Market Overview

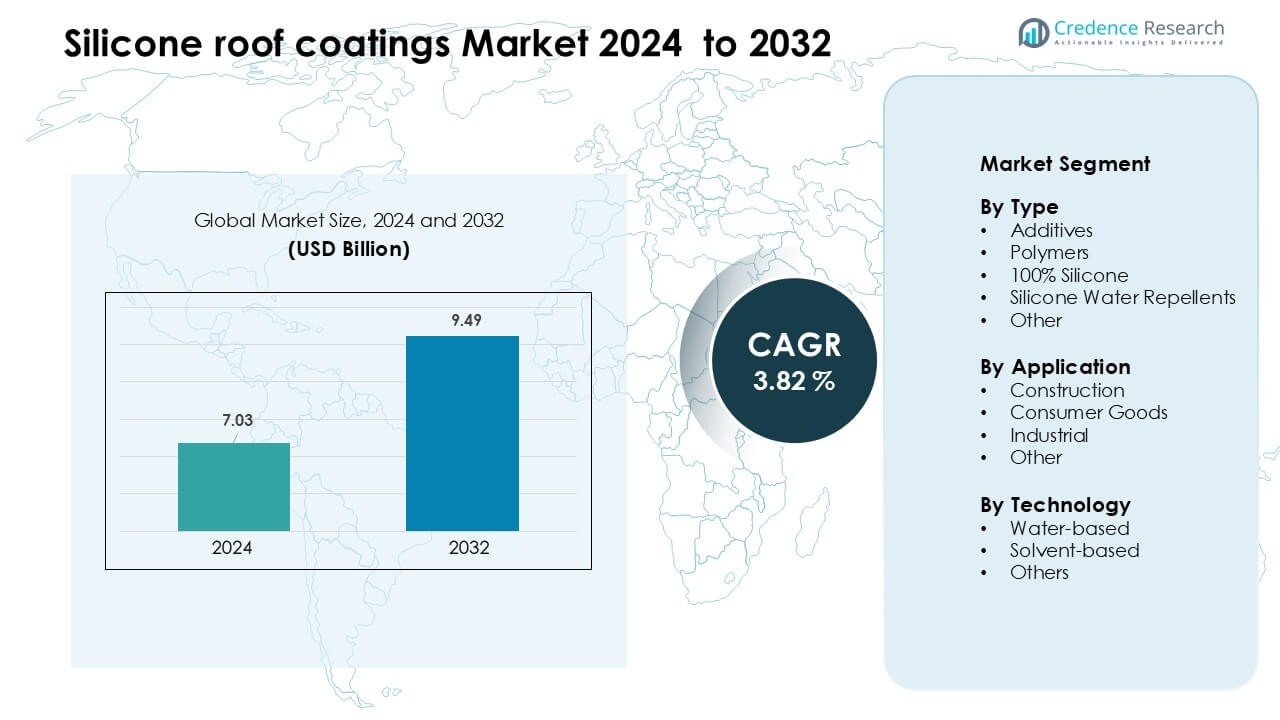

Silicone roof coatings market was valued at USD 7.03 billion in 2024 and is anticipated to reach USD 9.49 billion by 2032, growing at a CAGR of 3.82 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Roof Coatings Market Size 2024 |

USD 7.03 Billion |

| Silicone Roof Coatings Market, CAGR |

3.82 % |

| Silicone Roof Coatings Market Size 2032 |

USD 9.49 Billion |

The silicone roof coatings market is shaped by leading companies such as PPG Industries, Wacker Chemie AG, HITAC Adhesives & Coatings, The Sherwin-Williams Company, BASF SE, SIKA AG, Neogard, Akzo Nobel N.V., RPM International Inc., and DOW. These players compete through advanced coating technologies, strong distribution networks, and growing investments in reflective and low-VOC formulations. Product innovation focuses on durability, UV stability, and enhanced performance for commercial roof restoration. North America remained the leading region in 2024, holding about 38% share due to high retrofit activity, strong contractor ecosystems, and widespread adoption of cool-roof systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicone roof coatings market was valued at USD 7.03 billion in 2024 and is anticipated to reach USD 9.49 billion by 2032, growing at a CAGR of 3.82 % during the forecast period.

- Growth is driven by rising demand for energy-efficient roofing, expansion of restoration projects, and stricter regulations promoting low-VOC and reflective coating systems across commercial buildings.

- Key trends include rapid adoption of cool-roof standards, increasing use in large industrial and logistics facilities, and strong opportunities in regions facing high heat loads and aging infrastructure.

- Competition remains high as leading companies focus on durable 100% silicone formulations, improved UV resistance, and broader contractor partnerships, while price sensitivity and substrate compatibility issues act as restraints.

- North America held about 38% share in 2024 as the leading region, while 100% silicone led the type segment with nearly 41% share, supported by heavy commercial and industrial usage.

Market Segmentation Analysis:

By Type

100% silicone led the silicone roof coatings market in 2024 with nearly 41% share. Strong demand came from building owners seeking long-lasting UV stability, high reflectivity, and strong resistance to ponding water. This type gained wide adoption in commercial roofs because it extends service life and reduces cooling loads. Polymers and silicone water repellents advanced as cost-effective options for light-duty protection, while additives supported enhanced adhesion and curing. Growth across the type segment remained driven by rising retrofit projects and the need for durable protective layers in aging roofing systems.

- For instance, Henry Company’s Pro-Grade 988 silicone coating cures in just 15 minutes under rain-safe conditions according to its technical datasheet, while still delivering permanent ponding water resistance.

By Application

Construction dominated the market in 2024 with about 58% share. This segment expanded as residential, commercial, and industrial buildings adopted silicone coatings to reduce energy costs and delay full roof replacement. Construction firms preferred these coatings due to faster installation and strong weather resistance, which helped improve project timelines. Consumer goods and industrial applications grew for equipment surfaces and storage structures. Demand across applications increased as governments promoted cool-roof solutions to manage heat islands and support sustainability goals in urban regions.

- For instance, Enercon’s EnerFlex SP 300 100%-silicone coating, used on a commercial/industrial roof, has a Solar Reflective Index (SRI) of 110, and in a field application, dropping indoor thermostat-measured temperature from ~77 °F to ~72 °F over a week translated to a reduction of 2,733 kWh in HVAC consumption.

By Technology

Water-based technology held the largest share in 2024 with roughly 52%. Contractors selected water-based formulations because they offer lower VOC levels, safer handling, and faster drying times during roof restoration. These coatings gained traction in regions with strict air-quality regulations and high demand for environmentally compliant materials. Solvent-based coatings remained relevant for harsh climates requiring stronger chemical resistance, while other emerging technologies grew in niche repair and specialty coating tasks. Market growth across technologies was driven by rising green-building standards and the shift toward energy-efficient roofing solutions.

Key Growth Drivers

Rising Demand for Energy-Efficient Roofing

Demand for energy-efficient roofing systems continues to strengthen the silicone roof coatings market. Building owners and facility managers prefer silicone coatings because they reflect more sunlight and reduce indoor temperatures, which helps lower cooling loads in warm regions. Many commercial sites choose these reflective systems to cut long-term power use and delay full roof replacement. Growing awareness of heat-island effects in cities pushes companies to adopt cool-roof solutions. Governments in several regions also promote reflective coatings through codes and incentive programs. These factors encourage widespread upgrades in older commercial and industrial buildings, driving steady product adoption.

- For instance, Henry Company reports that its TropiCool® 887 100% silicone roof coating maintains reflectivity even after 3,000 hours of accelerated UV exposure, with recorded thermal emittance of 0.90 in independent testing.

Expansion of Roof Restoration Projects

Roof restoration activity is rising as property owners seek cost-effective alternatives to full roof replacement. Silicone coatings support this shift because they work well on aging membranes, metal roofs, and asphalt systems. The coatings extend roof life by improving UV resistance, blocking moisture, and reducing surface deterioration. Restoration projects also allow contractors to complete work faster, which limits business downtime. Stricter budgets across commercial facilities further increase preference for restoration solutions. As industrial spaces, warehouses, and retail centers expand, their long roof spans create large-scale opportunities for silicone-based restoration systems.

- For instance, Gaco’s S20 silicone system restored a 177,000 sq ft metal roof at RKI in Houston and extended the roof’s service life by 20 additional years under its full system warranty, eliminating the need for a tear-off.

Environmental and Regulatory Support

Environmental policies continue to strengthen demand for low-VOC and eco-friendly roofing materials. Water-based silicone coatings meet these goals by offering safer handling and fewer emissions during application. Green-building certifications such as LEED also encourage the use of reflective roof systems, helping silicone coatings gain wider acceptance. Many cities promote cool roofs to reduce urban heat and improve local climate resilience. These rules push construction firms to shift toward sustainable coating materials. Growing investment in green renovation programs across commercial buildings further increases demand and supports market expansion.

Key Trend & Opportunity

Adoption of Cool-Roof and Sustainable Building Practices

Cool-roof standards continue to shape demand as governments and large corporations aim to reduce energy use and support climate goals. Silicone coatings offer high reflectivity and long-term weather protection, making them ideal for buildings seeking green-building labels. More commercial developers now include reflective coatings in renovation cycles to improve thermal comfort and achieve operational savings. As heat-island concerns grow, cities in North America, Europe, and Asia promote cool-roof compliance through updated building codes. These shifts create a strong opportunity for silicone coatings across both new installations and retrofits.

- For instance, GAF’s UniSeal® Extreme Silicone is listed by CRRC with an initial solar reflectance of 0.83 and a thermal emittance of 0.90, allowing buildings to meet stringent cool-roof criteria under California Title-24 and LEED heat-island mitigation credits.

Growth of Large Commercial and Industrial Facilities

Warehouses, data centers, logistics hubs, and manufacturing plants are expanding worldwide, creating strong opportunities for silicone roof coatings. These large structures benefit from coatings that resist ponding water, UV degradation, and thermal stress. Many facility operators use silicone coatings to keep roof temperatures stable and reduce cooling expenses for wide-span buildings. The increase in e-commerce storage spaces and last-mile delivery centers further boosts demand. As industrial zones upgrade aging roofs, silicone coatings gain adoption as a low-maintenance and long-lasting protection layer, strengthening long-term growth prospects.

- For instance, Progressive Materials’ HS-3200 high-solids silicone coating was used on a 160,000 sq ft warehouse project, where post-application reflectivity measurements using ASTM C1549 recorded an initial solar reflectance of 0.88, enabling energy-efficiency compliance for large industrial buildings.

Key Challenge

Compatibility and Surface Preparation Issues

Not all existing roof surfaces are fully compatible with silicone coatings, which complicates installation for many contractors. Some substrates require extensive cleaning, repairs, or primer layers before silicone application, increasing project time and cost. Buildings with trapped moisture or severe structural damage face higher failure risks after coating. These concerns make property owners cautious and limit use in certain high-risk surfaces. Inconsistent application practices across regions also create performance variations. As a result, adoption slows in cases where surface preparation is expensive or where trained installers are limited.

Price Sensitivity and Competition From Alternative Coatings

Silicone roof coatings often cost more upfront than acrylic or polyurethane options, creating price sensitivity in cost-focused markets. Many small businesses and residential owners choose lower-priced coatings even if silicone products offer higher durability. Competing technologies continue to improve UV resistance and water performance, narrowing silicone’s advantage. Markets with low labor costs also favor cheaper coatings for large-scale projects. This competition pressures manufacturers to differentiate through warranties, improved formulations, and contractor training. High price awareness across buyers acts as a restraint and slows adoption in price-sensitive regions.

Regional Analysis

North America

North America led the silicone roof coatings market in 2024 with nearly 38% share. Strong adoption came from commercial buildings, warehouses, and industrial facilities seeking energy savings and roof-life extension. The region’s strict VOC regulations supported wider use of water-based silicone coatings, while high spending on retrofit projects boosted demand. Growing heat-island concerns encouraged major cities to promote reflective roof systems. Expanding e-commerce logistics hubs and data centers further increased usage. The U.S. remained the key contributor due to large roof areas, strong contractor networks, and steady investment in sustainable roofing upgrades.

Europe

Europe accounted for about 26% share in 2024, driven by stringent environmental regulations and the region’s strong focus on green-building certifications. Countries such as Germany, the U.K., and France adopted silicone coatings across commercial structures to enhance energy performance and reduce carbon footprints. Renovation of aging industrial roofs supported steady growth, while public-sector buildings increasingly shifted to cool-roof solutions. Rising awareness of heat reduction and long-term cost benefits encouraged wider use in southern Europe. The region’s commitment to sustainable construction and low-VOC materials kept silicone coatings in strong demand.

Asia-Pacific

Asia-Pacific held around 24% share in 2024 and recorded the fastest growth due to rapid urban development, expanding manufacturing facilities, and rising energy costs. China, India, Japan, and South Korea increased adoption as commercial complexes and industrial parks sought durable and reflective roof solutions. Growing construction activity and hot climatic conditions encouraged use of silicone coatings to manage heat load. Foreign investments in logistics hubs and large retail sites boosted demand. The region’s shift toward energy-efficient building materials and strong uptake of roof restoration solutions strengthened long-term market expansion.

Latin America

Latin America captured nearly 7% share in 2024, supported by rising restoration projects in commercial and industrial buildings. Countries such as Brazil, Mexico, and Chile used silicone coatings to improve UV resistance and protect roofs in high-temperature zones. Growing preference for low-maintenance roofing solutions helped drive adoption. Budget constraints pushed many property owners toward restoration instead of full roof replacement, which favored silicone coatings. As awareness of energy-efficient materials increased, more developers adopted reflective systems. Market growth remained steady despite economic fluctuations and reliance on imported raw materials.

Middle East & Africa

The Middle East & Africa region held about 5% share in 2024, with demand supported by extreme heat conditions and strong commercial infrastructure activity. Silicone coatings gained adoption in malls, hotels, warehouses, and industrial complexes due to their ability to withstand UV radiation and thermal stress. Gulf countries increased use of reflective roofs to manage cooling demand. Africa’s commercial development and warehouse expansion supported moderate growth. Limited contractor awareness and higher product costs slowed wider penetration, but long-term opportunities remained strong as governments promoted energy-efficient building materials.

Market Segmentations:

By Type

- Additives

- Polymers

- 100% Silicone

- Silicone Water Repellents

- Other

By Application

- Construction

- Consumer Goods

- Industrial

- Other

By Technology

- Water-based

- Solvent-based

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silicone roof coatings market features strong competition among global chemical companies and specialized roofing solution providers. Key players such as PPG Industries, Wacker Chemie AG, HITAC Adhesives & Coatings, The Sherwin-Williams Company, BASF SE, SIKA AG, Neogard, Akzo Nobel N.V., RPM International Inc., and DOW focus on expanding premium silicone formulations that deliver high reflectivity, long-term UV resistance, and strong weather durability. Many companies invest in R&D to improve ponding-water resistance and develop low-VOC, water-based technologies that meet tightening environmental rules. Partnerships with roofing contractors, warranty-backed restoration systems, and nationwide distribution networks strengthen market reach. Several manufacturers also expand production capacity and introduce integrated roof restoration systems to support growing commercial demand. As renovation and cool-roof programs rise globally, competition centers on performance reliability, application efficiency, and extended service life offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PPG Industries (U.S.)

- Wacker Chemie AG (Germany)

- HITAC ADHESIVES & COATINGS (India)

- The Sherwin-Williams Company (U.S.)

- BASF SE (Germany)

- SIKA AG (Switzerland)

- Neogard (U.S.)

- Akzo Nobel N.V. (Netherlands)

- RPM International Inc. (U.S.)

- DOW (U.S.)

Recent Developments

- In October 2025, Wacker showcased its high-tech silicones (including for coatings) at a trade event, emphasising new ceramifying silicone grades used in demanding applications. This signals ongoing innovation in silicone materials that can impact building-roof-coating segments.

- In October 2025, at METALCON 2025 AkzoNobel showcased energy-curing and silicone-modified coil coatings (CERAM-A-STAR® and related tech), highlighting durability and reflective/heat-management properties that are relevant to roof/coated metal building envelopes.

- In September 2025, Dow launched a new advanced silicone product, DOWSIL™ EG-4175 Silicone Gel (Sept 4, 2025) a high-temperature, high-reliability silicone gel designed for power electronics in EVs and renewables. While targeted at electronics, the launch signals Dow’s continued investment in silicone chemistries and global supply/channel moves that can affect availability and innovation of silicone polymers used in elastomeric roof-coating formulations. (Dow previously also named authorized distributors for silicone elastomeric roof-coating chemistries in prior years.)

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for silicone roof coatings will rise as more buildings adopt cool-roof systems.

- Restoration projects will expand as property owners prefer cost-effective roof life extension.

- Water-based silicone coatings will gain traction due to stricter VOC regulations.

- Large industrial and logistics facilities will drive strong adoption across major economies.

- Technological upgrades will improve durability, reflectivity, and moisture resistance.

- Manufacturers will strengthen contractor training programs to ensure consistent application quality.

- Premium 100% silicone formulations will remain the preferred choice for commercial roofs.

- Sustainability goals will push builders to adopt reflective coatings for energy savings.

- Emerging markets in Asia-Pacific and Latin America will record faster long-term growth.

- Competition will increase as more companies expand capacity and launch advanced coating systems.