Market Overview

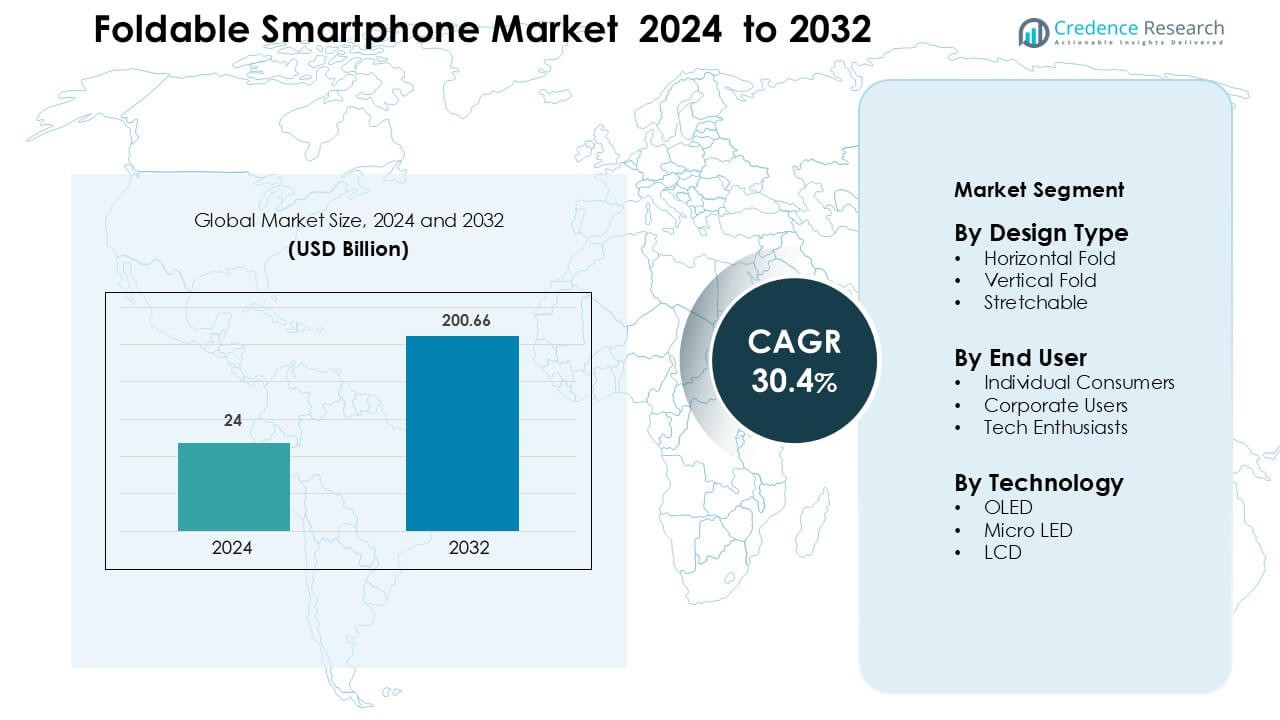

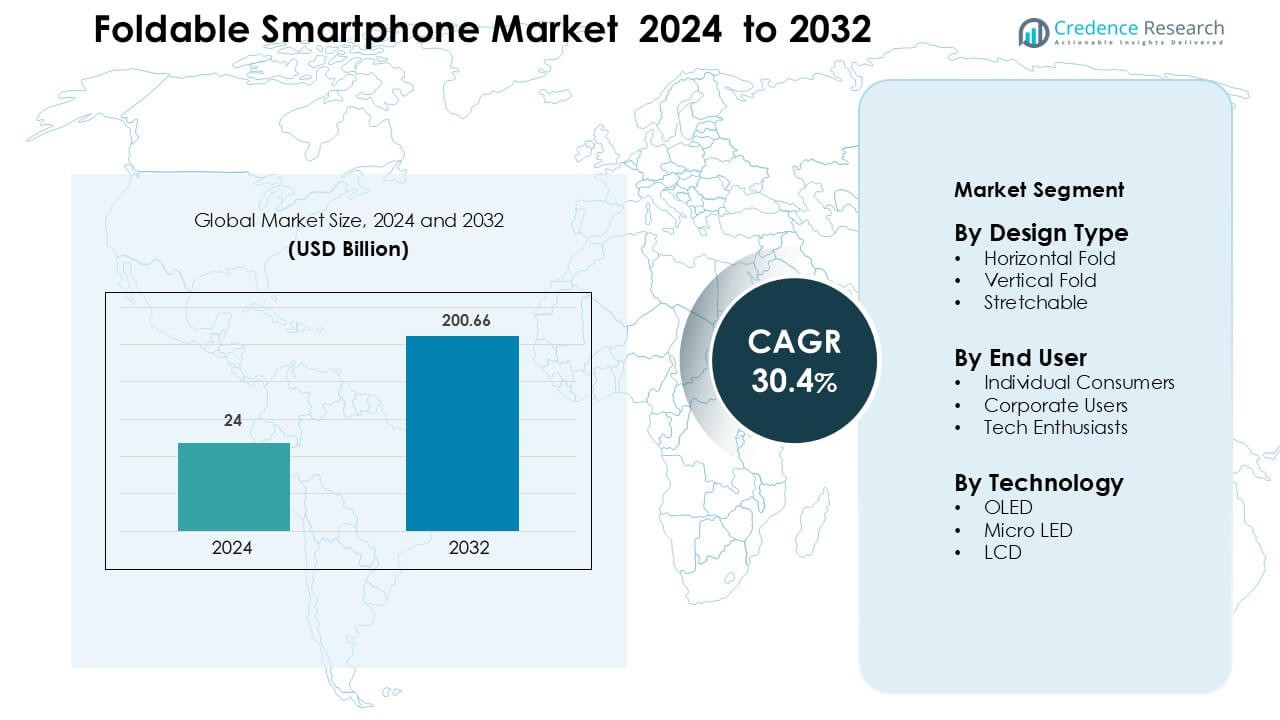

Foldable Smartphone Market was valued at USD 24 billion in 2024 and is anticipated to reach USD 200.66 billion by 2032, growing at a CAGR of 30.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foldable Smartphone Market Size 2024 |

USD 24 Billion |

| Foldable Smartphone Market, CAGR |

30.4% |

| Foldable Smartphone Market Size 2032 |

USD 200.66 Billion |

The Foldable Smartphone Market is shaped by leading companies such as Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Motorola Mobility LLC, Oppo Mobile Telecommunications Corp., Ltd., Xiaomi Corporation, Honor Device Co., Ltd., OnePlus Technology (Shenzhen) Co., Ltd., Microsoft Corporation, Google LLC, and Royale Corporation. These brands compete through advances in flexible OLED panels, stronger hinge engineering, and slimmer designs aimed at improving durability and usability. Product portfolios expand across premium and mid-range tiers, supported by aggressive marketing and software optimization for multitasking. Asia-Pacific leads the global market with about 34% share in 2024, driven by strong manufacturing ecosystems, rapid innovation cycles, and high adoption in China, South Korea, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Foldable Smartphone Market was valued at USD 24 billion in 2024 and is anticipated to reach USD 200.66 billion by 2032, growing at a CAGR of 30.4 % during the forecast period.

- Strong demand for large-screen mobility and rapid innovation in hinges, ultra-thin glass, and flexible OLED panels drive segment growth, with horizontal fold designs holding about 62% share.

- Key trends include expansion of mid-range foldables, improved app optimization for multi-screen layouts, and rising adoption among productivity-focused users supported by AI-enabled features.

- Competition intensifies as major brands introduce slimmer models, better durability, and competitive pricing, while increasing software partnerships to enhance multitasking and adaptive UI experiences.

- Asia-Pacific leads with 34% regional share, followed by North America at 33%, supported by high spending power and early tech adoption; individual consumers represent nearly 68% of end-user demand, reinforcing strong global uptake.

Market Segmentation Analysis:

By Design Type

Horizontal fold designs hold the dominant share at about 62% in 2024 due to their larger display area and strong adoption across premium users seeking tablet-like functionality in a compact form. Demand rises as brands refine hinge durability, crease reduction, and multitasking features. Vertical fold models grow through rising interest in pocket-friendly devices with flexible screens, while stretchable formats remain in early development. Growth across all formats accelerates as manufacturers improve flexible materials and reduce device thickness.

- For instance, Samsung’s Galaxy Z Fold 5 uses a “Flex Hinge” certified for 200,000 folds during its stress tests.

By End User

Individual consumers lead this segment with nearly 68% share in 2024 because buyers prefer compact designs, enhanced portability, and premium aesthetics supported by strong marketing from major smartphone brands. Corporate users adopt foldables for productivity gains linked to larger workspaces and split-screen capabilities. Tech enthusiasts help boost early adoption of advanced prototypes and limited-edition models. Market expansion continues as prices drop and durability improves, making foldables more accessible to mainstream users.

- For instance, Samsung’s enterprise shipments of Galaxy Z Fold and Z Flip devices rose by 105% between January–October 2022 compared to the same period in 2021, according to the company.

By Technology

OLED technology dominates with around 74% share in 2024 due to its flexibility, thin structure, and high contrast levels that support stable folding performance. Growth strengthens as manufacturers scale production of ultra-thin glass and flexible substrates. Micro LED remains a promising option with better brightness and longevity but stays in early commercialization due to high manufacturing complexity. LCD technology holds a minor share because the structure is less suited for foldable designs. Demand for advanced display materials drives ongoing innovation in flexible screen engineering.

Key Growth Drivers

Rising Demand for Large-Screen Mobility

Consumers want portable devices that provide bigger display areas for work, gaming, and streaming. Foldable smartphones meet this need by offering tablet-like screens in pocket-sized bodies. This balance between size and usability drives strong interest among premium users. Brands improve hinge strength, crease control, and thinness, which makes large-screen mobility more practical for daily use. Growing demand for multitasking also supports this shift, as users rely on split-screen tools for email, browsing, and media. As entertainment and productivity apps scale up their layouts for foldables, adoption increases further. This driver stays strong as users move toward devices that replace both phones and tablets.

- For instance, the Samsung Galaxy Z Fold 7 offers an 8.0-inch Dynamic AMOLED main display paired with a 6.5-inch cover screen.

Strong Innovation from Leading Smartphone Brands

Major smartphone companies invest heavily in foldable technology, which pushes rapid improvement in designs and performance. They introduce ultra-thin glass, stronger hinges, dust protection, and lighter frames that improve overall durability. These upgrades reduce early-stage concerns and help foldables move into mainstream premium categories. Marketing campaigns also highlight new features like Flex Mode, multi-angle use, and enhanced app continuity. Partnerships with app developers lead to optimized interfaces for larger screens. As global brands expand their foldable portfolios, competition lowers prices and widens accessibility. This innovation cycle keeps the market active and encourages buyers to upgrade more frequently.

- For instance, in the Samsung Galaxy Z Fold 7, the hinge is rated for up to 500,000 folds in durability tests, significantly boosting user confidence in long-term use.

Growing Adoption in Productivity and Work Applications

Foldable smartphones appeal to users who need greater workspace for business tasks. The larger displays help with reading documents, editing files, handling video calls, and multitasking. Corporate buyers appreciate the ability to replace laptops during travel or light work. Better stylus support and desktop modes also help expand professional use. With remote work on the rise, users value devices that blend mobility with efficiency. As enterprise software adapts to foldable layouts, the category becomes even more useful for day-to-day work. These functional gains help push adoption among business professionals and frequent travelers, supporting long-term market growth.

Key Trend & Opportunity

Expansion of Affordable Foldable Models

Foldable smartphones shift from a luxury tier toward mid-range pricing as production volumes increase. Brands introduce new models with simplified hinge systems, lower repair costs, and accessible screen sizes. This shift helps attract younger buyers and mainstream consumers who avoided early high-priced models. Component suppliers also scale up flexible OLED production, which reduces panel costs. As foldable prices move closer to flagship flat phones, adoption rises across regions. New financing plans and trade-in programs further support upgrade decisions. This trend opens major opportunities in price-sensitive markets across Asia, Latin America, and Eastern Europe, where demand for premium features at lower cost is rising quickly.

- For instance, BOE, a leading flexible OLED panel supplier, shipped nearly 140 million flexible AMOLED displays in 2024, and projects to reach 170 million in 2025, helping bring down panel costs.

Growth of App Ecosystem Optimized for Foldables

Software optimization becomes a major trend as developers design apps suited for flexible screens. Productivity apps add multi-column views, while entertainment platforms improve adaptive layouts. Gaming studios also create immersive modes that use the expanded screens when unfolded. These enhancements raise the value of foldables and encourage repeat usage. Opportunities grow for companies that offer UI frameworks or development tools tailored to foldable devices. As the ecosystem matures, users gain smoother transitions between folded and unfolded states. This software expansion helps unlock new use cases in education, design, media editing, and gaming—making foldables more appealing to diverse user groups.

- For instance, on the Galaxy Z Fold 6, Samsung has enabled Multi-Active Window to run up to three apps simultaneously, making Google Docs, Gmail, and Slack usable side-by-side.

Integration of AI and Advanced Sensor Technologies

Foldable smartphones integrate advanced AI features that enhance user experience. AI tools help adjust screen modes, optimize multitasking layouts, and improve battery use on large displays. Camera performance also benefits from AI-powered stabilization and scene detection. Future models may merge foldable designs with new sensor technologies like under-display cameras and biometric tools. These additions open opportunities for brands to differentiate their products. As AI-driven personalization expands, foldable devices may become central hubs for productivity and entertainment. This trend strengthens market potential by combining flexible hardware with intelligent software.

Key Challenge

High Production and Repair Costs

Foldable smartphones require complex components such as flexible OLED panels, ultra-thin glass, and advanced hinge systems. These parts raise manufacturing costs and limit affordability for many buyers. Repair costs also stay high because damaged flexible screens are harder to replace than traditional displays. This issue slows adoption in price-sensitive regions and reduces upgrade frequency. Brands must also manage quality issues like hinge wear and crease visibility, which add to warranty expenses. Until economies of scale reduce component prices, cost barriers remain one of the most significant challenges holding back wider market penetration.

Durability Concerns and Limited Long-Term Reliability

Durability stays a key challenge as users worry about hinge fatigue, dust intrusion, accidental drops, and screen creasing. Even with improved materials, foldable devices remain more delicate than standard smartphones. Outdoor users and frequent travelers face a higher risk of damage. Weather sealing and dust protection are still limited in many models. These concerns discourage some buyers from switching to foldable devices. Long-term reliability tests show progress, but users still expect clearer guarantees before investing in foldable products. Until durability reaches the level of traditional smartphones, hesitation will continue to affect adoption rates.

Regional Analysis

North America

North America holds about 33% share in 2024, driven by strong demand for premium devices and early adoption of advanced mobile technologies. Buyers prefer foldables for productivity, gaming, and entertainment, supported by high spending power. Leading brands expand availability through carrier partnerships and financing plans that boost upgrade cycles. Business users also help drive growth due to larger screen benefits in remote work. Expanding app optimization and strong marketing strengthen visibility across the region. Continued improvements in durability and mid-range foldable launches are expected to widen adoption, especially among younger consumers.

Europe

Europe accounts for nearly 27% share in 2024, supported by strong uptake in Germany, the UK, France, and Nordic countries where buyers value premium design and advanced features. Strict quality expectations push brands to supply durable hinges, improved displays, and eco-friendly materials. Corporate adoption increases in regions with strong remote-work culture, especially Western Europe. Buyers respond well to trade-in programs that reduce cost barriers. Growing availability of mid-range foldables strengthens demand in Southern and Eastern Europe. Market momentum remains stable as brands invest in localized marketing and expand AI-enabled productivity features.

Asia-Pacific

Asia-Pacific leads the market with around 34% share in 2024 due to high-volume demand in China, South Korea, and Japan, supported by strong manufacturing ecosystems. Regional brands offer diverse models across price points, which accelerates adoption among young and tech-focused consumers. China remains a key growth center with fast innovation cycles and aggressive pricing. India and Southeast Asia also show rising interest as mid-range foldables enter retail channels. Strong app ecosystems optimized for flexible screens further boost use. The region maintains leadership as brands compete through rapid advancements in hinges, ultra-thin glass, and AI-driven performance.

Latin America

Latin America holds about 4% share in 2024, shaped by growing interest in premium smartphones among urban professionals in Brazil, Mexico, and Chile. Adoption rises as brands introduce more affordable foldable options and expand online retail access. Economic constraints slow broad penetration, yet financing plans and trade-in offers help boost sales in major cities. Younger consumers and tech enthusiasts drive early uptake, especially for vertical fold designs that balance price and portability. As distribution networks improve and component prices fall, the region is expected to see steady, though gradual, growth in foldable adoption.

Middle East & Africa

The Middle East & Africa region captures nearly 3% share in 2024, with demand concentrated in the UAE, Saudi Arabia, and South Africa. High-income buyers in the Gulf region show strong interest in premium foldables due to advanced features and brand prestige. Retail expansion and digital channels improve product access across emerging markets. Price sensitivity limits wider adoption, but growing competition among smartphone brands helps introduce more cost-effective options. Productivity-focused users and early adopters drive early sales. Continued investment in 5G infrastructure and expanding retail finance options are expected to support a gradual rise in foldable smartphone demand.

Market Segmentations:

By Design Type

- Horizontal Fold

- Vertical Fold

- Stretchable

By End User

- Individual Consumers

- Corporate Users

- Tech Enthusiasts

By Technology

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Foldable Smartphone Market features major players such as Motorola Mobility LLC, OnePlus Technology (Shenzhen) Co., Ltd., Royale Corporation, Xiaomi Corporation, Huawei Technologies Co., Ltd., Google LLC, Microsoft Corporation, Oppo Mobile Telecommunications Corp., Ltd., Samsung Electronics Co., Ltd., and Honor Device Co., Ltd. These companies compete by advancing foldable display engineering, hinge durability, and ultra-thin glass technology to enhance product reliability and user experience. Brands focus on reducing device thickness, improving crease visibility, and integrating AI-driven features that optimize multitasking on flexible screens. Strategic pricing, expanded model portfolios, and strong marketing campaigns help attract both premium and mid-range buyers. Many players develop localized designs and carrier partnerships to strengthen regional presence. Software optimization becomes a key differentiator as brands collaborate with developers to create adaptive interfaces and app continuity features. Ongoing R&D investments, broader supply-chain scaling, and rising competition continue to push innovation and improve affordability across the global foldable smartphone landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Motorola Mobility LLC

- OnePlus Technology (Shenzhen) Co., Ltd.

- Royale Corporation

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Google LLC

- Microsoft Corporation

- Oppo Mobile Telecommunications Corp., Ltd.

- Samsung Electronics Co., Ltd.

- Honor Device Co., Ltd.

Recent Developments

- In February 2025, OnePlus Technology (Shenzhen) Co., Ltd. announced via a community post that it would not release a new foldable in 2025, effectively delaying the anticipated OnePlus Open 2 while positioning the move as a strategic “recalibration” of its foldable roadmap, not an exit.

- In November 2024, Royole Corporation, the pioneer behind the FlexPai foldable smartphone, was officially declared bankrupt after prolonged financial struggles, removing one of the earliest foldable-screen innovators from active competition in the foldable smartphone market.

Report Coverage

The research report offers an in-depth analysis based on Design Type, End-User, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Foldable smartphones will gain wider adoption as prices move closer to flagship models.

- Durability improvements will reduce hinge wear and crease visibility for long-term use.

- Mid-range foldable launches will expand access in developing markets.

- App ecosystems will grow as more developers optimize interfaces for flexible screens.

- AI-driven multitasking features will enhance productivity and user experience.

- Enterprise adoption will rise as foldables replace tablets for mobile work.

- Lighter frames and thinner designs will strengthen demand among frequent travelers.

- Battery efficiency will improve through adaptive power management on larger displays.

- More brands will enter the segment, increasing competition and innovation cycles.

- Integration of advanced sensors and under-display cameras will support premium feature upgrades.