Market Overview

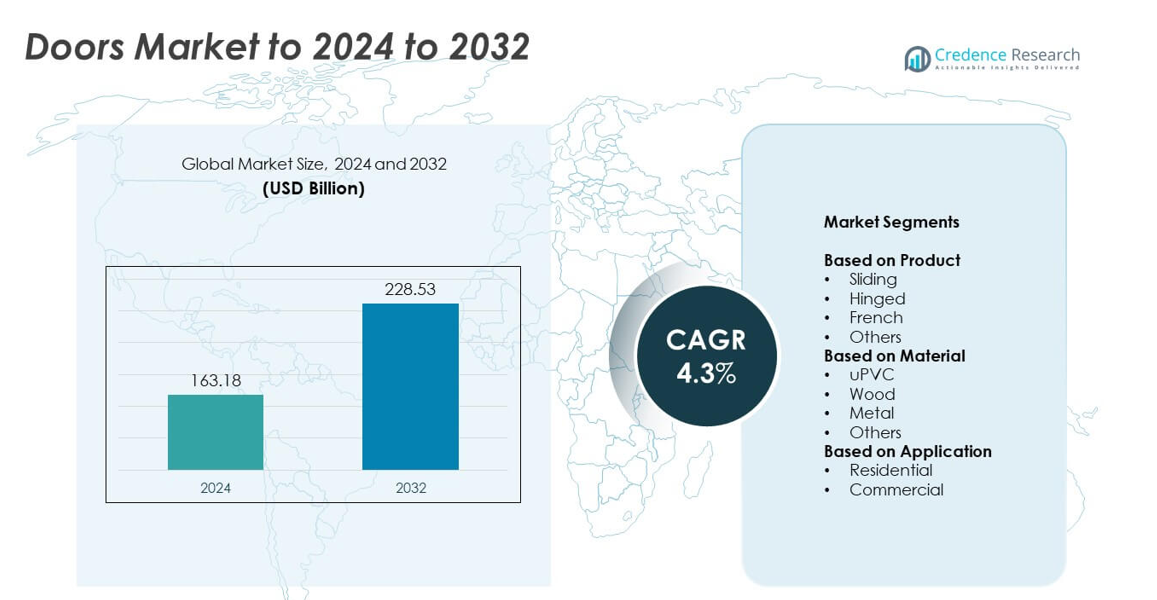

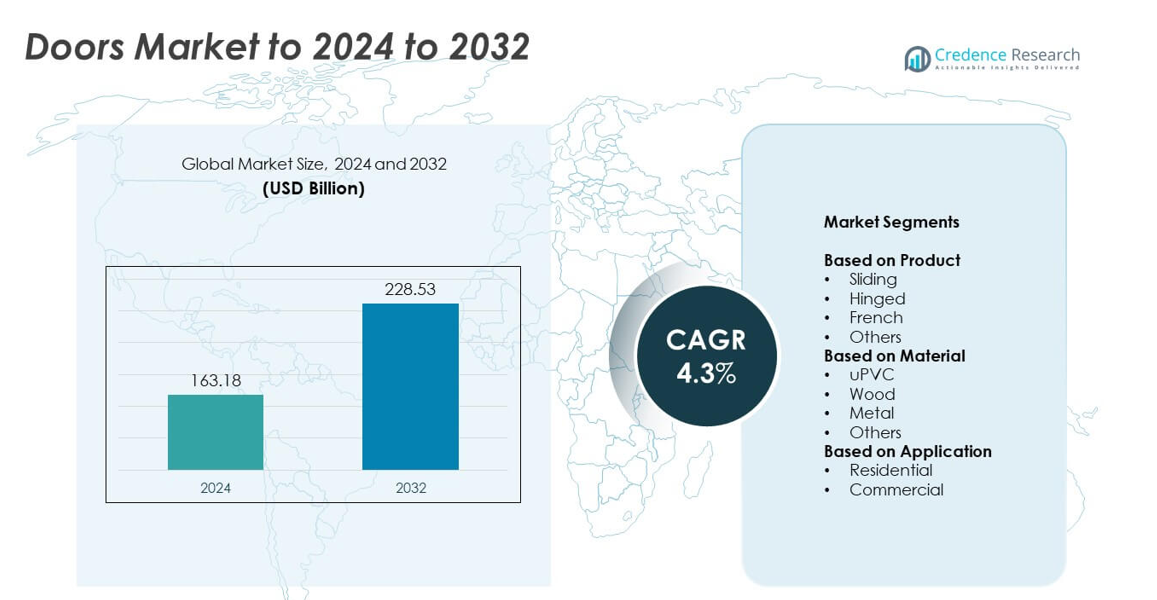

Doors Market size was valued at USD 163.18 Billion in 2024 and is anticipated to reach USD 228.53 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Doors Market Size 2024 |

USD 163.18 Billion |

| Doors Market, CAGR |

4.3% |

| Doors Market Size 2032 |

USD 228.53 Billion |

The doors market is highly competitive, with key players such as Masonite International Corporation, JELD-WEN, Inc, Deceuninck, Marvin Windows & Doors, and YKK Corporation leading global operations. These companies focus on innovation, energy efficiency, and sustainable manufacturing to strengthen their market presence. Asia-Pacific emerged as the leading region in 2024, capturing a 34% market share driven by rapid urbanization, housing expansion, and infrastructure development across China, India, and Japan. North America and Europe followed closely, supported by renovation projects, high consumer spending, and growing demand for smart and eco-friendly door systems across both residential and commercial sectors.

Market Insights

- The doors market was valued at USD 163.18 Billion in 2024 and is projected to reach USD 228.53 Billion by 2032, growing at a CAGR of 4.3%.

- Rising urbanization, infrastructure development, and demand for energy-efficient building materials are driving steady market expansion across residential and commercial sectors.

- The market is witnessing a growing shift toward smart, automated, and sustainable door systems, with uPVC and wooden materials gaining significant traction.

- Leading companies focus on product innovation, sustainable sourcing, and advanced manufacturing technologies to maintain competitiveness in a fragmented market.

- Asia-Pacific led the global market with a 34% share in 2024, followed by North America at 32% and Europe at 28%, while the hinged door segment dominated product demand with a 42% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The hinged doors segment dominated the doors market in 2024 with a 42% share. Their widespread use in residential and commercial buildings stems from their simple design, durability, and low maintenance needs. Hinged doors offer better insulation and soundproofing compared to sliding or French types, driving their popularity in modern housing. Growing urbanization and rising demand for energy-efficient housing solutions are further supporting the adoption of hinged doors. Manufacturers continue to innovate with advanced materials and customizable designs to meet evolving architectural preferences across global markets.

- For instance, Hörmann runs over 40 specialized factories and has delivered 20,000,000+ doors worldwide.

By Material

The wood segment held the largest share of 38% in 2024, driven by its aesthetic appeal and natural insulation properties. Wooden doors remain a preferred choice in residential applications due to their design versatility and strength. The increasing focus on eco-friendly materials and sustainable forestry practices boosts demand for certified wood products. However, competition from uPVC and metal doors is rising due to their superior weather resistance and lower maintenance. Technological advancements in engineered wood also enhance durability and moisture resistance, supporting steady market growth.

- For instance, As of mid-2024, Masonite International Corporation has been acquired by Owens Corning. While Masonite’s pre-acquisition workforce was noted as 10,000+ employees, and it operated numerous facilities, it is now part of a much larger parent company.

By Application

The residential segment led the doors market in 2024 with a 55% share, reflecting strong global housing demand. Expansion in urban housing projects and government initiatives for affordable homes are key growth drivers. The shift toward modern interior designs and energy-efficient door systems has increased the use of customized and smart doors in homes. Rapid urbanization, especially in Asia-Pacific, further strengthens residential demand. Meanwhile, the commercial segment grows steadily, driven by investments in offices, retail spaces, and institutional infrastructure emphasizing aesthetics and security.

Key Growth Drivers

Rising Urbanization and Construction Activities

Rapid urbanization and expansion of residential and commercial infrastructure are key factors driving the doors market. The surge in smart city projects and government housing initiatives has led to higher demand for durable and aesthetic door solutions. Growth in office spaces, retail outlets, and hospitality infrastructure further boosts market expansion. The increasing focus on energy-efficient and secure door installations supports consistent adoption across both developed and emerging economies, making urban infrastructure development a major market growth driver.

- For instance, Marvin opened a 400,000 sq ft manufacturing facility in Kansas City, Kansas, in 2025

Growing Demand for Energy-Efficient and Smart Doors

The rising preference for energy-efficient and automated door systems is accelerating market growth. Consumers are increasingly choosing smart doors equipped with sensors, remote control, and access management systems for enhanced security and convenience. Builders and developers prioritize such doors to meet green building certifications and sustainability goals. Continuous innovation in insulation materials and sensor-based technologies strengthens this trend, creating strong opportunities for premium and technology-integrated door solutions across residential and commercial projects.

- For instance, dormakaba is deploying access systems at 10 locations across 7 countries for thyssenkrupp.

Expansion of the Real Estate and Renovation Sector

The real estate sector’s steady growth and rising renovation activities are fueling door sales worldwide. Increasing disposable incomes and lifestyle upgrades encourage consumers to invest in high-quality doors with modern aesthetics. Rapid expansion of renovation projects in aging buildings, especially in North America and Europe, is driving replacement demand. Builders also focus on stylish, durable, and sustainable door designs to enhance property value. This sustained demand from both new construction and renovation activities acts as a strong market growth driver.

Key Trends and Opportunities

Adoption of Sustainable and Eco-Friendly Materials

The shift toward sustainable materials presents a major opportunity for the doors market. Manufacturers increasingly use recycled metals, certified wood, and uPVC to meet environmental standards. Eco-conscious consumers prefer low-VOC finishes and long-lasting products, driving innovation in green door materials. Governments’ support for sustainable construction and stricter building codes further encourage manufacturers to adopt environmentally responsible production practices, strengthening brand reputation and expanding market reach among green-certified building projects.

- For instance, REHAU’s ARTEVO TERRA profiles reach Uf 0.79 W/m²K with up to 78% recycled content.

Integration of Smart and Automated Door Systems

The integration of smart technologies such as IoT-enabled locking, motion sensors, and biometric systems is reshaping the door industry. Growing adoption of home automation and smart building infrastructure creates opportunities for technology-driven door solutions. These advanced systems enhance security, convenience, and energy efficiency. Rising consumer awareness about connected devices and demand for premium living experiences continue to push manufacturers to develop intelligent and customized door offerings, particularly in the residential and hospitality sectors.

- For instance, ASSA ABLOY employs 63,000 people worldwide and acquired Messerschmitt Systems (~100 employees) for hospitality access tech.

Key Challenges

Fluctuating Raw Material Prices

Volatile prices of key raw materials such as wood, aluminum, and steel pose a major challenge for manufacturers. Frequent cost variations impact production budgets and profit margins, forcing companies to balance between quality and affordability. The global supply chain disruptions and rising transportation costs have further intensified material price fluctuations. This instability makes it difficult for small and mid-sized manufacturers to maintain competitive pricing, hindering market expansion in cost-sensitive regions.

Intense Market Competition and Product Imitation

The doors market faces stiff competition due to the presence of numerous global and regional players offering similar products. The rise of low-cost imitations, particularly in developing markets, affects brand reputation and profit margins of established companies. Maintaining product differentiation and ensuring quality consistency remain critical challenges. To stay competitive, manufacturers must invest in design innovation, advanced materials, and digital marketing strategies while managing cost pressures from unorganized market participants.

Regional Analysis

North America

North America held a 32% share of the global doors market in 2024, supported by strong construction and remodeling activity. The region benefits from increasing investments in residential housing, commercial buildings, and smart infrastructure. Rising consumer preference for energy-efficient and secure door systems is driving demand for smart and insulated door products. The United States dominates the regional market due to advanced technology adoption and higher spending on home improvement. Sustainable materials and modern designs are gaining popularity as builders and homeowners focus on durability and environmental performance.

Europe

Europe accounted for 28% of the doors market in 2024, driven by renovation projects and green building initiatives. Stringent energy efficiency regulations and sustainability goals promote the use of eco-friendly and thermally insulated doors. Germany, the United Kingdom, and France remain key contributors due to high investments in residential and commercial construction. The demand for premium-quality wooden and aluminum doors is rising in both new buildings and restoration projects. Manufacturers in Europe focus on customizable designs and recycled materials to align with the region’s environmental and aesthetic standards.

Asia-Pacific

Asia-Pacific led the global doors market in 2024 with a 34% share, fueled by rapid urbanization and expanding infrastructure development. China, India, and Japan dominate the region due to large-scale housing projects and growing commercial construction. Increasing disposable income and lifestyle upgrades are driving demand for modern, durable, and stylish door solutions. Government initiatives for affordable housing and smart cities further strengthen market growth. The shift toward energy-efficient and uPVC doors is accelerating, supported by the region’s focus on sustainability and rapid industrial development in emerging economies.

Latin America

Latin America captured a 4% share of the doors market in 2024, supported by gradual recovery in construction activities. Brazil and Mexico are leading markets, driven by residential expansion and industrial development. Growing adoption of cost-effective materials such as uPVC and steel supports affordability in housing projects. Infrastructure modernization and renovation of aging structures provide steady growth opportunities. Manufacturers are expanding distribution networks and focusing on design versatility to meet regional preferences. The region’s demand is expected to rise steadily as economic conditions stabilize and urbanization continues.

Middle East & Africa

The Middle East and Africa held a 2% share of the doors market in 2024, driven by ongoing infrastructure and real estate developments. The Gulf countries, including the UAE and Saudi Arabia, lead the market due to large-scale commercial and hospitality projects. High demand for luxury doors and energy-efficient designs reflects the region’s preference for premium quality. Africa is witnessing growing residential construction supported by urban population growth. Expanding investment in smart and sustainable buildings, along with rising renovation projects, contributes to gradual but steady market expansion across the region.

Market Segmentations:

By Product

- Sliding

- Hinged

- French

- Others

By Material

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The doors market features strong competition among major players such as Masonite International Corporation, JELD-WEN, Inc, Deceuninck, Marvin Windows & Doors, YKK Corporation, and others. The market is characterized by continuous innovation, product differentiation, and a growing focus on sustainable manufacturing. Companies are investing in advanced materials, smart technologies, and automated production systems to enhance efficiency and meet evolving consumer preferences. Strategic partnerships, acquisitions, and geographic expansion are common approaches to strengthen market presence. Manufacturers also emphasize energy-efficient and customizable designs to cater to diverse residential and commercial needs. Growing demand for premium doors with enhanced durability and aesthetic appeal encourages players to diversify portfolios. The competitive intensity remains high, driven by rapid construction growth, environmental standards, and digital transformation across building materials industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Masonite International Corporation

- JELD-WEN, Inc

- Deceuninck

- Marvin Windows & Doors

- YKK Corporation

- Century Doors

- Vinylguard Window & Door Systems Ltd.

- Masco Corporation

- Entrematic Group AB

- Neuffer Windows + Doors GmbH

- Andersen Corporation

- Lixil Group Corporation

- Pella Corporation

- SGM Windows

- ASSA ABLOY

- Atrium Corporation

- Jarida Group

- ATIS Group

- Weru Group

- MI Windows and Doors LLC

Recent Developments

- In 2025, ASSA ABLOY acquired Kingspan Door Components, a leading manufacturer of high-quality door panels, enhancing its product portfolio and market reach.

- In 2025, Deceuninck Achieved first RecyClass certification for recycled PVC use and renewed VinylPlus® Product Label.

- In 2025, Vinylguard Window & Door Systems Ltd. Launched a web-based estimating and order entry system and unveiled 2025 entry door lineup.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing urbanization and housing development will continue to drive strong door demand.

- Adoption of smart and automated door systems will expand across residential and commercial sectors.

- Rising preference for energy-efficient and insulated doors will shape product innovation.

- Sustainable materials such as recycled metal, wood, and uPVC will gain higher market adoption.

- Rapid construction in emerging economies will create new growth opportunities for manufacturers.

- Digital manufacturing and customization technologies will enhance production efficiency.

- Expanding renovation activities in developed regions will support consistent replacement demand.

- Integration of biometric and IoT-based security systems will boost premium product sales.

- Strategic collaborations between material suppliers and builders will improve supply chain strength.\

- Focus on design aesthetics and long product lifespans will define future market competition