Market overview

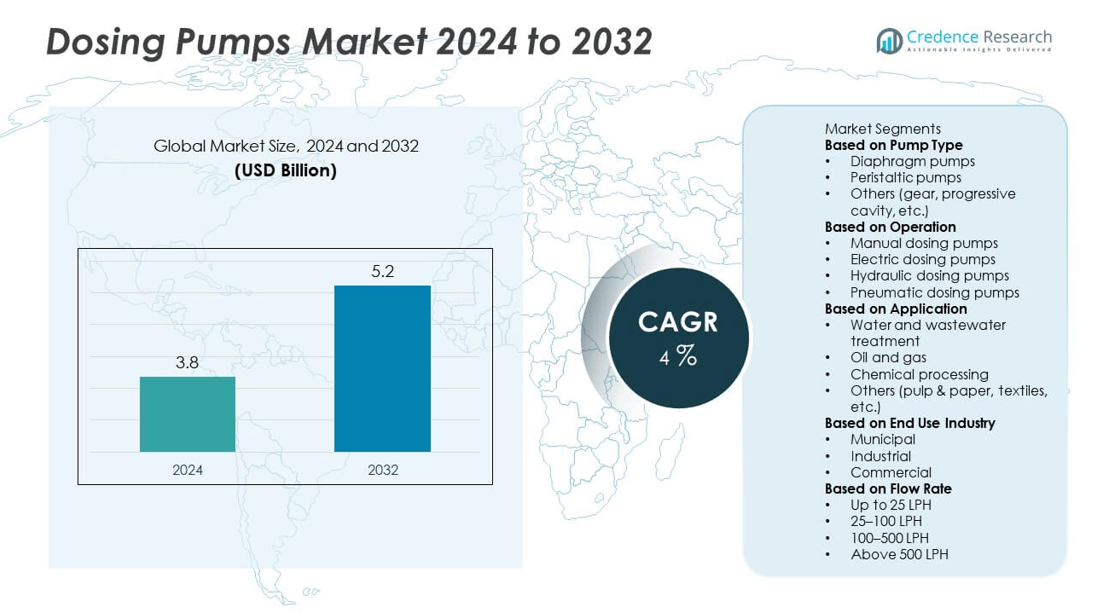

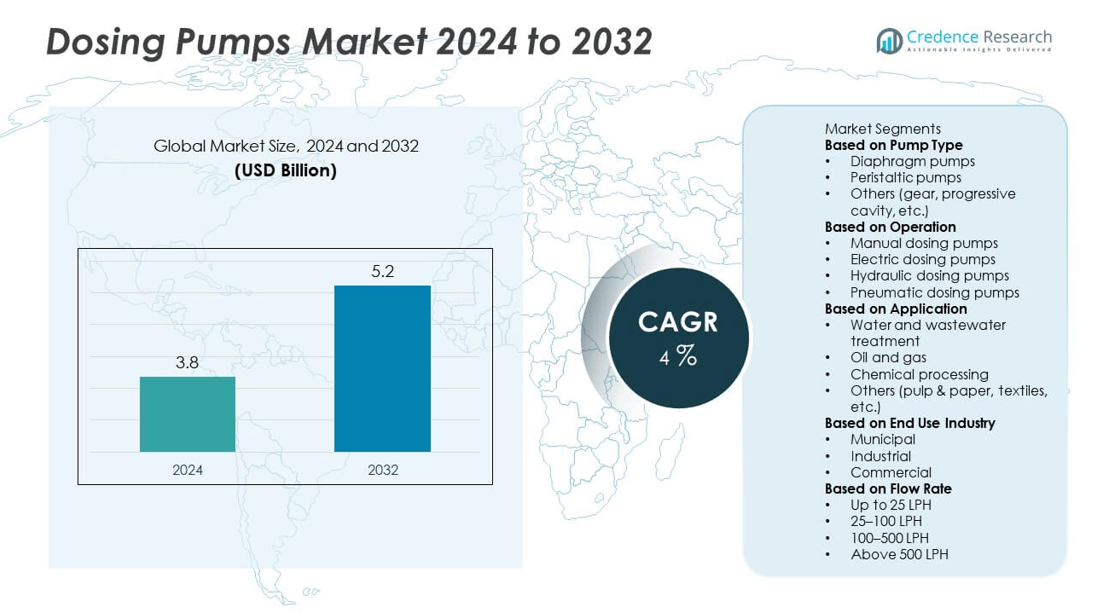

The dosing pumps market was valued at USD 3.8 billion in 2024 and is projected to reach USD 5.2 billion by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dosing Pumps Market Size 2024 |

USD 3.8 billion |

| Dosing Pumps Market, CAGR |

4% |

| Dosing Pumps Market Size 2032 |

USD 5.2 billion |

The dosing pumps market is led by major players including Grundfos, Xylem Inc., IDEX Corporation, SEKO S.p.A., SPX FLOW, Inc., Dover Corporation, ProMinent GmbH, Milton Roy, Verder Group, and Blue-White Industries Ltd. These companies dominate through innovative product designs, advanced digital control systems, and strong global distribution networks. North America leads the global market with a 37% share, driven by high adoption in water treatment and oil & gas industries. Europe follows with a 28% share, supported by stringent environmental regulations and growing demand for precision dosing. Asia-Pacific holds a 25% share, fueled by rapid industrialization, infrastructure development, and increasing investments in wastewater treatment and chemical processing facilities.

Market Insights

- The dosing pumps market was valued at USD 3.8 billion in 2024 and is projected to reach USD 5.2 billion by 2032, growing at a CAGR of 4% during the forecast period.

- Increasing demand for precise chemical dosing in water treatment, oil & gas, and chemical industries is driving global market growth.

- Smart and energy-efficient dosing systems integrated with IoT and digital control technologies are shaping market trends.

- Key players such as Grundfos, Xylem Inc., and ProMinent GmbH focus on automation, durability, and sustainable manufacturing to strengthen competitiveness.

- North America holds a 37% share, followed by Europe at 28% and Asia-Pacific at 25%, while diaphragm pumps lead with 46% share driven by their high precision, low maintenance, and suitability for corrosive fluid handling across diverse industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Pump Type

The diaphragm pumps segment dominated the dosing pumps market in 2024 with a 46% share. Their precision, chemical resistance, and suitability for handling corrosive fluids make them widely used across water treatment and chemical industries. Diaphragm pumps require minimal maintenance and offer consistent flow control, which enhances process efficiency. The segment’s growth is supported by increasing demand in wastewater treatment and pharmaceutical applications. Technological advancements such as digital control interfaces and energy-efficient motors further strengthen adoption, making diaphragm pumps the preferred choice for accurate and reliable chemical dosing operations globally.

- For instance, ProMinent GmbH developed the gamma/ X diaphragm dosing pump, equipped with a controlled solenoid drive that measures back pressure. This technology eliminates the need for an integrated pressure sensor, which increases operational safety.

By Operation

Electric dosing pumps held the largest market share of 42% in 2024, driven by their high accuracy, automation compatibility, and low energy consumption. These pumps are favored in industries requiring precise chemical metering, including water treatment, food processing, and oil refining. Integration with digital monitoring systems enables remote control and real-time performance tracking, improving operational efficiency. The growing trend toward smart and automated industrial systems is boosting adoption of electric dosing pumps. Additionally, reduced maintenance costs and enhanced reliability compared to manual and hydraulic types contribute to the segment’s continued dominance.

- For instance, Grundfos introduced the SMART Digital DDA-FCM electric dosing pump featuring a turndown ratio of 1:3000 and a maximum flow capacity of 30 liters per hour at 10 bar. The unit utilizes a 100-watt stepper motor with integrated flow and pressure sensors to deliver real-time adjustment of dosing volume. Data connectivity via Modbus RTU and Profibus allows full system integration for automated chemical dosing and predictive maintenance in industrial and municipal operations.

By Application

The water and wastewater treatment segment accounted for a 49% share of the dosing pumps market in 2024, making it the dominant application area. Increasing global demand for clean water and stringent environmental regulations are driving the installation of dosing systems for disinfection, pH control, and chemical treatment. Municipal and industrial facilities are expanding investments in advanced dosing technologies to optimize chemical usage and minimize waste. The integration of automated and sensor-based systems enhances accuracy and sustainability, reinforcing the segment’s leading position in global water infrastructure modernization projects.

Key Growth Drivers

Rising Demand for Water and Wastewater Treatment

Increasing global focus on water conservation and pollution control is driving the dosing pumps market. Governments and industries are investing heavily in wastewater treatment plants to meet environmental standards. Dosing pumps are essential for precise chemical dosing during disinfection and pH control. Growing urbanization and industrial expansion have intensified the need for efficient water treatment systems. The adoption of automated and energy-efficient dosing solutions ensures accurate chemical usage and reduced waste, strengthening demand across municipal and industrial wastewater management applications.

- For instance, SEKO S.p.A. launched the Tekna Evo TPG600 solenoid-driven dosing pump designed for wastewater treatment applications, which is capable of delivering up to 3 liters per hour at 18 bar pressure. The pump incorporates a digital control panel with proportional dosing based on analog (4–20 mA) or digital signals, as well as timer and statistics functions.

Expanding Applications in Chemical and Oil & Gas Industries

The chemical and oil & gas sectors are increasingly adopting dosing pumps for handling corrosive and viscous fluids. Their ability to deliver precise flow rates under varying pressures makes them ideal for critical processes like catalyst injection and corrosion inhibition. Expanding refinery operations and chemical production facilities, especially in Asia-Pacific and the Middle East, are fueling demand. The integration of advanced materials such as PTFE diaphragms and stainless steel construction enhances durability, supporting continuous operation in demanding environments and ensuring operational safety.

- For instance, Milton Roy developed the mROY® Series diaphragm metering pump, capable of achieving a maximum capacity of 180 liters per hour at 12 bar discharge pressure. The pump features a stroke frequency of 100 strokes per minute and is constructed with a 316 stainless-steel liquid end and PTFE diaphragm for superior corrosion resistance.

Shift Toward Automation and Digital Control Systems

The rising adoption of Industry 4.0 technologies is accelerating the integration of smart dosing pumps equipped with digital interfaces and IoT capabilities. These systems enable real-time monitoring, remote control, and predictive maintenance, improving overall efficiency. Automated pumps help reduce manual errors and optimize chemical dosing, leading to lower operational costs. Industrial facilities in sectors like food processing, water treatment, and energy are transitioning toward automated solutions for enhanced precision and process control. This digital transformation trend is significantly reshaping the dosing pumps market landscape.

Key Trends and Opportunities

Adoption of Energy-Efficient and Smart Dosing Systems

Energy efficiency is becoming a central focus in dosing pump development. Manufacturers are designing pumps with variable frequency drives (VFDs), digital displays, and automatic flow adjustments to reduce power consumption. Smart dosing systems integrated with AI and IoT enhance accuracy while minimizing chemical waste. The growing demand for sustainable industrial operations presents an opportunity for companies offering eco-friendly and intelligent dosing solutions. These innovations align with global initiatives for reducing carbon footprints and achieving operational efficiency across water treatment and chemical sectors.

- For instance, Xylem Inc. offers the Flygt SmartRun™ pump station controller, which uses variable speed control to automatically optimize wastewater pump performance and reduce energy usage by up to 50%. This intelligent control system combines a variable frequency drive with a pre-programmed controller that adapts to changing conditions, helping to reduce clogging and minimize overall costs.

Expansion of Dosing Applications in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid industrialization and urban growth, creating new opportunities for dosing pump adoption. Infrastructure development in water treatment, agriculture, and manufacturing is boosting demand for precision chemical dosing systems. Government programs promoting clean water access and industrial modernization are key growth catalysts. Local manufacturers are entering partnerships with global pump producers to introduce cost-effective and durable dosing solutions, accelerating regional market penetration and supporting long-term industry expansion.

- For instance, Verder Group expanded its dosing technology operations in India through the introduction of the Verderflex Dura 45 peristaltic pump, capable of delivering flow rates up to 14,500 milliliters per minute at 16 bar pressure. The pump employs reinforced rubber hose technology for chemical resistance and extended service life exceeding 20,000 operational hours.

Key Challenges

High Maintenance and Operational Costs

The installation and maintenance of advanced dosing pumps involve significant investment, limiting adoption in cost-sensitive industries. Components such as diaphragms, valves, and seals require periodic replacement, increasing operational expenses. Additionally, improper calibration can lead to performance inefficiencies and downtime. Small and medium enterprises often hesitate to adopt high-end digital dosing systems due to budget constraints. To address this challenge, manufacturers are focusing on modular designs and long-life materials to lower maintenance needs and enhance overall cost efficiency.

Complex Calibration and Technical Skill Requirements

Accurate dosing depends on precise calibration and skilled operation, which remain challenges for many end users. Variations in fluid viscosity, pressure, and chemical concentration demand continuous adjustments. In industries with limited technical expertise, errors in calibration can affect product quality and process safety. The lack of trained personnel, especially in developing regions, hampers optimal system utilization. Training programs and automated calibration features are being introduced to reduce dependency on manual intervention and improve performance consistency in complex dosing applications.

Regional Analysis

North America

North America dominated the dosing pumps market in 2024 with a 37% share, driven by strong industrial automation and advanced water treatment infrastructure. The U.S. leads the region due to rising demand for precision dosing systems in oil and gas, chemical, and municipal wastewater applications. Stringent environmental regulations by the EPA are encouraging industries to adopt efficient dosing technologies for pollution control. The presence of leading manufacturers and continuous technological advancements in digital dosing and smart monitoring systems further strengthen market growth across the U.S. and Canada.

Europe

Europe accounted for a 28% share of the global dosing pumps market in 2024, supported by increasing adoption in water treatment and food processing sectors. Countries such as Germany, France, and the U.K. are focusing on sustainable water management practices and emission control. The region’s strong chemical manufacturing base drives the use of accurate dosing solutions. EU regulations promoting energy efficiency and reduced chemical waste are fueling demand for automated dosing systems. Continuous investment in upgrading industrial equipment and wastewater treatment facilities further enhances Europe’s market expansion.

Asia-Pacific

Asia-Pacific held a 25% share of the dosing pumps market in 2024, fueled by rapid industrialization, urbanization, and expanding manufacturing sectors. China, India, and Japan are major contributors, driven by growing infrastructure projects and increased water reuse initiatives. Rising demand for reliable water treatment solutions in municipal and industrial facilities supports regional growth. The food and beverage and chemical industries are also adopting automated dosing technologies for precision and consistency. Increasing government investments in wastewater treatment and the presence of low-cost manufacturers are making Asia-Pacific a key growth hub for dosing pumps.

Latin America

Latin America captured a 6% share of the dosing pumps market in 2024, led by rising investments in clean water projects and industrial modernization. Brazil and Mexico are driving demand due to the expansion of the oil and gas, mining, and water treatment sectors. Regional governments are implementing stricter water quality regulations, encouraging the use of automated dosing technologies. Growing adoption in agriculture for fertilizer and chemical dosing also contributes to market growth. Despite challenges related to infrastructure limitations, foreign investments are improving accessibility to advanced pumping solutions across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the dosing pumps market in 2024, supported by increasing desalination activities and oil & gas production. The UAE and Saudi Arabia dominate regional demand, investing heavily in water treatment and energy projects. Expansion of chemical processing plants and wastewater recycling initiatives further support adoption. In Africa, rising industrialization and government focus on clean water access are creating growth opportunities. While infrastructure challenges persist, ongoing investment in industrial automation and energy-efficient dosing technologies continues to drive regional market development.

Market Segmentations

By Pump Type

- Diaphragm pumps

- Peristaltic pumps

- Others (gear, progressive cavity, etc.)

By Operation

- Manual dosing pumps

- Electric dosing pumps

- Hydraulic dosing pumps

- Pneumatic dosing pumps

By Application

- Water and wastewater treatment

- Oil and gas

- Chemical processing

- Others (pulp & paper, textiles, etc.)

By End Use Industry

- Municipal

- Industrial

- Commercial

By Flow Rate

- Up to 25 LPH

- 25–100 LPH

- 100–500 LPH

- Above 500 LPH

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the dosing pumps market is characterized by continuous innovation, technological advancement, and strategic expansion by key players such as Grundfos, Xylem Inc., IDEX Corporation, SEKO S.p.A., SPX FLOW, Inc., Dover Corporation, ProMinent GmbH, Milton Roy, Verder Group, and Blue-White Industries Ltd. These companies focus on developing energy-efficient and digitally controlled dosing solutions to meet rising industrial and environmental demands. Strategic collaborations, mergers, and product launches are strengthening their global presence. Manufacturers are investing in smart dosing systems integrated with IoT and automation for enhanced accuracy and real-time monitoring. Increasing emphasis on precision control, reliability, and reduced maintenance costs is driving product differentiation. Additionally, players are expanding their footprints in emerging markets through localized production and service networks, aligning with global sustainability goals and the growing demand for advanced chemical dosing technologies across water treatment, chemical processing, and oil and gas industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grundfos

- Xylem Inc.

- IDEX Corporation

- SEKO S.p.A.

- SPX FLOW, Inc.

- Dover Corporation

- ProMinent GmbH

- Milton Roy

- Verder Group

- Blue-White Industries Ltd.

Recent Developments

- In June 2025, Grundfos launched the DDA-FCM digital dosing variant optimized for OEM integration and fine control of chemical dosing.

- In March 2025, Grundfos released the DDA SMART Digital dosing pump, featuring a stepper motor with a turndown ratio of 1:3000 and remote setup via the Grundfos GO app.

- In September 2023, Blue-White Industries introduced a redesigned Hyperdrive technology to boost feed rates of its CD1 and MD1 diaphragm dosing pumps to a new range of 0.003 to 32.2 L/h, while minimizing vapor lock

Report Coverage

The research report offers an in-depth analysis based on Pump Type, Operation, Application, End Use Industry, Flow Rate and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart and automated dosing pumps will continue to expand across industries.

- Integration of IoT and AI technologies will enhance real-time monitoring and precision control.

- Demand for energy-efficient and low-maintenance pump systems will grow steadily.

- Water and wastewater treatment projects will remain the largest application area worldwide.

- Manufacturers will focus on developing corrosion-resistant and durable materials for harsh environments.

- Asia-Pacific will emerge as a key growth hub due to rapid industrialization and infrastructure development.

- Digital dosing solutions will gain traction in chemical and pharmaceutical processing sectors.

- Partnerships and mergers among global players will strengthen technological innovation and market reach.

- Government regulations promoting environmental sustainability will accelerate adoption of efficient dosing systems.

- Continued R&D investment will drive advancements in flow accuracy, automation, and cost optimization.