Market Overview

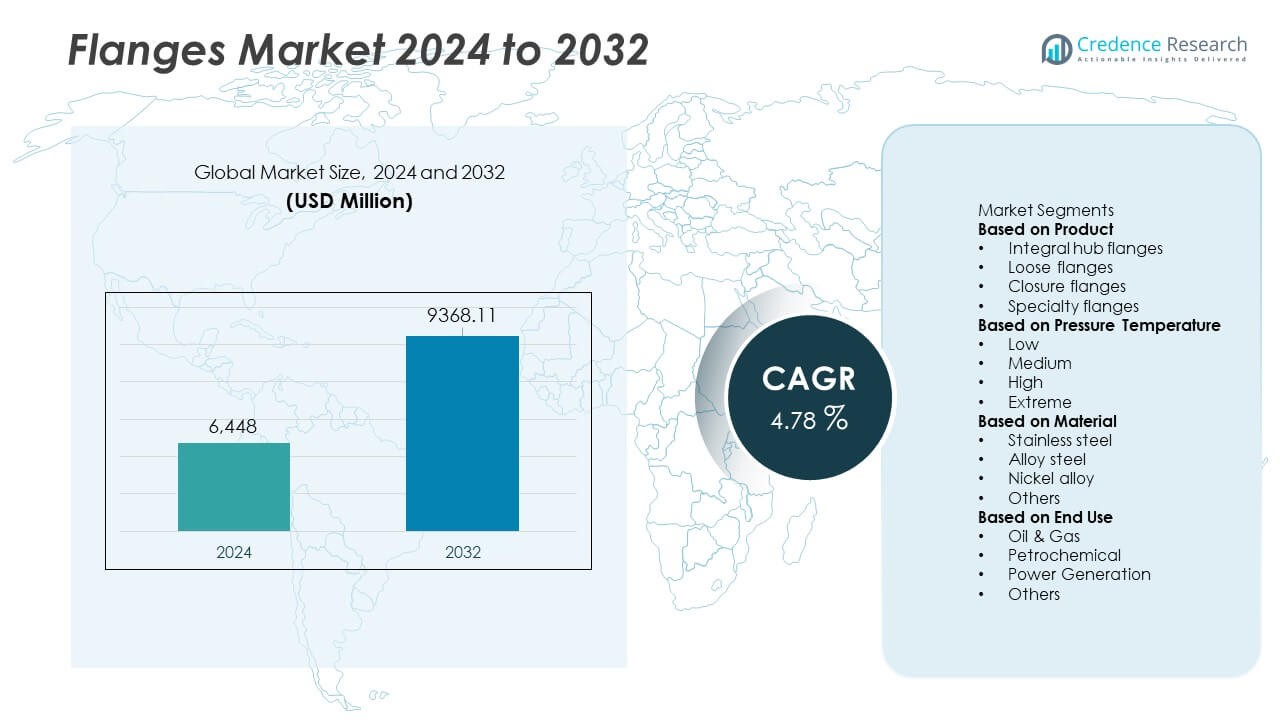

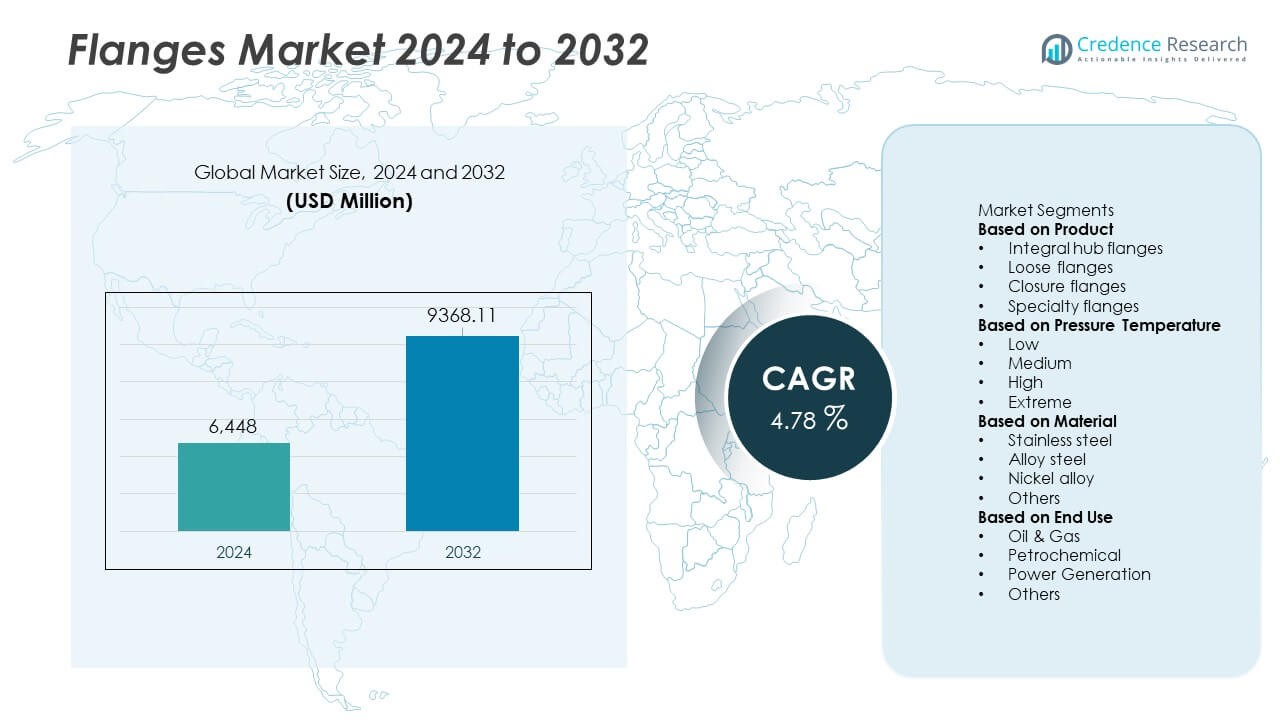

Flanges Market size reached USD 6,448 million in 2024 and is projected to rise to USD 9,368.11 million by 2032, expanding at a CAGR of 4.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flanges Market Size 2024 |

USD 6,448 Million |

| Flanges Market, CAGR |

4.78% |

| Flanges Market Size 2032 |

USD 9,368.11 Million |

Top players in the flanges market include Georg Fischer (GF Piping Systems), Parker Hannifin Corporation, Alleima, Outokumpu Oyj, ASC Engineered Solutions, Texas Flange, Metalfar S.p.A., Bonney Forge, Victaulic, and Flanschenwerk Bebitz GmbH. These companies strengthen their position through advanced materials, automated machining, and compliance with global performance standards across oil, gas, chemical, and power sectors. Asia Pacific leads the market with 38% share, driven by rapid industrialization, refinery expansion, and strong manufacturing activity. North America follows due to steady pipeline upgrades and refinery modernization programs, supporting long-term demand for high-performance flange assemblies.

Market Insights

Market Insights

- The flanges market reached USD 6,448 million in 2024 and is projected to hit USD 9,368.11 million by 2032, registering a CAGR of 4.78%.

- Integral hub flanges hold 42% share, supported by strong use in oil, gas, and industrial flow systems driven by rising infrastructure modernization.

- Automation in machining and demand for corrosion-resistant materials shape key trends as manufacturers invest in advanced alloys and precision forging to enhance product reliability.

- Leading companies such as Georg Fischer, Parker Hannifin, Bonney Forge, and Victaulic expand capacity and focus on specialty flanges, while competitive pressure increases from regional low-cost suppliers.

- Asia Pacific leads with 38% share, followed by North America at 32% and Europe at 26%, while sourcing challenges and volatile alloy prices continue to restrain production stability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Integral hub flanges hold 42% share and lead the product segment due to strong demand across petrochemical, power, and heavy engineering projects. These flanges support high-pressure flow systems and reduce leakage risk, which increases adoption in refineries and pipeline upgrades. Loose flanges gain traction in maintenance and modular piping due to easier installation, while closure and specialty flanges serve niche applications in chemical plants and offshore structures. Growing investments in oil transmission networks and expansion of high-integrity piping systems continue to push demand for precision-engineered integral hub designs and strengthen their dominance in the global market.

- For instance, Outokumpu expanded its stainless-steel slab production capacity at its Tornio works from 0.65 to 1.65 million tons annually (a 1 million ton increase) with a new steel plant that started up in September 2002, supporting the production of various stainless steel products.

By Pressure Temperature

High-pressure flanges dominate the segment with 39% share, driven by rising installation in chemical processing, LNG transport, and high-temperature steam lines. These flanges offer reliable performance under demanding operating conditions, supporting critical flow control in refineries and energy plants. Medium-pressure flanges remain important in commercial building networks, while low-pressure variants serve HVAC, water distribution, and general industrial systems. Extreme-pressure flanges grow steadily as aerospace and deep-well drilling adopt premium materials. The shift toward high-efficiency plants and upgraded thermal systems reinforces the strong preference for high-pressure assemblies in modern infrastructure.

- For instance, Alleima developed the advanced austenitic stainless steel grade Sanicro® 25, which is designed for use in advanced coal-fired power boilers operating at temperatures up to 700°C (1292°F).

By Material

Stainless steel flanges lead the material segment with 46% share, supported by strong corrosion resistance and suitability for food processing, chemical handling, and offshore installations. Alloy steel options gain use in high-temperature steam networks, while nickel alloys serve specialized applications such as cryogenic storage, subsea systems, and high-purity chemical pipelines. The “others” category includes carbon steel and duplex grades used in construction and water treatment networks. Demand for stainless steel continues to rise as industries prioritize longer service life, reduced maintenance, and compliance with stringent safety and hygiene standards across critical piping environments.

Key Growth Drivers

Rising Expansion of Oil, Gas, and Petrochemical Infrastructure

Global investment in oil refineries, LNG terminals, and cross-border pipeline networks strengthens demand for high-strength flanges. Energy companies upgrade flow systems to improve safety, reduce leakage, and support higher-pressure operations. Large offshore fields and shale extraction projects create consistent need for corrosion-resistant flange assemblies. Petrochemical plants adopt advanced flange designs to handle aggressive fluids and high temperatures. These upgrades push manufacturers to deliver precision-machined products that meet strict global standards. The expansion of downstream processing facilities further accelerates volume growth across high-pressure and specialty flange categories worldwide.

- For instance, Georg Fischer leverages advanced manufacturing and automation solutions through its divisions, such as GF Machining Solutions, to enable the production of high-precision components for various industrial applications, including those within the refinery and infrastructure sectors.

Growing Adoption in Power Generation and Industrial Manufacturing

Thermal, nuclear, and renewable power plants rely on durable flanges for steam lines, cooling systems, and heat-transfer units. Industrial sectors such as chemicals, fertilizers, pharmaceuticals, and food processing expand their production lines, creating steady demand for robust piping components. Upgrades in boiler systems and high-pressure reactors require stronger sealing performance and improved material quality. Manufacturers benefit from rising investments in combined-cycle plants and biomass facilities. Strict compliance standards and greater focus on operational safety strengthen the need for reliable flange systems across diverse industrial applications.

- For instance, Flanschenwerk Bebitz GmbH is a manufacturer that produces high-quality forged and machined rings up to an outer diameter of 2 meters. The company has a total capacity of approximately 24,000 tons of forged products per year and focuses on a wide range of applications in engineering, automotive, energy, and transmission.

Increasing Shift Toward Corrosion-Resistant and High-Performance Materials

Industries prefer stainless steel, duplex, nickel alloys, and specialty grades to enhance reliability in extreme environments. These materials offer better resistance to chemicals, heat, and pressure, supporting long equipment life and lower maintenance cycles. Demand rises in offshore platforms, desalination units, LNG storage, and chemical reactors where high durability is essential. Manufacturers introduce advanced metallurgical processes and tighter dimensional tolerances to meet evolving performance expectations. The shift toward high-integrity materials aligns with global quality frameworks and encourages long-term adoption of premium flanges.

Key Trends & Opportunities

Growing Use of Automation and Precision Manufacturing

Flange producers adopt CNC machining, robotic welding, and automated inspection to deliver tighter tolerances and consistent quality. Industries require high-precision flanges for complex flow systems and challenging operating conditions. Automation reduces machining errors and accelerates throughput, helping suppliers meet rising demand from oil, gas, and chemical sectors. Digital inspection tools, ultrasonic testing, and AI-driven defect detection create opportunities for premium, high-assurance flange lines. Companies offering advanced manufacturing capabilities position themselves strongly in global supply chains.

- For instance, Victaulic deployed advanced manufacturing technologies, including automated and robotic processes, that increase efficiency and reduce manual variability in flange fabrication.

Rising Demand for Customized and Specialty Flange Designs

End-users seek customized dimensions, unique sealing profiles, and material combinations to support specialized piping projects. Chemical processing, offshore drilling, and aerospace sectors prefer engineered designs that address extreme temperature, vibration, or corrosive environments. Manufacturers expand their catalog of compact, lightweight, and high-pressure specialty flanges. Growth in modular plant construction increases the need for tailor-made components that reduce installation time. This shift toward application-specific designs opens new revenue opportunities for suppliers offering flexible engineering support.

- For instance, Metalfar S.p.A. engineered a duplex-steel flange line certified for sustained operations at approximately 300°C (572°F) in corrosive reactors. Prolonged use above this temperature is not recommended due to material embrittlement caused by the precipitation of intermetallic phases.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

Stainless steel, alloy steel, and nickel grades experience frequent price fluctuations driven by energy costs, mining output, and geopolitical factors. High material volatility affects production planning and reduces profit margins for flange manufacturers. Supply chain disruptions cause delays in large projects, especially in oil and gas. Companies face difficulties maintaining steady inventory levels and meeting tight delivery schedules. These uncertainties create long-term risk for producers dependent on global material sourcing.

Intense Competition and Pressure to Offer Low-Cost Products

The global flange market includes numerous regional manufacturers offering low-priced standard components. This competitive landscape limits pricing flexibility for established players and increases pressure to reduce manufacturing costs. Customers, particularly in construction and general industrial sectors, often prioritize cost over technical performance. Maintaining quality while competing against low-margin suppliers remains a major challenge. Companies must balance innovation, compliance, and cost efficiency to stay competitive in high-volume markets.

Regional Analysis

North America

North America leads the flanges market with 32% share, supported by strong investments in oil exploration, shale gas production, and refinery upgrades. The United States drives most demand due to extensive pipeline expansion, LNG export capacity growth, and modernization of petrochemical facilities. Canada contributes through offshore and midstream projects that require high-pressure and corrosion-resistant flange assemblies. Strict safety regulations and adoption of advanced materials strengthen the regional shift toward premium stainless steel and alloy flanges. Rising maintenance activities in power generation and industrial plants further sustain long-term market growth.

Europe

Europe holds 26% share, driven by steady demand from chemical processing, power generation, and water treatment industries. Germany, the UK, and Italy remain key markets due to strong manufacturing bases and investments in energy-efficient infrastructure. The region emphasizes corrosion-resistant and high-integrity flange materials to comply with stringent environmental and safety standards. Growth in hydrogen infrastructure, district heating systems, and industrial automation supports adoption of precision-engineered flanges. The region also benefits from rising maintenance activities in aging industrial plants, boosting demand for replacement and specialty flange designs.

Asia Pacific

Asia Pacific dominates global consumption with 38% share, fueled by large-scale industrialization, refinery expansion, and petrochemical capacity additions in China and India. Rapid growth in power generation, construction, and manufacturing drives heavy use of stainless steel and alloy flanges. Southeast Asian countries invest in LNG terminals, offshore drilling, and pipeline networks, strengthening regional demand. The region’s competitive manufacturing ecosystem supports cost-effective production, attracting global partnerships. Continuous upgrades in chemical plants, desalination units, and water infrastructure reinforce Asia Pacific’s position as the fastest-growing market for high-performance flanges.

Latin America

Latin America accounts for 8% share, influenced by growth in oil production, mining, and industrial modernization. Brazil and Mexico lead regional consumption due to refinery upgrades, offshore deep-water projects, and investment in natural gas transport networks. Mining operations in Chile and Peru use durable flange assemblies for slurry pipelines and processing units. Infrastructure development in water management and power plants further supports uptake of corrosion-resistant materials. Although economic fluctuations affect large project timelines, long-term demand remains stable as energy and industrial sectors expand capacity.

Middle East & Africa

The Middle East & Africa region holds 10% share, driven by strong pipeline construction, refinery expansion, and petrochemical diversification programs. Saudi Arabia, the UAE, and Qatar invest heavily in high-pressure and specialty flanges for upstream and downstream operations. Africa’s growing LNG terminals, mining activities, and water infrastructure upgrades increase demand for durable flange materials. Harsh operating environments accelerate the shift toward stainless steel and nickel alloy designs. Ongoing industrialization and long-term energy projects ensure consistent market growth despite fluctuations in oil prices.

Market Segmentations:

By Product

- Integral hub flanges

- Loose flanges

- Closure flanges

- Specialty flanges

By Pressure Temperature

By Material

- Stainless steel

- Alloy steel

- Nickel alloy

- Others

By End Use

- Oil & Gas

- Petrochemical

- Power Generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Georg Fischer (GF Piping Systems), Parker Hannifin Corporation, Alleima, Outokumpu Oyj, ASC Engineered Solutions, Texas Flange, Metalfar S.p.A., Bonney Forge, Victaulic, and Flanschenwerk Bebitz GmbH. These companies compete through advanced material engineering, precision forging, and automated machining capabilities that support high-performance flanges for oil, gas, chemical, and power applications. Leading manufacturers focus on corrosion-resistant alloys, tighter dimensional tolerances, and compliance with global pressure standards to strengthen reliability in demanding environments. Strategic priorities include expanding production capacity, enhancing distribution networks, and offering customized flange solutions for specialized flow systems. Many players invest in digital inspection, CNC automation, and quality certification programs to maintain consistent output and meet international specifications. Partnerships with EPC contractors, pipeline operators, and industrial OEMs further reinforce competitive positioning. Continuous innovation in high-integrity and specialty flange designs remains key to sustaining leadership in global markets.

Key Player Analysis

- Outokumpu Oyj

- Texas Flange

- Victaulic

- Flanschenwerk Bebitz GmbH

- Bonney Forge

- Parker Hannifin Corporation

- Metalfar S.p.A.

- ASC Engineered Solutions

- Georg Fischer (GF Piping Systems)

- Alleima (formerly Sandvik Materials Technology)

Recent Developments

- In February 2024, Victaulic showcased its new pipe-system solutions (including innovative flange-less joining methods) at BIG 5 Construct Saudi 2024.

- In February 2024, ASC Engineered Solutions acquired Ward Manufacturing to strengthen its pipe-joining components portfolio including flanges and fittings.

- In January 2024, ASC Engineered Solutions introduced a new line of carbon steel press fittings for plumbing & mechanical applications (which may include flange-adjacent systems).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Pressure Temperature, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance flanges will rise as oil, gas, and petrochemical projects expand.

- Adoption of corrosion-resistant stainless steel and nickel alloys will grow in harsh environments.

- Automation in machining and inspection will improve production accuracy and consistency.

- Customized and specialty flange designs will gain traction in complex industrial systems.

- Upgrades in global pipeline networks will increase orders for high-pressure flange assemblies.

- Renewable energy plants will drive demand for durable flanges in steam and heat-transfer systems.

- Digital quality testing and certification will become standard across major manufacturers.

- Industrial modernization in Asia Pacific will continue to boost regional consumption.

- Supply chain restructuring will focus on resilient sourcing of alloy and steel materials.

- Long-term demand will remain stable as industries prioritize safety, efficiency, and compliance.

Market Insights

Market Insights