Market Overview

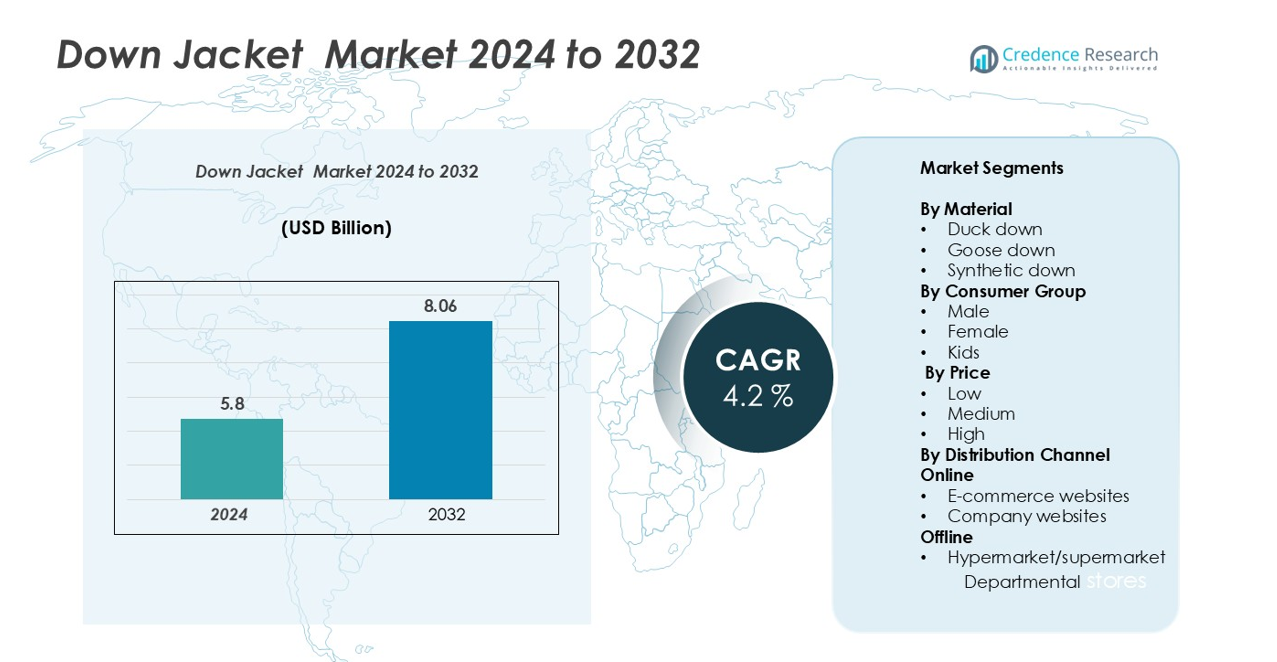

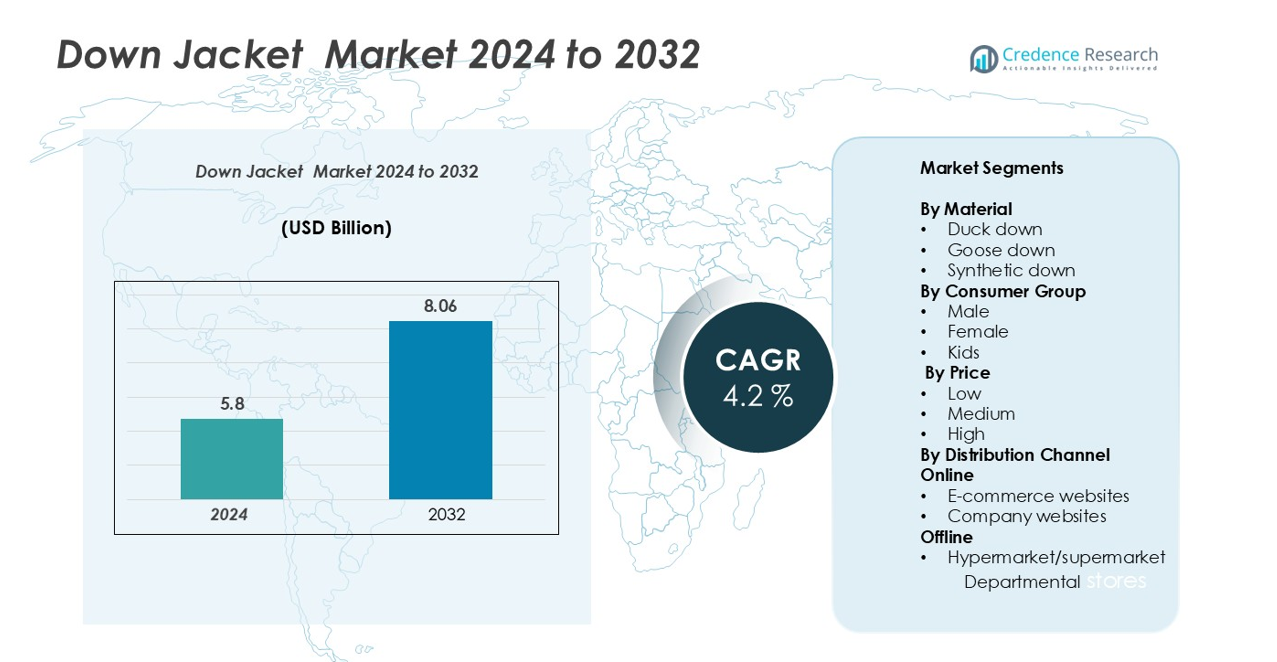

Down jacket market size was valued at USD 5.8 billion in 2024 and is anticipated to reach USD 8.06 billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Down Jacket Market Size 2024 |

USD 5.8 billion |

| Down Jacket Market, CAGR |

4.2% |

| Down Jacket Market Size 2032 |

USD 8.06 billion |

The down jacket market is led by prominent brands including Canada Goose, The North Face, Patagonia, Arc’teryx, Columbia Sportswear, Eddie Bauer, Marmot, Helly Hansen, Fjallraven, Black Diamond, Jack Wolfskin, Mountain Hardwear, Rab, Nike, and Mammut. Canada Goose and The North Face dominate the premium segment, leveraging superior insulation, design innovation, and brand recognition. North America holds the largest regional share at approximately 35%, driven by high consumer awareness, cold climates, and strong e-commerce penetration. Europe follows with a 28% share, supported by fashion-conscious consumers and winter sports demand. Asia-Pacific is emerging rapidly, accounting for 22% of the market, fueled by rising disposable incomes and urbanization. Market competition is intensified by product differentiation, technological innovation, and expansion across online and offline distribution channels.

Market Insights

- The global down jacket market was valued at USD 5.8 billion in 2024 and is projected to reach USD 8.06 billion by 2032, growing at a CAGR of 4.2%.

- Rising demand for premium and functional winter apparel, including goose and duck down jackets, is driving market growth across North America, Europe, and Asia-Pacific. Male consumers and the premium price segment account for the largest share, supported by outdoor activity and fashion trends.

- Key trends include increasing adoption of sustainable and ethically sourced materials, integration of smart features, and growth in online and omnichannel retail, which enhances accessibility and personalized shopping experiences.

- The market is highly competitive, led by Canada Goose, The North Face, Patagonia, Arc’teryx, and Columbia Sportswear, with differentiation based on quality, innovation, and brand positioning. High production costs and seasonal demand remain key restraints.

- North America dominates with a 35% market share, followed by Europe at 28% and Asia-Pacific at 22%, while Latin America and MEA account for smaller but growing shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The down jacket market is segmented by material into duck down, goose down, and synthetic down. Goose down emerges as the dominant sub-segment, capturing a significant market share due to its superior insulation, lightweight nature, and durability. Consumers increasingly prefer goose down for premium winter apparel, driving demand in both urban and high-altitude regions. Synthetic down, while gaining traction for affordability and hypoallergenic properties, remains secondary. The growth in the goose down segment is supported by rising consumer awareness of thermal performance, enhanced cold-weather protection, and brand differentiation strategies by leading manufacturers.

- For instance, Canada Goose reported that its Non-Heavyweight Down sales represented 46% of total revenue in fiscal 2024, up from 43% in fiscal 2023. This increase is a result of the company’s strategic focus on expanding its product categories to include more year-round apparel, such as rainwear, knitwear, and footwear, in addition to its traditional heavy-down parkas.

By Consumer Group

The market is segmented into male, female, and kids categories. Male consumers represent the dominant sub-segment, accounting for the largest market share, driven by higher purchasing power and a growing interest in outdoor and sportswear fashion. Female jackets are witnessing steady growth due to increasing adoption of stylish yet functional winter wear, while the kids’ segment benefits from rising parental spending on seasonal apparel. The male segment’s growth is fueled by brand campaigns targeting performance, durability, and lifestyle appeal, alongside expanding availability across both online and offline retail channels.

- For instance, the North Face offers down products with various weights and fill powers, ranging from 550-fill to 900-fill, catering to diverse consumer needs. The 900-fill down is available in extremely limited quantities and primarily in their high-performance Summit Series® gear.

By Distribution Channel

Distribution channels are classified into online and offline networks, with online further divided into e-commerce platforms and company websites, and offline comprising hypermarkets, supermarkets, and departmental stores. Online channels dominate the market, accounting for the highest share, driven by convenience, broader product availability, and personalized shopping experiences. E-commerce websites are particularly influential, offering competitive pricing, easy comparison, and rapid delivery. Offline channels maintain relevance through in-store experiences and immediate product access. The online segment’s growth is underpinned by rising internet penetration, mobile commerce adoption, and targeted digital marketing initiatives.

Key Growth Drivers

Rising Demand for Premium and Functional Winter Apparel

The growing consumer preference for high-performance winter wear is a major driver in the down jacket market. Increasing awareness of thermal efficiency, lightweight insulation, and durability has led consumers to invest in premium goose and duck down jackets. Urban populations in cold climates are particularly inclined toward jackets that combine style with functionality. Brands are responding by innovating with advanced fill power, water-resistant coatings, and ergonomic designs, which further boost market growth. Seasonal fashion trends, coupled with outdoor activities and sports, have expanded usage occasions beyond traditional winter wear. Consequently, manufacturers focusing on product quality and brand positioning are gaining a competitive edge, fueling the adoption of premium down jackets across both online and offline channels globally.

- For instance, the North Face offers Summit Series down jackets, such as the Pumori Down Parka, which feature 800-fill ProDown™ insulation, a water-resistant down that maintains loft and warmth even when damp. These jackets are valued for their high warmth-to-weight ratio and compressibility, making them a suitable choice for alpine mountaineering in cold, dry climates.

Expansion of E-commerce and Omnichannel Retail

E-commerce penetration has significantly transformed the down jacket market, offering consumers access to a wide variety of products, competitive pricing, and convenient delivery options. Online platforms, including e-commerce marketplaces and brand websites, dominate the market by enabling quick comparisons, personalized recommendations, and promotions targeting specific consumer groups. Omnichannel strategies, integrating online and offline touchpoints, allow brands to maintain visibility while catering to changing shopping behaviors. This distribution flexibility supports rapid inventory turnover, expands geographical reach, and attracts younger, digitally savvy consumers. As a result, online retail has become a critical driver for sales growth, particularly for premium and mid-range segments, while offline channels continue to complement with in-store experiences for high-touch product evaluation.

- For instance, Patagonia is a privately held company and as such, it does not publicly release detailed monthly financial reports like online store revenue. However, third-party analytics sources estimate that patagonia.com received approximately 7.57 million visits (sessions) in August 2025.

Rising Outdoor and Adventure Activities

The surge in outdoor recreation, adventure sports, and travel activities is propelling demand for durable and high-performance down jackets. Consumers increasingly prioritize protective apparel suitable for skiing, trekking, hiking, and other cold-weather activities, where insulation and comfort are crucial. This trend is particularly pronounced in North America, Europe, and parts of Asia-Pacific, where lifestyle changes have spurred interest in premium and functional outerwear. Brands leverage this demand by developing specialized collections, using advanced fill materials, ergonomic fits, and water-repellent fabrics. Marketing campaigns highlighting performance, technical specifications, and lifestyle appeal further drive adoption. Consequently, the focus on active and adventure-oriented consumer segments has emerged as a strategic growth lever, boosting both product diversification and market expansion.

Key Trends & Opportunities

Sustainable and Eco-friendly Materials

Sustainability has become a critical trend in the down jacket market, with consumers increasingly favoring eco-friendly and ethically sourced materials. Brands are adopting responsibly sourced goose and duck down, recycled synthetics, and biodegradable packaging to meet consumer expectations and regulatory requirements. This trend provides opportunities for differentiation, particularly among environmentally conscious millennials and Gen Z buyers. Companies investing in transparent supply chains and certifications, such as Responsible Down Standard (RDS), gain trust and enhance brand reputation. The adoption of sustainable practices not only aligns with global environmental initiatives but also drives product innovation, encouraging the development of jackets that are lightweight, durable, and low-impact, expanding market reach and long-term growth potential.

- For instance, Patagonia’s Men’s Down Sweater Hoody features a NetPlus® 100% postconsumer recycled nylon ripstop shell made from recycled fishing nets and 800-fill-power 100% Responsible Down Standard (RDS) certified goose down, highlighting the brand’s commitment to sustainable materials.

Integration of Smart and Functional Features

Technological innovation in down jackets presents opportunities for market expansion through smart features such as temperature regulation, built-in heating elements, and moisture management systems. Brands are integrating wearable technology and performance-enhancing materials to appeal to tech-savvy and active consumers. These advancements improve comfort, safety, and functionality, enhancing the overall value proposition of high-end jackets. Additionally, customization through modular designs, detachable layers, and adjustable insulation offers differentiated experiences, attracting premium buyers. The convergence of fashion, performance, and technology presents a significant growth avenue, allowing manufacturers to command higher margins and expand into niche markets within outdoor and lifestyle segments globally.

- For instance, the PYKRS connected sustainable jacket (specifically the X-TREME Parka model) includes features like app-controlled lighting, heating, and fall detection, made of durable sustainable materials.

Growth in Tier-2 and Tier-3 Markets

Emerging markets in tier-2 and tier-3 cities offer significant opportunities for down jacket brands. Increasing disposable incomes, rising cold-weather awareness, and expanding retail infrastructure in these regions drive adoption of both premium and mid-range products. E-commerce plays a pivotal role in reaching these consumers, while offline stores provide experiential touchpoints to build brand loyalty. Market players focusing on affordable, durable, and stylish options for these regions can capture untapped demand. This expansion strategy allows brands to diversify revenue streams, reduce dependency on saturated urban markets, and leverage localized marketing campaigns, ultimately fostering sustained market growth in previously underserved areas.

Key Challenges

High Production Costs and Price Sensitivity

Down jackets, particularly those using premium goose and duck down, are associated with high production costs due to sourcing, processing, and quality control requirements. These costs often translate into higher retail prices, limiting affordability for certain consumer segments. Price sensitivity is particularly evident in developing markets, where mid-range and low-price jackets dominate. Balancing quality with affordability poses a significant challenge for manufacturers seeking to maintain margins while expanding market penetration. Companies must invest in cost-effective production, supply chain optimization, and strategic pricing models to overcome these barriers without compromising insulation performance and durability, ensuring sustainable growth in competitive markets.

Seasonal Demand and Inventory Management

The down jacket market is highly seasonal, with peak sales concentrated during winter months. This seasonality creates challenges in inventory management, distribution planning, and demand forecasting. Overstocking can lead to markdowns and margin erosion, while understocking risks lost sales and customer dissatisfaction. Rapidly changing fashion trends and varying climate conditions further complicate supply planning. Manufacturers and retailers need agile production schedules, flexible supply chains, and data-driven forecasting systems to mitigate these risks. Efficient inventory management, coupled with strategic promotional campaigns during off-season periods, is essential to maintain revenue stability and optimize operational efficiency.

Regional Analysis

North America

North America holds a leading position in the down jacket market, accounting for a significant share due to high consumer awareness, cold climatic conditions, and strong purchasing power. The U.S. dominates the region, driven by demand for premium goose down jackets and functional outdoor apparel. Canada also contributes substantially, particularly in outdoor and winter sports segments. E-commerce penetration and omnichannel retailing further bolster sales, offering convenience and product variety. Market growth is supported by lifestyle trends emphasizing outdoor recreation and branded apparel. The region’s focus on innovation, quality, and performance jackets positions North America as a key contributor to global market expansion.

Europe

Europe represents a major market for down jackets, with notable shares in Western and Northern Europe. Countries such as Germany, France, and the U.K. lead demand for high-quality goose and duck down jackets, driven by fashion-conscious consumers and outdoor activity enthusiasts. Seasonal variations and cold climates increase the need for thermal wear, while sustainability trends encourage adoption of responsibly sourced materials. Retail expansion through online and offline channels ensures broad product accessibility. Strong brand presence, technological innovation in insulation, and a preference for premium outerwear contribute to Europe’s stable growth, making the region a crucial player in the global down jacket landscape.

Asia-Pacific

The Asia-Pacific region is emerging as a high-growth market for down jackets, capturing a growing market share driven by rising disposable incomes, urbanization, and increasing cold-weather awareness in countries like China, Japan, and South Korea. Youth adoption of fashion-oriented winter apparel and the expansion of e-commerce platforms are key growth catalysts. Seasonal tourism and outdoor activity trends further propel demand for functional and premium jackets. Market players are leveraging localized designs, affordable mid-range products, and targeted marketing to tap into diverse consumer segments. The region’s rapid retail modernization and growing consumer base make it a strategic growth hub.

Latin America

Latin America holds a moderate share in the down jacket market, with Brazil, Argentina, and Chile leading demand. Consumers increasingly favor warm, lightweight, and affordable winter wear in urban and high-altitude regions. Market growth is supported by rising disposable incomes, exposure to international fashion trends, and expanding e-commerce platforms. Localized pricing strategies and mid-range product offerings cater to price-sensitive buyers, while offline retail continues to play an important role in consumer experience. Despite seasonal fluctuations and climatic variations, the region offers opportunities for growth through targeted marketing, expansion into tier-2 cities, and partnerships with local distributors and retail chains.

Middle East & Africa (MEA)

The MEA region holds a smaller yet growing share of the down jacket market, primarily driven by cold-weather pockets in countries like the UAE, Saudi Arabia, and South Africa. Premium and branded jackets see traction among affluent consumers and travelers, while urbanization and rising fashion consciousness contribute to increasing adoption. Seasonal demand and limited winter months influence market cycles, making targeted promotions and e-commerce channels vital for growth. Companies focus on a mix of premium and mid-range products to cater to niche consumer segments. Strategic collaborations with local retailers and online platforms further enhance market penetration in this emerging region.

Market Segmentations:

By Material

- Duck down

- Goose down

- Synthetic down

By Consumer Group

By Price

By Distribution Channel

- Online

- E-commerce websites

- Company websites

- Offline

- Hypermarket/supermarket

- Departmental stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The down jacket market is highly competitive, dominated by established global brands such as Canada Goose, The North Face, Patagonia, Arc’teryx, Columbia Sportswear, and Moncler, alongside emerging regional players. Companies compete through product innovation, quality, and differentiation in materials, including premium goose and duck down or advanced synthetic alternatives. Strategic initiatives such as expanding e-commerce presence, omnichannel retailing, and targeted marketing campaigns strengthen brand visibility and consumer loyalty. Collaborations, limited-edition collections, and sustainability initiatives further enhance competitive positioning. Mid-range and value-focused brands, including Eddie Bauer, Marmot, and Helly Hansen, leverage affordability and functional designs to capture price-sensitive segments. Overall, the market’s competitive landscape is shaped by technological innovation, brand reputation, and consumer preferences for performance, style, and sustainability, driving continuous innovation and expansion across both mature and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arc’teryx

- Black Diamond

- Canada Goose

- Columbia Sportswear

- Eddie Bauer

- Fjallraven

- Helly Hansen

- Jack Wolfskin

- Mammut

- Marmot

- Mountain Hardwear

- Nike

- Patagonia

- Rab

- The North Face

Recent Developments

- In December 2024, Helly Hansen introduced its lightest-ever Odin Everdown Hooded Jacket. Designed for mountain professionals seeking lightweight yet warm insulation, the jacket weighs just 325g for men’s large and 275g for women’s medium. This launch highlights Helly Hansen’s commitment to performance-driven innovation, catering to outdoor enthusiasts who demand high-quality, ultra-light insulated gear.

- In September 2022, Dude Perfect, a sports and entertainment organization, joined forces with Columbia Sportswear in a partnership aimed at promoting outdoor activities and encouraging people to spend more time outside. This collaboration marks a celebration of the great outdoors as Dude Perfect and Columbia come together to inspire outdoor enthusiasts.

Report Coverage

The research report offers an in-depth analysis based on Material, Consumer Group, Price, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium goose and duck down jackets will continue to grow globally.

- Sustainable and eco-friendly materials will see wider adoption across brands.

- Online and omnichannel retail will become the dominant distribution strategy.

- Asia-Pacific will emerge as a high-growth market with expanding consumer base.

- Technological innovations, including smart and heated jackets, will gain traction.

- Mid-range and affordable segments will expand in emerging markets.

- Seasonal trends will drive limited-edition and fashion-oriented collections.

- Partnerships and collaborations between brands will increase to strengthen market presence.

- Consumer preference for multifunctional and adventure-ready jackets will rise.

- Market competition will intensify, with focus on differentiation through quality, performance, and sustainability.