Market Overview

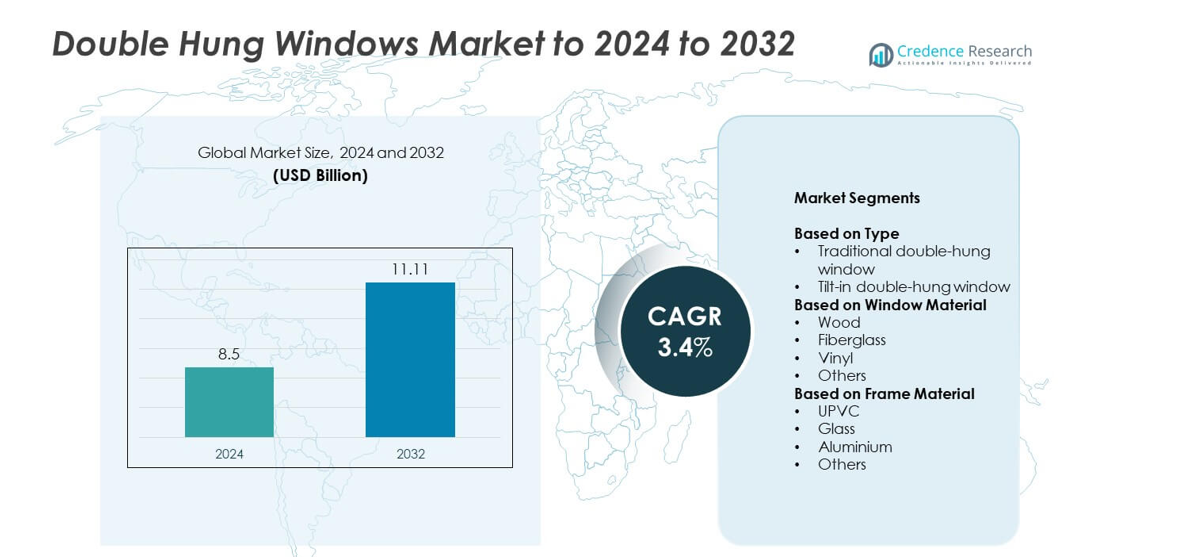

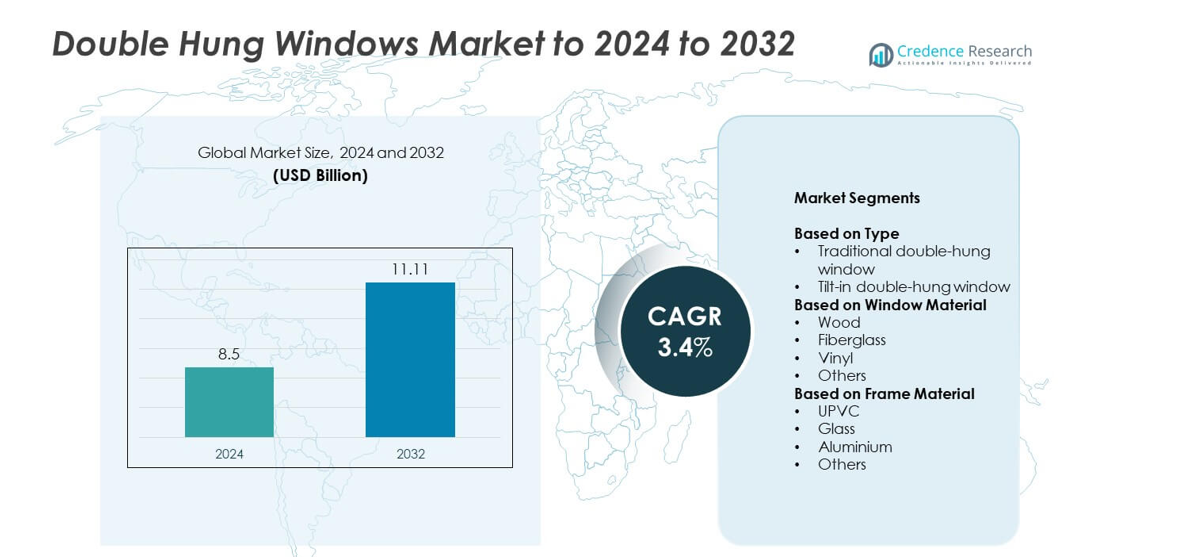

Double Hung Windows Market size was valued at USD 8.5 Billion in 2024 and is anticipated to reach USD 11.11 Billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Double Hung Windows Market Size 2024 |

USD 8.5 Billion |

| Double Hung Windows Market, CAGR |

3.4% |

| Double Hung Windows Market Size 2032 |

USD 11.11 Billion |

The double-hung windows market is shaped by major players such as Milgard Windows and Doors, Andersen, Pella, Jeld-Wen, Marvin Windows and Doors, Therma-Tru Doors, and Weather Shield Windows and Doors. These companies dominate through innovation in energy-efficient designs, durable materials, and customizable aesthetics suited for modern and traditional housing. Strategic advancements in UPVC, vinyl, and fiberglass frames enhance thermal performance and sustainability. North America leads the global market with a 37% share in 2024, supported by high renovation activity and stringent building efficiency standards, while Europe and Asia Pacific collectively account for over half of the global demand.

Market Insights

- The double-hung windows market was valued at USD 8.5 billion in 2024 and is projected to reach USD 11.11 billion by 2032, growing at a CAGR of 3.4%.

- Growth is driven by rising demand for energy-efficient housing, increased residential renovation projects, and government initiatives promoting sustainable building materials.

- The tilt-in double-hung window segment accounted for 61% share in 2024, supported by easy maintenance and modern design appeal, while vinyl and UPVC materials continue to dominate due to affordability and insulation benefits.

- The market is competitive with leading companies focusing on product innovation, eco-friendly materials, and digital design tools to enhance customization and compliance with green standards.

- North America led with 37% market share in 2024, followed by Europe at 28% and Asia Pacific at 24%, driven by urban construction growth and energy-efficient housing initiatives across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The tilt-in double-hung window segment dominated the market with a 61% share in 2024. This dominance is driven by its easy cleaning and maintenance features, as both sashes tilt inward for convenient access. Homeowners prefer these windows for improved ventilation and energy efficiency. Growing adoption in residential remodeling projects and energy-efficient home designs further supports demand. Traditional double-hung windows continue to hold steady demand in heritage restorations and classic architecture, but tilt-in designs are becoming the preferred choice for modern, low-maintenance homes.

- For instance,The Harvey Classic vinyl double-hung window features a standard DP40 rating for single units, with specific sizes and configurations performing even better. While the overall line’s air infiltration ratings range from 0.03 to 0.14 cfm/ft², testing has shown that certain single units, such as the 48″ x 84″ model, can achieve ratings as low as 0.01 cfm/ft². This air infiltration performance is significantly better than the industry maximum of 0.30 cfm/ft².

By Window Material

Vinyl-based double-hung windows accounted for the largest share of 54% in 2024. Their popularity stems from high durability, affordability, and strong insulation performance. Vinyl materials resist moisture and temperature fluctuations, making them ideal for diverse climates. Manufacturers focus on UV-resistant and recycled vinyl formulations to meet green-building standards. Wood and fiberglass materials appeal to premium and sustainable housing projects, yet vinyl remains dominant due to low maintenance costs and wide availability across both residential and light commercial applications.

- For instance, VEKA Class-A profiles use 3.0 mm outer walls and ~14% more material than Class-B, improving strength.

By Frame Material

UPVC frames led the segment with a 57% market share in 2024, driven by superior thermal efficiency and cost-effectiveness. These frames offer excellent insulation, corrosion resistance, and easy customization in design and color. Rising demand for energy-efficient window solutions in residential and institutional construction is boosting UPVC adoption. Aluminium and glass frames maintain relevance in modern architecture for aesthetic appeal and structural strength, but UPVC continues to lead due to its recyclability and low lifecycle costs, aligning with global sustainability and building efficiency goals.

Key Growth Drivers

Rising Demand for Energy-Efficient Housing

Growing awareness of energy conservation and sustainability is driving the adoption of double-hung windows with improved insulation and thermal performance. These windows minimize air leakage and support low-energy building designs. Governments and green certification programs encourage energy-efficient materials, boosting replacement and retrofit projects. Homeowners prefer double-hung windows for their dual-pane glass and low-emissivity coatings that enhance indoor comfort while reducing energy costs.

- For instance, Simonton Premium double-hung reports whole-window U-factor 0.29 with argon glass packages

Urbanization and Residential Construction Growth

Rapid urban expansion and increased housing development worldwide are fueling market growth. Builders and developers favor double-hung windows due to their aesthetic appeal, ease of installation, and ventilation control. Expansion of mid-rise and high-rise housing projects has amplified demand for durable and cost-efficient window systems. Increasing investment in smart and sustainable housing further enhances market opportunities for modern, tilt-in double-hung window designs.

- For instance, Andersen states a ground-level full-frame replacement typically takes 4–6 hours per window.

Technological Advancements in Materials and Design

Advancements in materials like UPVC, fiberglass, and insulated vinyl are reshaping product innovation. These materials improve thermal insulation, noise reduction, and weather resistance. Manufacturers integrate features such as low-maintenance coatings and improved locking systems for enhanced security. Growing use of automation in production also reduces costs, enabling large-scale customization. Such innovations increase adoption across both new construction and renovation projects.

Key Trends and Opportunities

Growing Focus on Sustainable Building Materials

Sustainability initiatives are pushing manufacturers toward eco-friendly materials and recyclable window components. Consumers and builders increasingly prefer products with reduced environmental footprints. UPVC and recycled vinyl windows are gaining traction for their durability and low maintenance. The trend aligns with global green certification standards, creating new opportunities for energy-efficient and sustainable double-hung window solutions.

- For instance, The REHAU ARTEVO profile system uses up to 78% recycled content. The ARTEVO Max variant, which includes a LowE film for additional insulation, can achieve a Uf value of up to 0.79 W/m²·K, while the standard ARTEVO profile has a Uf value of up to 0.97 W/m²·K.

Adoption of Smart and Automated Window Systems

The integration of smart technology in double-hung windows is emerging as a new opportunity. Automated control systems enable remote operation, improved ventilation, and better energy regulation. Demand for connected homes encourages manufacturers to incorporate sensors and smart glass technologies. These innovations enhance convenience and align with the growing trend of home automation across developed urban markets.

- For instance, VinylPlus reports 2023 rPVC uptake at 469,916 t, down 16.4% year-over-year.

Key Challenges

High Installation and Replacement Costs

Despite their energy and aesthetic benefits, double-hung windows often involve high installation and replacement expenses. Labor, customized fitting, and premium materials increase overall costs, limiting adoption in cost-sensitive markets. Manufacturers face challenges in maintaining affordability while meeting advanced performance standards, particularly in large-scale housing projects.

Fluctuating Raw Material Prices

Volatility in the prices of raw materials such as aluminum, vinyl, and glass poses a major challenge. Cost fluctuations affect manufacturing budgets and profit margins, leading to supply chain instability. Unpredictable material costs also make long-term pricing strategies difficult, compelling manufacturers to seek alternative sourcing and efficient production techniques.

Regional Analysis

North America

North America held the largest share of 37% in the double-hung windows market in 2024. The region benefits from strong residential renovation activity and widespread adoption of energy-efficient windows. The United States dominates due to high demand for vinyl and UPVC window frames in both new construction and retrofits. Favorable government programs promoting green building materials also drive regional growth. Manufacturers continue to introduce advanced designs that comply with Energy Star standards, supporting long-term demand across suburban and urban housing sectors.

Europe

Europe accounted for a 28% market share in 2024, supported by stringent energy efficiency regulations and a growing trend toward sustainable housing solutions. The United Kingdom, Germany, and France are leading markets due to extensive modernization of residential buildings. Consumers prefer double-hung windows for their insulation properties and aesthetic compatibility with traditional European architecture. Demand for eco-certified and recyclable materials is rising, particularly in Western Europe. Ongoing initiatives to achieve net-zero energy buildings are likely to sustain double-hung window adoption across the region.

Asia Pacific

Asia Pacific captured a 24% market share in 2024, driven by rapid urbanization and expanding residential construction across China, India, and Japan. Rising income levels and government-backed housing programs are accelerating the replacement of traditional window systems with modern, energy-efficient alternatives. Local manufacturers are investing in cost-effective vinyl and UPVC materials to serve growing domestic demand. Increasing awareness of sustainable building solutions and smart home integration further strengthens the region’s market position, particularly in emerging economies with large-scale urban development projects.

Latin America

Latin America held a 7% market share in 2024, with moderate growth driven by urban infrastructure development and residential construction in Brazil and Mexico. Consumers favor double-hung windows for improved ventilation and affordable maintenance. Rising adoption of UPVC and aluminum frames supports market penetration, though high installation costs limit broader uptake. Manufacturers are focusing on durable materials suited to tropical climates. Gradual economic recovery and regional construction investments are expected to enhance market potential in coming years, especially within mid-income housing segments.

Middle East and Africa

The Middle East and Africa region accounted for a 4% market share in 2024. Growth is supported by expanding construction projects in the United Arab Emirates, Saudi Arabia, and South Africa. Increasing preference for insulated and dust-resistant window systems drives adoption in residential and commercial buildings. Energy-efficient UPVC and aluminum-framed double-hung windows are gaining traction in high-temperature zones. However, limited awareness and availability of advanced designs pose challenges. Rising investments in smart city and sustainable housing initiatives are expected to gradually boost market demand.

Market Segmentations:

By Type

- Traditional double-hung window

- Tilt-in double-hung window

By Window Material

- Wood

- Fiberglass

- Vinyl

- Others

By Frame Material

- UPVC

- Glass

- Aluminium

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The double-hung windows market is led by prominent players such as Milgard Windows and Doors, Vinylmax, Kolbe Windows and Doors, Andersen, Weather Shield Windows and Doors, Therma-Tru Doors, Champion Windows, Pella, Jeld-Wen, Window World, Marvin Windows and Doors, American Craftsman, Blair Window and Door, Simonton Windows and Doors, and Harvey Building Products. The market is characterized by strong competition based on product innovation, design flexibility, energy efficiency, and durability. Companies focus on developing high-performance materials like UPVC, vinyl, and fiberglass to enhance thermal insulation and sustainability. Strategic investments in automated manufacturing technologies improve precision and reduce production costs. Many players also emphasize customizable designs and eco-friendly coatings to align with evolving building standards and consumer preferences. Expansion through partnerships with homebuilders and distributors remains a key strategy. Additionally, digital sales platforms and smart home integration capabilities are becoming essential differentiators in a competitive and design-driven market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Milgard Windows and Doors

- Vinylmax

- Kolbe Windows and Doors

- Andersen

- Weather Shield Windows and Doors

- Therma-Tru Doors

- Champion Windows

- Pella

- Jeld-Wen

- Window World

- Marvin Windows and Doors

- American Craftsman

- Blair Window and Door

- Simonton Windows and Doors

- Harvey Building Products

Recent Developments

- In 2025, Andersen expands its 100 Series with a new double-hung window, blending timeless design with the durability of Fibrex composite material

- In 2025, Marvin Windows and Doors Announced a new 400,000-square-foot manufacturing facility in Kansas City, Kansas, scheduled to open this year to increase production. The facility is a hub for manufacturing and assembling fiberglass windows and doors, and the company aims to grow its local workforce to 600 by 2028.

- In 2025, Kolbe Windows and Doors Displayed windows with integrated technology, such as privacy glass, at the 2025 International Builders’ Show.

Report Coverage

The research report offers an in-depth analysis based on Type, Window Material, Frame Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-maintenance window systems will continue to rise.

- Smart window technologies with automated control features will gain wider adoption.

- Manufacturers will invest more in recyclable and eco-friendly window materials.

- Vinyl and UPVC frames will remain the preferred choice for cost-effective construction.

- Renovation and home improvement projects will drive steady replacement demand.

- Integration of double-hung windows in smart homes will enhance product value.

- Asia Pacific will emerge as the fastest-growing regional market.

- Advances in glass coatings will improve insulation and noise reduction performance.

- Customization and aesthetic versatility will attract modern residential buyers.

- Strategic collaborations among manufacturers and builders will expand market reach.