Market Overview:

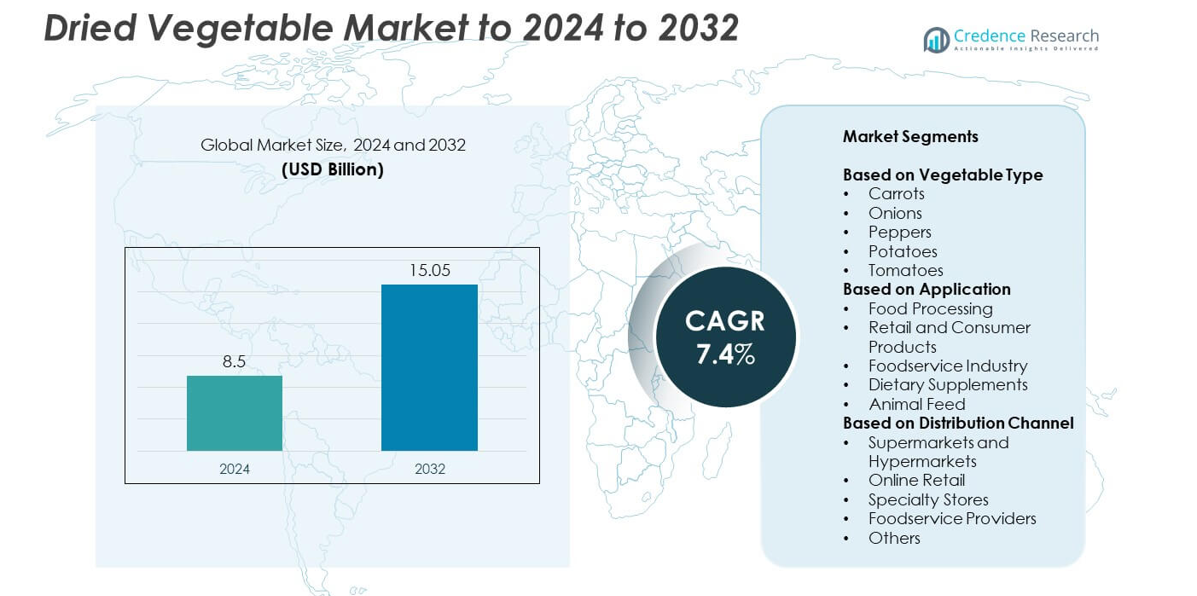

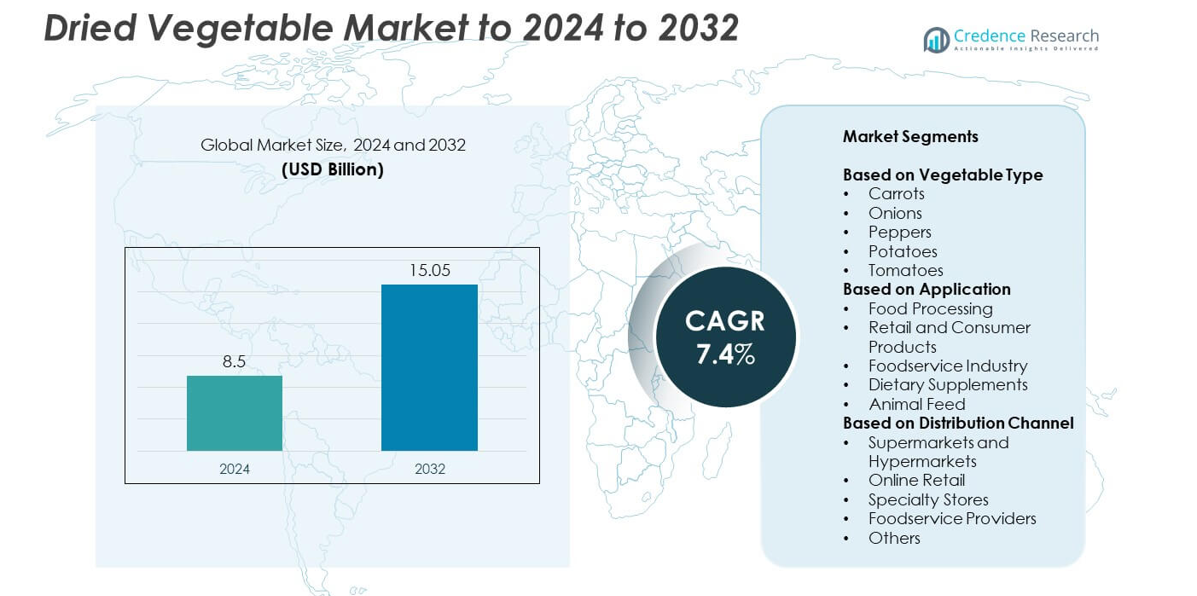

Dried Vegetable Market size was valued USD 8.5 Billion in 2024 and is anticipated to reach USD 15.05 Billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dried Vegetable Market Size 2024 |

USD 8.5 Billion |

| Dried Vegetable Market, CAGR |

7.4% |

| Dried Vegetable Market Size 2032 |

USD 15.05 Billion |

The dried vegetable market is led by major players such as Silva International, Jain Irrigation Systems, Eurocebollas, Olam International, Garlico Industries, Natural Dehydrated Vegetables, Henan Sunny Foodstuff, BCFoods, Richfield, Kanghua, BranchOut Food Inc., and Jaworski. These companies focus on advanced drying technologies, sustainable sourcing, and expanding export operations to meet global food processing demand. Product quality, innovation, and strategic partnerships remain key competitive factors. North America leads the global market with a 34% share, driven by strong consumption of convenience and processed foods, followed by Asia Pacific with 29%, supported by large-scale production and export capacity.

Market Insights

- The dried vegetable market was valued at USD 8.5 billion in 2024 and is projected to reach USD 15.05 billion by 2032, growing at a CAGR of 7.4%.

- Rising demand for convenience and processed foods is the primary growth driver, supported by increasing adoption of dried onions, which held a 32% share in 2024.

- Market trends highlight growing consumer preference for organic, clean-label, and sustainable dried vegetable products driven by health-conscious lifestyles.

- Competition remains strong as key players focus on technological advancements, product innovation, and global expansion to enhance supply chain efficiency and quality standards.

- Regionally, North America leads with a 34% share, followed by Asia Pacific at 29% and Europe at 27%, while Latin America and the Middle East & Africa collectively contribute the remaining share through emerging food processing and export growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vegetable Type

The dried vegetable market is segmented into carrots, onions, peppers, potatoes, and tomatoes. Onions hold the dominant position with a 32% market share in 2024. Their extensive use in processed foods, instant meals, and seasoning blends drives demand. The longer shelf life and strong flavor retention of dried onions make them preferred for industrial and consumer applications. Rising consumption of convenience foods and ready-to-eat meals further strengthens this segment. Carrots and peppers also witness growing use due to their color-enhancing and nutritional properties.

- For instance, ofi (Olam Food Ingredients), in a Q4-2024 market report, projected total dehydrated onion exports to be more than 90,000 MT for 2024, driven by strong export demand from India

By Application

The market by application includes food processing, retail and consumer products, foodservice industry, dietary supplements, and animal feed. The food processing segment leads with a 40% share in 2024. High demand from packaged soups, sauces, and instant noodles manufacturers fuels its dominance. Dried vegetables offer consistent quality, easy storage, and lower waste, making them ideal for mass production. The growing trend of clean-label and natural ingredients in processed foods also supports segment growth. Dietary supplements are gaining traction due to rising awareness of plant-based nutrition.

- For instance, Silva International operates a 380,000 sq ft ingredient plant in Momence, Illinois, employing 200+ people to supply processors.

By Distribution Channel

Based on distribution channels, the market is categorized into supermarkets and hypermarkets, online retail, specialty stores, foodservice providers, and others. Supermarkets and hypermarkets account for the largest share at 38% in 2024. Their dominance stems from broad product visibility, attractive packaging, and consumer preference for one-stop grocery solutions. The expansion of organized retail chains in urban areas also boosts segment growth. Online retail is emerging rapidly, supported by growing e-commerce adoption and doorstep delivery convenience. Specialty stores cater to niche consumers seeking premium, organic, or region-specific dried vegetable varieties.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The increasing consumption of ready-to-eat and instant meals is a major driver for the dried vegetable market. Dried vegetables offer easy storage, longer shelf life, and nutritional consistency, making them ideal for processed food applications. Expanding urban populations and busier lifestyles are pushing manufacturers to include dehydrated vegetables in packaged products. Growing demand from instant noodle, soup, and snack industries continues to strengthen this segment’s contribution to global food production.

- For instance, Van Drunen Farms manages 1,750 acres of farmland and, as of May 2024, operates several facilities globally, including its headquarters in Momence, Illinois.

Advancements in Drying Technologies

Technological progress in dehydration methods such as freeze-drying and vacuum drying enhances the nutritional value, flavor, and color of vegetables. These advanced techniques help preserve freshness and reduce moisture effectively, extending product shelf life. Manufacturers are adopting energy-efficient and automated systems to lower operational costs and improve quality consistency. Such innovations are enabling producers to meet rising consumer expectations for high-quality, natural dried vegetables in both retail and industrial markets.

- For instance, GEA produces both batch and high-volume continuous freeze-dryers. The RAY® batch freeze-dryers include models with varying output capacities. The RAY® 125, one of the larger models, has a potential output of up to 460 kg per 24 hours when processing fruit.

Expanding Applications in Health and Nutritional Products

The shift toward healthier diets is driving the inclusion of dried vegetables in nutritional supplements and functional foods. Rich in fiber, antioxidants, and minerals, these ingredients cater to the wellness-focused consumer base. Food supplement manufacturers are increasingly incorporating dried vegetable powders in capsules, bars, and meal replacements. The growing awareness of plant-based nutrition and clean-label formulations further supports this trend, enhancing product diversification opportunities for market players.

Key Trends and Opportunities

Growth of Online Retail Distribution

Online platforms are reshaping dried vegetable distribution by offering wider access to consumers and small businesses. E-commerce channels allow producers to reach global markets without relying solely on physical stores. Consumers increasingly prefer digital platforms for convenience, price comparison, and direct sourcing of specialty products. The integration of online marketing and delivery networks helps brands strengthen visibility and customer engagement, especially in emerging economies with rising digital adoption.

- For instance, Backpacker’s Pantry sells a 12-pouch / 24-serving emergency meal bucket online, with items carrying up to 10-year shelf life.

Sustainability and Organic Product Expansion

Sustainability has become a core trend across the dried vegetable industry. Consumers are favoring organic and pesticide-free vegetables processed through eco-friendly drying technologies. Producers are focusing on energy-efficient equipment and recyclable packaging to reduce environmental impact. The rise of certified organic dried products creates a lucrative niche market, aligning with global initiatives promoting sustainable agriculture and reduced food waste. This shift opens new growth opportunities for premium and ethical brands.

- For instance, Olam cites that their breeding efforts also produced water savings of 9.7 billion liters and GHG reduction of 20,138 metric tons.

Key Challenges

Fluctuating Raw Material Prices

Volatility in fresh vegetable supply and seasonal variations pose cost challenges for manufacturers. Factors such as climate change, transportation costs, and crop yield fluctuations influence raw material pricing. These inconsistencies affect production costs and profit margins for drying facilities. Ensuring reliable sourcing and developing long-term supplier relationships are essential to mitigate risks and stabilize the cost structure across global and regional supply chains.

Quality Control and Nutrient Retention Issues

Maintaining nutritional integrity and flavor during the drying process remains a key challenge. Improper drying or excessive heat exposure can degrade vitamins and texture quality. Manufacturers must balance efficiency with product consistency while adhering to stringent food safety regulations. Investing in advanced drying technologies and process monitoring helps preserve nutritional content, ensuring the product meets consumer expectations for taste, color, and freshness.

Regional Analysis

North America

North America dominates the dried vegetable market with a 34% share in 2024. The region benefits from strong demand for packaged and convenience foods across the United States and Canada. Food manufacturers increasingly use dehydrated vegetables in soups, sauces, and ready meals. Advanced food processing technologies and well-developed retail infrastructure support steady market growth. The growing popularity of plant-based and natural food products also drives the use of organic dried vegetables. Expanding online distribution and consumer preference for clean-label ingredients further strengthen the regional outlook.

Europe

Europe holds a 27% share in the dried vegetable market in 2024. The region’s growth is fueled by high consumption of ready-to-cook and health-oriented food products. Countries such as Germany, France, and the Netherlands lead production and exports of dehydrated vegetables. Rising vegetarian and vegan trends have increased demand for natural, nutrient-rich ingredients. Strict food quality standards and sustainability regulations encourage the use of energy-efficient drying technologies. European consumers also prefer locally sourced and organic dried vegetables, promoting product diversification across the region.

Asia Pacific

Asia Pacific accounts for a 29% market share in 2024, supported by expanding food processing industries and rising disposable income. China, India, and Japan are key contributors due to their growing packaged food consumption and large agricultural bases. The presence of low-cost manufacturing and abundant raw materials makes the region a major exporter of dried vegetables. Increasing demand from the instant meal and snack sectors strengthens regional production. Government support for food preservation and export-oriented agriculture also drives the market’s rapid expansion in this region.

Latin America

Latin America represents a 6% share of the dried vegetable market in 2024. Brazil, Mexico, and Argentina are the leading producers, driven by expanding agricultural capabilities and rising processed food demand. The shift toward packaged meals and nutritional snacks supports steady growth. Local manufacturers are adopting improved dehydration and storage technologies to enhance product quality. Export opportunities to North America and Europe further encourage regional production. Increasing consumer preference for sustainable and shelf-stable food products also enhances the market’s long-term potential in Latin America.

Middle East and Africa

The Middle East and Africa hold a 4% market share in 2024. Growing urbanization and the expansion of modern retail networks are boosting demand for dried vegetables. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa show rising adoption in packaged and convenience foods. Limited agricultural productivity in several areas increases reliance on imports. However, investments in food processing and improved storage facilities are strengthening regional capabilities. The growing focus on food security and reduced waste supports long-term market development across the region.

Market Segmentations:

By Vegetable Type

- Carrots

- Onions

- Peppers

- Potatoes

- Tomatoes

By Application

- Food Processing

- Retail and Consumer Products

- Foodservice Industry

- Dietary Supplements

- Animal Feed

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Retail

- Specialty Stores

- Foodservice Providers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dried vegetable market features leading players such as Silva International, Jain Irrigation Systems, Eurocebollas, Henan Sunny Foodstuff, Garlico Industries, Natural Dehydrated Vegetables, Olam International, Richfield, Kanghua, BCFoods, BranchOut Food Inc., and Jaworski. The competitive landscape is characterized by strong product innovation, strategic partnerships, and expansion into global distribution networks. Companies focus on enhancing product quality through advanced dehydration technologies and sustainable sourcing practices. Many are strengthening export capabilities to meet rising international demand for processed and convenience foods. Manufacturers emphasize organic and clean-label offerings to align with evolving consumer preferences. Continuous investment in automation, quality control, and efficient logistics supports consistent supply and cost optimization. Collaborations with food manufacturers and retailers further enhance market penetration, while regional players leverage local agricultural strengths to secure raw material access. Overall, competition remains intense, driven by technological progress, product diversification, and increasing consumer awareness of healthy food alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Olam Food Ingredients (OFI), a subsidiary of Olam Group, inaugurated a new instant coffee manufacturing facility in Linhares, Espírito Santo, Brazil.

- In 2025, BranchOut Food Inc. announced a nationwide expansion of its Brussels Sprout Crisps into 3,945 retail locations of the “nation’s largest retailer”

- In 2023, Henan Sunny Foodstuff the Chinese dehydrated vegetable producer collaborated with Agri-Neo, a food safety technology company.

Report Coverage

The research report offers an in-depth analysis based on Vegetable Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label ingredients will continue to drive dried vegetable adoption.

- Technological advancements in drying processes will improve efficiency and nutrient retention.

- Expanding use in functional foods and dietary supplements will boost market penetration.

- Rising online retail sales will enhance accessibility and global distribution of dried vegetables.

- Increasing focus on sustainability will promote eco-friendly packaging and energy-efficient production.

- Growth in the convenience food sector will sustain steady demand across regions.

- Organic dried vegetables will gain strong traction among health-conscious consumers.

- Asia Pacific will remain a major production and export hub due to low-cost resources.

- Strategic partnerships between farmers and processors will strengthen supply chain reliability.

- Product innovation with mixed vegetable blends and seasoning applications will attract new consumers.