Market Overview:

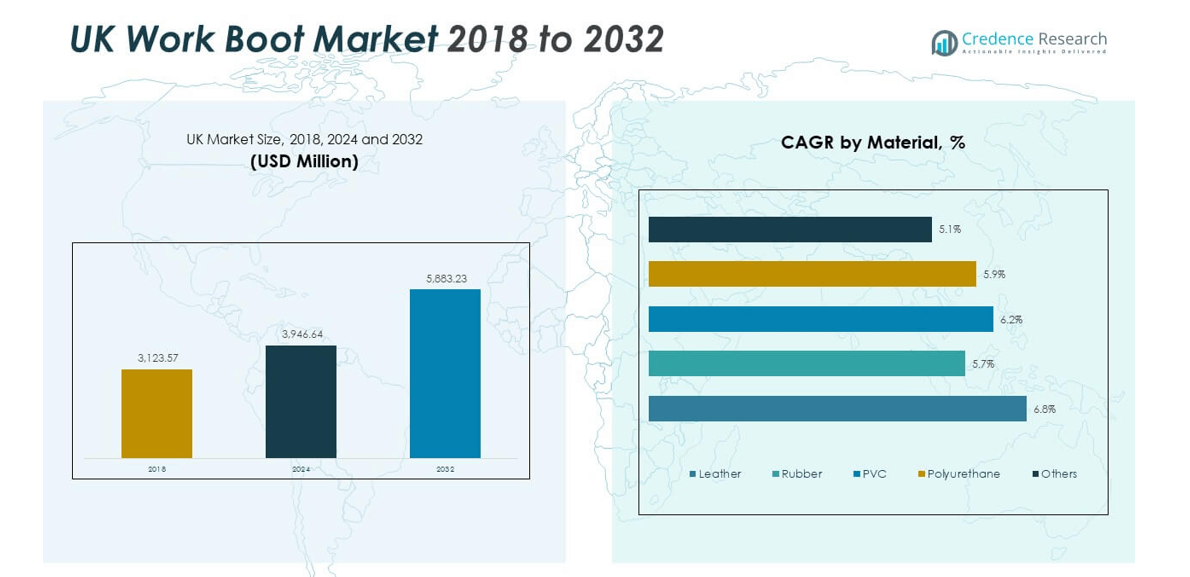

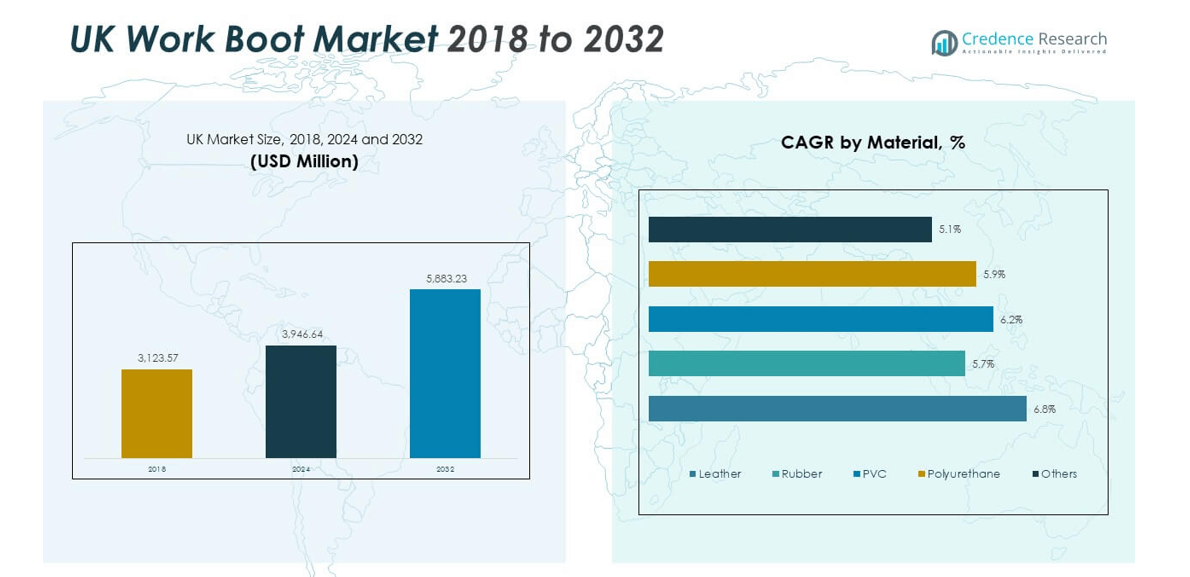

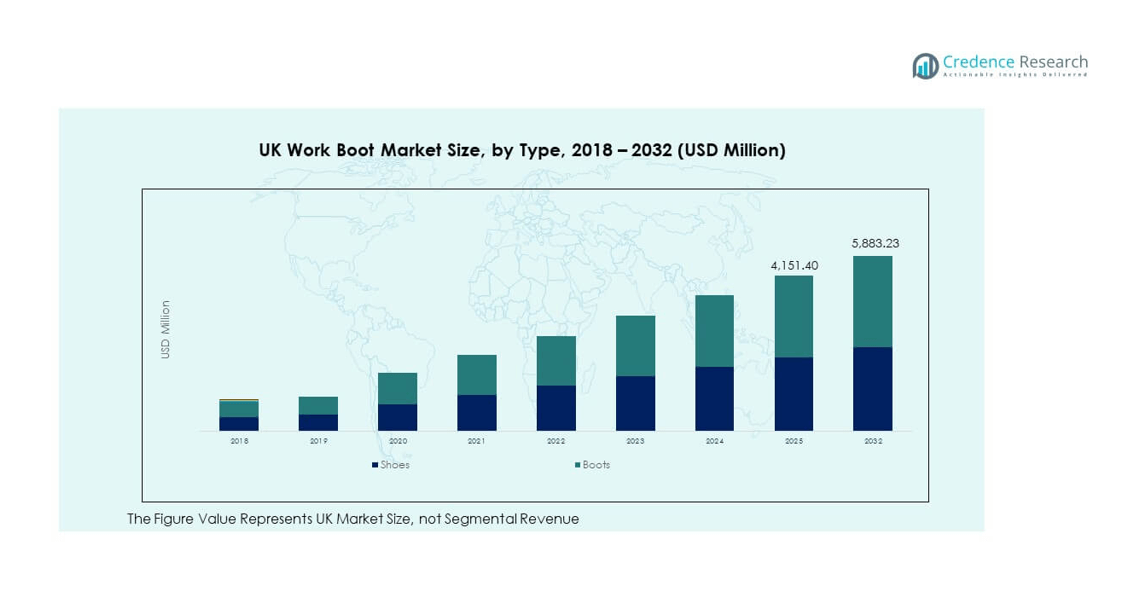

The UK Work Boot Market size was valued at USD 3,123.57 million in 2018, increased to USD 3,946.64 million in 2024, and is anticipated to reach USD 5,883.23 million by 2032, at a CAGR of 5.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Work Boot Market Size 2024 |

USD 3,946.64 million |

| UK Work Boot Market, CAGR |

5.11% |

| UK Work Boot Market Size 2032 |

USD 5,883.23 million |

Rising workplace safety standards and increasing industrial employment drive market expansion. Employers emphasize protective footwear to comply with stringent health and safety regulations. The demand is also rising from construction, oil & gas, and manufacturing sectors, where protective footwear reduces injury risks. Growth in e-commerce platforms and product innovation, such as lightweight and breathable designs, further strengthen consumer adoption. Sustainability initiatives are also encouraging the use of eco-friendly materials in premium safety footwear.

The UK serves as the central hub for work boot production and distribution across Europe, supported by advanced manufacturing infrastructure and strong retail networks. Demand remains high in industrial cities like Birmingham, Manchester, and Sheffield due to dense manufacturing activity. Scotland and Northern Ireland are emerging growth zones, benefiting from expanding logistics and energy projects. The increasing adoption of digital retail channels across all regions supports wider accessibility and faster product penetration nationwide.

Market Insights:

- The UK Work Boot Market was valued at USD 3,123.57 million in 2018, increased to USD 3,946.64 million in 2024, and is projected to reach USD 5,883.23 million by 2032, growing at a CAGR of 5.11% during the forecast period.

- England leads with a 68% share, supported by strong construction, manufacturing, and logistics activity, along with the presence of major brands and advanced retail infrastructure.

- Scotland follows with 18%, driven by energy, offshore, and industrial projects requiring durable, thermal, and waterproof safety boots. Wales and Northern Ireland together hold 14%, supported by growing industrial and logistics sectors.

- Scotland is the fastest-growing region due to expanding renewable energy investments and oil and gas activities demanding high-performance protective footwear.

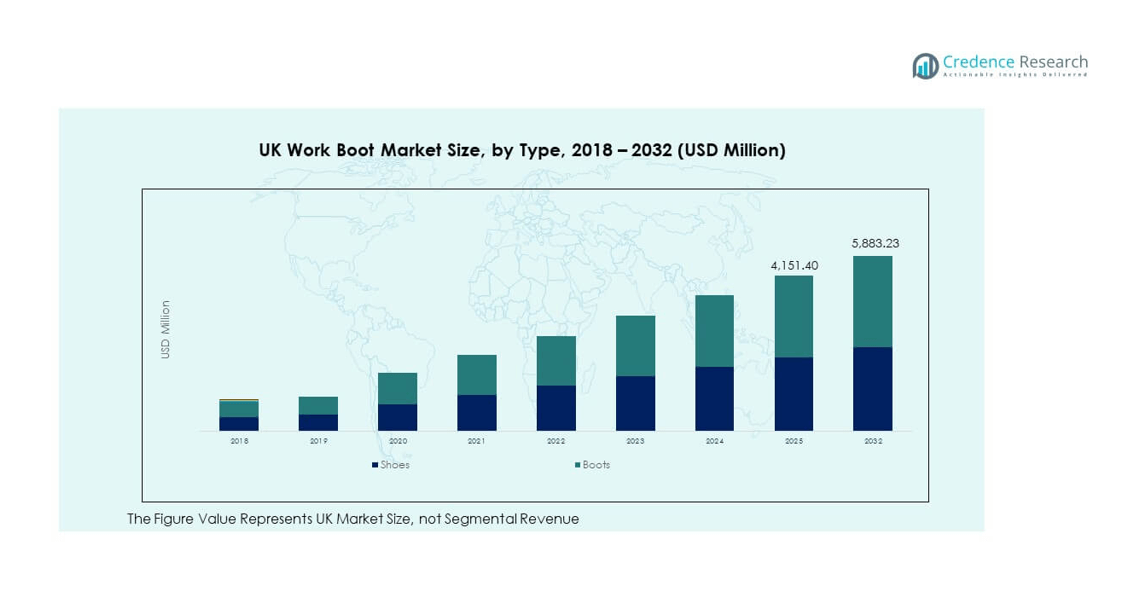

- By type, boots dominate the market with over 65% share in 2024 due to their superior protection and durability, while shoes hold around 35%, gaining popularity in light-duty and service sectors for comfort and mobility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Workplace Safety Regulations and Industrial Standards

Government safety mandates and stricter enforcement of workplace protection laws are fueling demand for durable work boots. Employers in manufacturing, mining, and construction prioritize compliance with the UK’s Health and Safety Executive (HSE) guidelines. The UK Work Boot Market benefits from growing awareness of injury prevention and worker welfare. Investments in heavy industries and energy infrastructure have further expanded the need for certified safety footwear. Enhanced public infrastructure spending also supports large-scale procurement of protective boots. Manufacturers are integrating steel toes, puncture-resistant soles, and chemical protection to meet safety norms. This alignment between safety compliance and innovation sustains steady market growth across industrial sectors.

- For instance, Dr. Martens’ steel toe boots are EN ISO 20345:2011 certified and provide protection against impacts of at least 200 joules, while achieving SRC slip-resistant safety standards, as specified in their official safety product listings.

Expansion of the Construction and Manufacturing Industries

Rapid urban development and industrial expansion across the UK have created consistent demand for high-performance work boots. Large-scale housing projects, transport infrastructure, and renewable energy developments require reliable worker protection. Manufacturers supply boots designed for comfort and durability during extended shifts on site. Product innovation focuses on lightweight materials that balance strength and flexibility. Demand is particularly strong from logistics and automotive assembly sectors, where safety and mobility are vital. Increased government investments in public infrastructure projects are also boosting demand. This industrial progress continues to strengthen product adoption across core economic sectors.

- For instance, Dunlop’s Purofort TerraPro work boots are up to 35% lighter than standard rubber boots and utilize triple-density sole technology, offering enhanced support for workers in the UK construction industry.

Growth of E-Commerce and Retail Distribution Networks

Expanding online retail platforms have transformed the distribution landscape for work boots. Consumers now have easier access to branded and customized safety footwear through digital channels. Retailers offer quick delivery, diverse designs, and size options catering to various occupations. The market benefits from aggressive online marketing and brand collaborations. It allows local manufacturers to reach broader audiences and scale sales nationwide. The availability of customer reviews and product comparisons supports purchase confidence. Digital transformation in retail operations continues to accelerate market expansion and brand competitiveness.

Technological Advancements and Focus on Comfort Design

Manufacturers are emphasizing technology-driven comfort and ergonomic performance in modern work boots. The use of lightweight composites, breathable fabrics, and anti-fatigue insoles enhances user experience. Smart manufacturing processes improve product consistency and durability. Advanced materials such as Kevlar, TPU, and microfiber leather reduce maintenance and increase flexibility. It enables long wear life and supports sustainability through eco-conscious production. Brands are investing in R&D to create energy-absorbing and temperature-regulating soles. This focus on comfort and innovation drives higher adoption among professionals across multiple industries.

Market Trends:

Increasing Adoption of Sustainable and Eco-Friendly Materials

Environmental awareness has encouraged the use of sustainable raw materials in safety footwear manufacturing. Producers are replacing traditional leather with recycled and plant-based alternatives. The UK Work Boot Market reflects this shift through growing adoption of eco-certified components. Brands are developing biodegradable soles and solvent-free adhesives to lower environmental impact. Manufacturers promoting green products attract consumers prioritizing sustainability and ethical production. Partnerships with recycling programs enhance brand credibility and supply chain efficiency. This transition aligns with global environmental standards and rising demand for responsible manufacturing.

- For instance, Dunlop’s Purofort TerraPro work boots are up to 35% lighter than standard rubber boots and utilize triple-density sole technology, offering enhanced support for workers in the UK construction industry.

Integration of Smart Technologies and Digital Features

Smart technologies are reshaping the next generation of protective footwear. Embedded sensors now monitor temperature, pressure, and posture to improve worker safety. Bluetooth connectivity enables real-time performance tracking and alerts for hazardous conditions. The market witnesses collaboration between safety equipment firms and tech developers. These advancements enhance workplace productivity while improving worker comfort and awareness. It represents a progressive shift toward intelligent protective wear solutions. Growing interest in connected PPE continues to influence future product development strategies.

- For instance, Uvex’s “1 G2 planet” series safety boots are manufactured with at least 30% recycled materials and achieve a verified reduction in carbon footprint—up to 19% less CO₂ compared to previous models, certified according to ISO 14021 standards.

Rise in Customization and Premiumization of Safety Footwear

Consumers increasingly prefer customized designs offering both protection and style. Brands introduce premium lines with improved aesthetics and ergonomic fits. This shift targets professionals seeking comfort without compromising workplace safety. The UK Work Boot Market benefits from expanding product variety across gender-specific and task-oriented designs. Manufacturers invest in 3D scanning and AI-based fitting systems for personalized comfort. Premium brands also emphasize craftsmanship and material authenticity to appeal to niche buyers. Customization drives brand differentiation and customer loyalty in a competitive market.

Influence of Fashion and Lifestyle Integration in Workwear

Work boots are evolving from functional safety gear to fashionable lifestyle accessories. Retailers highlight their versatility for both industrial and casual use. Younger consumers appreciate stylish designs suitable for outdoor and urban settings. Celebrity endorsements and social media campaigns enhance product visibility among new audiences. It encourages manufacturers to design boots that blend aesthetics with protective strength. The fusion of workwear and fashion promotes steady demand beyond industrial applications. This trend supports the growing crossover appeal of durable footwear across market segments.

Market Challenges Analysis:

Price Sensitivity and Intense Market Competition

High competition among local and international brands places pressure on pricing strategies. Many small players struggle to maintain margins while ensuring compliance with safety standards. Consumers often choose lower-cost options over premium-quality boots. The UK Work Boot Market faces challenges balancing affordability with durability. Rising raw material costs and labor expenses add strain to manufacturers. Frequent price wars in online retail channels reduce profitability. It demands strategic innovation and operational efficiency to sustain market share in a crowded industry.

Supply Chain Disruptions and Raw Material Volatility

Fluctuations in raw material prices, including leather, rubber, and synthetics, affect production stability. Global supply chain disruptions have caused delivery delays and increased manufacturing costs. Manufacturers dependent on imported materials experience reduced flexibility in pricing. Limited domestic sourcing increases vulnerability to international trade fluctuations. It impacts production planning and timely market availability. Companies must diversify supplier bases and adopt agile procurement strategies. Enhancing local production capabilities can help mitigate these challenges effectively.

Market Opportunities:

Rising Demand from Emerging Industrial and Renewable Energy Sectors

New industrial zones and renewable energy projects are creating strong growth avenues. Companies in wind, solar, and logistics sectors are expanding workforce protection budgets. The UK Work Boot Market benefits from safety initiatives supporting these sectors’ expansion. Employers emphasize protective gear as part of compliance and sustainability frameworks. Technological development encourages boots designed for specialized work environments. Growing partnerships between manufacturers and contractors enhance product penetration. These projects create recurring procurement opportunities across industrial applications.

Adoption of Innovative Marketing and Brand Diversification Strategies

Manufacturers are adopting advanced marketing strategies to capture evolving consumer preferences. Digital engagement through social media, influencer campaigns, and targeted ads drives awareness. E-commerce partnerships expand market accessibility across rural and urban regions. It allows brands to test new collections and gather real-time consumer feedback. Product diversification into lifestyle and adventure segments attracts a broader audience. Collaborations with industrial suppliers ensure consistent visibility in B2B markets. Strategic branding and diversified portfolios help companies strengthen long-term growth prospects.

Market Segmentation Analysis:

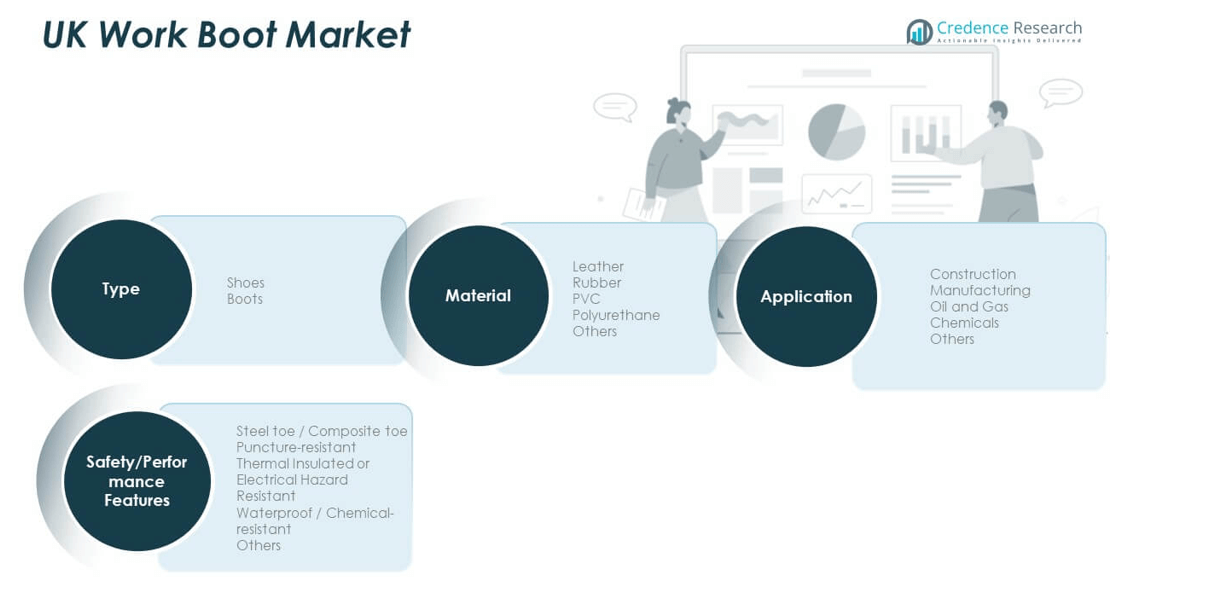

By Type

The UK Work Boot Market is segmented into shoes and boots. Boots dominate due to their superior protection, durability, and suitability for industrial and outdoor conditions. Safety boots are preferred in sectors such as construction, logistics, and manufacturing, where compliance with workplace safety standards is mandatory. Shoes are gaining traction in lighter-duty environments and service industries due to comfort and aesthetic appeal. Product innovation in lightweight and flexible materials continues to enhance user comfort and adoption.

- For instance, Rock Fall’s RF160 OHM boot achieves a total upper weight of under 600 grams per shoe and is certified for electrical hazard resistance up to 18kV, as validated by UK safety footwear suppliers.

By Application

Construction and manufacturing sectors remain the leading application areas, driven by high occupational safety requirements. Oil and gas industries demand flame-resistant and anti-slip footwear for hazardous conditions. The chemical sector prefers chemical-resistant boots with sealed seams for worker safety. Other applications, including logistics and maintenance, are expanding due to safety awareness and improved boot design adaptability.

- For instance, Haix Group’s Fire Eagle Pro boots are independently tested and certified according to CE 0193 EN 15090:2012 HI3 CI M AN CR SRC – Typ F2A. The HI3 classification means the sole assembly has been tested for heat insulation after exposure to a furnace at 300°C for 30 minutes, confirming high-level heat resistance for short-duration firefighting exposures.

By Material

Leather remains the most widely used material due to its strength and flexibility. Rubber and polyurethane boots are popular in heavy-duty and wet environments for their slip resistance. PVC variants cater to budget-conscious buyers seeking basic protection. Synthetic materials and hybrid designs are growing due to their lightweight properties and ease of cleaning.

By Safety/Performance Features

Steel toe and composite toe boots dominate due to strict safety compliance. Puncture-resistant and waterproof types are increasingly favored in construction and outdoor sectors. Thermal insulation and electrical hazard resistance support specialized industrial use. Advanced ergonomic designs enhance comfort and protection, strengthening overall product demand.

Segmentation:

By Type

By Application

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Others

By Material

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By Safety/Performance Features

- Steel Toe / Composite Toe

- Puncture-Resistant

- Thermal Insulated or Electrical Hazard Resistant

- Waterproof / Chemical-Resistant

- Others

Regional Analysis:

England – The Core Manufacturing and Construction Hub (68% Market Share)

England holds the largest share of the UK Work Boot Market, accounting for nearly 68% in 2024. The dominance stems from extensive industrial activity, large-scale infrastructure projects, and stringent safety compliance standards. Major construction developments across London, Manchester, and Birmingham have increased demand for protective footwear. Manufacturers in this region focus on high-performance boots with advanced materials and ergonomic designs. England also serves as the base for several leading domestic and international work boot brands, reinforcing its manufacturing strength. The strong presence of retail and e-commerce platforms enhances product accessibility across all professional sectors.

Scotland – Rising Industrial and Energy Sector Demand (18% Market Share)

Scotland contributes around 18% of the total market, supported by rapid expansion in the oil, gas, and renewable energy industries. The region’s harsh climatic conditions create sustained demand for thermal-insulated, waterproof, and durable boots. Companies in Aberdeen and Dundee cater heavily to offshore and industrial workers who require premium-grade footwear. It benefits from local investments in manufacturing and logistics infrastructure. Growing focus on safety compliance in mining and heavy engineering operations continues to stimulate product adoption. The demand for sustainable materials and protective designs has further strengthened the regional market outlook.

Wales and Northern Ireland – Expanding Industrial and Commercial Sectors (14% Market Share)

Wales and Northern Ireland collectively hold about 14% of the UK Work Boot Market. Their growth is driven by expanding logistics, manufacturing, and construction activities. Government initiatives promoting regional development have attracted new industrial investments, boosting safety gear demand. Local distributors and online retailers are expanding their reach, improving market penetration across rural and semi-urban areas. The adoption of advanced protective features, such as chemical resistance and composite toes, is increasing in small-scale industries. Rising awareness about worker safety and steady employment growth sustain the long-term demand outlook in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Martens

- Solovair

- Fairfax & Favor

- Timberland PRO

- Puma Safety

- Caterpillar

- Carhartt

- Helly Hansen

- Dickies

- Snickers Workwear

Competitive Analysis:

The UK Work Boot Market is highly competitive, featuring global brands and strong domestic manufacturers. Key players focus on safety innovation, material quality, and ergonomic designs to meet workplace protection standards. It demonstrates moderate market concentration, with companies like Dr. Martens, Caterpillar, Timberland PRO, and Helly Hansen maintaining strong brand recognition. Local brands such as Solovair and Fairfax & Favor cater to niche and premium segments, emphasizing craftsmanship and heritage design. Continuous investment in R&D, sustainability, and comfort-focused technologies strengthens competitiveness. Expansion into online retail and strategic partnerships also enhances market visibility and customer engagement across the country.

Recent Developments:

- In October 2025, Dr. Martens announced a new distribution partnership with Beside Group for the UAE market, marking a strategic expansion to boost its global footprint and optimize market-right distribution. This agreement will drive the brand’s presence in the Middle East, initially through wholesale and, later, monobranded store openings. The deal supports Dr. Martens’ capital-light model for entering growth markets, a direction also evidenced by recent milestones in Latin America with Crosby Group.

- In September 2025, Solovair, the heritage British footwear brand, collaborated with Carhartt WIP to release three exclusive, handmade leather styles for Fall/Winter 2025. These boots combine Solovair’s classic craftsmanship with Carhartt WIP’s core color palette and signature design touches, reinforcing both brands’ commitment to quality and style in the work boot segment.

- In October 2025, Fairfax & Favor unveiled new boots, bags, and accessories as part of its autumn arrivals, featuring fresh colors and refined designs that extend its reach in luxury and performance footwear. The brand continues to diversify its portfolio with launches targeted at the UK market, keeping pace with seasonal demands and consumer preferences.

- On October 3, 2025, Timberland PRO partnered with Telfar to launch a capsule collection reimagining the classic Yellow Boot, expanding its product horizon with new boot silhouettes and bags. This collection is available both online and at Timberland stores, aiming to bridge workwear heritage with modern fashion sensibilities and seasonal appeal.

Report Coverage:

The research report offers an in-depth analysis based on type, application, material, and safety/performance features. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue expanding with stronger industrial safety enforcement.

- Sustainable materials will gain higher preference among manufacturers and buyers.

- Smart and connected footwear technology will enhance worker protection.

- E-commerce and omnichannel retail will accelerate sales growth across regions.

- Premium and customized product lines will attract younger professionals.

- Lightweight and ergonomic designs will dominate new product launches.

- Local production and sourcing will increase to reduce import dependency.

- Partnerships with construction and energy firms will secure long-term contracts.

- Digital marketing will become essential for brand visibility and consumer engagement.

- Rising investment in R&D will lead to advanced, comfort-driven footwear innovation.