Market Overview:

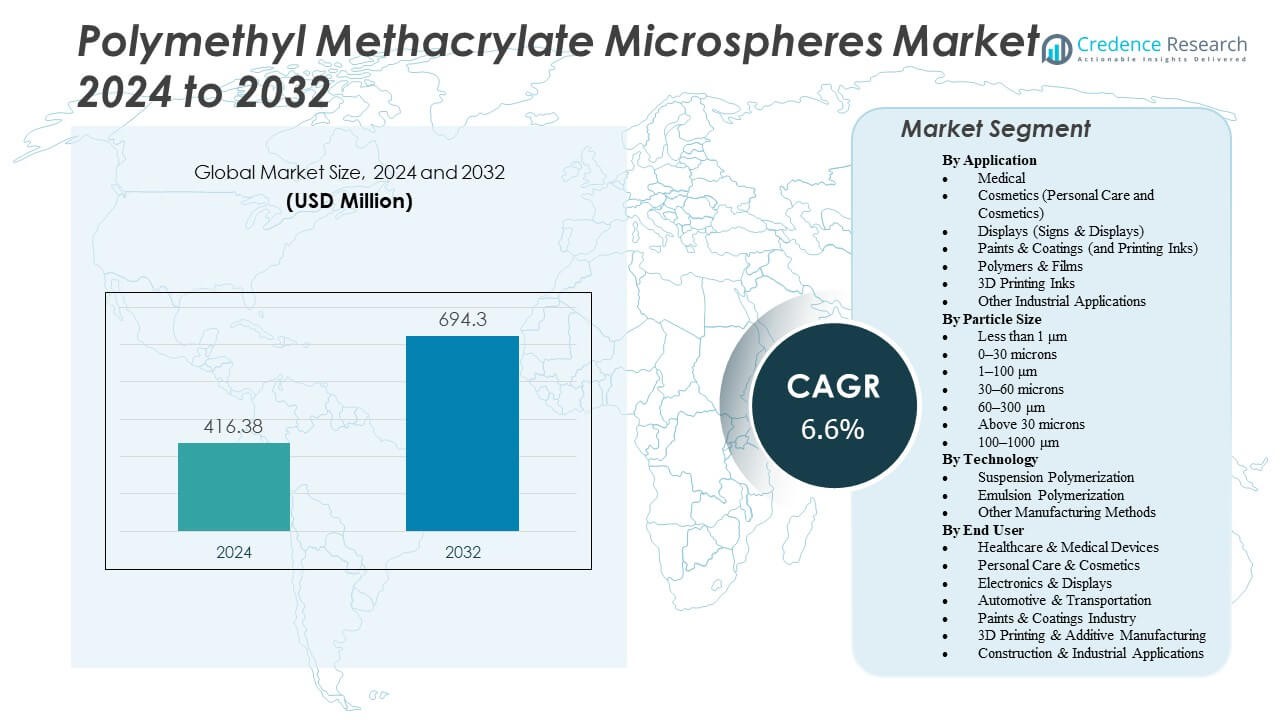

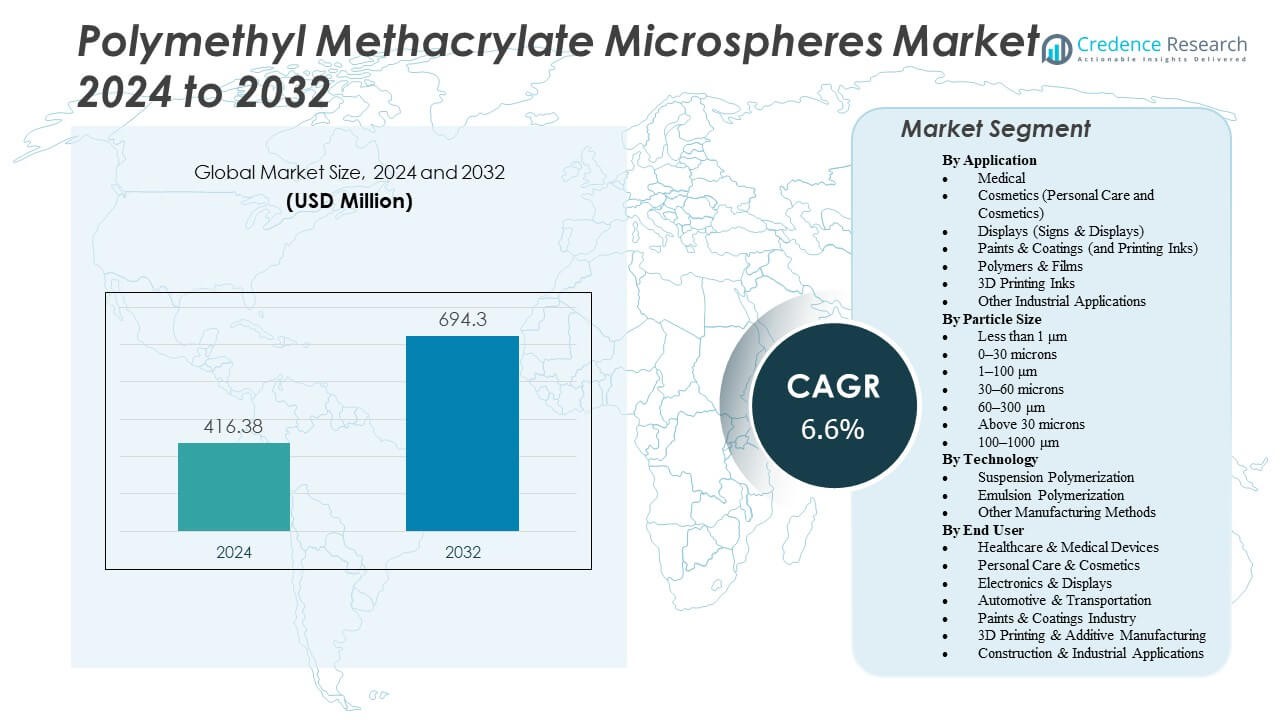

The Polymethyl Methacrylate Microspheres Market is projected to grow from USD 416.38 million in 2024 to an estimated USD 694.3 million by 2032, with a compound annual growth rate (CAGR) of 6.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymethyl Methacrylate Microspheres Market Size 2024 |

USD 416.38 Million |

| Polymethyl Methacrylate Microspheres Market, CAGR |

6.6% |

| Polymethyl Methacrylate Microspheres Market Size 2032 |

USD 694.3 Million |

Strong demand across medical, cosmetics, and industrial sectors drives this market’s expansion. Healthcare manufacturers use PMMA microspheres in drug delivery, diagnostics, and implant applications for their biocompatibility and clarity. The cosmetics industry increases consumption for textural improvement and visual enhancement. Expanding use in paints, coatings, and 3D printing applications strengthens the market presence in emerging industries.

North America leads the Polymethyl Methacrylate Microspheres Market due to advanced manufacturing, R&D capabilities, and strong medical device production. Europe holds a stable share supported by strict quality regulations and high-end cosmetic demand. Asia-Pacific demonstrates the fastest growth, driven by rising electronics and automotive production in China, Japan, and South Korea. Latin America and the Middle East & Africa show gradual adoption led by industrial diversification and expanding construction activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polymethyl Methacrylate Microspheres Market is valued at USD 416.38 million in 2024 and is projected to reach USD 694.3 million by 2032, registering a CAGR of 6.6%.

- Strong demand in medical, cosmetic, and coating sectors drives consistent market expansion globally.

- Healthcare applications benefit from PMMA’s optical clarity and compatibility for diagnostics and implants.

- Cosmetic manufacturers prefer PMMA microspheres for smooth texture and light-diffusing effects.

- Production cost volatility and dependence on petrochemical feedstocks act as key restraints.

- North America dominates due to advanced manufacturing capabilities and product innovation.

- Asia-Pacific records the fastest growth with expanding electronics, automotive, and healthcare sectors.

Market Drivers

Rising Demand for Lightweight and Durable Materials Across End-Use Industries

The Polymethyl Methacrylate Microspheres Market benefits from the growing need for lightweight yet strong materials in automotive, aerospace, and construction sectors. It helps manufacturers improve energy efficiency and design flexibility. The microspheres offer superior optical clarity, impact resistance, and reduced weight. Automotive makers adopt them for coating and light-diffusing parts. Aerospace firms use them for composite materials with enhanced strength-to-weight ratios. Building materials integrate them for improved durability and surface smoothness. The trend aligns with global sustainability and performance goals. Manufacturers explore bio-based alternatives to strengthen eco-friendly adoption.

- For instance, Cospheric PMMA microspheres provide a density of 1.19 g/cm³ with tensile strength of 80 MPa and tensile modulus of 2.4-3.3 GPa.

Increasing Use in Medical and Healthcare Applications

The market experiences strong traction in medical devices, drug delivery, and diagnostics. PMMA microspheres provide biocompatibility and controlled release functions. Healthcare product designers use them for aesthetic fillers, diagnostic reagents, and biomedical coatings. It enables consistent performance and precision in critical medical applications. Pharmaceutical companies adopt these microspheres for encapsulating drugs and enhancing delivery efficiency. The growing healthcare infrastructure in emerging economies supports expansion. Medical research advancements further enhance polymer formulations. The trend encourages greater cross-sector innovation between material science and healthcare technology.

- For instance, EPRUI Biotech PMMA microspheres offer particle sizes from 0.1 μm to 50 μm with CV <3.5% for precise medical dispersions.

Expanding Role in Cosmetics and Personal Care Formulations

Manufacturers use PMMA microspheres in skincare, makeup, and personal care formulations for their soft-focus and texture-enhancing effects. The microspheres improve product smoothness and spreadability. It enhances visual appeal and tactile comfort for end users. Brands incorporate these materials to deliver long-lasting matte finishes and lightweight formulations. Cosmetic innovation pushes demand for sustainable and biodegradable microspheres. Growing consumer awareness about skin safety supports product development. Manufacturers invest in R&D for bio-based variants with similar optical and tactile properties. The expanding beauty industry drives consistent adoption globally.

Growing Adoption in Advanced Coatings and Paint Applications

The Polymethyl Methacrylate Microspheres Market grows with increased integration into high-performance coatings and paints. The microspheres improve scratch resistance, gloss control, and surface uniformity. Industrial applications include automotive coatings, road markings, and electronic displays. It supports energy-efficient formulations with better heat reflection and UV stability. Paint manufacturers prefer PMMA microspheres for better pigment dispersion and reduced viscosity. Construction and consumer goods sectors also favor their durability and weather resistance. Ongoing innovations in coating technology expand usage in various substrates. Companies emphasize customization for industry-specific performance needs.

Market Trends

Shift Toward Bio-Based and Sustainable Microsphere Production

Sustainability shapes the next phase of PMMA microsphere development. Producers shift toward bio-based raw materials to reduce carbon footprints. The trend supports environmental regulations and consumer preferences for eco-safe polymers. It drives the adoption of renewable monomers and low-emission manufacturing methods. Research on biodegradable alternatives gains industry attention. The Polymethyl Methacrylate Microspheres Market responds with innovative green solutions across multiple sectors. Companies prioritize closed-loop systems to improve material recovery. Continuous R&D aims to balance sustainability with mechanical performance. This shift defines long-term competitiveness among global producers.

- For instance, Mitsubishi Chemical operates a pilot plant for methyl methacrylate (MMA) monomers using plant-derived materials, enabling up to 100% bio-derived carbon content in the produced MMA. This facility supports development of bio-PMMA with reduced carbon footprints through renewable feedstocks.

Integration with Advanced Manufacturing and 3D Printing Technologies

Additive manufacturing encourages the use of microspheres for precision molding and surface finishing. It enables enhanced print resolution and product strength. PMMA microspheres improve print quality through consistent particle size and controlled dispersion. The growing industrial 3D printing ecosystem fuels wider material experimentation. The market adapts to hybrid material systems combining PMMA with other polymers. It helps create lightweight structures and clear parts for design prototyping. Industrial designers value the microspheres’ optical clarity for transparent components. Continuous process optimization strengthens application diversity across production lines.

Rising Utilization in Optical and Electronic Applications

Optical clarity and refractive properties position PMMA microspheres for use in LEDs, displays, and sensors. Electronics companies integrate them to optimize light diffusion and reflection control. The microspheres enhance display brightness and uniform illumination. It supports miniaturization trends in smart devices. Growing LED lighting projects increase global demand. The Polymethyl Methacrylate Microspheres Market strengthens its footprint in optical engineering and consumer electronics. Precision optical lenses and micro-displays also benefit from these materials. Rising investment in optoelectronics boosts further innovation and market penetration.

- For example, Sekisui Chemical produces Micropearl™ PMMA microspheres known for their high optical clarity and precise particle size distribution, ranging from 1.5 µm to 600 µm. These microspheres exhibit a refractive index of about 1.49, making them suitable for optical and electronic applications such as displays and sensors.

Customization and Surface Modification Driving Application Innovation

Tailored surface treatment and coating processes expand PMMA microsphere functions. Modified microspheres improve adhesion, compatibility, and dispersion across varied media. Paints, adhesives, and composites leverage these surface-engineered variants. It enhances chemical resistance and reduces clumping in formulations. Manufacturers use plasma and silane treatments for performance optimization. The trend promotes product differentiation and improved consistency. The market focuses on functionalized microspheres with magnetic, conductive, or fluorescent properties. Such advances strengthen multi-industry applicability from electronics to life sciences.

Market Challenges Analysis

High Production Costs and Raw Material Price Volatility

The Polymethyl Methacrylate Microspheres Market faces persistent cost pressures linked to raw materials like methyl methacrylate monomers. Fluctuating petrochemical prices impact profit margins and production stability. Manufacturing PMMA microspheres requires controlled polymerization and purification, which increase expenses. It creates barriers for small and mid-scale producers entering the market. Competitive pricing from alternative materials like glass or polystyrene beads limits market penetration. Companies invest in process optimization to offset costs. Rising transportation and energy expenses further strain supply chains. These challenges require strategic sourcing and capacity planning.

Regulatory Barriers and Environmental Compliance Complexity

Stringent environmental regulations influence production, handling, and disposal of PMMA-based materials. Producers must adhere to evolving chemical safety and emission standards. Compliance costs rise due to strict policies in Europe and North America. It demands extensive documentation and testing for product approval. Limited clarity on biodegradable classifications complicates sustainable positioning. Manufacturers face hurdles while marketing products across global regions. Evolving plastic waste legislation affects long-term planning. Companies explore advanced recycling and cleaner synthesis routes to maintain compliance without losing competitiveness.

Market Opportunities

Emergence of Biomedical and Diagnostic Innovations

The Polymethyl Methacrylate Microspheres Market gains new momentum from its expanding use in biomedical science. The microspheres’ optical stability, chemical resistance, and biocompatibility make them ideal for imaging and drug delivery. It supports controlled release and targeted therapeutic systems. Medical diagnostics use them for precise calibration in testing equipment. Growing focus on personalized healthcare increases research collaborations. Innovations in nanotechnology enable multifunctional microspheres for combined diagnostic and therapeutic purposes. Pharmaceutical firms adopt advanced polymer composites to enhance medical safety. Expanding healthcare access in developing regions boosts future adoption.

Growth Potential in High-Performance Coatings and Energy Applications

Emerging sectors like renewable energy and infrastructure provide strong growth potential. The microspheres’ lightweight and reflective characteristics fit solar coatings, insulation panels, and specialty films. It strengthens energy efficiency and reduces maintenance needs in end-use industries. Manufacturers innovate formulations that balance transparency and UV resistance. The demand for durable, aesthetic, and functional coatings expands globally. Industrial digitization supports customized product development using PMMA microspheres. Collaborative projects with coating and electronics firms unlock new applications. Continuous R&D ensures steady advancement toward energy-efficient material technologies.

Market Segmentation Analysis:

By Application

The Polymethyl Methacrylate Microspheres Market shows broad adoption across medical, cosmetic, and industrial sectors. Medical applications lead with usage in drug delivery, diagnostics, and biomedical coatings. Cosmetics utilize microspheres for texture improvement and light-diffusion effects in skincare. Displays use them for clarity and brightness in LEDs and signage. Paints and coatings benefit from enhanced durability and gloss control. Polymers and films integrate them for improved strength and uniformity. The demand from 3D printing inks supports innovation in additive manufacturing. Industrial applications continue expanding with product diversification.

- For example, Phosphorex Inc. specializes in polymer-based microspheres and nanoparticles developed for drug delivery, vaccine formulation, and diagnostic applications. The company provides products engineered for precise size control and consistent release profiles to improve reproducibility and therapeutic performance in biomedical research.

By Particle Size

Particle size distribution plays a critical role in defining end-use suitability. Sizes below 1 μm are prominent in precision optical and electronic components. The 0–30 micron range serves coatings and films for smoother surfaces. The 1–100 μm category dominates cosmetics and healthcare products due to consistent dispersion. Larger sizes, such as 30–60 microns and 60–300 μm, cater to paints, fillers, and composites. Particles above 300 μm find niche use in filtration and structural reinforcement. It enables manufacturers to tailor formulations for varied technical requirements. Consistency in particle grading enhances market reliability.

- For example, Bangs Laboratories Inc. supplies polymer microspheres, including PMMA-based variants, used in research, diagnostics, and calibration processes. The company is recognized for producing uniform, traceable microsphere standards and materials supporting precise particle sizing and surface modification in biotechnology and materials testing.

By Technology

Suspension polymerization holds the largest share due to its ability to produce uniform microspheres with high optical clarity. Emulsion polymerization supports smaller particle formation for coatings and biomedical uses. Other manufacturing methods, including microfluidic and dispersion processes, serve specialized applications requiring tight particle control. It ensures scalability for high-volume production and precision-demanding industries. Technology advancement continues to reduce production costs and improve customization. Manufacturers emphasize process optimization for sustainability. This segment remains central to quality and innovation within the market landscape.

By End User

Healthcare and medical devices lead end-user adoption for their reliance on precision and biocompatibility. Personal care and cosmetics follow with strong integration in skincare and makeup formulations. Electronics and displays drive demand for high optical performance materials. Automotive and transportation sectors use PMMA microspheres for coatings and lightweight composites. The paints and coatings industry sustains steady growth through demand for high-durability formulations. 3D printing and additive manufacturing expand rapidly with material innovation. Construction and industrial applications strengthen global consumption through rising infrastructure and industrial output.

Segmentation:

By Application

- Medical

- Cosmetics (Personal Care and Cosmetics)

- Displays (Signs & Displays)

- Paints & Coatings (and Printing Inks)

- Polymers & Films

- 3D Printing Inks

- Other Industrial Applications

By Particle Size

- Less than 1 μm

- 0–30 microns

- 1–100 μm

- 30–60 microns

- 60–300 μm

- Above 30 microns

- 100–1000 μm

By Technology

- Suspension Polymerization

- Emulsion Polymerization

- Other Manufacturing Methods

By End User

- Healthcare & Medical Devices

- Personal Care & Cosmetics

- Electronics & Displays

- Automotive & Transportation

- Paints & Coatings Industry

- 3D Printing & Additive Manufacturing

- Construction & Industrial Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Healthcare and Industrial Demand

North America commands a significant portion of the global PMMA microspheres demand, with the United States and Canada driving uptake through robust medical device, coatings, and electronics sectors. The region holds roughly 35 %–40 % of the market share in 2024 according to recent estimates. It sustains demand because manufacturers exploit advanced regulatory standards and technological capabilities. It supports consistent demand for high-performance coatings, biomedical applications, and specialty polymers. The strong infrastructure for R&D and product innovation further reinforces leadership in this region.

Asia-Pacific Registers Fastest Growth Fueled by Industrial Expansion

Asia-Pacific leads growth momentum in the global market, capturing about 39–40 % share in 2024. Rapid urbanization, increasing automotive production, expanding electronics manufacturing, and rising demand for cosmetics and coatings drive adoption. Emerging economies such as China, India, Japan and South Korea steer demand for cost-effective PMMA solutions. It spurs growth across medical, cosmetic, and industrial applications. Market expansion benefits from growing manufacturing infrastructure and increasing foreign direct investments in these countries.

Europe and Rest-of-World Hold Moderate Shares With Stable Demand

Europe maintains stable demand with a moderate share thanks to automotive, medical device, cosmetics and coatings industries. Regional regulations and high quality standards uphold steady use of PMMA microspheres in coatings and medical applications. Latin America and Middle East & Africa presently account for smaller shares relative to North America and Asia-Pacific. These regions show gradual uptake driven by growing industrialization and rising demand in automotive, construction, and consumer goods sectors. Market growth there remains sensitive to local economic and regulatory conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cospheric LLC

- Matsumoto Yushi-Seiyaku Co., Ltd.

- Phosphorex Inc.

- Polysciences Inc.

- Sekisui Kasei Co., Ltd.

- Nippon Shokubai Co., Ltd.

- Kuraray Co., Ltd.

- Trinseo

- Microbeads AS

- Imperial Microspheres

- HEYO Enterprises Co. Ltd.

- Kobo Products Inc.

- Lab261

- Bangs Laboratories Inc.

- Goodfellow Cambridge Ltd.

- Sparsh Polychem Pvt Ltd.

Competitive Analysis:

The global competitive landscape for PMMA microspheres features a mix of established chemical firms and specialty-polymer manufacturers. Companies such as Nippon Shokubai Co., Ltd. and Kuraray Co., Ltd. from Japan hold notable positions due to long-standing polymer synthesis capabilities and diversified product portfolios. US-based players such as Cospheric LLC and Imperial Microspheres compete on customized offerings for coatings, medical and cosmetic clients. Several firms emphasize uniform particle size control, advanced manufacturing technologies, and regulatory compliance to differentiate their offerings. Competition remains strong because synthetic alternatives (e.g. polystyrene or other polymers) offer cost advantages. Companies address this threat through continuous process optimization, tight quality control, and innovation in surface-modification or functionalized microspheres. The resulting market remains fragmented, with leadership determined by technical capability, regulatory compliance, and end-user reach.

Report Coverage:

The research report offers an in-depth analysis based on Application, Particle Size, Technology and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand with sustained demand in healthcare, cosmetics, and coatings applications.

- Medical device manufacturing will continue integrating PMMA microspheres for controlled release and diagnostics.

- Bio-based and recyclable polymer innovations will improve environmental compliance and attract eco-conscious industries.

- Growth in 3D printing and additive manufacturing will widen material adoption for precision applications.

- Electronics and display manufacturing will benefit from high optical clarity and consistent particle quality.

- Rising R&D investments will lead to functionalized microspheres with magnetic, conductive, or fluorescent properties.

- Strategic partnerships between polymer producers and healthcare firms will strengthen technological development.

- Asia-Pacific will remain the fastest-growing region with increasing production capacity and domestic consumption.

- Automation in polymerization processes will reduce cost variability and improve product consistency.

- Long-term demand will remain resilient, supported by the market’s integration into sustainable and advanced material ecosystems.