Market Overview:

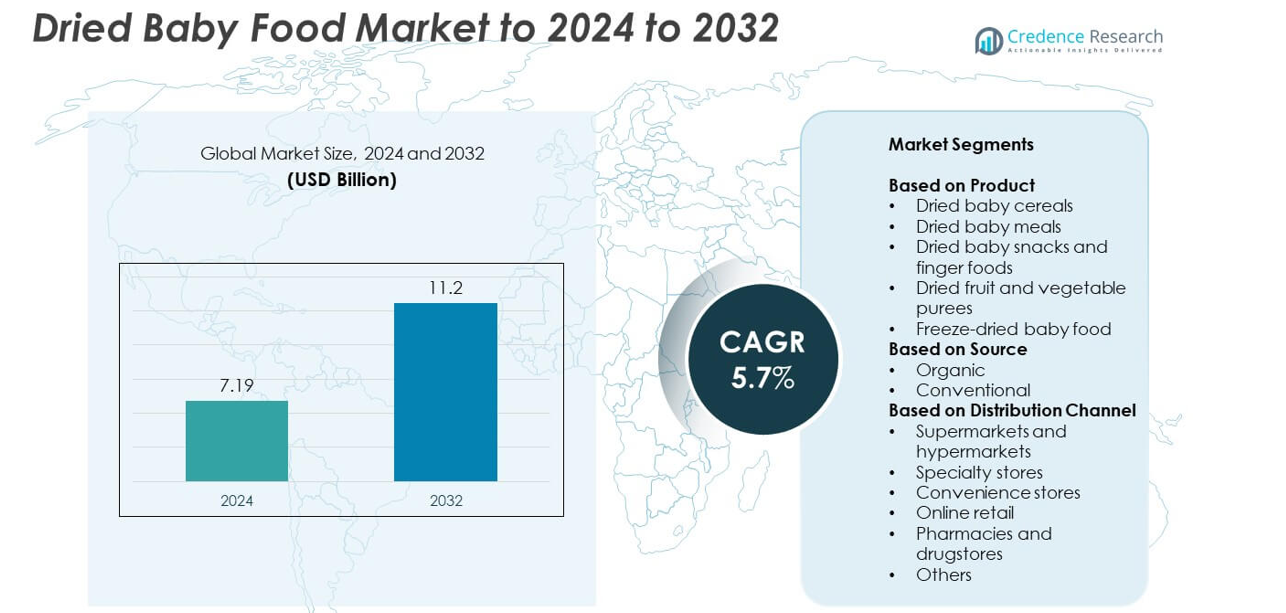

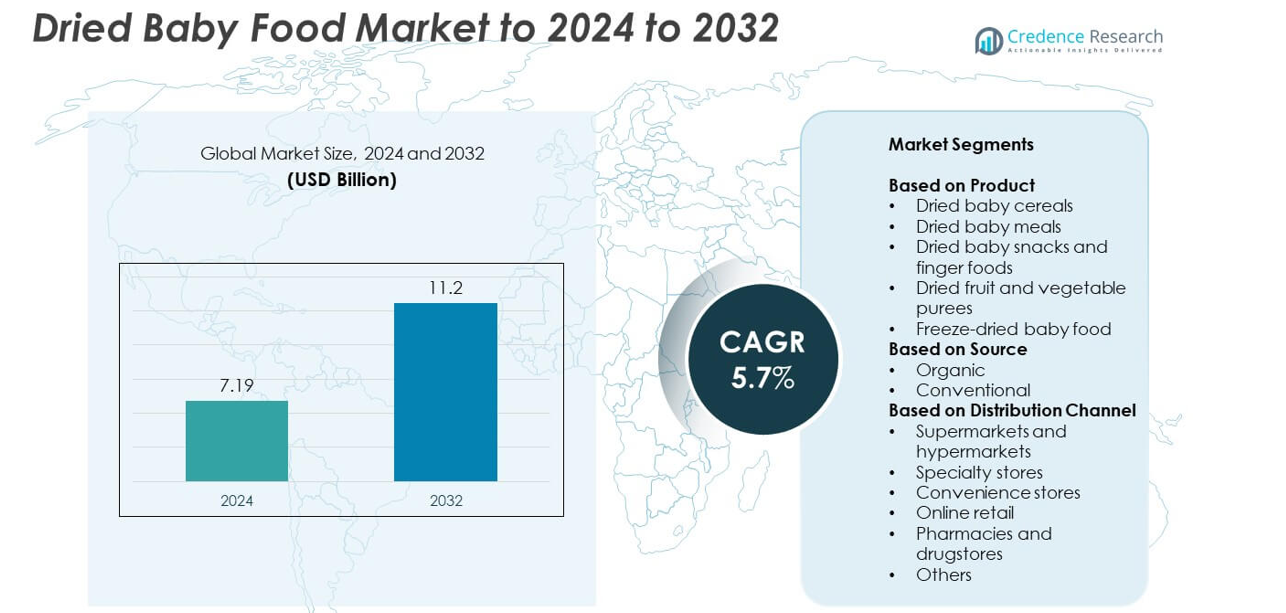

Dried Baby Food Market size was valued at USD 7.19 billion in 2024 and is anticipated to reach USD 11.2 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dried Baby Food Market Size 2024 |

USD 7.19 billion |

| Dried Baby Food Market, CAGR |

5.7% |

| Dried Baby Food Market Size 2032 |

USD 11.2 billion |

The dried baby food market features strong competition among major players such as Nestlé, Danone, Abbott, Mead Johnson / Reckitt, HiPP GmbH & Co., Holle Baby Food GmbH, Bellamy’s Organic, Kraft Heinz / Hero / Hain Celestial, Perrigo Company, and Earth’s Best. These companies focus on product innovation, organic formulations, and transparent labeling to meet evolving consumer preferences. Strategic investments in e-commerce and sustainable packaging are further strengthening their market reach. North America leads the global market with a 32% share in 2024, driven by high parental awareness, premium product adoption, and expanding retail distribution networks across the United States and Canada.

Market Insights

- The dried baby food market was valued at USD 7.19 billion in 2024 and is projected to reach USD 11.2 billion by 2032, growing at a CAGR of 5.7%.

- Rising parental awareness of nutrition, demand for convenient meals, and growing preference for organic products are key market drivers.

- Major trends include the adoption of freeze-drying technology, clean-label formulations, and increasing online retail penetration across global markets.

- The market is moderately competitive, with players focusing on innovation, fortified ingredients, and sustainable packaging to maintain brand differentiation.

- North America led with 32% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while dried baby cereals held the dominant product share due to their high nutrient content and easy digestibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Dried baby cereals dominated the market with over 34 percent share in 2024. Their strong position stems from high nutritional value, easy digestibility, and suitability for infants during early weaning. Parents prefer cereals fortified with iron, vitamins, and minerals to support healthy growth. Manufacturers are innovating with multigrain, rice, and oat-based variants that cater to regional dietary preferences. Expanding product portfolios and long shelf life further drive segment growth, while freeze-dried baby food is gaining traction due to its superior nutrient retention and convenience for travel use.

- For instance, Nestlé’s CERELAC Wheat shows 10 mg iron per 100 g, 14.3 g protein per 100 g, and 67.7 g carbohydrates per 100 g, per the product nutrition table.

By Source

The organic segment held the leading share of around 58 percent in 2024, driven by growing parental awareness of clean-label nutrition. Parents increasingly choose chemical-free and non-GMO ingredients to reduce exposure to pesticides and preservatives. The segment benefits from improved certification standards and broader retail availability of organic baby foods. Global brands are investing in traceable sourcing and transparent labeling to strengthen consumer trust. Meanwhile, conventional products maintain steady demand among price-sensitive consumers in emerging markets due to affordability and easy accessibility.

- For instance, Earth’s Best Organic Multigrain cereal lists ~6.3–6.7 mg iron per serving (≈18–25 g) on retail Nutrition Facts, confirming iron-fortified organic positioning.

By Distribution Channel

Supermarkets and hypermarkets accounted for the largest market share, exceeding 41 percent in 2024. These outlets attract consumers through broad product availability, promotional offers, and dedicated baby food aisles. The structured retail environment allows parents to compare brands and product variants easily. Major retailers have expanded shelf space for organic and freeze-dried options to meet shifting preferences. Online retail, however, is emerging as a rapidly growing channel, fueled by the convenience of home delivery, subscription models, and expanded availability of premium imported baby food brands.

Key Growth Drivers

Rising Parental Awareness Toward Nutritional Convenience

Increasing awareness among parents regarding balanced infant nutrition is a major growth driver. Dried baby foods offer essential vitamins, minerals, and proteins while ensuring long shelf life and portability. Urban lifestyles and dual-income families are fueling the preference for convenient, ready-to-prepare baby food options. Companies are introducing fortified formulations that align with pediatric dietary guidelines, encouraging adoption across developed and emerging markets.

- For instance, Gerber Powerblend cereal contains 10–11 g of whole grains, 2 g of plant protein, and added B. lactis probiotics per serving, supporting pediatric recommendations for introducing varied solids and gut health.

Expansion of E-Commerce Distribution Channels

The rapid digitalization of retail has made dried baby foods more accessible to a global consumer base. Online platforms provide parents with a broader selection, transparent product details, and easy price comparison. Subscription-based delivery models and personalized product recommendations further enhance customer retention. Growing partnerships between baby food manufacturers and e-commerce giants have boosted brand visibility, driving higher product penetration across urban and rural regions.

- For instance, Beech-Nut publishes testing of ingredients for up to 255 pesticides/toxins/heavy metals and up to 20 tests on finished purees, improving label transparency.

Shift Toward Organic and Clean-Label Products

The growing demand for organic and chemical-free baby food options remains a key driver of market growth. Parents are becoming more cautious about artificial additives and synthetic ingredients, leading to increased preference for certified organic products. Manufacturers are focusing on sustainable sourcing and transparent labeling to build brand credibility. The rise of eco-conscious millennial parents continues to shape purchasing behavior, propelling steady market expansion.

Key Trends and Opportunities

Adoption of Advanced Drying Technologies

Technological advancements such as freeze-drying and spray-drying are enhancing product quality and nutrient retention. These methods allow manufacturers to preserve natural flavors and extend shelf life without preservatives. Innovation in process automation and quality control also enables cost-efficient large-scale production. The trend toward premium dried baby food products with superior texture and taste is expected to accelerate as technology adoption deepens.

- For instance, GEA’s CONRAD™ freeze-dryers are available in various configurations, with the highest-capacity models achieving output examples of up to 28,800 kg per 24 hours for extracts with 45% dry matter.

Growing Penetration in Emerging Economies

Expanding middle-class populations in Asia-Pacific and Latin America are creating lucrative opportunities for market players. Rising disposable incomes and increased exposure to branded baby food products are driving consumption. Governments are also promoting infant nutrition awareness through health campaigns and fortified food programs. International manufacturers are entering these regions through local partnerships, improving supply chains, and offering region-specific product formulations.

- For instance, Danone reported 4.3% like-for-like sales growth in Q1 2025. This growth was broad-based across geographies, with a particularly strong performance in China, North Asia & Oceania, which saw 9.9% like-for-like sales growth and was a key driver, alongside strong momentum in high-protein products in North America. The overall growth was driven by contributions from both volume/mix (+1.9%) and price (+2.4%).

Key Challenges

Stringent Regulatory Compliance Requirements

The dried baby food market faces complex regulatory standards across regions, covering labeling, ingredient sourcing, and nutritional claims. Manufacturers must comply with strict safety and testing guidelines to maintain certification. Frequent changes in import and labeling regulations increase production costs and delay product launches. Non-compliance can result in product recalls, legal risks, and reputational damage, impacting brand credibility in sensitive consumer segments.

High Competition and Price Sensitivity

The market’s competitive landscape includes global brands and numerous local producers offering low-cost alternatives. Price-sensitive consumers, especially in developing countries, often favor economical conventional products over premium organic variants. Maintaining quality while managing production and distribution costs remains a significant challenge. The pressure to balance affordability with nutritional value and clean-label commitments intensifies competition among established and emerging players.

Regional Analysis

North America

North America held a market share of around 32% in 2024, driven by strong consumer awareness and high spending on infant nutrition. The United States remains the dominant country, with established retail networks and growing demand for organic baby foods. Manufacturers focus on product innovation with natural ingredients and fortified nutrients. Rising working mothers and increasing preference for ready-to-eat baby meals also support steady sales growth. Canada contributes through premium product adoption and strict food safety regulations promoting trustworthy labeling and ingredient transparency.

Europe

Europe accounted for nearly 28% of the global market in 2024, supported by strong regulatory frameworks and consumer trust in branded baby food. Countries such as Germany, the United Kingdom, and France lead with advanced production standards and organic certifications. The region’s demand for sustainable and plant-based ingredients aligns with evolving parental preferences. Growing health consciousness and rising female workforce participation further boost product uptake. Retail chains and online stores continue to expand product access, reinforcing Europe’s position as a mature and stable market for dried baby foods.

Asia-Pacific

Asia-Pacific captured a 25% share in 2024, emerging as the fastest-growing region in the market. Expanding middle-class populations and rising urbanization in China, India, and Japan are driving higher spending on convenient and safe baby food options. Local brands are expanding product lines with traditional grains and organic ingredients to meet cultural preferences. The rapid rise of e-commerce channels has made dried baby foods more accessible in tier-two and tier-three cities. Government-led nutrition initiatives also support the increasing adoption of fortified infant food products across the region.

Latin America

Latin America represented about 9% of the global dried baby food market in 2024, with Brazil and Mexico driving regional demand. Improving economic stability and growing female employment are influencing lifestyle changes favoring packaged baby foods. Awareness campaigns promoting infant nutrition are increasing brand penetration across urban markets. However, limited availability of premium organic products restricts faster adoption. Companies are expanding local manufacturing capacities and retail networks to reduce import dependency and address the needs of cost-conscious consumers seeking affordable yet nutritious dried baby food options.

Middle East and Africa

The Middle East and Africa accounted for nearly 6% of the total market share in 2024, showing steady expansion through growing urbanization and rising birth rates. Countries such as South Africa, the United Arab Emirates, and Saudi Arabia are leading markets due to improving retail infrastructure. Increasing awareness of infant nutrition and the availability of international brands are supporting growth. However, higher prices of imported products and limited awareness in rural areas restrain faster penetration. Manufacturers are introducing regionally tailored products to meet dietary preferences and affordability levels.

Market Segmentations:

By Product

- Dried baby cereals

- Dried baby meals

- Dried baby snacks and finger foods

- Dried fruit and vegetable purees

- Freeze-dried baby food

By Source

By Distribution Channel

- Supermarkets and hypermarkets

- Specialty stores

- Convenience stores

- Online retail

- Pharmacies and drugstores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dried baby food market is characterized by the presence of leading companies such as Nestlé, Danone, Abbott, Mead Johnson / Reckitt, HiPP GmbH & Co., Holle Baby Food GmbH, Bellamy’s Organic, Kraft Heinz / Hero / Hain Celestial, Perrigo Company, and Earth’s Best. The market exhibits strong competition driven by product innovation, organic formulations, and expanding retail presence. Companies are focusing on research and development to improve nutritional value and shelf stability while maintaining natural ingredients. Strategic partnerships with e-commerce platforms and healthcare professionals are enhancing consumer outreach. Firms are also investing in sustainable packaging and transparent labeling to align with evolving consumer expectations. Geographic expansion into emerging economies through local production and distribution partnerships remains a core growth strategy. Increasing demand for clean-label, allergen-free, and fortified products continues to push manufacturers toward technological upgrades and diversified product portfolios to secure a competitive advantage globally.

Key Player Analysis

- Nestlé

- Danone

- Abbott

- Mead Johnson / Reckitt

- HiPP GmbH & Co.

- Holle Baby Food GmbH

- Bellamy’s Organic

- Kraft Heinz / Hero / Hain Celestial

- Perrigo Company

- Earth’s Best

Recent Developments

- In 2025, Earth’s Best announced that its entire line of infant formulas had achieved Clean Label Project® Purity Awards.

- In 2024, Nestlé India launched “no refined sugar” variants of its Cerelac infant cereal in response to public controversy over high sugar content in some of its baby products.

- In 2024, Abbott Expands its Pure Bliss™ Line of Infant Formulas to Include European-Made and Organic Products

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for organic and clean-label dried baby foods will continue to expand globally.

- Technological improvements in freeze-drying and packaging will enhance product quality and shelf life.

- Online retail and subscription-based delivery models will gain stronger market traction.

- Manufacturers will focus on introducing region-specific flavors and nutrient blends.

- Partnerships between baby food brands and healthcare professionals will increase consumer trust.

- Sustainable packaging and eco-friendly sourcing practices will become key differentiators.

- Premium and fortified product lines will attract urban and health-conscious parents.

- Emerging economies in Asia-Pacific and Latin America will drive future market growth.

- Stringent food safety and labeling standards will encourage higher transparency and traceability.

- Continuous innovation in plant-based and allergen-free formulations will shape new market opportunities.