Market Overview

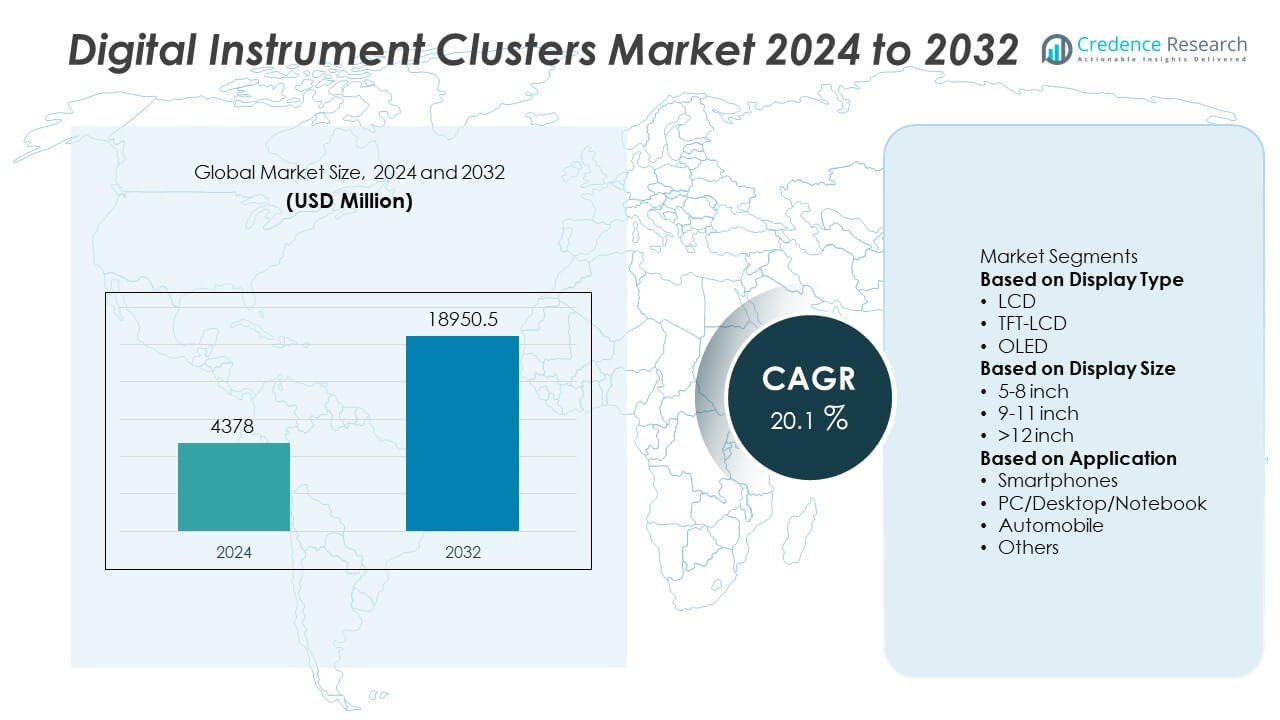

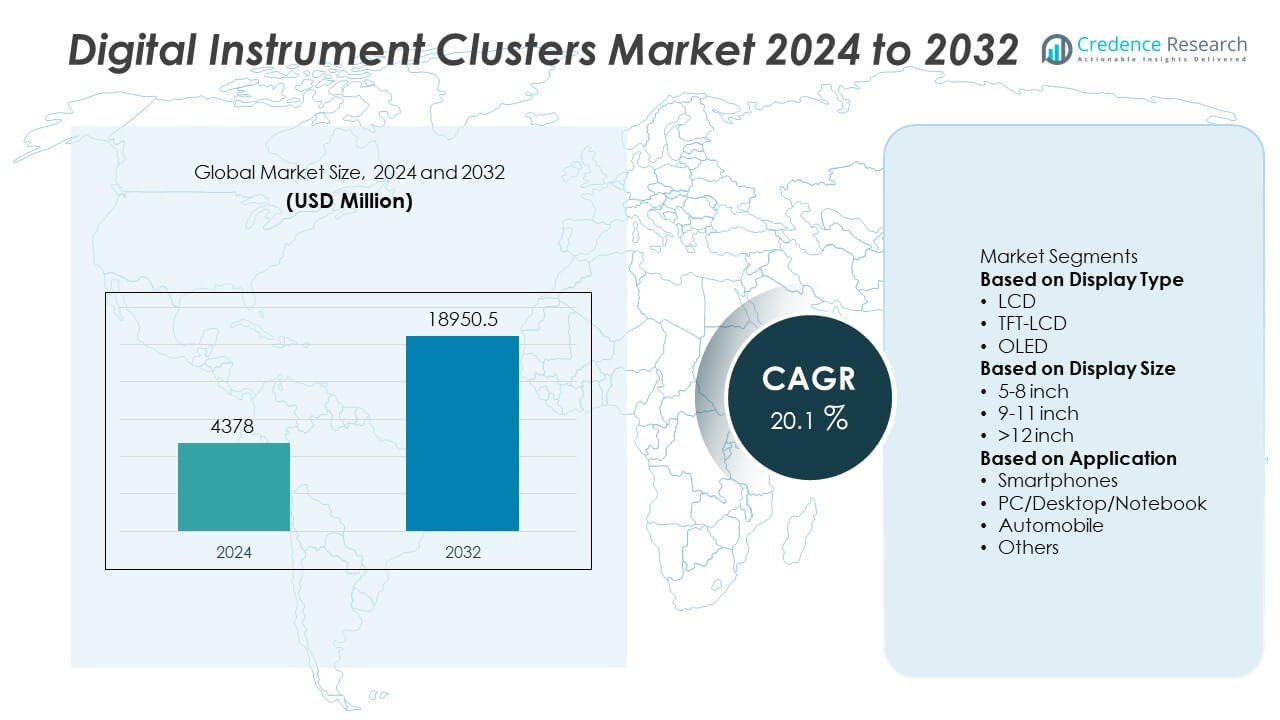

The Digital Instrument Clusters Market was valued at USD 4,378 million in 2024 and is projected to reach USD 18,950.5 million by 2032, growing at a CAGR of 20.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Instrument Clusters Market Size 2024 |

USD 4,378 Million |

| Digital Instrument Clusters Market, CAGR |

20.1% |

| Digital Instrument Clusters Market Size 2032 |

USD 18,950.5 Million |

Digital Instrument Clusters Market grows with rising adoption of connected vehicles, ADAS features, and electric mobility. Automakers integrate high-resolution digital clusters to display navigation, safety alerts, and vehicle diagnostics in real time. It improves driver awareness and enhances user experience with customizable layouts.

Digital Instrument Clusters Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Europe leading adoption due to advanced automotive manufacturing and early integration of digital cockpit technologies. North America benefits from high demand for connected vehicles and premium SUVs, while Asia-Pacific experiences rapid expansion driven by electric vehicle production, rising incomes, and consumer demand for tech-rich interiors. Latin America and Middle East & Africa present growing opportunities supported by urbanization, luxury car demand, and government investment in mobility infrastructure. Key players such as Continental, Bosch, Denso, and Hyundai Mobis focus on developing high-resolution TFT and OLED clusters, investing in AR-enabled dashboards, and expanding software capabilities. These companies collaborate with automakers to deliver customizable, scalable solutions that meet safety standards, improve driver engagement, and support integration with ADAS and infotainment systems, strengthening their position in this rapidly evolving market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Digital Instrument Clusters Market was valued at USD 4,378 million in 2024 and is projected to reach USD 18,950.5 million by 2032, growing at a CAGR of 20.1%.

- Rising demand for connected vehicles, ADAS features, and tech-driven interiors fuels market growth.

- Trends show increasing adoption of AR-enabled clusters, larger display sizes, and 3D visualization for better driver engagement.

- Key players such as Continental, Bosch, Denso, Hyundai Mobis, and Samsung Electronics focus on developing high-resolution OLED and TFT displays, expanding software capabilities, and partnering with automakers.

- High development costs, cybersecurity risks, and complex integration with vehicle electronics create major challenges for manufacturers and suppliers.

- Europe leads with strong innovation and EV adoption, while Asia-Pacific shows the fastest growth supported by rising production, government incentives, and expanding middle-class demand.

- Opportunities emerge from electric and autonomous vehicle production, connected ecosystems, and scalable cluster solutions for mid-range and mass-market vehicles worldwide.

Market Drivers

Growing Adoption of Advanced Driver Assistance Systems (ADAS)

Digital Instrument Clusters Market grows with increasing integration of ADAS and connected vehicle technologies. Modern vehicles require high-resolution, fully digital displays to present real-time data such as lane-keeping alerts, adaptive cruise control status, and collision warnings. Automakers use these clusters to enhance driver awareness and road safety. It supports seamless communication between driver and vehicle systems, improving decision-making during complex driving scenarios. Consumers prefer digital displays for their clarity and ability to customize information layouts. This demand pushes manufacturers to develop flexible, software-driven cluster solutions that support future upgrades and over-the-air updates.

- For instance, Visteon’s Premium Series clusters offer a display resolution of 2880×1080 pixels on a 12.3-inch screen with quad-core processor running at 1.1 GHz, enabling simultaneous rendering of ADAS warnings and navigation maps.

Rising Consumer Demand for Premium Vehicle Interiors

Digital Instrument Clusters Market benefits from growing interest in modern, tech-driven vehicle interiors. Drivers expect sleek dashboards with high-definition displays that mirror smartphone-like experiences. Automakers focus on using digital clusters to differentiate premium models and attract buyers seeking advanced features. It allows integration of infotainment, navigation, and performance data into a single display unit. Enhanced aesthetics and intuitive user interfaces help improve customer satisfaction. This trend drives adoption not only in luxury vehicles but also in mid-range and mass-market segments.

- For instance, Visteon’s Entry Series provides a 7-inch to 10.25-inch display with maximum resolution of 1280×768 pixels, aimed at affordability while offering features like brightness up to 1000 cd/m² for clear visibility in different lighting.

Shift Toward Electric and Hybrid Vehicles

Digital Instrument Clusters Market expands with rising production of electric and hybrid vehicles. EVs and hybrids rely on digital clusters to display battery status, range estimation, and energy consumption data. It provides critical information that helps drivers optimize performance and charging schedules. Automakers design customized layouts for EV clusters to highlight sustainability-focused metrics. Growing government incentives for EV adoption further fuel demand for such advanced display solutions. This segment offers manufacturers opportunities to innovate with energy-efficient and lightweight display technologies.

Technological Advancements in Display and Connectivity

Digital Instrument Clusters Market experiences strong growth from advancements in display resolution, graphics processing, and connectivity. TFT, OLED, and QLED panels enable sharper visuals and reduced power consumption. It supports seamless integration with smartphones, voice assistants, and cloud-based applications. Manufacturers invest in AR-enabled clusters that overlay navigation and safety information on the windshield. Growing use of 3D visualization improves user experience and vehicle personalization. Continuous R&D ensures faster processing speeds, better reliability, and reduced latency. These innovations keep digital clusters at the center of automotive cockpit evolution.

Market Trends

Integration of Augmented Reality and 3D Graphics

Digital Instrument Clusters Market is seeing rapid adoption of augmented reality (AR) and 3D visualization. Automakers use AR-enabled clusters to project navigation arrows, hazard alerts, and traffic data directly into the driver’s line of sight. It improves driver focus and reduces distraction by minimizing reliance on separate displays. 3D graphics enhance depth perception and make information easier to interpret quickly. Premium carmakers lead this trend, but mid-segment vehicles are starting to include similar features. These advancements improve the overall driving experience and strengthen brand differentiation.

- For instance, Geely’s Boyue L (2025 facelift) includes a 25.6-inch AR-HUD plus a separate 10.25-inch digital instrument cluster display.

Expansion into Mid-Range and Mass-Market Vehicles

Digital Instrument Clusters Market expands beyond luxury segments as costs decline and production scales up. Automakers now offer fully digital clusters in compact cars and entry-level SUVs. It increases market penetration and widens customer access to advanced cockpit technology. Drivers expect customizable displays with smartphone integration even in budget models. Manufacturers respond by developing cost-effective, modular cluster platforms suitable for multiple vehicle types. This democratization of technology supports long-term market growth and consumer adoption.

- For instance, the pre-2025 Geely Boyue L featured a 10.25-inch digital instrument cluster and a 13.2-inch central infotainment display. This system was powered by a Qualcomm Snapdragon 8155 processor, enabling smooth rendering of 3D graphics and real-time data.

Focus on Personalization and Connectivity

Digital Instrument Clusters Market benefits from rising demand for personalization and connected features. Drivers want dashboards that display relevant information based on driving style and preferences. It enables customizable themes, layouts, and widgets, allowing users to tailor their experience. Connectivity with smartphones and IoT ecosystems lets drivers receive updates, alerts, and media controls in real time. Automakers integrate cloud-based services to offer predictive maintenance and over-the-air software upgrades. These capabilities create a more interactive and intelligent cockpit environment.

Advances in Display Technology and Energy Efficiency

Digital Instrument Clusters Market grows with continuous improvement in display panels, processors, and software optimization. Manufacturers adopt TFT, AMOLED, and microLED displays for high resolution and low latency. It reduces power consumption while providing vivid color reproduction and improved durability. Thinner and lighter panels support weight reduction efforts for fuel efficiency. Automotive suppliers focus on enhancing brightness and anti-glare properties for better visibility in all conditions. Such innovations make clusters more reliable, cost-efficient, and suitable for future mobility platforms.

Market Challenges Analysis

High Development Costs and Complex Integration

Digital Instrument Clusters Market faces challenges due to high development costs and complex integration with vehicle electronics. Advanced clusters require powerful processors, high-resolution displays, and sophisticated software platforms, raising production expenses. It creates pressure on automakers to balance cost efficiency and premium user experience. Integration with multiple vehicle systems such as ADAS, infotainment, and telematics demands robust testing and validation. Any failure can impact safety, leading to recalls and warranty costs. Tier-1 suppliers invest heavily in R&D to deliver scalable and cost-effective solutions, but achieving affordability for mass-market vehicles remains difficult.

Cybersecurity Risks and Reliability Concerns

Digital Instrument Clusters Market is impacted by rising cybersecurity risks and system reliability issues. Clusters connected to cloud services and vehicle networks face threats of hacking and data breaches. It forces manufacturers to invest in secure software architectures and encryption protocols. Hardware and software failures can lead to display blackouts or incorrect data, creating safety hazards. Meeting strict automotive functional safety standards such as ISO 26262 increases development time. Suppliers must ensure robust performance under extreme temperatures, vibration, and electromagnetic interference. These challenges make reliability and security critical factors for market success.

Market Opportunities

Rising Adoption of Electric and Autonomous Vehicles

Digital Instrument Clusters Market holds significant opportunities with the global shift toward electric and autonomous mobility. EVs depend on digital clusters to display battery health, charging status, and energy consumption data in real time. It allows automakers to design advanced visual interfaces that educate drivers about energy efficiency and range management. Autonomous vehicles will need intelligent dashboards to provide status updates and reassure passengers about system performance. Automakers can offer premium personalization features and subscription-based services through these digital interfaces. Growing investment in EV infrastructure worldwide further boosts demand for advanced display solutions.

Expansion in Emerging Markets and Connected Ecosystems

Digital Instrument Clusters Market gains growth potential from rising vehicle production in Asia-Pacific, Latin America, and Middle East regions. Consumers in these markets increasingly expect modern, tech-rich interiors even in affordable cars. It creates opportunities for suppliers to develop scalable, low-cost digital cluster platforms. Growing penetration of connected cars and IoT-enabled services enhances value by offering navigation, telematics, and infotainment in one interface. Automakers can leverage data analytics to improve user experience and provide predictive maintenance alerts. These opportunities enable manufacturers to expand their global footprint and capture untapped demand.

Market Segmentation Analysis:

By Display Type

Digital Instrument Clusters Market is segmented by display type into LCD, TFT-LCD, and OLED. TFT-LCD dominates due to its balance of cost-effectiveness, durability, and ability to deliver high-resolution graphics. Automakers adopt OLED displays in premium models for their superior contrast, flexibility, and thinner design. It allows curved and customizable dashboards that enhance vehicle aesthetics. LCD displays maintain presence in entry-level vehicles because of their affordability. The transition toward fully digital clusters is accelerating, with hybrid analog-digital solutions slowly phasing out. This shift supports the industry’s move toward connected and intelligent cockpit systems.

- For instance, Visteon unveiled a curved large-format OLED display exceeding 27 inches in screen size, integrated into next-generation luxury electric vehicles to enable customizable dashboards and seamless infotainment-ADAS overlays.

By Display Size

Digital Instrument Clusters Market by display size is divided into less than 5 inches, 5–8 inches, and above 8 inches. Displays above 8 inches lead demand, driven by growing preference for wide, panoramic clusters in premium cars and SUVs. It enables seamless integration of navigation, infotainment, and ADAS alerts in a single screen. The 5–8-inch segment sees steady adoption in mid-range vehicles as manufacturers balance cost and functionality. Smaller clusters under 5 inches remain relevant in compact and entry-level models where minimal display space is required. Automakers continue to expand screen size offerings to create immersive driver experiences. The trend favors larger and high-resolution displays across multiple vehicle categories.

- For instance, an earlier version of BMW’s Live Cockpit Professional with iDrive 7.0 delivered a fully digital 12.3-inch instrument cluster and was accompanied in models like the pre-facelift G20 3 Series and G15 8 Series by a 10.25-inch center console display. In newer BMWs running iDrive 8 or later, the displays are larger and integrated into a single curved screen, which typically consists of a 12.3-inch instrument display and a 14.9-inch control display.

By Application

Digital Instrument Clusters Market by application includes passenger cars, commercial vehicles, and two-wheelers. Passenger cars dominate due to strong demand for comfort, connectivity, and advanced cockpit features. It drives adoption in SUVs, sedans, and electric cars globally. Commercial vehicles are integrating digital clusters to improve driver information access and enhance fleet monitoring. Two-wheeler adoption is rising in premium motorcycles and electric scooters, offering real-time navigation and performance data. This broadening application base strengthens revenue opportunities for display and software suppliers. Growing use across vehicle segments supports long-term market expansion and technology evolution.

Segments:

Based on Display Type

Based on Display Size

- 5-8 inch

- 9-11 inch

- >12 inch

Based on Application

- Smartphones

- PC/Desktop/Notebook

- Automobile

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 27% market share in the Digital Instrument Clusters Market, driven by strong adoption of connected vehicles and ADAS technologies. The U.S. leads production with high penetration of premium cars and SUVs equipped with digital cockpit solutions. It benefits from advanced automotive electronics infrastructure and early adoption of electric vehicles. Automakers invest in integrating large, high-resolution digital clusters to improve user experience and meet consumer demand for customization. Growth in over-the-air updates and subscription-based infotainment services further accelerates market adoption. Canada and Mexico contribute through manufacturing facilities and increasing vehicle production, supporting steady regional growth.

Europe

Europe accounts for 33% market share, making it the largest region in the Digital Instrument Clusters Market. German, French, and U.K. automakers drive innovation in digital cockpit design and use OLED and TFT displays in luxury and mid-range vehicles. It benefits from strong focus on driver safety, sustainability, and compliance with strict automotive standards. Electric vehicle sales continue to rise, creating demand for advanced digital dashboards to display energy consumption and range data. European consumers favor highly personalized driving experiences, encouraging automakers to offer customizable cluster themes and layouts. Partnerships with technology providers strengthen development of AR-enabled clusters across major brands.

Asia-Pacific

Asia-Pacific captures 29% market share and is the fastest-growing region in the Digital Instrument Clusters Market. China leads production, supported by large-scale automotive manufacturing and rapid adoption of electric vehicles. It benefits from government incentives promoting EV production and connected car technologies. Japan and South Korea contribute through innovation in display panels, semiconductors, and software solutions for intelligent cockpits. Rising middle-class incomes and urbanization drive demand for feature-rich vehicles across India and Southeast Asia. Expanding e-mobility ecosystems and smart city initiatives boost integration of digital clusters in multiple vehicle categories. This region is expected to remain the primary growth engine over the forecast period.

Latin America

Latin America holds 6% market share, supported by growing demand for tech-enabled passenger cars and SUVs. Brazil and Mexico drive regional sales with rising consumer interest in connected vehicle features. It faces cost constraints, but automakers introduce mid-range models with hybrid digital clusters to attract buyers. Economic recovery and expanding financing options increase new vehicle purchases. Local assembly plants adopt digital cockpit solutions, creating opportunities for Tier-1 suppliers. Increasing penetration of electric and hybrid vehicles supports future growth potential.

Middle East & Africa

Middle East & Africa represents 5% market share, driven by luxury vehicle demand and growing urban mobility projects. GCC countries such as UAE and Saudi Arabia lead adoption of premium cars with fully digital dashboards. It benefits from rising investments in smart infrastructure and electric mobility. Automakers focus on offering digital cluster options even in imported mid-segment vehicles to meet evolving consumer expectations. South Africa shows steady demand supported by growing SUV sales and local assembly operations. The region presents long-term opportunities as governments promote connected and sustainable transportation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Veoneer

- Yanfeng Automotive Electronics

- Pioneer

- Bosch

- Clarion

- Hyundai Mobis

- Continental

- Samsung Electronics

- Valeo

- Denso

Competitive Analysis

Competitive landscape of the Digital Instrument Clusters Market is shaped by leading players such as Continental, Bosch, Denso, Valeo, Hyundai Mobis, Yanfeng Automotive Electronics, Samsung Electronics, Pioneer, Clarion, and Veoneer. These companies focus on developing advanced TFT, OLED, and microLED cluster solutions with superior resolution, low latency, and energy efficiency to meet growing demand for connected and intelligent cockpits. They invest heavily in R&D to integrate AR capabilities, 3D graphics, and over-the-air software updates, enabling enhanced driver engagement and real-time data visualization. Partnerships with global automakers strengthen supply chain presence and ensure seamless integration with ADAS, infotainment, and telematics systems. Tier-1 suppliers expand production capacity and develop modular, scalable platforms that suit both premium and mass-market vehicle segments. Efforts to improve cybersecurity, functional safety, and compliance with ISO 26262 standards remain critical for maintaining trust and reliability. These strategies allow players to remain competitive in a rapidly evolving market.

Recent Developments

- In August 2025, Denso, Beginning a demonstration project named Solwer with Dream Incubator. It aims to build an integrated digital platform managing big data from India’s automotive aftermarket + supply chain.

- In August 2025, Denso, At ITS World Congress, Denso will showcase its MobiQ™ brand solutions including on-board and roadside V2X units, and keyless access HMI technologies.

- In 2025, At Bosch Tech Day in May 2025, the company emphasized AI-based solutions for assisted and automated driving. Likely such solutions feed into future digital cluster features, though no explicit cluster product was announced in that event

- In 2024, Yanfeng unveiled its EVI (Electric Vehicle Interior) concept at CES 2024. The concept eliminates the traditional instrument panel; replaces it with a Smart Cabin Seat module that integrates displays, HMI, safety systems, steer-by-wire input, and climate control.

Report Coverage

The research report offers an in-depth analysis based on Display Type, Display Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced digital clusters will rise with growing connected and autonomous vehicles.

- AR-enabled and 3D visualization features will become standard in premium and mid-range models.

- Larger, high-resolution OLED and microLED displays will dominate future vehicle interiors.

- Software-driven clusters will enable frequent over-the-air updates and new feature activation.

- Personalization options will expand, allowing drivers to customize layouts and themes.

- Electric and hybrid vehicles will boost demand for energy consumption and range-focused displays.

- Cybersecurity solutions will become a priority to protect connected vehicle data.

- Emerging markets will adopt digital clusters rapidly with increasing vehicle production and income levels.

- Collaborations between automakers and tech companies will speed up product innovation.

- Cost optimization and modular platforms will make digital clusters more accessible to mass-market vehicles.