Market Overview

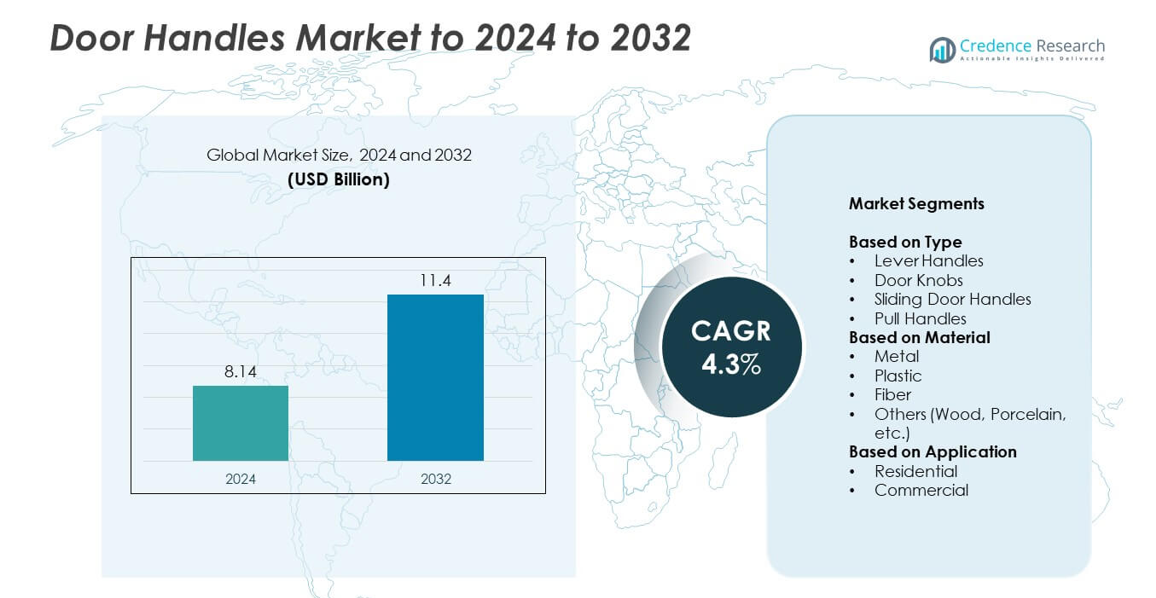

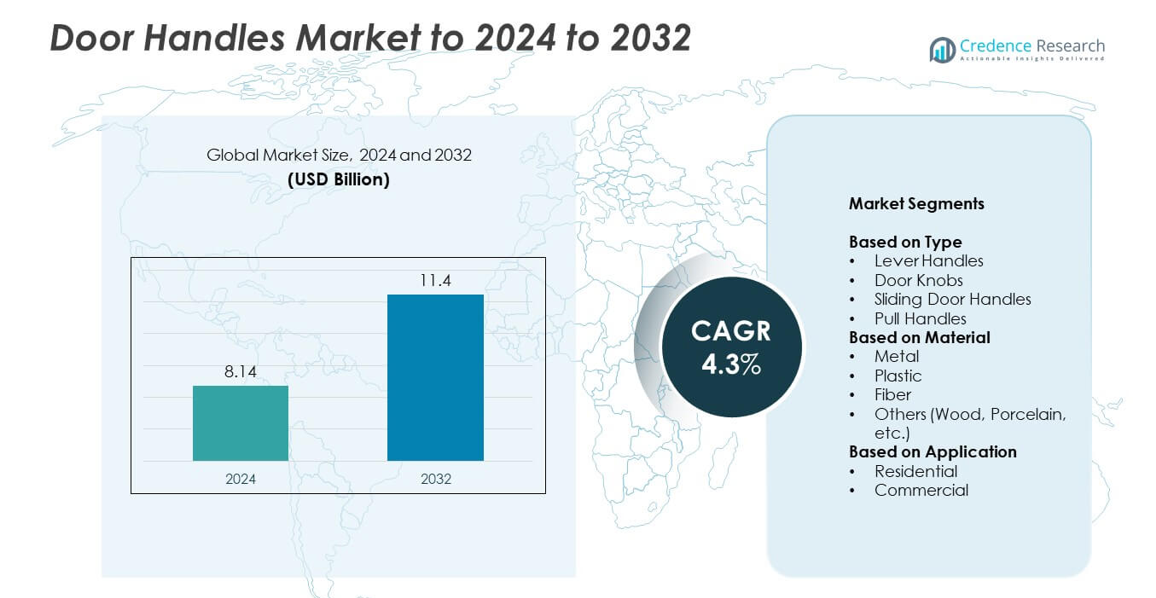

Door Handles Market size was valued USD 8.14 Billion in 2024 and is anticipated to reach USD 11.4 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Door Handles Market Size 2024 |

USD 8.14 Billion |

| Door Handles Market, CAGR |

4.3% |

| Door Handles Market Size 2032 |

USD 11.4 Billion |

The door handles market is shaped by prominent players such as Allegion Plc, Sugatsune America, Inc., Kuriki Manufacture Co., Baldwin Hardware, Hoppe Holding AG, Assa Abloy AB, Aarkay Vox, The Häfele Group, West INX Ltd., Kwikset, Emtek Products Inc., and Ace Hardware Corp. These companies focus on technological innovation, design customization, and sustainable production to enhance competitiveness. Product advancements include smart locking systems, ergonomic designs, and eco-friendly materials, catering to both residential and commercial demand. Regionally, Asia Pacific led the global market in 2024 with a 34% share, driven by rapid urbanization, infrastructure growth, and expanding housing developments, while North America and Europe followed as mature yet innovation-driven markets.

Market Insights

- The door handles market was valued at USD 8.14 billion in 2024 and is projected to reach USD 11.4 billion by 2032, growing at a CAGR of 4.3%.

- Rising residential and commercial construction activities, coupled with home renovation trends, are driving market expansion globally.

- Lever handles held the largest share of about 46% in 2024, supported by ergonomic design and high demand in modern buildings.

- The market is competitive, with key players focusing on smart, decorative, and sustainable handle designs to strengthen their global presence.

- Asia Pacific led the market with a 34% share in 2024, followed by North America at 28% and Europe at 25%, driven by strong infrastructure growth and product innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Lever handles dominated the door handles market in 2024, accounting for around 46% share. Their popularity stems from ergonomic design, ease of use, and compatibility with modern door systems. Lever handles are increasingly preferred in both residential and commercial settings for accessibility and aesthetic appeal. Manufacturers focus on smart lever designs with integrated locking systems to meet growing security and convenience demands. Rising renovation and construction projects globally continue to drive demand for lever handles, particularly in the premium architectural and hospitality sectors.

- For instance, dormakaba’s FOUR+ lever handles surpassed 1,000,000 test cycles under BS EN 1906 load testing.

By Material

Metal-based door handles held the leading position with nearly 58% market share in 2024. Stainless steel, brass, and aluminum are widely used due to durability, corrosion resistance, and elegant finishes. The material’s strength supports usage in heavy-duty commercial and industrial environments. The growing preference for metallic finishes in interior design also supports this dominance. Sustainable production of metal handles and growing use of recyclable alloys are emerging as additional growth drivers in the segment.

- For instance, Sugatsune’s 316-grade stainless handles list exact specs, such as 200 mm width and 1,000 g weight on model FT-T-220.

By Application

The residential segment accounted for the largest share of around 62% in 2024. Rapid urbanization, rising housing investments, and renovation activities are key growth drivers. Consumers increasingly prefer decorative and smart door handle solutions, aligning with modern home automation trends. Additionally, higher disposable income in developing nations supports demand for premium handles with advanced locking and aesthetic features. The increasing emphasis on home safety and customized interior design continues to strengthen the residential segment’s leadership in the overall door handles market.

Key Growth Drivers

Expanding Construction and Renovation Activities

The global rise in residential and commercial construction directly fuels demand for door handles. Rapid urbanization and infrastructure projects in developing nations increase installations across housing and office spaces. Renovation and remodeling trends in developed markets further boost replacement demand. The growing emphasis on energy-efficient and aesthetic building materials encourages adoption of modern and durable handle designs, driving steady market expansion.

- For instance, ASSA ABLOY completed 24 acquisitions in 2023, including the acquisition of Spectrum Brands’ Hardware and Home Improvement (HHI) division.

Rising Demand for Smart and Aesthetic Handles

The growing popularity of smart homes and connected devices is driving demand for digital and sensor-based door handles. Consumers seek advanced locking mechanisms with touchless or biometric features for enhanced convenience and safety. At the same time, modern interior design trends promote decorative finishes, customized shapes, and luxury aesthetics, encouraging premium product innovation among manufacturers.

- For instance, Häfele’s Genesis DL8800 smart lock stores 300 user codes and is rated IP55.

Increasing Focus on Material Innovation and Sustainability

The shift toward eco-friendly and durable materials is a major growth enabler. Manufacturers are adopting stainless steel, zinc, and recyclable alloys to enhance longevity and reduce environmental impact. Sustainable manufacturing processes and low-emission coatings also align with green building standards. These innovations enhance product performance and appeal to environmentally conscious consumers and construction firms.

Key Trends and Opportunities

Integration of Smart Technology in Door Hardware

The adoption of electronic and IoT-enabled door handles is transforming building security systems. Smart locks with wireless connectivity allow remote access and real-time monitoring, catering to residential and hospitality sectors. This shift toward digital door solutions opens new opportunities for hardware companies to collaborate with smart home technology providers.

- For instance, GEZE networked over 180 door systems in one campus and supports up to 200 connected devices per controller.

Growing Popularity of Premium and Customizable Designs

Consumers increasingly value personalization and aesthetics in home interiors. Manufacturers respond with customizable handles featuring varied textures, finishes, and color options. The surge in luxury housing projects and boutique hotels creates a lucrative opportunity for high-end handle designs that blend functionality with visual appeal.

- For instance, KURIKI’s catalog details configurable hardware, with an adjustable strike plate that provides a front-back adjustment range of ±2 mm.

Key Challenges

Price Fluctuations in Raw Materials

Volatility in prices of metals such as stainless steel and aluminum poses challenges to manufacturers. Rising raw material costs affect production budgets and profit margins, especially for mid-range and small-scale producers. This volatility also limits the affordability of premium designs for cost-sensitive markets.

Intense Market Competition and Product Imitation

The presence of numerous local and global manufacturers leads to intense price competition. Low-cost imitations and counterfeit products erode brand loyalty and hinder innovation investments. Maintaining product differentiation through quality assurance and design innovation remains a significant challenge for established brands.

Regional Analysis

North America

North America accounted for nearly 28% of the global door handles market in 2024. The region’s growth is driven by strong residential construction, renovation projects, and demand for smart locking systems. The United States dominates regional consumption due to rapid adoption of automated and designer handles. Energy-efficient housing and commercial remodeling trends also support product demand. Manufacturers focus on premium metal finishes and digital integration to meet evolving consumer preferences, strengthening the region’s competitive edge in the global market.

Europe

Europe held around 25% market share in 2024, supported by sustainable construction practices and demand for high-quality architectural hardware. Countries such as Germany, the U.K., and France lead consumption due to rising renovation activities and luxury housing trends. European consumers prefer handles made from recyclable materials, reflecting the region’s emphasis on eco-friendly designs. Regulatory standards promoting energy-efficient and sustainable products further drive innovation. Increasing adoption of contemporary and minimalist interior styles contributes to steady market expansion across residential and hospitality segments.

Asia Pacific

Asia Pacific dominated the global market with about 34% share in 2024. Rapid urbanization, housing demand, and government-backed infrastructure projects in China, India, and Southeast Asia boost product consumption. Growing middle-class income and rising interest in modern interior design support higher adoption of decorative and smart door handles. Local manufacturers are expanding capacity to meet domestic demand while competing with international brands. The region’s large construction sector and ongoing urban development make Asia Pacific the fastest-growing and most dynamic regional market.

Latin America

Latin America represented close to 7% market share in 2024, driven by recovery in residential construction and increasing commercial property development. Brazil and Mexico lead demand with growing investments in housing and hospitality infrastructure. Rising consumer preference for stylish and durable handles encourages the use of metal and fiber-based products. However, economic fluctuations and uneven supply chains affect product availability. Manufacturers are focusing on affordable yet durable solutions to cater to expanding urban populations and mid-range housing projects.

Middle East and Africa

The Middle East and Africa held nearly 6% market share in 2024. Growth is fueled by rapid urban development, hospitality expansion, and premium real estate projects in Gulf nations. The UAE and Saudi Arabia drive regional demand for luxury and smart handle designs. Increasing adoption of energy-efficient and decorative hardware in commercial buildings enhances market potential. However, limited awareness in rural areas and economic disparities constrain overall market penetration, though infrastructure investment continues to support steady growth across key cities.

Market Segmentations:

By Type

- Lever Handles

- Door Knobs

- Sliding Door Handles

- Pull Handles

By Material

- Metal

- Plastic

- Fiber

- Others (Wood, Porcelain, etc.)

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The door handles market is highly competitive, with key players such as Allegion Plc, Sugatsune America, Inc., Kuriki Manufacture Co., Baldwin Hardware, Hoppe Holding AG, Assa Abloy AB, Aarkay Vox, The Häfele Group, West INX Ltd., Kwikset, Emtek Products Inc., and Ace Hardware Corp. leading product innovation and global expansion. The market includes both multinational and regional manufacturers focusing on material advancement, ergonomic design, and integrated security solutions. Companies are investing in research to develop sustainable, smart, and aesthetically refined handles that cater to evolving architectural and consumer trends. Partnerships with construction developers and smart home solution providers are expanding product reach. Manufacturers emphasize high-quality metal finishes, touchless operation, and energy-efficient features to appeal to both residential and commercial sectors. Competitive strength is driven by design innovation, durability, and safety compliance. Growing e-commerce presence, customizable options, and eco-friendly production methods continue to define the industry’s future landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Allegion Plc

- Sugatsune America, Inc.

- Kuriki Manufacture Co.

- Baldwin Hardware

- Hoppe Holding AG

- Assa Abloy AB

- Aarkay Vox

- The Häfele Group

- West INX Ltd.

- Kwikset

- Emtek Products Inc.

- Ace Hardware Corp.

Recent Developments

- In 2025, Kwikset launched the Mirada collection, which features a reeded lever and handleset.

- In 2024, Aarkay Vox launched a new ball bearing drawer runner from its manufacturing plant, diversifying its hardware offerings beyond door handles.

- In 2023, Baldwin Hardware’s Graphite Nickel finish received the “DPHA Door Hardware Product of the Year” award. The finish was praised for its durability and unique fusion of warm and cool tones.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart and connected door handles will gain momentum with rising home automation adoption.

- Manufacturers will focus on sustainable materials and recyclable metals to meet green standards.

- Demand for decorative and customizable handles will increase in luxury housing projects.

- Integration of biometric and touchless locking technologies will become a key differentiator.

- Asia Pacific will continue to dominate global demand driven by urbanization and construction growth.

- Rising renovation activities in developed markets will boost replacement handle sales.

- Compact and ergonomic handle designs will attract wider consumer preference.

- Partnerships between hardware and smart tech firms will expand digital handle offerings.

- E-commerce platforms will play a vital role in product visibility and distribution growth.

- Innovation in anti-corrosion and antimicrobial coatings will enhance product longevity and appeal.