverse consumer groups. Additionally, ongoing concerns regarding long-term PPI adverse effects have encouraged clinicians to reconsider H2 blockers for maintenance therapy and intermittent treatment, reinforcing their market value. Combined, these epidemiological and patient-behavior factors strengthen the sustained demand for H2-receptor antagonists across both prescription and OTC channels.

- For example, Opella, the newly independent consumer-health company majority-owned by CD&R (with Sanofi and Bpifrance retaining minority stakes), owns over 100 brands including Dulcolax. The firm operates 13 strategic manufacturing sites worldwide and distributes products across around 100 countries.

Shift Toward Safer Alternatives After Ranitidine Withdrawal

Global regulatory actions leading to the removal of ranitidine from markets have redirected prescribers and consumers toward safer H2 blockers, especially famotidine. This shift created a structural boost in demand for alternative agents positioned as clinically reliable and free from NDMA contamination risks. Healthcare systems prioritized proven molecules with strong safety data, accelerating the rebalancing of market share toward famotidine-based formulations. The availability of high-strength OTC doses and hospital-grade IV formulations enables broad coverage across outpatient and acute-care settings. Manufacturers responded with expanded production, improved supply chain resilience, and updated formulations to fill therapeutic gaps created by ranitidine’s exit. As a result, demand for trusted, well-characterized alternatives continues to rise, reinforcing market stability and supporting sustained growth of the H2 antagonist class. This ongoing preference for safe and dependable acid-suppressive medications remains a key driver shaping future market trajectories.

- For example, FDA’s laboratory testing during the NDMA investigations confirmed that famotidine products including Pepcid® did not contain detectable levels of NDMA. This finding distinguished famotidine from ranitidine, which was withdrawn due to NDMA instability concerns. Pepcid® continues to be marketed by Kenvue’s McNeil Consumer Healthcare division

Expanding Use in OTC and Preventive Gastrointestinal Care

The widespread acceptance of H2 antagonists as fast-acting, convenient OTC solutions contributes significantly to market expansion. Consumers increasingly rely on these products for episodic heartburn, post-meal acidity, and nighttime reflux conditions that require rapid but short-duration relief. Their availability in multiple strengths and formulations, including chewable and liquid options, enhances user convenience and broadens accessibility. The shift toward preventive care has further driven adoption, as individuals proactively manage acid-related symptoms triggered by lifestyle habits, spicy diets, alcohol intake, and irregular eating patterns. Healthcare providers also recommend H2 blockers as safer alternatives for patients who cannot tolerate or do not require PPIs, enabling consistent demand across demographic groups. This convergence of consumer-driven behavior, preventive care emphasis, and broad OTC distribution solidifies H2 antagonists as a preferred category for managing mild gastrointestinal conditions.

Key Trends & Opportunities

Growth in Combination Therapies and Adjunctive Use

A significant trend shaping the H2 antagonist market is the growing emphasis on combination therapy, particularly in patients with breakthrough nocturnal symptoms. Clinicians increasingly combine H2 blockers with PPIs to manage persistent nighttime acid secretion, optimizing symptom relief and improving quality of life in refractory GERD cases. This adjunctive role creates opportunities for manufacturers to develop advanced formulations and dual-mechanism regimens tailored for chronic patients. Furthermore, hospitals continue using injectable H2 antagonists as complementary agents during perioperative care, stress ulcer prophylaxis, and acute gastrointestinal management. These evolving therapeutic patterns open pathways for innovation in sustained-release, rapid-onset, and combination-dose platforms. As treatment algorithms shift toward personalized acid-suppression strategies, H2 antagonists remain integral to multi-modal care frameworks, expanding their utility beyond monotherapy and strengthening long-term market prospects.

- For instance, Takeda’s Dexilant® uses a dual-delayed-release design with two granule fractions that release at approximately 1–2 hours and 4–5 hours after dosing, as confirmed in the FDA label. This extended release pattern helps maintain acid suppression over an extended window in GERD management.

Expansion of OTC Innovation and Consumer Education

Increasing consumer participation in gastrointestinal health management creates substantial opportunities for OTC-focused innovation. Manufacturers are launching user-friendly formats such as fast-dissolving tablets, flavored chewables, and dual-action formulations to enhance convenience and appeal to younger demographics. Retail pharmacies and digital health platforms also play a crucial role by educating consumers about differences between PPIs and H2 blockers, guiding appropriate, self-managed care. Improved packaging, clear dosing instructions, and integration with mobile symptom-tracking tools support safer and more informed use. Growth in e-commerce and direct-to-consumer channels further increases product visibility, enabling brands to capture a wider market. As awareness of long-term PPI side effects rises, H2 antagonists gain renewed relevance as safer, quick-relief alternatives. This convergence of product innovation, digital education, and consumer health consciousness creates meaningful expansion opportunities across regional and global OTC markets.

- For instance, Kenvue’s Pepcid AC® Original Strength chewable tablets are formulated with FDA-listed 10 mg famotidine and manufactured under OTC quality standards that require chewable tablets to meet USP disintegration criteria. These USP benchmarks specify a maximum 30-minute disintegration time for chewable tablet dosage forms.

Key Challenges

Competition from Proton Pump Inhibitors (PPIs)

Despite renewed interest, H2-receptor antagonists continue to face strong competitive pressure from PPIs, which remain the preferred therapy for moderate to severe GERD, erosive esophagitis, and ulcer healing. PPIs deliver more potent and sustained acid suppression, making them the standard of care in many clinical guidelines. This dominance reduces H2 blockers’ relevance for certain long-term treatments and specialist-driven prescriptions. Additionally, many PPIs are widely available as low-cost generics, increasing affordability for both patients and healthcare systems. As a result, H2 antagonists must rely heavily on OTC demand, mild case management, and niche indications to maintain market presence. Balancing clinical positioning against therapeutically superior alternatives remains a core challenge for manufacturers seeking long-term growth within the acid-suppressive therapy landscape.

Supply Chain Vulnerabilities and Manufacturing Constraints

Supply chain pressures represent another major challenge, especially as demand consolidated after ranitidine withdrawals. Manufacturers of alternative H2 antagonists must ensure uninterrupted raw material procurement, stringent quality control, and compliance with evolving impurity standards. Any disruption whether from regulatory audits, excipient shortages, or manufacturing delays can quickly affect availability, particularly for high-volume famotidine products. Moreover, injectable formulations require specialized sterile production capabilities, making them more susceptible to operational risks and compliance burdens. As global supply chains diversify and regulatory scrutiny intensifies, maintaining consistency, purity, and timely distribution remains complex. These vulnerabilities underscore the need for strategic manufacturing resilience and coordinated supply frameworks to support stable market performance.

Regional Analysis

North America

North America holds the largest market share of approximately 35%, driven by the high prevalence of GERD, extensive OTC use of famotidine products, and strong availability of branded and generic formulations. The U.S. leads regional demand due to widespread self-medication practices, strong retail pharmacy networks, and rapid adoption of safer H2 blockers following ranitidine withdrawal. Robust regulatory oversight, streamlined product approvals, and high consumer awareness of gastrointestinal health further support regional dominance. Continuous demand from hospital and outpatient settings reinforces North America’s strong position in the global market.

Europe

Europe accounts for roughly 28% of the global market, supported by well-established healthcare systems, widespread diagnosis of acid-related disorders, and strong clinical preference for famotidine-based therapies. Countries such as Germany, the U.K., France, and Italy drive significant consumption due to high GERD incidence and increasing OTC adoption. Regulatory harmonization under EMA standards has ensured consistent product quality and supply across major markets. The region also benefits from structured reimbursement frameworks and growing use of H2 antagonists in geriatric care. These factors collectively strengthen Europe’s position as the second-largest market.

Asia-Pacific

Asia-Pacific captures nearly 25% of the global market, driven by a large patient pool, rising incidence of gastrointestinal disorders, and expanding access to affordable generic H2 antagonists. Countries such as China, India, and Japan contribute significantly due to rapid urbanization, dietary shifts, and growing OTC consumption. Pharmaceutical manufacturers in the region maintain strong production capacities, supporting widespread availability in both hospital and retail channels. Increasing investment in healthcare infrastructure and expanding middle-class purchasing power further boost demand. This combination of demographic and economic factors positions Asia-Pacific as the fastest-growing regional contributor.

Latin America

Latin America holds an estimated 7% share of the global market, supported by increasing diagnosis of acid-related conditions and rising adoption of cost-effective H2 antagonists across Brazil, Mexico, Argentina, and Chile. Improved access to OTC formulations and growth in private healthcare services further drive utilization. While economic fluctuations and uneven reimbursement policies limit rapid expansion, steady demand for affordable, fast-acting acid-suppressive therapies keeps the market stable. Local and regional manufacturers actively supply generic famotidine and cimetidine, ensuring consistent product availability across retail pharmacies and hospital networks.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global market share, driven by rising gastrointestinal disease burden, lifestyle-related triggers, and growing access to urban healthcare facilities. GCC countries, particularly Saudi Arabia and the UAE, contribute most of the regional demand due to higher purchasing power and expanding retail pharmacy chains. In Africa, increasing penetration of generics and improvements in public healthcare distribution support modest growth. Despite infrastructure and affordability challenges in some markets, the region continues to show consistent adoption of essential H2 antagonists for acute and chronic treatment needs

Market Segmentations:

By Drug Type

- Cimetidine

- Ranitidine

- Famotidine

- Others

By Route of Administration

By Application

- Gastroesophageal Reflux Disease (GERD)

- Peptic Ulcers

- Zollinger–Ellison Syndrome

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the H2-receptor antagonists market is characterized by strong participation from multinational pharmaceutical companies and regional generic manufacturers that focus on high-volume production of famotidine and cimetidine. Industry leaders compete primarily on formulation innovation, supply chain reliability, and broad distribution across hospital, retail, and OTC channels. Following the global withdrawal of ranitidine, several manufacturers rapidly expanded famotidine output, intensifying competition and shifting market share toward producers with proven quality-control and impurity-mitigation capabilities. Companies strengthen their position through strategic collaborations, regulatory compliance excellence, and portfolio diversification, including oral, chewable, and injectable formats. In emerging markets, cost-effective generics drive competitive intensity, while in developed regions brand differentiation and patient-centric packaging remain key. Overall, the market reflects a balanced mix of established innovators and agile generic suppliers, with product safety, manufacturing resilience, and global distribution strength serving as the primary determinants of competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AstraZeneca

- AbbVie Inc.

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Novartis AG

- Bayer AG

- Merck & Co., Inc.

- Sanofi

- GlaxoSmithKline plc

- Pfizer Inc.

Recent Developments

- In November 2025, the U.S. Food and Drug Administration (FDA) approved a reformulated version of Ranitidine another H2-receptor antagonist marking its return to the U.S. market after safety-related withdrawal.

- In February 2025, Zydus Lifesciences obtained US FDA approval to market a combination tablet of 800 mg ibuprofen + 26.6 mg Famotidine

Report Coverage

The research report offers an in-depth analysis based on Drug type, Route of administration, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for H2-receptor antagonists will remain stable as clinicians continue recommending them for mild to moderate GERD and nighttime acid breakthrough.

- Famotidine will strengthen its position as the dominant molecule due to its proven safety profile and broad OTC acceptance.

- Manufacturers will expand formulation innovation, including fast-dissolving, chewable, and extended-release formats for improved patient convenience.

- Adoption of combination therapy with PPIs will rise to manage refractory or nocturnal symptoms more effectively.

- OTC channels will gain greater traction as consumers increasingly self-manage episodic acidity and heartburn.

- Emerging markets will witness faster growth driven by rising diagnosis rates and wider access to low-cost generics.

- Hospital demand for injectable H2 antagonists will remain steady for perioperative and acute gastrointestinal care.

- Digital health tools and telemedicine will influence prescription patterns by promoting symptom-based therapy selection.

- Regulatory focus on impurity control will drive higher manufacturing standards across global supply chains.

- Competition will intensify as generic players expand production capacity and strengthen distribution networks across developing regions.